Navigating the complexities of financing a child’s higher education can be daunting. The Federal Student Aid Parent PLUS Loan offers a potential solution, allowing parents to borrow funds to cover their child’s educational expenses. However, understanding the loan’s terms, conditions, and potential long-term financial implications is crucial before committing. This guide provides a comprehensive overview of Parent PLUS loans, addressing key aspects such as eligibility, interest rates, repayment options, and potential risks.

This in-depth exploration will equip parents with the necessary knowledge to make informed decisions regarding Parent PLUS loans. We’ll examine the application process, explore various repayment strategies, and compare Parent PLUS loans to alternative funding sources. Understanding the nuances of this loan program can empower parents to effectively manage their financial responsibilities while supporting their child’s academic pursuits.

Eligibility Requirements for Parent PLUS Loans

Securing a Parent PLUS Loan requires meeting specific criteria established by the federal government. Understanding these requirements is crucial for a successful application. Failure to meet these standards may result in loan denial. This section details the key eligibility factors.

Credit History Requirements for Parent PLUS Loan Applicants

The Department of Education conducts a credit check on all Parent PLUS loan applicants. A negative credit history, including bankruptcies, foreclosures, tax liens, or a history of late payments, can lead to loan denial. However, it’s not an automatic disqualification. Applicants with adverse credit history may still be eligible if they meet certain conditions, such as obtaining an endorser. An endorser is a creditworthy individual who agrees to repay the loan if the parent borrower defaults. The specific criteria for creditworthiness are determined by the Department of Education and are subject to change. Essentially, the credit check aims to assess the applicant’s ability and willingness to repay the loan.

Income Verification Process for Parent PLUS Loan Applications

While not explicitly stated as a requirement for approval, income verification is a crucial part of the application process. The lender will use the information provided on the application to assess the applicant’s ability to repay the loan. This information might include tax returns, pay stubs, or other documentation. This verification helps determine the borrower’s repayment capacity and the loan amount they can reasonably manage. While the Department of Education doesn’t mandate a specific minimum income, a demonstrably low income might raise concerns about repayment ability.

Step-by-Step Guide on Completing the Parent PLUS Loan Application

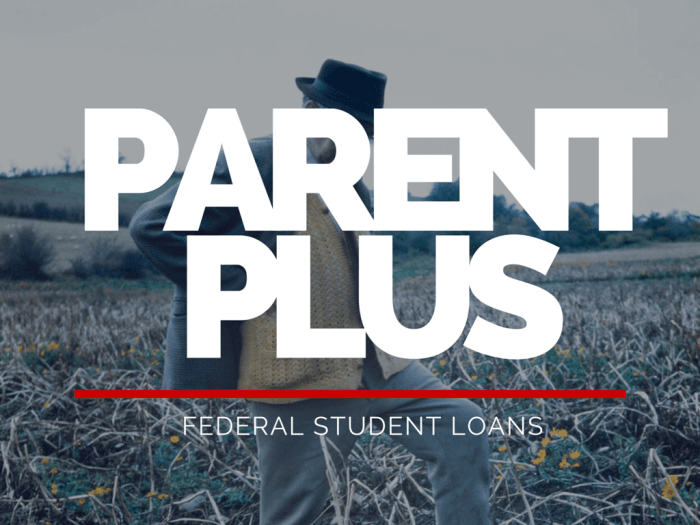

Completing the Parent PLUS loan application is a multi-step process that typically involves these key actions:

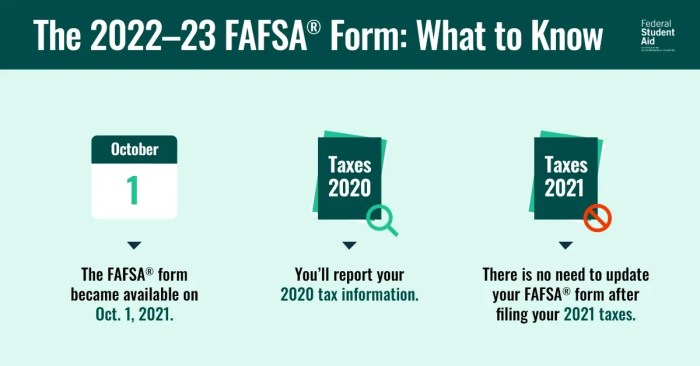

- Complete the FAFSA: The Free Application for Federal Student Aid (FAFSA) is the initial step. This application gathers necessary financial information about both the student and the parent.

