Federal Direct PLUS loans represent a significant financial commitment for parents and graduate students seeking higher education. Understanding the intricacies of these loans—from eligibility criteria and interest rates to repayment options and potential pitfalls—is crucial for responsible borrowing and financial well-being. This guide provides a detailed exploration of Federal Direct PLUS loans, empowering borrowers to make informed decisions and navigate the complexities of student loan financing effectively.

We’ll delve into the specifics of eligibility requirements, comparing parent PLUS loans with graduate student PLUS loans, and examining the crucial role of credit history. Further, we will dissect interest rates, fees, and available repayment plans, highlighting the implications of each choice on long-term financial health. Finally, we will address strategies for responsible borrowing, managing repayment, and avoiding default, ensuring a clear path towards successful loan management.

Eligibility Criteria for Federal Direct PLUS Loans

Federal Direct PLUS Loans offer parents and graduate students a valuable resource for financing higher education. Understanding the eligibility requirements is crucial for successful application and loan disbursement. This section details the specific criteria for both parent and graduate student borrowers.

Eligibility Requirements for Parent PLUS Loans

To be eligible for a Federal Direct PLUS Loan as a parent, you must be the biological or adoptive parent of a dependent undergraduate student enrolled at least half-time in a degree or certificate program at a participating school. You must also meet the credit requirements Artikeld below. The student must be enrolled at a school participating in the Federal Direct Loan program. Important to note, the student themselves does not need to meet any specific financial need requirements for the parent to qualify.

Eligibility Requirements for Graduate Student PLUS Loans

Graduate students pursuing a degree or certificate program at a participating school are eligible for Federal Direct PLUS Loans if they meet the credit requirements. Unlike parent PLUS loans, there is no requirement that the student be a dependent of another individual. The student must be enrolled at least half-time.

Credit History Requirements for PLUS Loan Applicants

Applicants for both Parent PLUS and Graduate PLUS loans are subject to a credit check. The Department of Education uses a credit history check to assess the applicant’s creditworthiness. Adverse credit history, such as bankruptcies, foreclosures, or a history of late payments, can result in loan denial. However, it’s important to note that a denial based on adverse credit history doesn’t automatically preclude borrowing. Applicants can often appeal a denial by providing documentation explaining their circumstances and demonstrating their ability to repay the loan.

Summary of Eligibility Factors for Different Borrowers

| Borrower Type | Student Enrollment Status | Credit Check | Additional Requirements |

|---|---|---|---|

| Parent (PLUS) | Dependent undergraduate student enrolled at least half-time | Yes, required | Must be biological or adoptive parent |

| Graduate Student (PLUS) | Enrolled at least half-time in a graduate program | Yes, required | No additional dependency requirements |

Interest Rates and Fees Associated with Federal Direct PLUS Loans

Understanding the interest rates and fees associated with Federal Direct PLUS loans is crucial for responsible financial planning. This section details the current rates, how they’re determined, and the associated costs, enabling borrowers to make informed decisions.

Federal Direct PLUS loan interest rates are variable and are set by the government. The rate for your loan will be fixed for the life of the loan, meaning it won’t change after your loan is disbursed. However, the rate itself changes periodically, based on the 91-day Treasury bill auction rate, plus a fixed margin. This means that the interest rate you receive will depend on the prevailing economic conditions at the time your loan is disbursed.

Interest Rate Determination

The interest rate for a Federal Direct PLUS loan is determined by adding a fixed margin to the average of the 91-day Treasury bill auction rates. The fixed margin is set by the government and can vary from year to year. This process ensures that interest rates reflect prevailing market conditions, although the government sets a cap on how high they can go. For example, if the average 91-day Treasury bill rate is 4%, and the fixed margin is 2.75%, then the interest rate for the PLUS loan would be 6.75%. This rate is fixed for the life of the loan, meaning it will not change, even if market rates fluctuate.

Fees Associated with Federal Direct PLUS Loans

Borrowers should be aware of the fees associated with Federal Direct PLUS loans. These fees are deducted from the loan disbursement, reducing the amount you actually receive. The primary fee is the origination fee, a percentage of the loan amount. There may also be other fees, such as late payment fees, depending on the loan servicer.

