Navigating the complexities of graduate school often involves confronting the financial realities of tuition and living expenses. Federal student loans provide crucial support, but understanding the specific limits for graduate students is essential for effective financial planning. This guide delves into the intricacies of federal loan limits, eligibility criteria, repayment options, and the long-term implications of graduate school debt, empowering students to make informed decisions about their educational funding.

This exploration covers various loan types, maximum borrowing amounts, and how factors like enrollment status and credit history influence eligibility. We’ll examine different repayment plans, including their advantages and disadvantages, and explore loan forgiveness programs that might alleviate the burden of student loan debt. Finally, we’ll offer strategies for managing debt and planning for a financially secure future after graduation.

Understanding Federal Graduate Loan Limits

Navigating the complexities of federal graduate student loans can be challenging. This section provides a clear overview of the different loan types, their maximum amounts, and how enrollment status impacts borrowing limits. Understanding these limits is crucial for responsible financial planning during your graduate studies.

Federal Graduate Student Loan Types and Maximum Amounts

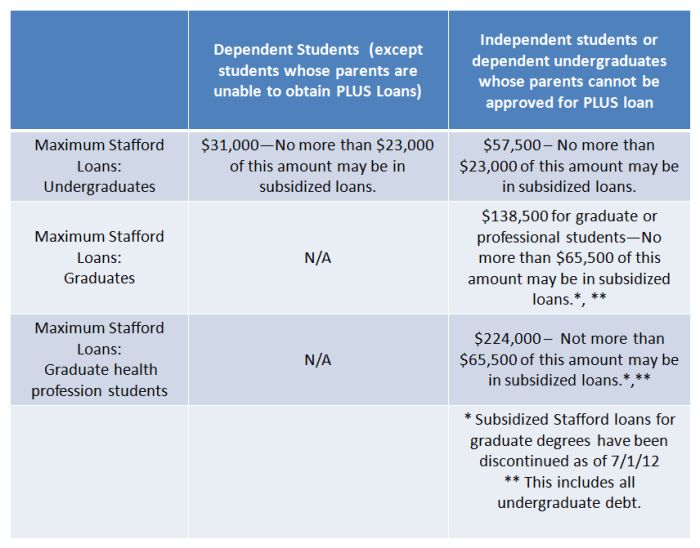

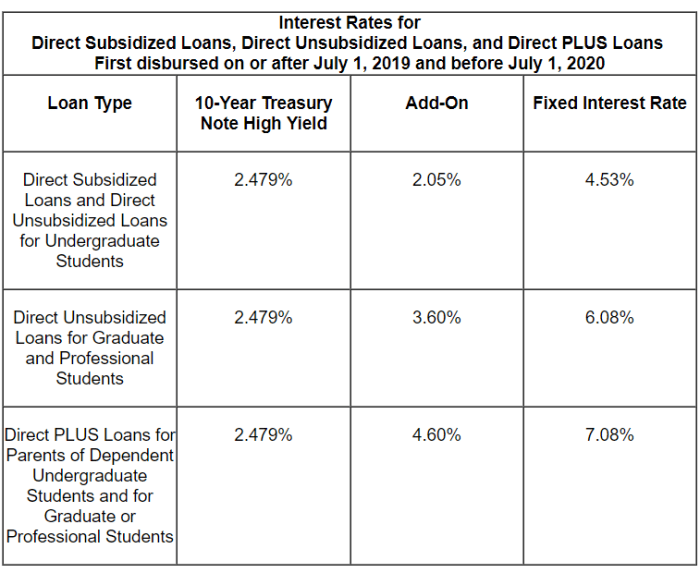

The federal government offers two main types of graduate student loans: Direct Unsubsidized Loans and Direct PLUS Loans. These loans differ primarily in their interest accrual and eligibility requirements. Direct Unsubsidized Loans are available to all graduate students who meet the basic eligibility criteria, while Direct PLUS Loans require a credit check and are subject to credit approval.

Direct Unsubsidized Loans accrue interest from the time the loan is disbursed, regardless of your enrollment status. Direct PLUS Loans also accrue interest from disbursement, and borrowers are responsible for all accrued interest.

