Pursuing higher education in the United States is a significant undertaking for international students, often requiring substantial financial resources. Securing funding can be a complex process, navigating various loan options, eligibility criteria, and repayment plans. This guide provides a comprehensive overview of education loans in the USA specifically designed for international students, addressing key aspects to ensure a smoother and more informed decision-making process.

From understanding eligibility requirements and exploring different loan types to mastering the application process and effectively managing finances, we aim to equip you with the knowledge needed to confidently finance your American education. We’ll delve into the intricacies of interest rates, repayment options, and alternative funding sources, empowering you to make well-informed choices aligned with your financial goals and academic aspirations.

Eligibility Criteria for International Students

Securing an education loan in the USA as an international student involves meeting specific requirements set by various lenders. These criteria ensure both the student’s ability to succeed academically and their capacity to repay the loan. Understanding these requirements is crucial for a successful application process.

Specific Requirements for Loan Eligibility

International students must typically meet several key requirements to be eligible for an education loan. These often include a minimum GPA, evidence of good academic standing, and proof of English language proficiency. Lenders also assess the applicant’s financial need and their ability to repay the loan after graduation. The specific requirements can vary depending on the lender and the type of loan.

Demonstrating Financial Need and Repayment Ability

Proving financial need usually involves submitting detailed financial documents, such as bank statements, tax returns, and income statements from parents or sponsors. This demonstrates the inability to fully fund education without external assistance. Demonstrating repayment ability often requires providing a detailed study plan, a post-graduation employment plan (including potential salary), and possibly a co-signer who is a US citizen or permanent resident with a strong credit history. A strong credit history is a plus, though not always mandatory for international students, especially with co-signer support.

Comparison of Eligibility Requirements Across Lenders

Eligibility requirements can differ significantly across various lenders. Some lenders may have stricter GPA requirements or place more emphasis on the co-signer’s creditworthiness. Others may offer loans with more flexible repayment terms or lower interest rates but demand more stringent proof of financial need. For instance, Sallie Mae might prioritize a strong academic record, while a private bank may focus more on the co-signer’s financial stability. It’s essential to compare offers from multiple lenders to find the most suitable option.

Summary of Eligibility Criteria for Various Loan Types

| Loan Type | Minimum GPA | English Proficiency | Financial Need Documentation |

|---|---|---|---|

| Federal Student Loans (unlikely for international students) | Generally not specified, but good academic standing is required. | TOEFL or IELTS scores often required. | Usually requires a high level of demonstrated financial need. |

| Private Loans (e.g., Sallie Mae) | Often requires a minimum GPA of 2.5 or higher. | TOEFL or IELTS scores often required. | Requires detailed financial documentation and often a co-signer. |

| Bank Loans (e.g., specific international student loan programs) | Requirements vary widely depending on the bank and program. | TOEFL or IELTS scores often required. | Detailed financial documentation, potential co-signer, and a strong repayment plan are crucial. |

| Credit Union Loans | Requirements vary significantly depending on the credit union. | TOEFL or IELTS scores may or may not be required. | May require a co-signer and detailed financial documentation. |

Types of Education Loans Available

Securing funding for your education as an international student in the USA can seem daunting, but understanding the various loan options available is the first step towards achieving your academic goals. This section details the different types of loans, highlighting their advantages and disadvantages to help you make an informed decision. Remember that eligibility criteria vary between lenders, so thorough research is crucial.

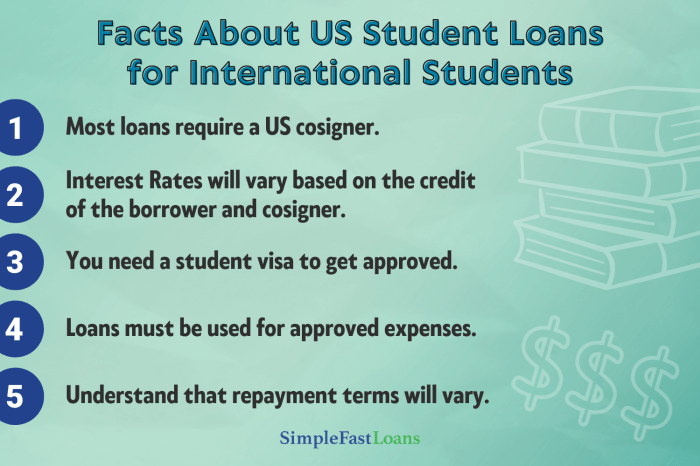

International students generally have access to two primary categories of education loans: private loans and, in some limited cases, federal loans. Scholarships and grants, while not loans, also represent significant funding opportunities and are discussed for completeness.

