Navigating the complex world of federal student loans can feel overwhelming. From understanding repayment plans and interest rates to exploring forgiveness programs and avoiding default, the journey requires careful planning and a solid grasp of the system. This guide provides a comprehensive overview, demystifying the process and empowering you to make informed decisions about your federal student loan debt.

We’ll delve into the history of federal student loan programs, examining their impact on higher education access and the broader economy. We’ll explore various repayment options, highlighting their advantages and disadvantages, and offering strategies for managing your debt effectively. We’ll also address the serious consequences of default and provide resources for those struggling to repay their loans.

Student Loan Forgiveness Programs

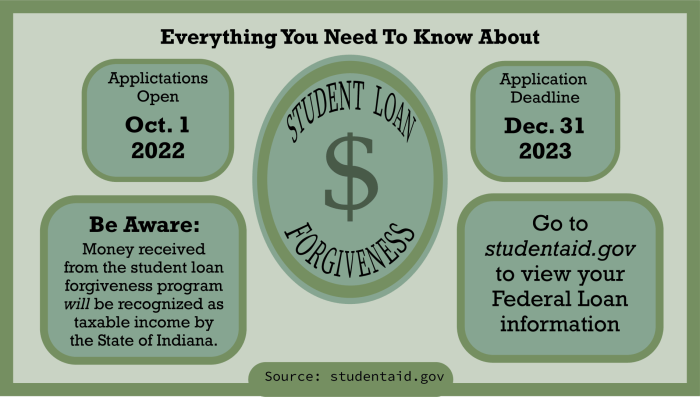

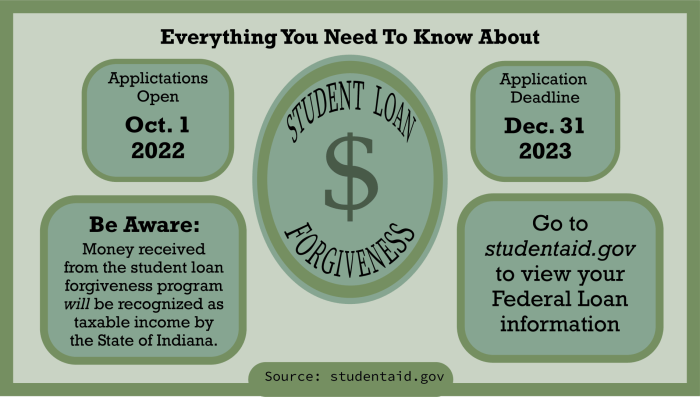

Federal student loan forgiveness programs aim to alleviate the burden of student debt for eligible borrowers. These programs have evolved over time, reflecting changing economic conditions and priorities. Understanding the nuances of each program is crucial for borrowers seeking relief.

History of Federal Student Loan Forgiveness Programs

The history of federal student loan forgiveness is relatively recent. While various forms of student aid existed prior, targeted forgiveness programs emerged more prominently in the late 20th and early 21st centuries. Early programs often focused on specific professions, such as teaching or public service, incentivizing individuals to pursue careers deemed crucial to the nation. More comprehensive income-driven repayment (IDR) plans, leading to potential forgiveness after a set period, gained traction later, reflecting a growing awareness of the challenges faced by borrowers struggling with high debt levels. The specifics of these programs have changed frequently, with modifications and expansions based on legislative action and evolving economic situations. For example, the Public Service Loan Forgiveness (PSLF) program has undergone several revisions since its inception.

Eligibility Criteria for Different Forgiveness Programs

Eligibility criteria vary significantly across different student loan forgiveness programs. For instance, the Public Service Loan Forgiveness (PSLF) program requires borrowers to work full-time for a qualifying government or non-profit organization and make 120 qualifying monthly payments under an income-driven repayment plan. Teacher Loan Forgiveness programs typically require a minimum number of years of teaching in a low-income school or educational service agency. Other programs, such as the Income-Driven Repayment (IDR) plans themselves, offer forgiveness after a certain number of years of payments, based on the borrower’s income and loan amount. Careful review of each program’s specific requirements is essential, as even minor discrepancies can disqualify a borrower.

