Navigating the complexities of higher education often involves understanding the intricacies of student financing. The Federal Unsubsidized Stafford Loan is a crucial element in this landscape, offering a significant pathway to funding college education but also presenting potential challenges. This comprehensive guide will delve into the essential aspects of these loans, equipping you with the knowledge to make informed decisions about your financial future.

From eligibility criteria and interest rates to repayment plans and potential pitfalls, we’ll unravel the key features of Federal Unsubsidized Stafford Loans. We’ll also explore how these loans compare to other financing options and provide practical strategies for effective debt management. Understanding these loans is key to responsible borrowing and successful financial planning during and after your academic journey.

Loan Eligibility and Requirements

Securing a Federal Unsubsidized Stafford Loan involves meeting specific eligibility criteria and navigating the application process. Understanding these requirements is crucial for prospective students seeking financial aid for their education.

Eligibility for a federal unsubsidized Stafford loan hinges on several factors. Applicants must be enrolled or accepted for enrollment at least half-time in a degree or certificate program at a participating institution. They must also be a U.S. citizen or eligible non-citizen, and possess a valid Social Security number. Finally, they must demonstrate financial need, although unlike subsidized Stafford loans, unsubsidized loans are not need-based.

Application Process Steps

The application process for a Federal Unsubsidized Stafford Loan is straightforward but requires careful attention to detail. First, students must complete the Free Application for Federal Student Aid (FAFSA). This form collects necessary financial information used to determine eligibility for federal student aid programs. Next, the student’s chosen educational institution processes the FAFSA information and determines the student’s financial aid package, including any offered unsubsidized Stafford loans. Finally, the student must accept the loan offer and complete loan entrance counseling.

Undergraduate and Graduate Student Eligibility Comparison

While both undergraduate and graduate students can generally access unsubsidized Stafford loans, there are some differences. The primary difference lies in loan limits. Graduate students are typically eligible for higher loan amounts than undergraduates. Both groups, however, must meet the general eligibility requirements mentioned previously: enrollment at a participating institution, U.S. citizenship or eligible non-citizen status, a valid Social Security number, and completion of the FAFSA. The specific loan limits vary annually and are determined by the Department of Education.

Impact of Credit History on Loan Approval

Credit history does not directly impact the approval of a Federal Unsubsidized Stafford Loan. These loans are primarily based on enrollment status, citizenship, and completion of the FAFSA. Unlike private loans, which often consider credit scores, federal student loans are generally available to students regardless of their credit history. This makes them an accessible option for students with limited or no credit history. However, a co-signer might be required for private student loans if the applicant has poor credit.

Interest Rates and Fees

Understanding the interest rates and fees associated with your federal unsubsidized Stafford loan is crucial for effective financial planning during and after your studies. This section details how these costs are determined and how they compare to subsidized loans.

Interest rates for federal unsubsidized Stafford loans are set by the government each year. The rate is fixed for the life of the loan, meaning it won’t change after your loan is disbursed. The specific rate depends on the loan’s disbursement date. The government announces the interest rate for each academic year, typically in the spring or summer prior to the start of the fall semester. This ensures transparency and predictability for borrowers.

Interest Rate Determination

The federal government determines the interest rate for unsubsidized Stafford loans based on a complex formula that considers various economic factors. These factors include, but aren’t limited to, the prevailing market interest rates, inflation rates, and the overall economic health of the country. The rates are typically reviewed and adjusted annually to reflect changes in the economic landscape. The goal is to strike a balance between providing affordable loans to students and managing the financial risks associated with the loan program.

Loan Fees

Federal unsubsidized Stafford loans come with an origination fee, which is a percentage of the loan amount. This fee is deducted from the loan disbursement, meaning you receive less money than the total loan amount. The origination fee helps cover the administrative costs of processing and managing the loan program. The fee amount varies depending on the loan’s disbursement date and is typically a small percentage.

Interest Rate Comparison: Unsubsidized vs. Subsidized

Unsubsidized Stafford loans accrue interest from the time the loan is disbursed, regardless of whether you are still in school. Subsidized Stafford loans, on the other hand, do not accrue interest while you are enrolled at least half-time in school, during grace periods, and during deferment periods. Therefore, the total cost of an unsubsidized loan will generally be higher than a subsidized loan of the same amount, even if the interest rates are initially the same. The difference becomes more significant over the life of the loan due to the compounding effect of interest.

