Navigating the complexities of student loan repayment can be daunting, especially understanding how interest accrual works during periods of deferment. Deferment offers temporary relief from loan payments, but it doesn’t necessarily mean a pause on interest. This crucial distinction significantly impacts the total amount you’ll eventually repay. Understanding the nuances of interest accrual during deferment is key to effective financial planning and avoiding unexpected debt burdens.

This guide explores the different types of deferments available, their eligibility criteria, and the specific rules regarding interest accrual for various federal and private student loan programs. We’ll examine how interest capitalization affects your loan balance and repayment schedule, providing clear examples to illustrate the long-term financial implications. We will also explore alternatives to deferment, such as forbearance and income-driven repayment plans, allowing you to make informed decisions about managing your student loan debt.

Understanding Deferment

Deferment is a temporary postponement of student loan payments. It offers borrowers a period of relief from making payments, but it’s crucial to understand that the terms and conditions vary significantly depending on the type of loan and the specific deferment program. This section will clarify the different types of deferments available, eligibility requirements, and the impact on interest accrual.

Types of Student Loan Deferments

Several types of deferments exist, each with its own set of eligibility criteria and duration. Understanding these differences is essential for borrowers to make informed decisions about managing their student loan debt.

Eligibility Criteria for Deferments

Eligibility for a deferment depends on factors such as the type of loan, the borrower’s financial circumstances, and the specific deferment program. These criteria can be complex, and it’s recommended to check directly with your loan servicer for the most up-to-date and accurate information.

Comparison of Deferment Periods for Various Loan Programs

The length of a deferment period varies depending on the type of loan and the reason for deferment. For example, economic hardship deferments may have a different duration than unemployment deferments. Furthermore, the specific terms may be dictated by the loan provider (e.g., federal versus private loans). This necessitates careful examination of individual loan agreements.

Summary of Deferment Types

| Deferment Type | Eligibility | Duration | Interest Accrual Status |

|---|---|---|---|

| Economic Hardship Deferment (Federal) | Demonstrated financial hardship, such as unemployment or low income. Specific documentation usually required. | Up to 36 months, potentially renewable depending on circumstances and loan servicer policies. | Interest typically accrues. |

| In-School Deferment (Federal) | Enrollment at least half-time in a degree or certificate program at an eligible institution. | While enrolled at least half-time, plus a grace period afterward. | Interest typically does *not* accrue on subsidized loans, but *does* accrue on unsubsidized loans. |

| Unemployment Deferment (Federal) | Proof of unemployment. | Typically up to 3 years, depending on circumstances and loan servicer policies. | Interest typically accrues. |

| Graduate Fellowship Deferment (Federal) | Receiving a graduate fellowship. | For the duration of the fellowship. | Interest typically accrues. |

Interest Accrual During Deferment

Understanding how interest accrues on student loans during a deferment period is crucial for managing your debt effectively. While deferment pauses your loan repayment, it doesn’t necessarily halt the growth of your loan balance through interest accumulation. The specifics depend on whether your loan is subsidized or unsubsidized.

Interest Accrual on Subsidized Loans During Deferment

The federal government pays the interest on subsidized federal student loans while you are in deferment. This means that your loan balance will not increase during the deferment period, provided you meet the eligibility requirements for deferment. However, it’s important to note that some types of deferments might not qualify for this interest subsidy. For example, certain deferments might only be available for unsubsidized loans, and these loans will continue to accrue interest even while in deferment. Always carefully review the terms and conditions of your specific loan.

Interest Capitalization

Interest capitalization is the process of adding accumulated interest to the principal balance of your loan. This occurs when your loan enters repayment after a deferment period, or when you switch from a subsidized to an unsubsidized loan. The capitalized interest then begins accruing interest itself, effectively increasing the total amount you owe and lengthening your repayment period. This significantly impacts the overall cost of your loan.

