The crushing weight of student loan debt is a pervasive reality for many aspiring physicians. The escalating costs of medical education, coupled with lengthy training periods, leave graduating doctors facing staggering financial obligations. This debt significantly impacts not only their personal finances but also the broader healthcare landscape, influencing career choices, practice locations, and ultimately, patient access to care. This exploration delves into the multifaceted challenges of doctor student loan debt, examining its causes, consequences, and potential solutions.

From the average debt burden across various specialties to the long-term financial implications on retirement and investment opportunities, we will analyze the complex interplay between medical training and financial stability. We’ll also explore strategies for effective debt management, including repayment plans, budgeting techniques, and available resources to help physicians navigate this challenging financial terrain.

The Magnitude of Doctor Student Loan Debt

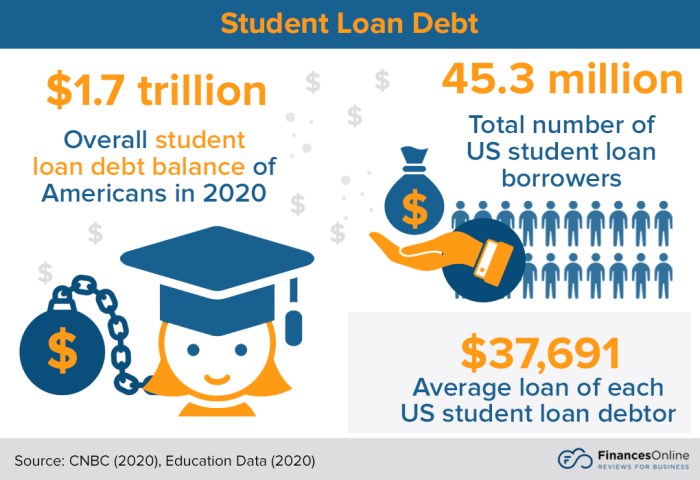

The staggering cost of medical education in the United States leaves many physicians burdened with substantial student loan debt, impacting their financial well-being and career choices. This debt significantly influences their lifestyle, financial planning, and even their specialty selection. Understanding the scale of this problem is crucial to addressing the systemic issues contributing to it.

Average Doctor Student Loan Debt and Variation Across Specialties

The average amount of student loan debt for medical school graduates in the US varies considerably depending on the specialty pursued, the length of training, and the individual’s spending habits during their education. While precise figures fluctuate yearly, reports consistently indicate that the average debt surpasses hundreds of thousands of dollars. Specialties requiring longer residencies and fellowships, such as neurosurgery or cardiology, often correlate with higher debt levels. Conversely, family medicine physicians, whose training is typically shorter, tend to graduate with lower debt loads. The variability highlights the complex interplay between educational costs, specialty choice, and financial burden.

Real-Life Scenarios Illustrating the Financial Burden

Consider a neurosurgeon graduating with $500,000 in student loan debt. Even with a high starting salary, a significant portion of their income will be allocated to loan repayments for many years, potentially delaying major life decisions such as homeownership, starting a family, or investing in retirement. Alternatively, a family physician with $200,000 in debt might face a more manageable repayment schedule, but still experience financial constraints, especially if they choose to work in underserved areas with lower compensation. These scenarios illustrate how the weight of student loan debt disproportionately affects physicians’ financial security and life choices.

Historical Trends in Doctor Student Loan Debt (Past Two Decades)

Over the past two decades, medical school tuition and associated costs have risen significantly, outpacing inflation. This has led to a consistent upward trend in student loan debt for graduating physicians. While there have been periods of slight deceleration or stabilization, the overall trajectory shows a marked increase in the average debt burden. Factors contributing to this include rising tuition, reduced federal funding for medical education, and increased reliance on private loans with higher interest rates. The financial impact on physicians has become increasingly pronounced over this period.

Comparison of Average Student Loan Debt Across Medical Specialties

| Specialty | Average Debt (USD) | Debt-to-Income Ratio (Estimated) | Years to Pay Off (Estimated) |

|---|---|---|---|

| Cardiology | $450,000 | 0.30 – 0.40 | 15-20 |

| Family Medicine | $200,000 | 0.15 – 0.25 | 7-10 |

| Surgery | $400,000 | 0.25 – 0.35 | 12-18 |

| Internal Medicine | $300,000 | 0.20 – 0.30 | 10-15 |

*Note: These figures are estimates based on available data and may vary depending on the institution, individual circumstances, and year of graduation. Debt-to-income ratios and repayment periods are also subject to considerable individual variation.