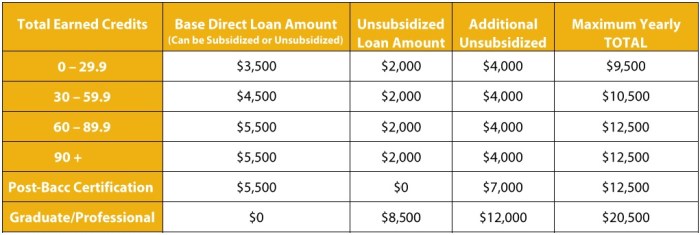

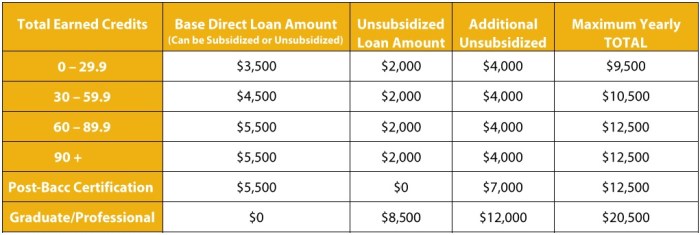

The maximum annual and aggregate loan limits for Direct Unsubsidized Loans are subject to change, and students should consult the official Federal Student Aid website for the most up-to-date information. As of the current year, a graduate student may borrow a substantial amount, depending on their specific circumstances. It is important to note that these limits are reviewed and may be adjusted annually.

Loan Limits Based on Enrollment Status

Loan limits are generally not directly tied to full-time or part-time enrollment status for Direct Unsubsidized Loans. The annual limit is based on the student’s dependency status and year in school. However, the total amount a student can borrow over their graduate career is capped. A student enrolled part-time might borrow less in a given year, but the aggregate loan limit remains the same over the duration of their program.

For Direct PLUS Loans, the loan amount is determined based on the cost of attendance minus other financial aid received. Therefore, enrollment status (full-time or part-time) indirectly affects the loan amount, as the cost of attendance might differ depending on the number of credits taken.

Changes in Loan Limits Over the Past Five Years

Federal student loan limits, including those for graduate students, are subject to periodic review and potential adjustments by Congress. While specific numbers fluctuate, there haven’t been significant, sweeping changes to the overall structure of graduate loan limits in the past five years. Minor adjustments may have occurred in response to economic conditions or legislative changes, and these would be best reviewed on the official Federal Student Aid website. For instance, a slight increase in the annual limit for Direct Unsubsidized Loans might have been implemented in one year, followed by no changes in subsequent years. Tracking these minor yearly fluctuations requires consulting the official sources.

Factors Affecting Loan Eligibility

Securing federal graduate student loans hinges on several key factors. Understanding these criteria is crucial for prospective borrowers to accurately assess their eligibility and plan accordingly. This section details the primary elements that influence loan approval and disbursement.

Credit History

A strong credit history isn’t always a requirement for federal graduate student loans, unlike many private loan options. However, a poor credit history *can* affect the terms of your loan, potentially leading to higher interest rates or a reduced loan amount. The Department of Education primarily assesses your creditworthiness based on your repayment history on other federal loans, if any. Significant negative marks, like bankruptcies or defaults, may impact your eligibility or necessitate a co-signer. While a perfect credit score isn’t mandated, responsible financial behavior demonstrably improves your chances of securing favorable loan terms.

Enrollment Status and Program Length

Your enrollment status directly influences your loan eligibility. You must be enrolled at least half-time in a graduate program at a participating institution to qualify for federal graduate student loans. The length of your program also plays a role, as loans are typically disbursed for the duration of your approved program of study. Changes in your enrollment status or program length may require adjustments to your loan disbursement schedule. For example, if a student reduces their course load below half-time, their loan disbursement may be affected or paused until they resume half-time enrollment.

Federal Graduate Loan Program Eligibility Criteria

| Loan Program | Credit Check Required? | Enrollment Requirement | Maximum Loan Amount |

|---|---|---|---|

| Direct Unsubsidized Loans | No (but credit history may affect interest rates) | At least half-time enrollment | Varies by program, year, and dependency status. Check the official Federal Student Aid website for current limits. |

| Direct PLUS Loans (Graduate Students) | Yes (a credit check is performed) | At least half-time enrollment | Cost of attendance minus other financial aid received. |

| Direct Subsidized Loans | No (but credit history may affect interest rates) | At least half-time enrollment, demonstrates financial need | Varies by program, year, and dependency status. Check the official Federal Student Aid website for current limits. |

Repayment Plans and Options

Choosing the right repayment plan is crucial for managing your federal graduate student loans effectively after graduation. Understanding the various options and their implications will help you navigate this important phase and avoid potential financial difficulties. The best plan for you will depend on your individual financial circumstances, income, and long-term goals.

