Navigating the complexities of higher education often involves understanding the financial landscape. For many undergraduate students, federal student loans represent a crucial component of funding their education. This exploration delves into the intricacies of federal student loan limits for undergraduates, examining current limits, historical trends, and the impact on students from diverse backgrounds. We’ll also consider alternative funding options and strategies for effective loan management.

Understanding these limits is paramount for prospective students and their families in making informed decisions about financing their college education. The amount a student can borrow significantly impacts their future financial well-being, influencing their post-graduation debt load and long-term financial planning. This guide aims to provide clarity and empower students to make responsible choices regarding their student loan borrowing.

Federal Student Loan Limits

Federal student loan limits for undergraduate students in the United States are designed to help make higher education more accessible, but the amounts available and their impact vary significantly depending on factors like dependency status, year in school, and program type. Understanding these limits is crucial for students and families planning for college expenses.

Current Federal Student Loan Limits for Undergraduate Students

The maximum amount a student can borrow annually in federal student loans varies based on their dependency status (dependent or independent) and year in school. For dependent undergraduate students, the annual limit for subsidized and unsubsidized loans combined is $5,500 for freshmen, $6,500 for sophomores, and $7,500 for juniors and seniors. Independent undergraduate students can borrow up to $9,500, $10,500, and $12,500 for their freshman, sophomore, and junior/senior years respectively. These amounts are subject to change based on Congressional action and updates from the Department of Education. It’s important to note that these are aggregate limits; a student may not receive the full amount if their chosen school’s cost of attendance is lower.

Historical Overview of Changes in Undergraduate Federal Student Loan Limits

Federal student loan limits have not remained static. Over the years, there have been adjustments reflecting inflation, changing educational costs, and policy shifts. For instance, in the past, the limits were often lower, particularly for dependent students. Increases have been implemented in response to rising tuition costs, aiming to keep pace with the increasing financial burden on students. However, these increases haven’t always kept up with the rate of tuition inflation, leading to ongoing debates about the adequacy of loan limits. Detailed historical data on loan limit changes can be found on the Department of Education’s website and through archived federal budget documents.

Impact of Loan Limits on Students from Different Socioeconomic Backgrounds

The impact of federal student loan limits differs significantly across socioeconomic groups. Students from lower-income families often rely more heavily on federal loans to cover college expenses, making the loan limits a critical factor in their ability to afford higher education. Reaching the maximum loan limit might still leave them with a significant shortfall in tuition and living expenses, potentially forcing them to take on private loans with higher interest rates or to forgo college altogether. Conversely, students from higher-income families may have more access to alternative funding sources, reducing their reliance on federal loans and the impact of the loan limits. This disparity highlights the continuing challenge of ensuring equitable access to higher education.

Comparison of Federal Student Loan Limits Across Different Undergraduate Programs

The maximum amount a student can borrow is generally the same regardless of whether they are pursuing an associate’s or a bachelor’s degree. However, the total amount borrowed over the course of the program will differ, reflecting the shorter duration of associate’s degree programs.

| Program Type | Dependent Student Annual Limit | Independent Student Annual Limit | Total Borrowing Potential (Estimate) |

|---|---|---|---|

| Associate’s Degree | $16,000 – $19,000 (2 years) | $27,000 – $32,000 (2 years) | Varies based on year-to-year borrowing and program length |

| Bachelor’s Degree | $28,500 – $30,000 (4 years) | $49,000 – $50,000 (4 years) | Varies based on year-to-year borrowing and program length |

Factors Influencing Loan Limits

Several key factors determine the maximum amount of federal student loans an undergraduate student can receive. These factors ensure that borrowing remains manageable and aligns with individual student needs and circumstances. Understanding these factors is crucial for students planning their higher education financing.

