Navigating the complex world of federal student loans can feel overwhelming, but understanding the options available is crucial for a successful academic and financial future. This guide delves into the intricacies of federal student loan programs, repayment plans, and the potential long-term impacts of student loan debt, providing essential information for current and prospective borrowers.

From exploring loan forgiveness programs like PSLF and TEPSLF to understanding the nuances of interest rates and repayment options, we aim to demystify the federal student loan system. We’ll examine the rising costs of higher education and the implications of increasing student loan debt on both individuals and the broader economy. Ultimately, this guide seeks to empower you with the knowledge needed to make informed decisions about your student loan journey.

Federal Student Loan Forgiveness Programs

Federal student loan forgiveness programs aim to alleviate the burden of student loan debt for specific borrowers. These programs have evolved over time, responding to changing economic conditions and societal priorities. Understanding their history, eligibility criteria, and benefits is crucial for borrowers seeking debt relief.

History of Federal Student Loan Forgiveness Programs

The history of federal student loan forgiveness is relatively recent. While loan repayment plans have existed for decades, targeted forgiveness programs emerged more prominently in the late 20th and early 21st centuries. Early iterations often focused on specific professions, like teaching, or on borrowers experiencing economic hardship. However, the scale and scope of these programs have expanded significantly in recent years, reflecting a growing awareness of the student loan debt crisis and its impact on individuals and the economy. The creation and expansion of programs like Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness reflect a broader policy shift toward addressing the challenges of higher education affordability. The evolution of these programs has been marked by both successes and controversies, leading to ongoing debates about their effectiveness and long-term sustainability.

Eligibility Requirements for Major Forgiveness Programs

Several federal student loan forgiveness programs exist, each with specific eligibility requirements. Two prominent examples are the Public Service Loan Forgiveness (PSLF) program and the Teacher Loan Forgiveness (TLF) program.

Public Service Loan Forgiveness (PSLF)

PSLF forgives the remaining balance on your Direct Loans after you’ve made 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a government organization or a non-profit organization. Crucially, these payments must be made on time. The type of employment and the repayment plan are subject to strict guidelines. Borrowers must consolidate their federal student loans into a Direct Consolidation Loan to be eligible.

Teacher Loan Forgiveness (TLF)

The TLF program forgives up to $17,500 of your federal student loans if you teach full-time for five complete and consecutive academic years in a low-income school or educational service agency. The definition of “low-income school” is determined by the U.S. Department of Education. This program targets teachers working in underserved communities.

Comparison of Forgiveness Programs

Different forgiveness programs offer varying benefits and drawbacks. While some programs offer substantial debt relief, they often come with stringent eligibility criteria and complex application processes. The potential for forgiveness needs to be weighed against the time commitment and the possibility of ineligibility due to even minor discrepancies in meeting program requirements. For instance, PSLF’s stringent requirements regarding payment plan and employment type have led to lower-than-expected forgiveness rates in the early years of the program. Changes to the program have been implemented to address these challenges, aiming for improved accessibility and clarity.

| Program Name | Eligibility Requirements | Forgiveness Amount | Application Process |

|---|---|---|---|

| Public Service Loan Forgiveness (PSLF) | 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a government or non-profit organization; consolidation into a Direct Consolidation Loan required. | Remaining loan balance | Online application through the Federal Student Aid website. |

| Teacher Loan Forgiveness (TLF) | Five complete and consecutive academic years of full-time teaching at a low-income school or educational service agency. | Up to $17,500 | Online application through the Federal Student Aid website. |

| Income-Driven Repayment (IDR) Plans (with potential forgiveness after 20-25 years) | Specific income and family size requirements; enrollment in a qualifying IDR plan. | Remaining loan balance after 20-25 years of payments | Enrollment in an IDR plan through your loan servicer. |

Interest Rates and Repayment Plans

Understanding federal student loan interest rates and repayment options is crucial for effective long-term financial planning. Choosing the right repayment plan can significantly impact the total cost of your loans and your monthly budget. This section will provide a clear overview of these key factors.

