Navigating the complex world of student loans can feel overwhelming, especially when differentiating between federal and private options. Both offer pathways to higher education, but their terms, eligibility requirements, and potential long-term financial implications differ significantly. This guide aims to illuminate the key distinctions, helping you make informed decisions about financing your education and managing your debt effectively.

Understanding the nuances of interest rates, repayment plans, and the potential consequences of default is crucial for responsible borrowing. We’ll explore the advantages and disadvantages of each loan type, delve into consolidation and refinancing strategies, and provide practical advice for budgeting and managing your student loan debt throughout your life.

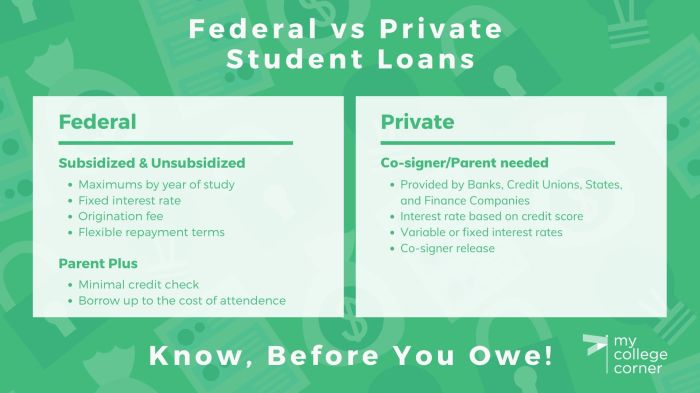

Types of Federal and Private Student Loans

Navigating the world of student loans can be complex, particularly understanding the differences between federal and private options. Both offer funding for higher education, but they differ significantly in terms of interest rates, eligibility requirements, and repayment options. This section will clarify these key distinctions.

Federal Student Loan Interest Rates

Federal student loan interest rates are generally lower than those offered by private lenders. These rates are set by the government and are typically fixed, meaning they remain consistent throughout the loan’s life. The specific rate depends on the type of loan (subsidized, unsubsidized, PLUS), the loan’s disbursement date, and prevailing market conditions. For example, a subsidized Stafford loan might have a rate of around 4-5%, while an unsubsidized loan could be slightly higher. It’s important to note that these rates are subject to change annually.

Federal Student Loan Eligibility

Eligibility for federal student loans is determined by factors such as the student’s financial need, enrollment status, and credit history (for PLUS loans).

Subsidized Loans

Subsidized federal loans are awarded based on financial need as determined by the Free Application for Federal Student Aid (FAFSA). The government pays the interest while the student is enrolled at least half-time, during grace periods, and in certain deferment periods.

Unsubsidized Loans

Unsubsidized loans are available to both undergraduate and graduate students regardless of financial need. Interest accrues from the time the loan is disbursed, even if the borrower is still in school.

PLUS Loans

Parent PLUS loans and Graduate PLUS loans are available to parents of dependent undergraduate students and to graduate or professional students, respectively. Credit checks are required, and borrowers must meet certain creditworthiness standards. If a parent or graduate student is denied a PLUS loan due to poor credit, they may still be eligible if they obtain an endorser.

Private Student Loan Repayment Options

Private student loans offer a variety of repayment options, often more flexible than federal loans, but potentially at a higher cost. These options can include standard repayment plans (fixed monthly payments over a set period), graduated repayment plans (payments increase over time), and extended repayment plans (longer repayment periods leading to lower monthly payments but higher overall interest).

Variable vs. Fixed Interest Rates

Private student loans can have either variable or fixed interest rates. Variable rates fluctuate based on market conditions, potentially leading to unpredictable monthly payments. Fixed rates remain constant throughout the loan term, offering predictability in budgeting. For example, a variable rate loan might start at 7% but could increase or decrease over the life of the loan, while a fixed rate loan might remain at a consistent 8%.

Comparison of Federal and Private Student Loans

| Loan Type | Interest Rates | Eligibility | Repayment Options |

|---|---|---|---|

| Federal (Subsidized, Unsubsidized, PLUS) | Generally lower, fixed rates set by the government | Based on financial need (for subsidized loans), enrollment status, and credit history (for PLUS loans) | Standard, graduated, extended repayment plans; income-driven repayment options available |

| Private | Generally higher, can be fixed or variable | Based primarily on creditworthiness and income; co-signer may be required | Standard, graduated, extended repayment plans; may offer other options depending on the lender |

Loan Consolidation and Refinancing

Navigating the complexities of student loan debt often leads borrowers to explore options like consolidation and refinancing to simplify repayment and potentially lower monthly payments. Understanding the processes and implications of each is crucial for making informed financial decisions.