Dependency Status

A student’s dependency status significantly impacts their federal student loan eligibility. Dependent students, typically those under age 24 and financially supported by their parents, have lower loan limits than independent students. This is because lenders often consider parents’ financial resources when assessing a student’s ability to repay loans. Independent students, on the other hand, are generally considered to have greater financial responsibility and may therefore be eligible for higher loan amounts. The Department of Education provides clear guidelines defining dependency status, considering factors like marital status, age, and financial independence from parents. For example, a married student, regardless of age, is typically considered independent.

Enrollment Status

The number of credit hours a student enrolls in directly affects their loan eligibility. Full-time students, typically enrolled in at least 12 credit hours per semester, are eligible for the maximum loan amounts. Part-time students, enrolled in fewer credit hours, will have their loan limits proportionally reduced. This is because loan amounts are generally tied to the cost of attendance, which is usually higher for full-time students due to the increased number of courses and associated expenses. A part-time student taking only 6 credit hours, for instance, might only be eligible for half the loan amount of a full-time student.

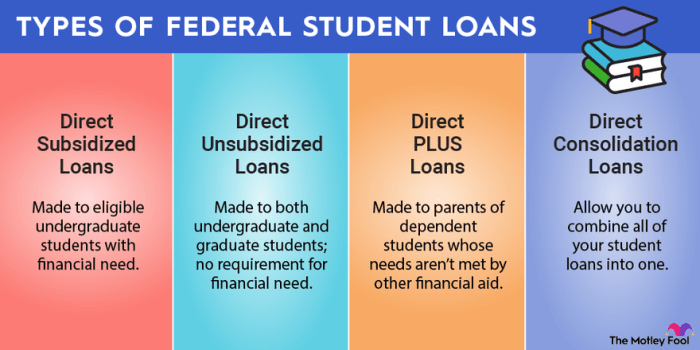

Subsidized and Unsubsidized Loan Eligibility

The eligibility criteria for subsidized and unsubsidized federal student loans differ. Understanding these differences is essential for students to maximize their financial aid options.

- Subsidized Loans: These loans are need-based. Eligibility is determined by the student’s demonstrated financial need as assessed through the FAFSA (Free Application for Federal Student Aid). The government pays the interest while the student is enrolled at least half-time, during grace periods, and during deferment periods.

- Unsubsidized Loans: These loans are not need-based. Students are eligible regardless of their financial need. Interest accrues from the time the loan is disbursed, even while the student is in school.

Impact of Loan Limits on Student Debt

Federal student loan limits significantly influence the amount of debt students accumulate, impacting their financial well-being for years after graduation. Understanding these impacts is crucial for both students making borrowing decisions and policymakers shaping higher education finance.

Average Student Loan Debt by Borrowing Amount

Studies consistently show a strong correlation between the amount borrowed and the total student loan debt upon graduation. Undergraduates who borrow the maximum allowed under federal loan programs generally graduate with considerably higher debt loads compared to those who borrow less. For example, a 2023 report by the Institute for College Access & Success (TICAS) might show that students who maxed out their federal loans had an average debt of $40,000, while those who borrowed less averaged $25,000. These figures are illustrative and vary based on factors like the institution attended, the student’s field of study, and living expenses. The disparity highlights the considerable financial burden associated with borrowing the maximum amount.

Consequences of Exceeding Federal Student Loan Limits

Exceeding federal loan limits often forces students to rely on private loans, which typically come with higher interest rates and less favorable repayment terms. This can lead to a significantly larger overall debt burden, making repayment more challenging. Additionally, students who exhaust all federal loan options may be left with limited funding to complete their degrees, potentially delaying graduation and increasing overall costs. The inability to manage high debt levels can also lead to significant financial stress, affecting credit scores and limiting future financial opportunities like homeownership or starting a business.

Long-Term Financial Burden of High Student Loan Debt

Imagine a visual representation: a towering mountain of debt, representing the accumulated loan balance. Each year of repayment, a small portion of the mountain is chipped away, but the sheer size of the mountain indicates the long-term commitment required. The steep incline represents the accumulating interest, which adds to the principal balance and slows the progress towards debt elimination. The mountain’s shadow extends far into the future, symbolizing the long-term impact on financial decisions such as purchasing a home, saving for retirement, or starting a family. This visual emphasizes the significant constraints high student loan debt places on future financial freedom and the potential for a prolonged period of financial strain.

