Navigating the complexities of homeownership while juggling student loan debt can feel daunting. This guide explores the intricate relationship between Federal Housing Administration (FHA) loans and student loan repayment, offering clarity on eligibility, strategies for success, and long-term financial planning. We’ll demystify the process, empowering you to make informed decisions about your financial future and the possibility of homeownership.

From understanding how your debt-to-income ratio (DTI) is calculated with student loans factored in, to exploring the impact of various repayment plans and forgiveness programs, we aim to provide a comprehensive resource. We’ll cover practical strategies for reducing debt, refinancing options, and the importance of meticulous financial planning to increase your chances of FHA loan approval.

FHA Loan Eligibility with Student Loan Debt

Securing an FHA loan with student loan debt is achievable, but understanding how your student loans impact your eligibility is crucial. Lenders carefully assess your financial situation, particularly your debt-to-income ratio (DTI), to determine your risk as a borrower. This analysis considers all your debts, including student loans, and weighs them against your gross monthly income.

Impact of Student Loan Debt on FHA Loan Approval

Student loan debt significantly influences your chances of FHA loan approval. A high student loan balance can lower your DTI, potentially making it difficult to qualify. Lenders prefer borrowers with a lower DTI, typically below 43%, although this can vary depending on the lender and other factors in your financial profile. A higher DTI suggests a greater risk of default, as a larger portion of your income is already committed to debt repayment. The type of student loan repayment plan you’re on also plays a significant role, as discussed below.

Debt-to-Income Ratio (DTI) Calculations for FHA Loans

The DTI calculation is a key factor in FHA loan approval. It’s expressed as a percentage and is calculated by dividing your total monthly debt payments (including student loans, credit cards, car payments, etc.) by your gross monthly income. For example, if your total monthly debt payments are $2,000 and your gross monthly income is $5,000, your DTI is 40% ($2,000/$5,000 = 0.40). For FHA loans, lenders generally prefer a DTI below 43%, but some may have stricter requirements. Remember that this is only one factor considered in the loan approval process; credit score and employment history also play a vital role.

Impact of Different Student Loan Repayment Plans on FHA Loan Eligibility

The type of student loan repayment plan you choose directly affects your DTI. Income-driven repayment plans, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE), adjust your monthly payments based on your income. These plans often result in lower monthly payments than standard repayment plans, which can improve your DTI and increase your chances of FHA loan approval. However, it’s important to remember that these plans typically extend the repayment period, leading to a higher total interest paid over the life of the loan. Standard repayment plans, while resulting in higher monthly payments, may lead to a faster payoff and lower overall interest, but could negatively impact your DTI in the short term.

FHA Loan Requirements Comparison: Borrowers with and without Significant Student Loan Debt

| Factor | Borrower without Significant Student Loan Debt | Borrower with Significant Student Loan Debt | Notes |

|---|---|---|---|

| DTI | Likely lower, potentially improving approval chances. | Likely higher, potentially reducing approval chances or requiring a larger down payment. | A DTI below 43% is generally preferred, but this can vary. |

| Down Payment | May qualify for a lower down payment (as low as 3.5%). | May require a higher down payment to compensate for higher DTI. | Higher down payments can offset the risk associated with higher debt. |

| Loan Approval Odds | Generally higher. | Potentially lower, depending on the overall financial profile. | Strong credit score and stable employment can help offset high DTI. |

| Interest Rate | Potentially lower due to lower perceived risk. | Potentially higher due to higher perceived risk. | Interest rates depend on multiple factors, including credit score and market conditions. |

Student Loan Repayment Strategies and FHA Loan Approval

Securing an FHA loan with existing student loan debt requires careful planning and strategic debt management. Understanding how your student loan repayment plan impacts your debt-to-income ratio (DTI) is crucial for FHA loan approval. A lower DTI generally increases your chances of approval.

Strategies for Reducing Student Loan Debt to Improve FHA Loan Eligibility

Reducing your student loan debt before applying for an FHA loan significantly improves your chances of approval. Several strategies can help lower your monthly payments and overall debt burden. These strategies, when implemented effectively, can positively influence your DTI, a key factor considered by lenders.

Benefits of Refinancing Student Loans Before Applying for an FHA Loan

Refinancing student loans can consolidate multiple loans into one, often with a lower interest rate. This can lead to lower monthly payments, freeing up cash flow and improving your DTI. However, it’s crucial to carefully consider the terms of any refinancing offer, ensuring it aligns with your financial goals and doesn’t extend your repayment period excessively. A shorter repayment term, while leading to higher monthly payments, can improve your DTI more quickly.

