Navigating the complexities of student loan debt can feel overwhelming, but refinancing offers a potential path to lower monthly payments and long-term savings. Earnest, a prominent player in the student loan refinancing market, provides a streamlined process and competitive rates. This guide explores Earnest’s refinancing options, outlining the eligibility requirements, interest rates, repayment plans, and application process. We’ll also compare Earnest to other lenders and address common concerns to help you make an informed decision.

Understanding the nuances of student loan refinancing is crucial for making financially sound choices. This guide aims to demystify the process, providing you with the knowledge needed to confidently explore your refinancing options with Earnest or other lenders. We’ll delve into the specifics of interest rates, fees, repayment structures, and the potential impact on your credit score, offering clear examples and comparisons to empower your decision-making.

Understanding Earnest Student Loan Refinancing

Earnest is a reputable lender offering student loan refinancing services. This process allows borrowers to consolidate multiple federal and/or private student loans into a single, new loan with potentially more favorable terms, such as a lower interest rate or a shorter repayment period. Understanding the process, eligibility requirements, and comparative benefits is crucial before making a decision.

The Earnest Student Loan Refinancing Process

Refinancing with Earnest involves a straightforward application process. First, borrowers will need to gather their financial information, including income, credit score, and student loan details. This information is then submitted through Earnest’s online application portal. Earnest will then review the application and provide a personalized rate quote. If the borrower accepts the offer, Earnest will work with their current lenders to pay off the existing loans. The entire process typically takes several weeks to complete, depending on the complexity of the borrower’s financial situation and the responsiveness of their previous lenders.

Earnest Student Loan Refinancing Eligibility Requirements

To be eligible for Earnest student loan refinancing, borrowers generally need to meet certain criteria. These typically include a minimum credit score (generally above 650, though this can vary), a stable income, and a demonstrable ability to repay the loan. Earnest may also consider factors such as the type and amount of student loan debt, the borrower’s debt-to-income ratio, and their employment history. Meeting these requirements increases the likelihood of approval and securing a favorable interest rate. Specific requirements are subject to change, so it’s essential to check Earnest’s website for the most up-to-date information.

Comparison of Earnest Refinancing Options with Other Lenders

Earnest competes with several other lenders in the student loan refinancing market. A key differentiator for Earnest often lies in its customer service and transparency. While specific interest rates and fees vary depending on individual circumstances and market conditions, a thorough comparison of offers from multiple lenders is highly recommended. Factors to consider when comparing lenders include interest rates, fees, repayment terms, and customer service reviews. Borrowers should carefully weigh these factors to determine which lender offers the most advantageous terms for their unique financial situation. For example, one lender might offer a slightly lower interest rate but charge higher fees, ultimately making another lender a more cost-effective choice.

Scenarios Where Refinancing with Earnest Might Be Beneficial

Refinancing with Earnest can be advantageous in various scenarios. For example, borrowers with a strong credit score and stable income might qualify for a significantly lower interest rate than their original student loan interest rates, leading to substantial savings over the life of the loan. Consolidating multiple loans into a single payment can also simplify the repayment process, reducing the risk of missed payments. Another scenario where refinancing is beneficial is when a borrower wants to switch from a variable interest rate to a fixed interest rate, thus protecting themselves from potential interest rate hikes. Finally, shortening the loan term, while increasing monthly payments, can lead to significant long-term savings by reducing the total interest paid.

Interest Rates and Fees

Understanding the interest rates and fees associated with Earnest student loan refinancing is crucial for making an informed decision. This section will compare Earnest’s offerings to those of competitors, explain the factors influencing Earnest’s rate determination, and highlight potential long-term savings and any associated fees.