- Parent PLUS Loan Application: After the FAFSA is processed, the parent will receive a notification about their eligibility for a Parent PLUS loan and will be able to complete the application through the student’s online account on the StudentAid.gov website.

- Credit Check: As part of the application process, a credit check will be performed.

- Notification of Approval or Denial: The applicant will receive notification regarding their loan approval or denial.

- Loan Acceptance and Promissory Note: If approved, the parent will need to accept the loan terms and sign a promissory note, legally obligating them to repay the loan.

- Disbursement of Funds: Once all steps are completed, the loan funds are disbursed to the student’s school.

Comparison of Parent PLUS Loan Eligibility Criteria with Other Federal Student Loan Programs

Parent PLUS loans have stricter eligibility requirements compared to other federal student loan programs like subsidized and unsubsidized Stafford loans. Stafford loans, for example, do not require a credit check and are available to students based on financial need (subsidized) or without regard to need (unsubsidized). Parent PLUS loans, on the other hand, prioritize the parent’s creditworthiness. This difference reflects the different risk assessments involved. The government assumes a higher risk lending to parents with less favorable credit history, thus implementing stricter requirements.

Interest Rates and Fees Associated with Parent PLUS Loans

Understanding the interest rates and fees associated with Parent PLUS loans is crucial for responsible financial planning. These costs directly impact the total amount you will repay, so it’s essential to have a clear understanding before borrowing. This section will detail the current rates, fees, and the effect of interest capitalization.

The interest rate for Parent PLUS loans is variable and is set by the government each year. It is based on the 10-year Treasury note rate plus a margin. The exact rate changes periodically, so it’s advisable to check the official Federal Student Aid website for the most up-to-date information before applying. Currently, the interest rate is subject to change and should be verified on the official website of the U.S. Department of Education.

Origination Fees for Parent PLUS Loans

Origination fees are charged when you receive your Parent PLUS loan. These fees are a percentage of the loan amount and are deducted from the total loan disbursement. This means you receive less money than the loan amount you were approved for. These fees help cover the administrative costs of processing the loan.

Interest Rates and Fees Over the Past Five Years

The following table illustrates the fluctuations in interest rates and origination fees for Parent PLUS loans over the past five years. Note that these are examples and the actual rates and fees can vary slightly depending on the specific disbursement date. Always consult the official Department of Education website for precise figures.

| Year | Interest Rate (Approximate) | Origination Fee (Approximate) | Example Loan Amount (after fee deduction) |

|---|---|---|---|

| 2023 | 8.05% | 4.228% | $9577.20 (on $10000 loan) |

| 2022 | 7.54% | 4.228% | $9577.20 (on $10000 loan) |

| 2021 | 7.08% | 4.228% | $9577.20 (on $10000 loan) |

| 2020 | 6.57% | 4.228% | $9577.20 (on $10000 loan) |

| 2019 | 7.6% | 4.228% | $9577.20 (on $10000 loan) |

Impact of Interest Capitalization

Interest capitalization is the process of adding accumulated unpaid interest to the principal loan balance. This increases the total amount you owe. For Parent PLUS loans, interest typically begins accruing as soon as the loan is disbursed. If you don’t make payments during periods of deferment or forbearance, the unpaid interest will be capitalized, resulting in a larger loan balance and higher overall repayment costs. For example, if you have $10,000 in unpaid interest at the end of a deferment period, that $10,000 will be added to your principal, increasing your loan balance and future interest calculations. This can significantly increase the total cost of the loan over its lifetime.

