Navigating the complexities of student loan repayment often leaves borrowers wondering about the true cost of their education. A crucial element in understanding this cost is the accumulation of interest. This exploration delves into the intricacies of compound interest on student loans, examining how it affects repayment and offering strategies for minimizing its impact.

Understanding whether student loan interest compounds, and how it does so, is vital for effective financial planning. This involves grasping the difference between simple and compound interest calculations, identifying factors that influence growth, and exploring various repayment strategies to mitigate the effects of compounding. The ultimate goal is to empower borrowers with the knowledge to make informed decisions and manage their debt effectively.

Understanding Simple vs. Compound Interest on Student Loans

Understanding the difference between simple and compound interest is crucial for managing student loan debt effectively. Simple interest is calculated only on the principal amount borrowed, while compound interest is calculated on the principal amount plus any accumulated interest. This seemingly small difference can lead to significant variations in the total amount repaid over the loan’s lifetime.

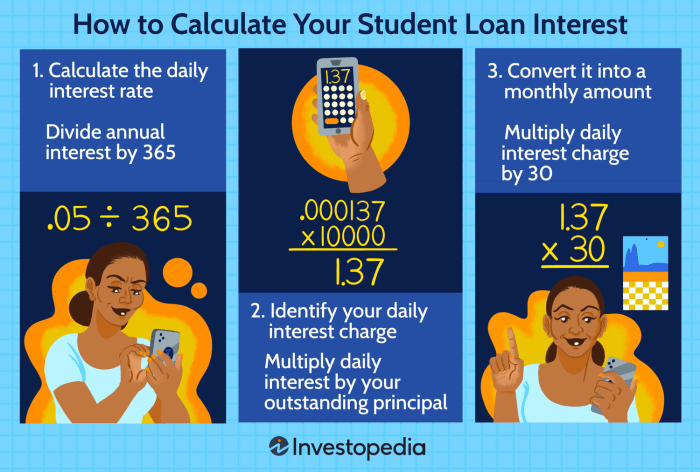

Simple Interest Calculation

Simple interest is calculated only on the original principal amount of the loan. It’s a straightforward calculation, making it easy to understand and predict the total repayment amount. The formula for calculating simple interest is: Simple Interest = Principal x Interest Rate x Time. For example, a $10,000 loan at a 5% annual interest rate over five years would accrue $2,500 in simple interest ($10,000 x 0.05 x 5 = $2,500). The total amount due after five years would be $12,500.

Compound Interest Calculation

Compound interest, unlike simple interest, is calculated on both the principal amount and the accumulated interest from previous periods. This means that interest earns interest, leading to faster growth of the debt over time. The formula for compound interest is slightly more complex: Future Value = Principal x (1 + Interest Rate)^Time. Using the same $10,000 loan at 5% interest over five years, the compound interest calculation would be: $10,000 x (1 + 0.05)^5 = $12,762.82. This shows that compound interest results in a significantly higher total repayment amount compared to simple interest.

Simple vs. Compound Interest Comparison Over Time

The following table illustrates the difference between simple and compound interest accumulation over 5, 10, and 15-year loan terms for a $10,000 loan at a 5% annual interest rate.

| Loan Term (Years) | Simple Interest Total | Compound Interest Total | Difference |

|---|---|---|---|

| 5 | $12,500 | $12,762.82 | $262.82 |

| 10 | $15,000 | $16,288.95 | $1,288.95 |

| 15 | $17,500 | $20,789.28 | $3,289.28 |

Factors Affecting Compound Interest on Student Loans

Understanding the factors that influence the accumulation of compound interest on student loans is crucial for effective financial planning. The total interest paid over the life of a loan isn’t simply a fixed percentage of the original principal; it’s a dynamic figure shaped by several key variables. This section will delve into these factors, providing a clearer picture of how they impact your overall loan cost.

Several interconnected factors determine the amount of compound interest accrued on student loans. These include the interest rate, the loan principal, the repayment plan chosen, and the process of capitalization. The interplay of these elements significantly impacts the total cost of borrowing, highlighting the importance of careful consideration before and during loan repayment.

Interest Rate and Loan Principal

The interest rate is the percentage charged annually on the outstanding loan balance. A higher interest rate leads to faster compound interest growth. The loan principal, the initial amount borrowed, forms the base upon which interest is calculated. A larger principal results in a higher absolute amount of interest, even with the same interest rate. For example, a $50,000 loan at 5% interest will accrue significantly more interest than a $20,000 loan at the same rate. The interaction between these two factors is multiplicative; a higher interest rate on a larger principal accelerates the growth of compound interest exponentially.

