Navigating the complex world of federal student loans can feel overwhelming. From understanding forgiveness programs and repayment plans to managing debt and avoiding the pitfalls of the student loan crisis, the journey requires careful planning and informed decision-making. This guide provides a clear and concise overview of the key aspects of federal student loans, empowering you to make responsible choices about your financial future.

We will explore the various types of federal student loan programs, detailing eligibility requirements, interest rates, and repayment options. We’ll also delve into the long-term financial implications of student loan debt, offering strategies for effective debt management and financial planning. Understanding the intricacies of deferment, forbearance, and loan consolidation is crucial, and this guide will provide the necessary clarity.

Federal Student Loan Forgiveness Programs

Navigating the complexities of federal student loan repayment can be daunting. Fortunately, several forgiveness programs exist to assist borrowers in managing their debt. Understanding the eligibility requirements and potential benefits of each program is crucial for making informed financial decisions. This section Artikels key federal student loan forgiveness programs, their eligibility criteria, and a comparison of their advantages and disadvantages.

Public Service Loan Forgiveness (PSLF) Program

The Public Service Loan Forgiveness (PSLF) program offers complete forgiveness of remaining federal student loan debt after 120 qualifying monthly payments under an income-driven repayment plan while working full-time for a qualifying government or non-profit organization. Eligibility requires employment by a qualifying employer, consolidation of eligible federal loans into a Direct Consolidation Loan, and consistent on-time payments under an income-driven repayment plan. A major benefit is the complete loan forgiveness; however, a significant drawback is the strict adherence to the 120-payment requirement and the need for continuous employment with a qualifying employer. The process can also be lengthy and requires meticulous record-keeping to ensure all payments are properly documented.

Teacher Loan Forgiveness Program

This program forgives up to $17,500 of federal student loan debt for teachers who have completed five years of full-time teaching in a low-income school or educational service agency. Eligibility hinges on teaching in a qualifying school or agency and completing the required years of service. The significant benefit is the substantial debt forgiveness; however, it’s limited to teachers meeting specific criteria, and the process of verification can be time-consuming. The program also requires consistent employment in a qualifying role for a specific period.

Income-Driven Repayment (IDR) Plans

Income-Driven Repayment (IDR) plans are not forgiveness programs themselves, but they can lead to loan forgiveness after 20 or 25 years of qualifying payments. These plans calculate monthly payments based on your income and family size, making payments more manageable. Eligibility depends on the type of federal student loans held and the borrower’s income and family size. The benefit is lower monthly payments, potentially leading to forgiveness after a long period. The drawback is the extended repayment period, resulting in potentially paying more in interest over the life of the loan compared to other repayment plans. Forgiveness under IDR plans is also subject to changes in policy and regulations.

Comparison of Key Features

| Program | Eligibility Requirements | Forgiveness Amount | Payment Period for Forgiveness |

|---|---|---|---|

| Public Service Loan Forgiveness (PSLF) | 120 qualifying payments under an IDR plan while employed full-time by a qualifying employer | Remaining loan balance | 10 years (120 months) |

| Teacher Loan Forgiveness | 5 years of full-time teaching in a low-income school or educational service agency | Up to $17,500 | 5 years |

| Income-Driven Repayment (IDR) Plans | Federal student loans, income and family size verification | Remaining loan balance after 20-25 years | 20-25 years |

Interest Rates and Repayment Plans

Understanding federal student loan interest rates and repayment plans is crucial for effective debt management. Choosing the right plan can significantly impact the total amount repaid and the length of time it takes to become debt-free. This section will provide a clear overview of these key aspects.

Current Federal Student Loan Interest Rates

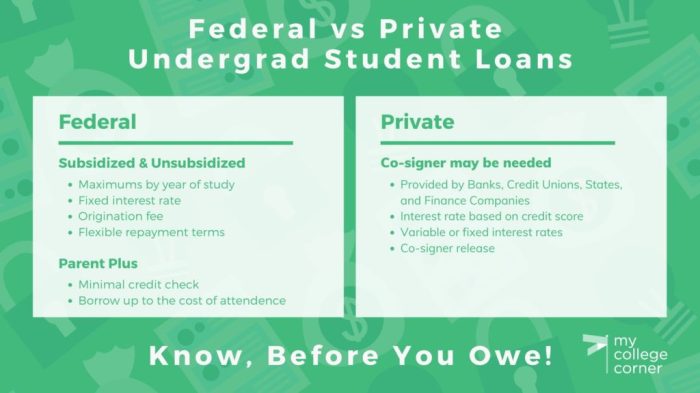

Federal student loan interest rates are variable and depend on the loan type (subsidized, unsubsidized, PLUS), the loan disbursement date, and the prevailing market interest rates. Rates are set annually by the government. It’s important to check the official Federal Student Aid website for the most up-to-date information, as rates change. Generally, subsidized loans, which do not accrue interest while the borrower is in school, tend to have lower interest rates than unsubsidized loans. Parent PLUS loans often carry higher interest rates than undergraduate loans. For example, in a recent year, the interest rate for Direct Subsidized Loans might have been around 4.99%, while the rate for Direct Unsubsidized Loans for the same period could have been slightly higher, perhaps around 5.24%. These rates are subject to change.

