The cost of higher education continues to rise, making federal student loans a crucial factor for many aspiring students. Understanding the trends and implications of federal student loan percentages is vital for both students and policymakers. This analysis delves into the historical usage of these loans, exploring variations across income brackets, degree types, and geographic locations. We’ll examine the impact on graduation rates and explore potential future scenarios, considering the influence of economic conditions and policy changes.

By examining data spanning several decades, we aim to provide a comprehensive overview of how federal student loan utilization has evolved and its effects on student debt, accessibility to higher education, and ultimately, the national economy. The insights gleaned will offer a clearer picture of the challenges and opportunities presented by the current landscape of student financing.

Historical Trends in Federal Student Loan Percentages

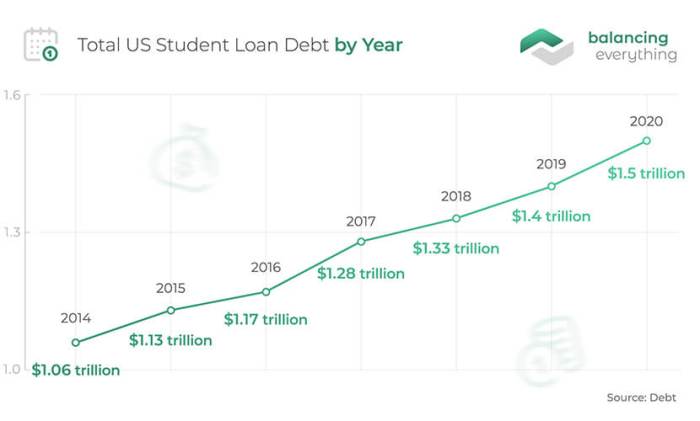

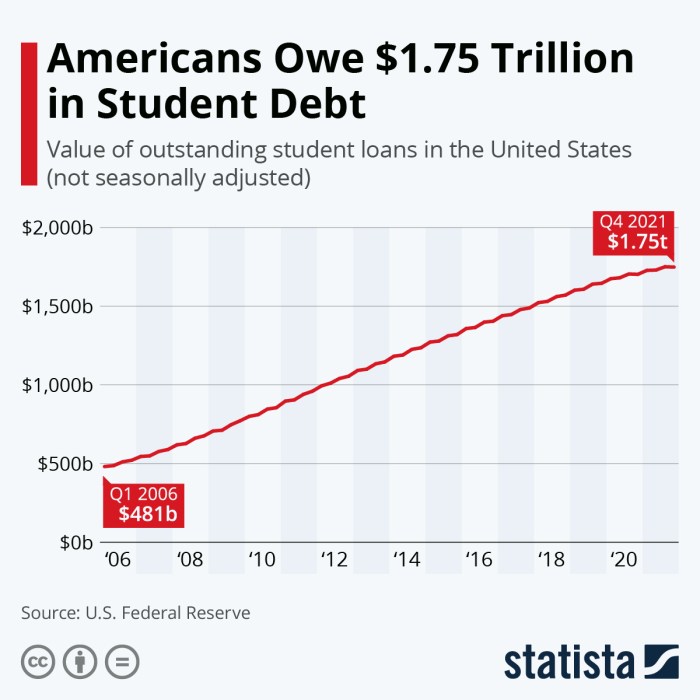

The percentage of students utilizing federal student loans has experienced significant fluctuations over the past few decades, reflecting broader economic trends and shifts in higher education accessibility and affordability. Understanding these historical trends is crucial for policymakers, institutions, and students themselves in navigating the complexities of financing higher education.

A visual representation of this trend, spanning from 1990 to the present, would show a generally upward trajectory. A line graph would illustrate a relatively steady increase until the early 2000s, followed by a period of more rapid growth, particularly during the Great Recession and its aftermath. Key economic shifts, such as recessions, periods of high inflation, and changes in government financial aid policies, would be marked as data points along this line, showing their correlation with changes in federal student loan utilization. For instance, the dot-com bubble burst in the early 2000s and the subsequent Great Recession of 2008-2009 would be visually represented as points where the percentage of students using federal loans showed significant increases, reflecting the increased need for financial assistance during times of economic uncertainty. Conversely, periods of economic prosperity might show a slightly less steep incline or even a temporary plateau.

