Navigating the world of higher education often involves the significant financial hurdle of tuition costs. Federal student loans offer a crucial lifeline for many aspiring students, providing access to the education they need to build their future. Understanding the intricacies of these loans, however, is essential to ensure responsible borrowing and successful repayment. This guide delves into the key aspects of federal student loans, empowering students to make informed decisions about their financial journey.

From eligibility requirements and loan amounts to repayment plans and forgiveness programs, we’ll explore the complete landscape of federal student aid. We aim to demystify the process, providing clear explanations and practical advice to help students confidently manage their student loan debt.

Loan Amounts and Repayment Plans

Understanding federal student loan amounts and repayment options is crucial for responsible borrowing and long-term financial planning. This section details the maximum loan amounts available and the various repayment plans offered to help borrowers manage their debt effectively.

Maximum Loan Amounts

Federal student loan limits vary depending on the student’s year in school (freshman, sophomore, junior, senior), their dependency status (dependent or independent), and whether they are attending graduate or professional school. These limits are set annually by the federal government and are subject to change. For the most up-to-date information, it is recommended to consult the official website of the Federal Student Aid (FSA) program. Generally, undergraduate students can borrow a cumulative amount over several years, while graduate students have separate, often higher, borrowing limits. Exceeding these limits typically requires demonstrating exceptional financial need.

Repayment Plan Options

After graduation or leaving school, borrowers have several repayment plan options to choose from. The best plan depends on individual financial circumstances and long-term goals. Choosing the right plan can significantly impact the total amount of interest paid over the life of the loan.

Repayment Plan Comparison

The following table illustrates monthly payment amounts for a sample $30,000 loan under different repayment plans. These are examples only and actual payments will vary based on loan amount, interest rate, and repayment plan chosen. Interest rates fluctuate, so the figures presented here are illustrative and should not be considered definitive.

| Repayment Plan | Loan Amount | Loan Term (Years) | Estimated Monthly Payment |

|---|---|---|---|

| Standard | $30,000 | 10 | $350 |

| Graduated | $30,000 | 10 | Starts at $250, increases over time |

| Extended | $30,000 | 25 | $150 |

| Income-Driven (Example) | $30,000 | 20-25 (variable) | Varies based on income; could be significantly lower than other plans |

Impact of Repayment Plan Choice on Total Interest Paid

Choosing a longer repayment term, such as with the Extended plan, will result in lower monthly payments but significantly higher total interest paid over the life of the loan. Conversely, a shorter repayment term, like the Standard plan, leads to higher monthly payments but lower overall interest costs. Income-driven repayment plans offer lower monthly payments based on income, but they often extend the repayment period, potentially increasing the total interest paid. Careful consideration of these trade-offs is essential.

Consequences of Defaulting on Federal Student Loans

Defaulting on federal student loans has serious consequences. These include damage to credit score, wage garnishment, tax refund offset, and difficulty obtaining future loans or credit. In severe cases, it can lead to legal action. It is crucial to contact your loan servicer immediately if you anticipate difficulty making your payments to explore options like deferment, forbearance, or a more suitable repayment plan to avoid default.

Interest Rates and Fees

Understanding the interest rates and fees associated with federal student loans is crucial for responsible borrowing and effective financial planning. This section details how these costs are determined and their impact on your overall loan repayment.