Federal Student Loan Repayment Plans

Several repayment plans are available to borrowers, each with its own terms and conditions. The choice of plan significantly impacts monthly payments and the total amount repaid over the life of the loan.

Standard Repayment Plan

This is the default plan for most federal student loans. It typically involves fixed monthly payments over a 10-year period. While offering a shorter repayment period, the monthly payments are usually higher compared to income-driven plans.

Extended Repayment Plan

This plan extends the repayment period to up to 25 years, resulting in lower monthly payments. However, it increases the total interest paid over the life of the loan. This plan is suitable for borrowers who want lower monthly payments but are willing to pay more in interest.

Income-Driven Repayment Plans

These plans, such as the Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR) plans, base monthly payments on a borrower’s income and family size. Payments are typically lower than those under standard or extended plans, but the repayment period can be extended to 20 or 25 years, potentially leading to higher total interest paid. These plans may also offer loan forgiveness after a certain number of years of payments, depending on the specific plan and the borrower’s circumstances.

Implications of Choosing Different Repayment Plans

The choice of repayment plan significantly impacts both monthly payments and the total cost of the loan. Standard repayment plans offer the shortest repayment period but result in higher monthly payments and potentially lower overall interest paid. Extended repayment plans lower monthly payments but extend the repayment period and increase the total interest paid. Income-driven plans offer the lowest monthly payments but may result in the highest total interest paid and the longest repayment period. Borrowers should carefully consider their financial situation and long-term goals when selecting a repayment plan.

Sample Monthly Payments Under Different Repayment Plans

The following table illustrates sample monthly payments for a $30,000 loan with a 5% interest rate under different repayment plans. Note that these are illustrative examples and actual payments may vary based on individual loan terms and interest rates.

| Repayment Plan | Repayment Period (Years) | Approximate Monthly Payment | Approximate Total Interest Paid |

|---|---|---|---|

| Standard | 10 | $316 | $7,000 |

| Extended | 25 | $160 | $20,000 |

| Income-Driven (Example) | 20 | $100 (assuming low income) | $16,000 |

The Impact of Federal Student Loans on Personal Finances

Federal student loans can significantly impact personal finances, both positively and negatively, extending far beyond the years of higher education. While these loans provide access to education and potentially higher earning potential, they also carry considerable financial responsibilities that require careful planning and management. Understanding the long-term implications is crucial for making informed decisions and navigating the complexities of repayment.

The long-term financial implications of federal student loan debt can be substantial. The principal amount borrowed, coupled with accumulated interest, can create a significant debt burden that stretches for years, even decades. This can affect major life decisions, such as purchasing a home, starting a family, or investing in retirement. For example, a borrower with $50,000 in student loans at a 5% interest rate could pay significantly more than the initial amount borrowed over the repayment period, depending on the chosen repayment plan. This increased cost represents a considerable opportunity cost, meaning the money could have been used for other financial goals.

Challenges Faced by Student Loan Borrowers

Borrowers often encounter several challenges when managing student loan debt. The most prominent is the sheer weight of the debt burden itself. High monthly payments can strain a budget, especially during the early years of a career when income may be relatively low. Additionally, the length of the repayment period can feel overwhelming, creating a sense of long-term financial constraint. Another significant challenge is the potential impact on credit scores. Missed or late payments can negatively affect a borrower’s creditworthiness, making it more difficult to secure loans for mortgages, car purchases, or other credit lines in the future. This can have far-reaching consequences for financial stability and future opportunities.

Strategies for Effective Student Loan Debt Management

Effective management of student loan debt requires a proactive and well-planned approach. One key strategy is to explore different repayment plans offered by the federal government. Income-driven repayment plans, for example, adjust monthly payments based on income and family size, making them more manageable for borrowers with lower incomes. Consolidation can simplify repayment by combining multiple loans into a single loan with a potentially lower interest rate. Furthermore, borrowers should prioritize paying down high-interest loans first to minimize the total amount of interest paid over the life of the loans. Careful budgeting and financial planning are crucial, and actively seeking advice from financial professionals can provide valuable guidance and support.