Origination Fees

The origination fee for Federal Direct PLUS loans is a percentage of the loan amount. This fee helps cover the costs of processing and administering the loan. The specific percentage may vary slightly depending on the loan amount and disbursement date. This fee is charged upfront and is deducted from the loan proceeds before they are disbursed to the borrower or the school. It is important to note that these fees are non-refundable.

Comparison of Interest Rates and Fees Over Different Loan Periods

The following table illustrates a hypothetical example of interest rates and fees over different loan periods. Remember that these are examples only, and actual rates and fees can vary. Always check the official government website for the most up-to-date information.

| Loan Period (Years) | Hypothetical Interest Rate (%) | Hypothetical Origination Fee (%) | Total Interest Paid (Hypothetical) |

|---|---|---|---|

| 5 | 7.00 | 4.23 | $XXXX |

| 10 | 7.00 | 4.23 | $YYYY |

| 15 | 7.00 | 4.23 | $ZZZZ |

Repayment Options for Federal Direct PLUS Loans

Choosing the right repayment plan for your Federal Direct PLUS loan is crucial, as it significantly impacts your monthly payments and the total amount of interest you’ll pay over the life of the loan. Understanding the various options and their implications will help you make an informed decision that aligns with your financial situation and long-term goals. The available plans offer flexibility, but careful consideration is essential to minimize overall cost.

Standard Repayment Plan

The Standard Repayment Plan is the default option for most federal student loans, including PLUS loans. Under this plan, you make fixed monthly payments over a 10-year period. While predictable, the monthly payments can be relatively high compared to other options, leading to a higher total interest paid over the loan’s lifespan. This plan is suitable for borrowers who prioritize a shorter repayment period and are comfortable with higher monthly payments.

Graduated Repayment Plan

The Graduated Repayment Plan offers lower initial monthly payments that gradually increase over time. This can be appealing to recent graduates or those anticipating increased income in the future. However, the longer repayment period and increasing payments can lead to significantly higher total interest paid compared to the Standard Repayment Plan. This plan is best suited for borrowers who anticipate a substantial increase in income during the loan repayment period.

Extended Repayment Plan

This plan extends the repayment period to up to 25 years, resulting in lower monthly payments than the Standard or Graduated plans. However, the extended repayment period leads to a substantial increase in total interest paid. This plan is generally recommended for borrowers with lower incomes or high debt burdens who need more manageable monthly payments, even at the cost of increased long-term interest.

Income-Driven Repayment Plans

Several income-driven repayment (IDR) plans are available for Federal Direct PLUS loans, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). These plans base your monthly payments on your income and family size. While monthly payments are typically lower, the repayment period can extend beyond 20 years, potentially leading to a higher total interest paid over the life of the loan. Forgiveness of the remaining loan balance may be possible after a certain number of years of payments, depending on the specific plan. The complexity of these plans requires careful consideration of their specific terms and conditions.

List of Repayment Plans and Their Key Features

- Standard Repayment Plan: Fixed monthly payments over 10 years; higher monthly payments, lower total interest compared to longer-term plans.

- Graduated Repayment Plan: Payments start low and increase over time; lower initial payments, but higher total interest than Standard Plan.

- Extended Repayment Plan: Fixed monthly payments over up to 25 years; lowest monthly payments, but significantly higher total interest.

- Income-Driven Repayment Plans (IBR, PAYE, REPAYE, ICR): Monthly payments based on income and family size; lower monthly payments, potentially longer repayment periods and higher total interest, possibility of loan forgiveness.

Managing and Avoiding Default on Federal Direct PLUS Loans

Successfully navigating the repayment of your Federal Direct PLUS loan requires proactive planning and responsible financial management. Understanding the potential consequences of default and having a plan in place to address financial hardship are crucial to avoiding serious long-term financial repercussions.

Strategies for Responsible Borrowing and Repayment

Responsible borrowing begins before you even receive the loan funds. Carefully consider the total amount you are borrowing and ensure it aligns with your anticipated earning potential after graduation. Create a realistic budget that incorporates loan repayment as a significant expense. This budget should account for living expenses, other debts, and potential unexpected costs. Regularly monitor your loan balance and repayment schedule to stay informed and on track. Consider exploring income-driven repayment plans early in the repayment process if you anticipate financial difficulties. These plans adjust your monthly payments based on your income and family size.