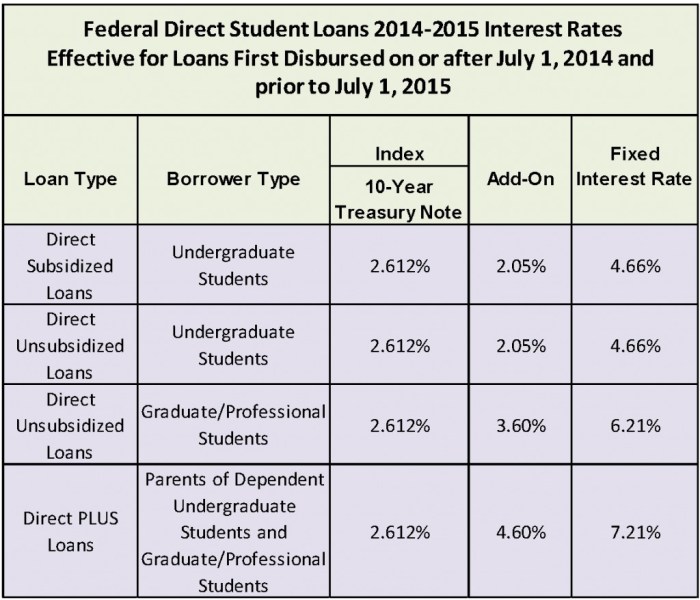

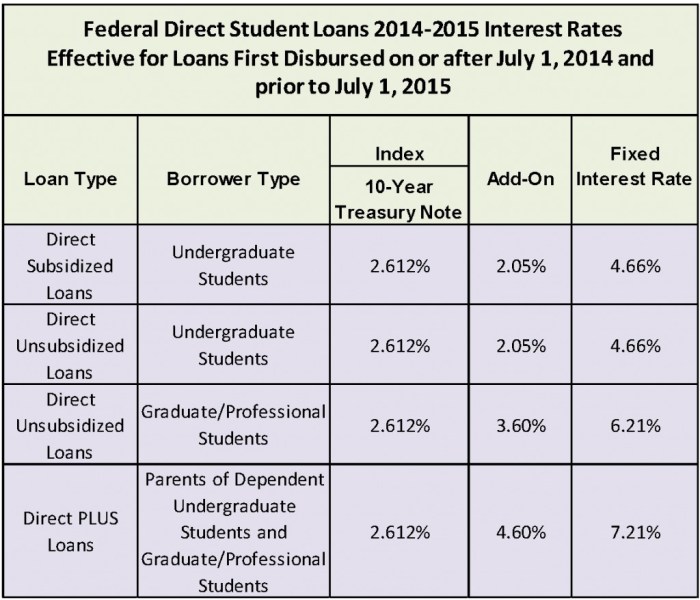

Federal student loan interest rates are not fixed; they fluctuate based on several factors. The most significant factor is the market interest rate at the time the loan is disbursed. The government uses a formula that incorporates the 10-year Treasury note rate, adding a predetermined percentage to account for the risk associated with lending to students. This ensures that the rates are competitive while also covering the cost of the loan program. The specific rate you receive also depends on the type of loan and when you borrowed the money. Rates are typically set annually for each loan program. For example, a Direct Subsidized Loan might have a different interest rate than a Direct Unsubsidized Loan, even within the same year.

Federal Student Loan Fees

Several fees can be associated with federal student loan programs. These fees are typically deducted from the loan disbursement amount, meaning you receive less money than the total loan amount approved.

Origination fees are one common type of fee. These are charged by the lender to cover the administrative costs of processing the loan. The fee amount varies depending on the type of loan and the loan year. Late payment fees are another important consideration. These fees are charged when a payment is not received by the due date. The exact amount of the late fee can vary, but it’s typically a percentage of the missed payment. It’s crucial to make timely payments to avoid accumulating unnecessary costs. Additional fees may apply in specific circumstances, such as for loan consolidation or deferment requests. Always review the loan documents carefully to understand all associated fees.

Comparison of Interest Rates for Different Federal Student Loan Programs

The interest rates for different federal student loan programs vary, reflecting the risk associated with each loan type. The following table provides a comparison (Note: These are examples and actual rates change annually. Consult the official Federal Student Aid website for the most current rates):

| Loan Program | Example Interest Rate (Fixed) | Example Interest Rate (Variable) |

|---|---|---|

| Direct Subsidized Loan | 4.99% | N/A |

| Direct Unsubsidized Loan | 5.99% | N/A |

| Direct PLUS Loan (Graduate/Parent) | 7.54% | N/A |

Calculating the Total Cost of a Loan

Calculating the total cost of a student loan involves considering both the principal amount and the accumulated interest. The formula for simple interest is:

Total Interest = Principal x Interest Rate x Time (in years)

For example, a $10,000 loan with a 5% interest rate over 10 years would accrue $5,000 in simple interest ($10,000 x 0.05 x 10). However, most student loans use compound interest, meaning interest accrues on both the principal and the accumulated interest over time. This makes the total cost significantly higher. To accurately calculate the total cost with compound interest, it’s best to use a loan amortization calculator readily available online. These calculators take into account the loan amount, interest rate, and repayment period to provide a precise estimate of the total repayment cost.

Impact of Interest Capitalization

Interest capitalization occurs when accrued but unpaid interest is added to the principal loan balance. This increases the principal amount, and subsequently, the amount of interest that accrues in the future. For example, if you have a grace period on your loan during which interest accrues but is not paid, this interest will be capitalized at the end of the grace period, increasing your total loan balance. This process can significantly increase the overall cost of your loan over its lifetime, especially if there are multiple periods of capitalization. Understanding capitalization is critical to minimizing your overall debt burden.