Repayment Options for Parent PLUS Loans

Understanding your repayment options is crucial for effectively managing your Parent PLUS loan. Several plans are available, each with its own set of benefits and drawbacks, tailored to different financial situations and repayment preferences. Choosing the right plan can significantly impact your monthly payments and overall repayment timeline.

The federal government offers several repayment plans for Parent PLUS loans, mirroring those available for federal student loans. The best plan for you will depend on your income, budget, and long-term financial goals. It’s important to carefully consider each option before making a decision.

Standard Repayment Plan

The Standard Repayment Plan is the default option for Parent PLUS loans. It involves fixed monthly payments over a 10-year period.

This plan is straightforward and easy to understand, making it a popular choice. However, the fixed monthly payments can be substantial, especially for larger loan amounts.

- Fixed monthly payments over 10 years.

- Highest monthly payment amount compared to other plans.

- Fastest repayment option, leading to less interest paid overall.

Example: A $50,000 Parent PLUS loan at a 7% interest rate would have an estimated monthly payment of approximately $590 under the Standard Repayment Plan. This is a rough estimate, and the actual amount may vary slightly depending on the exact interest rate and loan terms.

Extended Repayment Plan

The Extended Repayment Plan offers lower monthly payments than the Standard Repayment Plan by extending the repayment period. This can provide significant short-term financial relief.

While the lower monthly payments are beneficial, extending the repayment period means you’ll pay significantly more interest over the life of the loan. This is a trade-off between short-term affordability and long-term cost.

- Lower monthly payments than the Standard Repayment Plan.

- Repayment period of up to 25 years.

- Significantly higher total interest paid over the life of the loan.

Example: The same $50,000 loan at 7% interest might have a monthly payment around $300 under an Extended Repayment Plan (the exact amount depends on the chosen repayment period). However, the total interest paid could easily exceed $20,000 more than under the Standard plan.

Graduated Repayment Plan

The Graduated Repayment Plan starts with lower monthly payments that gradually increase over time. This can be helpful for borrowers anticipating income growth.

While initially more affordable, the increasing payments can become burdensome later in the repayment period if income doesn’t rise as expected. Careful budgeting is essential with this plan.

- Low initial monthly payments that increase every two years.

- Payments increase gradually, typically by 10% every two years.

- Repayment period is up to 10 years.

Example: A $50,000 loan might start with a payment of $300 under a Graduated Repayment Plan and increase to approximately $500 by year 10. Again, the exact figures depend on the interest rate and loan terms.

Income-Driven Repayment Plans

Income-Driven Repayment (IDR) Plans base your monthly payments on your income and family size. These plans are designed to make repayment more manageable, particularly during periods of low income.

These plans offer the lowest monthly payments, often making them the most attractive option for borrowers facing financial hardship. However, they often result in a longer repayment period and increased total interest paid. They also usually require recertification of income annually.

- Monthly payments are based on your income and family size.

- Lower monthly payments than other plans, often significantly lower.

- Longer repayment periods (potentially 20-25 years), resulting in higher total interest paid.

- Requires annual income recertification.

Example: For a $50,000 loan, an IDR plan could result in monthly payments as low as $100-$200, depending on income and family size. However, the loan repayment could extend beyond 20 years, leading to substantially higher total interest paid compared to other options.

Potential Impacts of Parent PLUS Loans on Borrowers

Taking out a Parent PLUS loan can significantly impact a family’s financial well-being. While it provides crucial funding for higher education, it also introduces substantial debt that requires careful planning and management to avoid long-term financial strain. Understanding the potential implications is crucial before applying for this type of loan.

Parent PLUS loans, like other forms of debt, carry significant financial implications. The most immediate impact is the monthly payment obligation, which can stretch family budgets and limit other financial goals like saving for retirement or purchasing a home. The loan’s interest rate, which is typically higher than other loan types, adds to the total amount owed over the loan’s life. This cumulative cost can be substantial, especially if repayment is delayed or if the borrower struggles to make timely payments. Careful consideration of the long-term financial implications is crucial before accepting the responsibility of a Parent PLUS loan.

