Navigating the complexities of federal student loan consolidation can be daunting, especially with the ever-present threat of scams. Millions of borrowers grapple with student loan debt, making them prime targets for fraudulent schemes promising quick fixes and unrealistic relief. Understanding the legitimate process of consolidation is crucial to avoid falling victim to these deceptive practices. This guide will equip you with the knowledge to identify red flags, protect yourself, and report any suspicious activity.

The landscape of student loan consolidation is fraught with potential pitfalls. While legitimate consolidation offers a pathway to simplify repayment and potentially lower monthly payments, unscrupulous individuals and organizations exploit borrowers’ vulnerabilities. This exploration will delve into the various tactics employed by scammers, highlighting the deceptive marketing, pressure tactics, and fraudulent schemes designed to steal your money and personal information. We will provide practical steps to protect yourself and resources to help you navigate this challenging process safely.

Understanding Federal Student Loan Consolidation

Federal student loan consolidation is a process that combines multiple federal student loans into a single loan with one monthly payment. This can simplify repayment and potentially offer benefits, but it’s crucial to understand the process thoroughly before proceeding. It’s important to remember that consolidation is a tool, and its suitability depends entirely on your individual financial circumstances.

Legitimate federal student loan consolidation is handled through the Federal Student Aid website or by contacting your loan servicer. The process involves applying online, providing necessary information, and undergoing a credit check (though this doesn’t affect your credit score in the same way a traditional loan application would). Once approved, your multiple loans are combined into a new, single loan with a new interest rate and repayment plan. This new loan will be serviced by a single loan servicer.

Benefits of Federal Student Loan Consolidation

Consolidating your federal student loans can offer several advantages. A primary benefit is simplification. Managing one monthly payment instead of multiple is significantly easier, reducing the risk of missed payments and late fees. Additionally, depending on your loan types and repayment history, consolidation might allow you to switch to a more manageable repayment plan, such as an income-driven repayment plan. This can lower your monthly payments, making them more affordable. Furthermore, if you have defaulted federal student loans, consolidation can help you regain eligibility for certain repayment plans and federal student aid programs.

Examples of Beneficial Consolidation Situations

Consolidation can be particularly advantageous in several scenarios. For instance, someone with multiple federal student loans from different lenders, each with a different interest rate and repayment schedule, could benefit from simplification and potentially a lower overall interest rate. Another example is a borrower struggling to manage multiple payments; consolidation can streamline their finances and potentially reduce their monthly payment burden through an income-driven repayment plan. Finally, individuals with defaulted federal loans might find consolidation a pathway to rehabilitation and future access to federal student aid.

Potential Drawbacks of Federal Student Loan Consolidation

While consolidation offers benefits, it’s important to acknowledge potential drawbacks. The most significant is that your new interest rate will likely be a weighted average of your existing loan interest rates. While this might be lower than your highest interest rate, it could potentially be higher than your lowest. Another factor is that the length of your repayment period might increase. This means you’ll pay more interest over the life of the loan, even if your monthly payments are lower. Finally, consolidating your loans might mean losing access to certain repayment plans or benefits associated with specific loan types, such as loan forgiveness programs for public service. Therefore, careful consideration is crucial before proceeding with consolidation.