Comparison of Student Loan Forgiveness Program Options

Several federal student loan forgiveness programs exist, each with its own set of advantages and disadvantages. The PSLF program, for example, offers complete loan forgiveness after 120 qualifying payments, but its stringent requirements can be challenging to meet. IDR plans, while offering forgiveness after a longer period (typically 20 or 25 years), provide more flexibility in repayment amounts based on income. Teacher Loan Forgiveness offers a more targeted approach, but the eligibility criteria are specific and might not be applicable to all teachers. The best option for a borrower depends on their individual circumstances, including their career path, income level, and loan amount.

Applying for Student Loan Forgiveness: A Step-by-Step Guide

Applying for student loan forgiveness typically involves several steps. First, determine your eligibility for the specific program you’re interested in. Second, carefully review all program requirements. Third, gather all necessary documentation, such as employment verification, tax returns, and loan information. Fourth, complete the application process, which may involve online forms or contacting your loan servicer. Fifth, track your application’s progress and address any requests for additional information promptly. It’s important to maintain meticulous records throughout the entire process, as proving eligibility can be complex. Many programs have specific deadlines and procedures that must be followed precisely.

Income-Driven Repayment Plans and Forgiveness Programs: A Comparison

| Plan/Program | Eligibility | Payment Calculation | Forgiveness Timeline |

|---|---|---|---|

| Income-Based Repayment (IBR) | Federal student loans | Based on income and family size | 20 or 25 years |

| Pay As You Earn (PAYE) | Federal student loans | Based on income and family size | 20 years |

| Revised Pay As You Earn (REPAYE) | Federal student loans | Based on income and family size | 20 or 25 years |

| Public Service Loan Forgiveness (PSLF) | Federal student loans, public service employment | Typically under an IDR plan | 120 qualifying payments |

Interest Rates and Repayment Plans

Understanding federal student loan interest rates and repayment plans is crucial for effective debt management. The right plan can significantly impact your monthly payments and overall loan cost. Choosing wisely requires careful consideration of your financial situation and long-term goals.

Factors Influencing Federal Student Loan Interest Rates

Several factors determine the interest rate applied to your federal student loan. These rates are not fixed and can vary depending on the loan type, the loan’s disbursement date, and prevailing market conditions. Subsidized loans, typically for undergraduate students demonstrating financial need, may have lower rates than unsubsidized loans. Graduate and professional student loans generally have higher rates than undergraduate loans. The interest rate is fixed for the life of the loan, meaning it won’t change after the loan is disbursed. For example, a subsidized Stafford loan disbursed in 2023 might have a different interest rate than one disbursed in 2024, reflecting changes in the market.

Federal Student Loan Repayment Plan Options

Borrowers have several repayment plan options to choose from, each with its own advantages and disadvantages. Selecting the best plan depends on individual circumstances, income, and debt load. The plans differ primarily in their payment amounts and loan repayment periods.

Standard Repayment Plan

This is the default plan, offering a fixed monthly payment over a 10-year period.

- Advantage: Shortest repayment period, leading to lower overall interest costs.

- Disadvantage: Higher monthly payments can be challenging for some borrowers.

For example, a $30,000 loan at 5% interest would have a monthly payment of approximately $317 under the standard plan. The total interest paid would be around $7,000.

Extended Repayment Plan

This plan stretches repayments over a longer period, resulting in lower monthly payments. The repayment period is determined by the loan balance, ranging from 12 to 30 years.

- Advantage: Lower monthly payments make repayment more manageable.

- Disadvantage: Significantly higher total interest paid over the life of the loan.

Using the same $30,000 loan example, a 20-year extended repayment plan would reduce the monthly payment but increase the total interest paid to approximately $14,000.

Graduated Repayment Plan

This plan starts with lower monthly payments that gradually increase over time.

- Advantage: Easier to manage payments initially, helpful for borrowers anticipating income increases.

- Disadvantage: Payments become progressively larger, potentially making repayment difficult later on.

The initial payments under this plan are lower than the standard plan, but the total interest paid will still be higher.

Income-Driven Repayment (IDR) Plans

These plans base monthly payments on your income and family size. Several IDR plans exist, including Revised Pay As You Earn (REPAYE), Income-Based Repayment (IBR), Income-Contingent Repayment (ICR), and Pay As You Earn (PAYE).

- Advantage: Affordable monthly payments, potentially leading to loan forgiveness after 20 or 25 years depending on the plan.