Factors Contributing to Rising Doctor Student Loan Debt

The escalating cost of medical education has created a significant financial burden for aspiring physicians, leading to a dramatic increase in doctor student loan debt. Several interconnected factors contribute to this alarming trend, impacting not only individual doctors but also the healthcare system as a whole. Understanding these factors is crucial for developing effective solutions to mitigate the problem.

Rising Tuition Costs and Medical School Debt

The most significant driver of increasing medical school debt is the unrelenting rise in tuition costs. Tuition at medical schools has outpaced inflation for decades, leaving prospective physicians with increasingly larger loan burdens. This surge is fueled by several factors, including the increasing cost of research, advanced technology, and faculty salaries. For example, a recent study showed that tuition at private medical schools has increased by an average of X% over the past Y years, significantly exceeding the rate of inflation. This dramatic increase directly translates into higher loan amounts needed to cover tuition, fees, and living expenses. The resulting debt can be crippling, impacting career choices and potentially limiting access to medical specialties for graduates with high loan balances.

The Role of For-Profit Medical Schools

The presence of for-profit medical schools further exacerbates the debt crisis. These institutions, driven by profit maximization, often have higher tuition rates than their non-profit counterparts. While they may offer more accessible pathways to medical education for some students, the high cost of attendance frequently results in graduates incurring significantly higher levels of debt. Moreover, some for-profit schools have faced criticism for questionable admissions practices and questionable academic standards, potentially further diminishing the return on investment for students who incur substantial debt. The business model of these institutions, focused on profit rather than solely on educational quality, creates a systemic incentive for higher tuition costs and potentially less focus on student support.

Increased Length of Medical Training and Residency

The lengthening duration of medical training, including medical school and residency, also contributes to the accumulation of student loan debt. Longer training periods mean more years of accumulating expenses, even as students are not yet earning a substantial income. Residency programs, while providing valuable clinical experience, often offer stipends that are insufficient to cover living expenses, forcing residents to rely further on loans to bridge the gap. The extended period of financial dependence significantly increases the total debt burden, creating a substantial financial strain that extends well into a physician’s early career. The added years of living expenses and continued interest accrual amplify the problem.

Limitations of Current Federal Loan Programs

Current federal loan programs, while designed to assist students, have limitations in addressing the unique financial needs of medical students. Loan amounts, while substantial, may not fully cover the escalating costs of medical education, especially for students attending high-cost private institutions. Furthermore, the repayment plans offered may not be sufficiently flexible or affordable for physicians facing high levels of debt and limited early-career income. The interest rates on these loans, while potentially lower than private loans, still contribute significantly to the overall debt burden over the repayment period. The lack of robust loan forgiveness programs specifically targeted at physicians in underserved areas further limits the ability of graduates to manage their debt effectively.

The Impact of Doctor Student Loan Debt on Healthcare

The crippling weight of student loan debt significantly impacts the landscape of healthcare in the United States. The financial burden faced by physicians extends far beyond their personal finances, influencing their career choices, impacting patient access to care, and contributing to a pervasive sense of burnout within the medical profession. This section explores the multifaceted ways in which doctor student loan debt affects the quality and accessibility of healthcare.

Physician Burnout and High Student Loan Debt

A strong correlation exists between high student loan debt and physician burnout. The immense pressure to repay substantial loans often leads to longer working hours, reduced time for personal well-being, and increased stress levels. Physicians burdened by debt may feel compelled to prioritize income over patient care, potentially compromising the quality of care provided. Studies have shown a direct link between financial stress and symptoms of burnout, including emotional exhaustion, depersonalization, and a reduced sense of personal accomplishment. For example, a physician choosing to work additional shifts at a high-paying hospital rather than pursuing a more fulfilling but lower-paying position in a rural clinic exemplifies this trade-off.

Influence of Loan Repayment on Medical Specialty Choice

The financial burden of loan repayment significantly influences the choice of medical specialty. High-paying specialties, such as dermatology, plastic surgery, and orthopedics, tend to attract more physicians due to their potential for faster loan repayment. Conversely, specialties like pediatrics, primary care, and public health, which often involve lower salaries and longer training periods, may be less appealing to those with substantial debt. This imbalance can lead to a shortage of physicians in crucial areas of healthcare, further exacerbating existing disparities in access to care. A recent survey indicated that a significant percentage of medical students cited financial concerns as a major factor in their specialty selection.