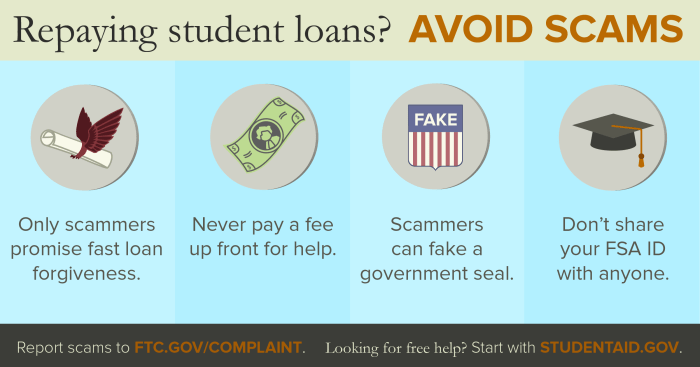

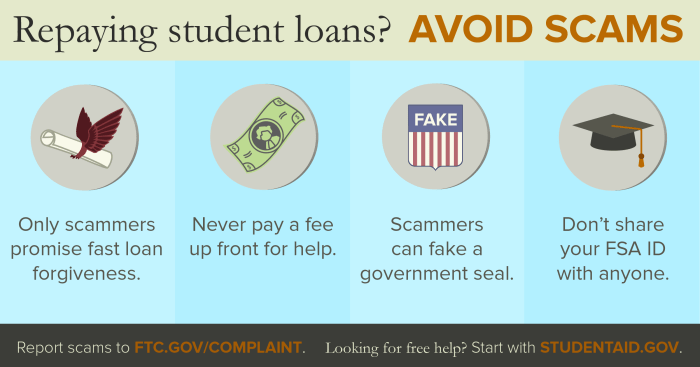

Identifying Red Flags of Consolidation Scams

Student loan consolidation can be a helpful tool for managing debt, but unfortunately, it also attracts scammers who prey on borrowers facing financial hardship. Understanding the tactics employed by these individuals is crucial to protecting yourself from fraudulent schemes. This section Artikels common red flags and provides strategies to avoid becoming a victim.

Scammers use various deceptive tactics to lure unsuspecting borrowers into their schemes. These tactics often exploit borrowers’ vulnerabilities and create a sense of urgency to pressure them into making quick decisions. By recognizing these warning signs, you can significantly reduce your risk of falling prey to a student loan consolidation scam.

Common Scam Tactics

The following table details common tactics used by scammers, along with corresponding red flags and protective measures.

| Scam Tactic | Description | Red Flag Indicators | Protective Measures |

|---|---|---|---|

| Upfront Fees | Scammers demand payment before consolidating your loans, often citing administrative or processing fees. Legitimate consolidation programs do not charge upfront fees. | Requests for payment before any loan consolidation occurs; unclear or vague fee descriptions. | Never pay upfront fees for student loan consolidation. Legitimate federal consolidation is free. |

| Guaranteed Approval | Scammers promise guaranteed loan consolidation approval, regardless of your credit history or financial situation. | Promises of guaranteed approval without any credit or financial assessment; high-pressure sales tactics. | Be wary of any promises of guaranteed approval. Your eligibility for loan consolidation depends on your financial situation. |

| High-Pressure Sales Tactics | Scammers use aggressive and manipulative tactics to pressure borrowers into making immediate decisions, often creating a sense of urgency or limited-time offers. | Aggressive phone calls, emails, or text messages; claims of limited-time offers or impending deadlines; refusal to provide written information. | Take your time to research and compare options. Do not feel pressured into making a hasty decision. |

| Fake Government Affiliation | Scammers falsely claim to represent the federal government or a legitimate student loan servicer. | Unsolicited contact; use of official-sounding titles or logos; requests for sensitive personal information via email or phone. | Verify the identity of any individual or organization contacting you regarding student loan consolidation. Contact the official government websites directly. |

| Lower Interest Rates than Possible | Scammers advertise interest rates significantly lower than what’s currently available through legitimate federal programs. | Interest rates that are unrealistically low compared to market rates or advertised federal rates. | Compare the offered interest rate to the current federal rates for loan consolidation. |

Pressure Tactics Employed by Scammers

Scammers often employ high-pressure tactics to overwhelm borrowers and prevent them from making informed decisions. This may involve repeated phone calls, threatening language, or creating a false sense of urgency, such as claiming a limited-time offer or an impending deadline. They might also use emotional manipulation, playing on borrowers’ anxieties about their debt. These tactics aim to bypass critical thinking and encourage quick, impulsive action.

Exploitation of Borrowers’ Financial Distress

Scammers specifically target individuals experiencing financial hardship, knowing they are more vulnerable to deceptive schemes. Borrowers struggling with debt may be more likely to believe promises of quick solutions or lower interest rates, even if those promises are unrealistic or fraudulent. The desperation and financial stress experienced by these individuals make them prime targets for exploitation.

Types of Federal Student Loan Consolidation Scams

Federal student loan consolidation scams prey on borrowers facing overwhelming debt, promising simplified repayment plans and lower interest rates. These scams often employ deceptive tactics and exploit vulnerabilities to steal personal information and money. Understanding the various types of these scams is crucial for protecting yourself.