Several repayment plans are available to help graduate students manage their loan debt. Each plan offers a different approach to repayment, impacting your monthly payments, loan term length, and overall interest paid. Carefully comparing these options is essential to making an informed decision.

Standard Repayment Plan

The Standard Repayment Plan is the default plan for federal student loans. It typically involves fixed monthly payments over a 10-year period. This plan is straightforward and easy to understand, making it a popular choice for many borrowers. However, the fixed monthly payments can be substantial, especially for those with high loan balances.

- Advantage: Simple and predictable monthly payments.

- Disadvantage: Higher monthly payments and total interest paid compared to income-driven repayment plans.

Graduated Repayment Plan

The Graduated Repayment Plan offers lower initial monthly payments that gradually increase over time. This can be beneficial in the early years after graduation when income may be lower. However, the payments will become significantly larger in later years.

- Advantage: Lower initial monthly payments.

- Disadvantage: Payments increase substantially over time, potentially leading to difficulty in later years. Total interest paid is generally higher than with the Standard Repayment Plan.

Income-Driven Repayment Plans

Income-Driven Repayment (IDR) plans, such as the Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR) plans, base your monthly payment on your discretionary income and family size. These plans typically result in lower monthly payments than the Standard or Graduated plans, but they may extend the repayment period to 20 or 25 years. The remaining balance may be forgiven after the repayment period, though this forgiveness is considered taxable income.

- Advantage: Lower monthly payments, potentially affordable for borrowers with lower incomes.

- Disadvantage: Longer repayment periods, leading to higher total interest paid over the life of the loan. Forgiveness of remaining balance is considered taxable income.

Extended Repayment Plan

The Extended Repayment Plan allows for longer repayment terms than the standard plan. This can significantly reduce monthly payments, but it will result in paying more interest over the life of the loan.

- Advantage: Lower monthly payments.

- Disadvantage: Significantly longer repayment period, leading to substantially higher total interest paid.

Sample Repayment Schedule (Standard Repayment Plan)

Let’s assume a graduate student has a total loan balance of $100,000 with a 6% interest rate. Under the Standard Repayment Plan (10-year term), their approximate monthly payment would be $1,110.21. This results in a total interest paid of approximately $31,225.20 over the life of the loan.

| Year | Beginning Balance | Payment | Interest Paid | Principal Paid | Ending Balance |

|---|---|---|---|---|---|

| 1 | $100,000.00 | $1,110.21 | $6,000.00 | $5,110.21 | $94,889.79 |

| 2 | $94,889.79 | $1,110.21 | $5,693.39 | $5,416.82 | $89,472.97 |

| 3 | $89,472.97 | $1,110.21 | $5,368.38 | $5,741.83 | $83,731.14 |

| … | … | … | … | … | … |

| 10 | … | $1,110.21 | … | … | $0.00 |

Note: This is a simplified example. Actual payments may vary slightly based on the specific loan terms and interest rate.

Loan Forgiveness and Cancellation Programs

Federal loan forgiveness and cancellation programs offer graduate students the opportunity to reduce or eliminate their student loan debt under specific circumstances. These programs are designed to incentivize individuals to pursue careers in public service or address critical national needs, while also providing relief to borrowers facing significant financial hardship. Understanding the eligibility requirements and application processes is crucial for maximizing the potential benefits.

Public Service Loan Forgiveness (PSLF) Program

The Public Service Loan Forgiveness (PSLF) program forgives the remaining balance on your Direct Loans after you have made 120 qualifying monthly payments under an income-driven repayment plan while working full-time for a qualifying employer. Qualifying employers include government organizations (federal, state, local, or tribal) and not-for-profit organizations. Examples of qualifying professions include teachers, social workers, nurses, and government employees. Eligibility requires having Direct Loans, making 120 qualifying payments, and working full-time for a qualifying employer. The application process involves submitting an Employment Certification form annually to your loan servicer, and a PSLF form once you believe you’ve made 120 qualifying payments.

