Navigating the complex world of federal student loan programs can feel overwhelming, but understanding the various options available is crucial for securing a higher education. From subsidized and unsubsidized loans to income-driven repayment plans and loan forgiveness programs, the system offers a range of choices tailored to individual circumstances. This guide provides a clear and concise overview, empowering you to make informed decisions about financing your education and managing your debt effectively.

This exploration delves into the intricacies of applying for federal student loans, including eligibility criteria, required documentation, and the FAFSA process. We’ll also examine the different repayment plans available, offering a comparative analysis of their advantages and disadvantages. Furthermore, we will explore strategies for effective debt management, highlighting the importance of responsible borrowing and proactive planning to avoid default.

Types of Federal Student Loan Programs

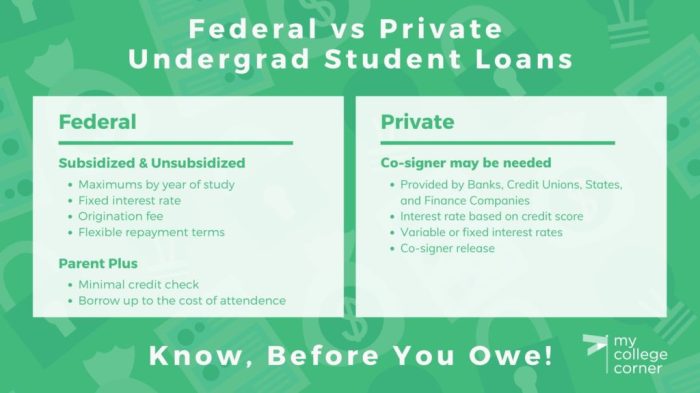

Navigating the world of federal student loans can seem daunting, but understanding the different types available is crucial for making informed financial decisions. This section will Artikel the key distinctions between various federal student loan programs, focusing on eligibility, interest rates, and repayment options. This information will empower you to choose the most suitable loan type for your specific circumstances.

Subsidized vs. Unsubsidized Loans

The primary difference between subsidized and unsubsidized federal student loans lies in the government’s interest payment responsibility. With Direct Subsidized Loans, the government pays the interest while you’re in school at least half-time, during grace periods, and during periods of deferment. Unsubsidized loans, however, accrue interest from the moment the loan is disbursed, regardless of your enrollment status. This means you’ll owe more upon graduation with an unsubsidized loan unless you choose to pay the accruing interest.

Eligibility Requirements for Federal Student Loans

Eligibility for federal student loans hinges on several factors, including enrollment status, financial need (for subsidized loans), credit history (for PLUS loans), and U.S. citizenship or eligible non-citizen status. Generally, students must be enrolled at least half-time in a degree or certificate program at an eligible institution to qualify. For subsidized loans, demonstrated financial need is assessed using the Free Application for Federal Student Aid (FAFSA). Direct PLUS loans, available to parents and graduate students, require a credit check and may be subject to additional requirements.

Interest Rates and Repayment Options

Interest rates for federal student loans are set annually by the government and vary depending on the loan type and the loan’s disbursement date. Subsidized loans typically have lower interest rates than unsubsidized loans. Repayment options include standard repayment plans (fixed monthly payments over 10 years), graduated repayment plans (payments increase over time), extended repayment plans (longer repayment periods), and income-driven repayment plans (payments based on income and family size). Borrowers can also explore loan forgiveness programs under certain circumstances, such as working in public service.

