Navigating the world of student loans can be daunting, especially when considering private options. This guide delves into Edly private student loans, providing a detailed examination of eligibility requirements, interest rates, repayment plans, and the application process. We’ll compare Edly to other major lenders and federal loan programs, equipping you with the knowledge to make informed decisions about financing your education.

Understanding the nuances of private student loans is crucial for responsible borrowing. This guide aims to clarify the complexities of Edly’s offerings, helping you assess whether an Edly private student loan aligns with your financial circumstances and long-term goals. We will explore various aspects, from the initial application to managing repayment, ensuring you have a clear picture before committing.

Edly Private Student Loan

Securing funding for higher education can be a significant undertaking. Private student loans, like those offered by Edly, provide an alternative financing option for students and parents who may need additional financial assistance beyond federal loans or scholarships. Understanding the eligibility requirements is crucial for a successful application process.

Edly Private Student Loan Eligibility Criteria

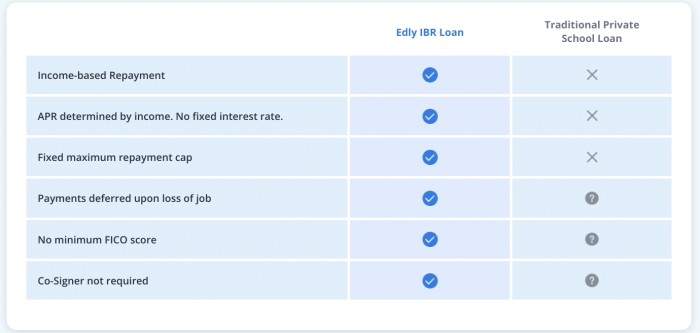

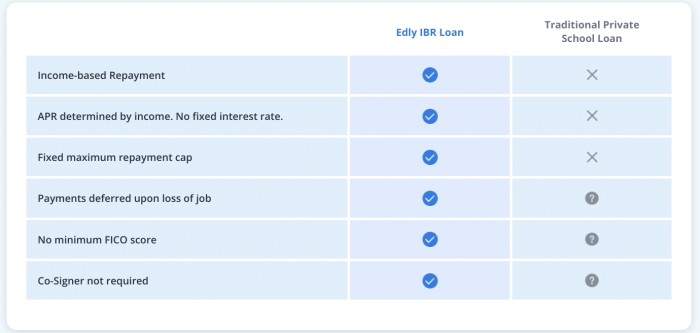

Edly’s eligibility criteria, like those of other private student loan providers, focus on assessing the applicant’s creditworthiness and ability to repay the loan. Key factors considered include credit history, income verification, and the potential need for a co-signer. A strong credit history significantly improves the chances of approval and may result in more favorable interest rates. Income verification helps lenders assess the borrower’s ability to manage monthly payments. In some cases, a co-signer—an individual with good credit who agrees to share responsibility for repayment—may be required to strengthen the application. The specific requirements can vary depending on the applicant’s circumstances and the loan amount sought.

Comparison of Eligibility Criteria Across Private Student Loan Providers

While Edly’s specific requirements aren’t publicly listed in detail on their website in a way easily comparable to other lenders, we can create a generalized comparison based on industry standards and publicly available information from similar lenders. It’s crucial to check directly with each lender for the most up-to-date and precise eligibility details.

| Lender | Credit Score Requirement | Income Verification | Co-signer Requirement |

|---|---|---|---|

| Edly | Generally requires a good credit score, but specifics vary based on co-signer availability and loan amount. A higher credit score typically leads to better terms. | Typically requires documentation of income, such as pay stubs or tax returns. | May be required for applicants with limited or poor credit history. |

| Sallie Mae | Generally requires a good to excellent credit score (often 660 or higher). | Requires documentation of income and employment. | Often required for applicants with poor or limited credit history. |

| Discover | Similar to Sallie Mae, typically requires a good to excellent credit score. | Requires documentation of income and employment. | May be required depending on credit history and loan amount. |

Edly Private Student Loan

Edly offers private student loans to help students finance their higher education. Understanding the interest rates and fees associated with these loans is crucial for borrowers to make informed decisions and manage their finances effectively. This section provides a detailed overview of Edly’s pricing structure, allowing for comparison with other lenders.

