Navigating the complex world of graduate school funding can feel overwhelming. Understanding federal student loan limits is crucial for prospective and current graduate students to plan their finances effectively. This guide delves into the specifics of federal loan programs, repayment options, and strategies for responsible debt management, empowering you to make informed decisions about your educational journey.

From understanding the different types of federal loans available to graduate students, such as Direct Unsubsidized and Direct PLUS Loans, to exploring various repayment plans like standard, graduated, and income-driven options, we aim to provide a comprehensive overview. We will also address factors influencing loan eligibility and offer practical advice on managing your loan debt effectively after graduation. This includes budgeting techniques, financial planning tools, and an understanding of the potential consequences of loan default.

Federal Student Loan Limits

Graduate school can be a significant financial undertaking, and understanding federal student loan limits is crucial for prospective students. This section provides a clear overview of the available loan programs, eligibility criteria, and maximum borrowing amounts for graduate students. Careful planning and awareness of these limits are essential for responsible borrowing and successful financial management during and after graduate studies.

Federal Graduate Student Loan Programs

The federal government offers several loan programs specifically designed to assist graduate students with funding their education. The primary programs are Direct Unsubsidized Loans and Direct PLUS Loans. Direct Unsubsidized Loans are available to graduate students based on financial need and credit history, and interest accrues from the moment the loan is disbursed. Direct PLUS Loans, on the other hand, are available to graduate students and their parents, and creditworthiness is a significant factor in approval. These loans are typically unsubsidized, meaning interest begins to accrue immediately. Additional loan options may be available through individual institutions.

Factors Influencing Graduate Student Loan Eligibility

Several factors determine a graduate student’s eligibility for federal student loans. These include credit history (particularly for Direct PLUS Loans), enrollment status (full-time or part-time), degree program, and satisfactory academic progress. Maintaining a minimum GPA and adhering to the program’s academic requirements are essential for continued loan eligibility. A history of responsible financial management, demonstrated through credit reports and repayment of previous loans, also positively influences loan approval. Additionally, completing the Free Application for Federal Student Aid (FAFSA) is a prerequisite for determining eligibility and loan amounts.

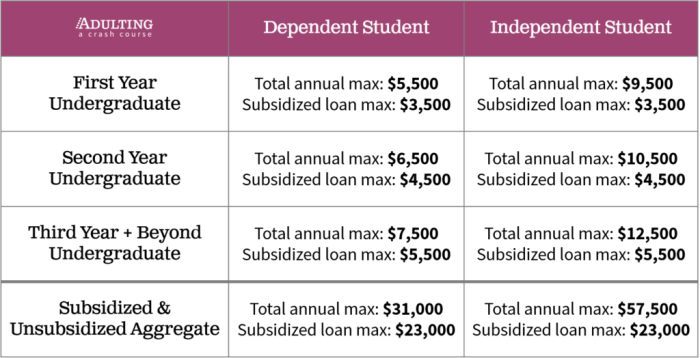

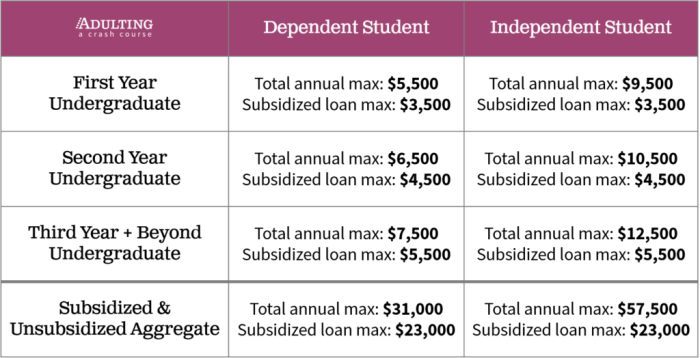

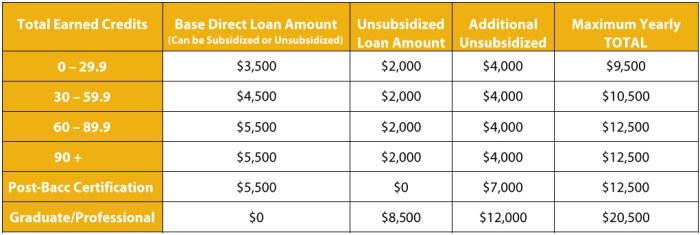

Maximum Loan Amounts for Graduate Students

The maximum amount a graduate student can borrow varies depending on the program, the student’s enrollment status, and the academic year. There are annual limits and aggregate limits (the total amount borrowed over the course of the student’s education). It is crucial to note that these limits can change annually, so checking the official government website for the most up-to-date information is vital. The following table provides a general example of potential loan limits. These figures are illustrative and may not reflect the precise amounts for all programs and years.