Scammers utilize a range of methods to defraud borrowers, often combining several tactics for maximum impact. These methods can be broadly categorized, but they frequently overlap and adapt to current trends in technology and communication. Recognizing these common approaches will empower you to identify and avoid these predatory schemes.

Upfront Fee Scams

Upfront fee scams involve companies or individuals demanding payment for services related to student loan consolidation. Legitimate federal student loan consolidation is free of charge. These scammers often create a sense of urgency, claiming limited-time offers or special programs requiring immediate payment to secure the “deal.” The promised consolidation services are rarely delivered, leaving borrowers out of pocket and still burdened with their debt. They might falsely claim to be affiliated with the government or a legitimate lender to enhance their credibility.

Fake Consolidation Companies

These scams involve the creation of entirely fraudulent companies that mimic legitimate lenders or government agencies. They often develop sophisticated websites that closely resemble official government websites, using similar logos, color schemes, and language. These fake companies solicit applications for loan consolidation, promising attractive terms and lower interest rates. Once borrowers submit their personal information, the scammers use it for identity theft or other fraudulent activities. They may even create fake documentation, such as loan agreements and acceptance letters, to further their deception.

Deceptive Marketing Materials

Scammers employ a variety of deceptive marketing materials to attract victims. Examples include:

- Unsolicited emails or text messages promising quick and easy loan consolidation.

- Advertisements on social media platforms or websites with exaggerated claims and testimonials.

- Cold calls from individuals claiming to be government representatives or loan specialists.

- Flyers or brochures distributed in public areas with misleading information about loan consolidation programs.

- Pop-up ads on websites that appear to be legitimate government notices.

These materials often contain vague or misleading language, avoid specifics, and pressure borrowers to act quickly. They frequently utilize emotionally charged language to exploit feelings of desperation and financial stress.

Methods of Obtaining Personal Information

Scammers use various methods to gain access to borrowers’ sensitive personal information:

- Phishing Emails/Texts: These messages often mimic legitimate communications from lenders or government agencies, requesting personal information such as Social Security numbers, bank account details, and login credentials.

- Malicious Websites: Fake websites designed to resemble official government or lender sites collect information when users submit applications or login details.

- Data Breaches: Scammers may purchase stolen data from data breaches affecting other companies, obtaining personal information that can be used to target borrowers.

- Social Engineering: Scammers use manipulative tactics to trick individuals into revealing their personal information over the phone or through other communication channels.

The information gathered is then used to file fraudulent tax returns, open credit accounts, or commit other forms of identity theft.

Protecting Yourself from Scams

Protecting yourself from student loan consolidation scams requires vigilance and a proactive approach. Understanding the legitimate process and recognizing common tactics used by scammers are crucial steps in safeguarding your financial well-being. By taking preventative measures and verifying information from trustworthy sources, you can significantly reduce your risk of becoming a victim.

Knowing how to identify and avoid these scams can save you significant financial hardship and stress. Remember, the government will never ask for your personal information via unsolicited email, text, or phone call.

Preventative Measures to Avoid Scams

Taking proactive steps is the best defense against student loan consolidation scams. These measures significantly reduce your vulnerability to fraudulent schemes.

- Never share your personal information (Social Security number, bank account details, etc.) unless you’ve initiated contact with a known and verified government agency or loan servicer.

- Verify any unsolicited communication about your student loans through official channels before taking any action.

- Be wary of promises that sound too good to be true, such as guaranteed loan forgiveness or incredibly low interest rates.

- Thoroughly research any company offering student loan consolidation services. Check their reputation with the Better Business Bureau and online reviews.

- Only use the official government website (StudentAid.gov) or your loan servicer’s website for information about your loans and consolidation options.

Flowchart for Verifying the Legitimacy of a Consolidation Offer

This flowchart Artikels the steps to take when evaluating a student loan consolidation offer to determine its authenticity.

