Navigating the complexities of student loan repayment can be daunting, especially when unforeseen circumstances arise. Understanding your options, particularly regarding deferment, is crucial for responsible financial management. This guide delves into the specifics of Fannie Mae’s role in student loan deferments, providing clarity on eligibility, the application process, and the long-term financial implications. We’ll explore various scenarios and offer insights to help you make informed decisions about managing your student loan debt effectively.

From the historical context of Fannie Mae’s involvement in the student loan market to a comparison of deferment options with those offered by other lenders, we aim to provide a comprehensive understanding of this important topic. We’ll also cover alternative strategies for managing student loan debt, including income-driven repayment plans and loan consolidation, helping you choose the path best suited to your individual circumstances.

Understanding Fannie Mae’s Role in Student Loan Deferments

Fannie Mae, the Federal National Mortgage Association, plays a significant, albeit indirect, role in the student loan deferment process. While not a direct student loan lender itself, its involvement stems from its role in the secondary mortgage market and its historical expansion into other sectors of the financial market. Understanding this role requires examining its historical context, the types of loans it handles, and its influence on deferment policies.

Fannie Mae’s historical involvement in the student loan market is relatively recent compared to its long history in the mortgage market. Initially focused on mortgages, Fannie Mae began to expand its activities to include other types of loans, including student loans, to diversify its portfolio and increase liquidity within the financial system. This expansion allowed for increased access to capital for lenders offering student loans, indirectly influencing the availability and terms of those loans, including deferment options.

Types of Student Loans Backed or Securitized by Fannie Mae

Fannie Mae primarily securitizes federal student loans, meaning it bundles these loans together and sells them as securities to investors. This process helps lenders free up capital to make more loans. While Fannie Mae doesn’t originate the loans directly, its involvement in the secondary market significantly impacts the overall student loan landscape. The specific types of federal student loans it securitizes include those offered under the Federal Family Education Loan (FFEL) program, though this program has largely been replaced by the Direct Loan program. Fannie Mae’s role in the securitization of FFEL loans provides a crucial understanding of its historical impact on student loan deferments.

Fannie Mae’s Criteria for Deferment Eligibility

Fannie Mae itself doesn’t directly grant deferments. Deferment eligibility is determined by the original lender and is governed by the terms of the specific student loan agreement. However, Fannie Mae’s securitization practices indirectly influence the criteria used by lenders. Since Fannie Mae purchases these loans, lenders must adhere to certain standards to ensure the loans are eligible for purchase. These standards, while not explicitly defining deferment criteria, indirectly influence the types of deferments lenders offer to maintain the value of the loans being securitized. Lenders, therefore, often align their deferment policies with broader federal guidelines and industry best practices to ensure the saleability of their loan portfolios.

Comparison of Fannie Mae-Backed Loan Deferments with Other Lenders

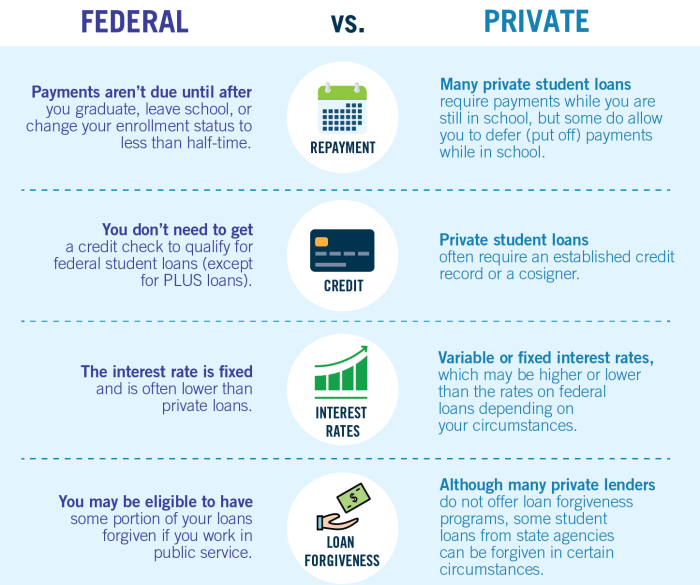

Direct comparison of deferment options between Fannie Mae-backed loans and loans from other lenders requires careful consideration. Because Fannie Mae doesn’t directly lend, comparing its deferment “options” is more about comparing the deferment policies of lenders whose loans are securitized by Fannie Mae to those of lenders whose loans are not. In general, deferment options offered by lenders whose loans are securitized by Fannie Mae tend to be consistent with federal guidelines and industry standards. Deferments for these loans may be more standardized, with criteria based on factors like unemployment, enrollment in school, or economic hardship. Lenders who don’t sell their loans to Fannie Mae might have more flexible or less standardized deferment policies. This difference reflects the impact of Fannie Mae’s involvement in the secondary market. The overall impact is one of standardization and adherence to federal guidelines for loans that are securitized through Fannie Mae.

Deferment Eligibility and Application Process

Securing a deferment on your Fannie Mae-backed student loan requires understanding the eligibility criteria and navigating the application process. This involves demonstrating financial hardship and providing necessary documentation to your loan servicer. The specific steps and requirements might vary slightly depending on your servicer, so always refer to their official guidelines.