| Program Type | Academic Year 2023-2024 (Example) | Academic Year 2024-2025 (Example) | Aggregate Limit (Example) |

|---|---|---|---|

| Direct Unsubsidized Loan | $20,500 | $21,000 | $138,500 |

| Direct PLUS Loan | Cost of Attendance – Other Financial Aid | Cost of Attendance – Other Financial Aid | Cost of Attendance – Other Financial Aid |

Loan Repayment Plans and Options

Navigating the repayment of federal graduate student loans can feel overwhelming, given the various plans available. Understanding the nuances of each plan is crucial for making informed financial decisions and minimizing long-term debt burden. Choosing the right repayment plan depends heavily on your individual financial situation and long-term goals.

Federal graduate student loans offer several repayment plans, each with its own set of benefits and drawbacks. The best option for you will depend on your income, expenses, and overall financial goals. Careful consideration of these factors is key to developing a manageable repayment strategy.

Standard Repayment Plan

The Standard Repayment Plan is the default option for federal student loans. It involves fixed monthly payments over a 10-year period. This plan offers the shortest repayment timeframe, leading to quicker payoff and less overall interest paid. However, the fixed monthly payments can be significantly higher than other plans, potentially creating financial strain for borrowers with lower incomes or fluctuating financial situations.

Graduated Repayment Plan

The Graduated Repayment Plan offers lower initial monthly payments that gradually increase over time. This can be appealing to borrowers anticipating increased income in the future. However, the lower initial payments mean that you will pay significantly more interest over the life of the loan compared to the Standard Repayment Plan, and the eventual increase in payments can still be challenging to manage.

Income-Driven Repayment Plans

Income-Driven Repayment (IDR) plans link your monthly payment to your income and family size. These plans typically offer lower monthly payments than standard or graduated plans, making them more manageable for borrowers with limited incomes. However, IDR plans generally extend the repayment period to 20 or 25 years, resulting in higher total interest paid over the loan’s lifetime. Several types of IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR), each with slightly different eligibility criteria and payment calculation methods. Choosing the most appropriate IDR plan requires careful analysis of your personal financial circumstances.

Applying for an Income-Driven Repayment Plan

The process for applying for an income-driven repayment plan generally involves these steps:

The following steps Artikel the process of applying for an income-driven repayment plan:

- Complete the application form online through the Federal Student Aid website (StudentAid.gov).

- Provide required documentation, such as tax returns and W-2 forms, to verify your income.

- Select your preferred IDR plan (IBR, PAYE, REPAYE, or ICR) based on your individual circumstances and eligibility.

- Submit your application and supporting documentation.

- Wait for confirmation from your loan servicer that your application has been processed and your repayment plan has been updated.

Long-Term Financial Implications of Different Repayment Strategies

Choosing a repayment plan is a long-term commitment with significant financial consequences. The Standard Repayment Plan, while resulting in less interest paid overall, may lead to short-term financial hardship. IDR plans, while providing immediate relief through lower monthly payments, often lead to significantly higher total interest paid over the life of the loan, extending the repayment period considerably. A borrower earning $50,000 annually might find a Standard plan’s payment challenging, but an IDR plan might provide manageable payments, albeit at the cost of significantly higher long-term interest. Conversely, a high-earning graduate might prefer the Standard plan to minimize total interest despite higher initial payments. Careful planning and consideration of future income projections are essential in making an informed decision.

Factors Affecting Loan Amounts

Several key factors interact to determine the maximum federal student loan amount a graduate student can borrow. Understanding these factors is crucial for effective financial planning during graduate studies. This section will detail how these factors influence loan eligibility and the process for appealing a loan amount decision.

The primary determinant of a graduate student’s loan eligibility is the cost of attendance (COA) at their chosen institution. This figure encompasses tuition, fees, room and board, books, and other necessary expenses. The federal government sets maximum loan limits, but these limits are often significantly influenced by the institution’s reported COA. Higher COA figures generally translate to higher maximum loan amounts.