Interest Rates and Their Determination

Edly’s private student loan interest rates are variable or fixed, depending on the borrower’s creditworthiness and the loan terms selected. Variable rates fluctuate with market conditions, potentially leading to lower payments initially but exposing borrowers to rate increases over time. Fixed rates remain constant throughout the loan term, providing predictable monthly payments. The specific interest rate offered to an individual borrower is determined by a complex algorithm considering factors such as credit score, credit history, income, loan amount, and the chosen repayment plan. A higher credit score and a strong credit history generally result in a lower interest rate. Additionally, co-signers can positively influence the interest rate offered.

Fees Associated with Edly Private Student Loans

Several fees may be associated with Edly private student loans. Origination fees, charged upfront, cover the lender’s administrative costs of processing the loan application. Late payment fees are incurred if a borrower misses a payment, impacting their credit score and increasing the total loan cost. Prepayment penalties, while less common with private student loans, might apply if a borrower pays off the loan early. It’s essential to carefully review the loan agreement to understand all applicable fees and their amounts. These fees, while seemingly small individually, can accumulate over the loan’s lifespan and significantly impact the overall cost of borrowing.

Comparison of Edly with Competitors

The following table compares Edly’s interest rates and fees with those of two hypothetical competitors, Lender A and Lender B. Note that actual rates and fees can vary based on individual borrower profiles and market conditions. This is a simplified comparison for illustrative purposes only, and prospective borrowers should always consult the lenders directly for the most up-to-date information.

| Lender | Interest Rate Type | APR (Example) | Fee Structure |

|---|---|---|---|

| Edly | Variable | 7.5% – 12% | Origination fee: 1% – 3%; Late payment fee: $25; No prepayment penalty |

| Lender A | Fixed | 8.0% – 13% | Origination fee: 2%; Late payment fee: $30; Prepayment penalty: 1% |

| Lender B | Variable | 7.0% – 11% | Origination fee: 0.5%; Late payment fee: $20; No prepayment penalty |

Edly Private Student Loan

Edly private student loans offer a range of financing options to help students cover the costs of higher education. Understanding the available repayment plans is crucial for responsible borrowing and effective financial management. Choosing the right plan can significantly impact your monthly payments and the total amount of interest you pay over the life of the loan.

Repayment Plan Options

Edly likely offers several repayment plans, each designed to cater to different financial situations and borrower preferences. The specific plans available and their terms may vary depending on the loan agreement and prevailing market conditions. It’s crucial to review your loan documents carefully to understand the options available to you.

- Standard Repayment Plan: This is typically the default option, involving fixed monthly payments over a set term (e.g., 10 or 15 years). The fixed payment amount remains consistent throughout the loan’s duration, making budgeting easier. However, this plan usually results in the highest total interest paid due to the longer repayment period.

- Extended Repayment Plan: This plan extends the loan repayment period, leading to lower monthly payments. While this provides short-term financial relief, it generally results in a significantly higher total interest paid over the loan’s lifetime. For example, extending a 10-year loan to a 20-year loan will drastically increase the total interest.

- Graduated Repayment Plan: This option starts with lower monthly payments that gradually increase over time. This can be beneficial for borrowers anticipating increased income in the future. However, the total interest paid might still be substantial, as the loan is outstanding for a longer period.

- Income-Driven Repayment Plan (if available): Some private lenders may offer income-driven repayment plans, though these are less common than with federal loans. These plans typically tie your monthly payments to your income and family size. While this offers flexibility, the repayment period might be significantly longer, leading to higher overall interest costs. Eligibility criteria usually apply.

Impact of Repayment Plan Choice on Total Interest Paid

The choice of repayment plan directly affects the total interest paid over the loan’s life. Shorter-term loans generally result in lower total interest, but higher monthly payments. Longer-term loans, conversely, have lower monthly payments but accumulate significantly more interest.

For instance, consider a $20,000 loan with a 7% interest rate. A 10-year standard repayment plan might result in a total interest payment of $7,000, while a 20-year extended repayment plan could lead to a total interest payment exceeding $14,000. This significant difference highlights the importance of careful consideration when choosing a repayment plan. The best option depends on individual financial circumstances and long-term financial goals. Borrowers should carefully weigh the benefits of lower monthly payments against the increased total interest cost.

