Navigating the complexities of federal student loans can be daunting, especially when unexpected life events disrupt repayment plans. Understanding the option of deferment is crucial for borrowers facing financial hardship or other qualifying circumstances. This guide provides a comprehensive overview of federal student loan deferment, outlining eligibility criteria, application processes, and the long-term implications of this crucial financial tool.

Deferment offers temporary relief from student loan payments, but it’s essential to understand that interest may still accrue on unsubsidized loans, potentially increasing your overall debt. This guide will clarify the different types of deferments, helping you determine if it’s the right choice for your situation and guiding you through the application process. We’ll also explore alternative options like forbearance and income-driven repayment plans to provide a complete picture of your available choices.

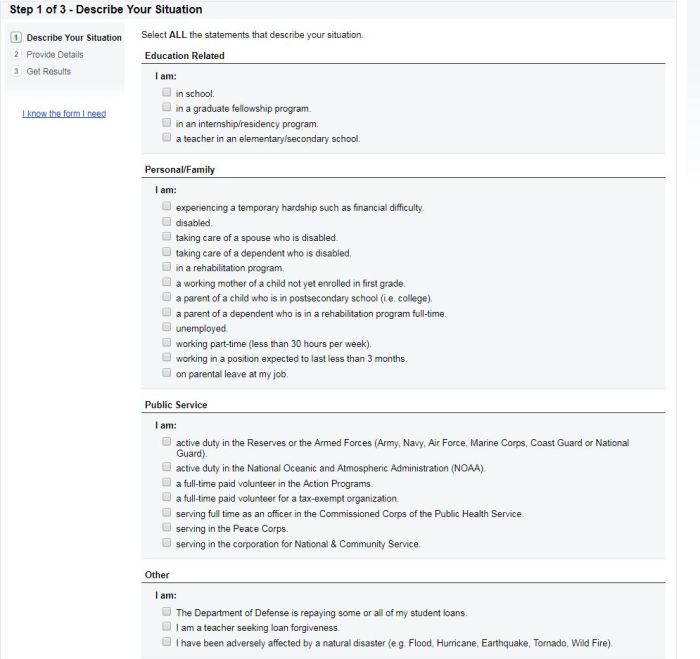

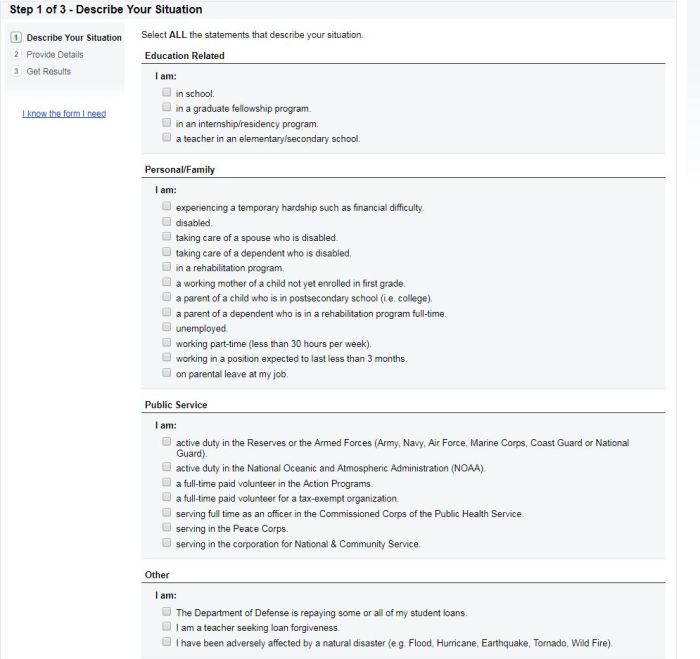

Eligibility Criteria for Federal Student Loan Deferment

Deferment allows eligible borrowers to temporarily postpone their federal student loan payments. This can provide crucial financial relief during periods of hardship or significant life changes. Understanding the eligibility criteria is key to successfully applying for a deferment.

General Requirements for Deferment Eligibility

To be eligible for a federal student loan deferment, you generally need to meet specific criteria, which vary depending on the type of deferment you’re seeking. Common requirements include having a federal student loan, being in repayment or in grace period, and demonstrating a qualifying reason for deferment. Documentation proving your eligibility is typically required. For instance, proof of unemployment or enrollment in graduate school may be needed. It’s essential to check the specific requirements for the type of deferment you are applying for.