Earnest Interest Rates Compared to Competitors

The interest rate you receive will depend on several factors, including your credit score, income, and the type of loan. It’s important to compare offers from multiple lenders before making a decision. The following table provides a general comparison, and actual rates may vary. Note that this data is for illustrative purposes only and may not reflect current rates. Always check directly with the lender for the most up-to-date information.

| Lender | Interest Rate Range | Loan Type | Fees |

|---|---|---|---|

| Earnest | 4.99% – 13.99% | Federal and Private | None (Origination Fee) |

| SoFi | 4.99% – 17.24% | Federal and Private | None (Origination Fee) |

| Splash Financial | 5.99% – 14.99% | Federal and Private | None (Origination Fee) |

| Credible | Variable, depends on lender | Federal and Private | Variable, depends on lender |

Factors Influencing Earnest’s Interest Rate Determination

Earnest’s interest rate is determined by a combination of factors, primarily focusing on the borrower’s creditworthiness. A higher credit score generally leads to a lower interest rate. Other factors include your income, debt-to-income ratio, loan amount, and the type of loan being refinanced (federal or private). Earnest uses a sophisticated underwriting model to assess risk and assign an appropriate interest rate. For example, a borrower with an excellent credit score and a low debt-to-income ratio is likely to qualify for a lower interest rate compared to a borrower with a lower credit score and a high debt-to-income ratio.

Potential Long-Term Savings from Refinancing

Refinancing your student loans with a lower interest rate can result in significant long-term savings. By reducing your monthly payment and shortening your repayment term, you can save thousands of dollars over the life of your loan. For instance, consider a $50,000 loan at 7% interest versus the same loan at 5%. Over a 10-year repayment period, the difference in total interest paid could be several thousand dollars. The exact savings will depend on your individual loan details and the interest rate reduction achieved through refinancing.

Earnest Refinancing Fees

Earnest generally does not charge origination fees for student loan refinancing. However, it’s crucial to review all documentation thoroughly to ensure there are no unexpected charges. While Earnest typically doesn’t have hidden fees, it’s always recommended to carefully read the loan terms and conditions before signing any agreement to avoid any potential surprises. Late payment fees may apply if payments are not made on time.

Loan Terms and Repayment Options

Choosing the right loan term and repayment option is crucial when refinancing your student loans with Earnest. Understanding the various options available will allow you to select a plan that best aligns with your financial situation and long-term goals. This section details the loan terms and repayment choices offered by Earnest, highlighting the advantages and disadvantages of each.

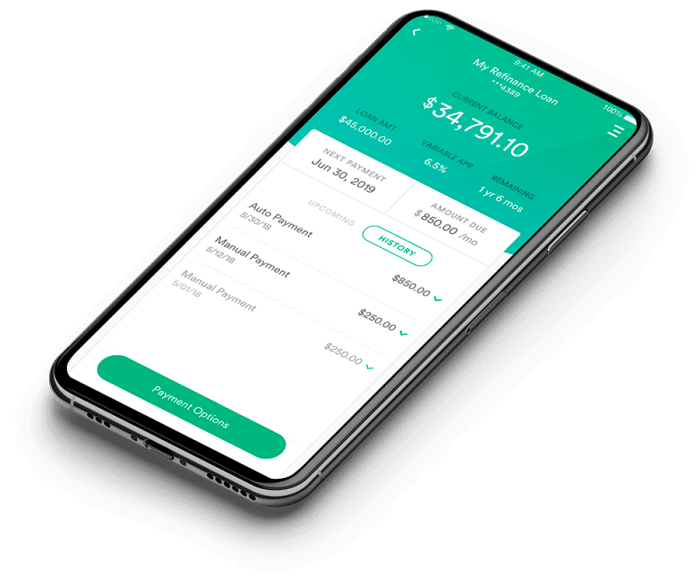

Earnest provides a range of loan terms and repayment options designed for flexibility. These options allow borrowers to tailor their repayment plan to fit their individual circumstances and budget. Key factors to consider include the length of the repayment period, the interest rate type (fixed or variable), and the resulting monthly payment amount.

Available Loan Terms

Earnest typically offers loan terms ranging from 5 to 15 years. Shorter loan terms result in higher monthly payments but significantly reduce the total interest paid over the life of the loan. Conversely, longer loan terms lead to lower monthly payments but result in a greater amount of interest paid overall. The optimal loan term depends on your individual financial capacity and long-term financial objectives. For example, a borrower with a higher disposable income might opt for a shorter term to minimize interest costs, while someone with a tighter budget might prefer a longer term for lower monthly payments.