Consolidating federal student loans combines multiple federal loans into a single new loan with a single monthly payment. This simplifies the repayment process by reducing the number of payments and potentially streamlining communication with lenders. Refinancing, on the other hand, involves replacing existing student loans—either federal or private—with a new loan from a private lender. This often offers the potential for a lower interest rate, resulting in lower monthly payments and reduced overall interest paid. However, refinancing federal loans means losing access to federal repayment programs and protections.

Federal Student Loan Consolidation

Federal student loan consolidation is managed through the Federal Student Aid website. Borrowers apply online, providing necessary information about their existing federal loans. The process involves combining Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans, and Federal Stafford Loans into a Direct Consolidation Loan. The new loan’s interest rate is a weighted average of the interest rates of the consolidated loans, fixed for the life of the loan.

Benefits of federal consolidation include simplified repayment, a single monthly payment, and potential access to income-driven repayment plans. However, drawbacks include a potentially longer repayment term (extending the loan’s life and increasing total interest paid), and the loss of certain loan forgiveness programs tied to specific loan types.

Private Student Loan Refinancing

Eligibility for private student loan refinancing depends on several factors, primarily the borrower’s credit score, debt-to-income ratio, and income. Lenders typically require a good credit history (a score above 670 is generally preferred) and a stable income to demonstrate the ability to repay the loan. Borrowers may also need to provide documentation of their existing student loans.

Unlike federal consolidation, private refinancing does not involve a government agency. Borrowers must directly apply with private lenders, who each have their own eligibility criteria and interest rates. This process is often more competitive, with lenders seeking borrowers with strong credit profiles.

Scenarios Where Consolidation or Refinancing is Advantageous

Consolidating federal loans can be beneficial for borrowers struggling to manage multiple loan payments, or those seeking access to income-driven repayment plans. Refinancing private loans is often advantageous when interest rates are lower than the existing loan rates, allowing borrowers to reduce their monthly payments and overall interest costs. For example, a borrower with several high-interest private student loans might significantly reduce their monthly payments and save thousands of dollars in interest over the life of the loan by refinancing to a lower interest rate. Similarly, a borrower with multiple federal loans might find consolidation simplifies their repayment process.

Impact of Refinancing on Credit Scores and Overall Financial Health

Refinancing can positively impact credit scores if it leads to lower debt utilization and improved payment history. However, the application process itself may temporarily lower a credit score due to a hard credit inquiry. If the refinancing results in lower monthly payments and responsible repayment, the positive impact on credit scores and overall financial health will generally outweigh the temporary dip. Conversely, missed payments on the refinanced loan will negatively affect credit scores and overall financial health. Carefully evaluating the terms and conditions of the refinanced loan and ensuring timely payments are crucial.

Default and its Consequences

Defaulting on student loans, whether federal or private, carries significant and long-lasting consequences that can severely impact your financial well-being. Understanding these repercussions is crucial for responsible loan management. This section details the potential outcomes of default and provides resources to help borrowers avoid this situation.

Default occurs when you fail to make your loan payments for a specified period, typically 90 days. The consequences differ significantly depending on whether the loan is federal or private.

Consequences of Defaulting on Federal Student Loans

Defaulting on federal student loans triggers a cascade of negative events. Your credit score will take a substantial hit, making it difficult to obtain loans, credit cards, or even rent an apartment in the future. The government may garnish your wages or tax refunds to recover the debt. Furthermore, your eligibility for federal financial aid, including future student loans, grants, and even some federal jobs, will be revoked. In some cases, the government may even pursue legal action to seize assets. The impact on your credit history can persist for seven years or even longer.

Consequences of Defaulting on Private Student Loans

The consequences of defaulting on private student loans are similarly severe, though the specific actions taken by the lender may vary. Your credit score will suffer significantly, impacting your ability to secure future credit. The lender may pursue legal action to collect the debt, potentially leading to wage garnishment, bank levy, or even property seizure. Private lenders often use aggressive collection agencies, which can result in significant stress and harassment. Unlike federal loans, there is no government program to help rehabilitate defaulted private loans.

Flowchart: Handling Student Loan Default

The following describes a flowchart illustrating the steps involved in handling student loan default. Imagine a branching diagram.

Start: Notice of default.

Branch 1 (Federal Loans): Contact your loan servicer immediately. Explore options like income-driven repayment plans, deferment, or forbearance. If these options are unsuitable or unsuccessful, consider loan rehabilitation or consolidation.

Branch 2 (Private Loans): Contact your lender immediately to discuss options. Explore possibilities such as repayment plans, hardship programs, or settlement options. Consider seeking help from a credit counselor or debt consolidation specialist.

