Navigating the complexities of higher education often involves understanding the financial landscape. Federal loans represent a significant pathway for undergraduate students seeking to fund their studies, offering various programs designed to meet diverse needs and circumstances. This exploration delves into the intricacies of federal student loan programs, providing a comprehensive guide to eligibility, application processes, repayment options, and responsible debt management.

From understanding eligibility requirements and the FAFSA application to comparing different loan types and navigating repayment plans, this resource aims to empower students with the knowledge needed to make informed decisions about financing their education. We’ll cover crucial aspects such as interest rates, subsidy availability, and strategies for avoiding loan default, ultimately helping students chart a course toward financial success after graduation.

Types of Federal Undergraduate Student Loans

Navigating the world of federal student loans can feel overwhelming, but understanding the different types available is crucial for making informed financial decisions. This section will Artikel the key characteristics of the primary federal loan programs for undergraduate students, focusing on interest rates, repayment options, and subsidy availability. Choosing the right loan can significantly impact your long-term financial health.

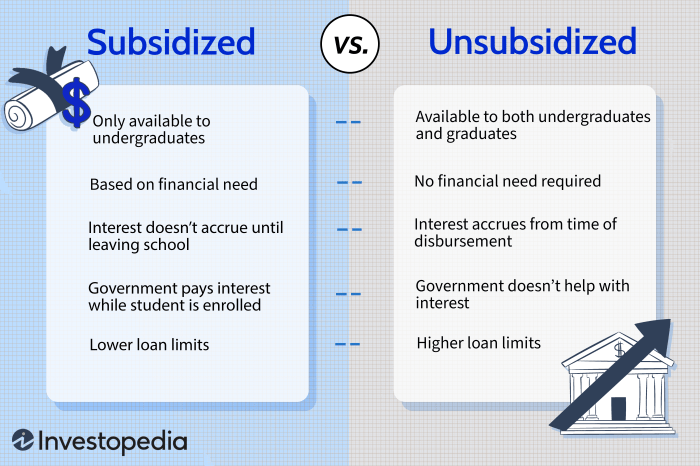

The federal government offers two main types of undergraduate student loans: subsidized and unsubsidized. The key difference lies in whether the government pays the interest while you’re in school, during grace periods, and during deferment periods. Understanding this distinction is paramount in managing your loan debt.

Subsidized Federal Stafford Loans

Subsidized Federal Stafford Loans are need-based loans. This means your eligibility is determined by your demonstrated financial need, as assessed by the Free Application for Federal Student Aid (FAFSA). The government pays the interest on these loans while you’re enrolled at least half-time, during grace periods, and during certain deferment periods. This can save you a significant amount of money over the life of the loan.

Unsubsidized Federal Stafford Loans

Unsubsidized Federal Stafford Loans are not need-based. You can borrow these loans regardless of your financial need, up to a certain limit. However, unlike subsidized loans, interest begins accruing from the moment the loan is disbursed. This means you’ll owe more than the original loan amount by the time you begin repayment unless you choose to pay the accruing interest while in school.

Federal PLUS Loans

Federal PLUS Loans are loans available to graduate and professional students, as well as parents of undergraduate students. These loans are credit-based, meaning your credit history will be checked. Interest rates are generally higher than Stafford loans, and interest accrues from disbursement. While these loans can help cover educational expenses, it’s crucial to understand the higher interest rates and potential impact on long-term repayment.

| Loan Type | Interest Rate | Repayment Options | Subsidy Details |

|---|---|---|---|

| Subsidized Federal Stafford Loan | Variable; set annually by the government | Standard, extended, graduated, income-driven | Government pays interest during certain periods |

| Unsubsidized Federal Stafford Loan | Variable; set annually by the government | Standard, extended, graduated, income-driven | No government interest subsidy |

| Federal PLUS Loan | Variable; generally higher than Stafford loans | Standard, extended, graduated, income-driven | No government interest subsidy |

Applying for Federal Undergraduate Student Loans

Securing federal student loans can significantly ease the financial burden of higher education. The application process, while seemingly complex, is manageable with careful planning and adherence to the necessary steps. Understanding the process and available resources will empower you to navigate it successfully.