Repayment Plan’s Influence on Total Interest

Different repayment plans significantly affect the total interest paid. A standard repayment plan typically involves fixed monthly payments over a set period (e.g., 10 years). Income-driven repayment plans, on the other hand, adjust monthly payments based on income and family size. While income-driven plans offer lower monthly payments initially, they often extend the repayment period, leading to a higher total interest paid over the loan’s life. For instance, a standard 10-year plan might have higher monthly payments but lower overall interest compared to a 20-year income-driven plan. The trade-off between affordability and total cost is a crucial consideration when selecting a repayment plan.

Capitalization’s Effect on Loan Cost

Capitalization refers to the process of adding unpaid interest to the principal balance of the loan. This increases the principal amount on which future interest is calculated, accelerating the growth of compound interest. For example, if interest is not paid during a period of deferment or forbearance, that unpaid interest is capitalized, increasing the loan’s principal and thus future interest payments. This practice can significantly increase the overall cost of the loan over time, making it essential to understand its implications.

Strategies to Minimize Compound Interest

Understanding how compound interest works empowers borrowers to implement strategies to mitigate its effects. Careful planning and proactive actions can substantially reduce the overall cost of repayment.

Minimizing the impact of compounding interest requires a proactive approach. Several effective strategies can significantly reduce the total interest paid over the loan’s lifetime.

- Make extra payments: Even small extra payments can substantially reduce the loan’s lifespan and, consequently, the total interest accrued.

- Refinance to a lower interest rate: Refinancing to a loan with a lower interest rate can drastically decrease the overall interest paid. This is especially beneficial for borrowers with strong credit scores.

- Choose a shorter repayment plan: While monthly payments will be higher, opting for a shorter repayment period significantly reduces the total interest paid.

- Avoid capitalization whenever possible: Diligent payment during periods of deferment or forbearance prevents capitalization and its compounding effect.

- Explore loan forgiveness programs: Certain professions or circumstances may qualify for loan forgiveness programs, reducing or eliminating the need to repay a portion or all of the loan.

Visualizing Compound Interest Growth on Student Loans

Understanding how compound interest affects your student loan balance over time is crucial for effective repayment planning. A visual representation, such as a graph, can effectively illustrate the accelerating nature of this growth compared to simple interest. This section will explore a hypothetical scenario and describe a graph that visually demonstrates the difference.

Let’s consider a hypothetical student loan of $20,000 with a 5% annual interest rate. We’ll compare the growth of this loan under both simple and compound interest scenarios over a 10-year period. In a simple interest model, only the principal amount earns interest each year. In a compound interest model, the interest earned each year is added to the principal, and subsequent interest calculations are based on this larger amount. This leads to exponential growth.

A Graphical Representation of Simple vs. Compound Interest

The following description details a graph illustrating the growth of a $20,000 student loan with a 5% annual interest rate over 10 years, comparing simple and compound interest.

The graph would have two lines, one representing simple interest and the other representing compound interest. The x-axis represents the time elapsed in years (0 to 10), and the y-axis represents the total loan balance (in dollars). The line representing simple interest would show a steady, linear increase. The line representing compound interest, however, would demonstrate an increasingly steeper slope, clearly showcasing the exponential growth. The legend would clearly label each line as “Simple Interest” and “Compound Interest,” respectively. Data points for each year could be displayed on both lines for easy comparison. For instance, at year 5, the simple interest line might show a balance of $25,000, while the compound interest line might show a balance closer to $26,000. This difference would become progressively more significant over the 10-year period. The graph would visually emphasize that while simple interest grows at a constant rate, compound interest accelerates over time, leading to a substantially larger loan balance. This visual representation would powerfully illustrate the long-term impact of compound interest on student loan debt.

The Impact of Different Interest Rates on Compound Interest

Understanding the effect of varying interest rates on the total cost of a student loan is crucial for effective financial planning. Even seemingly small differences in interest rates can significantly impact the amount of interest accrued over the loan’s lifespan, ultimately leading to a substantially higher total repayment amount. This section will illustrate this impact through a comparative analysis.

The following analysis demonstrates how different interest rates affect the total interest paid on a $20,000 student loan over a 10-year repayment period. We will examine scenarios with 4% and 8% interest rates to highlight the substantial difference even a 4% increase can make. This comparison uses simplified calculations for illustrative purposes; real-world loan calculations may involve more complex factors.

