Navigating the world of student loans can feel overwhelming, but understanding the options available can significantly ease the process. This guide clarifies the differences between federal and private loans, highlighting which might be the easiest to obtain based on your individual circumstances. We’ll explore eligibility requirements, application processes, and repayment options, empowering you to make informed decisions about financing your education.

Securing funding for higher education is a crucial step for many students. This guide demystifies the often-complex landscape of student loans, focusing on identifying the most accessible options. We’ll delve into factors such as credit scores, income, and financial need, providing practical advice and resources to help you navigate the application process successfully. Ultimately, our aim is to empower you to make informed choices and secure the financial support you need to pursue your educational goals.

Types of Student Loans

Navigating the world of student loans can feel overwhelming, but understanding the fundamental differences between federal and private loans is crucial for making informed borrowing decisions. This section will clarify the distinctions between these loan types and delve into the specifics of various federal loan programs, along with common features of private loans.

Federal vs. Private Student Loans

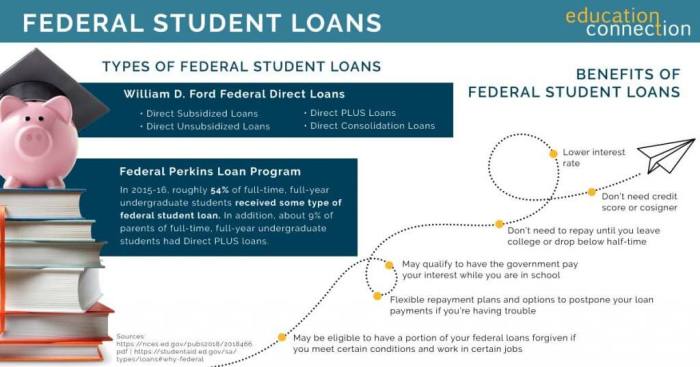

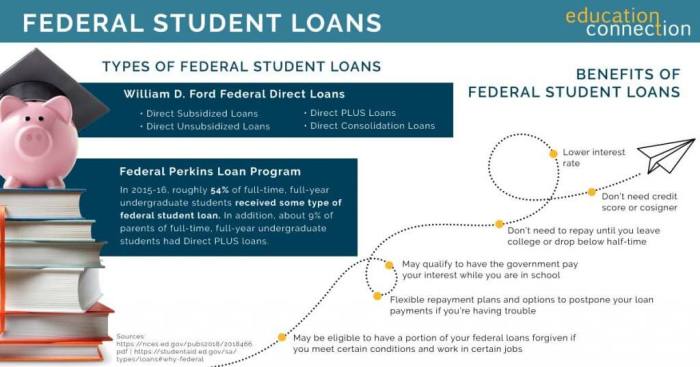

Federal student loans are offered by the U.S. government and generally come with more borrower protections than private loans. These protections include flexible repayment plans, income-driven repayment options, and loan forgiveness programs in certain circumstances. Private student loans, on the other hand, are offered by banks, credit unions, and other private lenders. They often have stricter eligibility requirements and may not offer the same level of borrower protections as federal loans. The interest rates on private loans are typically variable and can fluctuate, whereas federal loan interest rates are set annually.

Federal Student Loan Programs

The federal government offers several loan programs, each with its own eligibility criteria and terms.

Direct Subsidized Loans

Direct Subsidized Loans are need-based loans for undergraduate students demonstrating financial need. The government pays the interest while the student is enrolled at least half-time, during grace periods, and during deferment periods. This means borrowers don’t accrue interest during these periods.

Direct Unsubsidized Loans

Direct Unsubsidized Loans are available to undergraduate and graduate students, regardless of financial need. Interest accrues from the time the loan is disbursed, even while the student is in school. Borrowers are responsible for paying this accrued interest.

Direct PLUS Loans

Direct PLUS Loans are available to graduate or professional students and parents of dependent undergraduate students. Credit checks are performed, and borrowers with adverse credit history may be required to obtain an endorser or meet specific conditions to qualify. Interest accrues from the time the loan is disbursed.