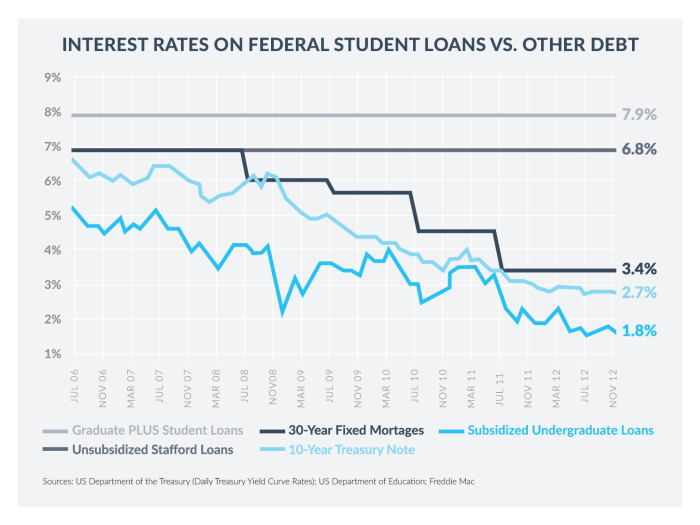

Federal Student Loan Interest Rates

Federal student loan interest rates vary depending on the loan type, the loan disbursement date, and whether the loan is subsidized or unsubsidized. Subsidized loans do not accrue interest while the borrower is enrolled at least half-time in school, during grace periods, and during periods of deferment. Unsubsidized loans accrue interest from the time the loan is disbursed. It’s important to note that interest rates are subject to change each year. Therefore, checking the current rates on the official Federal Student Aid website is recommended before making any decisions. Generally, Direct Subsidized Loans tend to have lower interest rates than Direct Unsubsidized Loans. Graduate PLUS loans typically have higher interest rates than undergraduate loans.

Federal Student Loan Repayment Plan Options

Several repayment plans are available to help borrowers manage their student loan debt. The best option depends on individual financial circumstances and long-term goals. Understanding the implications of each plan is essential for making an informed decision.

Impact of Repayment Plan Choice on Long-Term Loan Costs

The repayment plan selected directly affects the total interest paid over the life of the loan. Shorter repayment periods, like the Standard Repayment Plan, result in higher monthly payments but significantly reduce the total interest paid. Conversely, longer repayment plans, such as Income-Driven Repayment (IDR) plans, result in lower monthly payments but increase the total interest paid over time. Borrowers should carefully weigh the trade-off between affordability and long-term cost. For example, while an IDR plan offers immediate relief by lowering monthly payments, the extended repayment period might mean paying considerably more in interest over the life of the loan.

Sample Loan Repayment Comparison

The following table illustrates the differences in monthly payments, total interest paid, and loan repayment periods for a sample $20,000 loan under various repayment plans. These figures are for illustrative purposes only and actual amounts may vary based on the specific loan terms and interest rate.

| Repayment Plan | Monthly Payment (Estimate) | Total Interest Paid (Estimate) | Loan Repayment Period |

|---|---|---|---|

| Standard 10-Year | $210 | $4,200 | 10 years |

| Graduated 10-Year | Starts at $175, increases over time | $4,200 (approximately) | 10 years |

| Income-Driven (Example – 20 year repayment) | Varies based on income | $8,000 (estimate, significantly higher due to extended repayment) | 20 years |

The Impact of Federal Student Loans on Higher Education

The rising cost of higher education in the United States has created a complex relationship between students, institutions, and the federal government. This reliance on federal student loans to finance college has profound implications for individuals, institutions, and the broader economy. Understanding these impacts is crucial for developing effective policies and strategies to ensure equitable access to higher education.

The cost of attending college, including tuition, fees, room, and board, has increased significantly faster than inflation for several decades. This escalating cost has forced many students to rely heavily on federal student loan programs to cover their educational expenses. Consequently, student loan debt has reached unprecedented levels, impacting the financial well-being of millions of Americans and influencing broader economic trends.

Rising Costs of Higher Education and Increased Reliance on Student Loans

Data from the College Board consistently shows a dramatic increase in tuition and fees at both public and private institutions. For example, the average tuition and fees at four-year public colleges increased by over 150% between 1980 and 2020, far exceeding the rate of inflation during that period. This rise in costs has been accompanied by a parallel increase in the number of students borrowing money to finance their education. The Federal Reserve reports a significant growth in outstanding student loan debt, exceeding trillions of dollars. This reliance on borrowing demonstrates the growing affordability gap in higher education.