[Imagine a flowchart here. The flowchart would begin with a box labeled “Received a Student Loan Consolidation Offer?”. A “Yes” branch would lead to a series of boxes: “Is the offer from a known and trusted source (e.g., your loan servicer, StudentAid.gov)?”, “Does the offer match information on your official loan documents?”, “Have you independently verified the company’s legitimacy and reputation?”, “Does the offer seem too good to be true?”. Each “No” answer would lead to a final box: “Consider the offer suspicious. Do not proceed.” Each “Yes” answer would lead to the next box in the sequence. A “No” branch from the initial box would lead directly to the final box. The final box would have an arrow looping back to the initial box, suggesting continuous vigilance.]

Trustworthy Sources of Information

Reliable information is paramount in navigating the complexities of student loan consolidation. Relying on these sources ensures you’re making informed decisions based on accurate data.

- StudentAid.gov: The official website of the Federal Student Aid, a part of the U.S. Department of Education.

- Your loan servicer’s website: Check your loan documents for contact information and access your account online.

- The Federal Student Aid Information Center: You can contact them by phone for assistance.

- National Consumer Law Center (NCLC): A non-profit organization providing consumer education and advocacy.

Verifying the Identity of Contacting Individuals

It’s crucial to verify the identity of anyone contacting you about your student loans. Never assume that someone contacting you is legitimate.

Never provide personal information unless you have independently verified the individual or organization’s identity through official channels. If someone calls, email, or texts you claiming to be from your loan servicer or a government agency, independently confirm their identity by contacting the organization directly using contact information found on their official website, not the information provided by the contacting individual. If there’s a discrepancy, it’s a red flag indicating a potential scam.

Reporting and Addressing Scams

Dealing with a student loan consolidation scam can be distressing, but taking swift action is crucial to mitigate the damage and potentially recover your funds. Reporting the scam to the appropriate authorities and following the proper steps to address the situation can help you regain control and protect yourself from further harm.

Reporting suspected scams involves several key steps. First, gather all relevant documentation, including emails, websites, and any communication with the scammer. This evidence will be essential for investigations. Next, report the scam to the Federal Trade Commission (FTC) at ReportFraud.ftc.gov. The FTC is the primary agency for handling consumer fraud complaints. Simultaneously, report the incident to your state’s attorney general’s office, as they also investigate consumer fraud cases. Finally, if the scam involved a specific financial institution, contact them immediately to report the fraudulent activity and initiate a dispute process.

Reporting a Suspected Scam

The process of reporting a suspected student loan consolidation scam involves meticulously documenting all interactions with the scammer and promptly reporting the incident to the appropriate authorities. This includes filing a report with the Federal Trade Commission (FTC), contacting your state’s attorney general’s office, and reporting the fraudulent activity to the involved financial institution. Remember to retain copies of all documentation for your records and future reference. The more information you provide, the better equipped authorities will be to investigate and potentially recover funds.

Recovering from a Scam

Recovering from a student loan consolidation scam requires a proactive and multi-faceted approach. First, immediately place a fraud alert on your credit reports with Equifax, Experian, and TransUnion. This helps prevent the scammer from opening new accounts in your name. Second, review your bank and credit card statements for any unauthorized transactions and report them immediately. Third, contact your loan servicer to inform them of the fraudulent activity and determine if any actions need to be taken to protect your federal student loans. Finally, consider seeking legal advice to explore options for recovering any lost funds or damages.

Resources for Victims

Several resources are available to assist victims of student loan consolidation scams. The Federal Trade Commission (FTC) website provides valuable information, resources, and complaint filing options. The Consumer Financial Protection Bureau (CFPB) also offers guidance and assistance to consumers facing financial fraud. Additionally, many non-profit organizations dedicated to consumer protection provide support and resources to victims of scams. These organizations often offer free counseling and assistance navigating the legal and financial aspects of recovery. It is advisable to contact several of these organizations to determine which best suits your specific needs.

Identifying and Avoiding Phishing Attempts

Phishing attempts often mimic legitimate communications from student loan servicers or government agencies. These attempts typically involve fraudulent emails or websites designed to trick individuals into revealing sensitive personal and financial information. To avoid phishing attempts, always verify the sender’s email address and website URL. Legitimate organizations typically use secure websites with “https” in the address bar. Never click on links or open attachments from unknown or suspicious senders. If you receive a suspicious communication, contact your loan servicer or the government agency directly through official channels to verify its legitimacy. Be wary of unsolicited emails or phone calls promising quick loan consolidation solutions or unusually low interest rates. Remember, legitimate student loan consolidation processes are transparent and typically involve no upfront fees.