Teacher Loan Forgiveness Program

This program provides forgiveness of up to $17,500 on Direct Subsidized and Unsubsidized Loans, and Federal Stafford Loans. To qualify, you must have taught full-time for five complete and consecutive academic years in a low-income school or educational service agency. A low-income school is defined by the Department of Education. The application process involves submitting the Teacher Loan Forgiveness application to your loan servicer after completing the five years of service. The program is specifically targeted towards teachers working in underserved communities and aiming to address teacher shortages in these areas.

Income-Driven Repayment (IDR) Plans

While not strictly loan forgiveness programs, Income-Driven Repayment (IDR) plans significantly lower monthly payments based on income and family size. These plans include the Revised Pay As You Earn (REPAYE), Pay As You Earn (PAYE), Income-Based Repayment (IBR), and Income-Contingent Repayment (ICR) plans. These plans don’t directly forgive loans, but they can lead to loan forgiveness after 20 or 25 years of payments, depending on the plan, effectively reducing the overall debt burden. Eligibility depends on your income and family size, and the application process involves applying through your loan servicer. For example, a recent graduate with a low-paying job in the non-profit sector might find an IDR plan beneficial to manage their debt while pursuing their career goals.

Loan Forgiveness Programs: Summary Table

| Program | Loan Type | Eligibility Requirements | Forgiveness Amount |

|---|---|---|---|

| Public Service Loan Forgiveness (PSLF) | Direct Loans | 120 qualifying payments under an IDR plan while working full-time for a qualifying employer | Remaining loan balance |

| Teacher Loan Forgiveness | Direct Subsidized/Unsubsidized Loans, Federal Stafford Loans | 5 consecutive years of full-time teaching at a low-income school or educational service agency | Up to $17,500 |

| Income-Driven Repayment (IDR) Plans (Potential Forgiveness) | Various Federal Student Loans | Income and family size below certain thresholds | Remaining balance after 20-25 years of payments (depending on the plan) |

Impact of Graduate School Debt on Future Financial Planning

Graduate school can significantly enhance career prospects, but the accompanying debt can cast a long shadow over future financial well-being. Understanding the potential long-term implications and proactively managing debt are crucial for navigating this challenge successfully. Failing to plan effectively can lead to years of financial strain, impacting major life decisions such as homeownership, starting a family, and retirement planning.

The weight of graduate student loan debt can significantly impact various aspects of long-term financial planning. High monthly payments can restrict disposable income, limiting opportunities for saving, investing, and building wealth. This can delay major life purchases, such as a home or car, and may even necessitate lifestyle adjustments to meet repayment obligations. Furthermore, the interest accrued over time can substantially increase the total amount owed, potentially leading to a prolonged repayment period and impacting credit scores. The cumulative effect of these factors can create significant financial stress and hinder the achievement of long-term financial goals.

Strategies for Managing and Reducing Graduate Student Loan Debt

Effective debt management strategies are vital for mitigating the long-term financial burden of graduate school loans. These strategies encompass various approaches aimed at reducing the principal amount owed, minimizing interest payments, and optimizing cash flow. Prioritizing high-interest loans for repayment, exploring income-driven repayment plans, and considering loan refinancing options can all significantly impact the overall cost and duration of repayment.

The Importance of Budgeting and Financial Planning for Graduate Students

Budgeting and financial planning are paramount during graduate school and beyond. Creating a realistic budget that accounts for tuition, living expenses, and loan repayments is essential for managing finances effectively. This involves tracking income and expenses, identifying areas for potential savings, and establishing a clear financial plan that aligns with long-term goals. Regularly reviewing and adjusting the budget is crucial to adapt to changing circumstances and ensure financial stability. Furthermore, developing a comprehensive financial plan, which incorporates debt management strategies, investment planning, and retirement savings, is vital for securing long-term financial well-being.

Impact of Different Repayment Plans on Long-Term Financial Outcomes

Different repayment plans can significantly alter the long-term financial implications of graduate school debt. Consider two hypothetical scenarios:

Scenario 1: A graduate student with $100,000 in loans chooses the standard 10-year repayment plan at a 7% interest rate. Their monthly payment will be approximately $1,160, and they will pay approximately $134,400 in total, including interest.

