Navigating the complexities of student loan debt can feel overwhelming, especially when faced with the decision of consolidating federal and private loans. This process, while potentially beneficial in simplifying repayment, requires careful consideration of various factors, including interest rates, repayment plans, and long-term financial implications. Understanding the nuances of both federal and private consolidation options is crucial for making informed decisions that align with individual financial goals.

This guide explores the key differences between federal and private student loan consolidation, offering a comprehensive overview of the application processes, potential benefits and drawbacks, and the importance of understanding the long-term impact on your credit score and overall financial health. We’ll delve into the various repayment options available after consolidation and provide practical advice to help you choose the best path for your circumstances.

Understanding Federal Student Loan Consolidation

Federal student loan consolidation simplifies your repayment by combining multiple federal student loans into a single loan. This can streamline your monthly payments, potentially leading to a more manageable repayment plan. Understanding the process, eligibility, and potential benefits is crucial before making a decision.

Types of Federal Student Loans Eligible for Consolidation

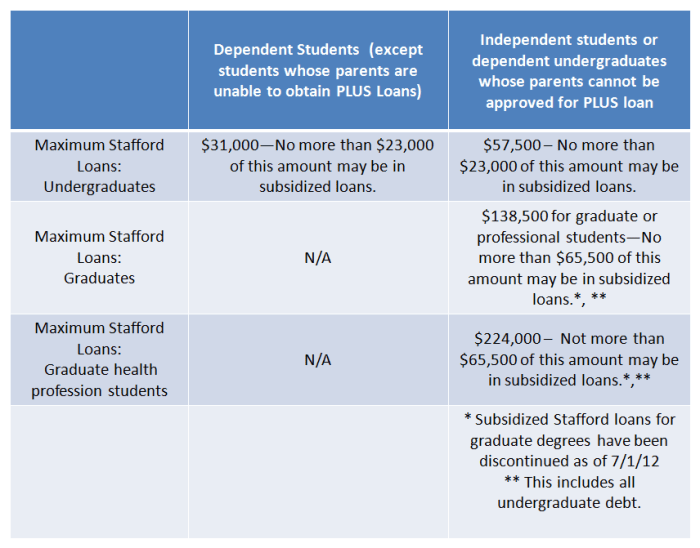

Federal student loan consolidation allows you to combine various federal student loans. This includes Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans (for parents and graduate students), and Federal Stafford Loans (older programs). Consolidation does *not* include private student loans or Perkins Loans (though Perkins Loans can be consolidated into a Direct Consolidation Loan).

Eligibility Requirements for Federal Student Loan Consolidation

To be eligible for federal student loan consolidation, you must have at least one eligible federal student loan. You also need to be a U.S. citizen or eligible non-citizen. Your loans must be in repayment, grace period, or deferment. Finally, you must complete the application process through the Federal Student Aid website. There is no credit check involved.

Step-by-Step Guide to the Federal Student Loan Consolidation Application Process

The application process is primarily online through the Federal Student Aid website (StudentAid.gov). Here’s a step-by-step guide:

1. Gather Information: Collect your loan details, including loan numbers, lenders, and outstanding balances.

2. Complete the Application: Carefully fill out the Direct Consolidation Loan application online. Review all information for accuracy before submitting.

3. Submit Your Application: Once completed, submit the application electronically.

4. Review Your Loan Terms: After approval, review your new loan terms, including the interest rate and repayment plan options. Ensure you understand the implications before accepting the consolidation.

5. Sign Your Master Promissory Note (MPN): You will need to electronically sign the MPN to finalize the consolidation.

Comparison of Interest Rates Before and After Federal Consolidation

The interest rate on your consolidated loan will be a weighted average of the interest rates on your individual loans, rounded up to the nearest one-eighth of a percent. This means your new interest rate may be slightly higher than the lowest rate among your existing loans, but it will likely be a fixed rate, which can provide predictability. The following table provides a hypothetical example:

| Loan Type | Initial Interest Rate | Consolidated Interest Rate | Interest Rate Savings (Hypothetical) |

|---|---|---|---|

| Direct Subsidized Loan | 3.76% | 4.25% | -0.49% |

| Direct Unsubsidized Loan | 5.04% | 4.25% | +0.79% |

| Direct PLUS Loan | 7.08% | 4.25% | +2.83% |

| Federal Stafford Loan | 6.8% | 4.25% | +2.55% |

*Note: This is a hypothetical example. Your actual interest rate will depend on the interest rates of your individual loans and the current weighted average rate.*

Understanding Private Student Loan Consolidation

Private student loan consolidation offers a way to simplify your student loan repayment by combining multiple loans into a single, new loan. Unlike federal consolidation, which is managed by the government, private consolidation is handled by private lenders, each with its own terms and conditions. Understanding the key differences between federal and private options is crucial before making a decision.