Comparison of Federal Student Loan Programs

The following table summarizes the key features of the major federal student loan programs:

| Loan Type | Interest Accrual | Eligibility | Repayment Options |

|---|---|---|---|

| Direct Subsidized Loan | Interest subsidized while in school (at least half-time), during grace periods, and deferment | Undergraduate students demonstrating financial need; enrolled at least half-time | Standard, graduated, extended, income-driven |

| Direct Unsubsidized Loan | Interest accrues from disbursement | Undergraduate, graduate, and professional students; enrolled at least half-time | Standard, graduated, extended, income-driven |

| Direct PLUS Loan | Interest accrues from disbursement | Parents of dependent undergraduate students; graduate and professional students; credit check required | Standard, graduated, extended |

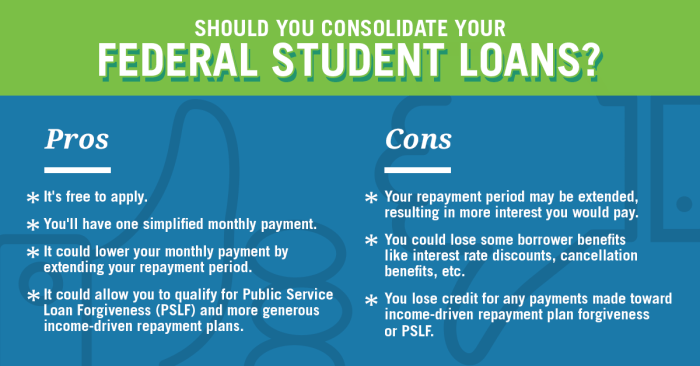

| Direct Consolidation Loan | Interest accrues from disbursement (new interest rate assigned) | Borrowers with multiple federal student loans | Standard, graduated, extended, income-driven |

Repayment Plans and Options

Navigating the repayment of federal student loans can seem daunting, but understanding the available options is crucial for managing your debt effectively. Several repayment plans cater to different financial situations and allow borrowers to tailor their repayment strategy to their individual needs and circumstances. Choosing the right plan can significantly impact your monthly payments and overall repayment timeline.

Federal student loan borrowers have access to a variety of repayment plans, each with its own set of terms and conditions. These plans differ primarily in their payment amounts, repayment periods, and eligibility requirements. Careful consideration of your current financial situation and future income projections is essential when selecting a plan.

Standard Repayment Plan

The Standard Repayment Plan is the default option for most federal student loan borrowers. It involves fixed monthly payments over a 10-year period. This plan offers predictable payments, but the monthly payments can be relatively high, especially for borrowers with significant loan balances.

Graduated Repayment Plan

Under the Graduated Repayment Plan, monthly payments start low and gradually increase over time. This option can be appealing to borrowers who anticipate increased income in the future. However, it’s important to note that the final payments will be significantly higher than the initial payments. This plan also extends the repayment period beyond 10 years.

Extended Repayment Plan

The Extended Repayment Plan provides a longer repayment period, up to 25 years, depending on the loan amount. This plan lowers monthly payments compared to the Standard plan but increases the total interest paid over the life of the loan. It’s suitable for borrowers who need lower monthly payments, even if it means paying more in interest over the long term.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans tie your monthly payment to your income and family size. These plans offer significantly lower monthly payments than other repayment options, making them attractive to borrowers with limited incomes. However, IDR plans typically extend the repayment period to 20 or 25 years, leading to higher total interest payments. There are several types of IDR plans, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). Each plan has specific eligibility requirements and calculation formulas.

Comparison of Repayment Strategies

Different repayment strategies offer distinct advantages and disadvantages. The optimal choice depends on individual financial circumstances and long-term goals. For example, a borrower with a high income might prefer the Standard Repayment Plan to minimize total interest paid, while a borrower with a low income might benefit from an IDR plan to manage monthly expenses.

| Repayment Plan | Payment Amount | Repayment Period | Advantages | Disadvantages |

|---|---|---|---|---|

| Standard | Fixed, relatively high | 10 years | Predictable payments, shortest repayment period | High monthly payments |

| Graduated | Starts low, increases gradually | 10+ years | Lower initial payments | Higher payments later, longer repayment period |

| Extended | Lower than Standard | Up to 25 years | Lower monthly payments | Longest repayment period, higher total interest |

| Income-Driven | Based on income and family size | 20 or 25 years | Lowest monthly payments | Longest repayment period, highest total interest |

Loan Forgiveness and Cancellation Programs

Federal student loan forgiveness and cancellation programs offer opportunities for borrowers to reduce or eliminate their loan debt under specific circumstances. These programs are designed to incentivize certain professions or address situations of economic hardship, ultimately aiming to make higher education more accessible and affordable. Eligibility criteria vary significantly depending on the program, so careful review of the specific program guidelines is crucial.