Fixed vs. Variable Interest Rates

Earnest offers both fixed and variable interest rates on refinanced student loans. A fixed interest rate remains constant throughout the life of the loan, providing predictable monthly payments. A variable interest rate, on the other hand, fluctuates based on market indices, potentially leading to unpredictable monthly payments that could increase or decrease over time.

Choosing between a fixed and variable rate depends on your risk tolerance and market outlook. A fixed rate offers stability and predictability, which is beneficial for borrowers who prefer consistent monthly payments. A variable rate might offer a lower initial interest rate, but carries the risk of higher payments if interest rates rise. For example, if interest rates are expected to remain low or decrease, a variable rate could be advantageous; however, if rates are expected to rise, a fixed rate provides a safer option.

Sample Repayment Schedule

The following table illustrates a sample repayment schedule comparing a 5-year loan with a 10-year loan, both at a fixed interest rate of 5% and a principal loan amount of $30,000. Note that these are simplified examples and actual repayment schedules may vary depending on the loan amount, interest rate, and other factors.

| Loan Term | Interest Rate | Monthly Payment (approx.) | Total Interest Paid (approx.) |

|---|---|---|---|

| 5 years | 5% fixed | $580 | $5,400 |

| 10 years | 5% fixed | $320 | $11,800 |

This table highlights the trade-off between monthly payment amount and total interest paid. The 5-year loan has a higher monthly payment but significantly less total interest paid compared to the 10-year loan. The best option depends on your individual financial priorities and capacity.

Application and Approval Process

Applying for Earnest student loan refinancing is a relatively straightforward process, designed to be completed online. The application itself involves providing personal and financial information, allowing Earnest to assess your eligibility and determine a potential interest rate. The entire process, from application to approval, can take several days or weeks depending on the completeness of your application and the speed of document verification.

The application process begins with completing an online form, providing details about your existing student loans, income, and credit history. Earnest will then use this information to pre-qualify you, giving you an indication of the interest rate and terms you might be offered. After pre-qualification, you’ll need to provide further documentation to finalize your application.

Required Documentation

Submitting the necessary documentation is crucial for a smooth and timely application process. Incomplete applications can lead to delays. The specific documents may vary slightly depending on your individual circumstances, but generally include:

- Personal identification (e.g., driver’s license or passport)

- Social Security number

- Details of your existing student loans (loan servicer, loan amount, interest rate, etc.)

- Proof of income (e.g., pay stubs, tax returns)

- Bank statements (to verify income and assets)

Credit Score Requirements and Impact on Approval

Your credit score plays a significant role in determining your eligibility for Earnest student loan refinancing and the interest rate you’ll receive. A higher credit score generally translates to a lower interest rate, reflecting lower perceived risk to the lender. While Earnest doesn’t publicly state a minimum credit score requirement, applicants with scores below 660 might find it challenging to secure approval or may be offered less favorable terms. A score above 700 typically results in the most competitive rates. Individuals with excellent credit histories and stable income are more likely to qualify for the best loan options. For example, an applicant with a 750 credit score and a stable income might qualify for a significantly lower interest rate compared to someone with a 650 credit score.

Reasons for Loan Application Rejection

Several factors can lead to the rejection of a student loan refinancing application. Understanding these common reasons can help prospective borrowers strengthen their applications.

- Insufficient Income: Earnest assesses your ability to repay the loan, and insufficient income relative to your debt burden can lead to rejection.

- Low Credit Score: As mentioned previously, a low credit score indicates higher risk to the lender, potentially resulting in rejection.

- Incomplete Application: Failure to provide all required documentation or inaccurate information can delay or prevent approval.

- Existing Delinquencies: A history of late payments or defaults on other loans significantly reduces your chances of approval.

- High Debt-to-Income Ratio: A high debt-to-income ratio suggests you may struggle to manage additional debt, making approval less likely.