The application for federal student aid is a streamlined process, primarily managed through the Free Application for Federal Student Aid (FAFSA). This form collects essential information to determine your eligibility for various federal student aid programs, including loans. The information provided on the FAFSA is used to calculate your Expected Family Contribution (EFC), a crucial factor in determining your financial need and the amount of aid you may receive.

The FAFSA Application Process

Completing the FAFSA is the cornerstone of the federal student loan application process. It’s a free online application requiring personal and financial information from both the student and their parents (if applicable). Accurate and complete information is crucial for a smooth and efficient processing of your application.

The FAFSA process involves several key steps. It’s important to gather all necessary documentation beforehand to expedite the process. This includes tax returns, W-2 forms, and Social Security numbers for both the student and their parents.

- Create an FSA ID: Before starting the FAFSA, both the student and a parent (if dependent) need to create an FSA ID. This is a username and password used to access and manage your FAFSA information. The FSA ID also provides digital signatures for the application.

- Gather Required Documents: Collect tax information (IRS 1040, W-2s), Social Security numbers, and other relevant financial documents for both the student and their parents (if applicable). Having this information readily available will significantly speed up the application process.

- Complete the FAFSA Form: Access the FAFSA website (studentaid.gov) and carefully complete the online application. Double-check all information for accuracy before submitting. Inaccurate information can delay or prevent the processing of your application.

- Submit the FAFSA: Once you have reviewed and confirmed all information, submit the FAFSA electronically. You will receive a confirmation number, which is crucial for tracking your application’s status.

- Review Your Student Aid Report (SAR): After submission, you will receive a Student Aid Report (SAR) summarizing your information and your eligibility for federal student aid. Review this carefully for any errors or discrepancies.

- Accept Your Loan Offer: Your school’s financial aid office will notify you of your loan offer. You will need to accept the loan offer through your school’s student portal or online system.

- Loan Counseling and Master Promissory Note (MPN): Before receiving your loan funds, you will be required to complete entrance counseling and sign a Master Promissory Note (MPN). This is a legal agreement outlining your responsibilities as a borrower.

Key Resources and Websites

The primary resource for applying for federal student loans is the Federal Student Aid website: studentaid.gov. This website provides comprehensive information on the FAFSA, loan programs, repayment options, and other related resources. It is crucial to consult this website throughout the application and repayment process. Additional information and assistance may be available through your school’s financial aid office.

Repayment Options for Federal Undergraduate Loans

After graduation, navigating the repayment of your federal student loans can feel overwhelming. Understanding the different repayment plans available is crucial to managing your debt effectively and avoiding potential financial hardship. Choosing the right plan depends on your individual financial situation, income, and loan amount.

Standard Repayment Plan

The standard repayment plan is the most straightforward option. It typically involves fixed monthly payments over a 10-year period. This plan offers predictable payments, allowing for better budgeting. However, the fixed monthly payments can be higher compared to income-driven repayment plans, potentially leading to a quicker payoff but potentially straining your budget, especially in the early years of your career. For example, a $30,000 loan at a 5% interest rate would have a monthly payment of approximately $317, totaling $38,040 in payments over 10 years.

Extended Repayment Plan

This plan offers longer repayment periods than the standard plan, extending the repayment timeline to up to 25 years. This results in lower monthly payments, making it more manageable for borrowers with limited income. The trade-off, however, is that you’ll end up paying significantly more in interest over the life of the loan. Using the same $30,000 loan example at 5% interest, a 25-year extended repayment plan would result in a monthly payment of approximately $169, but a total repayment of approximately $50,700.

Income-Driven Repayment Plans

Income-driven repayment plans (IDRs) link your monthly payment to your income and family size. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). These plans typically result in lower monthly payments, particularly in the early years of your career when income is often lower. However, the lower monthly payments often translate to a longer repayment period (potentially up to 20 or 25 years), and you may end up paying more in interest overall.