Federal Student Loans

Federal student loans, while primarily designed for US citizens and permanent residents, may be accessible to international students under very specific circumstances, often involving a co-signer who is a US citizen or permanent resident. These loans are generally considered favorable due to their fixed interest rates and potential for flexible repayment plans. However, accessing them as an international student is extremely challenging and requires meeting stringent eligibility requirements.

- Advantage: Fixed interest rates often lower than private loans, government-backed repayment options.

- Disadvantage: Extremely difficult to obtain for international students, requiring a US citizen or permanent resident co-signer.

- Example Lender: The US Department of Education (through participating lenders).

Private Education Loans

Private education loans are the most common financing option for international students pursuing higher education in the USA. These loans are offered by various banks and financial institutions. While they offer greater accessibility, they often come with higher interest rates and less flexible repayment terms compared to federal loans. It’s crucial to carefully compare interest rates, fees, and repayment options from different lenders.

- Advantage: More readily available to international students than federal loans, often less stringent eligibility requirements.

- Disadvantage: Typically higher interest rates than federal loans, potentially less flexible repayment options, may require a co-signer.

- Example Lenders: Sallie Mae, Discover Student Loans, MPOWER Financing, Prodigy Finance.

Scholarships and Grants

Scholarships and grants are forms of financial aid that do not need to be repaid. They are awarded based on merit, need, or specific criteria set by the awarding institution or organization. Securing scholarships and grants can significantly reduce the amount of loan debt needed. International students should actively research and apply for scholarships offered by universities, organizations, and governments.

- Advantage: Free money towards education, reducing the need for loans.

- Disadvantage: Competitive application processes, limited availability.

- Example Sources: University-specific scholarships, Fulbright scholarships, private foundations.

The Application Process

Securing an education loan as an international student in the USA involves a multi-step process that requires careful planning and thorough preparation. Understanding the requirements, timelines, and potential challenges is crucial for a successful application. This section Artikels the key steps, necessary documentation, and common hurdles faced by international students.

Applying for a student loan typically involves several key stages, from initial research and pre-qualification to final loan disbursement. Each step requires attention to detail and adherence to specific deadlines.

Required Documentation

The specific documents required may vary slightly depending on the lender, but generally include proof of admission to a US institution, transcripts from previous educational institutions, a detailed budget outlining educational expenses, and proof of financial resources (e.g., bank statements, tax returns, sponsorship letters). Lenders will also need personal identification documents like a passport and visa. Providing complete and accurate documentation is crucial to expedite the application process and increase the chances of approval. Incomplete applications often lead to delays or rejection.

The Application Timeline

The application timeline can range from a few weeks to several months, depending on the complexity of the application and the responsiveness of the lender. It’s advisable to begin the application process well in advance of the academic term’s start date. Allow ample time for gathering documents, completing the application forms, and addressing any queries from the lender. Procrastination can lead to missed deadlines and jeopardize your ability to secure funding before the semester begins. For example, an application submitted six months before the start date will likely have a smoother process than one submitted just a month before.

The Role of a Co-signer

Many lenders require a US-based co-signer with excellent credit history for international student loans. The co-signer assumes responsibility for loan repayment if the student defaults. Finding a reliable co-signer is crucial, as their creditworthiness significantly impacts the loan approval process. The co-signer’s financial stability and credit score are thoroughly scrutinized by the lender. It is essential to discuss the co-signing responsibilities with the potential co-signer before submitting the application.

Common Challenges Faced by International Students

International students often face unique challenges in securing education loans, including difficulties in meeting the credit history requirements, securing a co-signer with suitable credit, and navigating the complexities of the US financial system. Language barriers, unfamiliar documentation requirements, and cultural differences can also pose significant obstacles. Furthermore, the lack of a US-based credit history can make it harder to qualify for loans with favorable terms.

Application Process Flowchart

Imagine a flowchart with the following steps represented by boxes connected by arrows:

1. Research and Select Lender: (Box 1) This box represents the initial stage where the student researches different lenders and compares their loan terms.

2. Pre-qualification: (Box 2) This step involves checking eligibility and getting a preliminary assessment of loan approval chances.

3. Gather Documentation: (Box 3) This box highlights the collection of all necessary documents like acceptance letter, transcripts, financial statements, etc.

