Navigating the complexities of England’s student loan system can be daunting, particularly understanding the fluctuating interest rates applied to different loan types and repayment plans. This guide aims to demystify the process, providing a comprehensive overview of current rates, historical trends, and future projections. We’ll explore the factors influencing these rates, compare them to international counterparts, and illustrate the impact on overall repayment costs.

From the initial loan disbursement to final repayment, understanding the interest rate structure is crucial for effective financial planning. This in-depth analysis will equip students and graduates with the knowledge to make informed decisions about their financial future, allowing for better budgeting and long-term financial stability.

Current England Student Loan Interest Rates

Understanding the interest rates applied to student loans in England is crucial for effective financial planning. The system is complex, varying based on the type of loan, repayment plan, and income level. This section will clarify the current structure and influencing factors.

Interest Rate Structure for Different Loan Types

England’s student loan system uses a tiered interest rate structure, differing depending on when the loan was taken out. Loans taken out before 2012 are subject to different interest rates compared to those taken out since then. For loans taken out since 2012, the interest rate is set annually by the government, usually in line with inflation or a set RPI (Retail Prices Index) figure. Older loans often have fixed interest rates determined at the time of borrowing. This means that the interest rate for a given loan remains constant throughout its repayment period. This difference highlights the importance of knowing the exact year your loan was taken out to determine your interest rate.

Factors Influencing Student Loan Interest Rates

Several factors influence the annual interest rate applied to student loans in England. Primarily, the government uses the Retail Prices Index (RPI) as a benchmark. The RPI measures the change in the price of a basket of goods and services, effectively reflecting inflation. The government’s decision to adjust rates also takes into account broader economic conditions, government borrowing costs, and the overall fiscal position. Therefore, interest rates are not static and can fluctuate year to year. Changes are typically announced annually.

Interest Rates Based on Repayment Plan and Income Threshold

Student loan repayment in England is income-contingent. This means repayments are only made once a borrower’s income exceeds a certain threshold. The repayment threshold and the rate of repayment are both factors in determining the total interest accrued over the loan’s lifespan. The interest rate itself, however, is generally not directly affected by the repayment plan or income bracket. The interest accrues regardless of whether or not repayments are being made, and the amount accrued is dependent on the outstanding loan balance.

Student Loan Interest Rate Summary Table

| Loan Type | Interest Rate (Example – Subject to Change) | Repayment Plan | Income Bracket (Example – Subject to Change) |

|---|---|---|---|

| Plan 1 (Loans from 2012 onwards) | RPI + 3% (Illustrative – Check Gov.uk for Current Rate) | Income-Contingent | Above £27,295 (Illustrative – Check Gov.uk for Current Threshold) |

| Plan 2 (Loans from before 2012) | Variable (Check individual loan agreement) | Income-Contingent | Above £27,295 (Illustrative – Check Gov.uk for Current Threshold) |

| Postgraduate Loans | RPI + 3% (Illustrative – Check Gov.uk for Current Rate) | Income-Contingent | Above £27,295 (Illustrative – Check Gov.uk for Current Threshold) |

| Other Loan Types (e.g., specific professional courses) | Variable (Check individual loan agreement) | Income-Contingent | Above £27,295 (Illustrative – Check Gov.uk for Current Threshold) |

Note: The interest rates and income thresholds provided in this table are examples only and are subject to change. Always refer to the official government website (gov.uk) for the most up-to-date and accurate information.

Historical Trends in England Student Loan Interest Rates

Over the past decade, England’s student loan interest rates have experienced considerable fluctuation, impacting millions of borrowers. Understanding these trends requires examining the interplay between government policy, economic conditions, and the specific loan repayment plans in place. The following analysis explores these shifts and their underlying causes.

Significant changes in interest rates have been largely driven by government policy decisions. The rates are not fixed but are instead adjusted periodically, often reflecting broader economic factors such as inflation and the Bank of England’s base rate. However, the government retains considerable control, meaning political priorities and budgetary considerations often play a crucial role in determining the final rate.

Government Policy’s Influence on Interest Rate Fluctuations

Government policies directly influence student loan interest rates. For example, changes in the Retail Price Index (RPI) often serve as a benchmark for rate adjustments, though the government isn’t obligated to follow it exactly. Budgetary constraints can also lead to decisions to increase or decrease rates to manage the overall cost of the student loan system to the taxpayer. Furthermore, the government may adjust rates to encourage or discourage borrowing, influencing the overall number of students pursuing higher education. These policy choices, therefore, have a significant and direct impact on the cost of borrowing for students and the long-term financial implications for graduates.