Private student loan consolidation differs significantly from federal consolidation in several key aspects. Most notably, federal consolidation programs offer fixed interest rates and potential access to income-driven repayment plans, features not always available with private consolidation. Federal loans also benefit from consumer protections under federal law. Private lenders, however, may offer more flexible terms in certain situations, such as variable interest rates or loan terms tailored to individual circumstances, though this comes with inherent risks.

Differences Between Federal and Private Student Loan Consolidation

Federal student loan consolidation simplifies repayment by combining multiple federal loans into one. The resulting loan has a single monthly payment, often at a weighted average interest rate, and access to income-driven repayment plans. Private consolidation, conversely, combines multiple private loans (or a mix of federal and private loans, though this is less common and often not advisable due to the loss of federal benefits), with the terms and interest rate determined by the private lender. Federal consolidation offers significant borrower protections under federal law, unlike private consolidation which is governed by individual lender contracts. This includes protection against unfair practices and potentially more flexible repayment options.

Benefits of Consolidating Private Student Loans

Consolidating private student loans can simplify repayment by reducing the number of monthly payments. This can improve budgeting and potentially lower your overall monthly payment if a lower interest rate is secured. A streamlined payment process can lead to better organization and reduce the risk of missed payments. However, it’s crucial to carefully evaluate the terms of any private consolidation loan to ensure it’s beneficial.

Drawbacks of Consolidating Private Student Loans

A significant drawback is the potential for a higher interest rate than your current weighted average. This could lead to paying more interest overall throughout the loan’s life. Furthermore, consolidating private loans may eliminate certain benefits or protections associated with individual loans, such as shorter repayment terms or lower initial interest rates. Finally, the process of consolidating private loans can be complex and time-consuming, requiring careful comparison of various lenders and their offerings.

Private Lenders Offering Consolidation Programs

Many private lenders offer student loan consolidation programs. These lenders often have different eligibility requirements, interest rates, and repayment terms. It’s crucial to compare multiple offers before selecting a lender. Examples include large national banks, credit unions, and online lenders specializing in student loan refinancing. The specific lenders available to you will depend on your credit history and financial situation.

Examples of Private Loan Consolidation Programs

Before considering any private loan consolidation program, thoroughly research the terms and conditions. It’s important to compare offers from multiple lenders to find the best option for your financial situation. The examples below are illustrative and may not represent current offerings. Specific terms and conditions will vary depending on the lender and your individual circumstances.

- Lender A: Offers a fixed interest rate based on your credit score. Repayment terms range from 5 to 15 years. May require a co-signer if your credit history is weak. Origination fees may apply.

- Lender B: Offers a variable interest rate, potentially resulting in fluctuating monthly payments. Repayment terms are typically 10 years. May offer a discount for automatic payments. No co-signer is required.

- Lender C: Offers a fixed interest rate with a slightly higher rate for borrowers with lower credit scores. Repayment terms are flexible, ranging from 5 to 20 years. May offer a grace period before payments begin. No prepayment penalties.

Comparing Federal and Private Consolidation Options

Consolidating your student loans, whether federal or private, can simplify repayment. However, the processes and resulting loan terms differ significantly. Understanding these differences is crucial for making an informed decision that aligns with your financial goals. This section compares and contrasts federal and private loan consolidation options, focusing on interest rate calculations, repayment plan impacts, and key feature differences.

Interest Rate Calculation Methods

Federal student loan consolidation uses a weighted average of your existing loan interest rates. This means the new interest rate reflects the proportion of each loan’s principal balance to the total principal. The interest rate is typically rounded up to the nearest one-eighth of a percent. For example, if you have a $10,000 loan at 5% and a $5,000 loan at 7%, your consolidated loan’s interest rate would be calculated as follows: [(10000*0.05) + (5000*0.07)] / 15000 = 0.05667, or approximately 5.67%. This new rate is then fixed for the life of the consolidated loan.

Private loan consolidation, on the other hand, often involves a new interest rate determined by the lender based on your creditworthiness at the time of consolidation. This rate can be fixed or variable, depending on the lender and loan terms. A variable rate means the interest rate can fluctuate over time, potentially increasing or decreasing your monthly payments. This variability introduces a level of uncertainty that is absent with fixed-rate federal consolidation. The calculation of this rate is proprietary to the lender and isn’t publicly available.