4. Complete Application: (Box 4) This represents filling out the loan application forms accurately and completely.

5. Submit Application: (Box 5) This shows the submission of the complete application to the lender.

6. Loan Processing and Review: (Box 6) This box represents the lender’s review of the application and verification of documents.

7. Loan Approval/Denial: (Box 7) This shows the outcome of the review process, either approval or denial.

8. Loan Disbursement: (Box 8) This represents the final stage where the approved loan amount is disbursed to the student’s account.

Interest Rates and Repayment Options

Securing an education loan as an international student in the USA involves understanding the financial aspects beyond the initial approval. This section details the interest rates you can expect and the various repayment options available after you graduate. Careful consideration of these factors is crucial for managing your loan effectively and minimizing its overall cost.

Interest rates and repayment terms are key factors influencing the total cost of your education loan. Different lenders offer varying rates and repayment structures, making it essential to compare options before committing to a loan. Understanding the implications of each repayment plan allows you to make informed decisions that align with your post-graduation financial plan.

Interest Rates Comparison

Interest rates on education loans for international students are influenced by several factors, including the lender’s risk assessment, prevailing market interest rates, and the loan’s term. Generally, fixed interest rates provide predictability, while variable rates can fluctuate with market conditions. Private lenders often offer a wider range of interest rates compared to federal loan programs, which typically have fixed rates. It’s vital to shop around and compare offers from multiple lenders to find the most favorable terms. Remember that a lower interest rate translates to lower overall loan costs.

Repayment Options After Graduation

Upon graduation, several repayment options are typically available, including standard repayment plans, graduated repayment plans, extended repayment plans, and income-driven repayment plans (IDR). Standard plans involve fixed monthly payments over a set period, often 10 years. Graduated plans start with lower payments that gradually increase over time. Extended plans stretch repayments over a longer period, reducing monthly payments but increasing the total interest paid. IDR plans tie your monthly payments to your income, offering flexibility but potentially extending the repayment period significantly. Deferment and forbearance options may also be available under certain circumstances, temporarily suspending or reducing your payments, though interest may still accrue during these periods.

Impact of Repayment Plans on Total Loan Cost

The choice of repayment plan significantly impacts the total cost of your loan. While longer repayment terms (like those offered by extended plans or IDRs) lower monthly payments, they lead to higher overall interest costs. Conversely, shorter repayment terms (standard plans) result in higher monthly payments but lower total interest. For example, a $50,000 loan with a 7% interest rate repaid over 10 years (standard plan) might cost significantly less in total interest compared to the same loan repaid over 20 years (extended plan). Careful consideration of your post-graduation income and financial goals is essential to select the most appropriate repayment plan.

Comparison Table: Interest Rates and Repayment Options

| Lender | Interest Rate (Example – Variable/Fixed) | Standard Repayment (Years) | Extended Repayment (Years) |

|---|---|---|---|

| Lender A (Example: Private Lender) | 7% – Variable | 10 | 20 |

| Lender B (Example: Private Lender) | 6.5% – Fixed | 10 | 15 |

| Government Loan Program (Example) | 5% – Fixed | 10 | N/A |

*Note: The interest rates and repayment options provided in the table are examples only and may vary depending on the lender, creditworthiness of the borrower, and prevailing market conditions. Always consult the lender directly for the most up-to-date information.*

Financial Planning and Budgeting

Securing funding for your education in the USA is only half the battle; effectively managing your finances throughout your studies is equally crucial. Careful planning and budgeting are essential for a successful and stress-free academic experience. This section will guide you through creating a realistic budget, managing your finances, and calculating the total cost of your education, including loan interest and fees.

Creating a comprehensive budget is the cornerstone of sound financial management. It allows you to anticipate expenses, track spending, and make informed decisions about your money. Failing to budget effectively can lead to financial strain and potentially jeopardize your studies. A well-structured budget should account for all income and expenses, leaving room for unexpected costs and savings.

Calculating the Total Cost of Education

Accurately estimating the total cost of your education is paramount. This includes tuition fees, living expenses, books and supplies, health insurance, travel, and, crucially, the interest accruing on your education loan. Many universities provide detailed cost breakdowns on their websites. However, it’s advisable to add a buffer for unforeseen expenses. For example, if a university estimates annual tuition at $30,000, and your living expenses are projected at $15,000 annually for a two-year program, your total estimated cost without loan interest would be $90,000 ($30,000 x 3 + $15,000 x 3). Remember to factor in the interest rate on your loan and any associated fees, which will significantly increase the final amount you’ll need to repay. This calculation should be done carefully, considering the loan’s repayment period and interest compounding.

