Understanding how your student loans affect your Experian credit score is crucial for financial well-being. This comprehensive guide delves into the intricacies of Experian’s student loan reporting, exploring how this data is collected, its impact on your creditworthiness, and strategies for effective management. We’ll cover accessing your report, disputing inaccuracies, and leveraging this information to navigate student loan repayment and forgiveness programs effectively.

From the initial data collection process to the potential implications for loan forgiveness programs, we’ll illuminate the relationship between Experian’s reporting and your student loan journey. We’ll also provide practical advice on how to utilize this information to your advantage, helping you make informed decisions about your financial future.

Experian’s Role in Student Loan Reporting

Experian, one of the three major credit bureaus in the United States, plays a significant role in the collection and reporting of student loan data. This information is crucial for lenders, potential employers, and even individuals themselves in understanding their financial standing and creditworthiness. Understanding how Experian handles this data is vital for borrowers to manage their student loan debt effectively.

Experian’s Student Loan Data Collection and Reporting

Experian collects student loan data primarily from your lenders. These lenders, including both federal and private student loan servicers, regularly submit information on borrowers’ loan balances, payment history, and account status. This data is then processed and integrated into Experian’s credit reports. It’s important to note that Experian does not directly originate or issue student loans; its role is solely to compile and report the data provided by the lenders. The accuracy of this data, therefore, heavily relies on the accuracy of the information submitted by the lenders.

Types of Student Loan Information in Experian Reports

Experian’s student loan reports typically include several key pieces of information. This includes the lender’s name, loan amount, loan type (e.g., federal subsidized, federal unsubsidized, private), interest rate, monthly payment amount, payment history (showing on-time payments, late payments, or missed payments), and the current loan status (e.g., current, delinquent, in default, paid in full). This comprehensive overview allows for a detailed assessment of the borrower’s student loan debt management.

Comparison with Other Credit Bureaus

While the core function of reporting student loan information is similar across the three major credit bureaus (Experian, Equifax, and TransUnion), there might be slight variations in the specific data points included and the timing of updates. These differences are typically minor and generally do not significantly alter the overall picture of a borrower’s credit profile. However, it’s always beneficial to review your credit reports from all three bureaus to get a complete understanding of your credit history.

Impact of Inaccuracies in Experian’s Student Loan Data

Inaccuracies in Experian’s student loan data can have significant consequences for borrowers. For instance, reporting a late payment that never occurred could negatively impact a borrower’s credit score, making it more difficult to secure loans, rent an apartment, or even get a job in certain fields. Conversely, a missing or inaccurate payment history could lead to an underestimation of the borrower’s creditworthiness. It’s crucial to monitor your Experian report regularly and dispute any inaccuracies promptly. If a significant error is discovered, it can be crucial to follow the dispute process Artikeld by Experian.

Key Elements of a Typical Experian Student Loan Report

| Element | Description | Impact on Credit | Example |

|---|---|---|---|

| Lender Name | The name of the institution that issued the loan. | None directly, but indicates debt source. | Sallie Mae |

| Loan Amount | The original principal balance of the loan. | Influences debt-to-income ratio. | $25,000 |

| Loan Type | Indicates whether the loan is federal or private. | May influence repayment options. | Federal Subsidized |

| Payment History | A record of on-time and late payments. | Significant impact on credit score. | 36 months of on-time payments |

Impact of Student Loans on Experian Credit Scores

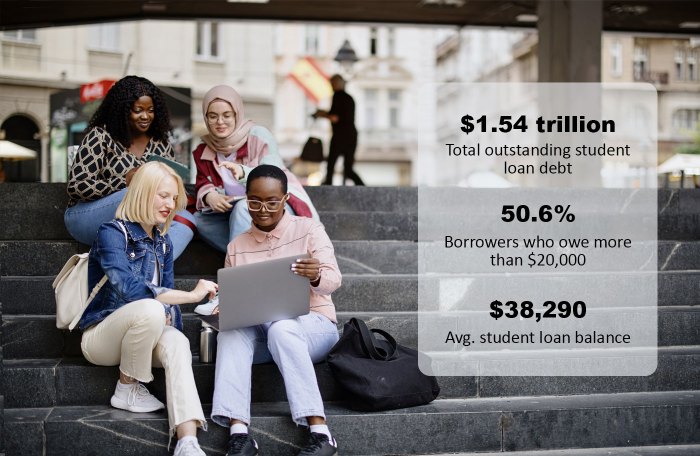

Student loan debt significantly impacts your Experian credit score, a crucial factor in various financial decisions. Understanding this impact and employing effective management strategies is key to maintaining a healthy credit profile. The way your student loans are handled directly affects your creditworthiness as assessed by Experian and other credit bureaus.