Impact of High Debt on Access to Healthcare in Underserved Areas

High student loan debt contributes to a shortage of physicians in underserved areas. The financial incentive to practice in affluent urban areas, where higher reimbursement rates and better working conditions are prevalent, outweighs the appeal of serving communities with limited resources and lower compensation. This disparity perpetuates healthcare inequalities, leaving vulnerable populations with limited access to essential medical services. For instance, a physician with $500,000 in student loan debt may be more likely to choose a lucrative position in a large city hospital than a lower-paying position in a rural clinic serving a medically underserved population.

Career Paths of Doctors with High vs. Low Student Loan Debt

Doctors with high student loan debt often prioritize maximizing income to accelerate loan repayment. This may lead them to choose higher-paying specialties, practice in affluent urban settings, and work longer hours. In contrast, doctors with lower debt may have more flexibility in their career choices, potentially pursuing less lucrative but more personally fulfilling specialties or practicing in underserved areas. For example, a physician with minimal debt might choose a career in public health, while a physician with significant debt might opt for a high-paying position in a specialized surgical practice in a major metropolitan area. This difference in career paths directly impacts the distribution of healthcare resources and the availability of care across different communities.

Strategies for Managing and Reducing Doctor Student Loan Debt

The substantial debt burden faced by many physicians necessitates proactive strategies for management and reduction. Effective planning and utilization of available resources are crucial for navigating this financial challenge and ensuring long-term financial well-being. This section Artikels various approaches to alleviate the pressure of student loan repayment.

Physician Repayment Plans

Several repayment plans are available to physicians, each offering different terms and benefits. The choice of plan depends on individual financial circumstances and long-term goals. Understanding the nuances of each option is essential for making an informed decision. These plans typically involve variations in payment amounts, interest accrual, and forgiveness programs.

- Standard Repayment Plan: This plan involves fixed monthly payments over a 10-year period. While straightforward, it may result in higher monthly payments compared to other options.

- Extended Repayment Plan: This plan extends the repayment period to up to 25 years, lowering monthly payments but potentially increasing the total interest paid.

- Graduated Repayment Plan: Payments start low and gradually increase over time, offering flexibility in the early years of a physician’s career when income may be lower.

- Income-Driven Repayment (IDR) Plans: These plans, such as REPAYE, PAYE, IBR, and ICR, base monthly payments on a percentage of discretionary income. Remaining balances may be forgiven after 20 or 25 years, depending on the plan, though this forgiveness is considered taxable income.

- Public Service Loan Forgiveness (PSLF): This program forgives the remaining balance of federal student loans after 120 qualifying monthly payments under an IDR plan while working full-time for a qualifying government or non-profit employer. Strict adherence to program requirements is crucial for forgiveness.

Sample Budget for a Young Physician

Creating a realistic budget is paramount for effective debt management. This example illustrates a potential budget for a young physician, highlighting the allocation of funds towards loan repayment and essential living expenses. Remember that this is a sample, and individual budgets will vary significantly based on location, lifestyle, and specific loan amounts.

| Income (Annual) | $250,000 |

|---|---|

| Loan Payment (Monthly) | $3,000 |

| Housing (Monthly) | $2,500 |

| Transportation (Monthly) | $500 |

| Food (Monthly) | $800 |

| Utilities (Monthly) | $300 |

| Insurance (Monthly) | $500 |

| Savings (Monthly) | $1,000 |

| Other Expenses (Monthly) | $400 |

| Total Monthly Expenses | $9,000 |

Effective Debt Management Strategies

Physicians can employ several strategies to effectively manage and reduce their student loan debt. These strategies often involve a combination of financial planning, disciplined spending, and strategic repayment choices.

- High-Interest Loan Prioritization: Focusing on repaying loans with the highest interest rates first minimizes the overall interest paid.

- Debt Avalanche Method: Prioritizing the loan with the highest balance, regardless of interest rate, can be psychologically rewarding and motivate further debt reduction.

- Bi-Weekly Payments: Making half a payment every two weeks effectively results in an extra monthly payment each year, accelerating loan repayment.

- Refinancing: If interest rates fall, refinancing student loans at a lower rate can significantly reduce the total interest paid over the life of the loan. However, carefully compare offers and ensure the new terms are beneficial.

- Budgeting and Financial Planning: Creating and adhering to a detailed budget helps track expenses, identify areas for savings, and allocate funds towards loan repayment.

Resources and Organizations for Financial Assistance

Several resources and organizations provide financial assistance and counseling to physicians grappling with student loan debt. These resources offer valuable support and guidance in navigating the complexities of loan repayment.

