Navigating the complex landscape of federal student loans can feel overwhelming. This guide provides a clear and concise overview of federal student loan programs, repayment options, and borrower rights. We’ll explore the historical context, current challenges, and potential future changes impacting millions of borrowers. Understanding these intricacies is crucial for responsible financial planning and securing a brighter financial future.

From the initial application process to long-term repayment strategies, we aim to demystify the process and empower you with the knowledge to make informed decisions. We’ll cover various forgiveness programs, interest rate structures, and the significant economic impact of student loan debt. This guide is designed to be your comprehensive resource for all things related to federal student loans.

Federal Student Loan Forgiveness Programs

Federal student loan forgiveness programs aim to alleviate the burden of student loan debt for eligible borrowers. These programs have evolved over time, reflecting changing economic conditions and policy priorities. Understanding the nuances of each program is crucial for borrowers seeking debt relief.

History of Federal Student Loan Forgiveness Programs

Early forms of student loan forgiveness were limited and often tied to specific professions, such as teaching or public service. The modern era of broader forgiveness programs began to take shape in the late 20th and early 21st centuries, driven by growing concerns about student loan debt levels and the desire to incentivize service in critical sectors. The expansion of income-driven repayment (IDR) plans and the creation of programs like Public Service Loan Forgiveness (PSLF) represent significant milestones in this evolution. However, the accessibility and effectiveness of these programs have been subject to ongoing debate and revisions.

Public Service Loan Forgiveness (PSLF) Program

The PSLF program forgives the remaining balance on federal Direct Loans after 120 qualifying monthly payments under an income-driven repayment plan while working full-time for a qualifying government or non-profit organization. Eligibility requires employment by a qualifying employer and consistent on-time payments. The application process involves submitting an employment certification form annually and a PSLF application after making 120 qualifying payments. Borrowers should meticulously document their employment and payment history.

Income-Driven Repayment (IDR) Forgiveness

IDR plans, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE), calculate monthly payments based on income and family size. After a set number of years (typically 20 or 25), any remaining balance may be forgiven. Eligibility hinges on having federal student loans and meeting income requirements. The application process involves enrolling in an IDR plan and making consistent payments. Forgiveness under IDR plans is contingent on meeting specific payment timelines and income thresholds. It’s crucial to understand that forgiven amounts are typically considered taxable income.

Teacher Loan Forgiveness Program

This program provides forgiveness of up to $17,500 on federal student loans for teachers who have completed five consecutive years of full-time teaching in a low-income school or educational service agency. Eligibility requires teaching in a qualifying school, maintaining full-time employment, and completing the required years of service. The application process involves completing a detailed application and providing documentation of employment and loan information.

Comparison of Key Features

| Program | Eligibility Requirements | Payment Requirements | Forgiveness Amount |

|---|---|---|---|

| PSLF | 120 qualifying payments under an IDR plan while employed full-time by a qualifying employer | On-time payments for 10 years | Remaining loan balance |

| IDR Forgiveness (e.g., IBR, PAYE, REPAYE) | Federal student loans and meeting income requirements | Consistent payments for 20 or 25 years | Remaining loan balance (taxable) |

| Teacher Loan Forgiveness | Five consecutive years of full-time teaching in a low-income school or educational service agency | N/A (Forgiveness after 5 years of service) | Up to $17,500 |

Interest Rates and Repayment Plans

Understanding federal student loan interest rates and repayment options is crucial for effective debt management. Borrowers need to carefully consider these factors to make informed decisions about their repayment strategy and minimize long-term costs. This section will provide a comprehensive overview of these key elements.

Historical Overview of Federal Student Loan Interest Rates

Federal student loan interest rates have fluctuated significantly over time, influenced by broader economic conditions and government policies. Historically, rates have been lower during periods of low inflation and economic stability, and higher during times of economic uncertainty or inflation. These rates are not fixed and can change yearly, impacting the overall cost of borrowing. For example, rates were considerably lower in the early 2000s compared to the period following the 2008 financial crisis. Detailed historical data on interest rates is readily available from the U.S. Department of Education and other financial websites.