Impact of Changes in Loan Limits on Overall Student Debt Levels

Changes in federal student loan limits directly influence the overall level of student debt in the country. Increasing loan limits can lead to higher borrowing and, consequently, higher overall student debt levels. Conversely, decreasing loan limits or implementing stricter eligibility criteria can potentially curb the growth of student debt. For example, a hypothetical scenario: if the maximum loan limit were reduced by 10%, we could expect a decrease in the average student loan debt, particularly among those who previously maxed out their loans. However, this could also limit access to higher education for some students. The impact of any change in loan limits is complex and requires careful consideration of its effects on both individual borrowers and the broader economy.

Alternative Funding Sources for Undergraduates

Securing funding for undergraduate education can be a significant challenge. While federal student loans are a common option, exploring alternative funding sources can help minimize debt and diversify financial support. This section will examine several alternatives, outlining their advantages and disadvantages and providing strategies for reducing reliance on loans.

Scholarships

Scholarships represent a form of “free money” for education, requiring no repayment. They are awarded based on merit, need, or specific criteria set by the awarding institution or organization. Examples include merit-based scholarships offered by universities, need-based scholarships from foundations, and scholarships targeted at students from specific backgrounds or pursuing particular fields of study. Compared to federal student loans, scholarships offer the clear advantage of not accumulating debt. However, securing scholarships can be competitive, requiring extensive research and application efforts. The disadvantage is the uncertainty of securing funding; many students apply to numerous scholarships without success.

Grants

Similar to scholarships, grants provide financial aid that doesn’t need to be repaid. However, grants are typically awarded based on financial need, determined through the Free Application for Federal Student Aid (FAFSA). Examples include Pell Grants, which are federal grants for undergraduates with exceptional financial need, and state-level grants offered by individual states. Grants, like scholarships, avoid debt accumulation, but they are often limited in amount and highly competitive, depending on available funding. Students must demonstrate financial need, often through extensive documentation, to be eligible.

Work-Study

Work-study programs are federally funded opportunities that allow students to earn money while attending college. These jobs are often on-campus, offering flexible hours to accommodate academic schedules. Work-study offers the advantage of earning income to directly offset educational expenses, thereby reducing the need for loans. However, the income generated might not fully cover tuition and living expenses, requiring supplementary funding. Furthermore, the available hours might be limited, and the work itself may not be directly related to the student’s chosen field.

Strategies to Minimize Reliance on Federal Student Loans

To minimize reliance on federal student loans, students should prioritize exploring and applying for scholarships and grants early in their high school or college career. Creating a comprehensive budget and exploring part-time employment outside of work-study programs can also significantly reduce the need for loans. Furthermore, students should carefully consider their college choices, opting for institutions with lower tuition costs or robust financial aid packages. Living at home or choosing affordable housing options can also help control overall expenses. Finally, maximizing savings throughout high school and utilizing summer employment opportunities for college funds can make a considerable difference.

Application Processes and Deadlines for Scholarships and Grants

The application processes and deadlines for scholarships and grants vary widely depending on the awarding organization. Some may require essays, transcripts, and letters of recommendation, while others may have simpler applications. Deadlines can range from early fall to late spring. It is crucial to research each opportunity thoroughly and meet all deadlines. It is important to start the application process well in advance.

| Funding Source | Application Process | Deadlines (Example) | Notes |

|---|---|---|---|

| Pell Grant | FAFSA completion | Varies by institution; typically early spring | Federal grant based on financial need. |

| Merit-Based Scholarships (University) | Application to university, supplemental scholarship application | Varies by university; often early spring | Competitive; awarded based on academic achievement. |

| Private Foundation Grants | Individual application; often requires essays and recommendations | Vary widely; check specific foundation websites. | Highly competitive; requires significant research. |

| Work-Study | FAFSA completion; application through college financial aid office | Varies by institution; typically early spring | Part-time employment on or off campus. |

Resources and Support for Student Loan Management

Navigating the complexities of federal student loans can be daunting, but numerous resources are available to help undergraduates understand and manage their debt effectively. Understanding these resources and proactively employing effective strategies can significantly impact a student’s financial well-being after graduation. This section details the available support, the application process, and practical budgeting techniques.