Consequences of Defaulting on a Federal Direct PLUS Loan

Defaulting on a Federal Direct PLUS loan has severe consequences. Your credit score will be significantly damaged, making it difficult to obtain future loans, credit cards, or even rent an apartment. The government may garnish your wages or tax refunds to recover the debt. Furthermore, you may lose eligibility for future federal student aid programs, and your professional licenses could be jeopardized in some fields. The debt will continue to accrue interest and fees, making the total amount owed substantially larger over time. In short, defaulting can have far-reaching and devastating effects on your financial well-being.

Steps for Borrowers Facing Difficulty Making Payments

If you are struggling to make your loan payments, contacting your loan servicer immediately is crucial. They can provide information about available options, such as deferment, forbearance, or income-driven repayment plans. Deferment temporarily postpones payments, while forbearance reduces or suspends payments for a specified period. Income-driven repayment plans adjust your monthly payment to a percentage of your discretionary income. Open communication with your servicer is key to finding a solution that works for your situation. They may also be able to offer counseling or connect you with resources to help improve your financial situation.

Step-by-Step Guide for Borrowers Experiencing Financial Hardship

Facing financial hardship requires a structured approach to avoid default.

- Assess your financial situation: Create a detailed budget outlining your income and expenses. Identify areas where you can reduce spending. Consider seeking free credit counseling from a reputable agency to help you develop a comprehensive financial plan.

- Contact your loan servicer: Explain your situation and explore available options, such as deferment, forbearance, or income-driven repayment plans. Request information about the specific terms and conditions of each option.

- Explore additional income sources: Consider part-time employment, freelancing, or selling unused assets to increase your income and improve your ability to make loan payments.

- Seek professional help: If you’re struggling to manage your finances independently, consider seeking guidance from a financial advisor or credit counselor. They can provide personalized advice and strategies to help you regain control of your finances.

- Negotiate a repayment plan: Work with your loan servicer to develop a manageable repayment plan that aligns with your current financial capabilities. This may involve modifying your payment amount or extending the repayment period.

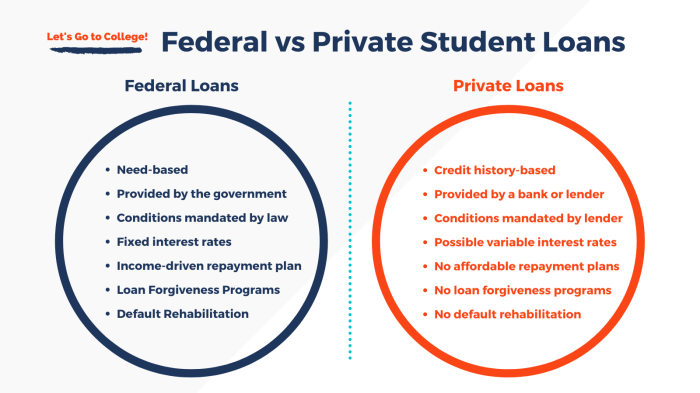

Comparison with Other Student Loan Options

Choosing the right student loan is crucial for managing your education costs effectively. Federal Direct PLUS loans are just one option among several federal student loan programs. Understanding the differences between them is key to making an informed decision that aligns with your financial situation and repayment capabilities. This section compares and contrasts Federal Direct PLUS loans with other federal student loan types, highlighting the advantages and disadvantages of each.

Federal Direct PLUS Loans Compared to Subsidized and Unsubsidized Loans

Federal Direct Subsidized and Unsubsidized Loans are typically available to undergraduate and graduate students who demonstrate financial need (Subsidized) or who don’t (Unsubsidized). In contrast, Federal Direct PLUS Loans are specifically designed for parents of dependent students or graduate students. Key distinctions lie in eligibility, interest accrual, and repayment terms.

| Feature | Federal Direct PLUS Loan | Federal Direct Subsidized Loan | Federal Direct Unsubsidized Loan |

|---|---|---|---|

| Borrower | Parent of dependent student or graduate student | Undergraduate or graduate student (demonstrates financial need) | Undergraduate or graduate student |

| Interest Accrual | Interest accrues from disbursement | Interest does not accrue while the student is enrolled at least half-time | Interest accrues from disbursement |

| Credit Check | Credit check required; adverse credit history may affect approval | No credit check required | No credit check required |

| Loan Limits | Cost of attendance minus other financial aid | Varies by year and dependency status | Varies by year and dependency status |

