Navigating the complexities of federal student loans can feel overwhelming, but understanding the various programs, repayment options, and government regulations is crucial for borrowers. This guide offers a clear and concise overview of the federal student loan system, empowering you to make informed decisions about your education and financial future. From loan forgiveness programs to repayment plans and the role of the federal government, we’ll explore the key aspects of managing your student loan debt effectively.

The impact of federal student loans on higher education is profound, influencing accessibility, tuition costs, and ultimately, the financial well-being of graduates. This guide will delve into the historical context of these programs, examining their evolution and the ongoing challenges faced by borrowers and the government alike. We will also provide practical strategies for managing student loan debt and highlight valuable resources available to those seeking assistance.

Federal Student Loan Forgiveness Programs

Federal student loan forgiveness programs in the United States aim to alleviate the burden of student loan debt for specific groups of borrowers. These programs have evolved over time, reflecting changing priorities and economic conditions. Understanding their history, eligibility requirements, and application processes is crucial for borrowers seeking debt relief.

History of Federal Student Loan Forgiveness Programs

The history of federal student loan forgiveness programs is relatively recent, gaining significant momentum in the late 2000s and early 2010s. Early iterations focused on limited programs targeting specific professions, such as teaching. However, the increasing cost of higher education and the growing student loan debt crisis have spurred the creation and expansion of several broader programs, notably the Public Service Loan Forgiveness (PSLF) program. These programs often undergo revisions and adjustments, reflecting ongoing policy debates and efforts to refine their effectiveness.

Comparison of Federal Student Loan Forgiveness Programs

Several federal student loan forgiveness programs exist, each with its own eligibility criteria and requirements. Two prominent examples are the Public Service Loan Forgiveness (PSLF) program and the Teacher Public Service Loan Forgiveness (TEPSLF) program. While both aim to forgive loans for public service, they differ in their eligibility requirements and application processes. Other programs, such as Income-Driven Repayment (IDR) plans, indirectly contribute to loan forgiveness through extended repayment periods and potential loan balances forgiven at the end of the repayment term.

Public Service Loan Forgiveness (PSLF) Program Eligibility Requirements

The PSLF program forgives the remaining balance on federal Direct Loans after 120 qualifying monthly payments under an eligible IDR plan while working full-time for a qualifying government or non-profit organization. Key eligibility requirements include having Direct Loans, working for a qualifying employer, and making consistent on-time payments under an approved IDR plan. It’s crucial to note that consolidation of Federal Family Education Loans (FFEL) and Perkins Loans into Direct Consolidation Loans is often required for eligibility.

Teacher Public Service Loan Forgiveness (TEPSLF) Program Eligibility Requirements

TEPSLF is designed specifically for teachers working full-time in low-income schools or educational service agencies. It offers a streamlined path to loan forgiveness compared to the standard PSLF program, often forgiving loans after just five years of qualifying payments. Similar to PSLF, borrowers must have Direct Loans, meet employment requirements, and make consistent payments under an approved IDR plan.

Application Process and Potential Challenges

The application process for these forgiveness programs can be complex and time-consuming. Borrowers must meticulously document their employment history, payment history, and loan details. One major challenge is the strict adherence to program requirements. Even minor inconsistencies or errors in documentation can lead to delays or rejection of the application. Another challenge is the lengthy timeframe involved; forgiveness is not immediate and can take several years to achieve. Furthermore, the evolving nature of the programs and their eligibility criteria can create confusion for borrowers.

| Program Name | Eligibility Criteria | Forgiveness Amount | Application Process |

|---|---|---|---|

| Public Service Loan Forgiveness (PSLF) | Direct Loans, 120 qualifying payments under an IDR plan, full-time employment with a qualifying employer | Remaining loan balance after 120 qualifying payments | Online application through the Federal Student Aid website, requiring extensive documentation of employment and payment history |

| Teacher Public Service Loan Forgiveness (TEPSLF) | Direct Loans, 5 years of qualifying payments, full-time employment at a low-income school or educational service agency | Remaining loan balance after 5 years of qualifying payments | Online application through the Federal Student Aid website, with requirements similar to PSLF, but often with a faster processing time |

| Income-Driven Repayment (IDR) Plans (leading to potential forgiveness) | Federal student loans, meeting income requirements, consistent payments under an IDR plan | Remaining loan balance after a set period (often 20-25 years), depending on the specific IDR plan | Selecting an IDR plan through the Federal Student Aid website, requiring annual income recertification |