Private Student Loan Features

Private student loans can offer various features, but borrowers should carefully consider their potential impact.

Variable vs. Fixed Interest Rates

Private loans often offer both variable and fixed interest rates. Variable rates fluctuate with market conditions, potentially leading to higher payments over the life of the loan. Fixed rates remain constant, providing predictable monthly payments.

Co-signers

Many private lenders require a co-signer with good credit to approve a loan application, especially for students with limited or no credit history. The co-signer shares responsibility for repayment if the borrower defaults.

Repayment Terms

Private loan repayment terms vary, ranging from several years to over a decade. Shorter terms result in higher monthly payments, while longer terms lead to more interest paid over the life of the loan.

Student Loan Comparison Table

| Loan Type | Interest Rate | Repayment Terms | Eligibility |

|---|---|---|---|

| Direct Subsidized Loan | Variable; set annually by the government | Standard 10-year repayment; income-driven repayment options available | Undergraduate students demonstrating financial need |

| Direct Unsubsidized Loan | Variable; set annually by the government | Standard 10-year repayment; income-driven repayment options available | Undergraduate and graduate students |

| Direct PLUS Loan | Variable; set annually by the government | Standard 10-year repayment; income-driven repayment options available | Graduate students, parents of dependent undergraduates (credit check required) |

| Private Student Loan | Variable or fixed; set by the lender | Varies by lender; typically 5-15 years | Varies by lender; typically requires good credit or a co-signer |

Credit Scores and History

Securing a private student loan often hinges on your creditworthiness, primarily assessed through your credit score. Lenders use this score to gauge the risk of lending you money; a higher score indicates a lower risk, leading to more favorable loan terms and a greater chance of approval. Conversely, a low or nonexistent credit history can significantly hinder your application.

Credit scores are numerical representations of your credit history, reflecting how responsibly you’ve managed credit in the past. Factors considered include payment history (missed or late payments negatively impact your score), amounts owed (high credit utilization is detrimental), length of credit history (longer history generally leads to better scores), credit mix (having various types of credit accounts is beneficial), and new credit (opening many new accounts in a short period can lower your score).

The Role of Co-signers in Loan Approval

A co-signer is an individual with established credit who agrees to share responsibility for repaying the loan. Their creditworthiness is considered alongside the student’s, significantly increasing the likelihood of loan approval, even if the student has limited or poor credit. Essentially, the co-signer acts as a guarantor, mitigating the risk for the lender. If the student defaults on the loan, the co-signer becomes responsible for the remaining balance. This is a significant commitment for the co-signer, so careful consideration is crucial for both parties involved. For example, a parent with a strong credit history can greatly improve a student’s chances of securing a private student loan.

Improving Credit Scores Before Applying for Loans

Building a positive credit history takes time and responsible financial behavior. Several actions can help students improve their credit scores before applying for student loans.

Building a positive credit history takes time and responsible financial behavior. Here are some steps students can take:

- Become an authorized user on a trusted individual’s credit card: This allows the positive payment history of the cardholder to be reflected on your credit report, boosting your score, provided the cardholder maintains a good payment record.

- Obtain a secured credit card: This requires a security deposit, which acts as your credit limit. Responsible use, paying on time and keeping the balance low, will help build credit.

- Pay all bills on time: Consistent on-time payments are the most significant factor influencing credit scores.

- Keep credit utilization low: Aim to use less than 30% of your available credit.

- Monitor your credit report regularly: Check for errors and fraudulent activity. You are entitled to a free credit report annually from each of the three major credit bureaus (Equifax, Experian, and TransUnion).

Resources for Improving Credit History

Several resources are available to assist students in understanding and improving their credit scores.

- AnnualCreditReport.com: The official website to obtain your free annual credit reports.

- Credit counseling agencies: These agencies can provide guidance on budgeting, debt management, and credit repair.