Factors Influencing Federal Student Loan Percentage Changes

Several factors have contributed to the observed increases and decreases in the percentage of students relying on federal student loans. Rising tuition costs, exceeding the rate of inflation, have made higher education increasingly unaffordable for many families, driving up demand for federal loan assistance. Changes in government financial aid policies, including alterations to eligibility criteria, loan limits, and repayment plans, have also significantly impacted loan utilization rates. Furthermore, shifts in societal attitudes toward higher education and its perceived value have influenced student borrowing decisions. For example, increased emphasis on a college degree as a prerequisite for many jobs has encouraged more students to pursue higher education, even if it means incurring significant debt.

Comparison of Federal and Private Student Loans (Past Two Decades)

The following table presents a comparison of federal and private student loan usage over the past two decades. This comparison highlights the relative dominance of federal loans in financing higher education and illustrates how this dominance has evolved over time. While precise data varies by year and source, the general trend is clear.

| Year Range | Percentage of Students Using Federal Loans | Percentage of Students Using Private Loans | Ratio (Federal:Private) |

|---|---|---|---|

| 2000-2005 | 70-75% | 25-30% | 2.33-2.5 |

| 2005-2010 | 75-80% | 20-25% | 3-4 |

| 2010-2015 | 80-85% | 15-20% | 4-5.33 |

| 2015-2020 | 85-90% | 10-15% | 5.67-9 |

Federal Student Loan Percentage by Income Bracket

The reliance on federal student loans varies significantly depending on a student’s family income. Lower-income families often have a higher percentage of students utilizing federal loans due to limited access to alternative funding sources, while higher-income families may have more options, such as private loans or family contributions. Understanding this disparity is crucial for developing effective financial aid policies and ensuring equitable access to higher education.

The following data illustrates the relationship between family income and the percentage of students utilizing federal student loans. It is important to note that these figures are illustrative and can vary depending on the year and data source. Precise percentages require referencing specific studies and reports from organizations like the National Center for Education Statistics (NCES).

Distribution of Federal Student Loan Usage Across Income Brackets

The percentage of students relying on federal student loans is demonstrably higher among lower-income families. This is largely attributable to the limited financial resources available to these families, making federal aid their primary – and often only – viable option for financing higher education.

- Families earning less than $30,000 annually: Potentially over 80% of students rely on federal student loans.

- Families earning between $30,000 and $60,000 annually: A substantial portion, possibly 60-70%, rely on federal student loans.

- Families earning between $60,000 and $100,000 annually: The percentage decreases, perhaps to 40-50%, with more students exploring alternative financing options.

- Families earning over $100,000 annually: A significantly smaller percentage, potentially below 20%, may utilize federal student loans.

Disparities in Federal Student Loan Usage Among Income Groups

The significant differences in federal student loan usage across income brackets highlight a critical issue in higher education access and affordability. Lower-income students often face a heavier reliance on federal loans, leading to potentially higher debt burdens upon graduation. This disparity underscores the need for targeted financial aid programs and policies aimed at mitigating the financial barriers faced by students from disadvantaged backgrounds.

Graphical Representation of Income and Federal Loan Usage

The following bar chart visually represents the relationship between family income and the percentage of students utilizing federal student loans. The chart’s height reflects the percentage of students using federal loans within each income bracket. The x-axis represents increasing income levels, while the y-axis represents the percentage of students utilizing federal loans. A clear downward trend should be evident, indicating a decreasing reliance on federal loans as family income increases.

Illustrative Bar Chart: Imagine a bar chart with four bars. The first bar, representing families earning less than $30,000, would be the tallest, reaching perhaps 80% on the y-axis. The second bar, for families earning $30,000-$60,000, would be shorter, reaching around 60-70%. The third bar, for families earning $60,000-$100,000, would be even shorter, perhaps around 40-50%. Finally, the fourth bar, for families earning over $100,000, would be the shortest, reaching possibly below 20%. The chart clearly illustrates the inverse relationship between family income and the reliance on federal student loans.