Applying for a deferment typically involves contacting your loan servicer directly. This is usually done through their online portal or by phone. They will guide you through the necessary steps and provide the appropriate forms. The process is generally straightforward, but requires careful attention to detail and accurate information.

Required Documentation for Deferment Applications

The documentation needed to support your deferment application will depend on the type of hardship you’re experiencing. However, you should generally be prepared to provide proof of your income, employment status, and the nature of your hardship. This might include tax returns, pay stubs, medical bills, or legal documents related to unemployment or disability. Providing comprehensive documentation significantly increases your chances of approval. Incomplete applications often lead to delays or denials.

Types of Hardships Qualifying for Deferment

Fannie Mae generally allows deferments for various financial hardships. These often include unemployment, illness, or other situations that prevent you from making timely payments. Specific examples include documented job loss resulting in a significant reduction in income, a serious medical condition requiring extensive treatment, or experiencing a natural disaster that has significantly impacted your financial stability. Each case is evaluated individually based on the provided documentation.

Examples of Deferment Denials and Reasons

While Fannie Mae aims to be accommodating, deferments aren’t guaranteed. A deferment application might be denied if the documentation provided is insufficient to support the claim of hardship. For instance, if someone claims unemployment but doesn’t provide proof of job loss or actively seeking employment, the application might be rejected. Similarly, vague or unsubstantiated claims of financial difficulty without supporting documentation will likely result in denial. Another common reason for denial is failing to meet the minimum requirements or submitting the application after the deadline. Finally, applying for a deferment while already having an active deferment period might also lead to rejection.

Impact of Deferment on Student Loan Payments and Interest Accrual

Deferment offers temporary relief from student loan payments, but it’s crucial to understand its impact on the overall cost of your loans. While you won’t make monthly payments during a deferment period, interest will typically continue to accrue, increasing your total loan balance. This section details how deferment affects your payments and interest, and compares its long-term financial implications with forbearance.

Deferment directly impacts your monthly payments by suspending them entirely for the deferment period. This provides short-term financial relief, allowing borrowers to focus on other financial priorities. However, this temporary reprieve comes with a cost, as interest continues to accumulate, leading to a larger loan balance upon the resumption of payments.

Interest Accrual During Deferment

The way interest accrues during deferment varies depending on the type of federal student loan. For subsidized loans, the government pays the interest while the loan is in deferment. Unsubsidized loans, however, accrue interest throughout the deferment period, and this interest is added to the principal balance. This means the borrower will ultimately repay a larger amount than the original principal. Private student loans usually accrue interest during deferment, regardless of the loan type, and the borrower is responsible for this accumulated interest.

Long-Term Financial Implications of Deferment versus Forbearance

Both deferment and forbearance temporarily postpone student loan payments, but they differ significantly in their long-term financial consequences. Deferment is generally preferred because, for subsidized federal loans, the government pays the interest during the deferment period. Forbearance, on the other hand, typically allows for interest to accrue on both subsidized and unsubsidized federal loans, and often on private loans as well, leading to a higher total loan balance at the end of the forbearance period. This results in a higher overall cost of borrowing and a longer repayment period. Choosing deferment, when eligible, is often a more financially responsible option than forbearance.

Cost Comparison: Deferment vs. Forbearance

The following table illustrates the potential cost differences between deferment and forbearance over a five-year period. These are examples and actual costs will vary based on individual loan terms, interest rates, and the length of the deferment or forbearance period.

| Scenario | Loan Amount | Interest Rate | Total Cost After 5 Years (Deferment) | Total Cost After 5 Years (Forbearance) |

|---|---|---|---|---|

| Unsubsidized Federal Loan | $20,000 | 6% | $26,900 | $28,000 |

| Unsubsidized Federal Loan | $30,000 | 7% | $40,350 | $42,500 |

| Private Loan | $15,000 | 8% | $22,100 | $23,250 |

Alternatives to Deferment for Managing Student Loan Debt

Deferment, while offering temporary relief, isn’t always the best solution for managing student loan debt. Several alternative strategies can provide more long-term financial stability and potentially lead to faster debt repayment. Understanding these options is crucial for borrowers seeking effective debt management solutions.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans adjust your monthly payments based on your income and family size. This can significantly lower your monthly payments, making them more manageable, especially during periods of lower income or unexpected financial hardship. Several IDR plans exist, each with its own eligibility requirements and payment calculation formulas. For example, the Revised Pay As You Earn (REPAYE) plan caps your monthly payment at 10% of your discretionary income, while the Income-Based Repayment (IBR) plan offers similar benefits. Choosing the right IDR plan depends on your individual financial circumstances and long-term repayment goals. Careful consideration of the potential for extended repayment periods and the impact on total interest paid is essential.