Interest Rate Comparison Across Loan Types

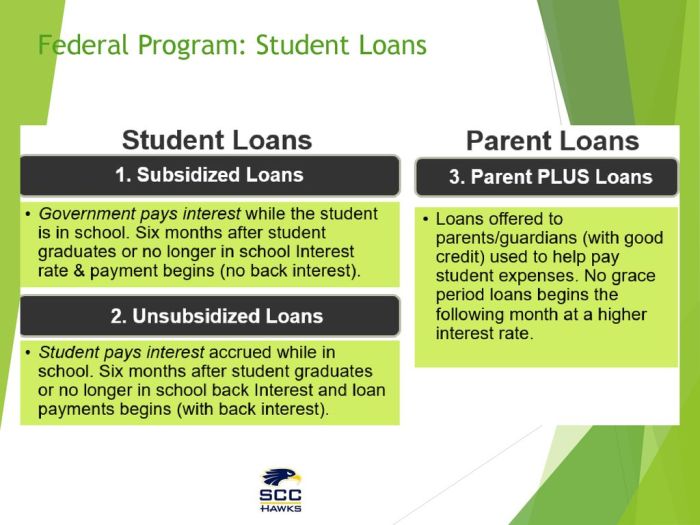

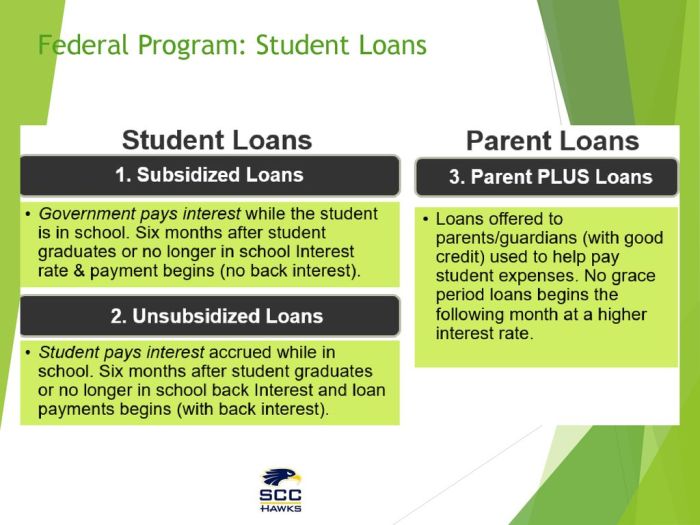

Federal student loans are categorized into several types, each with its own interest rate structure. Subsidized loans typically have lower interest rates than unsubsidized loans because the government pays the interest while the borrower is in school (under certain conditions). Unsubsidized loans accrue interest throughout the entire loan period, increasing the total amount owed. PLUS loans, designed for graduate students and parents of undergraduate students, generally carry higher interest rates than subsidized and unsubsidized loans. The specific interest rate for each loan type is determined at the time the loan is disbursed and can vary depending on the loan year and market conditions.

Federal Student Loan Repayment Plan Options

Several repayment plans are available to federal student loan borrowers, offering varying levels of flexibility and monthly payment amounts. The choice of repayment plan significantly impacts the total interest paid and the overall repayment timeline. Understanding the benefits and drawbacks of each plan is crucial for choosing the most suitable option based on individual financial circumstances.

Standard Repayment Plan

The standard repayment plan is the default option for most federal student loan borrowers. It involves fixed monthly payments over a 10-year period. The benefit is a shorter repayment period, leading to less interest paid overall. However, the monthly payments can be substantial, potentially straining a borrower’s budget, especially in the early stages of their career.

Extended Repayment Plan

This plan extends the repayment period to up to 25 years, resulting in lower monthly payments compared to the standard plan. The benefit is greater affordability, but the extended repayment period leads to significantly higher total interest paid over the life of the loan.