Cost of Attendance

The cost of attendance (COA) is the most significant factor influencing loan amounts. The COA is calculated by the individual institution and includes tuition, fees, room and board, books, supplies, and other living expenses. The higher the COA, the greater the potential loan amount a student may receive. For example, a graduate program at a private university will typically have a higher COA than a program at a public university, leading to potentially higher loan limits for students attending the private institution. Students should carefully review their institution’s COA to understand its impact on their loan eligibility.

Prior Education Loans

The amount of federal student loan debt a student already carries significantly impacts their eligibility for additional graduate loans. Federal regulations aggregate existing undergraduate and graduate loan balances to determine the student’s overall loan eligibility. This means that students with substantial undergraduate loan debt may have a reduced borrowing capacity for graduate studies. The total amount of outstanding loans, including both subsidized and unsubsidized loans, is considered in this calculation. This cumulative debt limit ensures that students do not accumulate unsustainable levels of debt.

Enrollment Status

A student’s enrollment status (full-time versus part-time) also influences their loan eligibility. Full-time graduate students typically qualify for higher loan amounts than part-time students because their cost of attendance is usually higher and they are expected to progress through their program more quickly. Part-time enrollment generally results in lower loan amounts, reflecting the reduced educational expenses associated with a lower course load. Students should understand that the amount of credit hours they enroll in will directly affect the amount they can borrow.

Appealing a Loan Amount Decision

Students who believe their loan amount is unfairly limited can appeal the decision. The appeal process usually involves submitting documentation supporting their claim, such as evidence of exceptional financial circumstances or unforeseen expenses. Each lender has a specific appeals process, and students should review their lender’s website or contact their loan servicer for detailed instructions. Supporting documentation may include medical bills, proof of significant unexpected expenses, or evidence of changes in family income. Success in appealing a loan amount decision is not guaranteed and depends on the validity of the student’s justification.

Impact of Factors on Loan Amounts

| Factor | Impact on Loan Amount | Example | Notes |

|---|---|---|---|

| Cost of Attendance (COA) | Directly proportional | Higher COA = Higher Loan Limit | Institution-specific |

| Prior Education Loans | Inversely proportional | Higher existing debt = Lower available loan amount | Aggregate debt considered |

| Enrollment Status | Directly proportional (full-time) | Full-time enrollment generally allows for higher loan amounts | Part-time enrollment limits borrowing capacity |

| Appeal | Potentially increases loan amount | Successful appeal based on extenuating circumstances | Dependent on justification and lender policy |

Graduate Student Loan Debt Management

Navigating graduate school often requires significant financial planning, and understanding how to manage the resulting student loan debt is crucial for long-term financial well-being. Effective strategies are essential to minimize stress and ensure a smooth transition into post-graduate life. This section Artikels practical approaches to debt management, budgeting techniques, and the potential consequences of default.

Strategies for Effective Graduate Student Loan Debt Management

Successful management of graduate student loan debt hinges on proactive planning and consistent effort. A key strategy is to understand your loan terms thoroughly, including interest rates, repayment plans, and any applicable fees. Creating a realistic budget, prioritizing repayment, and exploring options like income-driven repayment plans are all vital components of a comprehensive approach. Regularly monitoring your credit report is also essential to ensure accuracy and identify any potential issues.

Budgeting Techniques and Financial Planning Tools

Budgeting is paramount for managing student loan debt. A simple budgeting method involves tracking income and expenses using a spreadsheet or budgeting app. Categorize expenses (housing, food, transportation, loan payments) to identify areas for potential savings. Many free online budgeting tools and apps are available, offering features like automated expense tracking, budgeting categories, and financial goal setting. For example, Mint and YNAB (You Need A Budget) are popular options that provide detailed financial overviews and assist with budgeting. These tools allow users to visualize their spending habits and adjust their budgets accordingly. A well-structured budget helps ensure that loan payments remain a priority and avoids accumulating additional debt.