Income-Based Repayment Plans and Their Impact on Deferment

Income-driven repayment (IDR) plans, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR), calculate monthly payments based on your income and family size. While being on an IDR plan doesn’t automatically qualify you for deferment, it might influence your eligibility for certain types of deferments or make you consider alternative options to manage your payments during financial hardship. For example, if you experience a significant reduction in income while on an IDR plan, you might explore options like forbearance or an IDR plan recalculation before pursuing deferment.

Deferment Eligibility for Different Loan Types

Eligibility for deferment generally applies to most federal student loans, including subsidized, unsubsidized, and PLUS loans. However, the specific requirements and available deferment options might vary slightly. For example, subsidized loans may offer more deferment options than unsubsidized loans. PLUS loans, while eligible for deferment, often have different requirements and limitations. It’s crucial to check the specific terms and conditions for your particular loan type to understand your eligibility.

Eligibility Criteria Based on Various Factors

The following table summarizes eligibility criteria for federal student loan deferment based on various factors. Note that this is a simplified overview, and specific requirements may vary depending on the type of deferment and your individual circumstances. Always consult the official Federal Student Aid website for the most up-to-date information.

| Factor | Type of Deferment | Eligibility Requirements | Loan Types |

|---|---|---|---|

| Unemployment | Unemployment Deferment | Proof of unemployment, actively seeking employment | Subsidized, Unsubsidized, PLUS |

| Graduate School Enrollment | In-School Deferment | Enrollment at least half-time in a graduate program | Subsidized, Unsubsidized, PLUS |

| Economic Hardship | Economic Hardship Deferment | Demonstrated financial hardship, such as significant loss of income | Subsidized, Unsubsidized, PLUS |

| Military Service | Military Deferment | Active duty military service | Subsidized, Unsubsidized, PLUS |

Types of Federal Student Loan Deferments

Federal student loan deferment allows borrowers to temporarily postpone their loan payments. Several types of deferments are available, each with specific eligibility requirements and duration limits. Understanding these differences is crucial for borrowers seeking temporary relief from their repayment obligations.

Economic Hardship Deferment

Economic hardship deferment is available to borrowers experiencing financial difficulties that prevent them from making their loan payments. This deferment requires documentation demonstrating a significant reduction in income or an unexpected financial burden, such as medical expenses or job loss. Examples include situations where a borrower has experienced a substantial decrease in income due to a layoff, or is facing significant unexpected medical bills. The duration of this deferment is generally limited to a maximum of 36 months over the life of the loan, though specific limits may vary depending on the loan type and lender. The borrower must re-certify their eligibility periodically.

Unemployment Deferment

This deferment is for borrowers who are unemployed and actively seeking employment. Proof of unemployment, such as a recent unemployment claim, is usually required. The borrower must demonstrate active efforts to find new employment. For example, a borrower who has been laid off and is actively applying for jobs, attending job fairs, and networking would qualify. Similar to economic hardship deferment, the total duration is generally limited to a maximum of 36 months over the life of the loan.

Graduate School Deferment

Borrowers enrolled at least half-time in a graduate or professional degree program may qualify for this deferment. Enrollment verification from the educational institution is necessary. This deferment can last for the duration of the graduate program, providing flexibility for students focusing on their studies. There isn’t a maximum time limit tied to this deferment, beyond the length of the graduate program itself.

In-School Deferment

This deferment applies to undergraduate students enrolled at least half-time in a degree program. Proof of enrollment from the school is required. The deferment continues as long as the borrower remains enrolled at least half-time. Similar to Graduate School Deferment, there’s no set maximum time limit beyond the completion of the undergraduate program.

Military Deferment

Active duty military service members and those called to active duty in the National Guard or Reserves may qualify for a deferment. Official documentation from the military branch is required to verify active duty status. The duration of the deferment is generally tied to the length of the military service.

Applying for a Deferment: A Flowchart

A flowchart depicting the application process would visually represent the steps:

1. Assess Eligibility: Determine which deferment type applies to your situation based on the criteria Artikeld above.

2. Gather Documentation: Collect necessary documentation to support your claim (e.g., unemployment paperwork, proof of enrollment, medical bills).