Income-Driven Repayment Plans

Income-driven repayment plans (IDRs) link monthly payments to the borrower’s income and family size. These plans offer significantly lower monthly payments, often making them more manageable for borrowers with lower incomes. However, they typically extend the repayment period beyond 10 years, leading to higher overall interest payments. Specific IDR plans include the Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR) plans, each with slightly different eligibility criteria and payment calculations.

Illustrative Monthly Payment Table

| Loan Amount | Standard Plan (10 years) | Extended Plan (25 years) | Income-Driven Plan (Example – 20 years) |

|---|---|---|---|

| $20,000 | $210 (Example) | $95 (Example) | $100 (Example) |

| $40,000 | $420 (Example) | $190 (Example) | $200 (Example) |

| $60,000 | $630 (Example) | $285 (Example) | $300 (Example) |

Note: These are illustrative examples only. Actual monthly payments will vary depending on the interest rate, loan type, and individual circumstances. Consult the official federal student aid website for accurate payment calculations.

The Impact of Federal Student Loans on the Economy

Federal student loan debt represents a significant segment of the US economy, influencing individual financial well-being and broader economic growth. Understanding its impact requires examining its scale, its effects on personal finances and the economy, and the potential long-term ramifications, alongside the role of government policy in mitigating these effects.

The Scale of Federal Student Loan Debt

As of late 2023, the total amount of outstanding federal student loan debt surpasses $1.7 trillion. This staggering figure represents a substantial portion of the national debt and has significant implications for both borrowers and the economy as a whole. This massive debt burden impacts numerous aspects of the economy, from consumer spending to investment and overall economic growth. The sheer size of this debt necessitates careful consideration of its effects and potential solutions.

The Effect of Student Loan Debt on Personal Finance and Economic Growth

High levels of student loan debt can significantly constrain personal finances. Borrowers often face difficulties in saving for retirement, purchasing homes, starting families, and investing in other ventures. This reduced financial flexibility can hinder consumer spending, a key driver of economic growth. Moreover, the burden of repayment can delay or prevent individuals from pursuing entrepreneurial endeavors, potentially stifling innovation and job creation. The ripple effect of this reduced economic activity is substantial. For example, a recent study indicated that a significant portion of recent graduates delay major life purchases such as homes and cars due to student loan repayments, impacting related industries and overall economic activity.

Potential Long-Term Consequences of High Student Loan Debt

The persistent accumulation of student loan debt presents several potential long-term risks. A prolonged period of high debt levels could lead to decreased consumer confidence and reduced investment, potentially slowing economic growth. Furthermore, it could exacerbate income inequality, as those with higher levels of debt struggle to accumulate wealth compared to their debt-free peers. This disparity could lead to social and political instability in the long run. One potential scenario is a generation burdened by debt struggling to achieve financial independence, impacting future economic productivity and overall societal well-being.

The Role of Government Policies in Managing Student Loan Debt

Government policies play a crucial role in managing student loan debt. These policies encompass various measures, including interest rate adjustments, income-driven repayment plans, and loan forgiveness programs. The effectiveness of these policies in achieving their intended goals is a subject of ongoing debate and research. Government intervention, while aiming to address the problem, can also have unintended consequences, such as moral hazard and potential increases in tuition costs due to perceived safety nets. The delicate balance between supporting borrowers and maintaining fiscal responsibility is a constant challenge for policymakers.

Potential Economic Impacts of Various Loan Forgiveness Scenarios

The potential economic consequences of different student loan forgiveness scenarios are complex and varied. Before listing potential impacts, it’s crucial to understand that the effects are dependent on the specific design of any forgiveness program, including the amount forgiven, eligibility criteria, and the method of implementation.

Considering these caveats, here are some potential economic impacts:

- Increased Consumer Spending: Forgiveness could free up significant disposable income for borrowers, potentially stimulating consumer demand and economic growth.

- Reduced Household Debt: Lower debt burdens could improve household balance sheets, leading to increased financial stability.

- Increased Investment: Freed-up resources might be channeled into investments, boosting economic productivity.