Student Loan Debt and Post-Graduation Employment Prospects

High levels of student loan debt can significantly impact post-graduation employment prospects. Graduates burdened with substantial debt may be less likely to pursue lower-paying jobs in fields like social work or the arts, even if those fields align with their passions. The pressure to repay loans quickly can lead graduates to accept higher-paying but potentially less fulfilling jobs. Furthermore, the weight of debt can create stress and anxiety, potentially affecting job performance and career advancement. Studies have shown a correlation between high student loan debt and delayed major life decisions such as homeownership and starting a family.

Societal Impacts of High Student Loan Debt Levels

The high levels of student loan debt in the United States have far-reaching societal impacts. The burden of repayment can delay or prevent individuals from making significant life investments, such as purchasing a home, starting a family, or investing in retirement. This can have a ripple effect on the economy, impacting consumer spending and overall economic growth. Moreover, the concentration of student loan debt among younger generations could potentially strain social safety nets and increase income inequality. The long-term effects on economic mobility and social stability are significant concerns.

Potential Long-Term Effects of High Student Loan Debt

The following points illustrate the potential long-term effects of high student loan debt on individuals and the economy:

- Reduced Consumer Spending: Significant loan repayments can restrict disposable income, leading to decreased consumer spending and hindering economic growth.

- Delayed Homeownership: High debt burdens can make it difficult for young adults to save for a down payment and secure a mortgage, impacting housing market dynamics.

- Lower Retirement Savings: Repaying student loans often leaves less money available for retirement savings, potentially leading to financial insecurity in later life.

- Increased Income Inequality: The disproportionate impact of student loan debt on lower-income individuals can exacerbate existing income inequality.

- Limited Career Choices: The pressure to repay loans can influence career choices, potentially leading individuals away from public service or lower-paying but fulfilling careers.

- Strain on Social Safety Nets: As more individuals struggle with student loan debt, the demand for government assistance programs could increase, putting a strain on social safety nets.

Navigating the Federal Student Loan System

The federal student loan system, while offering crucial access to higher education, can feel complex. Understanding the application process, repayment options, and available resources is key to successful loan management and avoiding financial hardship. This section provides a practical guide to navigating this system effectively.

Applying for Federal Student Loans

The application process for federal student loans begins with completing the Free Application for Federal Student Aid (FAFSA). This form collects information about your financial situation and is used to determine your eligibility for federal student aid, including loans, grants, and work-study programs. After submitting the FAFSA, your school will use this information to create a financial aid award letter outlining the types and amounts of aid you’re offered. You then accept or decline the offered loans through your school’s financial aid portal. The funds are then disbursed directly to your school to cover tuition, fees, and other eligible expenses.

Managing and Repaying Federal Student Loans

Managing your federal student loans involves staying organized and actively engaging with your loan servicer. Your loan servicer is the company responsible for collecting your payments and providing customer service. You can access your loan information, make payments, and update your contact information through your servicer’s online portal or by phone. It’s crucial to keep track of your loan balances, interest rates, and repayment schedule. Understanding your repayment plan is vital for budgeting and avoiding delinquency. Missed payments can negatively impact your credit score and potentially lead to collection actions.

Resources for Borrowers Facing Repayment Difficulties

Federal student loan programs offer several options for borrowers struggling to make their payments. Deferment temporarily postpones your payments, often due to specific circumstances like unemployment or enrollment in school. Forbearance also postpones payments but doesn’t necessarily suspend interest accrual. Income-driven repayment plans adjust your monthly payments based on your income and family size, making them more manageable for borrowers with lower incomes. These plans often extend the loan repayment period. Contacting your loan servicer early to discuss your financial challenges is crucial to explore these options and avoid default.

Exploring Repayment Options and Consolidating Loans

Navigating the various repayment options and the possibility of loan consolidation can be daunting. Here’s a step-by-step guide:

- Understand Your Loans: Gather information about each loan’s interest rate, balance, and repayment schedule. This provides a clear picture of your overall debt.

- Explore Repayment Plans: The federal government offers several repayment plans, including standard, graduated, extended, and income-driven plans. Each plan has different terms and conditions; choose the one that best fits your financial situation. Consider factors such as monthly payment amount, total interest paid, and loan repayment period.

