The Federal Family Education Loan (FFEL) program, a significant chapter in the history of student financing, played a crucial role in helping millions access higher education. Understanding its intricacies, from eligibility requirements to repayment options, is vital for anyone navigating the complexities of student loan debt, even though the program itself is no longer active. This guide delves into the key aspects of FFEL program student loans, providing valuable insights for past and present borrowers alike.

We’ll explore the program’s history, the various loan types offered, and the key players involved. Furthermore, we’ll compare FFEL loans with the current Direct Loan program, highlighting their similarities and differences to provide a clearer understanding of the student loan landscape. Finally, we will offer practical advice and resources to help borrowers effectively manage their FFEL loan repayment.

FFEL Program Overview

The Federal Family Education Loan (FFEL) program played a significant role in financing higher education in the United States for many years. It was a government-backed student loan program that operated differently from the current Direct Loan program. Understanding its history and mechanics is crucial for comprehending the evolution of student financial aid in the country.

The FFEL program’s purpose was to provide affordable access to higher education by offering students various loan options to cover tuition, fees, and living expenses. Unlike the Direct Loan program, where the government directly lends the money, the FFEL program relied on a network of private lenders, guarantors, and the government to facilitate the loan process. This indirect lending model had both advantages and disadvantages, which ultimately contributed to its eventual replacement.

Types of FFEL Program Loans

The FFEL program offered several types of loans, each designed to cater to specific student needs and circumstances. These included subsidized and unsubsidized Stafford Loans, PLUS Loans for parents and graduate students, and Consolidation Loans that allowed borrowers to combine multiple loans into a single payment. Subsidized Stafford Loans offered interest rate subsidies while the borrower was in school, while unsubsidized loans did not. PLUS loans, designed for parents and graduate students, had different eligibility requirements and interest rates. Consolidation loans offered a way to simplify repayment by combining multiple loans into one.

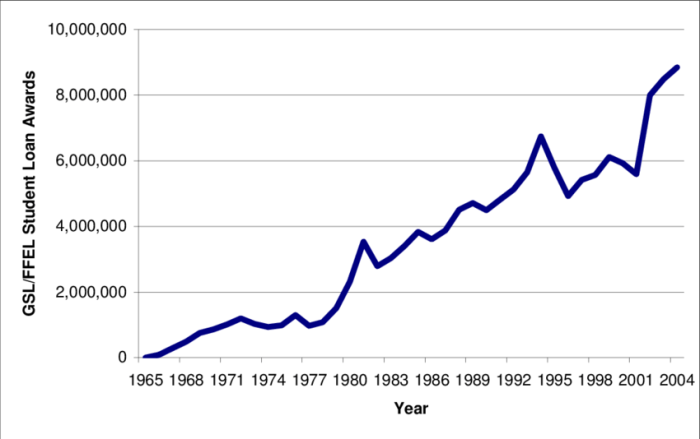

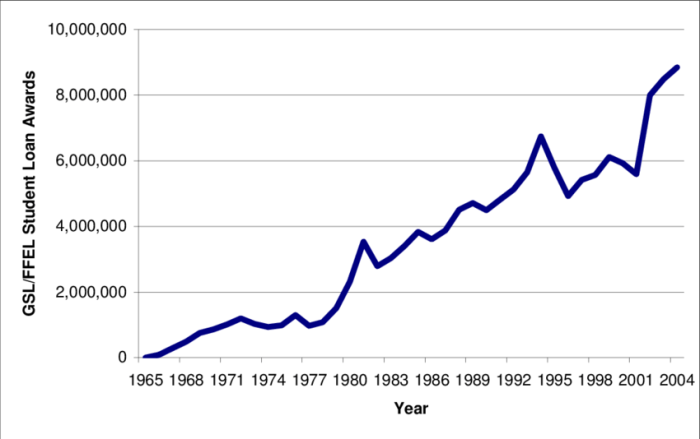

Timeline of Significant Events

The FFEL program’s history spans several decades, marked by periods of expansion, reform, and ultimately, its demise. A key milestone was the establishment of the program itself, followed by periods of growth and legislative changes that altered its structure and funding mechanisms. However, concerns about increasing costs, lender profitability, and program complexity ultimately led to its gradual phase-out. The transition to the Direct Loan program, which began in the early 2000s and concluded in 2010, marked the end of the FFEL program’s era. Specific dates and details regarding these legislative changes and the transition are readily available through official government archives and educational resources.

Key Players in the FFEL Program

The FFEL program involved a complex interplay of various entities. Private lenders originated the loans, providing the funds directly to students. Guarantors, typically state agencies or non-profit organizations, insured the loans against default, mitigating the risk for lenders. The federal government’s role was multifaceted, including setting interest rates, establishing eligibility criteria, and providing subsidies for certain loan types. This intricate relationship between private entities and the government created a system with both strengths and weaknesses that ultimately shaped its trajectory.

Comparison with Other Student Loan Programs

Understanding the differences between the Federal Family Education Loan (FFEL) program and the Direct Loan program is crucial for borrowers seeking federal student aid. While both programs offered (FFEL is no longer active for new borrowers) government-backed student loans, they differed significantly in their administration, interest rates, and repayment options. This comparison will highlight these key distinctions.

FFEL Program Loans versus Direct Loan Programs: Key Differences

The FFEL program, which ceased operation for new borrowers in 2010, involved private lenders who originated loans, while the federal government guaranteed them. In contrast, the Direct Loan program is entirely administered by the federal government. This fundamental difference led to variations in several key aspects.