Examples of Interest Capitalization’s Effect on Repayment Schedules

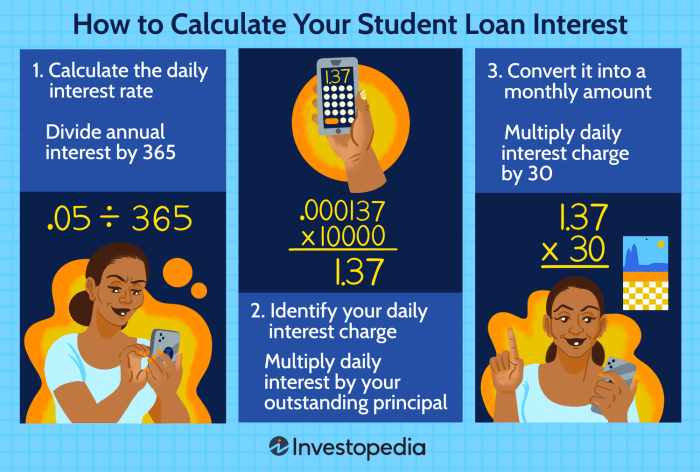

Interest capitalization directly impacts your repayment schedule. For instance, if you have $10,000 in outstanding loan debt, and $1,000 in accrued interest is capitalized, your new principal becomes $11,000. This larger principal amount will result in higher monthly payments, a longer repayment period, or both, depending on your repayment plan. The longer you defer your loan, and the higher the interest rate, the greater the impact of capitalization will be.

Hypothetical Scenario: Interest Accrual Over Five Years

To illustrate the impact of interest accrual during deferment, let’s consider a $10,000 loan with different interest rates over a five-year deferment period. We will assume that the interest is capitalized at the end of the five years.

- Scenario 1: 5% Interest Rate

After five years of deferment, approximately $2,500 in interest would accrue. Capitalizing this interest would increase the principal to $12,500. The monthly payment on a standard 10-year repayment plan would be significantly higher than if the interest hadn’t been capitalized. - Scenario 2: 7% Interest Rate

With a 7% interest rate, approximately $3,900 in interest would accrue over five years. Capitalization would increase the principal to $13,900. This results in an even greater increase in monthly payments and a potentially longer repayment timeline compared to the 5% scenario. - Scenario 3: 10% Interest Rate

At a 10% interest rate, the accrued interest after five years would be approximately $6,100. Capitalizing this would result in a principal of $16,100. The effect on monthly payments and repayment duration would be considerably more substantial than in the previous scenarios.

These scenarios demonstrate that even a seemingly short deferment period can significantly increase the total cost of a student loan due to interest capitalization. Careful consideration of these factors is essential for effective loan management.

Types of Student Loans and Deferment

Understanding how interest accrues on different types of student loans during a deferment period is crucial for effective financial planning. The policies governing interest accumulation vary significantly depending on whether the loan is federal or private, and also whether it’s subsidized or unsubsidized. This section will clarify these differences.

The primary distinction lies in the government’s role. Federal student loans are backed by the U.S. government, offering borrowers various protections and benefits, including specific deferment options. Private student loans, on the other hand, are provided by private lenders (banks, credit unions, etc.) and are subject to their individual terms and conditions, which often differ significantly from federal loan programs.

Federal vs. Private Student Loan Deferment Policies

A key difference between federal and private student loans lies in their interest accrual policies during deferment. Federal student loans, particularly subsidized ones, often offer deferment periods where the government pays the interest, preventing it from capitalizing (adding to the principal balance). Private loans, however, typically do not offer such benefits; interest continues to accrue during deferment, increasing the total amount owed.

Subsidized vs. Unsubsidized Loan Deferment Options

Within the realm of federal student loans, subsidized and unsubsidized loans differ in their handling of interest during deferment. Subsidized loans are need-based and the government pays the interest while the loan is in deferment. Unsubsidized loans, regardless of financial need, accrue interest throughout the deferment period, which is then added to the principal balance (capitalized) upon the end of the deferment or if not paid during the deferment.

| Loan Type | Interest Accrual During Deferment | Capitalization Implications |

|---|---|---|

| Federal Subsidized Loan | Interest does not accrue (government pays) | No capitalization of interest during deferment |

| Federal Unsubsidized Loan | Interest accrues | Interest is capitalized at the end of the deferment period, increasing the principal balance. |

| Private Student Loan | Interest typically accrues | Interest is usually capitalized at the end of the deferment period, increasing the principal balance. Specific capitalization policies vary by lender. |

Impact on Repayment

Deferring student loan payments might seem like a temporary solution to immediate financial hardship, but the long-term consequences of accruing interest during this period can significantly impact the total repayment cost. Understanding these implications is crucial for making informed financial decisions. The seemingly small amount of interest accumulating daily can compound over time, leading to a substantially larger loan balance than the original principal amount.