3. Complete Application: Fill out the appropriate deferment application form with your lender or loan servicer.

4. Submit Application: Submit the completed application and supporting documentation.

5. Review and Approval: Your lender or loan servicer will review your application and notify you of their decision.

6. Deferment Granted: If approved, your loan payments will be temporarily suspended.

The flowchart would visually represent these steps using boxes and arrows, with each step clearly labeled. The flowchart would highlight the branching paths depending on the type of deferment chosen, leading to the appropriate documentation requirements and application procedures.

The Application Process for Deferment

Applying for a federal student loan deferment involves several steps and requires gathering specific documentation. The process is generally straightforward, but understanding the requirements and the role of your loan servicer is crucial for a successful application. Failure to provide complete and accurate information can delay the process.

Steps in the Deferment Application Process

The application process typically follows these steps. It’s important to note that specific requirements and procedures may vary slightly depending on your loan type and servicer. Always refer to your servicer’s website or contact them directly for the most up-to-date information.

- Gather Necessary Documentation: Before starting the application, collect all required documentation. This typically includes proof of your eligibility for deferment (such as a letter from your employer confirming unemployment or enrollment verification from your school). You may also need to provide your Social Security number and other personal identifying information. Keep copies of all documents for your records.

- Locate Your Loan Servicer: Identify the loan servicer responsible for managing your federal student loans. This information can usually be found on your student loan statements or through the National Student Loan Data System (NSLDS) website. Knowing your servicer is essential because you’ll submit your application through their specific channels.

- Complete the Deferment Application: Most servicers allow you to apply for deferment online through their website. The application will require you to provide personal information, loan details, and supporting documentation proving your eligibility. Carefully review all information before submitting the application to avoid delays.

- Submit Your Application: Once you’ve completed the application and gathered all necessary documents, submit your application to your loan servicer. You may be able to submit electronically or via mail, depending on your servicer’s procedures. Keep a copy of your submitted application for your records.

- Monitor Your Application Status: After submitting your application, monitor its status. Most servicers provide online tools to track the progress of your application. If you haven’t heard back within a reasonable timeframe (usually a few weeks), contact your loan servicer to inquire about the status.

The Role of the Loan Servicer

Your loan servicer plays a vital role in the deferment process. They are responsible for receiving your application, verifying your eligibility, and processing your request. They will also communicate with you regarding the status of your application and any required additional information. Maintaining open communication with your servicer is crucial for a smooth process. They are your primary point of contact for any questions or concerns you may have.

Gathering Necessary Documentation

The specific documentation needed varies depending on the type of deferment you are applying for. However, generally you will need to provide proof of your eligibility. For example, if applying for an unemployment deferment, you will need documentation from your employer confirming your unemployment status and the date of unemployment. For an in-school deferment, you will need official documentation from your school verifying your enrollment status. Always check your servicer’s website or contact them directly for a complete list of required documents for your specific situation. Providing incomplete documentation will likely delay the processing of your deferment request.

Impact of Deferment on Loan Balance and Interest

Deferring your federal student loans provides temporary relief from repayment, but it’s crucial to understand the implications for your loan balance and overall cost. While you won’t be making payments during the deferment period, interest will likely still accrue, leading to a larger loan balance at the end of the deferment. This increase can significantly impact your long-term financial health.

Effect of Deferment on Principal Loan Balance

A deferment does not reduce your principal loan balance. The principal remains the same throughout the deferment period. However, because interest typically continues to accrue, the total amount you owe (principal plus accumulated interest) will increase. This means that when your deferment ends and you resume repayment, you’ll be responsible for a larger loan balance than the original amount borrowed.

Interest Accrual During Deferment

The way interest accrues during deferment differs between subsidized and unsubsidized loans. For subsidized loans, the government pays the interest while the loan is in deferment. For unsubsidized loans, however, interest continues to accrue and is added to your principal balance, increasing the total amount you owe. This capitalization of interest means you are paying interest on interest, potentially leading to substantial long-term cost increases.

Long-Term Financial Implications of Deferment

Choosing a deferment can have significant long-term financial consequences compared to other repayment options, such as income-driven repayment plans or extended repayment plans. While deferment offers short-term relief, the added interest can substantially increase the total cost of your loan over time, potentially extending the repayment period and increasing the total amount paid. Income-driven repayment plans, for example, adjust payments based on income and family size, potentially resulting in lower monthly payments and less overall interest paid in the long run. Extended repayment plans spread payments over a longer period, resulting in lower monthly payments but higher overall interest paid. Careful consideration of these factors is essential before opting for a deferment.