Financial Aid and Loan Consolidation

Federal student loans are a crucial part of financing higher education, but they are often most effective when used in conjunction with other financial aid sources. Understanding how grants, scholarships, and loans work together, and the option of loan consolidation, is essential for responsible debt management. This section will explore these vital aspects of managing your student loan debt.

Federal student loans are frequently used alongside grants and scholarships to cover educational expenses. Grants and scholarships are forms of financial aid that don’t need to be repaid, offering a significant advantage in reducing overall borrowing. By strategically combining these sources, students can minimize their reliance on loans and, consequently, their future debt burden. For example, a student might receive a Pell Grant, a merit-based scholarship from their university, and then supplement their funding with federal student loans to cover the remaining tuition and living expenses.

Loan Consolidation Process

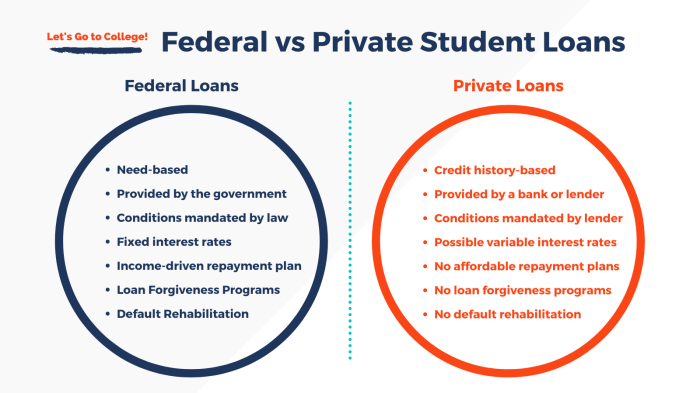

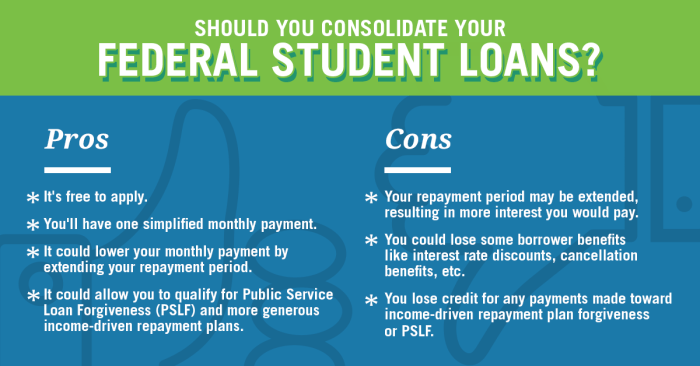

Consolidating federal student loans involves combining multiple federal student loans into a single, new loan. This simplifies repayment by reducing the number of monthly payments and potentially streamlining the repayment process. The consolidation process is handled by the Department of Education through a designated loan servicer. This process typically involves applying online, providing necessary documentation (like Social Security number and loan details), and undergoing a credit check (though this doesn’t impact approval for federal loan consolidation).

Benefits and Drawbacks of Loan Consolidation

Consolidating loans offers several potential benefits. A single monthly payment is simpler to manage than multiple payments, reducing the risk of missed payments and improving financial organization. Furthermore, consolidation may offer the opportunity to switch to a longer repayment plan, resulting in lower monthly payments (though this will increase the total interest paid over the life of the loan). However, consolidation is not always advantageous. Consolidation may result in a higher total interest paid over the life of the loan, especially if a longer repayment plan is chosen. Additionally, some borrowers may lose access to income-driven repayment plans or other benefits associated with their original loans after consolidation.

Steps Involved in Loan Consolidation

Before beginning the consolidation process, it’s crucial to carefully weigh the potential benefits against the drawbacks and consider your individual financial circumstances. The following steps Artikel the typical process:

- Gather information about your existing federal student loans, including loan numbers, balances, and interest rates.

- Complete the Direct Consolidation Loan application online through the Federal Student Aid website.

- Provide required documentation, such as your Social Security number and information about your federal student loans.

- Review and accept the terms of your new consolidated loan.

- Your new loan servicer will contact you with details about your new repayment plan.

Interest Rates and Repayment Terms Before and After Consolidation

The interest rate on a consolidated loan is typically a weighted average of the interest rates on the original loans. This means the new interest rate will likely fall somewhere between the highest and lowest rates of the original loans. The repayment term (loan length) can be extended when consolidating, resulting in lower monthly payments. However, extending the repayment term increases the total interest paid over the life of the loan. For example, a borrower with multiple loans totaling $30,000 at an average interest rate of 6% with a 10-year repayment plan might consolidate into a single loan with a similar interest rate but a 15-year repayment plan. This reduces their monthly payment but increases the total interest paid over the longer repayment period.