Consequences of Defaulting on Federal Student Loans

Defaulting on federal student loans carries severe consequences that can significantly impact your financial future. These consequences include damage to your credit score, wage garnishment, tax refund offset, and difficulty obtaining future loans or credit. Your credit score can be severely affected, making it harder to secure mortgages, car loans, or even rent an apartment. The government can garnish your wages, seizing a portion of your income to repay the debt. Tax refunds may be withheld to satisfy the debt. In essence, defaulting can create a cycle of financial hardship that is difficult to overcome. For example, a person with a defaulted loan might find it nearly impossible to buy a home or obtain a car loan, significantly limiting their life choices.

Building a Comprehensive Debt Repayment Plan

Creating a comprehensive debt repayment plan involves several key steps. First, consolidate all your loans to simplify repayment. Next, determine the total debt amount and the interest rates on each loan. Then, explore various repayment options, such as standard, extended, or income-driven repayment plans. Prioritize high-interest loans for faster repayment and consider making extra payments when possible to reduce the principal balance and interest accrued. Finally, track your progress regularly and adjust your plan as needed, ensuring that you consistently meet your repayment obligations. This methodical approach provides a clear roadmap to successfully manage and eliminate graduate student loan debt.

Impact of Graduate Education on Future Earnings

Pursuing a graduate degree is a significant financial commitment, but the potential return on investment (ROI) in terms of increased earning capacity is a key factor to consider. The relationship between graduate education, career prospects, and loan repayment ability is complex, varying significantly across fields of study. Understanding this relationship is crucial for prospective graduate students to make informed decisions.

Graduate education often leads to higher earning potential compared to those with only undergraduate degrees. This increase in salary, however, isn’t uniform across all fields. Some fields offer significantly higher returns than others, impacting the feasibility of loan repayment. The initial investment in education, including tuition and living expenses, needs to be weighed against the projected lifetime earnings increase.

Average Salaries and Loan Amounts by Field

The following provides a generalized comparison, acknowledging that actual salaries and loan amounts vary based on institution, program, and individual circumstances. Data from sources like the National Center for Education Statistics and the Bureau of Labor Statistics can provide more specific information. For example, a Master’s degree in Engineering might result in a significantly higher starting salary than a Master’s in the Humanities, but the engineering program might also involve higher tuition costs and therefore higher loan debt.

Return on Investment (ROI) of Graduate Education

Calculating the ROI of a graduate degree requires comparing the increase in lifetime earnings against the total cost of the education, including tuition, fees, and living expenses, as well as the interest accrued on student loans. A simplified calculation might involve estimating the difference in annual salary between a graduate and undergraduate with similar experience, projecting this difference over a career, and subtracting the total cost of the graduate degree. For instance, a medical doctor might have a substantial increase in lifetime earnings, easily offsetting the high cost of medical school. Conversely, someone with a Master’s in Fine Arts might face a slower path to a high-earning career, requiring a careful evaluation of the ROI.

Visual Representation of Graduate Degree Field, Starting Salary, and Loan Burden

Imagine a bar graph. The horizontal axis represents different graduate degree fields (e.g., Engineering, Business, Education, Humanities). The graph would have two sets of bars for each field. The first set of bars would represent the average starting salary for graduates in that field, shown in a positive value on the vertical axis. The second set of bars, displayed as negative values on the vertical axis, would represent the average loan burden (total loan amount) for graduates in that field. Visually, fields with taller positive bars (higher starting salary) and shorter negative bars (lower loan burden) would represent a higher ROI. Conversely, fields with shorter positive bars and taller negative bars would indicate a lower ROI. The visual would clearly demonstrate the varying relationships between field of study, earnings potential, and the financial burden of graduate education. The visual would highlight the need for careful consideration of career prospects and earning potential when choosing a graduate program and managing the associated debt.

Resources and Support for Graduate Students

Navigating the financial complexities of graduate school can be challenging. Fortunately, numerous resources and support systems exist to help students manage their finances and alleviate some of the pressure associated with student loan debt. This section Artikels key avenues for obtaining financial aid counseling, managing student loans, and improving financial literacy.

Many organizations offer assistance to graduate students facing financial hardship. These resources range from government-sponsored programs and websites to non-profit organizations dedicated to providing financial aid and counseling services. Understanding these resources is crucial for effectively managing the financial burden of graduate education.

Government Websites Offering Financial Aid and Counseling

Several government websites provide valuable information and resources related to federal student aid, loan repayment, and financial literacy. These sites offer comprehensive guides, tools, and calculators to help students understand their options and make informed decisions. The information provided is generally reliable and up-to-date, making these websites essential resources for graduate students.