Branch 3 (Both Federal and Private Loans): If negotiations fail, legal action may be taken. This may involve wage garnishment, bank levies, or lawsuits.

End: Resolution of the debt.

Resources for Borrowers Facing Student Loan Default

Several resources are available to help borrowers facing student loan default. These include:

- Your loan servicer: They are your primary point of contact and can provide information on available repayment options and hardship programs.

- The National Foundation for Credit Counseling (NFCC): They offer free or low-cost credit counseling and can help you create a budget and develop a plan to manage your debt.

- The U.S. Department of Education: Their website provides information on federal student loan programs, repayment options, and default prevention strategies.

- Student Loan Borrower Assistance Program: These programs provide guidance and assistance to borrowers struggling with student loan debt.

Key Differences in Consequences of Defaulting on Federal vs. Private Student Loans

- Government Intervention: Federal loan defaults involve government intervention, including wage garnishment and tax refund offset. Private loan defaults primarily involve lender actions.

- Rehabilitation Options: Federal loans offer rehabilitation programs to restore your eligibility for federal aid. Private loans generally lack such programs.

- Collection Practices: While both can involve aggressive collection practices, federal loan collection is governed by stricter regulations.

- Long-Term Impact: The negative impact on your credit score can last for several years for both, but federal loan defaults may have more extensive consequences regarding future federal aid eligibility.

Managing Student Loan Debt

Successfully navigating student loan repayment requires a proactive and organized approach. Effective budgeting, prioritization of payments, and a strong understanding of personal finances are crucial for minimizing stress and avoiding default. This section will Artikel practical strategies for managing your student loan debt effectively.

Effective Budgeting Strategies for Student Loan Repayments

Creating a realistic budget is the cornerstone of responsible student loan management. This involves meticulously tracking income and expenses to understand your financial picture clearly. By identifying areas where spending can be reduced, you can free up more funds for loan repayments. Consider using budgeting apps or spreadsheets to monitor your finances and ensure you stay on track. Remember to factor in unexpected expenses, creating a buffer for emergencies.

Prioritizing Student Loan Payments Alongside Other Financial Obligations

Balancing student loan payments with other financial responsibilities, such as rent, utilities, and groceries, can be challenging. Prioritizing loan payments depends on your individual circumstances and the terms of your loans. High-interest loans should generally be prioritized to minimize long-term costs. Consider creating a debt repayment plan that systematically addresses your highest-interest debts first, such as the avalanche method, or focus on paying off the smallest debts first for a sense of accomplishment, known as the snowball method. Always ensure you meet your minimum payments on all obligations to avoid late fees and negative impacts on your credit score.

Sample Budget Allocating Funds for Student Loan Payments, Living Expenses, and Savings

The following table illustrates a sample monthly budget. Remember that this is just an example, and your specific budget will need to reflect your individual income and expenses. Adjust the percentages to fit your unique financial situation. The key is consistency and regular review to ensure your budget remains relevant and effective.

| Category | Amount ($) | Percentage of Income (%) |

|---|---|---|

| Student Loan Payments | 500 | 25 |

| Rent/Mortgage | 1000 | 50 |

| Utilities | 150 | 7.5 |

| Groceries | 200 | 10 |

| Transportation | 100 | 5 |

| Savings | 50 | 2.5 |

| Other Expenses | 100 | 5 |

| Total | 2100 | 100 |

Importance of Financial Literacy and its Role in Managing Student Loan Debt

Financial literacy plays a vital role in effectively managing student loan debt. Understanding concepts like interest rates, loan amortization, and credit scores empowers you to make informed decisions about your repayment strategy. By actively seeking financial education through workshops, online resources, or financial advisors, you can improve your financial well-being and develop sound money management skills. This includes understanding the implications of different repayment plans, such as income-driven repayment, and the potential benefits of loan refinancing or consolidation. Proactive financial literacy reduces the risk of default and helps build a strong financial future.

Government Regulations and Policies

The landscape of federal student loan regulations is constantly evolving, significantly impacting borrowers’ rights, repayment options, and overall debt management strategies. Understanding these changes and the roles of governing agencies is crucial for navigating the complexities of student loan repayment.

Recent changes in federal student loan regulations have primarily focused on increasing borrower protections and addressing the rising concerns of student loan debt. These changes often involve modifications to repayment plans, income-driven repayment options, and forgiveness programs. The impact on borrowers varies depending on their individual circumstances and the specific changes implemented. For example, extensions to forbearance or changes to eligibility criteria for income-driven repayment plans can offer substantial relief to struggling borrowers, while modifications to loan forgiveness programs may alter long-term repayment strategies.