Understanding Loan Forgiveness Programs

Navigating the complexities of federal student loan repayment can be daunting. Fortunately, several loan forgiveness programs exist to help borrowers manage and potentially eliminate their debt. Understanding the eligibility requirements and limitations of these programs is crucial for making informed financial decisions.

Federal Student Loan Forgiveness Programs Overview

Several federal student loan forgiveness programs offer partial or complete debt relief based on specific criteria. These programs are designed to assist borrowers in various professions and financial situations. Eligibility often hinges on factors such as income, loan type, and years of qualifying employment.

Public Service Loan Forgiveness (PSLF) Program

The Public Service Loan Forgiveness (PSLF) program forgives the remaining balance on your Direct Loans after you’ve made 120 qualifying monthly payments under an income-driven repayment plan while working full-time for a qualifying government or non-profit organization. Eligibility requires employment by a qualifying employer, consistent monthly payments, and the correct type of federal student loans. This program significantly reduces or eliminates student loan debt for those serving the public good.

Teacher Loan Forgiveness Program

This program provides forgiveness of up to $17,500 on Direct Subsidized and Unsubsidized Loans and Federal Stafford Loans for teachers who have taught full-time for five complete and consecutive academic years in a low-income school or educational service agency. Eligibility is contingent upon teaching in a qualifying school, meeting the required teaching duration, and possessing the correct loan types. The program aims to incentivize individuals to pursue careers in education within underserved communities.

Income-Driven Repayment (IDR) Plans

While not strictly forgiveness programs, Income-Driven Repayment (IDR) plans are crucial because they can lead to loan forgiveness after a set number of years. These plans calculate monthly payments based on your income and family size, making payments more manageable. After a certain period (typically 20 or 25 years, depending on the plan), any remaining balance may be forgiven. Eligibility varies based on income and family size, but all federal student loan borrowers can typically apply. IDR plans significantly reduce monthly payments and can result in substantial debt reduction over time.

Summary of Key Features

| Program | Eligibility Requirements | Loan Forgiveness Amount | Key Limitations |

|---|---|---|---|

| Public Service Loan Forgiveness (PSLF) | 120 qualifying payments under an IDR plan while working full-time for a qualifying employer | Remaining loan balance | Strict employment and payment requirements; complex application process. |

| Teacher Loan Forgiveness | 5 consecutive years of full-time teaching at a low-income school or educational service agency | Up to $17,500 | Specific employment requirements; limited forgiveness amount. |

| Income-Driven Repayment (IDR) Plans | Federal student loans; income and family size considered for payment calculation | Remaining balance after 20-25 years | Forgiveness occurs only after a lengthy repayment period; accumulated interest can still be substantial. |

Limitations and Challenges of Loan Forgiveness Programs

Loan forgiveness programs, while beneficial, have limitations. The stringent eligibility requirements, complex application processes, and potential for program changes can create challenges for borrowers. For example, the PSLF program has faced criticism for its complicated application process and high rejection rate in the past. Additionally, the amount of forgiven debt may be subject to taxation as income in some cases. Thorough research and careful planning are essential before relying on these programs for debt relief.

End of Discussion

Securing a higher education is a significant investment in your future, and understanding the nuances of federal student loans is a critical step in that process. By carefully considering eligibility, loan amounts, repayment options, and potential forgiveness programs, students can effectively leverage these resources to achieve their academic goals without unnecessary financial burden. Remember to thoroughly research and plan to make informed decisions that align with your individual circumstances and long-term financial well-being.

FAQ Compilation

What happens if I don’t repay my student loans?

Defaulting on federal student loans can have serious consequences, including damage to your credit score, wage garnishment, and tax refund offset.

Can I refinance my federal student loans?

While you can’t refinance federal student loans with another federal program, you may be able to refinance with a private lender. However, this might result in losing federal protections.

What is the difference between subsidized and unsubsidized loans?

Subsidized loans don’t accrue interest while you’re in school, grace periods, and deferment. Unsubsidized loans accrue interest from the time they’re disbursed.

How long does it take to repay my student loans?

The repayment period depends on your loan type and repayment plan. Standard plans typically last 10 years, while others may extend longer.

Where can I find more information about loan forgiveness programs?

The Federal Student Aid website (studentaid.gov) provides detailed information on all federal student loan forgiveness programs and their eligibility requirements.