Loan forgiveness and cancellation programs differ in their eligibility requirements and the amount of debt that can be forgiven or cancelled. Forgiveness programs typically require borrowers to meet specific criteria over a period of time, such as working in public service or teaching in underserved areas. Cancellation programs, on the other hand, often relate to specific circumstances such as total and permanent disability or death of the borrower.

Public Service Loan Forgiveness (PSLF) Program Criteria

The Public Service Loan Forgiveness (PSLF) program forgives the remaining balance on your Direct Loans after you have made 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer. A qualifying employer includes government organizations at the federal, state, local, or tribal level, as well as certain non-profit organizations. Crucially, the type of employment and the repayment plan must meet specific requirements Artikeld by the Department of Education. For example, simply working for a non-profit organization is insufficient; the non-profit must be a 501(c)(3) organization and the employee must be working full-time in a qualifying position. Failure to meet all criteria, including consistent on-time payments, can lead to ineligibility.

Loan Cancellation Program Requirements

Several loan cancellation programs exist, each with its own set of requirements. For instance, loan cancellation may be granted in cases of total and permanent disability, where the borrower is unable to work and meet their repayment obligations. Documentation from a physician is typically required to verify the disability. Another example is the death of the borrower, in which case the remaining loan balance may be cancelled. The specific documentation required will vary depending on the program and the circumstances.

Examples of Professions Eligible for Loan Forgiveness

Many professions contribute to the public good and are eligible for loan forgiveness programs. Teachers, particularly those working in low-income schools, often qualify for loan forgiveness programs. Similarly, social workers, nurses, and other healthcare professionals working in underserved communities may be eligible. Government employees at all levels, from federal to local, can also participate in programs like PSLF. The specific eligibility criteria will depend on the program and the employer.

Summary of Loan Forgiveness and Cancellation Programs

The following is a summary of key aspects of loan forgiveness and cancellation programs. It is essential to consult the official Department of Education website for the most up-to-date and detailed information, as program rules and eligibility requirements can change.

- Public Service Loan Forgiveness (PSLF): Requires 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer. Qualifying employers include government organizations and certain non-profit organizations.

- Teacher Loan Forgiveness: Forgives a portion of federal student loans for teachers who teach full-time for five consecutive academic years in a low-income school or educational service agency.

- Loan Cancellation for Total and Permanent Disability: Cancels the remaining loan balance if the borrower is deemed totally and permanently disabled.

- Loan Cancellation upon Borrower’s Death: The remaining loan balance is typically cancelled upon the death of the borrower.

Managing Student Loan Debt

Successfully navigating student loan repayment requires proactive planning and consistent effort. Understanding your loan terms, budgeting effectively, and exploring available repayment options are crucial steps towards responsible debt management and ultimately, financial freedom. Failing to manage student loan debt effectively can lead to serious financial consequences, so a well-defined strategy is essential.

Effective Budgeting Strategies for Student Loan Payments

Creating a realistic budget is paramount to successfully managing student loan payments. This involves tracking income and expenses to identify areas where savings can be allocated towards loan repayment. A simple budgeting method is to categorize expenses (housing, transportation, food, entertainment, etc.) and compare them to your monthly income. Prioritizing essential expenses and reducing discretionary spending can free up funds for loan payments. Consider using budgeting apps or spreadsheets to simplify the process and monitor progress. Regularly reviewing and adjusting your budget as needed will ensure it remains effective throughout your repayment journey.

Strategies for Avoiding Student Loan Default

Defaulting on federal student loans has severe repercussions. To avoid this, proactive measures are necessary. Firstly, understand your repayment options. Explore different repayment plans (standard, extended, income-driven) to find one that aligns with your financial situation. Secondly, maintain open communication with your loan servicer. Contact them immediately if you anticipate difficulties making payments, as they may offer forbearance or deferment options. Thirdly, prioritize loan payments. Treat them like any other essential bill, ensuring timely payments each month. Finally, consider exploring options like loan consolidation to simplify repayment and potentially lower interest rates. By actively managing your loans and communicating with your servicer, you can significantly reduce the risk of default.