Non-Profit Organizations Providing Financial Aid Counseling

Numerous non-profit organizations specialize in providing free or low-cost financial aid counseling to students. These organizations often offer personalized guidance, workshops, and educational materials tailored to the specific needs of graduate students. Their services can be invaluable in navigating complex financial situations and developing effective budgeting and debt management strategies. For example, many local chapters of the National Foundation for Credit Counseling (NFCC) offer free or low-cost counseling services.

Contact Information for Key Agencies Offering Assistance with Student Loan Management

Effective student loan management is crucial for avoiding financial difficulties. Several agencies provide assistance with loan repayment, consolidation, and other related services. Contacting these agencies directly can provide valuable support and guidance in navigating the complexities of student loan repayment.

Below is a table summarizing contact information for some key agencies:

| Agency | Website | Phone Number |

|---|---|---|

| Federal Student Aid (FSA) | studentaid.gov | 1-800-4-FED-AID (1-800-433-3243) |

| National Foundation for Credit Counseling (NFCC) | nfcc.org | (Contact information varies by local chapter) |

Websites and Organizations Offering Free Financial Literacy Resources

Improving financial literacy is a crucial step towards effective debt management and long-term financial well-being. Many websites and organizations provide free resources, such as online courses, workshops, and budgeting tools, to help graduate students develop essential financial skills. These resources can significantly enhance students’ ability to manage their finances effectively throughout their graduate studies and beyond.

Examples of such resources include online budgeting tools and financial literacy courses offered by organizations like the Consumer Financial Protection Bureau (CFPB) and Khan Academy.

Concluding Remarks

Successfully financing a graduate education requires careful planning and a thorough understanding of available resources. By leveraging the information presented here on federal student loan limits, repayment strategies, and debt management techniques, graduate students can confidently pursue their academic goals while mitigating the long-term financial implications of student loan debt. Remember to explore all available resources and seek professional financial advice when needed to create a sustainable financial plan.

FAQ Guide

What is the difference between Direct Unsubsidized and Direct PLUS Loans?

Direct Unsubsidized Loans accrue interest while you’re in school, whereas Direct PLUS Loans have higher interest rates and require a credit check.

Can I consolidate my federal graduate student loans?

Yes, loan consolidation combines multiple loans into one, potentially simplifying repayment, but may not always lower your interest rate.

What happens if I default on my federal student loans?

Defaulting can lead to wage garnishment, tax refund offset, and damage to your credit score, making it difficult to obtain future loans or credit.

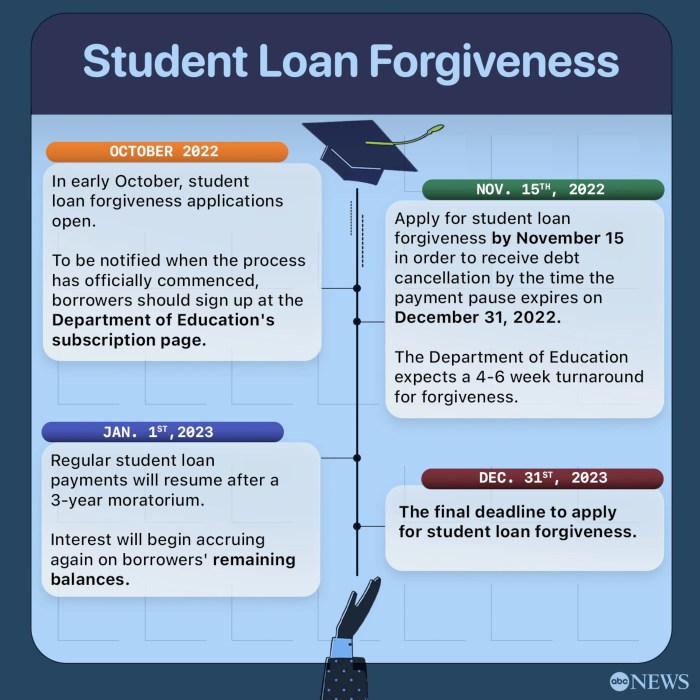

Are there any forgiveness programs for graduate student loans?

Yes, certain professions (e.g., public service) may qualify for loan forgiveness programs, but eligibility requirements vary.