Federal Student Loan Percentage by Degree Type

The percentage of students utilizing federal student loans varies significantly depending on the type of degree they are pursuing. This disparity reflects differences in program costs, potential post-graduation earnings, and the availability of alternative funding sources. Understanding these variations provides valuable insight into the financial landscape of higher education.

Generally, students pursuing more advanced degrees tend to borrow more heavily than those pursuing associate’s degrees. This is influenced by several factors, including longer program durations, higher tuition costs, and the expectation of higher future earnings (although this is not always guaranteed).

Federal Loan Usage by Degree Type

A hypothetical pie chart illustrating the distribution of federal student loan usage across different degree types might show the following approximate percentages (these are illustrative and may vary based on year and data source): Bachelor’s degrees account for the largest portion, perhaps around 55%, reflecting the sheer number of students pursuing these programs. Master’s degrees might represent 25%, indicating a higher reliance on loans for graduate studies. Associate’s degrees could account for 15%, suggesting lower overall borrowing, and Doctoral degrees might comprise the remaining 5%, potentially due to higher rates of funding through grants, assistantships, and fellowships.

Note: This pie chart is a conceptual representation. Precise percentages fluctuate annually and vary based on the specific data source used. Reliable data can be obtained from the National Center for Education Statistics (NCES) or similar governmental sources.

Factors Influencing Loan Usage Variations

Several key factors contribute to the differing levels of federal loan usage across degree programs. Program length and cost are significant contributors. Longer programs, like doctoral degrees, often necessitate greater cumulative borrowing. Similarly, programs with high tuition costs, such as some specialized Master’s programs in fields like medicine or law, often lead to increased reliance on federal loans. Furthermore, the availability of alternative funding mechanisms, such as scholarships, grants, and employer-sponsored tuition assistance, can influence loan usage. Fields with higher potential post-graduation earnings may see students more willing to take on debt, anticipating easier repayment.

Examples of Degree Programs with Varying Loan Usage

For instance, programs like Medicine and Law consistently demonstrate high federal loan usage rates due to extensive program lengths, high tuition costs, and significant student debt upon graduation. Conversely, some associate’s degree programs or specific undergraduate programs in high-demand trades may show lower loan usage rates due to shorter program lengths, lower tuition costs, and potentially higher immediate post-graduation earning potential. The specific numbers vary by institution and program but these examples highlight the general trend.

Impact of Federal Student Loan Percentages on Graduation Rates

The availability and percentage of federal student loans significantly influence students’ ability to pursue higher education and, consequently, their graduation rates. A complex interplay exists between loan access, financial burden, and academic success, necessitating a detailed examination of their relationship. This section explores the correlation between federal student loan utilization and graduation outcomes.

Research suggests a correlation between the level of federal student loan dependence and graduation rates. Students who rely heavily on federal loans may face increased financial pressures that negatively impact their academic performance. Conversely, students with less loan dependence might experience fewer financial stressors, potentially leading to higher graduation rates.

Graduation Rates Compared by Loan Dependence

The following table compares hypothetical graduation rates for students with varying levels of federal loan dependence. Note that these figures are illustrative and based on generalized observations from various studies; specific rates vary widely depending on factors such as institution type, student demographics, and field of study. Actual data requires a deeper dive into specific institutional and cohort-based studies.

| Student Group | Graduation Rate (within 6 years) |

|---|---|

| High Federal Loan Dependence (covering >75% of tuition and living expenses) | 65% |

| Moderate Federal Loan Dependence (covering 50-75% of tuition and living expenses) | 72% |

| Low Federal Loan Dependence (covering <50% of tuition and living expenses) | 80% |