- Financial literacy websites and educational materials: Many reputable organizations offer free resources on personal finance and credit management.

Income and Financial Need

Securing student loans often hinges on demonstrating financial need, a crucial factor influencing eligibility, particularly for federal loans. Lenders assess both your income and your ability to repay the loan, considering your existing financial resources and obligations. This evaluation process differs slightly between federal and private loan applications.

Demonstrated Financial Need and Federal Student Loans

The Free Application for Federal Student Aid (FAFSA) is the primary tool used to determine financial need for federal student loans. The FAFSA gathers information about your family’s income, assets, and household size. This data is then processed through a complex formula to calculate your Expected Family Contribution (EFC). Your EFC represents the amount your family is expected to contribute towards your education. Subtracting your EFC from the cost of attendance (tuition, fees, room, board, etc.) yields your financial need. A higher financial need generally translates to greater eligibility for federal grants and subsidized loans, which offer more favorable repayment terms.

Documentation Required to Prove Financial Need

To complete the FAFSA accurately, you’ll need to gather several documents. This typically includes tax returns (IRS Form 1040), W-2 forms, and pay stubs to verify income. You may also need documentation of untaxed income, such as Social Security benefits or child support. Information about assets, such as savings accounts, investments, and property, is also required. Finally, you’ll need details about the cost of attendance at your chosen institution, which can usually be obtained from the school’s financial aid office. Providing accurate and complete documentation ensures a smooth and efficient processing of your FAFSA application.

Lender Assessment of Income and Financial Stability for Private Student Loans

Private lenders employ a more credit-focused approach compared to federal loan programs. While financial need isn’t a primary eligibility criterion, your income and financial stability play a significant role in determining your loan eligibility and interest rate. Lenders review your credit history, credit score, debt-to-income ratio, and employment history to assess your ability to repay the loan. A higher income and a strong credit history usually result in more favorable loan terms. They may also request documentation similar to that required for the FAFSA, including tax returns and pay stubs, to verify your income and employment.

Hypothetical Student’s Financial Need Calculation

Let’s consider a hypothetical student. Assume the cost of attendance at their university is $25,000 per year. After completing the FAFSA, their calculated Expected Family Contribution (EFC) is $10,000.

Financial Need = Cost of Attendance – EFC

Financial Need = $25,000 – $10,000 = $15,000

In this scenario, the student’s demonstrated financial need is $15,000. This amount represents the portion of their educational expenses that they may be eligible to cover through federal grants and loans. The actual amount of aid received would depend on the availability of funds and the specific programs offered by the university.

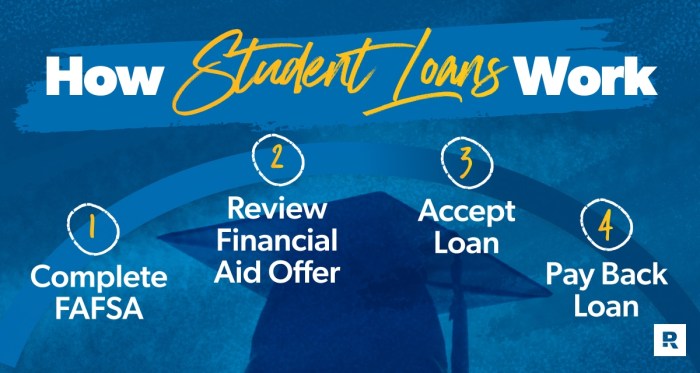

Application Process

Securing student loans, whether federal or private, involves a distinct application process. Understanding these steps is crucial for a smooth and successful application. This section details the procedures for both federal and private loan applications, highlighting key differences.

Applying for Federal Student Loans through the FAFSA

The Free Application for Federal Student Aid (FAFSA) is the gateway to federal student loans. Completing the FAFSA accurately and thoroughly is paramount. The process generally involves these steps:

- Create an FSA ID: Both the student and a parent (if the student is a dependent) need an FSA ID, a username and password used to access and sign the FAFSA. This is a crucial first step.