- Disadvantage: Longer repayment periods result in significantly higher total interest paid, and loan forgiveness might be subject to tax implications.

For a borrower with a low income, an IDR plan might result in very low monthly payments, but the total repayment period could be extended to 25 years, significantly increasing the total interest paid.

Choosing a Repayment Plan: A Flowchart

The following flowchart illustrates the decision-making process for selecting a repayment plan:

[Imagine a flowchart here. The flowchart would start with a question: “What is your financial situation and repayment goals?”. Branches would lead to different plan options based on answers such as “High income, prioritize quick repayment” (Standard Repayment), “Low income, need affordable payments” (IDR Plan), “Moderate income, manageable payments” (Extended Repayment), “Anticipate income increase” (Graduated Repayment). Each branch would eventually lead to a final decision box indicating the selected repayment plan.]

Default and its Consequences

Defaulting on your federal student loans is a serious matter with significant repercussions. It occurs when you fail to make your loan payments for a specific period, typically 270 days (nine months) after your loan enters repayment. This process can negatively impact your credit score and financial future, making it crucial to understand the implications and available resources.

The Student Loan Default Process

The process begins when you miss several loan payments. Your loan servicer will initially contact you, offering options like forbearance or deferment to help you get back on track. If these attempts are unsuccessful, your loan will eventually be certified in default. This means the entire loan balance becomes immediately due and payable. The Department of Education then typically refers the debt to a collection agency, and further actions are taken to recover the funds. The exact timeline can vary depending on the loan type and servicer.

Consequences of Defaulting on Federal Student Loans

The consequences of default are far-reaching and can severely impact your financial well-being. Your credit score will suffer significantly, making it difficult to obtain loans, credit cards, or even rent an apartment. Wage garnishment is a possibility, where a portion of your paycheck is automatically deducted to repay the debt. Tax refunds can also be seized to cover the outstanding balance. Furthermore, default can affect your ability to obtain federal financial aid in the future, impacting any educational goals for yourself or your dependents. In some cases, your professional licenses may be jeopardized.

Options Available to Borrowers Facing Default

Several options exist for borrowers facing default, although they may require immediate action. Rehabilitation is one option, where you make a series of on-time payments to reinstate your loan in good standing. Loan consolidation can simplify your repayment process by combining multiple loans into a single one with potentially more manageable terms. Income-driven repayment plans may reduce your monthly payment based on your income and family size, making them more affordable and preventing default. Finally, exploring options like a hardship discharge or total and permanent disability discharge may be possible in certain situations, but this requires documentation and meeting specific eligibility criteria.

Strategies for Avoiding Student Loan Default

Proactive planning is key to avoiding default. Creating a realistic budget that prioritizes loan payments is crucial. Contacting your loan servicer immediately if you anticipate difficulties making payments allows for exploring options like deferment or forbearance before default occurs. Considering income-driven repayment plans early on can prevent payments from becoming overwhelming. Regularly reviewing your loan details and understanding your repayment schedule are also vital preventative measures. Seeking financial counseling from a non-profit credit counseling agency can provide personalized guidance and support.

Resources for Borrowers Struggling with Repayment

Several resources can assist borrowers struggling with repayment. The Federal Student Aid website (studentaid.gov) offers comprehensive information on repayment options, default prevention strategies, and available resources. The National Foundation for Credit Counseling (NFCC) provides free or low-cost credit counseling services to help borrowers manage their debt. Local non-profit organizations and community colleges often offer free financial literacy workshops and individual counseling sessions. Finally, contacting your loan servicer directly to discuss your options is a crucial first step.

The Impact of Federal Student Loans on the Economy

Federal student loans play a crucial role in financing higher education, enabling millions of Americans to pursue post-secondary degrees and contribute to the workforce. However, the ever-increasing burden of student loan debt also presents significant economic challenges for individuals, families, and the nation as a whole. This section examines the multifaceted impact of federal student loans on the economy.

Federal Student Loans and Higher Education Access

Federal student loan programs significantly expand access to higher education. Without these programs, many individuals from low- and middle-income families would lack the financial resources to attend college or pursue advanced degrees. This increased access contributes to a more skilled and educated workforce, fostering economic growth and innovation. The availability of federal loans allows individuals to invest in their human capital, ultimately increasing their earning potential and contributing to the overall tax base.