Interest Rate Comparison Table

| Loan Type | Academic Year | Interest Rate (Example) | Origination Fee (Example) |

|---|---|---|---|

| Unsubsidized Stafford | 2023-2024 | 5.0% | 1.07% |

| Unsubsidized Stafford | 2024-2025 | 5.5% | 1.07% |

| Subsidized Stafford | 2023-2024 | 5.0% | 1.07% |

| Subsidized Stafford | 2024-2025 | 5.5% | 1.07% |

Note: The interest rates and origination fees provided in the table are examples only and are subject to change. Always refer to the official Federal Student Aid website for the most up-to-date information.

Repayment Options and Plans

Understanding your repayment options is crucial for effectively managing your federal unsubsidized Stafford loan. Choosing the right plan significantly impacts your monthly payments and the total amount you ultimately repay. Several plans are available, each with its own set of benefits and drawbacks. Careful consideration of your financial situation and long-term goals is essential.

Standard Repayment Plan

The Standard Repayment Plan is the default option for federal student loans. It involves fixed monthly payments over a 10-year period. While this plan offers predictable payments, it generally results in higher monthly payments compared to income-driven repayment plans. For example, a $30,000 loan with a 5% interest rate would result in monthly payments of approximately $316. The total amount repaid over the 10 years would be significantly higher than with a longer repayment plan due to accrued interest.

Extended Repayment Plan

This plan offers lower monthly payments than the Standard Repayment Plan by extending the repayment period to up to 25 years. This can be beneficial for borrowers with lower incomes or those facing financial hardship. However, it results in a significantly higher total amount repaid due to the longer repayment period and accumulated interest. For the same $30,000 loan example, a 25-year extended repayment plan might result in monthly payments around $158, but the total interest paid would be considerably more than with a 10-year plan.

Graduated Repayment Plan

Under this plan, payments start low and gradually increase every two years. This can be appealing to borrowers anticipating increased income over time. However, the initial low payments may not cover the accruing interest, leading to a larger balance in the early years of repayment. It’s important to carefully consider your projected income growth to determine if this plan is suitable for your circumstances.

Income-Driven Repayment Plans

Income-driven repayment plans (IDRs) link your monthly payment amount to your income and family size. These plans are designed to make repayment more manageable, particularly for borrowers with lower incomes. There are several types of IDR plans, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). Each plan has specific eligibility requirements and payment calculation formulas.

Income-Driven Repayment Plan Details

The calculation of your monthly payment under an IDR plan considers your adjusted gross income (AGI), family size, and the total amount of your federal student loans. The payment is typically capped at a percentage of your discretionary income (income above a certain poverty guideline). For example, under REPAYE, the payment is capped at 10% of discretionary income. After a specific repayment period (usually 20 or 25 years), any remaining loan balance may be forgiven, though this forgiveness is considered taxable income.

Selecting a Repayment Plan: A Step-by-Step Guide

- Assess your current financial situation: Evaluate your income, expenses, and overall financial stability.

- Determine your long-term financial goals: Consider your career aspirations and projected income growth.

- Compare repayment plan options: Use online repayment calculators to estimate monthly payments and total repayment costs under different plans.

- Consider your risk tolerance: Weigh the potential benefits of lower monthly payments against the higher total repayment costs of longer-term plans.

- Choose the plan that best aligns with your financial situation and goals: Select the plan that provides the most manageable monthly payments while minimizing the total interest paid over the life of the loan.

- Monitor your progress and adjust as needed: Regularly review your repayment plan to ensure it continues to meet your needs. You can switch plans once a year, if necessary.

Loan Forgiveness and Cancellation Programs

Federal unsubsidized Stafford loans, while offering crucial access to higher education, can leave borrowers with substantial debt. Fortunately, several government programs exist to alleviate this burden through loan forgiveness or cancellation. Understanding these programs is vital for borrowers seeking to reduce or eliminate their debt. These programs often have specific eligibility criteria and limitations, so careful consideration is essential.