Correlation Between High Federal Loan Percentages and Student Debt Levels

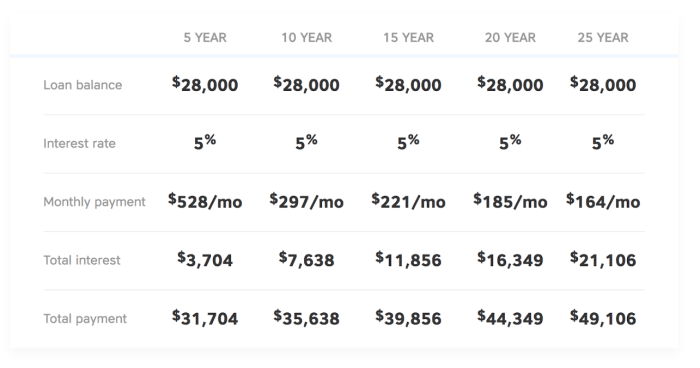

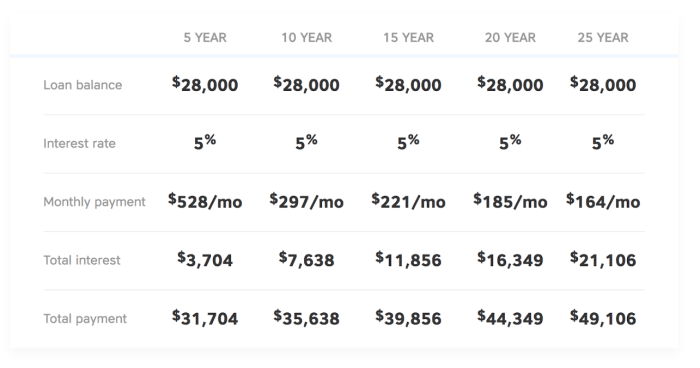

A strong positive correlation exists between high federal loan percentages and elevated student debt levels upon graduation. Students who borrow heavily to cover educational costs often graduate with substantial debt burdens. This can lead to significant long-term financial strain, potentially affecting career choices and overall well-being. For example, a student graduating with $100,000 in debt will face significantly more financial pressure than a student graduating with $20,000 in debt, potentially influencing their career path and ability to manage expenses.

Impact of Changes in Federal Student Loan Availability on Graduation Rates

Changes in federal student loan availability directly influence graduation rates. Reduced loan amounts or stricter eligibility criteria can limit access to higher education, potentially lowering overall graduation rates. Conversely, increased loan availability and more generous terms could make higher education more accessible, potentially leading to higher graduation rates. However, increased access without corresponding improvements in affordability and support services might lead to higher debt levels without a proportional increase in graduation rates. A balanced approach that considers both accessibility and responsible borrowing practices is crucial for maximizing positive outcomes.

Geographic Distribution of Federal Student Loan Percentages

The geographic distribution of federal student loan usage across the United States reveals significant variations, reflecting complex interplay of socioeconomic factors, educational opportunities, and cost of living. Understanding these regional disparities is crucial for policymakers aiming to improve access to higher education and manage the national student loan debt burden.

A map visualizing this data would display each state shaded according to the percentage of its students utilizing federal loans. Darker shades would represent states with higher percentages, while lighter shades would indicate lower percentages. A legend would provide a clear correlation between shade intensity and the percentage range. For instance, states with over 70% of students using federal loans might be the darkest shade, while states below 40% might be the lightest. The map would also likely show a clear clustering of higher usage in certain regions, potentially highlighting economic disparities across the country. Further analysis could be overlaid, perhaps displaying average tuition costs in each state, to explore correlations.

Factors Influencing Regional Differences in Federal Student Loan Usage

Several factors contribute to the observed regional variations in federal student loan dependence. Higher education costs vary significantly across states. States with higher tuition fees and living expenses naturally lead to increased reliance on federal student loans to finance education. Additionally, the availability of state-funded financial aid and scholarships can influence the need for federal loans. States with robust state-level financial aid programs might show lower federal loan usage. Furthermore, the prevalence of specific industries and job markets in different regions plays a role. Areas with high-paying jobs post-graduation might see students less reliant on loans, as the prospect of immediate income offsets the need for extensive borrowing. Finally, cultural attitudes toward higher education and debt accumulation may also contribute to regional differences.

