Securing a home loan can be a complex process, especially when student loan debt is involved. Understanding the intricacies of FHA rules regarding student loans is crucial for prospective homeowners burdened by educational financing. This guide navigates the often-murky waters of FHA loan eligibility, providing clarity on how student loan payments, repayment plans, and even loan forgiveness programs can influence your chances of approval. We’ll explore the various factors underwriters consider and offer strategies to improve your eligibility.

From debt-to-income ratios (DTI) and the different types of student loans to the documentation required and potential pitfalls, we aim to equip you with the knowledge necessary to confidently navigate the FHA loan application process. We’ll also examine effective strategies for managing student loan debt to maximize your chances of success.

FHA Loan Eligibility and Student Loan Debt

Securing an FHA loan, a government-backed mortgage, can be a crucial step for many homebuyers. However, the presence of student loan debt significantly impacts the eligibility process. Understanding how your student loan payments affect your debt-to-income ratio (DTI) is vital for a successful application.

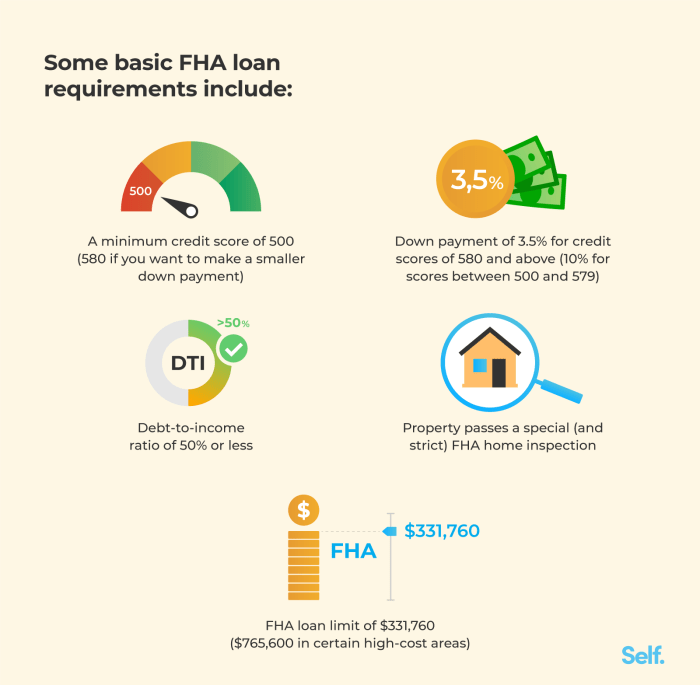

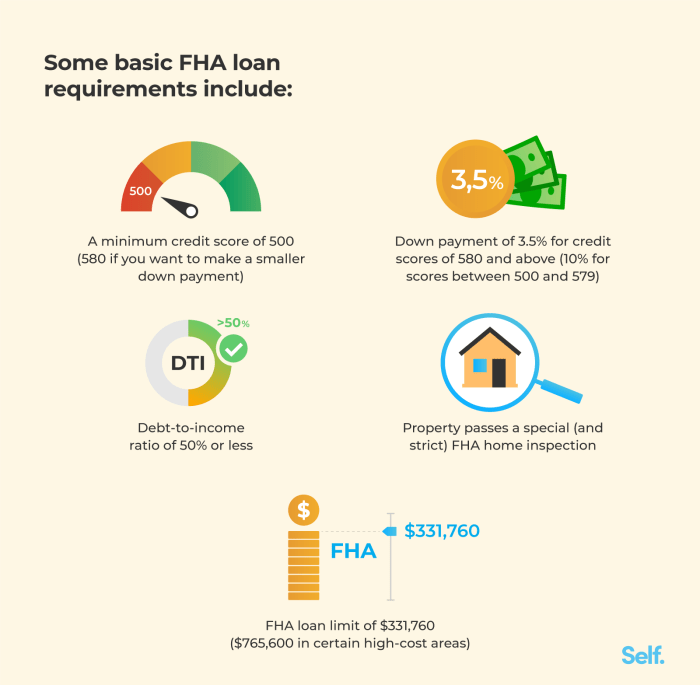

Student loan debt influences FHA loan eligibility primarily through its effect on the borrower’s debt-to-income ratio. Lenders use the DTI to assess the applicant’s ability to manage monthly mortgage payments alongside existing financial obligations. A higher DTI generally indicates a greater financial burden, potentially leading to loan denial or less favorable terms. The FHA typically allows for a higher DTI than conventional loans, but the inclusion of student loan payments still significantly affects the overall calculation.