Recent Changes in Federal Student Loan Regulations and Their Impact

Several significant regulatory changes have affected federal student loan borrowers in recent years. The expansion of income-driven repayment (IDR) plans, for instance, has made it easier for some borrowers to manage their monthly payments based on their income and family size. Conversely, changes to Public Service Loan Forgiveness (PSLF) program requirements have created challenges for some borrowers seeking loan forgiveness after completing 10 years of qualifying public service employment. These alterations highlight the ongoing adjustments to the system aimed at balancing borrower needs with fiscal responsibility. Specific examples of changes could include adjusted income thresholds for IDR plans or stricter documentation requirements for PSLF.

The Role of Government Agencies in Overseeing Student Loan Programs

The Department of Education (ED) plays a central role in overseeing federal student loan programs. Within the ED, the Federal Student Aid (FSA) office manages the day-to-day operations, including loan disbursement, repayment processing, and default management. Other agencies, such as the Consumer Financial Protection Bureau (CFPB), play a supervisory role, ensuring fair lending practices and protecting borrowers from predatory lending. The CFPB’s involvement highlights the multi-agency approach to student loan oversight, aiming to balance the interests of lenders and borrowers. For example, the CFPB might investigate complaints of unfair or deceptive practices by private lenders participating in federal loan programs.

Government Programs Aimed at Assisting Students with Loan Repayment

The federal government offers several programs designed to assist students with loan repayment. These include various income-driven repayment (IDR) plans, which adjust monthly payments based on income and family size. Public Service Loan Forgiveness (PSLF) offers loan forgiveness after 10 years of qualifying public service employment. Other programs may provide temporary relief through deferment or forbearance, allowing borrowers to temporarily suspend or reduce their payments during periods of financial hardship. The availability and specifics of these programs can change over time, so borrowers should regularly review their options. For example, the details of income calculations for IDR plans, or the specific types of employment qualifying for PSLF, are subject to change.

Timeline of Significant Events and Policy Changes

A timeline of significant events and policy changes related to federal student loans would include major legislative acts such as the Higher Education Act reauthorizations, which frequently revise the rules governing student aid. Key dates would also include the introduction and subsequent modifications to income-driven repayment plans, the establishment of the PSLF program and its subsequent rule changes, and periods of widespread loan forbearance or other emergency relief measures implemented in response to economic downturns. For example, the 2007-2008 financial crisis prompted significant changes to loan repayment options and forbearance programs. Similarly, the COVID-19 pandemic led to a prolonged period of payment pauses and other emergency relief measures.

The Role of Private Lenders

Private student loans represent a significant portion of the overall student loan market, offering an alternative funding source for students who may not qualify for federal aid or need additional funding beyond their federal loan limits. Understanding the role of these lenders is crucial for prospective borrowers to make informed decisions.

Private lenders operate differently than the federal government, focusing primarily on profitability and risk assessment. This often translates to higher interest rates and stricter eligibility requirements compared to federal loan programs. However, they can offer flexibility in terms of loan amounts and repayment options that may not be available through federal programs.

Key Players in the Private Student Loan Market

Several major financial institutions dominate the private student loan market. These include large banks like Sallie Mae (now Navient and Sallie Mae), Discover, and PNC Bank, as well as credit unions and smaller regional banks. Each lender has its own lending criteria and product offerings, creating a competitive market for borrowers. Some lenders specialize in certain types of loans, such as loans for graduate students or professional degree programs, while others cater to a broader range of borrowers.

Comparison of Lending Practices Among Private Lenders

Private lenders vary considerably in their lending practices. Interest rates, fees, repayment options, and eligibility requirements differ significantly across institutions. For instance, some lenders may offer variable interest rates, which fluctuate based on market conditions, while others offer fixed interest rates providing predictability throughout the loan term. Similarly, repayment plans can range from standard repayment schedules to income-driven repayment options, though these are less common with private loans than federal loans. Eligibility criteria often include credit history, co-signer requirements, and academic standing, with variations among lenders in the weight given to each factor.

Factors Considered by Private Lenders When Evaluating Loan Applications

Private lenders employ a rigorous evaluation process when assessing loan applications. Key factors considered include the applicant’s credit history (if applicable), credit score, debt-to-income ratio, co-signer’s creditworthiness (if a co-signer is required), academic performance, and the chosen school’s accreditation. A strong credit history and a high credit score significantly improve the chances of loan approval and may lead to more favorable interest rates. The applicant’s ability to repay the loan, as evidenced by their income and debt levels, is a critical aspect of the evaluation.