The primary impact of interest accrual during deferment is a larger overall loan balance at the end of the deferment period. This increased balance directly translates to higher monthly payments and a longer repayment timeline once the deferment ends. Even a short deferment can add considerable expense to the overall cost of the loan. The longer the deferment, the more significant this effect becomes, potentially adding thousands of dollars to the total amount repaid.

Total Loan Amount After Deferment

The total amount owed at the end of the deferment period is calculated by adding the accrued interest to the original principal loan balance. This new, higher balance then forms the basis for your repayment plan. Failing to understand this crucial point can lead to significant financial surprises and difficulties when repayment begins. Accurate calculations are essential for budgeting and planning for the post-deferment repayment phase.

Examples of Repayment Differences

To illustrate the impact of interest accrual, let’s consider two scenarios: one where interest accrues during deferment and another where it does not. These examples highlight the potential financial ramifications of choosing a deferment option.

- Scenario 1: Interest Accrues. Imagine a $20,000 student loan with a 6% annual interest rate. If the loan is deferred for two years, and the interest is capitalized (added to the principal) at the end of the deferment, the accrued interest over two years would be approximately $2,472 (calculated using compound interest). The new loan balance would be $22,472, significantly increasing the total repayment cost.

- Scenario 2: No Interest Accrual. In a hypothetical scenario where interest did not accrue during the two-year deferment, the loan balance would remain at $20,000. The total repayment cost would be considerably lower compared to Scenario 1.

The difference between these scenarios is substantial. In Scenario 1, the borrower would need to repay an extra $2,472 due solely to interest accumulation during the deferment period. This illustrates the importance of carefully considering the implications of interest accrual before opting for a deferment. Even seemingly small interest rates can have a large cumulative effect over time.

Alternatives to Deferment

Deferment pauses your student loan payments, but it’s not the only option available when facing financial hardship. Understanding the alternatives, such as forbearance and income-driven repayment plans, is crucial for making informed decisions about managing your student loan debt. Each option presents a unique balance of benefits and drawbacks concerning interest accrual and long-term repayment implications.

Forbearance and income-driven repayment plans offer different approaches to managing student loan payments during periods of financial difficulty. While deferment temporarily suspends payments, these alternatives provide more flexibility in adjusting payment amounts or extending the repayment timeline. Choosing the best option depends heavily on your individual financial situation and the type of student loan you possess.