The Role of Government Agencies in Combating Scams

Government agencies play a crucial role in protecting borrowers from student loan consolidation scams. Their efforts encompass prevention, intervention, and public education, aiming to minimize the financial harm inflicted by these fraudulent schemes. The coordinated actions of various agencies create a multi-faceted approach to combatting this pervasive problem.

The Federal Trade Commission (FTC) is a primary player in this fight. The FTC investigates and prosecutes companies and individuals engaging in deceptive student loan consolidation practices. They utilize their authority to issue cease-and-desist orders, impose financial penalties, and even pursue criminal charges against perpetrators. Other agencies, such as the Consumer Financial Protection Bureau (CFPB) and state attorneys general, also contribute significantly to these efforts, often collaborating with the FTC to build comprehensive cases and enforce regulations.

FTC Enforcement Actions and Protective Measures

The FTC employs various strategies to protect borrowers. These include investigating complaints, conducting undercover operations to expose fraudulent schemes, and working with other agencies to share information and coordinate enforcement actions. The FTC’s website provides resources and educational materials to help borrowers identify and avoid scams. They also actively monitor online activity to identify and take down fraudulent websites and advertisements. A notable example of successful FTC intervention involved a large-scale operation targeting multiple companies involved in deceptive student loan consolidation schemes, resulting in significant fines and restitution for affected borrowers. This action served as a deterrent and highlighted the FTC’s commitment to protecting consumers.

Public Awareness Campaigns and Educational Initiatives

Government agencies recognize that education is a critical component of scam prevention. The FTC, along with other agencies and consumer protection organizations, regularly launch public awareness campaigns. These campaigns utilize various media channels, including television, radio, print, and online platforms, to disseminate information about common student loan consolidation scams and educate borrowers about how to protect themselves. These campaigns often include practical tips, such as verifying the legitimacy of companies offering consolidation services and understanding the differences between legitimate and fraudulent offers. By proactively educating borrowers, these agencies empower individuals to make informed decisions and avoid falling victim to these schemes.

Examples of Successful Government Interventions

Numerous examples illustrate the effectiveness of government interventions. For instance, successful lawsuits have resulted in millions of dollars in restitution for defrauded borrowers, and the closure of numerous fraudulent companies. These actions not only provide financial relief to victims but also serve as a powerful deterrent to others considering engaging in similar fraudulent activities. Furthermore, the collaborative efforts of various agencies, such as joint investigations and coordinated enforcement actions, have proven particularly effective in dismantling large-scale scam operations. These interventions demonstrate the tangible impact of government involvement in protecting consumers from predatory practices within the student loan consolidation market.

Epilogue

Protecting yourself from federal student loan consolidation scams requires vigilance and awareness. By understanding the legitimate process, recognizing red flags, and taking proactive measures, you can significantly reduce your risk. Remember, legitimate consolidation providers will never demand upfront fees or pressure you into making hasty decisions. If something feels wrong, it probably is. Utilize the resources provided and report any suspicious activity to the appropriate authorities. Taking control of your financial future starts with informed decision-making and a commitment to safeguarding your hard-earned money.

Common Queries

What should I do if I think I’ve been scammed?

Immediately contact the Federal Trade Commission (FTC) and your loan servicer. Gather all relevant documentation and report the incident to law enforcement as well.

Are there legitimate companies that help with student loan consolidation?

Yes, but always verify their legitimacy through official government websites and independent reviews before engaging their services. Beware of companies promising unrealistic results or charging exorbitant fees upfront.

How can I verify the legitimacy of a consolidation offer?

Contact your loan servicer directly using contact information found on their official website. Never use contact information provided by a third party. Verify the details of the offer with your servicer.

What are the common warning signs of a student loan consolidation scam?

High-pressure sales tactics, promises of guaranteed loan forgiveness, requests for upfront fees, and unsolicited contact are all major red flags.