Sample Budget for an International Student

The following is a sample budget for a student studying in a moderately expensive city in the USA. Remember that these figures are estimates and may vary significantly depending on your lifestyle, location, and program of study.

| Category | Monthly Estimate | Annual Estimate |

|---|---|---|

| Tuition (per semester) | $7,500 | $15,000 |

| Rent | $1,000 | $12,000 |

| Utilities (electricity, water, internet) | $200 | $2,400 |

| Groceries | $300 | $3,600 |

| Transportation | $150 | $1,800 |

| Books and Supplies | $100 | $1,200 |

| Health Insurance | $100 | $1,200 |

| Personal Expenses | $250 | $3,000 |

| Loan Repayment (estimated, depending on loan amount and interest) | $300 | $3,600 |

| Total Monthly Expenses | $9,000 | $108,000 |

This sample budget illustrates the significant costs involved in studying in the USA. It’s crucial to adjust this budget based on your specific circumstances and to consistently track your spending against your planned budget.

Strategies for Effective Financial Management

Effective financial management requires discipline and proactive planning. Strategies include:

Prioritizing essential expenses over non-essential ones is key. This involves careful consideration of your spending habits and identifying areas where you can cut back. Regularly reviewing your budget and making necessary adjustments is crucial to ensure it remains relevant throughout your studies.

Tracking Expenses and Income

Utilizing budgeting apps or spreadsheets can help monitor your spending and income. Regularly reviewing these records enables you to identify areas of overspending and make necessary adjustments to your budget. This proactive approach helps maintain financial stability.

Understanding Loan Terms and Conditions

Securing an education loan is a significant financial commitment. Understanding the terms and conditions of your loan agreement is crucial to avoid potential problems and ensure a smooth repayment process. Failing to grasp these details could lead to unforeseen financial difficulties. This section Artikels key terms and clarifies their implications.

Grace Periods

A grace period is a timeframe after you complete your studies (or leave your course) before you’re required to begin making loan repayments. The length of the grace period varies depending on the lender and the type of loan. For example, some federal student loans offer a six-month grace period, while others might offer a longer period, or none at all. Knowing your grace period is essential for planning your post-graduation finances. During this time, interest may or may not accrue, depending on your loan type. It’s vital to check your loan agreement to understand whether interest accrues during your grace period and how this impacts your overall repayment amount.

Loan Default

Loan default occurs when you fail to make your loan payments according to the agreed-upon schedule. This has serious consequences, including damage to your credit score, potential wage garnishment, and the possibility of legal action by the lender. Defaulting on a student loan can significantly impact your ability to obtain credit in the future, such as for a mortgage or car loan. A defaulted loan may also be reported to credit bureaus, negatively impacting your creditworthiness for many years.

Late Payment Penalties

Most lenders impose late payment penalties if you miss a payment or pay late. These penalties can range from a fixed fee to a percentage of the missed payment. For instance, a penalty might be a flat fee of $25 or a percentage of the missed payment, such as 5%. These fees can add up quickly, increasing the total cost of your loan significantly. It’s crucial to set up automatic payments or use a reminder system to avoid incurring late payment fees.

Reviewing Loan Agreements

Before signing any loan agreement, carefully review all the terms and conditions. Don’t hesitate to ask the lender for clarification on anything you don’t understand. Understanding the repayment schedule, interest rates, fees, and consequences of default is essential. Consider seeking advice from a financial advisor if you have any questions or concerns about the loan terms. Ignoring this crucial step could lead to significant financial difficulties in the future.

Consequences of Non-Repayment

Failing to repay your education loan on time can result in several severe consequences. These include a damaged credit history, which can make it difficult to secure loans, credit cards, or even rent an apartment in the future. Further, lenders may pursue legal action to recover the outstanding debt, which can involve wage garnishment or the seizure of assets. In some cases, your tax refund may also be withheld to repay the debt. The impact of non-repayment can be far-reaching and long-lasting, impacting your financial stability for years to come.

