Navigating the complexities of student loans can feel overwhelming, especially when understanding the intricacies of interest rates. This guide delves into the world of FAFSA and federal student loans, providing a clear explanation of how interest rates are determined, how they impact your repayment, and strategies for managing your debt effectively. We’ll explore different loan types, repayment plans, and the influence of factors like financial aid and credit history on your overall loan costs.

Understanding your FAFSA student loan interest rate is crucial for long-term financial planning. This guide aims to demystify the process, equipping you with the knowledge to make informed decisions about your education financing and future repayment strategy. From subsidized and unsubsidized loans to repayment plans and debt management techniques, we cover all the essential aspects to empower you in your financial journey.

Understanding FAFSA and Student Loans

The Free Application for Federal Student Aid (FAFSA) is the gateway to federal student financial aid, including loans. Completing the FAFSA is crucial for determining your eligibility for various federal student loan programs. Understanding the FAFSA process and the types of loans available is essential for making informed decisions about financing your education.

The Relationship Between FAFSA and Student Loan Eligibility

The FAFSA application collects information about your financial situation, including your income, assets, and family size. This information is used to calculate your Expected Family Contribution (EFC), which represents your family’s estimated contribution towards your education costs. The difference between your cost of attendance and your EFC determines your financial need. Your financial need directly impacts your eligibility for federal student loans, with higher need often translating to higher loan eligibility. The FAFSA doesn’t guarantee loans; it determines how much you *might* qualify for. The actual loan amount offered will depend on your school’s policies and available funds.

Types of Federal Student Loans

The federal government offers several types of student loans, each with its own terms and conditions. These loans are generally preferred over private loans due to their more favorable repayment options and protections for borrowers.

Factors Influencing Student Loan Interest Rates

Several factors influence the interest rate you’ll receive on your federal student loans. These include the type of loan (subsidized vs. unsubsidized), the loan’s disbursement date (interest rates are set annually), and, in some cases, your credit history (though this is less common for federal loans compared to private loans). Additionally, the length of the repayment plan can indirectly affect the total interest paid, although the interest rate itself remains fixed. For example, a longer repayment period will result in more interest paid over the life of the loan, even if the interest rate is the same as a shorter repayment period.

Comparison of Subsidized and Unsubsidized Loans

The primary difference between subsidized and unsubsidized loans lies in whether the government pays the interest while you’re in school.

| Loan Type | Interest Accrual During School | Interest Rate (Example – rates vary annually) | Eligibility |

|---|---|---|---|

| Subsidized | No interest accrues while enrolled at least half-time. | Example: 5% | Based on demonstrated financial need. |

| Unsubsidized | Interest accrues from the time the loan is disbursed. | Example: 6% | Available to undergraduate and graduate students regardless of financial need. |

Interest Rate Calculation and Accrual

Understanding how interest rates are determined and how interest accrues on your student loans is crucial for effective financial planning. This section will clarify the process, helping you anticipate and manage your loan repayment. Knowing these details allows you to make informed decisions about your borrowing and repayment strategy.

The interest rate applied to your federal student loans depends on several factors, most notably the type of loan and the loan’s disbursement date. Subsidized federal Stafford loans, for example, typically have a lower interest rate than unsubsidized Stafford loans. This difference reflects the fact that the government pays the interest on subsidized loans while you’re in school (under certain conditions), while you are responsible for all interest on unsubsidized loans from the time the loan is disbursed. The interest rate for each loan type is set annually by the government and is fixed for the life of the loan. Private student loans, on the other hand, are offered by banks and other private lenders and typically have variable interest rates, meaning the rate can change over the life of the loan. This makes budgeting and planning more complex. It’s essential to carefully review the terms and conditions of any private loan before accepting it.