Tips for Budgeting and Financial Planning While Repaying Student Loans

Effective budgeting and financial planning are essential for managing student loan debt successfully. Careful planning allows borrowers to allocate funds for loan repayment while still meeting other financial obligations.

- Create a realistic budget that accounts for all income and expenses, including loan payments.

- Track spending habits to identify areas where expenses can be reduced.

- Prioritize high-interest debt and explore strategies like debt snowball or avalanche methods.

- Automate loan payments to ensure timely payments and avoid late fees.

- Explore opportunities to increase income through a second job or freelance work.

- Consider refinancing options if interest rates fall.

- Build an emergency fund to cover unexpected expenses and avoid loan defaults.

- Regularly review and adjust the budget as needed.

Federal Student Loan Deferment and Forbearance

Navigating the complexities of federal student loan repayment can be challenging. Understanding the options available for temporary pauses in repayment, such as deferment and forbearance, is crucial for responsible financial management. These programs offer temporary relief, but it’s important to understand their differences and potential long-term implications.

Deferment and forbearance are both temporary pauses in your federal student loan payments, but they differ significantly in their eligibility requirements, impact on your loan, and overall process. Choosing the right option depends on your specific circumstances and financial situation.

Deferment Eligibility and Process

Deferment allows you to temporarily suspend your student loan payments, and under certain circumstances, may even halt the accrual of interest. Eligibility is generally based on specific life events or situations. For example, returning to school at least half-time, experiencing unemployment, or undergoing military service are common reasons for deferment approval. The application process typically involves submitting documentation proving your eligibility to your loan servicer. This documentation might include enrollment verification, unemployment documentation, or military orders. Once approved, the deferment period will be clearly defined, and your payments will be paused during that time. It’s important to note that the specific requirements and available deferment options can vary based on the type of federal student loan you have.

Forbearance Eligibility and Process

Forbearance, unlike deferment, is a more general temporary suspension of payments granted when you’re experiencing financial hardship that prevents you from making payments. This hardship is typically not tied to specific qualifying events like those found in deferment. Instead, you’ll need to demonstrate to your loan servicer that you’re facing financial difficulties and unable to make your payments. The application process often involves providing documentation such as proof of reduced income or unexpected medical expenses. While forbearance may pause your payments, interest typically continues to accrue during the forbearance period, increasing your overall loan balance. The length of a forbearance period is generally determined on a case-by-case basis, often lasting for a limited time, after which repayment will resume.

Comparison of Deferment and Forbearance

| Feature | Deferment | Forbearance |

|---|---|---|

| Eligibility | Specific qualifying events (e.g., returning to school, unemployment) | Financial hardship |

| Interest Accrual | May be suspended (depending on loan type) | Usually continues to accrue |

| Impact on Loan Balance | May not increase loan balance | Increases loan balance due to accruing interest |

| Credit Score Impact | Generally less negative impact | Potentially more negative impact due to missed payments |

Applying for Deferment or Forbearance: A Flowchart

The following flowchart illustrates a simplified process. Individual loan servicers may have slightly different procedures.

[Imagine a flowchart here. The flowchart would start with a box labeled “Experiencing financial difficulty or qualifying event?”. A “yes” branch would lead to a box labeled “Determine eligibility for deferment or forbearance.” This would branch into two separate paths. One path (deferment) would lead to boxes labeled “Gather required documentation,” “Submit application to loan servicer,” and “Approval/Denial.” The other path (forbearance) would follow a similar sequence. Both paths would ultimately lead to a box labeled “Payment plan adjusted/Payments paused.” A “no” branch from the initial question would lead to a box labeled “Continue making regular payments.”]

The Role of the Federal Government in Student Lending

The federal government’s involvement in student lending has dramatically reshaped higher education access and affordability in the United States. Initially a small program, it has evolved into a massive system impacting millions of students and significantly influencing the national economy. This evolution reflects changing societal priorities, economic conditions, and political considerations.

The expansion of federal student loan programs has been driven by a desire to increase access to higher education, addressing concerns about equity and opportunity. However, this expansion has also led to debates about the rising cost of tuition, student debt levels, and the long-term sustainability of the program itself.