Comparison of Total Interest Paid at Different Interest Rates

The table below compares the total interest paid on a $20,000 student loan with a 4% interest rate versus an 8% interest rate over 10 years. Note that these calculations assume a fixed interest rate and consistent monthly payments. Fluctuations in interest rates or changes in payment schedules would alter the final results.

| Interest Rate | Loan Term (Years) | Total Interest Paid (Approximate) |

|---|---|---|

| 4% | 10 | $4,000 |

| 8% | 10 | $8,700 |

This table clearly demonstrates the significant impact of interest rate differences. While both loans have the same principal amount and repayment period, the higher interest rate results in nearly double the total interest paid. The difference of $4,700 represents a substantial additional cost to the borrower. This highlights the importance of securing the lowest possible interest rate when taking out student loans. Consider strategies such as exploring federal loan options, seeking scholarships, and maintaining a good credit score to improve your chances of securing favorable interest rates.

Practical Strategies for Managing Compound Interest on Student Loans

Understanding how compound interest works on student loans is crucial, but equally important is knowing how to mitigate its impact. By employing proactive strategies, borrowers can significantly reduce their overall loan costs and accelerate their path to debt freedom. This section Artikels practical approaches to manage and minimize the effects of compounding interest.

Effective repayment strategies are key to minimizing the long-term cost of student loans. Choosing the right repayment plan and actively managing your payments can save you thousands of dollars in interest over the life of your loans.

Repayment Plan Selection

Choosing the right repayment plan is a critical first step. While a standard repayment plan might seem straightforward, exploring options like income-driven repayment (IDR) plans or extended repayment plans can significantly impact your monthly payments and total interest paid. IDR plans, for example, base your monthly payment on your income and family size, making them more manageable for borrowers with lower incomes. Extended repayment plans stretch your repayment period, leading to lower monthly payments but higher overall interest. Careful consideration of your financial situation and long-term goals is essential to selecting the most appropriate plan. For instance, a borrower with a high income might prefer a standard plan to pay off their debt faster, minimizing total interest, while a borrower with a lower income might benefit from an IDR plan to ensure affordability.

Accelerated Repayment Strategies

Making extra payments towards your principal loan balance is one of the most effective ways to combat compound interest. Even small additional payments can significantly reduce the total interest paid over the life of the loan. For example, consider a $30,000 loan with a 5% interest rate and a 10-year repayment term. Making an extra $100 payment per month would reduce the total interest paid by approximately $3,000 and shorten the repayment period by about 18 months. This strategy is especially effective in the early stages of repayment when the majority of your payment goes towards interest. By paying down the principal faster, you reduce the amount of interest that accrues over time. This illustrates the power of even small, consistent extra payments.

Budgeting and Financial Planning

Careful budgeting and financial planning are essential for successfully managing student loan debt. Creating a detailed budget allows you to track your income and expenses, identifying areas where you can save money to allocate towards extra loan payments. Prioritizing debt reduction within your overall financial plan demonstrates commitment and can lead to quicker debt repayment. For example, a borrower who successfully reduces discretionary spending by $200 per month can allocate those funds to their student loans, resulting in substantial savings over time. This proactive approach ensures that extra payments are sustainable and integrated into a long-term financial strategy.

Closing Notes

In conclusion, understanding how compound interest affects student loans is paramount for responsible debt management. While the exponential growth of compound interest can seem daunting, proactive strategies like choosing an appropriate repayment plan, making extra payments, and seeking refinancing options can significantly reduce the overall cost of borrowing. By taking a proactive approach and armed with this knowledge, borrowers can navigate the complexities of student loan repayment and achieve financial freedom.

Quick FAQs

What is capitalization in the context of student loans?

Capitalization is when unpaid interest is added to your principal loan balance, increasing the amount on which future interest is calculated. This accelerates the growth of your debt.

Can I refinance my student loans to a lower interest rate?

Yes, refinancing can lower your interest rate, potentially saving you a significant amount over the life of the loan. However, be sure to compare offers and understand the terms before refinancing.

How does my credit score affect my student loan interest rate?

A higher credit score typically qualifies you for lower interest rates on student loans. Improving your credit score before refinancing or applying for new loans can lead to significant savings.

Are there any government programs to help with student loan repayment?

Yes, several government programs offer income-driven repayment plans and other forms of assistance to help borrowers manage their student loan debt. Research these options to see if you qualify.