Securing higher education shouldn’t be hindered by financial constraints. Education loans for students offer a vital pathway to academic success, but navigating the complexities of loan types, eligibility, and repayment can feel overwhelming. This guide provides a clear and concise overview, empowering students to make informed decisions and successfully manage their educational financing.

From understanding the nuances of federal versus private loans to mastering effective debt management strategies, we’ll explore every facet of the student loan journey. We’ll also address common misconceptions and potential pitfalls, equipping you with the knowledge to confidently pursue your educational aspirations without unnecessary financial burden.

Types of Education Loans

Securing funding for higher education is a crucial step for many students. Understanding the different types of education loans available is essential to making informed decisions about financing your studies. This section will Artikel the key differences between federal and private loans, as well as briefly discuss scholarships, to help you navigate this important process.

Federal Student Loans

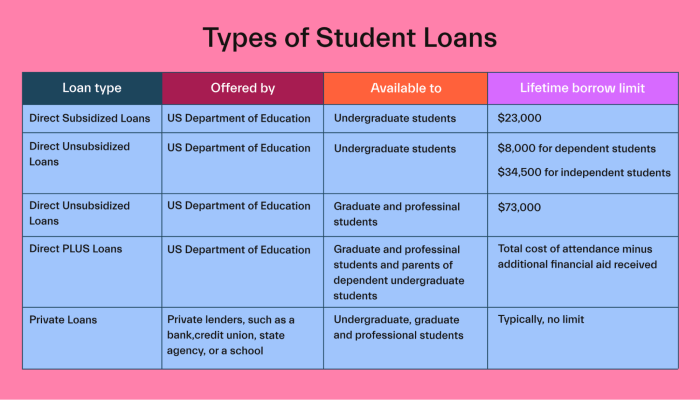

Federal student loans are offered by the U.S. government and generally come with more favorable terms than private loans. These loans are often considered the first choice for students due to their borrower protections and flexible repayment options. They are available to both undergraduate and graduate students who meet certain eligibility requirements. The main types of federal student loans include subsidized and unsubsidized loans, as well as PLUS loans for parents and graduate students. Subsidized loans don’t accrue interest while the student is enrolled at least half-time, while unsubsidized loans begin accruing interest immediately. PLUS loans have higher interest rates but allow parents or graduate students to borrow more.

Private Education Loans

Private education loans are offered by banks, credit unions, and other private lenders. These loans are often more difficult to obtain than federal loans, as they typically require a creditworthy co-signer, a strong credit history (for the borrower or co-signer), and a demonstrated ability to repay the loan. Interest rates on private loans are generally higher than federal loan rates and can vary significantly depending on the lender and the borrower’s creditworthiness. Repayment terms can also be less flexible than those offered on federal loans. While private loans can fill funding gaps not covered by federal loans or scholarships, careful consideration of the terms and conditions is crucial.

Scholarships

Scholarships represent a form of financial aid that does not need to be repaid. Unlike loans, scholarships are awarded based on merit, financial need, or other criteria set by the awarding institution or organization. Many scholarships are offered by colleges and universities, but numerous external organizations also provide scholarships. Finding and applying for scholarships can be a time-consuming process, but the potential for significant financial assistance makes it worthwhile. It’s crucial to begin searching for scholarships early in the college application process.

Comparison of Federal and Private Education Loans

The following table summarizes the key differences between federal and private education loans:

| Loan Type | Interest Rates | Repayment Terms | Eligibility |

|---|---|---|---|

| Federal Student Loans | Generally lower than private loans; vary by loan type and year. | Various repayment plans available, including income-driven repayment options. | Based on financial need and enrollment status; may require FAFSA completion. |

| Private Education Loans | Generally higher than federal loans; vary based on creditworthiness and lender. | Typically fixed terms, often shorter than federal loan repayment plans. | Requires a creditworthy co-signer in many cases; based on credit history and income. |

Eligibility Criteria for Education Loans

Securing an education loan hinges on meeting specific eligibility criteria set by lending institutions. These criteria are designed to assess the applicant’s ability and likelihood to repay the loan after completing their education. Lenders carefully evaluate several factors to make informed decisions, balancing the need to support students with responsible lending practices.