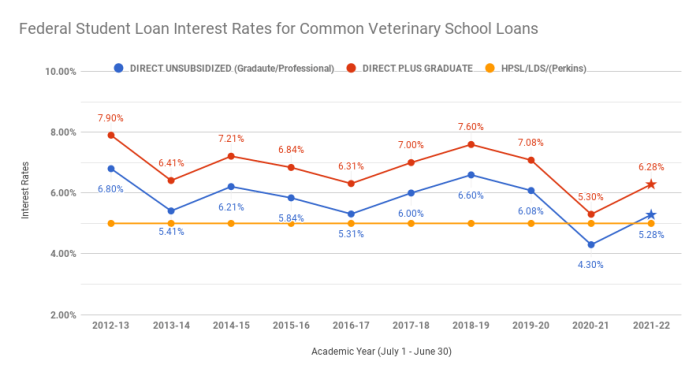

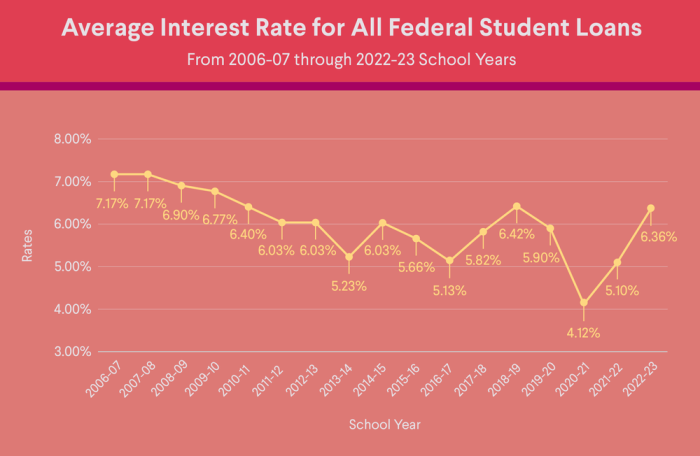

Interest Rate Determination for Federal Student Loans

The interest rate for federal student loans is determined by the U.S. Department of Education. These rates are usually set annually and are based on the 10-year Treasury note yield, plus a fixed margin. The specific margin varies depending on the type of loan. For example, subsidized Stafford loans might have a smaller margin than unsubsidized Stafford loans. The government publishes these rates, making them readily accessible to students and borrowers. It’s advisable to check the Federal Student Aid website for the most up-to-date information.

Interest Capitalization

Interest capitalization is the process of adding accrued but unpaid interest to the principal loan balance. This means that the interest that accumulates on your loan while you are in school or during grace periods (before repayment begins) is added to your loan’s principal amount. This increases the total amount you owe and, consequently, increases the total amount of interest you’ll pay over the life of the loan. For instance, if you have $10,000 in student loan debt and $1,000 in accrued interest, after capitalization, your new principal balance becomes $11,000. You will then pay interest on this higher amount.

Impact of Different Interest Rates on Loan Repayment

The interest rate significantly impacts your total loan repayment. A higher interest rate means you’ll pay more in interest over the life of the loan, even if your monthly payment remains the same. Let’s illustrate with examples: Consider two loans of $10,000 each, one with a 5% interest rate and another with a 7% interest rate, both repaid over 10 years. The loan with the 7% interest rate will result in a significantly higher total repayment amount. This is because a larger portion of each payment will go towards interest rather than principal.

Loan Principal Growth with Varying Interest Rates Over 10 Years

The following table illustrates the growth of a $10,000 loan principal with different interest rates over a 10-year period, assuming no payments are made (to highlight the impact of compounding interest). This is a simplified example, and actual repayment scenarios will vary based on payment plans and schedules.

| Year | 5% Interest | 7% Interest | 9% Interest |

|---|---|---|---|

| 0 | $10,000 | $10,000 | $10,000 |

| 1 | $10,500 | $10,700 | $10,900 |

| 2 | $11,025 | $11,449 | $11,881 |

| 3 | $11,576 | $12,250 | $12,950 |

| 4 | $12,155 | $13,108 | $14,116 |

| 5 | $12,763 | $14,026 | $15,386 |

| 6 | $13,401 | $15,007 | $16,771 |

| 7 | $14,071 | $16,059 | $18,280 |

| 8 | $14,775 | $17,182 | $19,926 |

| 9 | $15,513 | $18,385 | $21,719 |

| 10 | $16,289 | $19,672 | $23,674 |

Repayment Plans and Interest Rates

Choosing the right repayment plan for your federal student loans is crucial, as it significantly impacts your monthly payments and the total interest you’ll pay over the life of the loan. Understanding the various plans and how interest rates affect them is essential for responsible debt management. This section will Artikel the key differences between several federal student loan repayment plans and explain how interest rates influence your best choice.