Potential Increase in Loan Balance Due to Accrued Interest

The following table illustrates how interest accrual during a deferment can increase your loan balance. These are illustrative examples and the actual increase will depend on your specific loan terms, interest rate, and the length of the deferment.

| Initial Loan Balance | Annual Interest Rate | Deferment Period (Years) | Approximate Loan Balance After Deferment |

|---|---|---|---|

| $10,000 | 6% | 1 | $10,600 |

| $10,000 | 6% | 2 | $11,236 |

| $20,000 | 7% | 3 | $24,500 (approximate) |

| $30,000 | 8% | 5 | $44,000 (approximate) |

Alternatives to Deferment

Choosing a path for managing your federal student loans often involves considering options beyond deferment. While deferment temporarily postpones payments, it’s crucial to understand the potential long-term implications and explore alternative strategies that might better suit your financial circumstances. Understanding the nuances of each option is key to making an informed decision.

Several alternatives to deferment exist, each with its own set of benefits and drawbacks. These include forbearance and various income-driven repayment plans. Careful consideration of your current financial situation and long-term goals is vital in selecting the most appropriate approach.

Forbearance

Forbearance, like deferment, temporarily suspends your student loan payments. However, unlike deferment, forbearance doesn’t always halt interest accrual. This means that while you aren’t making payments, your loan balance could grow larger due to accumulating interest. This can significantly increase the total amount you ultimately repay. Forbearance is often granted for short-term hardships, such as temporary unemployment.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans calculate your monthly payment based on your income and family size. Several types of IDR plans exist, each with its own eligibility criteria and payment calculation formula. These plans are designed to make monthly payments more manageable, particularly for borrowers with lower incomes. While payments are lower, the repayment period is typically longer, leading to a higher total amount paid over the life of the loan due to accrued interest.

Comparison of Deferment, Forbearance, and IDR Plans

Let’s compare the three options using a hypothetical scenario:

| Feature | Deferment | Forbearance | IDR Plan |

|---|---|---|---|

| Payment | Suspended | Suspended | Based on income |

| Interest Accrual | Usually Suspended (depends on loan type) | Usually Accrues | Accrues, but payment may be lower than interest |

| Loan Balance | Remains the same (excluding capitalized interest) | Increases due to interest | Increases due to interest, but at a potentially slower rate |

| Credit Score | Generally no negative impact | Potentially negative impact if payments are missed | Generally no negative impact |

| Repayment Period | Extended by deferment period | Extended by forbearance period | Potentially much longer |

Situations Where Each Option Might Be Most Suitable

The best option depends heavily on individual circumstances.

Deferment: Suitable for temporary, short-term situations where you anticipate a brief period of financial hardship and your loan allows for deferment without interest capitalization. Example: A student pursuing a postgraduate degree.

Forbearance: Appropriate for short-term financial emergencies when deferment isn’t an option, but the situation is expected to resolve quickly. Example: A temporary job loss.

IDR Plan: Best suited for long-term financial challenges where lower monthly payments are needed, even if it means a longer repayment period. Example: A borrower with a low income and high student loan debt.

Long-Term Cost Implications: Hypothetical Scenarios

Consider these scenarios to illustrate long-term costs:

Scenario 1: A borrower with a $30,000 loan at 5% interest takes a one-year deferment. Assuming interest capitalization, the loan balance after deferment will be approximately $31,500. This is a $1,500 increase.

Scenario 2: The same borrower enters forbearance for one year. The loan balance would increase to approximately $31,500, similar to deferment with capitalization, but this might be higher depending on the forbearance agreement.

Scenario 3: An IDR plan might lower monthly payments, but the extended repayment period (e.g., 25 years instead of 10) will result in a significantly higher total repayment amount due to accumulated interest over the longer period. The exact amount depends on the plan and income fluctuations.

Potential Challenges and Considerations

Securing a federal student loan deferment can offer crucial financial breathing room, but the process isn’t always straightforward. Borrowers should be aware of potential hurdles and carefully consider the long-term implications before applying. Understanding the terms and conditions is paramount to avoiding unforeseen difficulties.