- The American Medical Association (AMA): Offers resources and information on financial planning and debt management for physicians.

- National Foundation for Credit Counseling (NFCC): Provides certified credit counselors who can offer personalized financial advice and guidance.

- StudentAid.gov: The official U.S. Department of Education website for federal student aid, offering information on repayment plans and forgiveness programs.

- Your Loan Servicer: Contact your loan servicer to discuss available repayment options and explore potential hardship deferments or forbearances.

Long-Term Financial Implications for Doctors

The crushing weight of student loan debt extends far beyond residency, significantly impacting a physician’s long-term financial well-being and shaping their future financial landscape. The high cost of medical education creates a ripple effect, influencing retirement planning, investment opportunities, and even tax liabilities. Understanding these long-term consequences is crucial for physicians to navigate their financial future effectively.

Retirement Planning Challenges

High student loan debt significantly hampers retirement planning. The substantial monthly payments can severely restrict the amount of money a physician can contribute to retirement savings accounts like 401(k)s and IRAs. This shortfall in contributions can lead to a smaller nest egg upon retirement, potentially forcing physicians to work longer than anticipated or compromise their desired lifestyle in their later years. For instance, a physician with $300,000 in debt might find themselves diverting funds earmarked for retirement to meet loan obligations, delaying the accumulation of retirement assets by several years, possibly even decades. This delay compounds over time due to the power of compounding interest, leading to a significantly smaller retirement fund.

Impact on Investment in Practice or Other Ventures

The financial burden of student loan debt often restricts a physician’s ability to invest in their practice or pursue other entrepreneurial ventures. The need to prioritize loan repayment may limit their capacity to expand their practice, upgrade equipment, or explore alternative income streams. This can hinder professional growth and limit potential earnings in the long run. A physician might forgo purchasing cutting-edge medical technology or opening a new clinic location because a large portion of their income is dedicated to debt repayment, thereby potentially impacting their patient care capabilities and their overall earning potential.

Tax Implications of Student Loan Debt Repayment

The tax implications of student loan debt repayment can also have long-term financial ramifications. While interest payments on student loans are generally tax-deductible, this benefit is subject to certain income limitations and can be complex to navigate. Moreover, the significant amount of income diverted to debt repayment reduces the amount available for tax-advantaged investments, further impacting long-term wealth accumulation. The interplay between loan repayment schedules, tax brackets, and investment strategies requires careful planning to minimize the overall tax burden. For example, strategies such as maximizing contributions to tax-advantaged retirement accounts while simultaneously strategically managing student loan repayments can significantly affect a physician’s long-term tax liability.

Projected Net Worth Over a 30-Year Career

A visual representation, such as a line graph, could illustrate the projected net worth of a physician over a 30-year career, comparing scenarios with varying levels of student loan debt. The graph would show three lines representing physicians with low, moderate, and high levels of student loan debt. The line representing the physician with low debt would show a steadily increasing net worth over the 30 years, while the line representing the physician with high debt would show a significantly slower increase, potentially even a period of negative net worth in the early years. The moderate debt line would fall somewhere between these two extremes, illustrating the direct correlation between student loan debt and long-term financial success. The graph would clearly demonstrate how the burden of high debt significantly impacts a physician’s overall financial trajectory, impacting wealth accumulation and long-term financial security.

End of Discussion

The pervasive issue of doctor student loan debt demands a multifaceted approach. While the financial burden is substantial, understanding the contributing factors and available resources empowers physicians to make informed decisions about their careers and financial futures. Effective debt management strategies, coupled with proactive financial planning, can mitigate the long-term consequences and allow physicians to focus on providing quality patient care without the constant pressure of overwhelming debt.

Helpful Answers

Can I declare bankruptcy to discharge my medical student loans?

Generally, medical student loans are not dischargeable through bankruptcy. There are very limited exceptions, typically requiring a showing of undue hardship, which is a difficult legal standard to meet.

What is income-driven repayment (IDR)?

IDR plans base your monthly student loan payment on your income and family size. Several IDR plans exist, each with different eligibility requirements and repayment periods. They can significantly lower monthly payments but may result in higher total interest paid over the life of the loan.

Are there loan forgiveness programs for doctors?

Yes, several loan forgiveness programs exist, particularly for physicians working in underserved areas or specific specialties. These programs often have strict eligibility criteria and service requirements.

How does student loan debt affect my credit score?

Missed or late student loan payments will negatively impact your credit score. Consistent on-time payments, however, will help maintain or improve your creditworthiness.