Consequences of Defaulting on Federal Student Loans

Defaulting on federal student loans carries severe financial and legal consequences. Your credit score will be severely damaged, making it difficult to obtain loans, credit cards, or even rent an apartment in the future. Wage garnishment is a possibility, where a portion of your paycheck is automatically deducted to repay the debt. Tax refunds can also be seized to cover outstanding loan balances. Furthermore, default can negatively impact your ability to secure future employment opportunities, particularly those requiring government security clearances. In some cases, default can lead to legal action, including lawsuits and potential wage garnishment. The long-term financial and personal implications of default are substantial, underscoring the importance of proactive debt management.

Creating a Student Loan Repayment Plan: A Step-by-Step Guide

Developing a comprehensive repayment plan involves several key steps. First, gather all relevant information about your loans: loan amounts, interest rates, and repayment terms. Second, calculate your total monthly loan payments. Third, create a detailed budget that accounts for all income and expenses, prioritizing loan payments. Fourth, explore different repayment plans offered by your loan servicer to find the most suitable option. Fifth, automate your loan payments to ensure consistent and timely repayments. Sixth, regularly review and adjust your repayment plan as your financial situation changes. Finally, consistently monitor your progress and make necessary adjustments to ensure you remain on track to repay your loans successfully. This structured approach ensures a proactive and manageable repayment strategy.

Impact of Federal Student Loan Programs on Higher Education

Federal student loan programs have profoundly shaped the landscape of higher education in the United States, significantly impacting access, affordability, and the overall structure of the educational system. Their influence is multifaceted, presenting both advantages and disadvantages that warrant careful consideration.

The availability of federal student loans has undeniably increased access to higher education for millions of Americans. Prior to the widespread availability of these programs, college was largely inaccessible to individuals from low- and middle-income families. Loans provided a crucial financial bridge, allowing students to pursue post-secondary education regardless of their financial background. This has led to a more diverse student body in colleges and universities across the nation, fostering a richer learning environment and contributing to a more skilled workforce.

Increased Access to Higher Education Through Federal Student Loans

Federal student loan programs have dramatically expanded access to higher education, particularly for students from disadvantaged backgrounds. Before the significant expansion of these programs, college was primarily accessible to the wealthy. The introduction of need-based and merit-based loans created opportunities for students who would otherwise have been excluded due to financial constraints. This broadened participation has led to increased social mobility and a more diverse and inclusive higher education system. The Pell Grant program, for example, specifically targets low-income students, providing crucial financial assistance.

Impact of Changes in Federal Student Loan Policies on College Affordability

Changes in federal student loan policies directly affect college affordability. For instance, increases in interest rates or reductions in loan amounts can make college more expensive for students, potentially leading to increased borrowing and higher levels of student debt. Conversely, policies that expand loan availability or reduce interest rates can improve affordability and make college more accessible. The current debate surrounding loan forgiveness demonstrates the direct link between policy changes and the overall cost of higher education for students. For example, the pause on student loan payments during the COVID-19 pandemic offered temporary relief, highlighting the significant impact policy decisions can have.

Drawbacks of the Current Federal Student Loan System

The current federal student loan system, while providing vital access to education, also presents several drawbacks. The rising cost of higher education coupled with increased borrowing has resulted in a significant increase in student loan debt for many graduates. This debt can delay major life decisions like homeownership, starting a family, and investing in retirement. Furthermore, the complexity of the loan repayment system and the lack of clear guidance can leave borrowers feeling overwhelmed and unprepared to manage their debt effectively. The potential for predatory lending practices by private institutions further complicates the situation for some students.