Lenders consider a range of factors when evaluating education loan applications. This comprehensive assessment ensures that both the student and the lender are protected throughout the loan process. Understanding these criteria is crucial for prospective borrowers to increase their chances of approval.

Credit Score and History

A strong credit score is often a significant factor in loan approval. While students may not have extensive credit histories, lenders may consider factors such as co-signer credit scores, payment history on existing accounts (like mobile phone bills or credit cards), and any history of debt defaults. A higher credit score generally indicates a lower risk of default, leading to more favorable loan terms. A low or non-existent credit score can make it difficult to secure a loan without a co-signer with a good credit history.

Income and Financial Stability

Lenders assess the applicant’s and their family’s financial stability to gauge their repayment capacity. This involves reviewing income statements, tax returns, and other financial documents to verify the applicant’s ability to manage monthly loan repayments after graduation. Consistent income sources and a demonstrable capacity to handle debt are key elements in this assessment. Applicants with inconsistent income or significant existing debt may find it challenging to secure a loan.

Academic Performance and Course of Study

Academic performance plays a role in loan approval. Lenders often consider the applicant’s academic record, including GPA, transcripts, and standardized test scores. This helps them assess the likelihood of successful completion of the course and subsequent employment prospects, which directly impact repayment ability. Strong academic standing increases the chances of loan approval. The chosen course of study is also a factor; programs with high employment rates and earning potential generally pose less risk to lenders.

Collateral and Co-signers

In some cases, lenders may require collateral to secure the loan. This could be a property or other valuable asset that can be used to repay the loan if the borrower defaults. The availability of collateral significantly improves the chances of loan approval, especially for larger loan amounts. Alternatively, a co-signer with a strong credit history and stable income can act as a guarantor, assuming responsibility for repayment if the borrower fails to do so. This significantly reduces the lender’s risk and increases the likelihood of loan approval.

Situations Leading to Ineligibility and Alternative Financing Options

Several situations can lead to loan ineligibility. For instance, applicants with a history of bankruptcy or significant debt may be rejected. Those pursuing programs with low employment prospects or lacking sufficient income to cover repayments might also face difficulty. In such cases, alternative financing options include scholarships, grants, part-time jobs, and family contributions. Exploring these options can help students fund their education even if they are not eligible for a traditional education loan. Some institutions also offer private loans with less stringent requirements, although these often come with higher interest rates.

The Loan Application Process

Securing an education loan involves a series of steps, from initial research and application to final disbursement of funds. Understanding this process is crucial for a smooth and efficient experience. Careful planning and preparation are key to a successful application.

The application process typically begins with researching different lenders and loan options available. This involves comparing interest rates, repayment terms, and eligibility criteria. Once you’ve identified a suitable lender, you’ll need to gather the necessary documents and complete the application form accurately and thoroughly. Submitting a complete application is vital for timely processing and approval.

Application Form Completion

The application form itself usually requires detailed personal and financial information. You’ll need to provide accurate details about your academic background, chosen course of study, and expected costs. It’s important to double-check all entries for accuracy before submission to avoid delays. Many lenders offer online application portals, streamlining the process. Some lenders may require you to visit a branch in person to submit your application. Following the instructions carefully is paramount to a successful application.

Required Documentation

A comprehensive list of documents is typically required to support your loan application. Submitting incomplete documentation can lead to delays or rejection. It is essential to gather all necessary documents before beginning the application process.