Advantages and Disadvantages of Each Loan Type

The best loan type depends on individual circumstances. For example, a subsidized loan is advantageous for students who qualify because it avoids interest accrual during their studies. However, the lower borrowing limits might necessitate exploring other options. A PLUS loan, while offering higher borrowing potential, requires a credit check and incurs interest from disbursement. Unsubsidized loans provide flexibility but carry the burden of interest accumulation throughout the loan period. Careful consideration of these factors is crucial before making a decision.

The Application Process for Federal Direct PLUS Loans

Applying for a Federal Direct PLUS loan involves several key steps, from completing the application itself to receiving the loan funds. Understanding this process ensures a smooth transition into financing your education. The process is primarily online, making it convenient for most applicants.

Required Documentation for Federal Direct PLUS Loan Application

Before beginning the application, gather the necessary documents to streamline the process. This typically includes your Social Security number, driver’s license or other government-issued identification, and tax information (for credit check purposes). You will also need your federal student aid ID (FSA ID) to access and complete the application. Having this information readily available will significantly reduce application time.

Step-by-Step Application Guide for Federal Direct PLUS Loans

The application process is straightforward and can be completed online through the National Student Loan Data System (NSLDS) website. Following these steps will guide you through the application procedure:

- Complete the PLUS Loan Application: Log in to StudentAid.gov using your FSA ID and complete the PLUS loan application. The application will request information about your income and credit history.

- Credit Check and Approval: The Department of Education will perform a credit check. If approved, you will receive notification of your eligibility and the loan amount you are approved for. If denied, you may be able to submit an endorser to help you qualify.

- Acceptance of Loan Terms: Once approved, carefully review the loan terms, including the interest rate, fees, and repayment schedule. You will need to electronically sign and accept the loan terms to proceed.

- School Certification: Your school will need to certify your loan. This ensures the loan amount is appropriate for your educational costs.

Loan Disbursement Process

After your school certifies the loan, the funds are disbursed according to your school’s disbursement schedule. This schedule is typically aligned with academic terms, with funds released directly to your school to cover tuition, fees, and other educational expenses. You may receive a portion of the funds directly, depending on your school’s policies. Schools often provide detailed information regarding their specific disbursement procedures. It is important to be aware of your school’s disbursement schedule to plan your finances effectively.

Understanding Loan Consolidation and Refinancing Options

Managing your Federal Direct PLUS loans effectively often involves exploring options to simplify repayment and potentially lower your overall cost. Two key strategies to consider are loan consolidation and refinancing. Both offer ways to restructure your debt, but they differ significantly in their processes and implications.

Consolidation and refinancing are distinct approaches to managing multiple student loans, each with its own set of advantages and disadvantages. Understanding these differences is crucial for making informed decisions that align with your financial goals.

Federal Direct Loan Consolidation

Federal Direct Loan Consolidation allows you to combine multiple federal student loans, including your Federal Direct PLUS loans, into a single new loan. This simplifies repayment by reducing the number of monthly payments and potentially lowering your monthly payment amount, although the total amount paid over the life of the loan may increase due to changes in interest rates and loan terms. The consolidated loan will have a weighted average interest rate based on the interest rates of your original loans, and this rate will be fixed for the life of the loan. This process is managed through the Federal Student Aid website.

Refinancing Federal Direct PLUS Loans

Refinancing involves replacing your existing Federal Direct PLUS loans with a new private loan from a lender, such as a bank or credit union. This new loan typically offers a lower interest rate than your current PLUS loan, potentially saving you money over the life of the loan. However, refinancing your federal loans with a private lender means losing the benefits associated with federal student loan programs, such as income-driven repayment plans and deferment options. The interest rate offered on a refinanced loan will depend on your credit score and other financial factors. Careful comparison shopping among various private lenders is essential.