Glossary of Common Loan Terms

| Term | Definition |

|---|---|

| Grace Period | The period after graduation before loan repayment begins. |

| Default | Failure to make loan payments as agreed. |

| Late Payment Penalty | Fee charged for missed or late payments. |

| Interest Rate | The percentage charged on the outstanding loan balance. |

| Principal | The original amount of the loan. |

| Amortization | The process of paying off a loan through regular payments. |

| Cosigner | An individual who agrees to repay the loan if the borrower defaults. |

| Loan Consolidation | Combining multiple loans into a single loan. |

| Deferment | Temporary postponement of loan payments. |

| Forbearance | Temporary reduction or suspension of loan payments. |

Alternative Funding Options

Securing funding for higher education in the USA as an international student can be challenging. While education loans provide a crucial avenue, exploring alternative funding sources significantly enhances your financial planning and reduces reliance on loans alone. These alternatives can lessen the overall debt burden and offer valuable financial flexibility.

Exploring scholarships, grants, and assistantships offers a multifaceted approach to financing your education. These options, while often competitive, can substantially reduce or even eliminate the need for extensive borrowing. Understanding their nuances and effectively applying for them is key to maximizing your chances of success.

Scholarships

Scholarships are merit-based or need-based awards that don’t require repayment. Many institutions and organizations offer scholarships specifically designed for international students. These awards are often based on academic achievement, extracurricular involvement, leadership qualities, or demonstrated financial need. Some scholarships are highly specific, targeting students from particular countries or pursuing specific fields of study. Others are more broadly available. A successful scholarship application typically involves a compelling personal statement, strong academic transcripts, and letters of recommendation.

Grants

Similar to scholarships, grants are financial aid that doesn’t need to be repaid. However, grants are usually awarded based on financial need, assessed through the student’s and family’s financial circumstances. Government agencies, universities, and private organizations offer various grants for international students. The application process for grants usually involves completing a detailed financial aid application, such as the CSS Profile, and submitting supporting documentation to verify financial need.

Assistantships

Assistantships combine financial aid with work experience. Many universities offer graduate students assistantships, which involve part-time work in exchange for tuition waivers and a stipend. These positions often involve research, teaching, or administrative tasks related to the student’s field of study. Assistantships provide valuable professional experience while simultaneously reducing the financial burden of education.

Comparing Alternative Funding Options with Education Loans

| Feature | Scholarships/Grants | Assistantships | Education Loans |

|---|---|---|---|

| Repayment | None | None | Required |

| Eligibility | Merit/Need-based | Academic merit and availability | Creditworthiness |

| Impact on future finances | Positive; no debt | Positive; income and experience | Negative; debt burden |

| Application Process | Competitive application process | Application and interview process | Credit check and application |

Searching for and Applying for Scholarships and Grants

Finding suitable funding opportunities requires proactive research. Begin by exploring the financial aid websites of your chosen universities. Many universities maintain comprehensive databases of scholarships and grants specifically for their international students. Additionally, numerous online databases and search engines specialize in connecting students with financial aid opportunities. Remember to thoroughly read eligibility requirements and application deadlines. Carefully craft your application materials, highlighting your strengths and qualifications. Seeking assistance from your university’s international student office or financial aid department can significantly enhance your application success.

Resources for Finding Financial Aid Opportunities

Several reliable resources can aid your search for financial aid. These include:

- The university’s financial aid office

- Online scholarship search engines (e.g., Peterson’s, Fastweb)

- Governmental websites (e.g., U.S. Department of Education)

- International organizations (e.g., Fulbright, UNESCO)

- Private foundations and corporations

Wrap-Up

Financing your education in the USA as an international student requires careful planning and a thorough understanding of the available options. By carefully considering eligibility criteria, comparing loan types, and developing a robust financial plan, you can navigate the complexities of securing funding and focus on your academic pursuits. Remember to explore all available resources, including scholarships and grants, and to thoroughly review loan agreements before committing to any financial obligations. With diligent preparation and informed decision-making, you can successfully achieve your educational goals in the United States.

FAQs

What is a co-signer, and why is it often required for international student loans?

A co-signer is a US citizen or permanent resident with good credit who agrees to repay the loan if the student defaults. Lenders often require co-signers for international students due to a lack of US credit history.

Can I work part-time while studying to help pay for my education?

Yes, many international students work part-time jobs to supplement their finances. However, there are limitations on the number of hours you can work, and you must obtain the necessary work authorization.

What happens if I cannot repay my loan?

Failure to repay your loan can result in serious consequences, including damage to your credit score, wage garnishment, and potential legal action. It’s crucial to understand the repayment terms and plan accordingly.

Are there any government-sponsored loan programs for international students in the US?

Federal student loans are generally not available to international students. Funding is primarily sourced through private lenders or alternative funding options.