Implications of Various Student Loan Repayment Options on FHA Loan Applications

Different student loan repayment plans—such as standard repayment, extended repayment, graduated repayment, and income-driven repayment (IDR) plans—impact your monthly payments and overall debt. IDR plans, while offering lower monthly payments, often extend the repayment period, potentially impacting your DTI negatively in the long run. Standard repayment plans, while demanding higher monthly payments, may offer a shorter repayment period, ultimately benefiting your DTI faster. The choice depends on your individual financial situation and long-term goals. Lenders will assess your chosen repayment plan and its impact on your DTI.

Resources Available to Borrowers Seeking to Manage Student Loan Debt While Pursuing FHA Homeownership

Several resources can assist borrowers in managing their student loan debt while pursuing FHA homeownership. These resources offer valuable guidance and support throughout the process.

- Federal Student Aid (FSA): The FSA website provides comprehensive information on various repayment plans, loan forgiveness programs, and debt management strategies.

- National Foundation for Credit Counseling (NFCC): The NFCC offers free and low-cost credit counseling services, helping borrowers create a budget and develop a plan to manage their student loan debt.

- HUD-approved Housing Counselors: These counselors provide guidance on FHA loan requirements and can help borrowers navigate the home-buying process.

- Your Student Loan Servicer: Contacting your servicer directly can provide personalized information on your repayment options and potential hardship programs.

Impact of Student Loan Forgiveness Programs on FHA Loans

Student loan forgiveness programs, while offering significant financial relief, can present complexities when applying for an FHA loan. The impact on your application hinges on how the forgiveness is handled and verified by the lender. Understanding these nuances is crucial for a smooth and successful FHA loan process.

The effect of student loan forgiveness programs, such as the Public Service Loan Forgiveness (PSLF) program or Income-Driven Repayment (IDR) plans, on FHA loan applications is multifaceted. While forgiveness itself doesn’t directly disqualify you, the process and timing can influence your eligibility. Lenders assess your debt-to-income ratio (DTI) and credit score, both of which can be affected by the presence of student loans, even if forgiveness is pending or in progress. The uncertainty surrounding the timing and amount of forgiveness can make it challenging for lenders to accurately assess your financial stability.

Student Loan Forgiveness and DTI Calculations

Lenders generally consider your total monthly student loan payments when calculating your DTI. If you’re enrolled in an IDR plan or anticipate forgiveness, you might provide documentation outlining your current payments and any projected future reductions. However, lenders are often cautious about relying solely on projected future payments, particularly if forgiveness is far off or contingent on specific criteria. They tend to prioritize your current payment obligations to ensure a more conservative assessment of your ability to repay the FHA loan. A scenario involving a borrower with a high DTI due to student loan payments might see their DTI improve significantly if they can demonstrate a realistic path to forgiveness. For example, a borrower with $1,000 in monthly student loan payments and a high DTI might show a substantial DTI reduction if they are eligible for and can provide sufficient documentation for forgiveness, thereby improving their chances of loan approval.

Challenges and Benefits of Using Student Loan Forgiveness Programs Before or During the FHA Loan Process

Using student loan forgiveness programs before applying for an FHA loan can simplify the process by reducing your monthly debt payments and improving your DTI. However, it’s important to note that the timing can be critical. If forgiveness is recently granted, lenders might need time to verify the changes in your financial profile. Conversely, applying *during* the forgiveness process presents challenges due to the uncertainty surrounding the outcome. Lenders may require extensive documentation to verify your eligibility and projected payments, potentially delaying the loan approval. The benefits include a potentially lower DTI and improved credit score post-forgiveness, while the challenges involve complexities in documentation and verification, and potential delays in the approval process.

Scenario: Partial Student Loan Forgiveness and FHA Loan Approval

Imagine Sarah, a teacher, with $50,000 in student loan debt and monthly payments of $700. She’s eligible for PSLF and anticipates $20,000 in forgiveness within the next year. Her current DTI is high, hindering her FHA loan application. However, by providing documentation demonstrating her eligibility for PSLF and the projected reduction in her monthly payments, the lender can adjust her DTI calculation, potentially leading to approval. The lender might still consider the $700 payment for the short term, but the potential for a $350 reduction in the near future will be a significant factor in the decision-making process. This scenario highlights how demonstrating a clear path to forgiveness can positively influence loan approval.

Verification of Student Loan Forgiveness Programs During FHA Loan Underwriting

Lenders use various methods to verify student loan forgiveness. This usually involves requesting official documentation directly from the student loan servicer. This documentation could include: a letter confirming the borrower’s eligibility for the forgiveness program, a detailed repayment schedule showing the projected impact of forgiveness, and proof of payments made under the qualifying repayment plan. Lenders might also verify the borrower’s employment history to confirm eligibility criteria for programs like PSLF. They scrutinize the information provided to ensure its authenticity and accuracy before incorporating it into their assessment of the borrower’s creditworthiness. The lender’s verification process aims to minimize risk by ensuring the information about forgiveness is reliable and accurately reflects the borrower’s financial situation.