- Potential Inflationary Pressures: A sudden surge in consumer spending could potentially lead to inflationary pressures if the economy is operating near its capacity.

- Fiscal Implications: Large-scale loan forgiveness programs would have significant fiscal implications, requiring increased government spending or tax increases to offset the cost.

- Impact on Future Borrowing: The effects on future borrowing behavior and tuition costs are uncertain and depend on the structure and communication surrounding the forgiveness program.

Borrower Rights and Protections

Federal student loan borrowers are afforded significant rights and protections designed to ensure fair treatment and prevent exploitation. Understanding these rights is crucial for navigating the loan repayment process effectively and resolving any issues that may arise. This section Artikels key borrower protections and resources available to assist in managing federal student loans.

Dispute Resolution with Loan Servicers

Borrowers experiencing difficulties with their loan servicer, such as inaccurate billing, improper account handling, or unsatisfactory customer service, have several avenues for redress. The first step is typically contacting the servicer directly to attempt a resolution. If this proves unsuccessful, borrowers can escalate the complaint through the servicer’s internal complaint process, often detailed on their website. If the issue remains unresolved, borrowers can file a complaint with the Federal Student Aid (FSA) ombudsman, an independent office dedicated to resolving student loan complaints. The FSA ombudsman can investigate the complaint and work to facilitate a resolution between the borrower and the servicer. In some cases, legal action may be an option, although this is generally a last resort.

Options for Borrowers Facing Financial Hardship

Federal student loan programs offer several options for borrowers experiencing financial hardship. These include income-driven repayment plans (IDR), which adjust monthly payments based on income and family size. Deferment and forbearance temporarily postpone payments, offering a breather during periods of unemployment or financial instability. However, it’s important to note that interest may still accrue during deferment or forbearance, potentially increasing the total loan amount owed. Borrowers should carefully weigh the pros and cons of each option and choose the one that best fits their individual circumstances. Contacting your loan servicer to discuss your options is recommended.

Resources for Managing Federal Student Loans

The federal government provides numerous resources to assist borrowers in managing their loans. The Federal Student Aid website (studentaid.gov) offers comprehensive information on loan repayment options, available programs, and answers to frequently asked questions. Additionally, many colleges and universities provide student loan counseling services to help graduates understand their repayment options and develop a repayment plan. Numerous non-profit organizations also offer free or low-cost student loan counseling, providing guidance and support throughout the repayment process. These resources can help borrowers understand their rights, navigate complex repayment options, and avoid potential pitfalls.

Protecting Against Predatory Lending Practices

Borrowers can take proactive steps to protect themselves from predatory lending practices. Understanding the terms and conditions of their loan before signing is crucial. This includes carefully reviewing the interest rate, repayment terms, and any associated fees. Be wary of lenders offering unusually low interest rates or promising unrealistic benefits; these may be signs of a predatory loan. Comparing offers from multiple lenders ensures that borrowers secure the best possible terms. Seeking advice from a trusted financial advisor or counselor can also help borrowers make informed decisions and avoid potentially harmful loans.

- Thoroughly research any lender before borrowing.

- Compare loan offers from multiple lenders.

- Avoid lenders who pressure you into making quick decisions.

- Understand all fees and terms before signing a loan agreement.

- Seek independent financial advice before borrowing.

- Keep detailed records of all loan transactions.

- Report any suspicious activity to the appropriate authorities.

The Future of Federal Student Loans

The federal student loan program faces significant challenges and potential changes in the coming years. The current system, while providing access to higher education for millions, is also grappling with high levels of debt and concerns about affordability and long-term economic impacts. Understanding potential policy shifts and their consequences is crucial for both borrowers and policymakers.

Potential Policy Changes Related to Federal Student Loan Programs

Several policy changes are under consideration to address the student loan debt crisis. These include proposals for income-driven repayment (IDR) plan reforms, loan forgiveness programs targeted at specific demographics or debt levels, and adjustments to interest rates and loan origination fees. Furthermore, discussions are ongoing regarding the potential for increased government funding for grant programs, reducing reliance on loans. Some proposals advocate for simplifying the repayment process and improving borrower communication and support. Others focus on preventative measures, such as promoting greater financial literacy among prospective students and strengthening oversight of higher education institutions.

