Navigating the world of student loans can feel overwhelming, especially when faced with the complexities of federal funding options. This guide delves into the intricacies of ED Fund student loans, providing a clear understanding of eligibility, application processes, repayment strategies, and potential forgiveness programs. We aim to demystify the process, empowering you with the knowledge to make informed decisions about your educational financing.

From understanding the various loan types and their associated interest rates to developing effective repayment plans and exploring avenues for loan forgiveness, we cover all the essential aspects. We’ll also address common challenges faced by applicants and provide practical tips for managing your student loan debt effectively, ensuring a smoother path towards financial stability after graduation.

Understanding ED Fund Student Loans

ED Fund student loans, while not a federally-backed program like those offered by the Department of Education, represent a significant avenue for financing higher education. Understanding their eligibility criteria, available loan types, and comparative advantages is crucial for prospective students considering this option. This section will provide a clear overview of ED Fund loans, enabling informed decision-making.

Eligibility Criteria for ED Fund Student Loans

Eligibility for ED Fund student loans varies depending on the specific lender and the loan program. Generally, lenders will assess creditworthiness, income, and debt-to-income ratio. Applicants are typically required to be enrolled or accepted into an eligible educational program at an accredited institution. Specific requirements regarding minimum credit scores, acceptable debt levels, and proof of enrollment will be Artikeld in the lender’s application materials. It’s crucial to review these requirements carefully before applying.

Types of ED Fund Student Loans

ED Fund loans are not a single, monolithic program. Instead, various lenders offer a range of student loan products under the ED Fund umbrella. These may include private student loans, federal student loans (if the lender participates in federal programs), and potentially other financing options tailored to specific educational needs or institutions. The exact types of loans offered will vary depending on the lender and their partnerships. Direct comparison across lenders is essential to find the most suitable option.

Comparison of ED Fund Loans with Other Federal Student Loan Programs

ED Fund loans differ significantly from federal student loan programs like Direct Subsidized and Unsubsidized Loans, Stafford Loans, and PLUS Loans. Federal loans generally offer more favorable interest rates and repayment options, often including income-driven repayment plans and loan forgiveness programs. Federal loans also come with robust consumer protections. In contrast, ED Fund loans, being primarily private, may have higher interest rates, stricter eligibility requirements, and fewer government-backed safeguards. The choice between federal and ED Fund loans depends on individual circumstances and risk tolerance.

Situations Where an ED Fund Loan Would Be Beneficial

An ED Fund loan might be a beneficial option in situations where a student does not qualify for federal loans due to credit history or income. Additionally, if a student’s educational needs exceed the borrowing limits of federal programs, a supplemental ED Fund loan could bridge the gap. Finally, some ED Fund loans might offer unique features, such as flexible repayment plans or lower initial payments, that could align better with a student’s financial circumstances. However, careful consideration of interest rates and overall cost is crucial.

Comparison of Interest Rates and Repayment Terms

The interest rates and repayment terms for ED Fund loans vary considerably depending on the lender, the type of loan, and the borrower’s creditworthiness. The following table provides a hypothetical comparison, emphasizing the variability rather than specific, fixed rates. Always consult the lender directly for the most current information.

| Loan Type | Interest Rate (Example) | Repayment Term (Example) | Notes |

|---|---|---|---|

| Private Loan (Good Credit) | 6-8% | 5-10 years | Rates can fluctuate based on market conditions. |

| Private Loan (Fair Credit) | 9-12% | 5-15 years | Higher rates reflect increased risk for the lender. |

| Federal Loan (Subsidized) | Variable, currently around 4-5% | 10-20 years | Interest may not accrue while in school. |

| Federal Loan (Unsubsidized) | Variable, currently around 4-5% | 10-20 years | Interest accrues from disbursement. |

Application and Approval Process

Securing an ED Fund student loan involves a straightforward yet crucial process. Understanding the steps, required documentation, and potential hurdles can significantly improve your chances of a successful application. This section details the application procedure, common challenges, and reasons for rejection.

The application process for an ED Fund student loan typically begins online through the lender’s designated portal. Applicants will need to create an account and complete a comprehensive application form, providing accurate and detailed personal and financial information. This information is used to assess creditworthiness and determine eligibility for the loan.

Required Documentation

A successful application hinges on providing complete and accurate documentation. Incomplete applications often lead to delays or rejection. Therefore, gathering all necessary documents beforehand is highly recommended.