Economic Impact of Student Loan Debt on Individuals and Families

The accumulation of student loan debt significantly impacts individuals and families’ financial well-being. High levels of debt can delay major life decisions such as homeownership, starting a family, and saving for retirement. Borrowers often face financial strain, limiting their ability to invest in other areas crucial for long-term economic security. This can lead to reduced consumer spending and overall economic activity. Furthermore, the psychological burden of significant debt can affect mental health and overall quality of life.

Student Loan Debt Levels and Trends

The total amount of student loan debt outstanding in the United States has grown dramatically over the past few decades. Statistics consistently show a steady upward trend, reaching trillions of dollars. This growth reflects rising tuition costs, increased borrowing by students, and changes in loan repayment programs. For example, the average student loan debt for a graduating class in 2023 is significantly higher than that of a graduating class in 2003, highlighting the accelerating trend. These figures are readily available from sources like the Federal Reserve and the Department of Education.

Potential Long-Term Effects of High Student Loan Debt

The long-term consequences of high student loan debt extend beyond individual financial hardship. Persistent high levels of debt can negatively impact economic growth by reducing consumer spending, hindering entrepreneurship, and slowing overall economic activity. Furthermore, the burden of student loan debt disproportionately affects certain demographics, exacerbating existing economic inequalities. This can lead to reduced social mobility and hinder long-term economic prosperity for the nation. The potential for widespread loan defaults also poses a systemic risk to the financial system.

Visual Representation of Student Loan Debt Growth

Imagine a line graph. The horizontal axis represents time, spanning several decades. The vertical axis represents the total amount of student loan debt in trillions of dollars. The line starts relatively low at the beginning of the graph, representing the lower levels of student loan debt in the past. As the graph progresses towards the present day, the line steadily and steeply increases, illustrating the dramatic growth in student loan debt over time. The slope of the line becomes increasingly steep in more recent years, highlighting the accelerating pace of this growth.

Navigating the Federal Student Loan System

The federal student loan system can seem daunting, but understanding its intricacies is crucial for responsible borrowing and repayment. This guide provides a comprehensive overview of the system, helping you navigate the process from application to repayment. Familiarizing yourself with the different loan types, application procedures, and online account management tools will empower you to make informed decisions about your education financing.

Types of Federal Student Loans

Federal student loans are categorized into several types, each with its own eligibility requirements and repayment terms. Understanding these differences is vital for choosing the most appropriate loan for your individual circumstances. The main categories include subsidized and unsubsidized loans, which differ primarily in whether interest accrues while you’re in school, and PLUS loans, designed for graduate students and parents of undergraduate students. There are also Perkins Loans, a need-based loan program with particularly favorable interest rates, though availability may be limited. Each loan type has specific criteria for eligibility and repayment schedules.

The Federal Student Loan Application Process

Applying for federal student loans involves completing the Free Application for Federal Student Aid (FAFSA). This application gathers information about your financial situation to determine your eligibility for federal student aid, including grants, scholarships, and loans. The FAFSA is typically completed online and requires information such as your Social Security number, tax information, and your parents’ financial information (if you are a dependent student). After submitting the FAFSA, your school will receive your Student Aid Report (SAR), which Artikels your eligibility for federal student aid. You will then work with your school’s financial aid office to complete the loan process.

Common Misconceptions about Federal Student Loans

Several misconceptions surround federal student loans. One common misconception is that all federal student loans have the same interest rates and repayment terms. In reality, interest rates and repayment plans vary depending on the loan type and the year the loan was disbursed. Another misconception is that federal student loans are always easy to obtain. While generally more accessible than private loans, eligibility still depends on factors like credit history (for PLUS loans) and demonstrated financial need. Finally, some believe that defaulting on a federal student loan has minimal consequences. However, defaulting can lead to significant financial repercussions, including damage to your credit score, wage garnishment, and tax refund offset.

Accessing and Managing Federal Student Loan Accounts Online

Managing your federal student loans is simplified through online account access. The National Student Loan Data System (NSLDS) provides a central location to view your federal student loan information, regardless of your lender. Through the NSLDS website, you can access details about your loan balances, interest rates, repayment plans, and payment history. You can also consolidate multiple loans into a single loan, and explore various repayment options. Many loan servicers also provide their own online portals, offering additional features such as making payments and modifying your repayment plan. Regularly reviewing your account information ensures you stay informed about your loan status and make timely payments.