A Decade of Interest Rate Changes: 2014-2024 (Illustrative Example)

To illustrate the historical trends, consider a simplified example covering the period from 2014 to 2024. Note that this is a simplified representation and actual rates have varied significantly across different loan repayment plans and years. Precise data requires referencing official government sources like the Student Loans Company website.

Line Graph Description: A line graph would depict the trend, with the horizontal (x-axis) representing the year (2014-2024) and the vertical (y-axis) representing the annual interest rate (as a percentage). The line would show fluctuations over the decade. For example, we might see a relatively low rate in 2014, a gradual increase until 2018, followed by a period of relative stability or even slight decreases, and then perhaps another increase towards 2024. Key data points could include the highest and lowest rates within the decade, as well as years where significant policy changes were implemented leading to notable shifts in the interest rate.

Note: This description provides a framework for understanding the graph. The actual data points and precise shape of the line would need to be populated using official government data on student loan interest rates.

Comparison with Other Countries’ Student Loan Interest Rates

Understanding the cost of higher education requires a global perspective. While the English student loan system is unique, comparing its interest rates and structure to those of other developed nations offers valuable insights into different approaches to financing tertiary education. This comparison will focus on the United States, Canada, and Australia, highlighting key similarities and differences.

Interest rates and loan structures vary significantly across countries, reflecting differing economic priorities, government policies, and societal expectations regarding higher education access. Factors such as the level of government subsidy, the repayment mechanisms, and the overall economic climate all play a role in shaping the landscape of student loans. These differences can have a profound impact on graduates’ long-term financial well-being.

United States Student Loan Interest Rates

The US student loan system is notably more complex than England’s, featuring both federal and private loans with varying interest rates and repayment plans. Federal loans generally have lower interest rates than private loans, and rates can fluctuate depending on the loan type and the borrower’s creditworthiness. Repayment terms are also more flexible, with options like income-driven repayment plans that adjust payments based on earnings.

- Federal Loans: Interest rates vary depending on the loan type (e.g., subsidized, unsubsidized) and the year the loan was disbursed. Rates are typically fixed, but can change annually for new loans. Repayment begins six months after graduation or leaving school.

- Private Loans: Interest rates are typically higher than federal loans and are determined by the lender based on the borrower’s credit score and other factors. Repayment terms vary, and there are often fewer protections for borrowers.

- Key Difference from England: The US system emphasizes a broader range of loan options, but also entails a higher degree of individual responsibility for managing debt, with a greater potential for high-interest accumulation.

Canada Student Loan Interest Rates

Canada’s student loan system involves both federal and provincial loans. Interest rates are generally lower than in the US, and the government provides substantial subsidies. Interest does not accrue while a student is studying, and repayment is typically income-based, with a grace period before repayment begins.

- Federal Loans: Interest rates are set by the federal government and are relatively low. Repayment plans are flexible, and the government offers assistance to borrowers who are experiencing financial hardship.

- Provincial Loans: Each province has its own loan program, with slight variations in interest rates and repayment terms. However, the overall structure is broadly similar to the federal program.

- Key Difference from England: Canada’s system emphasizes government support and income-based repayment, leading to potentially lower long-term debt burdens for graduates compared to the US, but possibly less flexible than the UK system’s income-contingent repayment.

Australia Student Loan Interest Rates

Australia’s Higher Education Loan Program (HELP) operates on a similar income-contingent repayment model to England’s system. Interest is charged on the loan balance, but the rate is tied to inflation, which can fluctuate. Repayment is linked to income, and the loan is only repaid once a borrower’s income reaches a certain threshold.

- HELP Loan: The interest rate is linked to inflation and is generally lower than commercial interest rates. Repayment is income-contingent and begins once income surpasses a certain threshold.

- Key Difference from England: While both systems are income-contingent, the specific interest rate calculation and income thresholds for repayment may differ, leading to variations in the overall cost of the loan over time. Australia’s system might be more lenient in its repayment schedule compared to England’s.