Federal Student Loan Repayment Plan Comparison

Several federal student loan repayment plans cater to different financial situations and repayment preferences. The most common plans include Standard, Graduated, Extended, and Income-Driven Repayment (IDR) plans. Each plan has a different repayment schedule and, consequently, a different impact on the total interest paid. The Standard Repayment Plan, for example, involves fixed monthly payments over 10 years, while the Extended Repayment Plan stretches payments over a longer period (up to 25 years), resulting in lower monthly payments but higher overall interest costs. Graduated repayment plans start with lower monthly payments that increase over time.

Interest Rate’s Influence on Repayment Plan Selection

The interest rate on your federal student loans directly affects the total cost of repayment, regardless of the plan chosen. A higher interest rate means you’ll pay more in interest over the life of the loan. Therefore, choosing a repayment plan with shorter repayment periods (like the Standard plan) might seem attractive for minimizing total interest, but only if you can comfortably afford the higher monthly payments. Conversely, a longer repayment period, like the Extended plan, might be more manageable monthly, but it comes with the trade-off of significantly higher overall interest charges. For example, a $30,000 loan at 5% interest repaid over 10 years (Standard) will cost considerably less than the same loan repaid over 25 years (Extended).

Consequences of Deferment or Forbearance on Interest Accrual

Deferment and forbearance are temporary pauses in your loan repayments. While they offer short-term relief, it’s crucial to understand their impact on interest. During deferment, interest may or may not accrue depending on the type of loan and the reason for deferment. For subsidized loans, the government typically pays the interest during certain deferment periods. However, for unsubsidized loans, interest continues to accrue during deferment and is added to the principal balance, increasing the total loan amount. Forbearance usually means that interest continues to accrue on both subsidized and unsubsidized loans, increasing the overall cost of borrowing. Therefore, while deferment or forbearance can provide temporary financial breathing room, they often lead to a larger overall debt burden due to accumulated interest.

Income-Driven Repayment (IDR) Plans and Their Impact on Interest Payments

Income-Driven Repayment plans link your monthly payments to your income and family size. These plans typically offer lower monthly payments than other repayment plans, making them more manageable for borrowers with limited incomes. However, because the payments are lower, the repayment period is usually extended (potentially up to 20 or 25 years), leading to a higher total interest paid over the life of the loan. There are several types of IDR plans, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). Each plan has slightly different eligibility requirements and payment calculation formulas.

| Repayment Plan | Payment Calculation | Repayment Period | Interest Impact |

|---|---|---|---|

| Income-Based Repayment (IBR) | Based on discretionary income and family size | Up to 25 years | High total interest due to longer repayment |

| Pay As You Earn (PAYE) | Based on discretionary income and family size | Up to 20 years | High total interest due to longer repayment |

| Revised Pay As You Earn (REPAYE) | Based on discretionary income and family size | Up to 20 or 25 years | High total interest due to longer repayment |

| Income-Contingent Repayment (ICR) | Based on income and loan amount | Up to 25 years | High total interest due to longer repayment |

Impact of Credit History and Financial Aid

While your credit history doesn’t directly influence your student loan interest rates in the same way it affects other loans (like mortgages or auto loans), it can indirectly impact your borrowing experience and overall cost. This indirect influence stems from the interplay between your creditworthiness and your eligibility for additional financial aid.

Your credit history, or lack thereof, can affect your ability to secure private student loans, which often have higher interest rates than federal loans. A strong credit history might make you eligible for more favorable terms from private lenders, potentially resulting in lower interest rates. Conversely, a poor or nonexistent credit history could limit your options or result in higher interest rates, increasing your overall loan burden. This is because lenders assess risk, and a poor credit history indicates a higher risk of default.

Credit History’s Indirect Influence on Student Loan Interest Rates

A strong credit history, while not directly impacting federal student loan interest rates, can open doors to more favorable private loan options, potentially offering lower interest rates. Conversely, a poor credit history might restrict access to private loans or lead to higher interest rates on those loans. This makes securing additional financial aid, especially grants and scholarships, even more crucial for students with less-than-perfect credit.