Impact on Credit Score

A Parent PLUS loan’s effect on a parent’s credit score is directly tied to their repayment behavior. Consistent on-time payments positively influence the credit score, demonstrating responsible credit management. Conversely, missed or late payments can significantly damage the credit score, impacting future borrowing opportunities such as mortgages, auto loans, or even securing favorable interest rates on credit cards. For example, a parent consistently missing payments could see their credit score drop by 100 points or more, making it harder to obtain loans in the future with favorable terms. Conversely, responsible repayment can demonstrate financial stability and improve creditworthiness over time.

Financial Risks Associated with Parent PLUS Loans

Understanding the potential risks associated with Parent PLUS loans is vital for responsible borrowing. These risks can significantly affect a family’s financial stability if not properly managed.

- High Interest Rates: Parent PLUS loans typically carry higher interest rates compared to other loan types, increasing the total amount repaid over the loan’s lifetime.

- Large Debt Burden: The significant amount borrowed can create a substantial debt burden, impacting a family’s ability to meet other financial obligations.

- Negative Impact on Credit Score: Missed or late payments can severely damage a parent’s credit score, affecting future borrowing opportunities.

- Financial Hardship: Difficulty in making monthly payments can lead to financial stress and potential hardship for the family.

- Default Risk: Failure to repay the loan can result in serious consequences, including wage garnishment, tax refund offset, and damage to credit history.

Strategies for Managing Parent PLUS Loan Debt

Effective management of Parent PLUS loan debt requires a proactive and well-planned approach. Several strategies can help borrowers mitigate the financial risks and ensure timely repayment.

- Create a Realistic Budget: Develop a detailed budget that incorporates the monthly loan payment, ensuring sufficient funds are allocated for repayment without compromising other essential expenses.

- Explore Repayment Options: Investigate different repayment plans offered by the lender to find one that aligns with the family’s financial capacity. This could include income-driven repayment plans, if eligible.

- Consider Refinancing: Explore refinancing options to potentially lower the interest rate and reduce the total amount repaid. However, carefully weigh the pros and cons before making a decision.

- Prioritize Loan Repayment: Make timely payments a top priority to avoid late fees and negative impacts on the credit score.

- Seek Financial Counseling: If facing financial difficulties, seek professional financial counseling to develop a personalized debt management plan.

Alternatives to Parent PLUS Loans

Securing funding for your child’s education can involve several avenues beyond the Parent PLUS loan. Understanding the alternatives, their advantages, and disadvantages is crucial for making an informed financial decision that best suits your family’s circumstances. This section will explore some key alternatives and their implications.

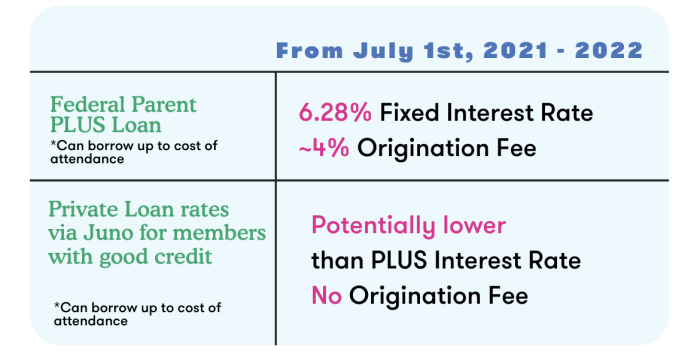

Parent PLUS Loans Compared to Private Education Loans

Parent PLUS loans are federal loans, offering benefits like fixed interest rates and various repayment plans. Private education loans, on the other hand, are offered by banks and credit unions. While they might offer more flexible terms in some cases, they often come with variable interest rates, potentially leading to higher overall costs. Furthermore, private loans typically require a credit check and may demand a co-signer if the borrower’s credit history is insufficient. The interest rates on private loans are usually higher than those on federal Parent PLUS loans, particularly for borrowers with less-than-stellar credit. Choosing between the two depends on your creditworthiness, financial situation, and risk tolerance. A careful comparison of interest rates, fees, and repayment terms from multiple lenders is essential before making a decision.