Scenario 2: The same student opts for an income-driven repayment plan (IDR) that adjusts payments based on their income. While their monthly payments might be lower initially, the repayment period will likely be extended to 20 or even 25 years. This could result in a higher total amount paid over the life of the loan due to accumulated interest, despite lower monthly payments.

The choice of repayment plan significantly impacts the total cost and duration of loan repayment. While IDRs offer short-term financial relief, they can lead to significantly higher total interest payments in the long run. Therefore, careful consideration of both short-term affordability and long-term financial implications is crucial when selecting a repayment plan.

Resources and Further Information

Navigating the complexities of federal graduate student loans requires access to reliable information and support. This section provides a compilation of helpful resources, contact details, and a visual guide to aid in the application process. Understanding these resources is crucial for successfully managing your graduate education financing.

This section offers a range of resources to assist you in understanding and managing your federal graduate student loans. These include websites providing comprehensive information, contact details for relevant government agencies and loan servicers, and a description of a visual guide that illustrates the application process.

Reputable Websites and Organizations

Several reputable websites and organizations offer reliable information on federal graduate student loans. These resources provide comprehensive guides, FAQs, and tools to help you navigate the loan process effectively. Utilizing these resources can ensure you are well-informed and prepared throughout your graduate studies.

- Federal Student Aid (FSA): This website, managed by the U.S. Department of Education, is the primary source of information on federal student aid programs, including graduate student loans. It offers detailed explanations of loan programs, eligibility requirements, and repayment options.

- National Student Loan Data System (NSLDS): NSLDS provides a centralized database allowing students to access their federal student loan information, including loan balances, repayment schedules, and servicer contact information.

- Your Loan Servicer’s Website: Once you have loans, you’ll be assigned a loan servicer. Their website will provide specific details about your loans, repayment options, and contact information.

Contact Information for Relevant Agencies and Servicers

Direct contact with relevant agencies and servicers is crucial for addressing specific questions and resolving any issues that may arise. Keeping accurate contact information readily available can streamline the process and save time.

- Federal Student Aid (FSA) Helpline: The FSA website provides a phone number for assistance with federal student aid questions.

- Your Loan Servicer: Your loan servicer’s contact information, including phone numbers and email addresses, will be provided once your loans are disbursed.

Visual Guide to Applying for Federal Graduate Student Loans

The following describes a visual guide illustrating the application process for federal graduate student loans. The guide would use a flowchart format, starting with the initial step of determining eligibility. Each step would be clearly labeled with concise descriptions and would visually connect to the subsequent step, providing a clear and straightforward path through the process.

The flowchart would begin with a box labeled “Determine Eligibility,” followed by boxes representing the steps of completing the FAFSA (Free Application for Federal Student Aid), receiving your Student Aid Report (SAR), selecting your loan type and amount, accepting your loan offer, and finally, receiving your loan funds. Each step would visually connect to the next through arrows, with any required documents or information clearly indicated. A final box would indicate successful loan disbursement. The overall design would be clean, easy to follow, and visually appealing, utilizing different colors and shapes to highlight key steps and information.

Final Summary

Securing a graduate education requires careful consideration of financing options. By understanding the intricacies of federal loan limits, eligibility requirements, and repayment strategies, graduate students can proactively manage their finances and mitigate the potential long-term impact of student loan debt. This guide serves as a starting point for a comprehensive financial plan, emphasizing informed decision-making and responsible borrowing practices to ensure a successful and sustainable path toward achieving academic and career goals. Remember to utilize the resources provided to further refine your understanding and navigate your unique financial circumstances.

FAQs

What happens if I don’t repay my federal student loans?

Failure to repay federal student loans can result in negative consequences, including damage to your credit score, wage garnishment, and potential tax refund offset.

Can I consolidate my federal graduate student loans?

Yes, you can consolidate multiple federal student loans into a single loan with a new repayment plan. This can simplify repayment but may not always lower your interest rate.

Are there income-driven repayment plans for graduate student loans?

Yes, several income-driven repayment plans are available, adjusting your monthly payments based on your income and family size. These plans can lead to loan forgiveness after a specified period.

What is the difference between subsidized and unsubsidized graduate loans?

Subsidized loans don’t accrue interest while you’re in school, grace periods, or deferment. Unsubsidized loans accrue interest from the time the loan is disbursed.