Relationship Between Financial Aid and Loan Interest Burden

Receiving additional financial aid, particularly grants and scholarships, significantly reduces the amount of money you need to borrow in student loans. This, in turn, directly lowers your overall interest burden. By reducing the principal loan amount, you pay less interest over the life of the loan.

Examples of Financial Aid Mitigating High-Interest Loan Costs

Consider two scenarios:

* Scenario 1: A student receives a $20,000 federal loan at a 5% interest rate and has no additional financial aid. Over ten years, their total interest paid could be substantial.

* Scenario 2: Another student receives the same $20,000 federal loan at the same 5% interest rate, but also secures a $10,000 grant. Their loan principal is now only $10,000, leading to significantly lower total interest paid over the same ten-year period. The difference represents the direct impact of financial aid in reducing interest costs.

Scenario Comparing Two Students with Different Financial Aid Packages

Let’s compare two students:

- Student A: Receives a $30,000 federal loan at 4.5% interest and a $5,000 scholarship. Their total loan amount is $25,000.

- Student B: Receives a $40,000 federal loan at 5% interest and no additional financial aid. Their total loan amount is $40,000.

Even with a lower interest rate, Student A will pay significantly less in interest over the life of the loan due to the smaller loan principal. Student B, despite potentially having higher earning potential post-graduation that might justify the larger loan, faces a substantially larger interest burden, highlighting the crucial role of financial aid in mitigating loan costs. This emphasizes the importance of proactive grant and scholarship seeking to minimize long-term financial strain.

Managing Student Loan Debt and Interest

Successfully navigating student loan debt requires a proactive approach to minimize interest accumulation and optimize repayment. Understanding various strategies and their long-term implications is crucial for achieving financial stability. This section explores practical methods for managing student loan debt and interest effectively.

Effective management of student loan debt hinges on minimizing interest payments and strategically planning repayment. This involves understanding the mechanics of interest accrual and employing strategies to reduce the overall cost of borrowing.

Minimizing Interest Payments on Student Loans

Several strategies can significantly reduce the amount of interest paid over the life of your student loans. Prioritizing higher-interest loans for repayment, exploring income-driven repayment plans, and making extra principal payments are all effective approaches. Careful budgeting and disciplined financial planning are essential components of this process.

Benefits of Extra Principal Payments

Making extra principal payments on your student loans can substantially reduce the total interest paid and shorten the loan repayment term. Even small additional payments each month can accumulate significant savings over time. This accelerates loan payoff and frees up more of your income sooner. For example, consider a $30,000 loan at 5% interest over 10 years. An extra $100 per month could reduce the total interest paid by thousands of dollars and shorten the repayment period by several years.

Risks of Refinancing Student Loans

Refinancing student loans can offer lower interest rates, potentially saving money in the long run. However, refinancing also carries risks. It may result in the loss of federal student loan benefits, such as income-driven repayment plans and deferment options. Carefully weigh the potential benefits against these risks before refinancing. For example, a borrower with federal loans benefiting from an income-driven repayment plan might lose this benefit if they refinance into a private loan, potentially increasing their monthly payments significantly.

Long-Term Financial Implications of Different Repayment Strategies

The choice of repayment strategy significantly impacts long-term financial health. Different strategies lead to varying levels of total interest paid, repayment timelines, and available financial resources.

- Standard Repayment: This plan involves fixed monthly payments over a set period (typically 10 years). While straightforward, it may result in higher total interest payments.

- Extended Repayment: This plan stretches payments over a longer period (up to 25 years), lowering monthly payments but increasing total interest paid.

- Income-Driven Repayment (IDR): IDR plans adjust monthly payments based on income and family size. They typically result in lower monthly payments but may extend the repayment period significantly, leading to higher total interest.

- Aggressive Repayment: This involves making extra principal payments to shorten the loan term and reduce overall interest costs. This requires a higher level of financial discipline but offers substantial long-term savings.

Resources and Further Information

Navigating the complexities of student loan interest rates and repayment can feel overwhelming. Fortunately, numerous resources are available to help borrowers understand their options and manage their debt effectively. This section provides details on accessing reliable information and contacting relevant authorities for assistance.