- Completed loan application form

- Proof of identity (e.g., passport, driver’s license)

- Proof of address (e.g., utility bill, bank statement)

- Academic transcripts and certificates

- Admission letter from the chosen institution

- Course fee structure

- Parent/guardian’s income proof (salary slips, tax returns)

- Collateral security details (if required)

- Bank statements (for both applicant and co-applicant, if applicable)

Loan Processing and Disbursement

Once the application and supporting documents are submitted, the lender will review your application. This may involve credit checks and verification of the information provided. The processing time can vary depending on the lender and the complexity of your application. Upon approval, the loan amount will be disbursed directly to the educational institution or to your account, as per the lender’s policies. This disbursement typically happens in installments, corresponding to the fee payment schedule of the educational institution. You will receive a loan agreement outlining the terms and conditions of the loan.

Interest Rates and Repayment Options

Securing an education loan is a significant step towards achieving your academic goals, but understanding the associated costs and repayment structures is crucial for responsible financial planning. This section details the factors influencing interest rates and the various repayment options available to help you navigate this process effectively.

Education loan interest rates are not fixed; they vary depending on several key factors. A borrower’s creditworthiness plays a significant role. A strong credit history, demonstrating responsible borrowing and repayment in the past, often leads to lower interest rates. Lenders view this as a lower risk. Conversely, a poor credit history or lack of credit history may result in higher rates or even loan rejection. The type of loan also influences the interest rate. For example, loans backed by the government or offered through specific educational institutions may have lower rates compared to private loans. Finally, prevailing market interest rates also impact the rates offered on education loans. During periods of higher overall interest rates, loan rates tend to increase.

Factors Influencing Education Loan Interest Rates

Several interconnected factors determine the interest rate you’ll receive on your education loan. These include your credit score, the type of loan (federal vs. private), the loan amount, the repayment term, and prevailing economic conditions. A higher credit score generally translates to a lower interest rate, reflecting a lower perceived risk for the lender. Federal loans often carry lower interest rates than private loans due to government backing and subsidies. Larger loan amounts might attract slightly higher rates, and longer repayment periods can lead to higher overall interest costs, though monthly payments will be lower. Finally, macroeconomic factors, such as inflation and central bank policies, impact the general interest rate environment and thus influence education loan rates.

Repayment Options for Education Loans

Understanding your repayment options is critical for effective financial planning after graduation. Various repayment plans cater to different financial situations and allow borrowers to manage their debt effectively. Choosing the right plan depends on your income, expenses, and long-term financial goals.

Comparison of Repayment Plans

The following table compares different repayment plans, highlighting key features to aid in your decision-making process. Note that specific details may vary depending on the lender and loan type. Always consult your lender for the most accurate and up-to-date information.

| Plan Name | Monthly Payment Calculation | Total Repayment Time | Eligibility Criteria |

|---|---|---|---|

| Standard Repayment Plan | Fixed monthly payment over a set period (e.g., 10 years) | 10-20 years, depending on loan amount and interest rate | Generally available to all borrowers |

| Graduated Repayment Plan | Payments start low and gradually increase over time | 10 years | Typically available for federal loans |

| Income-Driven Repayment Plan (IDR) | Monthly payment based on income and family size | 20-25 years | Available for federal loans; income verification required |

| Deferment | Temporary postponement of payments | Varies depending on the reason for deferment and loan terms | Specific qualifying circumstances, such as returning to school or experiencing unemployment |

Managing Education Loan Debt

Successfully navigating education loan repayment requires proactive planning and consistent effort. Understanding your repayment options and developing effective financial strategies are crucial to avoiding potential pitfalls and ensuring timely repayment. This section will Artikel practical strategies for managing your education loan debt.

Effective management of education loan debt hinges on a multi-pronged approach encompassing budgeting, prioritizing payments, and exploring debt consolidation options. Ignoring your loan responsibilities can lead to serious financial consequences, so a proactive strategy is essential.