Public Service Loan Forgiveness (PSLF) Program

The Public Service Loan Forgiveness (PSLF) program offers complete forgiveness of your remaining federal student loan debt after 120 qualifying monthly payments under an income-driven repayment plan while working full-time for a qualifying government or non-profit organization. Eligibility requires employment by a qualifying employer and consistent payments on a qualifying repayment plan. The program’s benefit is the complete elimination of student loan debt after 10 years of service; however, a significant drawback is the strict adherence required to the program’s rules, including maintaining consistent employment and on-time payments. Examples of qualifying professions include teachers, social workers, and government employees.

Teacher Loan Forgiveness Program

This program provides forgiveness of up to $17,500 on federal student loans for teachers who have completed five years of full-time teaching in a low-income school or educational service agency. To be eligible, teachers must meet specific requirements related to their teaching position and loan type. The benefit is a substantial reduction in loan debt for eligible teachers, but it’s crucial to note the limited amount of forgiveness and the requirement to teach in a designated low-income setting. This program specifically targets educators in underserved communities.

Income-Driven Repayment (IDR) Plans

While not strictly loan forgiveness, Income-Driven Repayment (IDR) plans, such as PAYE, REPAYE, IBR, and ICR, significantly reduce monthly payments based on your income and family size. These plans extend the repayment period, leading to less monthly debt burden but potentially higher overall interest paid over the life of the loan. Eligibility is based on income and family size, making it accessible to borrowers with lower incomes. The benefit is lower monthly payments, improving affordability; however, the drawback is that it increases the total amount of interest paid over the loan’s lifespan. These plans are beneficial for borrowers who anticipate fluctuating incomes or need immediate relief from high monthly payments.

Comparison of Programs

| Program | Forgiveness Amount | Eligibility Requirements | Benefits | Drawbacks |

|---|---|---|---|---|

| PSLF | Full Loan Forgiveness | 120 qualifying payments under IDR plan, qualifying employment | Complete debt elimination | Strict eligibility, lengthy repayment period |

| Teacher Loan Forgiveness | Up to $17,500 | 5 years of teaching in low-income school, qualifying loan type | Significant debt reduction | Limited forgiveness amount, specific employment requirements |

| IDR Plans | No direct forgiveness | Income and family size | Lower monthly payments | Increased total interest paid |

Impact on Credit Score and Financial Health

Taking out federal unsubsidized Stafford loans can significantly impact your financial health, both positively and negatively. While they provide access to crucial education, responsible management is vital to avoid long-term financial strain and protect your credit score. Understanding the potential effects and employing effective strategies is key to navigating this phase successfully.

Managing student loan debt effectively requires a proactive approach. Your credit score is a crucial factor in securing loans, credit cards, and even some jobs. Late or missed payments can severely damage your credit, while consistent on-time payments build positive credit history.

Credit Score Impact

Federal unsubsidized Stafford loans, like other loans, are reported to credit bureaus. On-time payments contribute positively to your credit score, demonstrating responsible borrowing behavior. Conversely, missed or late payments will negatively impact your credit score, potentially leading to higher interest rates on future loans and impacting your ability to secure favorable financial products. The impact depends on factors like the severity and duration of payment issues. For example, consistently making on-time payments for several years will build a strong credit history, while multiple late payments can significantly lower your score. Credit scores are typically measured on a scale, and a drop of even a few points can have implications.

Strategies for Effective Debt Management

Creating a comprehensive budget and sticking to it is crucial for successful loan repayment. This involves carefully tracking income and expenses, identifying areas for potential savings, and allocating a specific amount towards loan repayment each month. Prioritizing loan repayment, even with a tight budget, can minimize interest accumulation and accelerate the repayment process. Exploring different repayment plans, such as income-driven repayment, can also provide flexibility and potentially lower monthly payments. Furthermore, consolidating multiple loans into a single loan can simplify repayment and potentially lower interest rates.