For example, consider a borrower with a $40,000 loan and an annual income of $35,000. Under a standard repayment plan, their monthly payment might be substantial. However, an IDR plan would calculate their monthly payment based on their income, potentially resulting in a much lower monthly payment, although the total interest paid would likely be higher than under a standard plan. The exact amount would depend on the specific IDR plan chosen and the borrower’s income and family size. The specific calculations for each plan are complex and are best determined using the official federal student aid website’s repayment calculators.

Comparison of Repayment Plan Features

The following table summarizes the key features of the discussed repayment plans:

| Repayment Plan | Repayment Period | Monthly Payment | Total Interest Paid |

|---|---|---|---|

| Standard | 10 years | Higher | Lower |

| Extended | Up to 25 years | Lower | Higher |

| Income-Driven | Up to 20-25 years | Variable (based on income) | Potentially Higher |

Managing Federal Student Loan Debt

Successfully navigating federal student loan debt requires proactive planning and responsible financial habits throughout your college years and beyond. Understanding your borrowing limits, budgeting effectively, and utilizing available resources are crucial for minimizing stress and maximizing your financial well-being after graduation. This section will Artikel strategies for responsible borrowing, budgeting, and accessing support services to help you manage your student loan debt effectively.

Responsible borrowing begins with understanding your financial needs and exploring all available funding options before taking out loans. It’s vital to borrow only the amount necessary to cover your educational expenses, avoiding unnecessary debt accumulation. Creating a realistic budget that accounts for tuition, fees, living expenses, and loan repayments is key to responsible financial management during your studies and beyond. Overspending can quickly lead to a larger debt burden, making repayment more challenging.

Strategies for Responsible Borrowing and Budgeting While in College

Effective budgeting and responsible borrowing are interconnected. A well-structured budget helps you track your income and expenses, ensuring you stay within your means and avoid overspending. This allows you to allocate funds for loan repayments while still meeting your daily needs. This proactive approach prevents financial strain and allows for responsible borrowing, minimizing future debt burdens.

Prioritize needs over wants. Create a detailed budget that includes tuition, fees, housing, food, transportation, books, and other essential expenses. Track your spending meticulously using budgeting apps or spreadsheets. Regularly review and adjust your budget to reflect changing circumstances, such as unexpected expenses or changes in income. Explore opportunities for part-time employment or scholarships to reduce your reliance on loans.

Resources Available to Help Students Manage Loan Debt

Several resources are available to assist students in managing their federal student loan debt. These resources provide valuable support and guidance throughout the loan repayment process. These services can help simplify the often complex process of repayment, offering tools and advice to manage debt effectively.

The National Student Loan Data System (NSLDS) provides a central location to view your federal student loan information. Your loan servicer is another critical resource; they manage your loan payments and can answer questions about repayment plans and options. Additionally, many colleges and universities offer financial aid offices and loan counseling services to provide personalized guidance and support to students.

Creating a Realistic Budget that Incorporates Student Loan Payments

Building a realistic budget that includes student loan payments is crucial for successful debt management. This involves carefully estimating your monthly expenses and income to determine how much you can comfortably allocate toward loan repayments without compromising your financial stability. It’s important to create a budget that works for your individual circumstances and financial goals.

Begin by listing all your monthly income sources, including wages, scholarships, and grants. Next, list all your monthly expenses, including housing, food, transportation, utilities, and loan payments. Subtract your total expenses from your total income to determine your monthly surplus or deficit. If you have a deficit, you may need to adjust your expenses or explore additional income sources. Consider using budgeting tools or apps to help you track your spending and stay organized. Remember to account for unexpected expenses, such as medical bills or car repairs, by building an emergency fund.

Defaulting on Federal Student Loans

Defaulting on your federal student loans has serious and long-lasting consequences that can significantly impact your financial well-being. It’s a situation to be avoided at all costs through proactive planning and responsible management of your loan repayment. Understanding the potential repercussions and available resources is crucial for borrowers.