- Completed application form

- Government-issued photo identification (e.g., passport, driver’s license)

- Proof of enrollment or acceptance letter from an accredited educational institution

- Social Security number

- Tax returns (or proof of income for non-tax filers)

- Bank statements (demonstrating sufficient funds for loan repayment)

- Co-signer information (if required)

Potential Application Challenges

Applicants may encounter various challenges during the application process. Being aware of these potential issues can help mitigate delays and improve the likelihood of approval.

- Incomplete or inaccurate information: Errors or omissions on the application form can lead to delays or rejection.

- Insufficient documentation: Failing to provide all required documents can significantly hinder the process.

- Credit history issues: A poor credit history can negatively impact loan approval chances. This includes defaults, bankruptcies, or late payments.

- Lack of sufficient income or assets: Lenders assess applicants’ ability to repay the loan. Insufficient income or assets may lead to rejection.

- Errors in the application system: Technical glitches or errors within the online application system can cause delays. Contacting customer support can resolve these issues.

Application and Approval Process Flowchart

The following flowchart illustrates the typical steps involved in the ED Fund student loan application and approval process:

[Imagine a flowchart here. The flowchart would begin with “Application Submission,” branching to “Complete Application?” Yes leads to “Document Verification,” then “Credit Check,” then “Loan Approval/Rejection.” No leads back to “Complete Application.” Rejection branches to “Reasons for Rejection,” and Approval branches to “Loan Disbursement.”]

Common Reasons for Loan Application Rejection

Understanding the common reasons for loan application rejection allows applicants to proactively address potential issues and improve their chances of approval.

- Poor credit history: A history of late payments or defaults significantly impacts creditworthiness.

- Insufficient income: Lenders assess the applicant’s ability to repay the loan. Low income may indicate an inability to meet repayment obligations.

- Lack of assets: Limited assets can signal a higher risk to the lender.

- Incomplete application: Missing information or documentation prevents a thorough assessment of the application.

- Inaccurate information: Providing false or misleading information will result in immediate rejection.

- Failure to meet eligibility criteria: Not meeting the lender’s specific requirements, such as enrollment in an eligible program, will lead to rejection.

Repayment Options and Strategies

Understanding your repayment options is crucial for successfully managing your ED Fund student loans. Choosing the right plan and developing a sound repayment strategy can significantly impact the total amount you pay and the length of time it takes to become debt-free. This section Artikels various repayment plans and offers strategies to minimize interest costs and effectively manage your debt.

ED Fund Loan Repayment Plans

The ED Fund likely offers several repayment plans, each with its own set of advantages and disadvantages. These typically include standard repayment plans, graduated repayment plans, extended repayment plans, and income-driven repayment plans. A standard plan involves fixed monthly payments over a set period (usually 10 years). A graduated plan starts with lower payments that gradually increase over time. Extended plans stretch repayments over a longer period, lowering monthly payments but increasing total interest paid. Income-driven plans base monthly payments on your income and family size, offering potentially lower payments but potentially extending the repayment period significantly. The specific plans available and their details will be Artikeld in your loan agreement and on the ED Fund’s website.

Advantages and Disadvantages of Repayment Plans

| Repayment Plan | Advantages | Disadvantages |

|---|---|---|

| Standard Repayment | Predictable payments, shortest repayment period | Higher monthly payments |

| Graduated Repayment | Lower initial payments | Payments increase significantly over time, longer repayment period |

| Extended Repayment | Lowest monthly payments | Longest repayment period, highest total interest paid |

| Income-Driven Repayment | Payments adjusted to income, potentially affordable payments | Longer repayment period, potential for loan forgiveness after 20-25 years (depending on the specific plan and program requirements), may lead to higher total interest paid over time. |

Repayment Strategies to Minimize Interest Costs

Making extra payments, even small ones, can significantly reduce the total interest paid and shorten the repayment period. For example, paying an extra $50 per month on a $10,000 loan could save thousands of dollars in interest and pay off the loan years earlier. Another effective strategy is to prioritize higher-interest loans. If you have multiple loans, focus on paying down the loan with the highest interest rate first, a method known as the avalanche method. Alternatively, the snowball method focuses on paying off the smallest loan first for a psychological boost of motivation. Both strategies can be effective depending on individual preferences and financial situations. A real-life example would be someone with a $5,000 loan at 8% interest and a $10,000 loan at 5%. The avalanche method would focus on the $5,000 loan first.