- Consider Loan Consolidation: Consolidating your loans combines multiple federal student loans into a single loan with a new interest rate and repayment schedule. This can simplify repayment, but it’s crucial to understand the implications of the new interest rate. A higher interest rate could result in paying more interest over the life of the loan. Consider whether the simplification outweighs the potential cost.

- Contact Your Loan Servicer: Discuss your options with your loan servicer. They can provide personalized guidance based on your specific circumstances and help you choose the most suitable repayment plan or consolidation option.

Choosing the right repayment plan is crucial for long-term financial well-being. Carefully weigh the pros and cons of each option before making a decision.

Federal Student Loan Default and its Consequences

Defaulting on federal student loans carries significant and lasting negative consequences that extend far beyond simply owing the money. These consequences can severely impact your credit score, financial stability, and even your future employment opportunities. Understanding these repercussions is crucial for borrowers to prioritize responsible loan management.

Defaulting on a federal student loan triggers a series of actions by the government to recover the debt. These actions can have a profound and long-term impact on a borrower’s financial well-being.

Consequences of Federal Student Loan Default

The consequences of defaulting on federal student loans are severe and multifaceted. They include wage garnishment, where a portion of your paycheck is automatically seized to pay the debt. Your tax refunds can also be offset, meaning the government intercepts your refund to apply it to your outstanding loan balance. Furthermore, default significantly damages your credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future. This negative impact on credit can persist for years, even after the debt is resolved. Additionally, certain federal benefits and opportunities, such as professional licenses or federal employment, may be jeopardized.

Loan Rehabilitation

Loan rehabilitation is a process that allows borrowers to restore their defaulted federal student loans to good standing. This process involves making nine on-time, consecutive monthly payments, typically of a smaller, affordable amount determined through an income-driven repayment plan. Once these payments are completed, the default is removed from the borrower’s credit report, and the loan is reinstated to its original terms. However, it’s important to note that any accrued interest during the default period will still need to be paid. The rehabilitation process requires active participation and commitment from the borrower. It is not an automatic process and needs to be initiated and maintained by the borrower.

Resources for Borrowers Facing Loan Default

Several resources are available to assist borrowers facing loan default. The National Student Loan Data System (NSLDS) provides a central location to view your loan information and contact your loan servicer. Your loan servicer can provide personalized guidance and explore potential repayment options, including income-driven repayment plans and deferment or forbearance options. Additionally, non-profit credit counseling agencies offer free or low-cost financial guidance and can help you develop a budget and manage your debt effectively. These agencies can also assist you in navigating the complexities of loan rehabilitation and other repayment options.

Illustrative Scenario of Loan Default

Consider Sarah, a recent college graduate with $30,000 in federal student loans. Due to unexpected job loss and medical expenses, she falls behind on her loan payments. After several missed payments, her loans enter default. Her credit score plummets, impacting her ability to secure a new apartment or obtain a car loan. The government begins wage garnishment, seizing a significant portion of her already limited income. She also loses her tax refund for the year. The financial strain leads to further stress and difficulty in managing her daily expenses. Eventually, Sarah seeks help from a non-profit credit counseling agency. They assist her in enrolling in an income-driven repayment plan and navigating the loan rehabilitation process, allowing her to eventually regain financial stability, although it takes considerable time and effort to recover from the default. The long-term financial consequences, including the damage to her credit history, will continue to impact her for many years.

Last Recap

Successfully managing federal student loans requires careful planning and a proactive approach. By understanding the various programs, repayment options, and potential consequences of default, borrowers can make strategic choices that minimize long-term financial burdens. This guide serves as a starting point for your research; remember to consult official government resources and financial advisors for personalized guidance tailored to your unique circumstances.

FAQ Summary

What happens if I miss a student loan payment?

Missing payments can lead to late fees, damage your credit score, and eventually, default. Contact your loan servicer immediately if you anticipate difficulties making payments to explore options like deferment or forbearance.

Can I consolidate multiple federal student loans?

Yes, you can consolidate multiple federal student loans into a single loan with a new interest rate and repayment plan. This can simplify repayment but may not always lower your overall interest paid.

How do I find my loan servicer?

You can locate your loan servicer through the National Student Loan Data System (NSLDS) website or by contacting the Federal Student Aid office.

What is the difference between deferment and forbearance?

Deferment temporarily postpones payments and may or may not accrue interest, depending on the type of deferment. Forbearance temporarily reduces or suspends payments, but interest usually continues to accrue.