Using Savings or Other Funds Instead of Parent PLUS Loans

Utilizing existing savings or other readily available funds to cover educational expenses offers several advantages. Foremost, it eliminates the need to incur debt and its associated interest payments, saving you significant money in the long run. However, relying solely on savings might not be feasible for all families. If your savings are insufficient to cover the full cost of education, you may need to explore other funding options to bridge the gap. It’s crucial to assess your financial resources thoroughly and determine whether your savings are adequate to avoid the need for loans. For instance, a family with substantial savings might comfortably pay for college without loans, while a family with limited savings may need to consider loans to meet their financial obligations.

Implications of Co-signing a Student Loan

Co-signing a student loan means you agree to repay the loan if the primary borrower (your child) defaults. This carries significant financial responsibility. If your child fails to make payments, the lender will pursue you for the full amount. Your credit score will suffer, impacting your ability to secure future loans or credit cards. Careful consideration of the risks involved is vital before co-signing. It’s essential to understand the terms of the loan agreement thoroughly, including the repayment schedule and the potential consequences of default. While co-signing can help your child gain access to loans they might otherwise be ineligible for, it places a considerable burden on the co-signer.

Resources for Finding Additional Financial Aid Options for College

Numerous resources can help you explore additional financial aid options. The Federal Student Aid website (studentaid.gov) provides comprehensive information on federal grants, scholarships, and work-study programs. Your child’s college financial aid office can also provide guidance and assistance in navigating the financial aid process. Additionally, many private organizations offer scholarships based on various criteria, such as academic merit, athletic ability, or community involvement. Websites like Fastweb and Scholarships.com are valuable tools for searching and applying for scholarships. Exploring all available avenues can significantly reduce the reliance on loans, easing the financial burden on both you and your child.

Understanding the Loan Deferment and Forbearance Options

Parent PLUS loans, like other federal student loans, offer deferment and forbearance options, providing temporary relief from making payments under specific circumstances. Understanding the differences between these options and their potential long-term effects is crucial for responsible loan management.

Conditions for Parent PLUS Loan Deferment

Deferment temporarily postpones your Parent PLUS loan payments, and under certain circumstances, interest may not accrue during the deferment period. Eligibility for deferment is typically tied to specific situations, such as unemployment, or if the parent borrower or the student is enrolled at least half-time in an eligible degree or certificate program. The exact requirements and duration of the deferment period are determined by the lender. It’s important to note that not all deferment options eliminate interest accrual; some deferment periods may still involve accruing interest.

Differences Between Loan Deferment and Forbearance

Deferment and forbearance are both temporary pauses on loan repayment, but they differ significantly. Deferment is typically granted based on specific qualifying circumstances, as Artikeld above, and may or may not involve interest capitalization. Forbearance, on the other hand, is usually granted based on temporary financial hardship, such as an unexpected job loss or medical emergency. Forbearance often results in interest accruing during the forbearance period, and that accumulated interest is generally capitalized (added to the principal balance), increasing the total amount owed. This is a key distinction: deferment offers a potentially more favorable option if it eliminates interest accrual, compared to forbearance where interest continues to grow.

Applying for Loan Deferment or Forbearance

Applying for either deferment or forbearance involves contacting your loan servicer. This is the company responsible for managing your loan payments. You’ll need to provide documentation supporting your request. For deferment, this might include proof of enrollment or unemployment documentation. For forbearance, it might include documentation of financial hardship, such as medical bills or proof of job loss. The application process typically involves completing an online form or contacting the servicer via phone or mail. The servicer will review your application and supporting documents, and notify you of their decision.