Customer Reviews and Experiences

Understanding customer feedback is crucial when considering refinancing student loans. Earnest’s reputation is built on the experiences of its borrowers, and a comprehensive review of these experiences provides valuable insight into the company’s performance. This section summarizes customer reviews and highlights both positive and negative aspects of the refinancing process and customer service.

Customer reviews from various sources, including Trustpilot, Google Reviews, and the Better Business Bureau, paint a mixed picture of Earnest’s performance. While many customers express satisfaction, others highlight areas for improvement.

Summary of Customer Reviews and Ratings

Customer reviews are scattered across multiple platforms, making it difficult to get a truly holistic view. However, a general summary based on numerous reviews reveals the following:

- Positive reviews frequently cite a smooth and efficient application process, competitive interest rates, and responsive customer service.

- Negative reviews often mention difficulties in contacting customer service, lengthy processing times for certain requests, and occasional issues with online account management.

- Overall ratings tend to hover around a 4 out of 5 stars across different platforms, indicating a generally positive but not universally perfect experience.

Examples of Positive and Negative Customer Experiences

Positive experiences often involve borrowers who praise the ease of the online application and the speed at which they received loan approval and funding. For example, one reviewer stated that the entire process took less than a week, and the interest rate offered was significantly lower than their existing loans. Conversely, negative experiences frequently center around long wait times for customer service responses, particularly during periods of high volume. One common complaint is the difficulty in reaching a live representative via phone, leading to frustration and delays in resolving issues. Another frequent complaint involves inconsistencies in information provided by different customer service representatives.

Earnest’s Customer Service Responsiveness and Helpfulness

Earnest’s customer service is generally described as helpful when contacted, although accessibility can be a challenge. Many positive reviews praise the knowledge and professionalism of the representatives they spoke with. However, negative reviews frequently cite long wait times to reach a representative via phone or email, and occasionally, a lack of clear or consistent information provided across different interactions. The overall impression is that while the service is capable, improvements in accessibility and response time are needed to meet customer expectations consistently.

Hypothetical Customer Interaction Scenario

Imagine a borrower, Sarah, who is experiencing difficulty accessing her online account. After several unsuccessful attempts to log in, she calls Earnest’s customer service. She initially encounters a lengthy hold time before reaching a representative. The representative, while polite, initially struggles to troubleshoot the issue, leading to frustration for Sarah. However, after transferring Sarah to a specialist, the problem is quickly resolved. The specialist identifies a technical glitch affecting several accounts and provides Sarah with temporary access while the issue is resolved. This scenario highlights both the potential challenges and the potential for positive resolution through effective escalation procedures within Earnest’s customer service structure. While the initial delay was frustrating, the ultimate resolution showcases the company’s capacity to provide satisfactory service despite operational setbacks.

Alternatives to Earnest Refinancing

Choosing the right student loan refinancing lender is crucial, as it significantly impacts your monthly payments and overall repayment cost. While Earnest is a popular option, several other lenders offer competitive refinancing programs. Exploring these alternatives allows you to compare rates, terms, and features to find the best fit for your financial situation. This section will Artikel several alternatives to Earnest, highlighting their key features and comparing them to Earnest’s offerings.

Comparison of Student Loan Refinancing Lenders

The following table compares Earnest with three other prominent student loan refinancing lenders. Note that interest rates are variable and depend on individual creditworthiness and market conditions. The data provided represents a snapshot in time and should be verified with the lenders directly before making any decisions.

| Lender | Loan Type | Interest Rate Range (Example – subject to change) | Key Features |

|---|---|---|---|

| Earnest | Federal and Private Loans | 5.00% – 12.00% APR | Competitive rates, flexible repayment options, customer-focused service, potential for discounts. |

| SoFi | Federal and Private Loans | 4.99% – 13.00% APR | Excellent customer service, unemployment protection, career services for members, various discounts. |

| LendKey | Federal and Private Loans | 5.50% – 14.00% APR | Partners with many credit unions and banks, potentially offering access to more favorable rates through specific partnerships, strong community focus. |

| Splash Financial | Federal and Private Loans | 6.00% – 15.00% APR | Focuses on personalized service and guidance, strong online tools and resources for borrowers, may be a good option for borrowers with unique financial situations. |

Advantages and Disadvantages of Alternative Lenders

Each lender presents a unique set of advantages and disadvantages. Careful consideration of these factors is essential before selecting a refinancing option.