Impact of Repayment Plans on Total Loan Cost

The choice of repayment plan significantly affects the total cost of your consolidated loans. Federal consolidated loans offer various income-driven repayment (IDR) plans, such as the Income-Driven Repayment (IDR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Based Repayment (IBR) plans. These plans adjust monthly payments based on your income and family size, potentially leading to lower monthly payments but extending the repayment period and increasing the total interest paid over the life of the loan. Standard repayment plans for federal loans offer fixed monthly payments over a 10-year period.

Private loan consolidation typically offers fewer repayment plan options, often limiting borrowers to standard fixed-payment plans with terms ranging from 5 to 15 years. The absence of income-driven repayment options may result in higher monthly payments and potentially a faster repayment timeline, but this also means a lower total interest paid compared to a longer repayment term. The specific terms depend entirely on the lender’s policies. It’s important to carefully compare the total interest paid under different repayment plans before making a decision.

Key Features of Federal and Private Consolidation

| Feature | Federal Consolidation | Private Consolidation | Key Differences |

|---|---|---|---|

| Interest Rate | Weighted average of existing loan rates, fixed | Determined by lender based on creditworthiness, fixed or variable | Federal rates are fixed and transparent; private rates can vary and are less predictable. |

| Repayment Plans | Multiple options, including income-driven plans | Fewer options, usually standard fixed-payment plans | Federal consolidation offers more flexibility for borrowers with varying incomes. |

| Loan Forgiveness Programs | Eligible for certain federal loan forgiveness programs (e.g., Public Service Loan Forgiveness) | Not eligible for federal loan forgiveness programs | Federal consolidation maintains eligibility for federal benefits; private consolidation does not. |

| Eligibility | Generally available to borrowers with federal student loans | Available to borrowers with private student loans; often requires good credit | Federal consolidation is more accessible; private consolidation has stricter eligibility requirements. |

| Fees | Typically no fees | May involve origination or other fees | Federal consolidation usually avoids additional fees; private consolidation may include various charges. |

Repayment Options After Consolidation

Consolidating your federal student loans simplifies your repayment process by combining multiple loans into a single one. However, the choice of repayment plan significantly impacts your monthly payment amount and the total interest paid over the life of the loan. Understanding the available options is crucial for effective financial planning.

After consolidating your federal student loans, you’ll have access to several repayment plans, each designed to cater to different financial situations and income levels. The plan you choose will directly affect your monthly payment and the total interest you pay over the life of the loan. Careful consideration of your financial circumstances is essential in making the right choice.

Standard Repayment Plan

The Standard Repayment Plan is the default option after federal student loan consolidation. It typically involves fixed monthly payments over a 10-year period. This plan offers a predictable payment schedule, but it often results in higher monthly payments compared to income-driven plans.

Example: A $30,000 loan at 5% interest would have a monthly payment of approximately $330 under the Standard Repayment Plan. A $60,000 loan at the same interest rate would roughly double the monthly payment to approximately $660. A $90,000 loan would result in a monthly payment of approximately $990.

Graduated Repayment Plan

The Graduated Repayment Plan starts with lower monthly payments that gradually increase over time. This option may be attractive to borrowers anticipating higher income in the future. However, it ultimately leads to higher total interest payments compared to the Standard Repayment Plan due to the longer repayment period.

Example: A $30,000 loan at 5% interest might start with a monthly payment around $200, increasing over time. The exact increase schedule would depend on the loan servicer’s specifications. This plan typically extends beyond the 10-year timeframe of the Standard Repayment Plan.

Extended Repayment Plan

This plan stretches the repayment period to a maximum of 25 years, leading to lower monthly payments. However, it results in significantly higher total interest paid over the life of the loan. This option is suitable for borrowers who need lower monthly payments, but it’s crucial to weigh the long-term cost of increased interest.

Example: A $30,000 loan at 5% interest under an Extended Repayment Plan might have a monthly payment around $160, significantly lower than the Standard Repayment Plan. However, the total interest paid would be considerably higher due to the extended repayment period.

Income-Driven Repayment Plans

Income-driven repayment plans base your monthly payments on your income and family size. These plans include options like the Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR) plans. These plans typically offer lower monthly payments and potentially lead to loan forgiveness after 20 or 25 years, depending on the specific plan and income. However, the longer repayment period can result in higher overall interest payments.

Examples for Income-Driven Repayment Plans are complex and vary significantly based on individual income, family size, and loan amount. The exact monthly payment calculation involves a formula considering these factors, and it’s best to use the official federal student aid website’s repayment calculators for personalized estimates.