Alternative Financing Options for Higher Education

While federal student loans remain the primary source of funding for many students, several alternative financing options exist. These include scholarships, grants, and work-study programs, all of which can reduce the reliance on loans. Additionally, many institutions offer institutional scholarships and grants based on academic merit or financial need. Savings plans, such as 529 plans, allow families to save for college expenses tax-advantaged. Finally, private loans, while often carrying higher interest rates, represent another potential source of funding. However, it’s crucial to carefully evaluate the terms and conditions of any private loan before committing to it.

Understanding Interest Rates and Fees

Federal student loan interest rates and fees are crucial factors influencing the overall cost of your education. Understanding these components is essential for effective financial planning and responsible debt management. This section will clarify how these rates and fees are determined and how they vary across different loan types.

Federal Student Loan Interest Rate Determination

The interest rate applied to your federal student loan depends primarily on the loan type (subsidized, unsubsidized, PLUS), the loan’s disbursement date, and, in some cases, the applicant’s creditworthiness. Subsidized loans often have lower interest rates than unsubsidized loans because the government pays the interest during certain periods (like while the borrower is in school). Unsubsidized loans accrue interest from the moment the funds are disbursed. PLUS loans, intended for parents and graduate students, typically carry higher interest rates. The rates are set annually by the government and are generally fixed for the life of the loan, ensuring predictability in repayment calculations. Specific rates are available on the Federal Student Aid website.

Types of Fees Associated with Federal Student Loan Programs

Several fees can be associated with federal student loans. Origination fees are one common example. These are upfront fees charged by the lender (usually the government) and are deducted from the loan amount before the funds are disbursed to the borrower. This means the borrower receives less money than the total loan amount. There are no other significant fees directly associated with the loan itself. However, late payment fees can accrue if payments are not made on time, adding to the overall debt. Additionally, some private loan servicers may charge additional fees; however, these are not part of the federal loan program.

Comparison of Interest Rates and Fees Across Loan Types

A direct comparison requires referencing the current rates published by the Federal Student Aid website, as these rates are subject to change. Generally, subsidized Stafford loans have the lowest interest rates, followed by unsubsidized Stafford loans. PLUS loans usually have the highest interest rates. Origination fees are typically a small percentage of the loan amount and are consistent across loan types, although the percentage might vary slightly depending on the year. It’s crucial to check the current rates before making any borrowing decisions, as the differences can significantly impact the total cost of borrowing.

Illustrative Example of Interest Accrual

Imagine a student loan of $10,000 with a 5% annual interest rate. Let’s simplify and assume simple interest for illustration purposes (compounding is more complex but follows the same principle). In the first year, the interest accrued would be $500 ($10,000 x 0.05). In the second year, assuming no principal repayment, the interest would again be calculated on the original $10,000, plus the accumulated interest from the first year. This means the interest would continue to grow over time, even without additional borrowing. A visual representation could be a graph showing a steadily increasing curve, representing the growing loan balance due to accumulated interest. The steeper the curve, the higher the interest rate. This visualization would clearly show how even small interest rates can significantly impact the total repayment amount over the life of the loan.

Outcome Summary

Securing a higher education is a significant investment, and understanding the landscape of federal student loan programs is essential for navigating this process successfully. By carefully considering the various loan types, repayment options, and available forgiveness programs, students can make informed choices that align with their financial goals. Remember, responsible planning and proactive debt management are key to ensuring a positive outcome. This guide serves as a starting point; further research and consultation with financial advisors are recommended for personalized guidance.

User Queries

What happens if I don’t repay my student loans?

Failure to repay your federal student loans can lead to serious consequences, including damage to your credit score, wage garnishment, and tax refund offset.

Can I refinance my federal student loans?

While you can’t technically refinance federal student loans with another federal loan, you can refinance with a private lender. However, this may result in losing federal protections.

What is the difference between a subsidized and unsubsidized loan?

Subsidized loans don’t accrue interest while you’re in school, grace periods, and during certain deferment periods. Unsubsidized loans accrue interest from the time the loan is disbursed.

How long do I have to repay my student loans?

The repayment period depends on your loan type and chosen repayment plan. Standard repayment plans typically span 10 years, but other plans offer longer terms.