Budgeting and Financial Planning While Repaying Loans

Effective budgeting during loan repayment involves a careful balance between essential expenses and loan payments. Creating a realistic budget necessitates a thorough assessment of your income, expenses, and loan repayment obligations. Prioritizing essential expenses such as housing, food, and transportation, while minimizing discretionary spending, is key. A successful budget incorporates a dedicated line item for loan payments, ensuring timely and consistent repayments. Tracking expenses meticulously allows for identification of areas where spending can be reduced to free up more funds for loan repayment.

Sample Budget

| Income | Amount |

|---|---|

| Monthly Salary | $3000 |

| Expenses | Amount |

| Housing | $1000 |

| Food | $400 |

| Transportation | $200 |

| Utilities | $150 |

| Student Loan Payment | $500 |

| Savings | $250 |

| Other Expenses | $500 |

This sample budget allocates a significant portion of income to student loan repayment while still allowing for essential expenses and savings. The “Other Expenses” category can be further broken down to include specific items and track spending more effectively. Adjusting this budget to reflect your individual income and expenses is crucial for creating a personalized and realistic plan. Remember, this is just a sample; your budget should reflect your specific circumstances.

Comparison with Other Loan Types

Choosing the right student loan is crucial for managing your education costs and future finances. Understanding the differences between various loan options, particularly federal unsubsidized Stafford loans, subsidized Stafford loans, and private student loans, is essential for making an informed decision. This section compares these loan types to highlight their key distinctions and help you determine which best suits your needs.

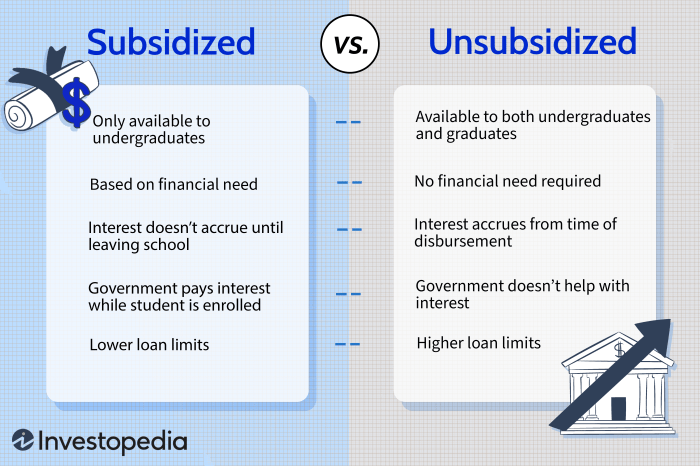

Federal Unsubsidized vs. Subsidized Stafford Loans

The primary difference between unsubsidized and subsidized Stafford loans lies in interest accrual. With unsubsidized loans, interest begins accruing from the moment the loan is disbursed, even while you’re still in school. This means the total amount you owe will be higher by the time you begin repayment. Subsidized Stafford loans, conversely, do not accrue interest while you are enrolled at least half-time in an eligible degree program. This can significantly reduce the overall cost of the loan. Eligibility for subsidized loans is based on financial need, as determined by the Free Application for Federal Student Aid (FAFSA). Unsubsidized loans are generally available to all eligible students, regardless of financial need. Both loan types offer similar repayment options and are subject to federal loan forgiveness programs.

- Unsubsidized Stafford Loans: Advantages include broader eligibility; Disadvantages include interest accruing during school, leading to a potentially higher total repayment amount.

- Subsidized Stafford Loans: Advantages include no interest accrual during school, potentially lower total repayment amount; Disadvantages include stricter eligibility requirements based on financial need.