Understanding your specific loan details and available repayment plans is crucial for effective debt management. The following sections Artikel the steps involved in accessing this information and the resources available to support you.

Reputable Websites for Student Loan Information

Several trustworthy websites offer comprehensive information on federal student loans, interest rates, and repayment options. These sites provide valuable resources for borrowers at all stages of the loan process, from initial application to repayment. Accessing this information empowers borrowers to make informed decisions about their financial future.

- Federal Student Aid (FSA): This official U.S. Department of Education website (studentaid.gov) is the primary source for information on federal student loans. It provides details on loan programs, interest rates, repayment plans, and debt management strategies.

- National Foundation for Credit Counseling (NFCC): The NFCC (nfcc.org) offers free and low-cost credit counseling services, including assistance with student loan debt management. They can provide personalized guidance on repayment options and budgeting strategies.

- Consumer Financial Protection Bureau (CFPB): The CFPB (consumerfinance.gov) is an independent agency that protects consumers’ financial interests. Their website offers resources on student loans, including information on avoiding predatory lending practices and understanding your rights as a borrower.

Contacting Federal Student Loan Servicers

Effective communication with your loan servicer is vital for managing your student loan debt. Your servicer handles your payments, provides information about your loan terms, and can assist with repayment plan adjustments. Knowing how to contact them and what information to provide ensures efficient resolution of any issues.

- Locate your servicer: You can find your servicer’s contact information on the National Student Loan Data System (NSLDS) website (nslds.ed.gov) or through your FSA account.

- Gather your information: Before contacting your servicer, gather your loan information, including your loan ID numbers and social security number.

- Choose your contact method: Most servicers offer multiple contact options, including phone, email, and online messaging. Select the method most convenient for you.

- Clearly state your request: Be clear and concise about the reason for your contact. This will help the servicer address your needs efficiently.

Obtaining Information About Your Loan

Understanding your specific loan details is fundamental to effective debt management. This involves accessing your loan interest rate, repayment schedule, and other relevant information.

To obtain this information, you should log into your student loan servicer’s website. Most servicers provide online portals that allow borrowers to view their loan details, including interest rates, repayment schedules, and payment history. If you are unable to access this information online, contact your servicer directly via phone or email.

Visual Representation of Student Loan Debt Management

Imagine a flowchart. The starting point is “Understanding Your Loans.” This branches into two paths: “Contact Your Servicer” and “Research Repayment Options.” “Contact Your Servicer” leads to “Obtain Loan Details” (interest rate, repayment schedule, etc.) which then connects to “Create a Budget.” “Research Repayment Options” leads to “Choose a Repayment Plan” which also connects to “Create a Budget.” “Create a Budget” leads to “Track Payments” and finally “Successful Debt Management.” Arrows clearly indicate the flow between each step. The entire flowchart is visually appealing, using different colors for different stages, and is simple enough to be easily understood.

Final Wrap-Up

Successfully managing your FAFSA student loan interest rate requires proactive planning and a comprehensive understanding of the various factors at play. By carefully considering loan types, repayment options, and employing effective debt management strategies, you can minimize the long-term financial impact of student loans. Remember to utilize the available resources and seek assistance when needed to navigate this crucial aspect of your educational and financial future. Armed with knowledge and a strategic approach, you can confidently manage your student loan debt and achieve your financial goals.

FAQ Resource

What is the difference between subsidized and unsubsidized loans?

Subsidized loans don’t accrue interest while you’re in school (at least half-time), during grace periods, or during deferment. Unsubsidized loans accrue interest from the time the loan is disbursed.

Can I refinance my federal student loans?

Yes, but refinancing federal student loans with a private lender means losing federal protections like income-driven repayment plans. Carefully weigh the pros and cons before refinancing.

What happens if I don’t make my student loan payments?

Failure to make payments can lead to delinquency, negatively impacting your credit score and potentially resulting in wage garnishment or tax refund offset.

How can I find my loan servicer?

You can usually find your loan servicer information on the National Student Loan Data System (NSLDS) website or through your FAFSA account.

What is interest capitalization?

Interest capitalization is when unpaid interest is added to your principal loan balance, increasing the total amount you owe.