Budgeting Techniques

Creating a realistic budget is the cornerstone of effective debt management. This involves meticulously tracking your income and expenses to identify areas where you can reduce spending and allocate funds towards loan repayments. Several budgeting methods can help. The 50/30/20 rule, for example, suggests allocating 50% of your after-tax income to needs, 30% to wants, and 20% to savings and debt repayment. Alternatively, the zero-based budget method involves allocating every dollar of your income to a specific category, ensuring that all income is accounted for. Using budgeting apps or spreadsheets can further streamline this process, providing a clear visual representation of your financial situation. For instance, a spreadsheet could track income sources, loan payments, living expenses, and savings goals. Consistent monitoring allows for adjustments as needed, ensuring the budget remains relevant and effective.

Prioritizing Loan Payments

Prioritizing loan payments strategically can significantly impact your overall debt management. Focusing on high-interest loans first, through methods like the avalanche method, can save you money on interest in the long run. This involves making minimum payments on all loans except the one with the highest interest rate, to which you allocate as much extra money as possible. The snowball method, alternatively, prioritizes paying off the smallest loan first, providing a sense of accomplishment and motivation to continue. Both strategies have merit, and the best approach depends on individual financial circumstances and psychological preferences. Careful consideration of your loan terms and interest rates is crucial in making this decision.

Debt Consolidation Options

Debt consolidation involves combining multiple loans into a single loan, often with a lower interest rate. This simplifies repayment and can potentially reduce the overall cost of borrowing. Several options exist, including refinancing your student loans with a private lender or a federal consolidation loan program. Before consolidating, carefully compare interest rates, fees, and terms from different lenders to ensure you’re securing the most favorable deal. It’s crucial to understand the implications of consolidation, as it may affect your eligibility for certain repayment plans or forgiveness programs.

Consequences of Defaulting on Education Loans

Defaulting on your education loans has severe consequences. It can result in damaged credit scores, wage garnishment, tax refund offset, and difficulty obtaining future loans or credit. Furthermore, it can negatively impact your ability to rent an apartment, buy a car, or even secure certain jobs. The impact of a default can extend far beyond the immediate financial repercussions.

Addressing Financial Hardship

If you face financial hardship, several options are available to prevent default. Contacting your lender immediately to discuss your situation is crucial. They may offer forbearance or deferment, temporarily suspending or reducing your payments. Income-driven repayment plans, which adjust your monthly payments based on your income, may also be available. Exploring options such as negotiating a repayment plan or seeking professional financial counseling can provide valuable guidance and support during challenging times. Early intervention is key to mitigating the potential consequences of financial hardship.

Government Grants and Scholarships

Securing funding for higher education can be challenging, but thankfully, various government grants and scholarships are available to alleviate the financial burden. Understanding the differences between these funding options and the application processes is crucial for students seeking financial aid. This section will clarify the distinctions between grants, scholarships, and loans, and Artikel the application procedures for government-sponsored financial aid.

Government grants, scholarships, and loans all offer financial assistance for education, but they differ significantly in their terms and conditions. Grants are essentially free money awarded based on financial need or merit. Scholarships are also awarded based on merit, academic achievement, or specific criteria, and typically do not need to be repaid. Loans, on the other hand, must be repaid with interest over a set period.

Types of Government Funding and Their Differences

Grants and scholarships are both forms of financial aid that don’t require repayment, but they are awarded based on different criteria. Grants are usually based on financial need, demonstrated through a FAFSA (Free Application for Federal Student Aid) application, while scholarships are often merit-based, recognizing academic excellence, athletic prowess, or specific talents. Loans, conversely, are borrowed funds that must be repaid with interest.

The Application Process for Government Grants and Scholarships

The application process varies depending on the specific grant or scholarship. Many federal grants are accessed through the FAFSA, a standardized application used by colleges and universities to determine financial need. This application requires detailed financial information from the student and their family. State and local governments, as well as private organizations, often have their own unique application processes, which may involve essays, recommendations, or transcripts. It is crucial to carefully review the specific requirements for each opportunity. Early application is always recommended as many programs have limited funds and deadlines.