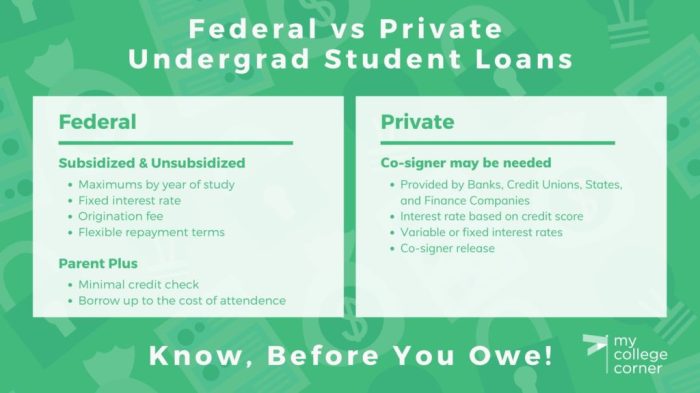

Federal Stafford Loans vs. Private Student Loans

Federal Stafford loans, both subsidized and unsubsidized, offer several advantages over private student loans. Federal loans typically have more flexible repayment options, including income-driven repayment plans and loan forgiveness programs, which are not always available with private loans. Furthermore, federal loans often have fixed interest rates, protecting borrowers from interest rate fluctuations. Private loans, on the other hand, may offer higher interest rates, variable interest rates, and less favorable repayment terms. Eligibility for federal loans is determined by your FAFSA application, while private loan eligibility is based on your creditworthiness and income. Borrowers with poor credit or limited income may find it difficult to secure private student loans or may face significantly higher interest rates.

- Federal Stafford Loans: Advantages include fixed interest rates, flexible repayment options, and government-backed protections; Disadvantages may include lower loan amounts compared to some private loans.

- Private Student Loans: Advantages include potentially higher loan amounts; Disadvantages include higher interest rates (often variable), less flexible repayment options, and potential lack of government protections.

Potential Scams and Misinformation

Navigating the world of student loans can be confusing, and unfortunately, this confusion creates opportunities for scammers. Understanding common scams and misinformation surrounding federal unsubsidized Stafford loans is crucial to protecting your financial well-being. This section will Artikel tactics used by fraudulent actors and provide guidance on how to avoid becoming a victim.

Scammers often prey on students’ anxieties about loan repayment and their lack of experience with financial matters. They employ various methods to deceive borrowers, leading to financial losses and damage to credit scores. Knowing what to look for and how to verify information can help you safeguard yourself against these predatory practices.

Common Scams Targeting Student Loan Borrowers

Several common tactics are used by those perpetrating student loan scams. These include phishing emails that appear to be from the Department of Education or your loan servicer, requesting personal information or login credentials. Another prevalent scam involves fraudulent companies offering loan consolidation or forgiveness services for a fee, often promising unrealistic results. These companies frequently charge hefty upfront fees and fail to deliver on their promises. Finally, some scammers pose as legitimate loan servicers, attempting to collect payments on loans you don’t owe or directing payments to fraudulent accounts.

Identifying and Avoiding Student Loan Scams

Protecting yourself from student loan scams requires vigilance and a healthy dose of skepticism. Never share your personal information, including your Social Security number, student loan details, or banking information, unless you are absolutely certain of the recipient’s legitimacy. Always verify the identity of anyone contacting you about your student loans by contacting your loan servicer directly through official channels listed on their website. Beware of unsolicited emails, phone calls, or text messages that promise quick loan forgiveness or consolidation. Legitimate loan servicers will not solicit personal information in this manner. Furthermore, thoroughly research any company offering student loan services before engaging with them. Check their reputation with the Better Business Bureau and look for reviews from other students.

Red Flags Indicating Potential Scams

Several red flags should immediately raise your suspicion. These include unsolicited offers of loan forgiveness or consolidation that seem too good to be true, high-pressure sales tactics, requests for upfront payments or fees, and communication that is vague, unprofessional, or uses poor grammar. If you receive a communication that makes you feel uncomfortable or unsure, err on the side of caution and do not respond. Instead, contact your loan servicer or the Department of Education directly to verify the information.

Verifying the Legitimacy of Loan Information and Lenders

Verifying the legitimacy of loan information and lenders is essential. Always access your student loan information through the official website of your loan servicer or the National Student Loan Data System (NSLDS). Never rely on information received through unsolicited emails or phone calls. When researching lenders or loan service providers, check their website for contact information, physical addresses, and licensing details. Consult the Better Business Bureau and online review sites to assess their reputation. If you are unsure about the legitimacy of a lender or loan servicer, contact the Department of Education directly for assistance. Remember, if something seems too good to be true, it probably is.

The Role of the Federal Government

The federal government plays a crucial role in the administration and oversight of the Federal Unsubsidized Stafford Loan program, ensuring access to higher education for eligible students while managing the associated financial risks. This involvement stems from a recognition that access to higher education is vital for individual economic advancement and national prosperity.