The Impact of Federal Student Loans on Higher Education

Federal student loans have profoundly shaped the landscape of higher education in the United States, acting as a crucial financial bridge for millions seeking college degrees. Their impact, however, is multifaceted, encompassing both positive contributions to accessibility and potential negative consequences related to rising debt levels. Understanding this complex relationship is vital for policymakers, institutions, and students alike.

The Role of Federal Student Loans in Expanding Access to Higher Education

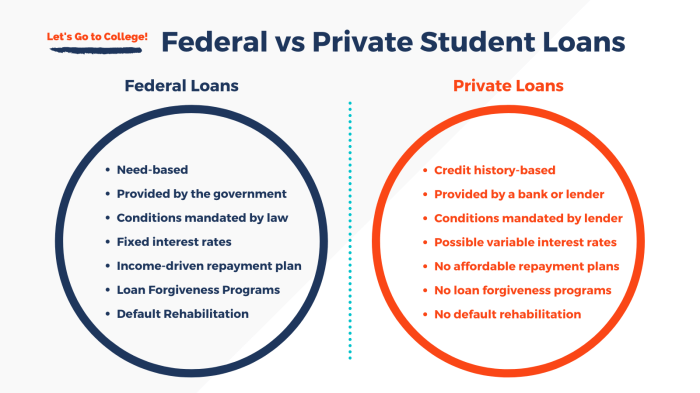

Federal student loan programs have significantly increased access to higher education for students from diverse socioeconomic backgrounds. Prior to the widespread availability of federal loans, college was largely inaccessible to those lacking substantial family resources. These programs, including subsidized and unsubsidized loans, have enabled students with limited financial means to pursue higher education, thereby broadening participation and contributing to a more diverse and skilled workforce. The availability of federal loans has allowed many students to attend colleges and universities they might not otherwise have been able to afford, fostering social mobility and economic growth.

The Correlation Between Rising Tuition Costs and Increasing Student Loan Debt

A significant concern is the escalating correlation between rising tuition costs and the increasing burden of student loan debt. Over the past several decades, tuition at both public and private institutions has risen at a rate significantly outpacing inflation. This increase has been fueled by various factors, including decreased state funding for public colleges, rising administrative costs, and an increase in demand for higher education. Consequently, students have increasingly relied on federal loans to cover these escalating costs, leading to a substantial rise in overall student loan debt. This trend highlights the need for greater transparency in tuition pricing and a renewed focus on affordability in higher education.

Negative Consequences of High Student Loan Debt on Graduates

High levels of student loan debt can have significant negative consequences for graduates. The burden of repayment can delay major life milestones such as homeownership, starting a family, and investing in retirement. Furthermore, excessive debt can lead to increased financial stress, impacting mental and physical health. In some cases, high debt can even limit career choices, as graduates may be forced to prioritize higher-paying jobs over those aligned with their passions or personal values. The long-term economic implications of substantial student loan debt are considerable, affecting both individual financial well-being and broader economic growth.

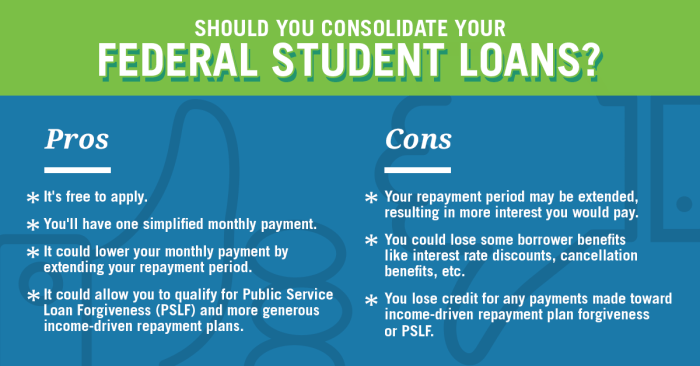

Strategies for Effective Student Loan Debt Management

Effective management of student loan debt is crucial for mitigating its negative consequences. Strategies include exploring income-driven repayment plans, which adjust monthly payments based on income and family size. Consolidation can simplify repayment by combining multiple loans into a single payment. Refinancing, if available at a lower interest rate, can also significantly reduce the total cost of borrowing. Careful budgeting and financial planning are essential, along with seeking professional financial advice when needed. Understanding the terms of your loans and proactively engaging with your loan servicer are also vital steps.