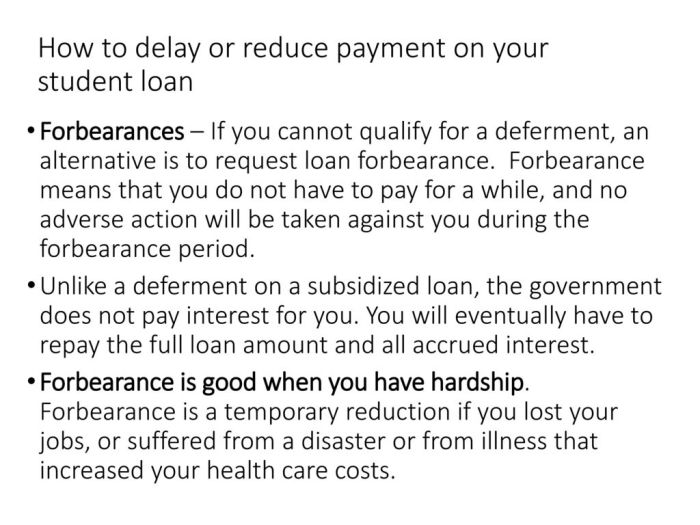

Forbearance

Forbearance allows you to temporarily suspend or reduce your student loan payments. Unlike deferment, forbearance is typically granted on a case-by-case basis and often requires documentation demonstrating financial hardship. The key difference lies in interest accrual; while deferment often allows for interest to accrue (depending on the loan type), forbearance almost always results in interest accumulating on your loan balance. This means your total debt will grow even while you’re not making payments. The accumulated interest is typically added to your principal balance at the end of the forbearance period, leading to a larger overall debt. Eligibility criteria for forbearance vary depending on your lender.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans are designed to make student loan repayment more manageable by basing your monthly payment on your income and family size. Several IDR plans exist, each with its own eligibility requirements and payment calculation formula. These plans typically extend your repayment period significantly, often to 20 or 25 years. While this lowers your monthly payment, it generally leads to paying more interest over the life of the loan compared to a standard repayment plan. However, some IDR plans may offer loan forgiveness after a certain number of qualifying payments, effectively reducing your total debt. Eligibility for IDR plans depends on the type of loan and your income.

Comparison of Options

The following table summarizes the key features of deferment, forbearance, and income-driven repayment plans.

| Option | Interest Accrual | Eligibility | Impact on Credit Score |

|---|---|---|---|

| Deferment | Varies by loan type; may or may not accrue. | Specific circumstances (e.g., unemployment, graduate school) | Generally no negative impact, but late payments during deferment may affect credit. |

| Forbearance | Almost always accrues. | Financial hardship (documentation usually required) | Potentially negative impact if payments are missed. |

| Income-Driven Repayment | Accrues, but lower payments may extend repayment period significantly. | Income and family size; varies by plan. | Generally no negative impact as long as payments are made as agreed. |

Illustrative Example

Understanding the growth of interest on a student loan during deferment can be challenging. A visual representation, such as a line graph, can effectively clarify this concept. This graph would depict the accumulation of interest over time, showcasing the impact of compounding.

A line graph would be the most suitable visual aid. The horizontal axis (x-axis) would represent time, specifically the duration of the deferment period, marked in months or years. The vertical axis (y-axis) would represent the total accumulated interest, starting at zero at the beginning of the deferment. Data points would be plotted along the line, showing the increasing amount of interest accrued at regular intervals (e.g., monthly or quarterly). The line itself would not be straight; instead, it would curve upwards, demonstrating the accelerating growth of interest due to compounding. This upward curve visually represents how interest earned in earlier periods adds to the principal, leading to even higher interest accumulation in later periods. The graph’s title could be “Interest Accrual During Student Loan Deferment,” and a clear legend would define the axes and units of measurement. For example, the y-axis could be labeled “Total Accumulated Interest ($)” and the x-axis labeled “Months in Deferment.”

Graphical Representation of Compound Interest

The upward curve of the line graph visually emphasizes the principle of compound interest. Each data point represents a snapshot of the total accumulated interest at a specific point in the deferment period. The increasing steepness of the curve as time progresses illustrates how the interest grows at an accelerating rate, rather than at a constant rate. To further enhance understanding, the graph could include annotations highlighting specific data points and explaining the impact of compounding at those intervals. For instance, an annotation could point to a data point midway through the deferment and state something like, “At this point, the accumulated interest is $X, which includes interest earned on the original principal and previously accumulated interest.” This combination of a visual representation and textual explanation effectively communicates the concept of compound interest during a deferment period.

Ultimate Conclusion

Successfully managing student loan debt requires a thorough understanding of deferment and its impact on interest accrual. While deferment provides temporary relief from payments, it’s crucial to remember that interest may still accrue, potentially increasing your total loan amount. By carefully considering the various deferment options, understanding the implications of interest capitalization, and exploring alternatives like forbearance or income-driven repayment plans, you can develop a strategic repayment plan that aligns with your financial capabilities and long-term goals. Proactive planning and informed decision-making are key to minimizing the long-term financial burden of student loans.

General Inquiries

What happens if I can’t afford my student loan payments?

Explore options like deferment, forbearance, or income-driven repayment plans. Contact your loan servicer to discuss your options.

Does deferment affect my credit score?

While deferment itself doesn’t typically negatively impact your credit score, consistently missing payments (even during deferment if applicable) can.

Can I defer my private student loans?

Deferment options for private loans vary greatly depending on your lender. Check your loan agreement or contact your lender directly.

How long can I defer my student loans?

The length of a deferment period depends on the type of loan and the reason for deferment. There are often limits on the total amount of time a loan can be deferred.