- Gather Necessary Information: Collect your Social Security number, federal tax returns (yours and your parents’, if applicable), and other financial documents. Accurate information is vital for determining your eligibility.

- Complete the FAFSA Form: The online form requests detailed information about your financial situation, family income, assets, and educational plans. Carefully review each question before submitting.

- Submit the FAFSA: Once completed and reviewed, submit the form electronically. You’ll receive a Student Aid Report (SAR) confirming receipt and providing preliminary eligibility information.

- Review Your Student Aid Report (SAR): Check the SAR for accuracy. Correct any errors promptly. This report is essential for understanding your financial aid package.

- Accept Your Financial Aid Offer: Your school will notify you of your financial aid offer, including federal student loans. You’ll need to accept the loans you wish to receive.

Applying for Private Student Loans

Private student loans are offered by banks, credit unions, and other financial institutions. The application process differs significantly from federal loans and often involves:

- Research Lenders: Compare interest rates, fees, and repayment terms from multiple lenders to find the best option. Interest rates can vary significantly.

- Pre-qualification (Optional): Some lenders offer pre-qualification, allowing you to check your eligibility without impacting your credit score. This provides a good starting point.

- Complete the Application: The application will require personal information, financial details (income, credit history, etc.), and information about your education. Be prepared to provide supporting documentation.

- Provide Supporting Documentation: This typically includes proof of enrollment, tax returns, and possibly bank statements. The lender will verify this information.

- Credit Check: Most private lenders perform a credit check. A good credit score significantly improves your chances of approval and securing a favorable interest rate.

- Loan Approval and Disbursement: Once approved, the funds are disbursed directly to your school or to you, depending on the lender’s policy. This usually takes a few weeks.

Comparison of Federal and Private Loan Application Processes

Federal loans, through the FAFSA, emphasize need-based aid and generally have a simpler application process. Private loans, conversely, are credit-based, requiring a credit check and often a co-signer, leading to a more complex application. Federal loans offer various repayment options and protections, while private loans typically have less flexibility.

Private Student Loan Application Flowchart

A flowchart illustrating the typical private student loan application process would visually depict the steps as follows:

[Start] –> [Research Lenders] –> [Pre-qualification (Optional)] –> [Complete Application] –> [Provide Documentation] –> [Credit Check] –> [Loan Approval/Denial] –> [Loan Disbursement (if approved)] –> [End]

Each step would be represented by a box, with arrows indicating the flow of the process. A “no” outcome at the credit check would lead back to exploring options such as a co-signer or alternative lenders.

Repayment Options

Choosing the right repayment plan for your student loans is crucial for managing your debt effectively and avoiding financial hardship. Understanding the various options available, both for federal and private loans, is key to making an informed decision. The best plan will depend on your individual financial situation and income.

Federal Student Loan Repayment Plans

The federal government offers several repayment plans designed to cater to different borrowers’ needs and financial circumstances. These plans provide flexibility and options to manage monthly payments.

Standard Repayment Plan: This is the default plan, requiring fixed monthly payments over a 10-year period. It’s straightforward but may result in higher monthly payments compared to income-driven plans.

Graduated Repayment Plan: Payments start low and gradually increase every two years over a 10-year period. This option might be appealing initially, but payments become significantly higher in later years.

Extended Repayment Plan: This plan stretches payments over a longer period (up to 25 years), lowering monthly payments but increasing the total interest paid.

Income-Driven Repayment Plans: These plans, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR), tie monthly payments to your income and family size. Payments are typically lower, and any remaining debt may be forgiven after 20 or 25 years, depending on the plan. Forgiveness is subject to tax implications.

Private Student Loan Repayment Options

Private lenders offer a range of repayment options, often less generous than federal plans. These options typically lack the income-driven repayment flexibility and loan forgiveness programs available with federal loans.

Standard Repayment: Similar to the federal standard plan, this involves fixed monthly payments over a set period, usually 5-15 years.