Default occurs when you fail to make your loan payments for 270 days (nine months). The consequences extend far beyond a damaged credit score; they can affect your employment prospects, tax returns, and even your ability to obtain future loans.

Consequences of Defaulting on Federal Student Loans

Defaulting on federal student loans triggers a cascade of negative effects. Your credit score will plummet, making it difficult to obtain credit cards, mortgages, auto loans, or even rent an apartment. The government can garnish your wages, seize your tax refunds, and even pursue legal action to recover the outstanding debt. Furthermore, default can impact your ability to secure government jobs or obtain security clearances. In some cases, professional licenses may be revoked. The financial and personal repercussions can be substantial and long-lasting.

Resources for Borrowers Experiencing Difficulty Making Loan Payments

Several resources are available to help borrowers facing challenges in repaying their federal student loans. The Federal Student Aid website (studentaid.gov) provides comprehensive information on repayment plans, including income-driven repayment options that adjust your monthly payment based on your income and family size. Borrowers can also contact their loan servicer directly to explore options such as deferment or forbearance, which temporarily postpone or reduce payments. Additionally, many non-profit organizations offer free financial counseling services to assist with budgeting, debt management, and exploring available repayment options. These services can provide personalized guidance and support to navigate the complexities of student loan repayment.

Steps to Avoid Defaulting on Federal Student Loans

Proactive steps can significantly reduce the risk of defaulting on your federal student loans. Planning ahead and understanding your repayment options are essential.

- Create a Realistic Budget: Track your income and expenses to determine how much you can comfortably afford to pay each month towards your student loans. This will help you choose a repayment plan that aligns with your financial situation.

- Choose the Right Repayment Plan: Explore different repayment plans offered by the federal government, such as income-driven repayment plans, standard repayment plans, and graduated repayment plans. Select the plan that best suits your current financial circumstances and long-term goals.

- Contact Your Loan Servicer Early: If you anticipate facing difficulties making your loan payments, contact your loan servicer immediately. Don’t wait until you’re in default. They can help you explore options such as deferment, forbearance, or a different repayment plan to avoid default.

- Explore Income-Driven Repayment (IDR) Plans: IDR plans tie your monthly payments to your income and family size. If your income is low, your monthly payment may be significantly reduced or even zero. This can provide crucial relief during periods of financial hardship.

- Seek Professional Financial Counseling: A non-profit credit counseling agency can provide free or low-cost guidance on managing your student loan debt and developing a comprehensive financial plan. They can offer valuable support and strategies to navigate challenging financial situations.

Federal Loan Forgiveness Programs

Navigating the complexities of student loan repayment can be daunting, but several federal loan forgiveness programs offer pathways to debt relief for eligible borrowers. These programs, designed to incentivize public service and address economic hardship, provide partial or complete loan forgiveness under specific conditions. Understanding the eligibility requirements and application processes is crucial for those seeking relief.

Federal loan forgiveness programs are not a guaranteed path to debt elimination; they require meeting stringent criteria and often involve a significant time commitment. Careful consideration of eligibility and the long-term implications is essential before pursuing these options.

Public Service Loan Forgiveness (PSLF) Program

The Public Service Loan Forgiveness (PSLF) Program forgives the remaining balance on your Direct Loans after you’ve made 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer. Qualifying employers include government organizations (federal, state, local, or tribal) and not-for-profit organizations. The application process involves submitting an Employment Certification form annually, confirming your employment with a qualifying employer. Failure to maintain consistent employment with a qualifying employer throughout the 120-payment period will jeopardize forgiveness. Examples of professions that qualify include teachers, social workers, nurses, and government employees.

Teacher Loan Forgiveness Program

This program provides up to $17,500 in loan forgiveness to qualified teachers who have taught full-time for at least five consecutive academic years in a low-income school or educational service agency. Eligibility requires teaching in a qualifying school and completing the required years of service. The application process involves submitting documentation verifying employment and service at a qualifying institution. This program specifically targets educators committed to serving students in underserved communities.