Resources Available to Students Struggling with Loan Repayment

Many resources are available to assist students struggling with loan repayment.

- The National Student Loan Data System (NSLDS): Provides a central location to access your federal student loan information.

- Your Loan Servicer: Your servicer can provide information about repayment options, deferment, and forbearance.

- The Federal Student Aid website (studentaid.gov): Offers comprehensive information on federal student loan programs and repayment options.

- Nonprofit Credit Counseling Agencies: These agencies can provide free or low-cost financial counseling and assistance with debt management.

- Your College or University’s Financial Aid Office: Can offer guidance and support related to loan repayment.

Federal Student Loan Repayment Plans

Navigating the complexities of federal student loan repayment can feel overwhelming. Understanding the various repayment plans available is crucial for managing your debt effectively and minimizing long-term costs. Choosing the right plan depends on your individual financial situation, income, and long-term goals. This section Artikels the key features of different repayment plans, compares their advantages and disadvantages, and provides a structured approach to selecting the most suitable option.

Standard Repayment Plan

The Standard Repayment Plan is the default option for most federal student loan borrowers. It involves fixed monthly payments over a 10-year period. This plan offers the shortest repayment timeline, leading to lower overall interest costs compared to longer-term plans. However, the fixed monthly payments can be substantial, potentially straining your budget, especially in the early years of your career.

Graduated Repayment Plan

The Graduated Repayment Plan offers lower payments in the initial years, gradually increasing over time. This can be beneficial for borrowers anticipating income growth, allowing for manageable payments during their early career stages. However, the longer repayment period compared to the Standard Plan results in higher overall interest costs due to the accumulation of interest over a longer duration. It’s important to consider whether the initial affordability outweighs the increased long-term cost.

Income-Driven Repayment Plans

Income-driven repayment plans (IDRs) tie your monthly payments to your income and family size. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). These plans generally result in lower monthly payments than standard or graduated plans, making them more manageable for borrowers with lower incomes. However, they often extend the repayment period to 20 or 25 years, leading to significantly higher overall interest payments compared to shorter-term plans. Forgiveness may be available after a certain number of years, depending on the plan and loan type, but this is contingent upon consistent payments and meeting eligibility requirements. This forgiveness may be considered taxable income.

Choosing a Repayment Plan: A Step-by-Step Guide

Choosing the right repayment plan requires careful consideration of your current financial situation and future projections. The following steps can guide this process:

1. Assess your current income and expenses: Create a detailed budget to understand your monthly cash flow.

2. Estimate your future income: Consider your career trajectory and projected income growth.

3. Compare repayment plan options: Use online calculators provided by the federal government or reputable financial institutions to estimate monthly payments and total interest paid under each plan.

4. Consider long-term implications: Evaluate the trade-off between lower monthly payments and higher overall interest costs.

5. Choose the plan that best aligns with your financial goals: Select the plan that offers the best balance between affordability and long-term cost-effectiveness. This may involve prioritizing manageable monthly payments initially, even if it means paying more interest over time.

Impact of Repayment Plans on Long-Term Loan Costs

Different repayment plans significantly impact the total interest paid over the life of the loan. For example, a borrower with a $30,000 loan at a 5% interest rate would pay approximately $6,000 in interest under a standard 10-year plan. However, the same loan under an income-driven plan with a 20-year repayment period could result in interest payments exceeding $15,000, depending on the specifics of the plan and the borrower’s income. This substantial difference highlights the importance of carefully considering the long-term financial implications of each plan.