Potential Impact of Proposed Changes on Borrowers and the Economy

The impact of these policy changes will vary significantly depending on their specific design and implementation. For example, expanded IDR plans could provide immediate relief to struggling borrowers, potentially stimulating consumer spending and boosting economic growth. However, such programs may also increase the overall cost to taxpayers. Conversely, large-scale loan forgiveness initiatives could provide substantial short-term relief to borrowers, but might also lead to inflationary pressures and raise concerns about the long-term sustainability of the federal student loan program. Interest rate adjustments could have a direct impact on borrowers’ monthly payments and the overall cost of borrowing.

Approaches to Addressing the Student Loan Debt Crisis

Different approaches exist for addressing the student loan debt crisis, each with its own set of advantages and disadvantages. One approach focuses on debt relief measures, such as loan forgiveness or income-driven repayment plan improvements. Another approach emphasizes preventative measures, such as increasing financial aid grants, controlling tuition costs, and promoting greater financial literacy. A third approach involves a combination of both, aiming to provide immediate relief while simultaneously implementing long-term reforms to prevent future crises. The optimal approach likely involves a multifaceted strategy tailored to the specific needs of borrowers and the broader economic context.

Examples of Successful Student Loan Programs in Other Countries

Several countries have implemented successful student loan programs that offer valuable lessons for the United States. For example, Australia’s Higher Education Loan Program (HELP) features income-contingent repayments, ensuring that loan repayments are manageable based on borrowers’ income. Germany’s system emphasizes grants over loans, significantly reducing the burden of student debt. These examples demonstrate that alternative models exist and could inform policy decisions in the United States. A comparative analysis of these international models can highlight best practices and identify potential areas for improvement in the US system.

Impact of Policy Proposals on Different Demographics of Borrowers

The following table illustrates how various policy proposals might differentially affect different demographics of borrowers. These are illustrative examples and the actual impact would depend on the specifics of the policy.

| Policy Proposal | High-Income Borrowers | Middle-Income Borrowers | Low-Income Borrowers |

|---|---|---|---|

| Increased Grant Funding | Minimal Impact | Positive Impact (reduced loan burden) | Significant Positive Impact (reduced or eliminated loan burden) |

| Large-Scale Loan Forgiveness | Significant Positive Impact (substantial debt reduction) | Positive Impact (substantial debt reduction) | Significant Positive Impact (potential for complete debt elimination) |

| Income-Driven Repayment Reform | Minimal Impact | Positive Impact (lower monthly payments) | Significant Positive Impact (significantly lower monthly payments) |

| Interest Rate Reduction | Positive Impact (lower interest costs) | Positive Impact (lower interest costs) | Positive Impact (lower interest costs) |

Wrap-Up

Managing federal student loans effectively requires a proactive approach and a thorough understanding of available resources. This guide has provided a framework for navigating the complexities of loan repayment, forgiveness programs, and borrower protections. By utilizing the information presented, individuals can make informed decisions that align with their financial goals and mitigate potential long-term challenges. Remember to proactively engage with your loan servicer and explore all available options to optimize your repayment strategy.

FAQs

What happens if I can’t make my student loan payments?

Contact your loan servicer immediately. They can help you explore options like deferment, forbearance, or income-driven repayment plans to avoid default.

Can I consolidate my federal student loans?

Yes, consolidation combines multiple federal loans into a single loan with a new interest rate and repayment schedule. This can simplify repayment, but it may not always lower your overall cost.

What is the difference between subsidized and unsubsidized loans?

Subsidized loans don’t accrue interest while you’re in school (under certain conditions), while unsubsidized loans do.

How do I find my loan servicer?

You can find your loan servicer’s contact information on the National Student Loan Data System (NSLDS) website.