Student Loan Consolidation and Refinancing

Managing multiple student loans can feel overwhelming. Consolidation and refinancing offer potential solutions to simplify repayment and potentially lower your monthly payments. However, it’s crucial to understand the nuances of each option before making a decision. Both strategies aim to streamline your loan payments, but they differ significantly in their mechanisms and implications.

Student loan consolidation and refinancing are distinct processes with different goals and outcomes. Consolidation involves combining multiple federal student loans into a single loan with a new repayment plan. Refinancing, on the other hand, replaces your existing loans—federal or private—with a new private loan. This often comes with a lower interest rate, but it means losing the benefits of federal loan programs.

Federal Student Loan Consolidation

Federal student loan consolidation simplifies repayment by combining multiple federal loans into one. This results in a single monthly payment, making budgeting easier. The interest rate on the consolidated loan is a weighted average of the rates of your original loans, rounded up to the nearest one-eighth of a percent. While you won’t necessarily lower your interest rate, the convenience of a single payment and the potential for an income-driven repayment plan can be beneficial. Consolidation also maintains eligibility for federal repayment programs like income-driven repayment plans and deferment or forbearance options.

Private Student Loan Refinancing

Private student loan refinancing replaces your existing federal or private loans with a new private loan from a bank or credit union. A key advantage is the potential for a lower interest rate, especially if your credit score has improved since you took out your original loans. However, refinancing federal loans with a private lender means losing access to federal benefits like income-driven repayment plans, deferment, and forbearance. This could be risky if you experience financial hardship in the future. It’s essential to carefully weigh the potential interest savings against the loss of federal protections.

The Process of Consolidating or Refinancing Federal Student Loans

Consolidating federal student loans is relatively straightforward. You can apply online through the Federal Student Aid website. The process involves providing information about your existing loans and choosing a repayment plan. Refinancing, however, involves applying through a private lender. This process typically includes a credit check and requires providing financial documentation. Lenders will assess your creditworthiness and offer a rate based on your individual circumstances. The specific requirements and documentation needed will vary depending on the lender.

Situations Where Consolidation or Refinancing Might Be Beneficial

Consolidation is beneficial for borrowers with multiple federal loans seeking simplified repayment and potentially accessing income-driven repayment plans. Refinancing might be beneficial for borrowers with good credit who want to lower their interest rate, potentially saving money over the life of the loan. However, it’s crucial to remember that refinancing federal loans eliminates federal protections. Consider refinancing only if you’re confident in your ability to consistently make payments even in unforeseen circumstances.

Factors to Consider Before Consolidating or Refinancing Loans

Before making a decision, carefully consider these factors:

It is crucial to weigh the potential benefits against the risks associated with each option. A thorough understanding of your financial situation and future goals is essential before proceeding.

- Current interest rates: Compare your current interest rates with the offered rates for consolidation or refinancing.

- Credit score: Your credit score significantly impacts the interest rate you’ll receive for refinancing.

- Loan terms: Examine the length of the repayment period and the total interest paid under different options.

- Federal loan benefits: Refinancing federal loans eliminates access to federal repayment programs and protections.

- Fees: Check for any associated fees with consolidation or refinancing.

- Financial stability: Assess your ability to consistently make payments under the new loan terms.

Closing Summary

Successfully managing federal student loan debt requires proactive planning and a thorough understanding of the available resources. By understanding the intricacies of repayment plans, forgiveness programs, and the potential consequences of default, you can develop a personalized strategy to minimize your debt burden and achieve financial stability. Remember to utilize the available resources and seek professional advice when needed. Your financial future depends on it.

Query Resolution

What happens if I can’t make my student loan payments?

Contact your loan servicer immediately. They can help you explore options like deferment, forbearance, or income-driven repayment plans to avoid default.

Can I consolidate my federal student loans?

Yes, federal student loan consolidation combines multiple loans into a single loan with a new interest rate and repayment schedule. This can simplify payments but may not always reduce your overall cost.

What is the difference between deferment and forbearance?

Deferment temporarily suspends your payments, and under certain circumstances, interest may not accrue. Forbearance also temporarily suspends payments, but interest usually continues to accrue.

How do I find my federal student loan servicer?

You can find your servicer’s contact information on the National Student Loan Data System (NSLDS) website.