Student loan payments, or lack thereof, are a major component of your credit score calculation. Experian, like other credit reporting agencies, uses a scoring model that heavily weighs payment history. Consistent on-time payments demonstrate financial responsibility, positively impacting your score. Conversely, missed or late payments can severely damage your credit score, potentially leading to higher interest rates on future loans and difficulty securing credit. The length of your credit history also plays a role; a longer history of responsible student loan management strengthens your credit profile.

Student Loan Repayment Plans and Their Credit Report Implications

Different repayment plans influence how your student loans are reported on your Experian credit report. For instance, while an income-driven repayment plan might offer lower monthly payments, any period of forbearance or deferment, where payments are temporarily suspended, will be recorded on your credit report. While this doesn’t automatically translate to a negative mark, it can impact your credit score, especially if it extends for a long period. On the other hand, consistently making payments under any plan, even a smaller amount, demonstrates responsible financial behavior. This positive behavior outweighs the impact of the plan itself on your credit report. In contrast, defaulting on your student loans will severely damage your credit score and can lead to wage garnishment or collection actions.

Factors Beyond Payment History Affecting Student Loan Assessment

While payment history is paramount, other factors influence Experian’s assessment of your student loan accounts. The total amount of your student loan debt relative to your available credit is a key consideration. High levels of student loan debt compared to your income can indicate higher risk to lenders. Furthermore, the type of loan—federal or private—can also play a role. Experian assesses the overall picture, considering the interplay between your payment history, debt-to-income ratio, and the types of loans you hold. Finally, the age of your student loan accounts is considered; older accounts with a history of on-time payments contribute positively to your credit score.

Proactive Steps to Mitigate Negative Impacts

It’s crucial to proactively manage your student loans to avoid negative impacts on your Experian credit score. Here are some key steps:

- Automate Payments: Set up automatic payments to ensure on-time payments every month.

- Budget Carefully: Create a realistic budget that prioritizes student loan payments.

- Monitor Your Credit Report: Regularly check your Experian credit report for accuracy and identify any potential issues.

- Explore Repayment Options: Research and choose a repayment plan that aligns with your financial capabilities.

- Communicate with Lenders: Contact your lenders if you anticipate difficulties making payments to explore potential solutions.

Accessing and Understanding Experian Student Loan Information

Understanding how your student loans are reported on your Experian credit report is crucial for managing your finances and credit health. This information can significantly impact your credit score and your ability to obtain future credit. Accurate and readily accessible information empowers you to address any discrepancies and maintain a positive credit history.

Obtaining a Copy of Your Experian Credit Report

To access your Experian credit report, you can visit the Experian website directly or utilize AnnualCreditReport.com, the only authorized source for free credit reports from the three major credit bureaus (Experian, Equifax, and TransUnion). AnnualCreditReport.com allows you to request a free copy of your report from each bureau once every 12 months. The process typically involves providing some personal information for verification purposes. Once you have your report, locate the section detailing your student loan accounts.

Key Elements of Student Loan Information on an Experian Report

Your Experian report will display key details about your student loans, including the lender’s name, account number (often partially masked for security), loan balance, payment status (current, past due, etc.), and the date the account was opened. It also shows your payment history, which is a critical factor influencing your credit score. Look for any inconsistencies or inaccuracies; these are important to address promptly. The report might also indicate the type of loan (e.g., federal subsidized, federal unsubsidized, private). Understanding these details allows you to track your progress in paying off your loans and to identify potential problems.

Disputing Inaccurate Student Loan Information

If you discover inaccuracies in your student loan information on your Experian report, you have the right to dispute them. This process typically involves submitting a dispute form directly through the Experian website or by mail. The form requires you to clearly identify the inaccurate information and provide supporting documentation, such as loan agreements or payment confirmations. Experian will then investigate your claim and update your report accordingly if the error is confirmed. Keep records of all communication with Experian during this process.

Interpreting Experian Student Loan Notations and Codes

Experian uses various codes and notations to indicate the status of your student loans. For example, “Current” signifies that your payments are up-to-date, while “Past Due” indicates missed or late payments. Understanding these notations is vital for interpreting the overall health of your student loan accounts. The report will also show the date of last activity on the account, and any collections status. Experian provides a glossary of terms on their website that can help you understand the meaning of specific codes and notations.