Loan Consolidation

Loan consolidation combines multiple federal student loans into a single loan with a new interest rate and repayment schedule. This simplifies repayment by reducing the number of payments you need to track and potentially lowering your monthly payment, although this depends on the new interest rate. Consolidation can be particularly beneficial if you have loans with varying interest rates, allowing you to potentially secure a lower overall interest rate. However, it’s important to note that consolidating federal loans into a private loan can lead to the loss of certain federal benefits, such as income-driven repayment plans and loan forgiveness programs. Careful evaluation of the potential benefits and drawbacks is necessary before proceeding with consolidation.

Loan Forgiveness Programs

Certain professions, such as teaching, public service, and medical work in underserved areas, may qualify for loan forgiveness programs. These programs can partially or fully eliminate your student loan debt after meeting specific requirements, such as a certain number of years of service. For instance, the Public Service Loan Forgiveness (PSLF) program forgives the remaining balance of federal student loans after 120 qualifying monthly payments while working full-time for a qualifying employer. Eligibility criteria vary significantly depending on the specific program, so thorough research is essential to determine suitability.

Comparison of Deferment, Forbearance, and Income-Driven Repayment

Understanding the key differences between deferment, forbearance, and income-driven repayment is crucial for making informed decisions about your student loan repayment strategy.

- Deferment: Temporarily suspends payments, but interest may still accrue on unsubsidized loans. Eligibility is often based on specific circumstances, such as unemployment or enrollment in school.

- Forbearance: Temporarily reduces or suspends payments, but interest typically continues to accrue. It is often granted for temporary financial hardship, and the terms are typically negotiated between the borrower and the lender.

- Income-Driven Repayment (IDR): Adjusts monthly payments based on income and family size. Payments are typically lower than standard repayment plans, but the repayment period is usually longer.

Illustrative Scenarios and Case Studies

Understanding the practical implications of student loan deferment requires examining real-world examples. The following scenarios and case studies illustrate both the potential benefits and drawbacks of utilizing this option. It’s crucial to remember that individual circumstances significantly impact the outcome of a deferment.

Impact of Deferment on Credit Score

A hypothetical scenario: Sarah, a recent graduate with $30,000 in student loans, experiences unexpected job loss. She successfully applies for a 12-month deferment. While her payments are paused, interest continues to accrue, increasing her loan balance. Because she’s not making payments, this will likely negatively affect her credit score, potentially lowering it by several points. The exact impact depends on various factors including her credit history, utilization ratio, and the credit scoring model used. However, the absence of on-time payments will be reflected negatively. After the deferment period, if she resumes payments promptly and consistently, her credit score should gradually recover.

Long-Term Cost of Deferment

Let’s consider a $50,000 student loan with a 6% annual interest rate. If the borrower defers payments for three years, the interest will accrue significantly. During the deferment, no principal is repaid. The interest accrued over three years would be approximately $9,770 (calculated using compound interest). At the end of the deferment, the loan balance would be approximately $59,770. This increased balance will then need to be repaid over the remaining loan term, potentially leading to higher monthly payments and a longer repayment period. The total cost of the loan will be significantly higher than if payments had been made consistently.

Successful Deferment Case Studies

Several situations demonstrate successful deferment utilization. For instance, a borrower facing a temporary medical emergency might utilize a deferment to avoid default while addressing their health concerns. This allows them to focus on recovery without the immediate pressure of loan repayments. Another example involves a borrower who experiences a job loss but secures a new position within the deferment period. This allows them to manage their financial situation during a period of transition without significant long-term negative consequences. Finally, a borrower pursuing further education might use a deferment to focus on studies before resuming repayments after graduation.

Unsuitable Deferment Scenario

Deferment isn’t always the best option. Consider Mark, who has a high-interest student loan and a stable income. While he might be tempted by the temporary relief of a deferment, the long-term cost of accruing interest could significantly outweigh any short-term benefits. In this case, exploring alternative repayment plans, such as income-driven repayment or refinancing with a lower interest rate, might be more financially prudent. The accrued interest during the deferment period would likely negate any benefits gained from temporary payment relief.

Closing Summary

Successfully navigating student loan repayment requires proactive planning and a thorough understanding of available options. While deferment can offer temporary relief, it’s vital to weigh its long-term financial consequences carefully. By understanding the intricacies of Fannie Mae’s deferment programs, exploring alternative repayment strategies, and considering potential legal aspects, you can make informed decisions that align with your financial goals and long-term well-being. Remember to consult with a financial advisor or legal professional for personalized guidance.

Essential Questionnaire

What happens to my credit score if I defer my Fannie Mae student loan?

Deferring your loan will likely impact your credit score, though the severity depends on several factors. It’s generally recommended to explore alternative options first, but deferment itself is not automatically catastrophic for credit.

Can I defer my student loan indefinitely?

No, deferments are typically granted for a limited period. The specific duration varies depending on the type of loan and the reason for deferment. Renewal may be possible under certain circumstances.

What if my deferment request is denied?

If your request is denied, you’ll typically receive notification explaining the reasons. You can usually appeal the decision, providing additional documentation to support your claim of hardship.

How do I apply for a deferment on my Fannie Mae-backed student loan?

The application process usually involves contacting your loan servicer directly. They will provide you with the necessary forms and instructions. You’ll likely need to document your reason for requesting a deferment.