History and Evolution of the Federal Student Loan Program

The federal government’s role in student lending began modestly. Early programs, dating back to the 1950s and 60s, were primarily focused on providing loans to students pursuing specific fields, such as science and engineering, deemed critical to national interests. The legislation gradually expanded over the years, encompassing a wider range of students and institutions. The creation of the Guaranteed Student Loan Program (GSLP) in 1965 marked a significant turning point, shifting responsibility for loan origination to private lenders while maintaining federal guarantees. Subsequent legislation, including the Higher Education Act of 1965 and its subsequent reauthorizations, further expanded eligibility and increased funding, leading to the complex system we see today. The shift from a primarily subsidized loan system to a more unsubsidized one also occurred during this period, altering the risk and cost for both borrowers and the government.

Key Players and Agencies Involved in Federal Student Loan Administration

Several key agencies play crucial roles in the administration of federal student loans. The primary agency is the Department of Education, specifically the Federal Student Aid (FSA) office. FSA oversees the entire program, including loan origination, disbursement, servicing, and collection. Other agencies involved include the Department of Treasury, which manages the financial aspects of the program, and various loan servicers, private companies contracted by the government to manage borrowers’ accounts. These servicers handle tasks such as processing payments, answering borrower inquiries, and managing loan deferments and forbearances.

Government Regulation of Interest Rates and Repayment Terms

The federal government plays a significant role in setting interest rates and repayment terms for federal student loans. Interest rates for federal student loans are typically tied to market indices, such as the 10-year Treasury note, ensuring they reflect prevailing economic conditions. However, the government sets caps on these rates, preventing them from becoming excessively high. Repayment terms, including loan repayment periods and income-driven repayment plans, are also established by federal legislation. These plans provide more flexibility for borrowers with lower incomes, allowing them to make smaller monthly payments based on their financial situation.

Timeline of Significant Events and Policy Changes

The following timeline highlights key milestones in the evolution of the federal student loan program:

| Year | Event | Significance |

|---|---|---|

| 1958 | National Defense Education Act | Established the first major federal student loan program, focusing on students in science and engineering. |

| 1965 | Higher Education Act | Created the Guaranteed Student Loan Program (GSLP), expanding access to federal student loans. |

| 1972 | Creation of the Student Loan Marketing Association (Sallie Mae) | A private corporation created to facilitate the purchase and sale of student loans. |

| 1990s – 2000s | Gradual increase in unsubsidized loans | A shift towards greater reliance on unsubsidized loans, increasing borrower responsibility. |

| 2007 | Creation of the Direct Loan Program | The federal government assumed direct lending responsibilities, eliminating the role of private lenders. |

| 2010 | Health Care and Education Reconciliation Act | Further expanded income-driven repayment plans. |

Navigating the Federal Student Loan Repayment Process

Successfully navigating the federal student loan repayment process requires a proactive approach and a thorough understanding of your loan terms. This involves several key steps, from understanding your loan details to exploring repayment options and managing your debt effectively. Failing to understand these aspects can lead to missed payments, penalties, and long-term financial strain.

Applying for Federal Student Loan Repayment

After graduation or leaving school, your federal student loans will typically enter a grace period before repayment begins. This grace period allows you to transition into repayment without immediate financial pressure. However, it is crucial to start preparing for repayment during this time. You will need to log into your student loan servicer’s website, usually provided in your loan documents. This site will provide information about your loan details, including the total amount borrowed, interest rates, and repayment options. You’ll be able to create an account and choose your repayment plan. Some servicers may automatically enroll borrowers into a standard repayment plan, while others require active selection.

Understanding Loan Terms and Conditions

Understanding your loan terms and conditions is paramount. This includes knowing your interest rate, loan balance, repayment schedule, and the consequences of late or missed payments. Each loan may have slightly different terms depending on the type of loan (e.g., subsidized, unsubsidized, PLUS). Carefully review all loan documents and contact your loan servicer if anything is unclear. Ignoring this step can result in unexpected costs and financial difficulties. For example, a borrower unaware of their interest rate might underestimate their monthly payments, leading to difficulties meeting their obligations.

Resources and Tools for Managing Student Loan Debt

Several resources are available to help borrowers manage their student loan debt effectively. The Federal Student Aid website (studentaid.gov) offers a wealth of information, including repayment calculators, repayment plan comparisons, and contact information for loan servicers. Many loan servicers also provide online tools and resources to track payments, view loan balances, and explore repayment options. Budgeting apps and financial advisors can also be invaluable in creating a repayment plan that aligns with your financial goals and circumstances. For example, the repayment calculator on studentaid.gov allows borrowers to input their loan details and see projected monthly payments under various repayment plans.