Comparison of Loan Consolidation and Refinancing

| Feature | Consolidation (Federal) | Refinancing (Private) |

|---|---|---|

| Loan Source | Federal government | Private lender |

| Interest Rate | Weighted average of existing loans (fixed) | Variable or fixed, determined by creditworthiness |

| Loan Terms | Standardized federal terms | Vary depending on lender |

| Borrower Benefits | Access to income-driven repayment, deferment/forbearance options | Potentially lower interest rate, simplified payments |

| Risks | May not significantly lower interest rate | Loss of federal loan benefits, potential for higher interest rates if credit score is poor |

Potential Risks and Benefits of Consolidation

Consolidating your federal student loans simplifies repayment, but it may not always lead to significant interest rate savings. For example, if your current loans have relatively low interest rates, consolidating them may not result in a substantial decrease in your monthly payment or total interest paid. The benefit is primarily in the simplification of the repayment process. The risk is that extending the repayment period may lead to paying more interest overall.

Potential Risks and Benefits of Refinancing

Refinancing can offer substantial interest rate savings, particularly if you have a good credit score. However, refinancing federal loans with a private lender means losing access to federal loan benefits such as income-driven repayment plans and deferment options. This can be a significant risk if your financial circumstances change unexpectedly. The benefit is the potential for significant cost savings through a lower interest rate. The risk is losing the safety net of federal loan programs.

Visual Representation of Loan Amortization

Understanding how your Federal Direct PLUS loan will be repaid requires visualizing the amortization schedule. This schedule illustrates the breakdown of each payment into principal and interest over the life of the loan. It allows you to see how much you’ll pay each month and how your balance decreases over time.

A typical amortization schedule is presented as a table. The table’s first column usually lists the payment number, sequentially numbered from 1 to the total number of payments (e.g., 120 payments for a 10-year loan). The second column displays the payment date. The third and fourth columns show the payment amount allocated to interest and principal, respectively. A fifth column shows the remaining loan balance after each payment.

Amortization Schedule Table Structure

The table would begin with the initial loan amount in the “Beginning Balance” column (this would be the first row, before payment number 1). Each subsequent row reflects the effect of the monthly payment. The “Interest” column calculates the interest accrued on the remaining balance for that month, using the applicable interest rate. The “Principal” column shows the portion of the payment that reduces the loan’s principal balance. This amount increases over time as the interest portion decreases. The “Ending Balance” column is calculated by subtracting the principal payment from the beginning balance. This ending balance then becomes the beginning balance for the next month’s payment. The final row shows a zero balance, indicating full loan repayment.

Example Data Points

Let’s consider a simplified example: A $10,000 loan at 7% annual interest, amortized over 10 years (120 months). The monthly payment would be approximately $116.11. The first month’s interest would be calculated as (0.07/12) * $10,000 = $58.33. Subtracting this from the monthly payment ($116.11 – $58.33 = $57.78) gives the principal payment for the first month. The ending balance would then be $10,000 – $57.78 = $9,942.22. This process repeats for each subsequent month, with the interest portion gradually decreasing and the principal portion gradually increasing until the loan is fully repaid. The table would visually demonstrate this progressive reduction in the loan balance over the 10-year period.

Ultimate Conclusion

Securing a higher education often requires leveraging financial resources, and Federal Direct PLUS loans can play a vital role. By carefully considering eligibility, interest rates, repayment options, and potential risks, borrowers can effectively manage their debt and achieve their educational goals. This guide has provided a framework for understanding the nuances of these loans, equipping readers with the knowledge to make informed decisions and navigate the process with confidence. Remember to always explore all available options and seek professional financial advice when needed.

Question & Answer Hub

What happens if I am denied a PLUS loan?

If denied, you can explore alternative funding options like private loans or appeal the decision with additional documentation.

Can I consolidate my PLUS loan with other federal loans?

Yes, you can consolidate your PLUS loan with other federal student loans through the Direct Consolidation Loan program.

What is the difference between a subsidized and unsubsidized PLUS loan?

PLUS loans are unsubsidized; interest accrues from the time the loan is disbursed. Subsidized loans for undergraduate students do not accrue interest while the student is enrolled at least half-time.

What are the consequences of defaulting on a PLUS loan?

Defaulting can result in damage to your credit score, wage garnishment, tax refund offset, and difficulty obtaining future federal student aid.

How often are PLUS loan interest rates adjusted?

PLUS loan interest rates are fixed for the life of the loan and are set annually by the government. They are not adjusted after the loan is disbursed.