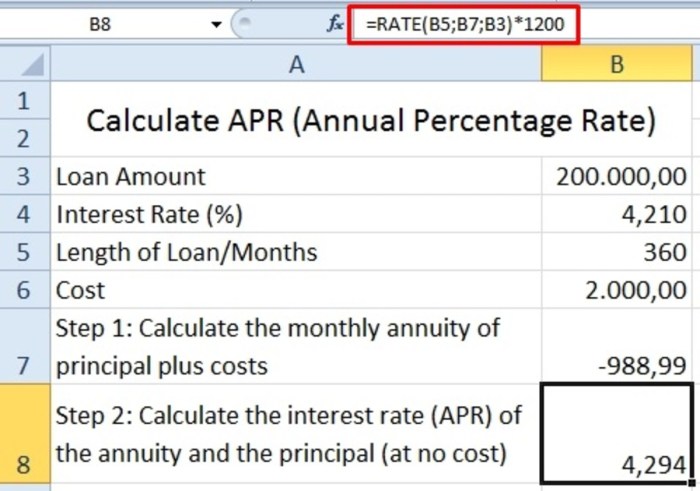

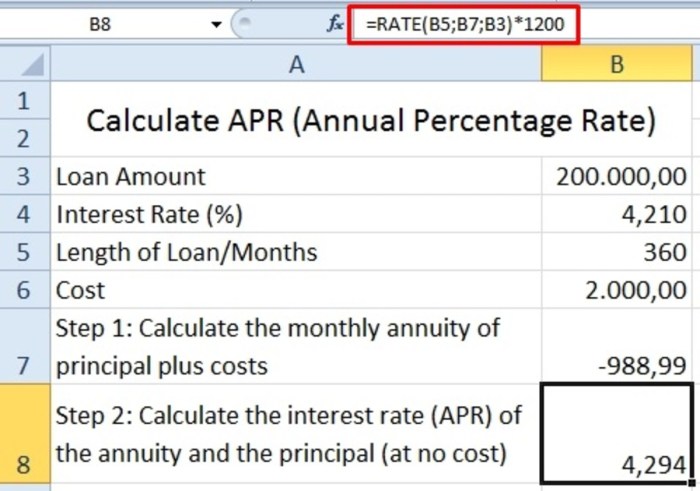

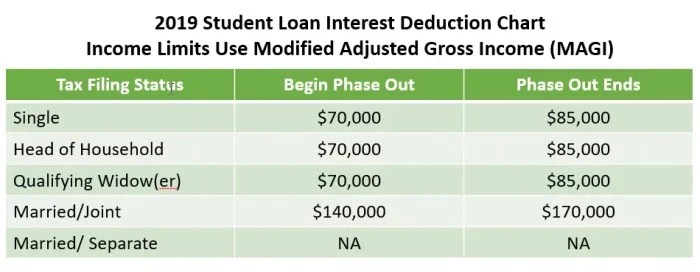

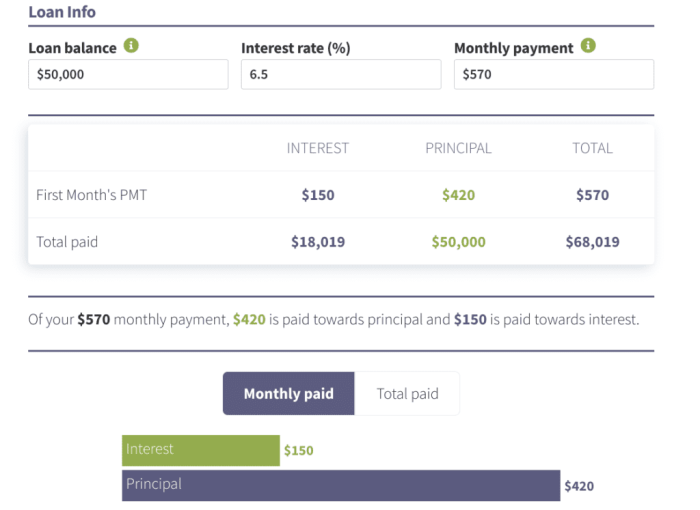

Impact of Interest Rates on Student Loan Repayment

The interest rate applied to a student loan significantly impacts the total amount repaid over the loan’s lifespan. Higher interest rates lead to larger overall repayments, while lower rates result in lower total costs. Understanding this relationship is crucial for effective financial planning after graduation. This section will explore how different interest rates affect repayment amounts across various repayment periods and loan sizes.