Graduated Repayment: Similar to the federal graduated plan, this option starts with lower payments that increase over time.

Short-Term Repayment: Some private lenders offer shorter repayment terms, leading to higher monthly payments but less overall interest paid.

Deferment and Forbearance: Private lenders may offer deferment (temporary postponement of payments) or forbearance (reduction of payments) under specific circumstances, but these are often less flexible than federal programs. It’s crucial to review the terms carefully, as interest may still accrue during these periods.

Comparison of Repayment Plans

Different repayment plans offer varying advantages and disadvantages. Choosing the right plan requires careful consideration of your financial situation, income, and long-term goals.

| Repayment Plan | Payment Amount | Repayment Period | Advantages | Disadvantages |

|---|---|---|---|---|

| Standard | Fixed, higher | 10 years | Predictable payments, pays off loan quickly | Higher monthly payments |

| Graduated | Starts low, increases | 10 years | Lower initial payments | Substantially higher payments later |

| Extended | Lower | Up to 25 years | Lower monthly payments | More interest paid overall |

| Income-Driven | Based on income | 20-25 years (potential forgiveness) | Lower payments, potential forgiveness | Longer repayment period, potential tax implications on forgiveness |

Understanding Loan Terms

Securing a student loan involves understanding several key terms that directly impact your borrowing experience and long-term financial health. Familiarizing yourself with these terms will empower you to make informed decisions and avoid potential pitfalls. This section clarifies crucial loan components and their implications.

Interest Rate

The interest rate is the cost of borrowing money, expressed as a percentage of the principal loan amount. A higher interest rate means you’ll pay more in interest over the life of the loan. For example, a loan with a 5% interest rate will accrue less interest compared to a loan with a 7% interest rate, assuming all other factors remain constant. The interest rate is usually fixed or variable. A fixed interest rate remains constant throughout the loan term, while a variable rate can fluctuate, potentially increasing or decreasing your monthly payments. Understanding the type of interest rate is crucial for budgeting and long-term financial planning.

Principal

The principal is the original amount of money borrowed. This is the amount you’ll need to repay, excluding interest. For instance, if you borrow $10,000 for your education, the $10,000 represents the principal. Throughout the repayment period, your payments will gradually reduce the principal amount until it reaches zero.

Amortization

Amortization is the process of gradually paying off a loan over time through regular payments. Each payment typically covers both interest and a portion of the principal. An amortization schedule details the breakdown of each payment, showing how much goes towards interest and how much reduces the principal balance. Early in the repayment period, a larger portion of your payment goes toward interest, while later payments allocate more towards the principal.

Deferment

Deferment is a temporary postponement of loan payments. During a deferment period, interest may or may not accrue, depending on the loan type and terms. Deferments are often granted under specific circumstances, such as unemployment or enrollment in further education. It’s essential to understand the terms of any deferment granted, as accruing interest during this period can significantly increase the total loan cost.

Impact of Different Interest Rates

Consider two loans, both for $10,000, but with different interest rates: one at 5% and another at 7%, both over a 10-year repayment period. The 5% loan will likely result in significantly lower total interest paid compared to the 7% loan. This difference can amount to hundreds or even thousands of dollars over the life of the loan, highlighting the importance of securing the lowest possible interest rate. The exact difference will depend on the specific repayment plan.

Consequences of Defaulting on Student Loans

Defaulting on student loans has severe consequences. These can include damage to your credit score, making it difficult to obtain loans or credit cards in the future. Wage garnishment, where a portion of your paycheck is seized to repay the debt, is another possibility. The government may also take tax refunds to repay the debt. In extreme cases, it could affect your ability to rent an apartment or even obtain professional licenses. Avoiding default requires careful financial planning and proactive communication with your loan servicer if you anticipate difficulties in making payments.