Repayment Plan Comparison Table

| Repayment Plan | Monthly Payment (Low Loan Amount – $30,000) | Monthly Payment (Medium Loan Amount – $60,000) | Monthly Payment (High Loan Amount – $90,000) |

|---|---|---|---|

| Standard | ~$330 | ~$660 | ~$990 |

| Graduated | Starts at ~ $200, increases over time | Starts at ~ $400, increases over time | Starts at ~ $600, increases over time |

| Extended | ~$160 | ~$320 | ~$480 |

| Income-Driven (Variable) | Variable, depends on income | Variable, depends on income | Variable, depends on income |

Note: The monthly payment amounts in the table are estimates and may vary based on the specific interest rate, loan terms, and individual circumstances. It’s crucial to consult your loan servicer for accurate payment calculations.

Potential Risks and Considerations

Consolidating your student loans, whether federal or private, can seem like a straightforward solution to managing multiple payments. However, it’s crucial to understand the potential drawbacks before making a decision. While consolidation simplifies your repayment process, it can also lead to unforeseen consequences if not carefully considered. This section Artikels key risks and factors to evaluate.

Consolidating loans with varying interest rates can significantly impact your overall repayment cost. The new interest rate on your consolidated loan is typically a weighted average of your existing loan rates. This means that if you have a mix of high and low interest rates, the average could be higher than you expect, potentially leading to a longer repayment period and increased total interest paid. For example, consolidating loans with rates of 4%, 6%, and 8% might result in a consolidated loan rate of 6% or higher, depending on the loan balances. This seemingly small increase in interest can accumulate substantially over the life of the loan.

Interest Rate Implications

The weighted average interest rate applied to a consolidated loan is crucial. A higher average interest rate than your current lowest rate will increase your total interest paid over the life of the loan, extending the repayment timeline and ultimately costing you more money. Conversely, if your highest interest rates are significantly higher than your lower rates, consolidation could still be beneficial by reducing the average interest rate. Careful calculation and comparison are essential to determining the true financial impact.

Credit Score Impacts

Consolidating your loans can affect your credit score, both positively and negatively. While the simplification of your debt management may improve your credit utilization ratio (a positive factor), the process itself can trigger a temporary dip in your score. This is because opening a new loan, even a consolidation loan, introduces a new credit inquiry and temporarily reduces your average credit age. The impact on your credit score varies depending on your credit history and the credit scoring models used. It is generally recommended to check your credit score before and after consolidation to monitor any changes.

Warning Signs to Watch Out for

It’s important to be aware of potential red flags when considering loan consolidation. Before proceeding, consider these warning signs:

- Unusually high fees or upfront costs associated with the consolidation process. Legitimate consolidation programs have minimal or transparent fees.

- Aggressive sales tactics or high-pressure sales pitches. Reputable lenders provide clear and unbiased information.

- A lack of transparency regarding the terms and conditions of the consolidated loan. Be wary of lenders who are vague or unwilling to fully explain the details.

- Promises that seem too good to be true, such as dramatically lower interest rates without any explanation or justification.

- Difficulty in contacting the lender or obtaining clear answers to your questions.

Impact on Credit Score

Consolidating your student loans can have a noticeable impact on your credit score, both in the short term and long term. The effect isn’t always straightforward and depends on several factors, including your existing credit history and how responsibly you manage your consolidated loans. Understanding these potential effects is crucial for making an informed decision.

The process of consolidating your loans can temporarily lower your credit score. This is primarily because opening a new loan account, even a consolidation loan, creates a hard inquiry on your credit report. Hard inquiries slightly decrease your score as they indicate increased credit risk to lenders. Additionally, the age of your credit accounts is a factor in your credit score calculation, and consolidation effectively resets the age of your student loan debt. Your average account age will decrease, leading to a minor, temporary dip in your score. This effect is usually short-lived, however, and typically resolves within a few months.

Credit Utilization and Payment History

Consolidation affects credit utilization and payment history, both key components of your credit score. Credit utilization refers to the percentage of your available credit you’re currently using. Before consolidation, you might have several smaller loans with varying credit limits, potentially leading to a higher overall utilization rate across all accounts. Consolidation combines these loans into a single, larger loan, potentially reducing your credit utilization ratio if the new loan’s credit limit is significantly higher than the sum of your previous limits. This reduction can positively impact your score. However, if the consolidation loan’s credit limit is lower, it could negatively affect your credit utilization and your score. Consistent on-time payments after consolidation are critical. A history of late or missed payments, even on the consolidated loan, will significantly harm your credit score, regardless of the initial positive effects of consolidation.