Flowchart: Obtaining and Reviewing Experian Student Loan Information

A flowchart illustrating this process would begin with a box labeled “Request Credit Report (AnnualCreditReport.com or Experian.com)”. An arrow would lead to a box labeled “Receive Credit Report”. Another arrow would point to a box labeled “Locate Student Loan Section”. From there, an arrow branches to two boxes: “Information Accurate” (leading to a box labeled “Monitor Regularly”) and “Information Inaccurate” (leading to a box labeled “File Dispute with Experian”). The “File Dispute” box leads to a box labeled “Provide Documentation” and then to a box labeled “Await Experian Response.” Finally, an arrow from both the “Monitor Regularly” and “Await Experian Response” boxes leads to a final box labeled “Review Credit Report Regularly”. This visual representation provides a clear path for navigating the process.

Student Loan Management and Experian Data

Experian provides a valuable, albeit limited, snapshot of your student loan debt. Understanding how this data interacts with information directly from your loan servicer is crucial for effective student loan management. While Experian reports offer a consolidated view of your credit profile, including student loans, your servicer holds the detailed account information needed for repayment planning and troubleshooting.

Effectively using both sources of information allows for a more comprehensive understanding of your financial picture and empowers you to make well-informed decisions regarding your student loan repayment strategy.

Experian Data Versus Servicer Data

Experian reports generally show the total amount of your student loan debt, the number of accounts, and your payment history as reflected on your credit report. This information is summarized and may not include granular details like specific loan terms (interest rates, repayment plans), current balance, or upcoming payment dates. In contrast, your student loan servicer provides a detailed account statement, including all the aforementioned information and more. Comparing these two data sources can help identify discrepancies or missing information, ensuring accuracy in your financial planning. For instance, a discrepancy in the reported balance between Experian and your servicer could indicate a reporting error that needs to be addressed.

Utilizing Experian Data for Informed Repayment Decisions

Experian data, while not exhaustive, plays a crucial role in informing repayment strategies. By observing your payment history as reflected on your Experian report, you can assess your current repayment performance. Consistent on-time payments, as reflected in a positive payment history, positively impact your credit score, which in turn can help you secure better interest rates on future loans or other financial products. Conversely, late or missed payments can negatively impact your credit score and potentially lead to higher interest rates and financial difficulties. Monitoring this data enables proactive adjustments to your repayment strategy, ensuring you stay on track.

Identifying Potential Problems with Student Loan Accounts

Regularly reviewing your Experian report can reveal potential problems with your student loan accounts. Inconsistencies in reported balances, inaccurate payment history, or the presence of accounts you don’t recognize are all red flags requiring immediate investigation with your loan servicer. Early detection of these issues allows for timely resolution, preventing more significant financial repercussions. For example, a sudden drop in your credit score could signal a missed payment or a reporting error that needs immediate attention.

Negotiating with Student Loan Servicers Using Experian Data

While Experian data itself won’t directly influence a loan servicer’s decision, it can be a valuable tool when negotiating repayment plans. If you’ve consistently made on-time payments as reflected on your Experian report, this demonstrates a history of responsible financial behavior, which can strengthen your case when requesting a modification or forbearance. It provides concrete evidence of your commitment to repayment, increasing the likelihood of a favorable outcome. However, remember that the primary source of information for the servicer remains your official loan account details.

Sample Letter to a Student Loan Servicer

To illustrate how Experian data can support communication with your loan servicer, here’s a sample letter. Remember to replace the bracketed information with your specific details.

[Your Name]

[Your Address]

[Your Phone Number]

[Your Email Address][Date]

[Servicer Name]

[Servicer Address]Subject: Inquiry Regarding Student Loan Account [Account Number]

Dear [Servicer Contact Person],I am writing to inquire about a discrepancy between my Experian credit report and my student loan account statement for account number [Account Number]. My Experian report indicates [Specific detail from Experian report, e.g., a late payment on a specific date], while my account statement shows [Specific detail from your account statement, e.g., an on-time payment]. Could you please investigate this discrepancy and provide clarification?

Thank you for your time and attention to this matter.

Sincerely,

[Your Signature]

[Your Typed Name]

Experian and Student Loan Forgiveness Programs

Experian, as a major credit reporting agency, plays a significant role in how student loan forgiveness programs impact an individual’s credit profile. While Experian doesn’t directly administer these programs, the data it holds is frequently used in the qualification process and reflects the outcome on a borrower’s credit report. Understanding this interplay is crucial for borrowers navigating loan forgiveness.