Decision-Making Flowchart for Selecting a Repayment Plan

[A flowchart would be depicted here. The flowchart would start with a question: “What is your current financial situation and income?” This would branch into two options: “Stable Income, Comfortable Budget” and “Limited Income, Tight Budget”. The “Stable Income” branch would lead to a choice between “Standard Repayment” and “Graduated Repayment”, with considerations of shorter repayment time vs. lower initial payments. The “Limited Income” branch would lead to a selection of “Income-Driven Repayment”, with further branching to consider the specific IDR plan options based on individual needs and eligibility. The flowchart would conclude with the selection of a specific repayment plan.]

The Role of the Federal Government in Student Lending

The federal government’s involvement in student lending has profoundly shaped higher education access and the national economy. Its evolution reflects shifting societal priorities, economic conditions, and political considerations, resulting in a complex system with both benefits and drawbacks. Understanding this history is crucial to evaluating current policies and future reforms.

A History of Federal Student Loan Programs

The federal government’s role in student lending began modestly. Early programs were limited in scope and primarily focused on veterans returning from World War II. Over time, however, the scale and complexity of these programs dramatically increased, driven by growing demand for higher education and a recognition of its importance for economic growth. This expansion saw the creation of various loan programs, each designed to address specific needs and demographics. The evolution from small, targeted initiatives to a vast, multi-billion-dollar enterprise reflects the evolving understanding of higher education’s role in national development.

Government Regulation of Student Loan Interest Rates and Fees

The federal government plays a significant role in setting and regulating student loan interest rates and fees. These rates are often tied to market indices, but the government can influence them through subsidies and other policy interventions. Regulations also govern the fees charged by lenders, aiming to protect borrowers from excessive costs. The interplay between government regulation and market forces determines the overall cost of borrowing for students, influencing their choices and long-term financial well-being. Changes in these regulations, such as those seen during periods of economic uncertainty, can significantly impact both borrowers and the lending industry.

The Economic Impact of Federal Student Loan Programs

Federal student loan programs have a substantial impact on the national economy. They increase access to higher education, leading to a more skilled workforce and potentially higher economic productivity. However, the accumulation of student loan debt also poses risks. High levels of debt can hinder economic growth by reducing consumer spending and delaying major life decisions like homeownership. The government’s role is to balance these competing factors, ensuring that student loan programs promote economic opportunity without creating unsustainable levels of debt. For example, economic studies have shown a correlation between higher education attainment and increased lifetime earnings, but this positive effect can be diminished by high debt burdens.

Government Efforts to Address the Student Loan Debt Crisis

The rising levels of student loan debt have prompted various government initiatives to address the crisis. These efforts include income-driven repayment plans, loan forgiveness programs, and increased transparency in loan terms and conditions. The effectiveness of these measures is a subject of ongoing debate, with some arguing for more comprehensive solutions, such as tuition reform or increased funding for grant programs. The government’s ongoing efforts highlight the complexities of balancing the need to support higher education access with the need to mitigate the risks of high student loan debt. Recent legislative efforts, such as the expansion of income-driven repayment plans, represent attempts to navigate this delicate balance.

Timeline of Key Events in Federal Student Loan Programs

The following timeline illustrates significant milestones in the history of federal student loan programs:

- 1944: The Servicemen’s Readjustment Act (GI Bill) provides educational benefits for World War II veterans, laying the groundwork for future federal student aid programs.

- 1958: The National Defense Education Act is enacted, providing funding for student loans and fellowships, partially in response to the Soviet Union’s launch of Sputnik.

- 1965: The Higher Education Act establishes the basic framework for federal student financial aid, including grants, loans, and work-study programs.

- 1972: The Guaranteed Student Loan Program is established, expanding access to federal student loans through private lenders.

- 1992: The Federal Family Education Loan Program (FFELP) is replaced by the Direct Loan Program, with the federal government becoming the primary lender.

- 2007-2008: The Great Recession leads to increased concerns about student loan debt and its impact on the economy.

- 2010: The Health Care and Education Reconciliation Act of 2010 makes significant changes to student loan programs.

- 2020-Present: The COVID-19 pandemic leads to widespread student loan payment pauses and increased discussion of loan forgiveness.