Debt-to-Income Ratio (DTI) and FHA Loan Requirements

The DTI is calculated by dividing your total monthly debt payments by your gross monthly income. For FHA loans, lenders generally prefer a DTI below 43%, although some may accept slightly higher ratios depending on other factors like credit score and down payment. Student loan payments are a key component of this calculation. The amount of your monthly student loan payment directly impacts your DTI, and a higher payment translates to a higher DTI. This can affect your chances of approval or may influence the loan terms offered.

Impact of Different Student Loan Repayment Plans on DTI

Different repayment plans for student loans can significantly alter the monthly payment amount, thereby influencing the DTI calculation. For example, an income-driven repayment (IDR) plan, such as ICR, PAYE, or REPAYE, adjusts the monthly payment based on income and family size. This can result in a lower monthly payment compared to a standard repayment plan, potentially leading to a lower DTI and increasing the likelihood of FHA loan approval. Conversely, a standard repayment plan, which typically involves fixed monthly payments over a shorter timeframe, might result in a higher monthly payment and consequently a higher DTI.

FHA Loan Eligibility with Varying Student Loan Debt

The following table illustrates how different levels of student loan debt can affect FHA loan eligibility. It’s crucial to remember that these are examples and actual eligibility depends on numerous factors beyond student loan debt, including credit score, income stability, and down payment.

| Student Loan Debt Amount | Monthly Payment | DTI | Eligibility Status |

|---|---|---|---|

| $10,000 | $150 | 30% | Yes |

| $30,000 | $400 | 38% | Yes (Conditional – may require a larger down payment or other mitigating factors) |

| $50,000 | $700 | 45% | No |

| $70,000 | $900 | 52% | No |

Types of Student Loans and FHA Loan Approval

Understanding the nuances of student loan debt is crucial when applying for an FHA loan. The type of student loan and its repayment status significantly impact your eligibility. This section will clarify the differences between federal and private student loans and their influence on the FHA loan approval process.

Federal student loans and private student loans are treated differently in FHA loan underwriting. The impact of each on your ability to secure an FHA loan hinges primarily on the borrower’s debt-to-income ratio (DTI) and their repayment history.

Federal Student Loans and FHA Loan Approval

Federal student loans, while potentially impacting your DTI, generally present less of a hurdle than private student loans for FHA loan approval. This is because the federal government offers various income-driven repayment plans and forbearance options that underwriters can consider. A consistent repayment history, even with a high loan balance, often demonstrates responsibility to lenders, improving the chances of FHA loan approval. However, a consistently high DTI, even with federal loans, may still hinder approval. Lenders prefer to see a DTI below 43%, although this can vary slightly depending on the lender and the specific circumstances of the borrower.

Private Student Loans and FHA Loan Approval

Private student loans pose a more significant challenge during FHA loan application processing. Unlike federal loans, private lenders often lack the flexibility in repayment plans. Defaulting on a private student loan can severely damage your credit score, making FHA loan approval significantly more difficult, if not impossible. The underwriting process for private student loans is more stringent, requiring thorough documentation of the loan terms and repayment history. High interest rates on private student loans can also increase your DTI, potentially exceeding acceptable limits for FHA loan approval.

Defaulted Student Loans and FHA Loan Applications

A defaulted student loan is a serious impediment to securing an FHA loan. Defaulting signifies a significant breach of contract, resulting in negative reporting to credit bureaus. This drastically lowers your credit score, increasing the risk assessment for lenders. The severity of the default, including the amount owed and the length of the default, will be carefully scrutinized during the FHA loan application review. In most cases, resolving the default, such as through rehabilitation or consolidation, is necessary before an FHA loan application will be considered. The process of resolving a defaulted loan can take time, and may require professional assistance.

Documentation Required for Student Loan Verification

Accurate and complete documentation of all student loan debt is essential for a successful FHA loan application. This typically includes:

- Student loan statements or promissory notes, detailing the loan amount, interest rate, and repayment schedule for each loan.

- Proof of repayment history, demonstrating on-time payments or details of any forbearance or deferment periods.