Understanding the effect of interest rates on your student loan repayment is key to managing your finances post-graduation. Even small differences in interest rates can accumulate to substantial variations in your total repayment cost over the life of the loan. This is because interest is calculated on the outstanding balance, meaning you pay interest on interest, a phenomenon known as compound interest.

Repayment Scenarios with Varying Interest Rates and Loan Amounts

The following examples illustrate how different interest rates and loan amounts affect the total repayment. We will assume a standard repayment plan for simplicity, focusing solely on the impact of interest rate changes. These are illustrative examples and may not reflect the exact specifics of any particular repayment plan.

Example 1: A £20,000 loan repaid over 20 years.

Scenario A: 2% interest rate. The total repayment would be significantly lower compared to higher interest rates, due to the smaller amount added as interest to the principal loan amount.

Scenario B: 5% interest rate. The total repayment would be considerably higher than Scenario A, showcasing the impact of even a seemingly small increase in the interest rate.

Scenario C: 8% interest rate. This scenario will demonstrate a markedly higher total repayment than both Scenario A and Scenario B, highlighting the substantial impact of higher interest rates on long-term repayment. This emphasizes the importance of choosing a repayment plan carefully and seeking advice where needed.

Impact of Interest Rates on Total Repayment

The table below summarizes the total interest paid and the total repayment amount under different interest rate scenarios for a £20,000 loan repaid over 20 years. These figures are illustrative and based on simple interest calculations for ease of understanding. Actual repayment amounts may vary depending on the specific repayment plan and any potential changes to interest rates during the repayment period. It’s crucial to consult official sources for precise calculations relevant to your individual circumstances.

| Interest Rate | Total Interest Paid (£) | Total Repayment (£) |

|---|---|---|

| 2% | 4,000 (approximate) | 24,000 (approximate) |

| 5% | 12,000 (approximate) | 32,000 (approximate) |

| 8% | 24,000 (approximate) | 44,000 (approximate) |

The Role of Inflation on Student Loan Interest Rates

Inflation plays a significant role in determining the interest rates applied to English student loans. The relationship is complex, impacting both borrowers and the government, and necessitating adjustments to interest rate calculations to maintain a degree of fairness and fiscal responsibility.

Inflation erodes the purchasing power of money. When inflation rises, the real value of a pound decreases. This affects both borrowers and the government in relation to student loans. For borrowers, higher inflation means that the real cost of repaying their loan, adjusted for the reduced value of money, is lower than it would be in a low-inflation environment. Conversely, for the government, high inflation diminishes the real value of the loan repayments it receives, potentially impacting its ability to fund future education initiatives. The government must therefore carefully consider the inflationary environment when setting interest rates to ensure the long-term sustainability of the student loan system.

Inflation’s Impact on Borrowers

Higher inflation generally leads to higher nominal interest rates on student loans. However, the impact on the borrower is not solely determined by the nominal rate. The real interest rate, which accounts for inflation, provides a more accurate picture of the loan’s true cost. For example, if the nominal interest rate is 5% and inflation is 3%, the real interest rate is approximately 2%. In periods of high inflation, the government might set higher nominal rates, but these could still represent a relatively low real cost to the borrower, especially compared to periods of low inflation and low nominal interest rates. This necessitates a nuanced understanding of the relationship between nominal and real interest rates to fully assess the impact on borrowers.

Inflation’s Impact on the Government

From the government’s perspective, inflation affects the real value of future loan repayments. High inflation reduces the real value of the money received from borrowers. This means that the government receives less in real terms than initially projected, potentially creating budgetary challenges for the student loan program. Conversely, low inflation, or even deflation, could increase the real value of repayments, resulting in higher-than-expected returns for the government. This dynamic influences the government’s decision-making process concerning the setting of student loan interest rates and the overall management of the student loan system.