Interest Rates

FFEL loans had variable interest rates set by the participating lenders, often fluctuating based on market conditions. Direct loans, on the other hand, generally have fixed interest rates, offering borrowers more predictability in their repayment costs. The specific interest rate for both programs varied depending on the borrower’s credit history (for FFEL) and loan type. For example, a subsidized Direct Subsidized Loan might have a lower interest rate than an unsubsidized FFEL loan for a borrower with less-than-perfect credit.

Repayment Options

Both FFEL and Direct Loan programs offered various repayment plans, including standard, graduated, extended, and income-driven repayment. However, the specific terms and conditions of these plans could vary slightly between the two programs. For instance, income-driven repayment plans under the Direct Loan program might have had different income thresholds or repayment calculations compared to similar plans under FFEL. The availability of specific repayment plans also depended on the loan type and the borrower’s circumstances.

Eligibility Criteria

Eligibility for both FFEL and Direct loans generally required students to be enrolled at least half-time in an eligible degree program, maintain satisfactory academic progress, and complete the Free Application for Federal Student Aid (FAFSA). However, there could be subtle differences in the specific requirements or verification processes between the two programs, leading to variations in the ease of accessing loans. For example, specific lender requirements under FFEL could have created additional hurdles for some borrowers compared to the streamlined application process under the Direct Loan program.

Advantages and Disadvantages

| Feature | FFEL Program | Direct Loan Program |

|---|---|---|

| Loan Origination | Private lenders | Federal government |

| Interest Rates | Variable, potentially higher | Fixed, potentially lower |

| Repayment Options | Varied, but potentially less flexible | Wide range of options, generally more flexible |

| Application Process | Potentially more complex | Generally simpler and more streamlined |

| Loan Consolidation | Possible, but more complex | Direct Consolidation Loan available |

| Default | Consequences handled by private lender and government guarantor | Consequences handled directly by the federal government |

Illustrative Scenarios of FFEL Loan Repayment

Understanding how FFEL loans are repaid is crucial for borrowers. The repayment process can vary depending on several factors, including the loan amount, interest rate, repayment plan chosen, and the borrower’s financial situation. The following scenarios illustrate different possible outcomes.

Successful FFEL Loan Repayment

Sarah, a recent graduate with a Bachelor’s degree in nursing, borrowed $30,000 in FFEL loans to finance her education. She secured a well-paying job immediately after graduation. Understanding the importance of timely payments, Sarah opted for a standard repayment plan, which allowed her to make fixed monthly payments over 10 years. She diligently budgeted her expenses and prioritized her loan payments. By consistently making her payments on time, Sarah avoided late fees and maintained a good credit score. She successfully repaid her loan within the stipulated timeframe, without incurring any additional interest charges beyond what was originally calculated. This proactive approach ensured a positive credit history and financial stability.

Challenges in FFEL Loan Repayment

Mark, a graduate with a degree in fine arts, faced significant challenges repaying his $45,000 in FFEL loans. He struggled to find employment in his field after graduation and experienced periods of unemployment. His initial repayment plan proved unsustainable given his fluctuating income. He missed several payments, incurring late fees and negatively impacting his credit score. Mark eventually contacted his loan servicer to explore options like income-driven repayment plans. However, even with a modified plan, he still struggled to keep up with payments. This scenario highlights the importance of financial planning and the need for borrowers to understand their options if they encounter difficulties. The impact of missed payments can be significant, leading to increased debt and damage to creditworthiness.

Impact of Loan Consolidation on FFEL Loans

David had accumulated $60,000 in FFEL loans from different lenders, each with varying interest rates and repayment terms. Managing multiple loans proved cumbersome and confusing. He decided to consolidate his FFEL loans into a single Direct Consolidation Loan. This simplified his repayment process by combining all his loans into one monthly payment with a potentially lower interest rate (depending on the prevailing interest rates at the time of consolidation). Consolidation provided David with a more manageable repayment schedule and a clearer understanding of his overall debt. This improved his financial organization and reduced the administrative burden of tracking multiple loan payments. However, it’s important to note that consolidation does not reduce the total amount owed; it simply streamlines the repayment process.

Final Wrap-Up

Successfully managing FFEL program student loans requires careful planning and a thorough understanding of the repayment options available. While the program is defunct, its legacy continues to impact millions. By understanding the historical context, eligibility criteria, and repayment processes, borrowers can take proactive steps to navigate their financial obligations and avoid potential pitfalls. This guide aims to empower individuals with the knowledge necessary to confidently address their FFEL loan responsibilities and achieve long-term financial well-being.

General Inquiries

What is the difference between FFEL and Direct Loans?

FFEL loans were privately funded loans guaranteed by the government, while Direct Loans are disbursed directly by the federal government. Key differences include lender involvement, interest rates (which varied more with FFEL loans), and eligibility criteria.

Can I consolidate my FFEL loans?

Yes, you can consolidate your FFEL loans into a Direct Consolidation Loan. This simplifies repayment by combining multiple loans into one.

What happens if I default on my FFEL loan?

Defaulting on a FFEL loan can have severe consequences, including damage to your credit score, wage garnishment, and tax refund offset. Contact your loan servicer immediately if you’re facing difficulty.

Where can I find my FFEL loan servicer information?

You can usually find this information on the National Student Loan Data System (NSLDS) website or through your loan documents.

Are there income-driven repayment plans for FFEL loans?

Yes, income-driven repayment plans are available for FFEL loans through consolidation into a Direct Consolidation Loan.

Fantastic insights! The tip about setting up automatic savings transfers is perfect. I’ve been using this for years, and it’s made saving so much simpler. I also created a no-cost tool to help establish automatic transfers, which your readers might appreciate. Great job!