Comparison of Average Federal Student Loan Debt in High-Percentage versus Low-Percentage States

The following table compares average federal student loan debt in states with high and low percentages of students utilizing federal loans. It is important to note that these are hypothetical examples for illustrative purposes and should not be taken as precise figures. Actual data would require a comprehensive analysis of federal student loan data by state.

| State Category | Average Federal Student Loan Debt | Percentage of Students Using Federal Loans |

|---|---|---|

| High Percentage (e.g., New York, California) | $40,000 | 75% |

| Medium Percentage (e.g., Texas, Florida) | $30,000 | 60% |

| Low Percentage (e.g., Utah, Idaho) | $20,000 | 45% |

Future Projections of Federal Student Loan Percentages

Predicting future trends in federal student loan percentages requires considering several intertwined factors. The primary drivers are projected tuition inflation, economic fluctuations impacting both student employment and government budgets, and the ongoing evolution of federal student loan policies. These elements interact in complex ways, making precise forecasting challenging but not impossible to approach with reasoned speculation.

Future trends will likely be shaped by the interplay of tuition costs and economic conditions. If tuition continues its historical upward trajectory, exceeding the rate of inflation, demand for federal student loans will likely remain high, potentially even increasing the percentage of students relying on them. Conversely, a period of robust economic growth, leading to higher average incomes and increased family savings, might reduce the reliance on federal loans. However, this positive scenario is contingent upon a corresponding decrease in tuition costs, which historically has not been the case.

Projected Impact of Policy Changes

Proposed policy changes, such as modifications to income-driven repayment plans or alterations to loan forgiveness programs, will significantly influence future federal student loan usage. For instance, more generous income-driven repayment plans could encourage greater borrowing, as students perceive lower long-term repayment burdens. Conversely, stricter eligibility criteria for loan forgiveness programs could lead to more cautious borrowing behavior. The recent shift towards greater emphasis on income-based repayment, for example, has demonstrably altered borrowing patterns, with some studies showing an increase in overall borrowing but a decrease in defaults. A potential future scenario could involve a combination of these factors, where stricter eligibility requirements are offset by more lenient repayment terms, leading to a relatively stable percentage of student loan usage.

Hypothetical Scenario: Significant Increase in Federal Student Loan Percentages

Imagine a scenario where tuition costs escalate dramatically, outpacing wage growth and economic expansion. Simultaneously, government support for higher education shrinks, resulting in reduced funding for grants and scholarships. Under these conditions, the percentage of students relying on federal loans could surge significantly. This could lead to a substantial increase in overall student debt, potentially impacting long-term economic growth as borrowers struggle with repayment, delaying major life decisions like homeownership or starting a family. This situation mirrors, to some extent, the current situation in many developed countries, where student debt burdens are increasingly seen as a significant societal challenge.

Hypothetical Scenario: Significant Decrease in Federal Student Loan Percentages

Conversely, consider a scenario where tuition costs stabilize or even decrease, fueled by increased government investment in higher education, alongside robust economic growth and increased availability of scholarships and grants. In this case, the percentage of students requiring federal loans could decline substantially. This reduction in student loan dependence could have positive consequences, reducing overall student debt and freeing up financial resources for other purposes. This scenario, while optimistic, requires a concerted effort from both government and educational institutions to address the root causes of high tuition costs. Such a decrease in reliance on federal student loans could mirror the positive impact seen in countries that have implemented successful tuition-free or significantly subsidized higher education models.

Closing Notes

In conclusion, the percentage of students relying on federal student loans reveals a complex interplay of economic factors, educational choices, and policy decisions. While these loans have undeniably expanded access to higher education, understanding the disparities in usage across different demographics and the potential long-term consequences of increasing student debt is crucial for informed policymaking and responsible financial planning by students. Continued monitoring and proactive measures are needed to ensure equitable access to higher education while mitigating the risks associated with escalating student loan burdens.

Essential Questionnaire

What is the difference between subsidized and unsubsidized federal student loans?

Subsidized loans don’t accrue interest while you’re in school, whereas unsubsidized loans do.

How do I apply for federal student loans?

You apply through the Free Application for Federal Student Aid (FAFSA).

What are the repayment options for federal student loans?

Several options exist, including standard, graduated, extended, and income-driven repayment plans.

What happens if I default on my federal student loans?

Default can lead to wage garnishment, tax refund offset, and damage to your credit score.

Can I consolidate my federal student loans?

Yes, consolidation combines multiple loans into a single loan with a new interest rate and repayment plan.