Government Mechanisms for Adjusting Interest Rates in Response to Inflation

The UK government uses a variety of mechanisms to adjust student loan interest rates in response to inflation. These mechanisms aim to balance the needs of borrowers and the fiscal sustainability of the loan program. While the precise formula is subject to change and is not publicly available in a simple, easily understood form, it generally incorporates elements of the Retail Price Index (RPI) or Consumer Price Index (CPI) as measures of inflation. These indices track the changes in the price of a basket of goods and services, providing a measure of the overall rate of inflation in the economy. The government’s calculations incorporate a margin over the inflation rate, taking into account factors such as the government’s borrowing costs and the risk associated with student loan repayments. The resulting interest rate is then applied to the outstanding loan balances. The complexity of this calculation reflects the intricate interplay between inflation, government finances, and the need to maintain a fair and sustainable student loan system.

Future Projections of England Student Loan Interest Rates

Predicting future interest rates on England’s student loans is inherently complex, involving numerous interwoven economic and political factors. While precise forecasting is impossible, analyzing current trends and potential influences allows for a reasoned discussion of likely scenarios. The following explores potential future trajectories and their implications for borrowers.

Several key factors will shape future interest rate movements. The most significant is likely to be the overall economic climate. Periods of strong economic growth, typically accompanied by inflation, might lead the government to increase interest rates to manage inflation. Conversely, during economic downturns or recessions, the government might opt for lower rates to stimulate borrowing and spending. Government policy itself plays a crucial role, with changes in fiscal policy, political priorities, and the overall approach to student loan management directly impacting interest rate decisions. For example, a government committed to reducing the national debt might prioritize higher interest rates to accelerate loan repayment, even at the cost of increased borrower burden. Conversely, a government prioritizing access to higher education might favor lower rates to encourage enrollment.

Economic Growth and Inflation’s Influence

The relationship between economic growth, inflation, and student loan interest rates is intricate. High inflation, often a symptom of robust economic growth, can pressure the government to raise interest rates to curb rising prices. This would translate directly into higher interest payments for student loan borrowers. Conversely, during periods of slow economic growth or deflation, the government might lower interest rates to stimulate the economy. However, this could lead to slower repayment of student loans, potentially impacting the government’s fiscal position. For example, the period of high inflation following the 2008 financial crisis led to fluctuating interest rates on student loans, demonstrating the direct link between macroeconomic conditions and student loan costs.

Government Policy and its Impact

Government policy significantly influences student loan interest rates. Changes in government priorities, such as a shift towards increased funding for higher education or a focus on fiscal austerity, will likely be reflected in interest rate adjustments. A government committed to making higher education more accessible might maintain lower interest rates, while a government aiming to reduce national debt might favor higher rates to accelerate loan repayments. The introduction of new student loan schemes or modifications to existing repayment plans could also indirectly affect interest rates, reflecting the government’s broader strategy for managing student debt. For instance, a shift towards income-contingent repayment plans might be accompanied by adjustments to interest rates to balance the financial implications for both borrowers and the government.

Potential Impact on Student Borrowers

Future interest rate changes will directly affect the financial burden faced by student borrowers. Higher interest rates will lead to increased repayment costs over the loan’s lifetime, potentially delaying debt repayment and impacting borrowers’ financial well-being. Conversely, lower interest rates will reduce the total amount paid, providing financial relief to borrowers. The impact will vary significantly depending on individual loan amounts, repayment plans, and income levels. For instance, graduates entering a high-earning career might be less affected by increased interest rates compared to those entering lower-paying jobs. The uncertainty surrounding future interest rate movements underscores the importance of careful financial planning for prospective and current student loan borrowers.

Ending Remarks

Understanding England’s student loan interest rate system is paramount for responsible financial management. While the system’s complexity can be overwhelming, this guide has provided a framework for navigating the intricacies of current rates, historical trends, and future projections. By grasping the interplay of government policies, inflation, and individual repayment plans, borrowers can better anticipate their repayment obligations and plan accordingly. Proactive financial planning, coupled with a thorough understanding of the loan terms, is key to successful repayment and long-term financial well-being.

FAQ Insights

What happens if I don’t repay my student loan?

Failure to repay your student loan can result in debt collection actions, impacting your credit score and potentially leading to legal proceedings.

Are there any ways to reduce my student loan interest?

While you can’t directly reduce the interest rate, diligent repayment and exploring income-contingent plans can minimize the overall interest paid.

How are student loan interest rates determined?

Interest rates are typically set by the government and are often influenced by factors such as inflation, economic conditions, and government policy.

Can I consolidate my student loans?

Currently, there isn’t a standard student loan consolidation program in England. However, you might explore other debt consolidation options with a financial advisor.