Consolidating Multiple Federal Student Loans

Consolidating multiple federal student loans into a single loan can simplify the repayment process. This involves combining several loans into one new loan with a single monthly payment. While consolidation doesn’t reduce the total amount owed, it can streamline payments and potentially lower your monthly payment amount by extending the repayment term (though this will increase the total interest paid over the life of the loan). The Federal Student Aid website provides information on the consolidation process, eligibility requirements, and potential benefits and drawbacks. Borrowers should carefully weigh the pros and cons before deciding whether consolidation is the right option for their individual financial situation. For instance, a borrower with several loans at different interest rates might benefit from consolidation if the new loan offers a lower weighted average interest rate.

The Student Loan Debt Crisis

The student loan debt crisis in the United States represents a significant economic and social challenge. The sheer scale of outstanding debt, coupled with its disproportionate impact on certain demographics, has far-reaching consequences for individual borrowers, the economy, and society as a whole. Understanding the contributing factors and exploring potential solutions is crucial to mitigating the crisis and ensuring equitable access to higher education.

The scale of the student loan debt crisis is staggering. As of [Insert most recent reliable data on total student loan debt in the US], the total amount of outstanding student loan debt in the United States exceeds [Insert most recent reliable data on total student loan debt in trillions of dollars]. This figure surpasses both credit card debt and auto loan debt, making it the second-largest consumer debt category after mortgages. This massive debt burden impacts millions of Americans, hindering their ability to achieve financial stability and participate fully in the economy. Delinquency and default rates remain concerningly high, further exacerbating the problem.

Contributing Factors to Rising Student Loan Debt

Several interconnected factors have contributed to the dramatic increase in student loan debt. The rising cost of tuition and fees at colleges and universities, significantly outpacing inflation, is a primary driver. This increase is fueled by factors such as reduced state funding for public institutions, increased administrative costs, and the growth of non-instructional spending. Simultaneously, stagnant wages and increased living expenses have made it more challenging for students and families to cover educational costs without resorting to loans. Furthermore, the proliferation of for-profit colleges and universities, often with questionable academic quality and high tuition rates, has added to the problem. The increasing reliance on student loans as a primary source of funding for higher education, coupled with a lack of adequate financial literacy among students and families, further contributes to the unsustainable growth of student loan debt.

Potential Solutions and Policy Proposals

Addressing the student loan debt crisis requires a multifaceted approach involving both immediate relief measures and long-term structural reforms. One potential solution is targeted debt forgiveness programs, focusing on specific demographics or loan types. For example, programs could prioritize borrowers with high levels of debt relative to their income or those who attended institutions with poor repayment outcomes. Another strategy involves expanding income-driven repayment plans, making monthly payments more affordable for borrowers. This could include lowering the minimum monthly payment or extending the repayment period. Further, significant reforms are needed to address the root causes of the crisis. These reforms include increasing federal and state funding for higher education to control tuition costs, strengthening consumer protections for borrowers, and promoting financial literacy among students and families. Furthermore, greater transparency regarding college costs and repayment outcomes could empower students to make informed decisions about their educational investments.

Student Loan Debt Burden Across Demographics

A visual representation, in the form of a bar chart, could effectively illustrate the disparity in student loan debt burdens across different demographics. The horizontal axis would represent demographic groups (e.g., race, gender, income level, educational attainment). The vertical axis would represent the average student loan debt or the percentage of borrowers with significant debt within each group. The chart would visually demonstrate how certain demographics, such as Black and Hispanic borrowers, or those from low-income families, disproportionately carry a heavier burden of student loan debt compared to their white or higher-income counterparts. This disparity reflects existing inequalities in access to higher education and socioeconomic opportunities. The chart would underscore the need for targeted interventions and policies to address these systemic inequities.

Final Conclusion

Successfully managing federal student loans requires proactive planning and a thorough understanding of available resources. By carefully considering the information presented in this guide—from exploring loan forgiveness programs to strategizing for repayment—you can navigate the complexities of student loan debt and build a secure financial future. Remember to utilize the available resources and tools to effectively manage your debt and avoid the potential pitfalls of the student loan crisis. Empower yourself with knowledge and take control of your financial well-being.

Essential Questionnaire

What happens if I can’t make my student loan payments?

Contact your loan servicer immediately. They can discuss options like deferment, forbearance, or income-driven repayment plans to help you manage your payments.

Can I consolidate my federal student loans?

Yes, you can consolidate multiple federal student loans into a single loan with a new interest rate and repayment plan. This can simplify repayment but may not always lower your overall cost.

What is the difference between a subsidized and unsubsidized loan?

Subsidized loans don’t accrue interest while you’re in school, during grace periods, or in deferment. Unsubsidized loans accrue interest from the time they’re disbursed.

Where can I find my loan servicer information?

Your loan servicer information can be found on the National Student Loan Data System (NSLDS) website or your student loan documents.