Experian’s data is utilized by lenders and loan servicers to verify borrower information and track loan repayment history. This information is essential in determining eligibility for forgiveness programs, as many require a specific number of qualifying payments or adherence to specific repayment plans. The accuracy and completeness of the data reported to Experian directly affect the success of a forgiveness application.

Experian Data in Student Loan Forgiveness Qualification

The accuracy of information reported to Experian regarding your student loans—including payment history, loan balances, and types of loans—is vital for determining eligibility for forgiveness programs. Inaccurate or incomplete data could lead to delays or rejection of your application. For instance, a missed payment might be incorrectly recorded, potentially impacting your eligibility for programs that require consistent on-time payments. Conversely, accurately reported information demonstrating consistent repayment over the required period can strengthen your application.

Impact of Successful Forgiveness on Experian Credit Reports

Successful completion of a student loan forgiveness program typically results in the reporting of the loan as “paid in full” or “settled” on your Experian credit report. This positive change can improve your credit score, as it removes the burden of a large outstanding debt. The positive impact will depend on several factors, including your overall credit history and the size of the forgiven loan. For example, forgiving a significant portion of your debt will generally have a more noticeable positive impact than forgiving a small loan amount.

Factors Affecting Reporting of Forgiven Student Loans

Several factors influence how forgiven student loans are reported on Experian reports. The specific program rules, the loan servicer’s reporting practices, and the timing of the forgiveness are all key considerations. For example, some programs may require a specific waiting period before the loan is marked as paid in full, leading to a temporary delay in seeing the positive impact on your credit score. Also, inconsistencies in reporting between the loan servicer and Experian can cause delays or inaccuracies in reflecting the forgiven loan status.

Potential Misinterpretations of Experian Data Related to Loan Forgiveness

While Experian strives for accuracy, misinterpretations can occur. For example, a lender reviewing your credit report might not fully understand the nuances of a forgiven loan. They may mistakenly interpret the previous history of missed payments or late payments before forgiveness, without considering the ultimate positive outcome of the loan being forgiven. Similarly, a lender may initially see a significant drop in your credit utilization ratio (the percentage of your available credit you’re using) after forgiveness, but this should be interpreted positively in the context of the forgiven debt. Careful review and understanding of the complete credit history is essential to avoid misinterpretations.

Comparison of Student Loan Forgiveness Programs and Their Impact on Experian Credit Reports

The impact of different student loan forgiveness programs on Experian credit reports can vary. While the ultimate outcome—a paid-in-full status—is generally the same, the timeline and reporting accuracy can differ.

| Program | Time to Reflect on Report | Potential Impact on Score | Reporting Considerations |

|---|---|---|---|

| Public Service Loan Forgiveness (PSLF) | Varies, often several months after forgiveness | Significant positive impact due to removal of substantial debt | Requires meticulous documentation of qualifying payments; delays possible due to verification process. |

| Income-Driven Repayment (IDR) Plans leading to forgiveness | Varies depending on plan and income; often after 20-25 years | Positive impact, but less dramatic than PSLF due to longer repayment period | Requires consistent reporting of income and adherence to plan requirements; delays possible due to complexities of income-based calculations. |

| Teacher Loan Forgiveness | Varies; typically after completing required service | Positive impact proportional to loan amount forgiven | Requires verification of teaching service; reporting delays possible due to verification processes. |

| Other Federal Forgiveness Programs | Varies depending on the specific program | Positive impact proportional to loan amount forgiven | Specific program requirements and reporting timelines vary significantly. |

End of Discussion

Successfully navigating the complexities of student loan repayment requires a proactive approach. By understanding how Experian reports your student loan information and utilizing the strategies Artikeld in this guide, you can gain control over your financial narrative. Regularly monitoring your Experian report, actively managing your debt, and understanding the nuances of loan forgiveness programs empowers you to build a strong credit profile, paving the way for future financial success.

FAQ Compilation

How often does Experian update student loan information?

Experian updates its data regularly, though the frequency varies depending on the information source. It’s best to check your report monthly for any changes.

Can I dispute inaccurate student loan information on my Experian report?

Yes, Experian provides a process to dispute inaccurate information. Gather supporting documentation and follow their dispute resolution procedures carefully.

Does paying off student loans quickly significantly improve my Experian credit score?

Yes, consistently making on-time payments and reducing your debt-to-credit ratio will positively impact your score. However, the extent of the improvement depends on several factors.

How does Experian handle student loans in default?

Student loans in default are typically reported negatively, significantly impacting your credit score. Addressing the default promptly is crucial to mitigate the damage.