SoFi: SoFi’s strong customer service and additional benefits like unemployment protection are attractive. However, their rates might not always be the absolute lowest compared to other lenders. The additional benefits may offset a slightly higher rate for some borrowers.

LendKey: LendKey’s partnership network can lead to potentially better rates depending on the credit union or bank involved. However, the process of finding the best rate might require more research and comparison across multiple partners.

Splash Financial: Splash Financial prioritizes personalized service and guidance, which is beneficial for borrowers needing extra support. However, this personalized approach might mean a slightly less streamlined application process compared to some larger lenders.

Decision-Making Flowchart for Student Loan Refinancing

The following flowchart provides a simplified framework to help borrowers navigate the refinancing decision. Remember to always check the latest rates and terms directly with each lender before making a final decision.

Start → Assess your credit score and financial situation → Compare rates and terms from Earnest and at least three other lenders (SoFi, LendKey, Splash Financial are examples) → Consider loan type (Federal vs. Private) and eligibility requirements → Evaluate key features (e.g., customer service, unemployment protection, discounts) → Choose the lender that best aligns with your needs and financial goals → Complete the application process → Review loan documents carefully before signing → End

Impact on Credit Score

Refinancing your student loans can impact your credit score, but the effect isn’t always predictable. It depends on several factors related to your credit history and how you manage the refinancing process. Understanding these factors can help you navigate the process and minimize any potential negative consequences.

Refinancing generally involves a “hard inquiry” on your credit report, which temporarily lowers your score by a few points. However, this is usually a minor and short-lived impact. More significant factors influencing your score after refinancing are your credit utilization ratio and the length of your credit history. Successfully refinancing and maintaining responsible repayment behavior can positively affect your credit score over the long term.

Hard Inquiries and Their Impact

A hard inquiry is a credit check performed when you apply for credit, like a student loan refinancing. Each hard inquiry slightly lowers your credit score, typically by a few points. However, multiple hard inquiries within a short period can have a more substantial impact. Credit scoring models generally account for multiple inquiries within a short timeframe as a single inquiry, mitigating this effect. The impact of a hard inquiry usually fades within a year. For example, if you apply for refinancing with Earnest and another lender simultaneously, the impact might be similar to a single inquiry.

Credit Utilization Ratio and its Influence

Your credit utilization ratio is the percentage of your available credit that you’re using. A lower utilization ratio (ideally below 30%) is generally better for your credit score. Refinancing can improve your credit utilization if it reduces your overall debt or increases your available credit. For instance, if you consolidate multiple loans with higher interest rates into a single loan with a lower rate, your monthly payment might decrease, freeing up more credit and lowering your utilization ratio. This positive change could lead to a gradual increase in your credit score.

Length of Credit History and Refinancing

A longer credit history generally leads to a better credit score. Refinancing can extend your credit history if your new loan has a longer repayment term than your existing loans. However, if you close your old loans entirely, the age of those accounts will no longer be considered in your credit score calculation. This effect can be minimized by maintaining a balance on other credit accounts, thus preserving the length of your overall credit history. For example, maintaining an active credit card account while refinancing student loans could mitigate the negative impact of closing older loan accounts.

Long-Term Implications of Credit Score Changes

The long-term impact of refinancing on your credit score depends on your responsible management of the new loan. Consistent on-time payments will help rebuild any credit score dip from the hard inquiry and will contribute to a gradual improvement in your score over time. Conversely, missed payments can severely damage your credit score, potentially impacting future financial decisions like buying a house or securing a car loan. A good credit score can lead to better interest rates on future loans and other financial benefits.

Illustrative Examples

Understanding the potential benefits and drawbacks of Earnest student loan refinancing requires examining specific scenarios. The following examples illustrate both successful and less successful refinancing experiences, highlighting key factors to consider.