The government’s primary purpose in participating in student loan programs is to promote educational opportunity and economic growth. By providing a mechanism for students to finance their education, the government helps alleviate the financial burden, enabling more individuals to pursue higher education regardless of their socioeconomic background. This investment in human capital ultimately benefits society through a more skilled and productive workforce.

Government Oversight and Regulation

The federal government establishes and maintains the framework for the Federal Unsubsidized Stafford Loan program. This includes setting eligibility criteria, determining interest rates and fees, and overseeing loan disbursement and repayment processes. Agencies like the Department of Education and its associated loan servicers are responsible for enforcing regulations, ensuring compliance, and managing the overall program. These agencies also monitor lenders to prevent predatory lending practices and protect borrowers’ rights. They handle applications, process loan approvals, and ensure that funds are disbursed correctly to educational institutions. They also manage the default process and work to resolve disputes between borrowers and lenders.

Impact of Government Policies on Student Loan Access and Affordability

Government policies significantly influence student loan access and affordability. For example, changes in interest rates directly impact the cost of borrowing, while modifications to eligibility requirements can affect the number of students who qualify for loans. Government subsidies, such as those offered through subsidized Stafford loans (not the focus here, but relevant for comparison), reduce the overall cost of borrowing, making education more affordable. Conversely, policies that limit loan amounts or increase interest rates can make accessing higher education more challenging. The introduction of income-driven repayment plans has also significantly impacted affordability by aligning monthly payments with borrowers’ income levels. These policies aim to balance the need to provide accessible education with the responsibility of managing the national student loan debt.

Visual Representation of Government Involvement

Imagine an infographic with a central image depicting a student graduating, symbolizing the goal of the program. Flowing into this central image are three distinct pathways representing the key government functions:

Pathway 1: Loan Application and Approval: This pathway starts with a student submitting a loan application. Arrows then show the application moving to the Department of Education for processing, followed by approval (or denial) and the subsequent disbursement of funds to the educational institution.

Pathway 2: Loan Servicing and Repayment: This pathway begins with the disbursement of funds. Arrows illustrate the process of loan servicing by private or government-contracted companies. The pathway continues with arrows representing different repayment options (standard, income-driven, etc.), leading to eventual loan repayment or forgiveness.

Pathway 3: Policy and Regulation: This pathway highlights the role of Congress and the Department of Education in setting policies, establishing regulations, and overseeing the entire process. Arrows indicate the influence of these policy decisions on interest rates, loan amounts, and repayment options, ultimately impacting the pathways above.

The infographic would use clear visual cues, such as different colored arrows and concise text labels, to show the flow of funds and information throughout the entire process, clearly demonstrating the government’s significant role in each stage.

Summary

Securing a college education is a significant investment, and understanding the financial tools available is paramount. Federal Unsubsidized Stafford Loans offer a valuable avenue for funding your studies, but careful consideration of eligibility, interest rates, and repayment plans is essential. By employing sound financial planning and understanding the potential implications, you can leverage these loans to achieve your educational goals while mitigating long-term financial risks. Remember, responsible borrowing and proactive debt management are key to a successful outcome.

Quick FAQs

What happens if I don’t repay my loan?

Failure to repay your loan can lead to negative consequences, including damage to your credit score, wage garnishment, and potential legal action.

Can I refinance my Federal Unsubsidized Stafford Loan?

While you can’t technically refinance a federal student loan with another federal loan, you might consider refinancing with a private lender. However, this often comes with its own set of implications and should be carefully evaluated.

What is the difference between subsidized and unsubsidized Stafford loans?

Subsidized loans don’t accrue interest while you’re in school, whereas unsubsidized loans do. This means you’ll owe more on an unsubsidized loan upon graduation.

How do I apply for a Federal Unsubsidized Stafford Loan?

You apply through the Free Application for Federal Student Aid (FAFSA).

What if my financial situation changes after I’ve taken out the loan?

Contact your loan servicer to discuss options such as deferment or forbearance, which may temporarily suspend or reduce your payments.