Positive Payment History and Credit Score Improvement

Maintaining a positive payment history after consolidation is paramount to improving your credit score. Each on-time payment on your consolidated loan demonstrates responsible credit management to credit bureaus. This positive behavior builds a strong payment history, a significant factor in credit scoring models. Over time, consistent on-time payments will outweigh the initial negative impact of the hard inquiry and the age of accounts. For example, if you consistently make on-time payments for 12-24 months after consolidation, you’re likely to see a noticeable increase in your credit score, potentially surpassing your pre-consolidation score. The length of your positive payment history directly correlates with the magnitude of score improvement. The longer you maintain a positive payment history, the more your score will benefit.

Choosing the Right Consolidation Option

Choosing between federal and private student loan consolidation requires careful consideration of your individual financial situation and long-term goals. The best option depends on factors such as your current loan types, creditworthiness, and desired repayment terms. This section provides a framework to guide your decision-making process.

This decision-making framework helps borrowers systematically assess their needs and circumstances to select the most suitable consolidation option. It considers key factors that can significantly impact the long-term cost and benefits of consolidation. Careful analysis of these points will lead to a more informed choice.

Federal vs. Private Consolidation: A Decision-Making Framework

The choice between federal and private student loan consolidation hinges on several key factors. A systematic approach, considering these elements, will help you make an informed decision. Below is a suggested decision-making process.

| Factor | Federal Consolidation | Private Consolidation |

|---|---|---|

| Loan Types | Suitable for all federal student loans (Direct and FFEL). | Generally accepts a mix of federal and private loans, but may not include all loan types. Eligibility varies by lender. |

| Credit Score Impact | Generally minimal impact, as it doesn’t involve a hard credit inquiry for most federal consolidation programs. | Often requires a credit check, which can result in a temporary dip in credit score, and approval depends on creditworthiness. |

| Interest Rates | Fixed weighted average of your existing federal loan interest rates, resulting in a single, fixed rate. | Variable or fixed rates, determined by your credit score and the lender’s terms; may be higher than federal rates. |

| Repayment Options | Access to various income-driven repayment plans, deferment, and forbearance options. | Fewer repayment options available compared to federal loans; options vary by lender. |

| Government Protections | Benefits from federal consumer protections, including borrower defenses to repayment and potential loan forgiveness programs. | Limited or no government protections; recourse is primarily through the lender. |

| Fees | Typically no fees associated with the consolidation process itself. | Potential origination fees or other charges depending on the lender. |

Flowchart for Choosing a Consolidation Option

The following flowchart visually represents the decision-making process Artikeld above.

[Imagine a flowchart here. The flowchart would begin with a central question: “Do you have only federal student loans?”. A “Yes” branch would lead to “Choose Federal Consolidation”. A “No” branch would lead to a second question: “Is your credit score good enough for private consolidation?”. A “Yes” branch would lead to a comparison of federal vs. private rates and benefits, eventually leading to a choice. A “No” branch would lead to “Consider Federal Consolidation Only”. Each decision point would include considerations such as interest rates, fees, and available repayment options.]

Last Word

Ultimately, the decision to consolidate federal and private student loans is a deeply personal one, requiring careful analysis of your individual financial situation and long-term goals. By understanding the intricacies of each option, weighing the potential benefits against the risks, and utilizing the resources and guidance available, borrowers can make informed decisions that lead to a more manageable and ultimately successful repayment journey. Remember to seek professional financial advice if needed to ensure you’re making the best choice for your unique circumstances.

FAQ Summary

What is the difference between a federal and private student loan?

Federal student loans are offered by the government and often have more flexible repayment options and protections for borrowers. Private student loans are offered by banks and other financial institutions and typically have less stringent eligibility requirements but may come with higher interest rates.

Can I consolidate loans with different interest rates?

Yes, you can consolidate loans with varying interest rates. However, the interest rate on your consolidated loan will typically be a weighted average of your individual loan rates. This means you may not always see a significant reduction in your overall interest rate.

Will consolidating my loans affect my credit score?

Consolidating loans can temporarily impact your credit score, as it introduces a new account and alters your credit utilization ratio. However, consistent on-time payments after consolidation can positively impact your credit score over the long term.

What happens if I miss a payment after consolidation?

Missing payments after consolidation can negatively affect your credit score and may lead to penalties and collection actions from your lender. It’s crucial to adhere to your repayment schedule.