Long-Term Implications of Deferment and Forbearance

While deferment and forbearance provide temporary relief, it’s crucial to understand their long-term consequences. The most significant impact is the potential increase in the total amount owed due to interest capitalization. Delaying payments through forbearance, especially, almost always results in a larger overall loan balance. This, in turn, can lead to higher monthly payments and a longer repayment period. Prolonged use of these options can significantly increase the total cost of the loan over its lifespan, potentially impacting the borrower’s financial health. Therefore, while these options are beneficial in times of crisis, they should be utilized judiciously and only when truly necessary. A thorough understanding of the terms and conditions before applying is essential.

Visual Representation of Loan Repayment

Understanding the impact of different repayment plans and the interplay between loan amount, interest rate, and monthly payment is crucial for effective financial planning. Visual aids can significantly clarify these complex relationships. The following descriptions illustrate how these relationships can be effectively represented graphically.

Comparison of Repayment Plan Impacts on Total Interest Paid

This visual would be a bar chart comparing the total interest paid across various repayment plans (e.g., Standard, Extended, Graduated). The horizontal axis would list the different repayment plans, and the vertical axis would represent the total interest paid in dollars. Each bar would represent a specific repayment plan, with its height corresponding to the total interest accumulated over the loan’s lifetime under that plan. For example, a longer repayment plan like Extended Repayment might have a taller bar indicating higher total interest paid, while a Standard Repayment plan would have a shorter bar, reflecting lower total interest. The chart would clearly show the financial implications of choosing one repayment plan over another. A key would clearly label each bar with the corresponding repayment plan name.

Relationship Between Loan Amount, Interest Rate, and Monthly Payment

This visual would be a three-dimensional scatter plot. The three axes would represent the loan amount (in dollars), the interest rate (as a percentage), and the resulting monthly payment (in dollars). Each point on the plot would represent a specific combination of loan amount and interest rate, with its vertical position indicating the corresponding monthly payment. The plot would demonstrate how increasing the loan amount or interest rate increases the monthly payment. Conversely, it would also illustrate that a smaller loan amount and lower interest rate result in a lower monthly payment. The density of points in different regions of the plot would visually highlight the impact of varying loan amounts and interest rates on monthly payments. A color gradient could be used to further emphasize the relationship, with warmer colors representing higher monthly payments and cooler colors representing lower monthly payments. This allows for a clear visualization of the complex interplay between these three key variables.

Concluding Remarks

Securing a child’s education often requires careful financial planning. The Federal Student Aid Parent PLUS Loan presents a significant financial commitment, demanding a thorough understanding of its intricacies. By carefully considering eligibility requirements, interest rates, repayment options, and potential risks, parents can make informed decisions that align with their financial capabilities and long-term goals. Remember to explore alternative financing options and seek professional financial advice when necessary to ensure responsible borrowing practices.

Essential FAQs

What happens if I can’t repay my Parent PLUS loan?

Defaulting on a Parent PLUS loan can severely damage your credit score, impacting your ability to obtain future loans or credit. Explore options like repayment plans or deferment/forbearance before defaulting. Contact your loan servicer immediately if you anticipate difficulties in repayment.

Can I refinance my Parent PLUS loan?

While you can’t refinance a Parent PLUS loan with the federal government, private lenders may offer refinancing options. Carefully compare interest rates, fees, and terms before refinancing, as it may affect your eligibility for future federal loan programs.

How does the Parent PLUS loan affect my taxes?

Interest paid on Parent PLUS loans is generally not tax deductible. However, consult a tax professional for personalized advice based on your specific circumstances and tax laws.

What is the difference between a Parent PLUS loan and a Direct Unsubsidized loan for the student?

A Parent PLUS loan is borrowed by the parent, while a Direct Unsubsidized loan is borrowed by the student. Interest accrues on both, but the Unsubsidized loan’s interest accrues while the student is in school (unless the student chooses to pay it), whereas the Parent PLUS loan’s interest accrues immediately.

Excellent insights! The advice about using a rewards credit card is genius. I’ve been using one for years, and it’s helped me save me a lot. I also wrote a guide on how to maximize rewards, which might help your audience. Keep up the amazing work!