Glossary of Common Student Loan Terminology

| Term | Definition |

|---|---|

| Interest Rate | The percentage charged on the principal loan amount. |

| Principal | The original amount borrowed. |

| Amortization | The process of paying off a loan gradually over time. |

| Deferment | A temporary postponement of loan payments. |

| Forbearance | A temporary reduction or suspension of loan payments. |

| Loan Servicer | The company responsible for managing your student loans. |

| Default | Failure to make loan payments as agreed. |

| Subsidized Loan | The government pays the interest while you’re in school. |

| Unsubsidized Loan | Interest accrues while you’re in school. |

Potential Risks and Considerations

Taking out student loans can be a crucial step towards achieving higher education, but it’s vital to understand the potential financial implications. Borrowing significant sums of money for education carries inherent risks, and careful planning and responsible borrowing habits are essential to navigate these challenges successfully. Failing to do so can lead to significant long-term financial strain.

Student loan debt, if not managed effectively, can significantly impact your financial future. The weight of repayment can delay major life decisions like buying a home, starting a family, or investing in retirement. Understanding the potential risks and employing sound financial strategies is crucial for mitigating these challenges.

Responsible Borrowing Strategies

Effective debt management begins with careful planning and budgeting. Before taking out any loans, create a realistic budget that accounts for tuition fees, living expenses, and loan repayments. Explore all available financial aid options, including grants and scholarships, to minimize the amount you need to borrow. Prioritize loans with the lowest interest rates and favorable repayment terms. Regularly monitor your loan balances and repayment progress, making extra payments whenever possible to reduce the principal amount and save on interest. Consider creating a dedicated savings account for unexpected expenses or emergencies to avoid relying on additional loans. Finally, maintain open communication with your loan servicer to address any concerns or difficulties promptly.

Financial Literacy and Debt Counseling Resources

Numerous resources are available to help students navigate the complexities of student loan debt. Many universities offer financial literacy workshops and counseling services, providing personalized guidance on budgeting, loan management, and financial planning. Non-profit organizations, such as the National Foundation for Credit Counseling (NFCC), offer free or low-cost credit counseling and debt management services. Government agencies, like the Federal Student Aid website (studentaid.gov), provide comprehensive information on federal student loans, repayment plans, and debt forgiveness programs. Online resources and educational materials are also readily available, covering topics such as budgeting, saving, and investing. Utilizing these resources can empower students to make informed decisions and manage their finances effectively.

Warning Signs of Student Loan Debt Problems

Several warning signs can indicate potential problems with student loan debt. Difficulty making minimum monthly payments, consistently relying on credit cards to cover expenses, and accumulating high-interest debt are significant red flags. Experiencing significant stress or anxiety related to student loan repayments is another indicator of potential issues. If you find yourself frequently falling behind on payments, facing wage garnishment, or struggling to meet your basic living expenses due to loan repayments, it’s crucial to seek professional help immediately. Ignoring these warning signs can lead to serious financial consequences, including damage to your credit score, collection agency involvement, and potential legal action. Proactive intervention through debt counseling or exploring repayment options can help prevent these negative outcomes.

Outcome Summary

Choosing the right student loan can significantly impact your financial future. By understanding the nuances of federal and private loans, eligibility criteria, and repayment options, you can make informed decisions that align with your financial situation. Remember to explore all available resources and seek professional advice if needed to ensure a smooth and successful loan application process. Proactive planning and responsible borrowing are key to managing your student loan debt effectively.

FAQ Guide

What is the difference between subsidized and unsubsidized federal loans?

Subsidized loans don’t accrue interest while you’re in school, grace periods, or deferment. Unsubsidized loans accrue interest from the time the loan is disbursed.

Can I get a student loan with bad credit?

Federal student loans generally don’t require a credit check, but private loans often do. A co-signer with good credit may increase your chances of approval with bad credit.

What happens if I default on my student loans?

Defaulting can result in wage garnishment, tax refund offset, and damage to your credit score. It can also make it difficult to obtain future loans.

How long does the student loan application process take?

The timeframe varies depending on the type of loan and lender. Federal loans can be processed relatively quickly, while private loans may take longer.