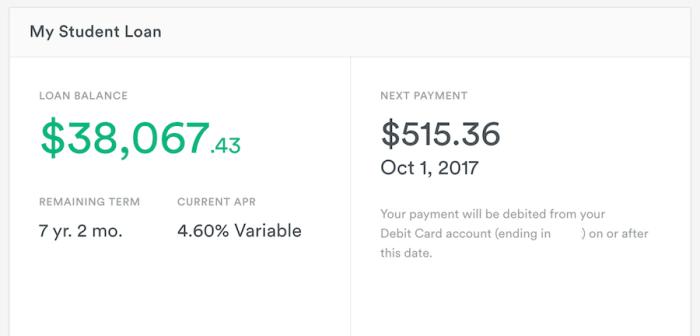

Successful Refinancing Scenario

Let’s imagine Sarah, a recent graduate with $40,000 in federal student loans at an average interest rate of 6.8%. She’s struggling to manage her monthly payments and is considering refinancing. After researching options, she chooses Earnest. Earnest offers her a refinancing package with a 4.5% interest rate, reducing her monthly payment and shortening her loan term from 10 years to 7 years. This results in significant interest savings over the life of the loan. Her new monthly payment is approximately $600, down from her previous $450, but the shorter repayment period allows her to become debt-free sooner.

Key Takeaways: Careful research and a strong credit score enabled Sarah to secure a significantly lower interest rate, leading to substantial savings on interest payments and faster debt repayment. Her improved financial situation resulted from a well-informed decision and a favorable outcome from the refinancing process.

Unsuccessful Refinancing Scenario

Consider Mark, who also has $40,000 in student loan debt. However, Mark has a lower credit score due to some past financial difficulties. When he applies for refinancing with Earnest, he’s offered a higher interest rate of 7.2%, only slightly lower than his current rate. The new monthly payment is only marginally lower than his current payment, and the loan term remains the same. He ends up saving little to no money, and the process consumed time and effort.

Key Takeaways: Mark’s less successful experience highlights the importance of a good credit score and financial stability when refinancing. The benefits of refinancing are not guaranteed, and borrowers with less-than-ideal credit profiles may not receive favorable interest rates or terms. He should have considered alternative options, such as income-driven repayment plans, before proceeding with refinancing.

Loan Amortization Schedule Visualization

Imagine a graph with two axes. The horizontal axis represents the time period (months) of the loan, while the vertical axis represents the dollar amount. Two lines are plotted on the graph. One line, representing the principal payment, starts low and gradually increases over time. The other line, representing the interest payment, starts high and gradually decreases over time. The sum of the two lines at any given month represents the total monthly payment. As the loan progresses, the proportion of the monthly payment going towards principal increases, while the proportion going towards interest decreases. The graph visually demonstrates how the repayment works and how the principal is gradually paid off over the life of the loan. The graph would clearly show a steeper decline in the principal balance with a shorter loan term.

Conclusion

Refinancing your student loans with Earnest or a comparable lender can significantly impact your financial future. By carefully weighing the benefits and drawbacks of different options, understanding the associated costs and risks, and considering your individual financial circumstances, you can make an informed choice that aligns with your long-term goals. Remember to thoroughly research all available options, compare rates and terms, and assess the potential impact on your credit score before proceeding. A well-informed decision can lead to substantial savings and a more manageable repayment plan.

FAQ Compilation

What is the minimum credit score required for Earnest student loan refinancing?

Earnest’s minimum credit score requirement isn’t publicly stated, but generally, a good to excellent credit score (typically above 670) significantly increases your chances of approval and securing favorable interest rates.

Can I refinance federal student loans with Earnest?

Yes, Earnest allows refinancing of federal student loans, but be aware that doing so will lose federal protections such as income-driven repayment plans and loan forgiveness programs.

How long does the Earnest refinancing application process take?

The application process can vary, but generally, it takes several weeks from application to final approval. The exact timeline depends on factors like the completeness of your application and the processing time.

What happens if my application is rejected by Earnest?

If your application is rejected, Earnest typically provides reasons for the denial. Common reasons include insufficient credit score, high debt-to-income ratio, or incomplete application information. You can reapply after addressing the stated issues.