Examples of Government Funding Opportunities

Many federal, state, and local governments offer various grant and scholarship programs. For instance, the Pell Grant is a federal grant program for students with exceptional financial need, while many states offer merit-based scholarships to top-performing high school graduates. Specific programs vary by location and eligibility criteria, so researching opportunities specific to your state and institution is essential.

Summary of Funding Options

| Funding Type | Eligibility Criteria | Application Process | Funding Amount |

|---|---|---|---|

| Federal Pell Grant | Demonstrated financial need (FAFSA) | Complete the FAFSA form | Varies, up to a federally determined maximum |

| State Merit-Based Scholarships | High GPA, standardized test scores, residency requirements | Application varies by state, often involves essays and transcripts | Varies by state and program |

| Federal Stafford Loan | Enrollment in an eligible educational program | FAFSA and loan application through the institution | Varies based on financial need and cost of attendance |

| Institutional Scholarships | Academic achievement, extracurricular activities, specific talents | Application varies by institution | Varies by institution and program |

Potential Risks and Scams Related to Education Loans

Securing an education loan is a significant step towards achieving your academic goals, but it’s crucial to be aware of the potential risks and scams that unfortunately exist in this sector. Understanding these risks can help you protect yourself from financial harm and ensure a smooth borrowing experience. This section will Artikel common scams and provide guidance on identifying and avoiding them.

Navigating the world of education loans requires diligence and a healthy dose of skepticism. Many legitimate lenders operate, but unfortunately, fraudulent schemes also exist, preying on students’ financial needs and aspirations. Thorough research and verification are key to avoiding these pitfalls.

Common Education Loan Scams

Several types of fraudulent activities target students seeking education loans. These scams often involve deceptive marketing tactics, false promises, and hidden fees. One common tactic is to advertise unrealistically low interest rates or flexible repayment terms to lure unsuspecting borrowers. Another involves upfront fees disguised as processing or application charges, which legitimate lenders rarely require. Some scammers may even impersonate genuine lenders, creating convincing websites and documentation to deceive applicants. Finally, some fraudulent loan offers might involve loans that are not actually approved, leading to wasted time and potential financial losses.

Verifying Lender Legitimacy

Before applying for an education loan, it’s essential to thoroughly research and verify the legitimacy of the lender. Check the lender’s registration with relevant regulatory bodies, such as the relevant national financial services authority or equivalent. Look for reviews and testimonials from previous borrowers online, paying attention to both positive and negative feedback. Contact the lender directly via their official website or phone number listed on their website, not a number provided through an unsolicited email or text. Be wary of lenders who are unwilling to provide clear information about their fees, interest rates, and repayment terms. If anything feels suspicious or unclear, it is best to err on the side of caution and seek advice from a trusted financial advisor or educational institution.

Warning Signs of Education Loan Scams

Several warning signs can indicate a potential education loan scam. These include unsolicited offers with exceptionally low interest rates or flexible terms that seem too good to be true. Requests for upfront fees before loan approval are also a significant red flag, as reputable lenders generally do not charge such fees. Poor grammar, spelling errors, or unprofessional communication in emails, websites, or other marketing materials should raise suspicion. Pressure to apply quickly without sufficient time to research and compare options is another warning sign. If a lender avoids providing clear details about their licensing, registration, or contact information, this is a major cause for concern. Finally, if the lender requests personal information beyond what’s reasonably necessary for the loan application, it’s crucial to exercise extreme caution.

The Impact of Education Loans on Future Financial Planning

Securing an education loan can be a significant step towards achieving your academic goals, but it also introduces a long-term financial commitment that needs careful consideration. Understanding how education loan repayments will affect your future financial planning, including major milestones like homeownership and retirement, is crucial for responsible borrowing and successful long-term financial health. Failing to adequately plan for loan repayments can lead to significant financial strain and hinder the achievement of other important life goals.