Understanding Federal Student Loan Deferment and Forbearance

Navigating the complexities of federal student loan repayment can be challenging, and understanding options like deferment and forbearance is crucial for responsible financial management. These programs offer temporary pauses in loan payments, but they differ significantly in their eligibility criteria, consequences, and application processes. Choosing between them, or neither, depends heavily on your individual circumstances.

Deferment and Forbearance: Key Differences

Deferment and forbearance both temporarily postpone your student loan payments, but they differ fundamentally in their reasons for granting the pause and their impact on your loans. Deferment is generally granted based on specific qualifying circumstances, such as unemployment or enrollment in school, and usually doesn’t accrue interest on subsidized loans. Forbearance, on the other hand, is typically granted when you’re experiencing financial hardship and often accrues interest on both subsidized and unsubsidized loans, increasing your overall loan balance.

Eligibility Requirements for Deferment

Eligibility for deferment depends on the type of federal student loan and the specific reason for requesting it. Common reasons include returning to school at least half-time, unemployment, or experiencing economic hardship. Specific documentation, such as proof of enrollment or unemployment verification, is typically required. The maximum deferment period varies depending on the reason and loan type. For example, economic hardship deferment may be limited to a specific timeframe, while deferment due to enrollment may be granted for the duration of your schooling.

Eligibility Requirements for Forbearance

Forbearance is generally granted when you demonstrate an inability to make your loan payments due to financial hardship. This could involve job loss, medical emergencies, or other unforeseen circumstances. Lenders typically require documentation to support your claim of financial hardship, which may include proof of income loss or medical bills. The length of a forbearance period is determined on a case-by-case basis, often granted in increments and subject to renewal.

Potential Consequences of Deferment and Forbearance

While deferment and forbearance offer temporary relief, they are not without consequences. The most significant is the accumulation of interest, especially with forbearance. This can lead to a larger overall loan balance upon the resumption of payments, potentially extending your repayment period and increasing your total interest paid. Furthermore, prolonged use of either program may negatively impact your credit score. Repeated use of deferment or forbearance might be seen as a sign of financial instability, making it harder to secure future loans or credit.

Examples of Appropriate Use

Deferment may be appropriate for a student returning to graduate school after a period of employment or for someone experiencing a period of unemployment after a job loss. Forbearance may be suitable for individuals facing unexpected medical expenses or a significant decrease in income due to unforeseen circumstances, like a business closure. It’s crucial to carefully weigh the short-term benefits against the potential long-term consequences before choosing either option.

Applying for Deferment or Forbearance

The application process generally involves contacting your loan servicer. You’ll need to complete an application form and provide supporting documentation to justify your request. The specific requirements and documentation needed vary depending on the reason for requesting deferment or forbearance and the loan servicer. It’s essential to carefully review the requirements and ensure you submit all necessary documentation to avoid delays in processing your application. You can typically apply online through your servicer’s website, by phone, or via mail. Once approved, your servicer will notify you of the effective dates of your deferment or forbearance.

Closing Notes

Successfully managing federal student loans requires careful planning and a thorough understanding of the available options. This guide has provided a framework for navigating the complexities of the federal student loan system, from exploring forgiveness programs and repayment plans to understanding deferment and forbearance. By utilizing the resources and strategies Artikeld, borrowers can confidently address their student loan debt and build a secure financial future. Remember, proactive planning and informed decision-making are key to achieving long-term financial success.

FAQ

What is the difference between subsidized and unsubsidized federal student loans?

Subsidized loans don’t accrue interest while you’re in school, during grace periods, or while in deferment. Unsubsidized loans accrue interest throughout your entire loan term.

Can I consolidate my federal student loans?

Yes, you can consolidate multiple federal student loans into a single loan with a new interest rate and repayment terms. This can simplify repayment but may not always lower your overall interest cost.

What happens if I default on my federal student loans?

Defaulting on federal student loans can result in serious consequences, including wage garnishment, tax refund offset, and damage to your credit score. It’s crucial to contact your loan servicer if you’re struggling to make payments.

How do I apply for a federal student loan?

You apply for federal student loans through the Free Application for Federal Student Aid (FAFSA).

What are income-driven repayment plans?

Income-driven repayment plans base your monthly payments on your income and family size, potentially leading to loan forgiveness after 20-25 years of payments, depending on the plan.