Federal Student Aid Website

The Federal Student Aid website (studentaid.gov) is the primary resource for information on federal student loans. This website provides comprehensive details on eligibility requirements, loan types, interest rates, repayment plans, and loan forgiveness programs. It also offers interactive tools and calculators to help students estimate their loan needs and project their future payments. The site is regularly updated and provides clear, concise information presented in an easily accessible manner. Users can access their loan information directly through their FSA ID, allowing for convenient monitoring of loan balances and payment history.

Applying for Federal Student Loans

The application process for federal student loans typically begins with completing the Free Application for Federal Student Aid (FAFSA). This form gathers necessary financial information to determine eligibility for federal student aid, including grants, scholarships, and loans. Once the FAFSA is processed, students will receive a Student Aid Report (SAR) outlining their eligibility and offered aid. Students then accept the loans offered through their school’s financial aid office. After accepting the loans, loan disbursement occurs, typically in installments, directly to the student’s school to cover tuition and fees. Careful review of the loan documents is crucial to understand the terms and conditions of each loan.

Reputable Organizations Offering Guidance

Several reputable organizations provide valuable guidance on student loan repayment strategies. The National Foundation for Credit Counseling (NFCC) offers free and low-cost credit counseling services, including assistance with developing a repayment plan tailored to individual circumstances. Similarly, the U.S. Department of Education’s website provides resources and tools to help borrowers understand their repayment options and manage their debt effectively. These organizations often offer workshops, webinars, and one-on-one counseling sessions to address specific questions and concerns. Seeking guidance from these established organizations can provide valuable support and reduce the stress associated with managing student loan debt.

Effective Budgeting Techniques for Student Loan Debt Management

Effective budgeting is paramount for managing student loan debt. A practical approach involves creating a detailed budget that tracks all income and expenses. This budget should allocate funds for essential living expenses, student loan payments, and savings. Utilizing budgeting apps or spreadsheets can facilitate this process. Prioritizing loan payments and exploring options such as income-driven repayment plans can minimize financial strain. For example, a student might use the 50/30/20 rule, allocating 50% of their income to needs, 30% to wants, and 20% to savings and debt repayment. This method ensures a balance between immediate needs and long-term financial goals, including paying down student loan debt. Another strategy is to track expenses meticulously for a month to identify areas where spending can be reduced. This allows for reallocation of funds towards loan repayment, accelerating the debt reduction process.

Ultimate Conclusion

Successfully navigating the world of undergraduate financing requires a comprehensive understanding of federal student loan limits and available resources. While federal loans provide crucial support, careful consideration of borrowing limits, alternative funding sources, and effective budgeting strategies is vital for responsible financial management. By proactively planning and utilizing available resources, students can mitigate the long-term financial burden of student loan debt and embark on their post-graduate journeys with greater financial confidence.

Essential FAQs

What happens if I borrow more than the federal student loan limit?

Exceeding the federal limit typically necessitates exploring private student loans, which often come with higher interest rates and less favorable repayment terms. Careful consideration of the long-term financial implications is crucial.

Can I get a federal student loan if I’m attending a vocational school?

Yes, federal student loans are generally available to students attending eligible vocational schools and programs. Eligibility requirements may vary depending on the program and school.

How does my credit score affect my ability to get a federal student loan?

Federal student loans, unlike private loans, do not typically require a credit check for undergraduate students. Your credit history is generally not a factor in determining eligibility for federal student aid.

What if my financial situation changes after I’ve started receiving loans?

Students experiencing financial hardship may be eligible for loan deferment or forbearance. Contact your loan servicer to explore available options and avoid default.