Financial Planning for FHA Loan Borrowers with Student Loans

Securing an FHA loan while managing student loan debt requires careful financial planning. Successfully navigating this process involves understanding your budget, prioritizing debt repayment, and maintaining a strong credit score. This section provides a practical framework for borrowers aiming to achieve homeownership despite existing student loan obligations.

Sample Budget for an FHA Loan Borrower with Student Loan Debt

Creating a realistic budget is crucial. This involves meticulously tracking income and expenses to determine affordability. A sample budget for a borrower with student loan debt might look like this:

| Income | Amount |

|---|---|

| Gross Monthly Income | $5,000 |

| Expenses | Amount |

| Student Loan Payment | $300 |

| Rent/Mortgage (Current) | $1,200 |

| Utilities | $200 |

| Groceries | $400 |

| Transportation | $250 |

| Other Expenses (Entertainment, etc.) | $350 |

| Total Expenses | $2,700 |

| Net Income (Income – Expenses) | $2,300 |

This example shows a significant portion of income allocated to existing expenses. Before applying for an FHA loan, the borrower needs to analyze their ability to incorporate the added costs of homeownership (mortgage, property taxes, insurance) within their budget. The remaining net income would need to comfortably cover these additional costs, along with an emergency fund.

Step-by-Step Guide to Financial Planning for FHA Loan Applicants Managing Student Loan Payments

Effective financial planning involves a structured approach.

- Assess Current Financial Situation: Calculate your monthly income, expenses, and debt obligations (including student loans). Use budgeting tools or spreadsheets to track this information accurately.

- Analyze Debt-to-Income Ratio (DTI): Lenders heavily consider DTI, which compares your monthly debt payments to your gross monthly income. A lower DTI improves your chances of loan approval.

- Explore Student Loan Repayment Options: Consider income-driven repayment plans or refinancing options to potentially lower your monthly payments and improve your DTI.

- Develop a Realistic Homeownership Budget: Factor in estimated mortgage payments (principal, interest, taxes, insurance – PITI), along with potential maintenance and repair costs. Ensure you can comfortably afford these additional expenses.

- Save for a Down Payment and Closing Costs: FHA loans require a smaller down payment than conventional loans, but you still need to save diligently for this and associated closing costs.

- Improve Credit Score: A higher credit score significantly impacts loan approval and interest rates. Address any negative items on your credit report and pay bills on time.

- Shop for Mortgage Rates: Compare rates from multiple lenders to secure the best terms for your FHA loan.

Credit Score Management for Borrowers with Student Loans Seeking FHA Financing

Maintaining a good credit score is paramount for FHA loan approval. Student loan payments, if made consistently on time, positively impact credit scores. Conversely, late or missed payments can significantly lower your score, hindering your chances of loan approval. Strategies include: paying all bills on time, keeping credit utilization low (avoid maxing out credit cards), and monitoring your credit report regularly for errors.

Checklist of Financial Documents Required for FHA Loan Applications with Significant Student Loan Debt

The following documents are generally required:

- Completed loan application

- Proof of income (pay stubs, tax returns)

- Bank statements (showing sufficient funds for down payment and closing costs)

- Student loan statements (showing payment history and outstanding balance)

- Credit report

- Proof of employment (employment verification letter)

- Tax returns (for verification of income)

Providing comprehensive documentation proactively streamlines the loan application process.

Understanding FHA Loan Insurance and Student Loan Debt

Obtaining an FHA loan with significant student loan debt requires a careful understanding of how these two financial obligations interact. The presence of student loan debt impacts your debt-to-income ratio (DTI), a crucial factor in FHA loan approval. Furthermore, the FHA mortgage insurance premium (MIP) is a significant cost that adds to your overall monthly payment. Understanding these aspects is crucial for responsible financial planning.

FHA mortgage insurance premiums are calculated based on several factors, including the loan amount, loan term, and the type of MIP (annual or upfront). Your student loan debt indirectly influences your MIP by affecting your DTI. A higher DTI, resulting from substantial student loan payments, may lead to a higher loan-to-value ratio (LTV), which in turn can influence the MIP calculation. While there isn’t a direct calculation that incorporates student loan debt into the MIP formula itself, the indirect impact through DTI is significant. Lenders assess your ability to repay the loan, considering all your debts, including student loans. A higher DTI might necessitate a larger down payment, potentially lowering the LTV and reducing the MIP.