Edly Private Student Loan

Securing funding for higher education can be a significant undertaking. Edly Private Student Loans offer a potential pathway to financing your studies, but understanding the application and approval process is crucial for a successful outcome. This section details the steps involved, potential challenges, and provides a practical guide for prospective borrowers.

Edly Private Student Loan Application Process

Applying for an Edly private student loan involves several key steps. A clear understanding of these steps will streamline the process and increase the likelihood of a successful application. Remember that specific requirements and procedures might vary depending on your individual circumstances and the lender’s current policies. Always refer to the most up-to-date information directly from Edly.

- Pre-qualification: Before formally applying, it’s beneficial to check your pre-qualification eligibility. This involves providing some basic information to get an estimate of how much you might be able to borrow and what interest rates you could expect. This step doesn’t impact your credit score and helps you manage expectations.

- Complete the Application: Once you’re ready, complete the formal application. This will require more detailed information, including your financial history, academic details, and co-signer information (if required). Accuracy is paramount at this stage.

- Document Submission: Gather all necessary supporting documents. This typically includes proof of enrollment, tax returns, bank statements, and potentially other financial documentation. Ensure all documents are clear, legible, and meet the specified requirements.

- Credit Check: Edly, like most lenders, will conduct a credit check as part of the application process. Your credit score significantly impacts the interest rate and loan terms you’ll be offered. A strong credit history is advantageous.

- Review and Acceptance: Once Edly has reviewed your application and supporting documentation, they will make a decision. If approved, you’ll receive a loan offer outlining the terms, interest rates, and repayment schedule. Carefully review the terms before accepting.

- Loan Disbursement: After accepting the loan offer, the funds will be disbursed according to the terms Artikeld in your loan agreement. This usually involves direct deposit to your educational institution or to you, depending on the lender’s procedures.

Potential Challenges in the Application Process

While the application process is generally straightforward, several potential challenges could arise. Being aware of these challenges can help you prepare and mitigate potential delays.

- Insufficient Credit History: Lack of a sufficient credit history can negatively impact your chances of approval or result in less favorable loan terms. Building credit before applying is beneficial.

- Low Credit Score: A low credit score can lead to higher interest rates or even loan denial. Improving your credit score before applying is crucial.

- Incomplete Application: Missing or inaccurate information on your application can delay the process or lead to rejection. Ensure you provide complete and accurate information.

- Missing Documentation: Failure to provide all required supporting documents will also cause delays. Organize your documents beforehand to avoid this.

- Co-signer Requirements: If you lack a strong credit history, a co-signer might be required. Securing a reliable co-signer willing to assume responsibility for the loan if you default is essential.

Edly Private Student Loan

Edly offers private student loans designed to help students finance their higher education. Understanding the customer service and support mechanisms available is crucial for a positive borrowing experience. This section details Edly’s approach to assisting borrowers throughout the loan lifecycle.

Edly’s Customer Service Channels

Edly typically provides multiple avenues for borrowers to access customer service. These channels usually include a dedicated phone number for direct contact with representatives, an email address for submitting inquiries, and an online chat function for immediate assistance. The availability and responsiveness of each channel can vary, and it’s advisable to check Edly’s official website for the most up-to-date contact information. While specific wait times are not consistently published, anecdotal evidence suggests that response times can fluctuate depending on the time of year and the volume of inquiries.

Comparison of Edly’s Customer Service with Other Lenders

Comparing Edly’s customer service to other private student loan lenders requires considering various factors. Some lenders may be known for their exceptionally quick response times via phone, while others might excel in providing detailed and helpful responses via email. For example, some borrowers have reported positive experiences with Edly’s online chat, praising the immediate assistance received for simple questions. Conversely, others have noted longer wait times when contacting customer service via phone. Direct comparisons require examining individual customer reviews across multiple platforms and considering the specific issues addressed. It’s important to remember that individual experiences can be subjective and may not represent the overall quality of service.

Resources for Borrowers Experiencing Financial Difficulties

Edly, like many other private student loan lenders, offers various resources for borrowers facing financial hardship. These typically include forbearance and deferment options. Forbearance allows borrowers to temporarily suspend or reduce their loan payments, often without accruing additional interest. Deferment, on the other hand, postpones payments for a specified period, and may or may not involve interest capitalization depending on the specific terms. The eligibility criteria for forbearance and deferment, and the specific terms offered, are usually detailed in the loan agreement and on Edly’s website. It is crucial for borrowers facing financial challenges to contact Edly’s customer service promptly to explore available options and avoid potential negative consequences such as delinquency or default. The specific documentation required and the process involved in applying for forbearance or deferment will vary depending on the borrower’s individual circumstances.