Tips for Managing Student Loan Debt Effectively

Budgeting is essential for effective debt management. Track your income and expenses to understand where your money is going and identify areas where you can cut back. Automate payments to avoid late fees and ensure consistent payments. Explore refinancing options if interest rates have fallen since you took out your loans. Consider consolidating multiple loans into a single loan with a potentially lower interest rate. Finally, maintain open communication with your loan servicer; if you anticipate difficulty making payments, contact them promptly to explore options like forbearance or deferment. Proactive communication can prevent negative consequences and help you find a solution.

Creating a Personal Student Loan Repayment Budget

Developing a detailed budget is crucial for successful student loan repayment. This will help you visualize your financial situation and track your progress.

- List all income sources: Include salary, part-time jobs, and any other income streams.

- Track all expenses: Categorize expenses (housing, food, transportation, entertainment, etc.) to identify areas for potential savings.

- Calculate your net income: Subtract total expenses from your total income.

- Allocate funds for student loan payments: Determine how much you can comfortably afford to pay each month based on your net income and expenses.

- Create a repayment schedule: Artikel your payment plan, including payment amounts, due dates, and loan balances.

- Regularly review and adjust your budget: Life circumstances change, so periodically review your budget and make necessary adjustments.

Default and its Consequences

Defaulting on an ED Fund student loan carries significant and long-lasting negative consequences that extend far beyond simply owing money. It can severely impact your credit score, financial stability, and future opportunities. Understanding these consequences is crucial for responsible loan management.

Defaulting on a federal student loan means you have failed to make payments for 270 days (nine months). This triggers a series of actions by the loan servicer and the government, significantly impacting your financial life.

Consequences of Student Loan Default

Defaulting on your ED Fund student loan has several serious repercussions. Your credit score will be severely damaged, making it difficult to obtain loans, credit cards, rent an apartment, or even secure certain jobs. The government may garnish your wages, seize your tax refunds, and even pursue legal action to recover the debt. Furthermore, your ability to access future federal student aid, including grants and loans, will be significantly restricted. The negative impact on your credit report can remain for seven years or even longer, hindering your financial prospects for an extended period. For example, someone who defaults on a $20,000 loan could face thousands of dollars in additional fees and collection costs, along with the long-term damage to their creditworthiness.

Options for Borrowers Facing Loan Default

Several options are available to borrowers facing imminent default or who have already defaulted. The most common and effective strategies include loan rehabilitation and consolidation. These programs offer a path towards resolving the default and restoring your creditworthiness. It is vital to contact your loan servicer immediately if you are struggling to make payments, as they can explain your options and help you avoid default. Waiting until default occurs will significantly limit your options and increase the challenges you face.

Loan Rehabilitation After Default

Loan rehabilitation is a process that allows you to restore your defaulted federal student loan to good standing. This involves making nine on-time payments over a 10-month period. Once you complete the rehabilitation process, the default is removed from your credit report, and you may be eligible for certain federal student aid programs again. The rehabilitation process requires careful planning and commitment, but it can be a highly effective way to address a defaulted loan and avoid more serious consequences.

Long-Term Financial Impact of Loan Default

The long-term financial consequences of student loan default can be substantial and far-reaching. A damaged credit score will make it difficult to secure favorable interest rates on future loans, leading to higher borrowing costs for mortgages, car loans, and other essential financing. It can also limit your access to employment opportunities, as many employers conduct credit checks. The accumulation of fees and collection costs associated with a defaulted loan can significantly increase the overall debt burden, making it even harder to recover financially. For example, a person defaulting on a loan could find themselves unable to purchase a home or secure a loan for a business venture, leading to significant limitations on their future financial prospects.

Resources for Borrowers Struggling with Loan Repayment

Several resources are available to assist borrowers struggling with student loan repayment. The National Foundation for Credit Counseling (NFCC) offers free and low-cost credit counseling services, including debt management plans. The U.S. Department of Education’s website provides detailed information on loan repayment options, default prevention strategies, and available assistance programs. Additionally, many non-profit organizations offer financial literacy programs and support services to individuals facing financial hardship. These resources can provide valuable guidance and support in navigating the complexities of student loan repayment and avoiding default.