Navigating the deferment application process can present several challenges. Delays in processing applications are possible, particularly during periods of high demand or if the borrower fails to provide complete and accurate documentation. Incorrectly completed forms or missing information can lead to significant delays, potentially impacting the borrower’s ability to access the deferment when needed. Furthermore, some borrowers may face difficulty meeting the specific eligibility criteria for certain deferment types, requiring them to explore alternative options or appeal a denial. Finally, a lack of clear communication from loan servicers can contribute to confusion and frustration throughout the process.

Difficulties Encountered During the Application Process

Delays in processing applications are a common concern. For example, a borrower submitting an incomplete application might experience a delay of several weeks while the servicer requests missing documentation. Similarly, system errors or high application volumes within the loan servicing agency can also cause unexpected delays. Furthermore, the specific requirements for documentation can vary depending on the type of deferment sought and the individual’s circumstances, potentially leading to further delays if the borrower is unsure what to provide. A proactive approach, involving careful review of the application requirements and meticulous preparation of supporting documentation, can significantly mitigate these risks.

Understanding Deferment Agreement Terms and Conditions

A thorough understanding of the deferment agreement is critical. The agreement Artikels the period of deferment, the implications for interest accrual, and any stipulations regarding repayment following the deferment period. Failure to understand these terms can lead to unexpected debt increases due to accumulated interest or difficulties resuming payments after the deferment ends. For instance, some deferment options may only allow for a limited number of months of deferment over the loan’s lifetime. Others may require the borrower to re-apply periodically to maintain the deferment. Ignoring these terms could result in the deferment being revoked or the borrower facing immediate repayment demands. Carefully reading and understanding the terms before signing the agreement is essential.

Avoiding Negative Financial Consequences

Careful planning is crucial to prevent negative financial consequences associated with deferment. While deferment provides temporary relief from loan payments, interest usually continues to accrue during the deferment period. This can lead to a significantly larger loan balance upon the resumption of payments. To mitigate this risk, borrowers should explore options to make at least the interest payments during the deferment period, if financially feasible. Alternatively, considering a forbearance program, where both principal and interest payments may be temporarily suspended, may be a more beneficial choice in certain situations. Failure to plan adequately can result in a substantial increase in the total loan amount and extended repayment periods.

Potential Pitfalls to Watch Out For

Understanding potential pitfalls can help borrowers navigate the deferment process more effectively.

- Incomplete or inaccurate application: Missing information or errors can cause significant delays and potentially lead to rejection.

- Failure to meet eligibility criteria: Not qualifying for the chosen deferment type can leave the borrower without relief.

- Unclear understanding of terms and conditions: Misinterpreting the agreement can lead to unexpected financial burdens.

- Ignoring interest accrual: Allowing interest to accumulate unchecked can substantially increase the total loan amount.

- Lack of communication with loan servicer: Not proactively addressing issues or seeking clarification can lead to delays and misunderstandings.

- Overreliance on deferment: Using deferment repeatedly without addressing the underlying financial issues can exacerbate long-term debt.

Conclusive Thoughts

Successfully navigating the federal student loan system requires careful planning and a thorough understanding of available options. While deferment can offer much-needed temporary relief, it’s vital to weigh the potential long-term financial consequences, including interest accrual. By carefully considering your circumstances and exploring alternative repayment strategies, you can make informed decisions that protect your financial future. Remember to consult your loan servicer for personalized guidance and to stay informed about any changes in federal student loan policies.

FAQ Summary

What happens to my loan balance during a deferment?

Your principal loan balance remains unchanged during deferment, but interest may still accrue depending on your loan type (subsidized or unsubsidized).

How long can I defer my federal student loans?

The maximum deferment period varies depending on the type of deferment and your specific circumstances. It’s best to check with your loan servicer for details.

Can I defer my student loans indefinitely?

No, deferments are typically granted for a limited time. The length of the deferment depends on the qualifying reason and is subject to limitations set by the federal government.

What if I don’t qualify for deferment?

Other options include forbearance, income-driven repayment plans, or exploring loan consolidation. Consult your loan servicer to discuss alternatives.

Will deferment affect my credit score?

While deferment itself doesn’t directly impact your credit score, consistently missing payments (even during a deferment period if required payments are not made) can negatively affect your credit.