Marketing Strategies Used by Private Lenders to Attract Borrowers

Private lenders employ a variety of marketing strategies to reach potential borrowers. These often include online advertising, partnerships with educational institutions, and direct mail campaigns. Marketing materials typically highlight the benefits of private loans, such as flexible repayment options and potentially higher loan amounts compared to federal loans. However, it’s important for borrowers to critically evaluate these marketing messages, comparing offers from multiple lenders before making a decision. Some lenders may emphasize low initial interest rates without fully disclosing the terms and conditions, including potential increases in rates over the loan’s life.

Impact on Personal Finances

Student loan debt can significantly impact personal finances, extending far beyond the repayment period. The weight of this debt can influence major life decisions and long-term financial well-being, requiring careful consideration and proactive planning. Understanding the potential consequences is crucial for making informed choices about higher education and managing future financial stability.

Student loan debt’s long-term financial implications are multifaceted and can significantly affect a borrower’s ability to achieve financial goals. The monthly payments represent a consistent outflow of funds that could otherwise be used for savings, investments, or other financial priorities. This persistent financial strain can limit opportunities for wealth accumulation and delay major life milestones.

Long-Term Financial Implications

The accumulation of significant student loan debt can have profound and lasting effects on personal finances. The extended repayment periods, often spanning several years or even decades, mean consistent monthly payments that reduce disposable income. This can hinder saving for retirement, purchasing a home, or investing in other assets. The opportunity cost of these missed opportunities can be substantial over a lifetime. Furthermore, high-interest rates can exacerbate the overall cost of borrowing, leading to a larger total repayment amount than the initial loan principal.

Effects on Major Life Decisions

Student loan debt frequently impacts significant life choices. The financial burden of monthly repayments can make it challenging to save for a down payment on a house, delaying homeownership or forcing borrowers to compromise on their ideal living situation. Similarly, starting a family can be postponed due to financial constraints imposed by student loan debt. The decision to have children often involves considering the added expenses of childcare, healthcare, and education, making it difficult for individuals with substantial loan repayments to balance their financial obligations with family planning.

Impact on Credit Scores and Future Borrowing

Student loan debt directly influences credit scores and future borrowing capacity. Consistent and timely payments demonstrate responsible credit management, positively impacting credit scores. However, missed or late payments can severely damage credit scores, making it difficult to secure loans for a mortgage, car purchase, or other financial needs in the future. A lower credit score translates to higher interest rates on future loans, further increasing the financial burden. A history of responsible loan repayment, on the other hand, can help secure more favorable loan terms and interest rates.

Impact Across Income Levels and Career Paths

The impact of student loan debt varies considerably depending on income levels and career paths.

- High-Income Earner, Stable Career: A doctor earning a high salary might find student loan repayments manageable, despite the substantial initial debt. They may still experience some limitations, but the impact is less severe compared to lower-income earners.

- Low-Income Earner, Unstable Employment: A recent graduate with a humanities degree and low-paying job may struggle significantly with loan repayments. Missed payments could lead to default, severely impacting their credit score and future financial prospects. The repayment burden may be disproportionately high compared to their income, leading to financial hardship.

- Mid-Income Earner, Variable Income: A teacher with a moderate salary and fluctuating income may face challenges managing student loan payments, especially during periods of unemployment or reduced income. Unexpected expenses could easily overwhelm their budget, leading to late payments or difficulty making timely repayments.

Conclusive Thoughts

Successfully managing student loan debt requires proactive planning and a clear understanding of your options. By carefully weighing the pros and cons of federal and private loans, implementing effective budgeting strategies, and staying informed about relevant regulations and policies, you can navigate this crucial financial journey with confidence. Remember, seeking professional financial advice can prove invaluable in tailoring a repayment plan that aligns with your individual circumstances and long-term financial goals.

Answers to Common Questions

What is the difference between subsidized and unsubsidized federal student loans?

Subsidized loans don’t accrue interest while you’re in school, grace periods, and during certain deferment periods. Unsubsidized loans accrue interest from the time they are disbursed.

Can I refinance my federal student loans with a private lender?

Yes, but be aware that refinancing federal loans with a private lender means you lose the benefits and protections offered by federal loan programs.

What happens if I miss a student loan payment?

Missing payments can negatively impact your credit score and may lead to late fees, collection actions, and even default, which has serious financial consequences.

How can I find a reputable private student loan lender?

Research lenders carefully, comparing interest rates, fees, and repayment options. Look for lenders with positive customer reviews and a strong reputation for ethical lending practices.

Are there any government programs to help with student loan repayment?

Yes, various programs exist, including income-driven repayment plans and loan forgiveness programs for certain professions. Eligibility requirements vary.