FHA Loan Insurance Premiums and Long-Term Financial Implications

The long-term financial implications of FHA loan insurance for borrowers with student loans are multifaceted. The upfront MIP, if applicable, adds to the initial closing costs, potentially requiring a larger down payment or increasing the overall loan amount. The annual MIP adds to your monthly mortgage payment for the life of the loan, increasing your total interest paid. This additional cost needs to be factored into your budget, especially when already managing student loan repayments. For example, a borrower with a $250,000 FHA loan and a 1.75% annual MIP will pay an additional $4,375 annually, or $364.58 monthly, increasing the overall financial burden alongside student loan payments. Careful financial planning is essential to ensure affordability.

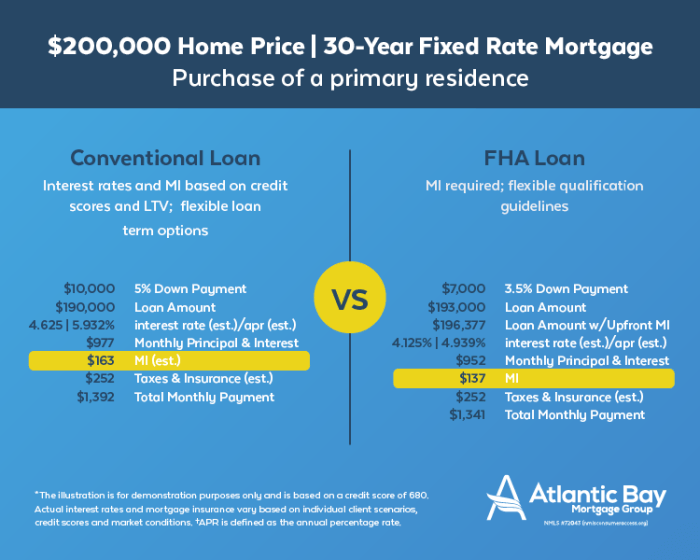

Comparison of FHA and Conventional Loans for Borrowers with Student Loan Debt

Choosing between an FHA and a conventional loan depends on individual circumstances. FHA loans generally offer lower down payment requirements and more lenient credit score standards, making them attractive to borrowers with student loan debt who might struggle to meet the stricter criteria of conventional loans. However, FHA loans come with MIP, adding to the overall cost. Conventional loans, while often requiring higher credit scores and larger down payments, may offer lower long-term costs due to the absence of MIP, provided the borrower qualifies for a better interest rate. A comparative analysis of the total cost of ownership, including MIP, interest rates, and down payment requirements, is necessary to make an informed decision. This analysis needs to account for the borrower’s specific financial situation, including their student loan repayment plan.

Advantages and Disadvantages of Using an FHA Loan with Existing Student Loan Obligations

The decision to use an FHA loan while managing student loan debt involves weighing several factors.

- Advantages: Lower down payment requirements can make homeownership more accessible; more lenient credit score requirements can accommodate borrowers with less-than-perfect credit impacted by student loans; easier qualification process compared to conventional loans can be beneficial for those with existing debt.

- Disadvantages: MIP adds to the overall cost of the loan, increasing monthly payments and long-term expenses; higher interest rates compared to conventional loans for borrowers with excellent credit are possible; the FHA loan process can still be somewhat complex, requiring time and effort.

Wrap-Up

Securing an FHA loan with student loan debt is achievable with careful planning and a strategic approach. By understanding the interplay between your student loans and FHA loan requirements, you can significantly improve your chances of homeownership. Remember, proactive debt management, a strong credit score, and a well-defined financial plan are crucial elements in this journey. This guide serves as a starting point; consulting with financial advisors and mortgage lenders will further personalize your path to success.

Questions Often Asked

Can I get an FHA loan if I’m currently in student loan deferment?

While deferment might temporarily reduce your monthly payments, lenders will still consider your total student loan debt when calculating your DTI. Your eligibility will depend on your overall financial picture.

How does my credit score impact FHA loan approval with student loan debt?

A higher credit score is always beneficial, but it’s especially important when you have student loan debt. A good credit score demonstrates responsible financial behavior, improving your chances of approval and potentially securing a better interest rate.

What if my student loans are in default?

Student loan default significantly impacts your credit score and will likely prevent FHA loan approval. You’ll need to resolve the default before applying for a mortgage.

Are there any specific FHA loan programs designed to help borrowers with student loan debt?

While no specific programs target student loan debt directly, FHA loans are designed to help those with lower credit scores and less-than-perfect financial histories, making them potentially accessible to borrowers with student loan debt. However, meeting the DTI requirements remains critical.