Impact of ED Fund Loans on Students and the Economy

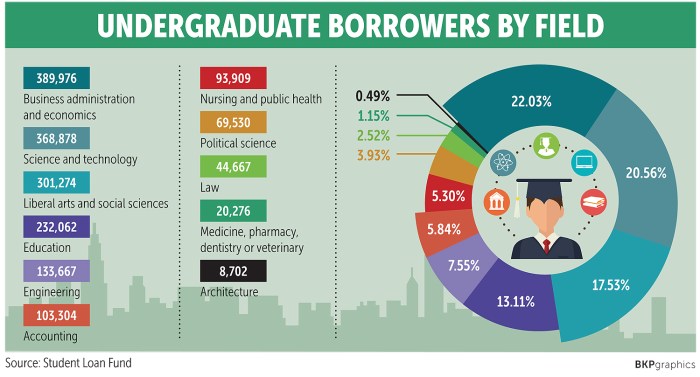

ED Fund loans play a significant role in shaping both individual lives and the broader economic landscape. By providing access to higher education for students who might otherwise be unable to afford it, these loans contribute to a more skilled and productive workforce, ultimately boosting economic growth. However, the increasing burden of student loan debt also presents challenges that warrant careful consideration.

ED Fund loans’ primary impact is expanding access to higher education. Many students rely on these loans to cover tuition, fees, living expenses, and other educational costs. This increased access leads to a more diverse and qualified workforce, benefiting various sectors of the economy. The availability of these funds allows individuals from lower socioeconomic backgrounds to pursue higher education, increasing social mobility and reducing income inequality.

Economic Benefits of Student Loan Programs

Student loan programs, like the ED Fund, contribute significantly to the economy. Increased educational attainment leads to higher earning potential for graduates, resulting in increased tax revenue for the government. Furthermore, a more educated workforce fosters innovation, technological advancements, and overall economic productivity. Studies consistently show a positive correlation between higher education levels and economic growth. For instance, a 2019 study by the Georgetown University Center on Education and the Workforce found that individuals with bachelor’s degrees earn significantly more over their lifetime than those with only high school diplomas, contributing to greater overall economic output.

Impact of Student Loan Debt on Graduates’ Financial Well-being

While student loan programs offer undeniable benefits, the accumulating debt can significantly impact graduates’ financial well-being. Many graduates face challenges in managing their loan repayments, particularly those with high debt burdens. This can delay major life milestones such as homeownership, starting a family, and saving for retirement. The stress associated with managing student loan debt can also negatively affect mental health and overall quality of life. For example, a recent survey indicated that a significant percentage of recent graduates reported delaying marriage or homeownership due to student loan repayments.

Long-Term Effects of Student Loan Debt

The long-term effects of student loan debt can be far-reaching. High levels of debt can restrict career choices, as graduates may prioritize job security and salary over passion or career fulfillment. This can lead to a less fulfilling professional life and potentially lower overall job satisfaction. Furthermore, the burden of student loan debt can be passed down through generations, impacting families for years to come. For example, some individuals may delay having children or provide less financial support to their own children due to their existing debt burden. The societal impact includes a potential reduction in entrepreneurial activity, as individuals burdened by debt may be less inclined to take the financial risks associated with starting a business.

Student Loan Debt and Future Career Choices

The level of student loan debt can significantly influence career choices. Graduates with substantial debt may be more likely to accept higher-paying jobs, even if those jobs are less fulfilling or don’t align with their career aspirations. They may also be less likely to pursue further education or training, limiting their long-term career prospects. Conversely, those with lower debt burdens have more flexibility to pursue careers aligned with their interests, potentially leading to greater job satisfaction and overall well-being. This effect is particularly pronounced in fields that traditionally offer lower salaries, such as the arts or social work, where graduates may forgo these careers due to the financial constraints of high debt levels.

End of Discussion

Securing an education shouldn’t be hindered by financial constraints. Understanding ED Fund student loans, their benefits, and potential drawbacks is crucial for prospective and current students alike. By carefully considering eligibility criteria, navigating the application process, and developing a sound repayment strategy, borrowers can leverage these loans to achieve their educational goals without jeopardizing their long-term financial well-being. Remember to explore all available resources and seek professional advice when needed to make the most informed decisions about your student loan journey.

Question Bank

What is the difference between subsidized and unsubsidized ED Fund loans?

Subsidized loans don’t accrue interest while you’re in school, grace periods, and deferment. Unsubsidized loans accrue interest from disbursement.

Can I consolidate my ED Fund loans?

Yes, consolidating your ED Fund loans can simplify repayment by combining them into a single loan with one monthly payment. However, be aware of potential impacts on interest rates and repayment terms.

What happens if I miss a student loan payment?

Missing payments can lead to late fees, damage your credit score, and eventually, default. Contact your loan servicer immediately if you anticipate difficulty making payments.

Are there income-driven repayment plans for ED Fund loans?

Yes, several income-driven repayment plans adjust your monthly payments based on your income and family size, potentially lowering your monthly payments and extending your repayment period.