Edly Private Student Loan

Choosing the right student loan is a crucial decision impacting your financial future. This section compares Edly private student loans with federal student loans, highlighting their key differences to help you make an informed choice. Understanding the advantages and disadvantages of each type is essential for responsible borrowing.

Edly Private Student Loans versus Federal Student Loans: A Comparison

Federal and private student loans differ significantly in their terms, benefits, and eligibility requirements. Federal loans generally offer more borrower protections and flexible repayment options, while private loans, like those offered by Edly, may offer more competitive interest rates in certain situations. The best choice depends on individual circumstances and financial profiles.

Interest Rates and Repayment Options

Interest rates for Edly private student loans are variable and determined by creditworthiness, income, and co-signer availability. They can fluctuate based on market conditions. Federal student loans, conversely, typically have fixed or variable interest rates that are set by the government and generally lower than private loan rates. Repayment options for federal loans are more varied and include income-driven repayment plans, which adjust monthly payments based on income and family size. Edly private loans may offer standard repayment plans but usually lack the same flexibility.

Borrower Protections and Default

Federal student loans provide significant borrower protections, including deferment and forbearance options during periods of financial hardship. These programs allow for temporary suspension of payments or reduced payments. Defaulting on a federal student loan can result in wage garnishment and tax refund offset, but the government also offers rehabilitation and consolidation programs to help borrowers get back on track. Edly private loans, while potentially offering various repayment plans, typically have fewer borrower protections, and the consequences of default can be severe, including negative impacts on credit scores and potential legal action.

Situations Favoring Private or Federal Loans

A private student loan like Edly’s might be preferable if a borrower has excellent credit, qualifies for a low interest rate, and needs to borrow more than the federal loan limits allow. Conversely, federal student loans are often the better option for borrowers with limited credit history or lower credit scores, as they offer more accessible funding and greater borrower protections. Federal loans are also preferred for their income-driven repayment plans and other flexible repayment options.

Key Feature Comparison: Edly Private Loan vs. Federal Student Loan

| Feature | Edly Private Loan | Federal Student Loan | Key Differences |

|---|---|---|---|

| Interest Rates | Variable, based on creditworthiness | Fixed or variable, generally lower | Private loan rates can be higher, influenced by credit score. Federal rates are set by the government. |

| Repayment Options | Standard repayment plans | Standard, income-driven, and other flexible plans | Federal loans offer more flexible repayment options tailored to individual circumstances. |

| Borrower Protections | Limited protections | Significant protections (deferment, forbearance) | Federal loans provide substantial safeguards against financial hardship. |

| Eligibility | Credit check required, co-signer may be needed | Based on financial need and enrollment status | Private loans have stricter eligibility requirements; Federal loans are more accessible. |

| Loan Limits | No government-set limits | Government-set annual and aggregate limits | Private loans can exceed federal borrowing limits, but this can increase financial risk. |

Final Review

Securing funding for higher education is a significant step, and choosing the right loan is paramount. This comprehensive overview of Edly private student loans provides a foundation for informed decision-making. By understanding the eligibility criteria, interest rates, repayment options, and the application process, you can confidently assess whether an Edly loan suits your needs. Remember to carefully compare Edly’s offerings with other lenders and federal loan programs to find the best fit for your financial situation.

General Inquiries

What credit score is typically required for an Edly private student loan?

While Edly doesn’t publicly state a minimum credit score, a good to excellent credit history is generally needed. A co-signer may be required for those with lower credit scores.

Can I refinance my existing student loans with Edly?

Edly’s offerings primarily focus on new student loans. Refinancing options are typically not available through their platform.

What happens if I miss a payment on my Edly student loan?

Late payments will incur fees and negatively impact your credit score. Contact Edly immediately if you anticipate difficulty making a payment to explore options like forbearance or deferment.

Does Edly offer any grace periods after graduation?

Grace periods are typically determined by the terms of the loan agreement. Check your loan documents for specific details regarding your grace period, if applicable.