Education loans significantly impact long-term financial goals by creating monthly debt obligations that compete for funds otherwise allocated to savings, investments, and other significant purchases. For example, a substantial monthly loan repayment can reduce the amount available for saving for a down payment on a house, potentially delaying homeownership or requiring a smaller, less desirable property. Similarly, the consistent outflow of funds towards loan repayment can decrease the amount available for retirement savings, potentially resulting in a smaller nest egg upon retirement. The earlier you begin to proactively incorporate loan repayments into your financial planning, the better equipped you’ll be to manage these challenges.

Homeownership and Education Loan Repayments

The impact of education loan repayments on homeownership is considerable. The larger your monthly loan payment, the less money you have available to save for a down payment. This could lead to a longer savings timeline or necessitate opting for a smaller home or a less desirable location. Consider this example: A borrower with a $500 monthly loan payment might need to save an additional $500-$1000 per month to reach their down payment goal within a reasonable timeframe. Effective financial planning necessitates carefully budgeting for both loan repayments and homeownership savings simultaneously. Strategies such as increasing income, reducing unnecessary expenses, and exploring high-yield savings accounts can help accelerate the homeownership process despite existing loan repayments.

Retirement Planning and Education Loan Repayments

Education loans can also significantly impact retirement planning. Consistent loan repayments reduce the amount available to contribute to retirement accounts, potentially diminishing the size of your retirement nest egg. For instance, a borrower contributing the maximum amount to their 401(k) while also making significant loan repayments might find it difficult to maintain the same savings rate if their income doesn’t significantly increase. A sound strategy involves prioritizing both loan repayment and retirement savings concurrently. This might involve exploring strategies like refinancing your student loan to a lower interest rate to reduce monthly payments or increasing income through promotions or side hustles.

Incorporating Loan Repayments into a Financial Plan

Creating a comprehensive financial plan that successfully incorporates education loan repayments involves several key steps. First, accurately estimate your total loan repayment amount, including interest. Next, allocate a specific portion of your monthly budget to loan repayment. This should be treated as a non-negotiable expense, similar to rent or utilities. Then, develop a realistic savings plan for your other financial goals, considering the impact of your loan repayments. Finally, regularly review and adjust your plan as needed, based on changes in your income, expenses, or loan repayment status. Utilizing budgeting apps or working with a financial advisor can greatly assist in this process.

Strategies for Minimizing the Long-Term Financial Burden

Several strategies can help minimize the long-term financial burden of education loans. Refinancing your loans to a lower interest rate can significantly reduce the total amount you pay over the life of the loan. Income-driven repayment plans can adjust your monthly payments based on your income, making them more manageable in the short term. Making extra payments whenever possible can help pay off your loans faster and reduce the total interest paid. Finally, exploring loan forgiveness programs, if eligible, can provide additional relief. Each of these strategies requires careful consideration and may involve trade-offs, so it’s essential to thoroughly research and understand their implications before implementing them.

Final Wrap-Up

Successfully navigating the world of education loans requires careful planning and a thorough understanding of the available options. By weighing the pros and cons of different loan types, diligently completing the application process, and proactively managing repayments, students can effectively leverage educational financing to achieve their academic goals and build a strong financial foundation for the future. Remember, responsible borrowing and proactive financial planning are key to a successful and debt-free future.

FAQ Guide

What happens if I can’t repay my student loan?

Failure to repay your student loan can lead to serious consequences, including damage to your credit score, wage garnishment, and potential legal action. Contact your lender immediately if you anticipate difficulties in repayment to explore options like deferment or forbearance.

Can I refinance my student loans?

Yes, refinancing can potentially lower your interest rate and monthly payments. However, carefully compare offers from different lenders and consider the long-term implications before refinancing.

How long does the loan application process take?

The application process varies depending on the lender and loan type. It can generally take several weeks to several months from application to disbursement.

What is the difference between a subsidized and unsubsidized loan?

Subsidized loans don’t accrue interest while you’re in school, whereas unsubsidized loans do. Eligibility criteria also differ.