Income-Driven Repayment (IDR) Plans and Forgiveness

While not strictly forgiveness programs, Income-Driven Repayment (IDR) plans, such as ICR, PAYE, REPAYE, and IBR, can lead to loan forgiveness after 20 or 25 years of payments, depending on the plan. These plans calculate your monthly payments based on your income and family size. Any remaining loan balance after the specified period is forgiven; however, this forgiven amount is considered taxable income. Various professions can benefit from IDR plans, as the forgiveness is based on income and repayment history, not specific employment.

The Impact of Federal Student Loans on Higher Education

Federal student loans have profoundly shaped the landscape of higher education in the United States, significantly impacting both accessibility and affordability. Their influence is multifaceted, presenting both substantial benefits and considerable drawbacks that continue to be debated and analyzed. Understanding this impact requires examining their role in expanding access, the complexities of the current system, and the resulting burden of student loan debt on graduates.

The Role of Federal Student Loans in Expanding Access to Higher Education

Federal student loan programs have undeniably increased access to higher education for millions of Americans. Prior to the widespread availability of federal loans, higher education was largely limited to those from affluent backgrounds. The introduction of subsidized and unsubsidized loans, along with grant programs, has enabled students from lower-income families to pursue post-secondary education, broadening participation and diversifying college campuses. This expansion has had a significant positive impact on the social and economic mobility of many individuals.

Benefits and Drawbacks of the Current Federal Student Loan System

The current federal student loan system, while expanding access, presents a complex interplay of benefits and drawbacks. On one hand, it provides crucial financial support, enabling students to afford tuition, fees, and living expenses. This support is particularly vital for students pursuing higher education in fields with limited scholarship opportunities or those from families with limited financial resources. However, the system also faces criticism for contributing to rising tuition costs (due to increased demand), the accumulation of substantial debt, and the potential for borrowers to struggle with repayment. The lack of transparency in some loan programs and the complexity of repayment options can also pose challenges for borrowers.

Student Loan Debt Levels and Their Impact on Graduates

The level of student loan debt in the United States has reached alarming proportions. According to the Federal Reserve, total student loan debt surpassed $1.7 trillion in 2023. This represents a significant financial burden on millions of graduates. The impact of this debt extends beyond immediate financial constraints; it can delay major life decisions such as homeownership, starting a family, and investing in retirement. Furthermore, high levels of student loan debt can negatively affect mental health and overall well-being, leading to increased stress and anxiety. Studies have shown a correlation between high student loan debt and delayed career advancement, as graduates may prioritize debt repayment over pursuing higher-paying job opportunities or further education. The long-term economic consequences of this debt burden are significant and continue to be a subject of ongoing research and policy debate.

Final Conclusion

Securing a college education is a significant investment, and understanding federal student loan options is crucial for financial planning. This guide has provided a framework for navigating the complexities of federal loans, from initial eligibility to long-term repayment strategies. By carefully considering the various loan types, repayment plans, and available resources, undergraduate students can effectively manage their finances and pursue their educational goals with confidence. Remember to always prioritize responsible borrowing and proactive debt management to ensure a positive outcome.

Questions and Answers

What is the FAFSA, and why is it important?

The Free Application for Federal Student Aid (FAFSA) is a form used to determine your eligibility for federal student aid, including grants, loans, and work-study programs. Completing the FAFSA is crucial for accessing federal student loan funds.

What happens if I can’t repay my loans?

If you are struggling to repay your loans, contact your loan servicer immediately. They can discuss options like deferment, forbearance, or income-driven repayment plans to help you manage your debt. Failing to repay your loans can lead to serious consequences, including damage to your credit score and potential wage garnishment.

Are there any penalties for early loan repayment?

Generally, there are no penalties for repaying your federal student loans early. In fact, it can save you money on interest in the long run.

Can I consolidate my federal student loans?

Yes, you can consolidate multiple federal student loans into a single loan with a new repayment plan. This can simplify repayment, but it might not always lower your interest rate.