- Documentation showing any efforts to resolve defaulted loans, such as loan rehabilitation plans or consolidation agreements.

Failure to provide complete and accurate documentation can delay the approval process or lead to rejection of the application. It is crucial to gather all necessary documentation well in advance of applying for an FHA loan.

Addressing Student Loan Debt Before Applying for an FHA Loan

The following flowchart illustrates the recommended steps to address student loan debt before applying for an FHA loan:

[Diagram Description: A flowchart showing a decision tree. The starting point is “Student Loan Debt?”. If yes, the next step is “Federal or Private?”. If Federal, the next step is “Current on Payments?”. If yes, proceed to “FHA Loan Application”. If no, the next step is “Rehabilitation/Consolidation?”. If yes, proceed to “FHA Loan Application”, if no, then “Improve Credit Score”. If Private, the next step is “Current on Payments?”. If yes, proceed to “FHA Loan Application”, if no, the next step is “Rehabilitation/Consolidation?”. If yes, proceed to “FHA Loan Application”, if no, then “Improve Credit Score”. Finally, “Improve Credit Score” leads to “FHA Loan Application”.]

Strategies for Managing Student Loan Debt to Qualify for an FHA Loan

Securing an FHA loan with significant student loan debt can be challenging, as lenders carefully assess debt-to-income ratios (DTI). A lower DTI improves your chances of approval. Several strategies can help borrowers manage their student loan debt and increase their likelihood of FHA loan qualification.

Effective student loan management involves a multifaceted approach, encompassing debt reduction techniques, strategic repayment planning, and leveraging available resources. Understanding the nuances of these strategies is crucial for maximizing your chances of FHA loan approval.

Debt Consolidation Options and Their Impact on DTI

Debt consolidation can simplify repayment by combining multiple student loans into a single loan with a potentially lower interest rate. This simplification can lead to a more manageable monthly payment, positively impacting your DTI. For example, consolidating several loans with varying interest rates into a single loan with a fixed, lower rate can significantly reduce your overall monthly payment, thereby improving your DTI. However, it’s crucial to carefully compare interest rates and fees associated with different consolidation options. A longer repayment term, while lowering monthly payments, may ultimately increase the total interest paid.

Income-Driven Repayment Plans and Their Effects on FHA Loan Eligibility

Income-driven repayment (IDR) plans adjust your monthly student loan payments based on your income and family size. While these plans can make monthly payments more affordable, they often extend the repayment period, potentially leading to higher total interest paid over the life of the loan. This extended repayment period might not drastically improve your DTI in the short term, but it can make your monthly payments more manageable, freeing up funds for other expenses, including a potential down payment on a home. However, it’s vital to consider the long-term cost of increased interest payments when deciding if an IDR plan aligns with your financial goals.

Resources for Borrowers Seeking Student Loan Repayment Assistance

Several resources can assist borrowers in navigating student loan repayment. The National Foundation for Credit Counseling (NFCC) offers free and low-cost credit counseling services, including assistance with debt management plans. The Federal Student Aid website provides comprehensive information on various repayment options, including IDR plans and loan forgiveness programs. Additionally, many universities and colleges offer financial aid offices that can provide guidance and support to alumni struggling with student loan debt. These resources can provide valuable support and guidance throughout the process of managing student loan debt and working toward FHA loan eligibility.

FHA Loan Underwriting and Student Loan Considerations

The FHA loan underwriting process is a thorough evaluation of a borrower’s financial stability and creditworthiness to determine their ability to repay the loan. A significant aspect of this process involves a careful assessment of the applicant’s student loan debt, as it represents a recurring monthly expense that impacts their debt-to-income ratio (DTI) and overall financial capacity. Underwriters analyze various factors related to student loans to gauge the risk involved in approving the loan.

Underwriters assess the risk associated with student loan debt by considering several key factors. The most crucial is the borrower’s debt-to-income ratio (DTI), which compares their total monthly debt payments (including student loans, mortgages, car payments, etc.) to their gross monthly income. A higher DTI indicates a greater financial burden and increased risk of default. Beyond the DTI, underwriters examine the type of student loans (federal vs. private), the repayment status (current, delinquent, deferred), the interest rate, and the remaining loan balance. The length of the repayment period also plays a role, as longer repayment terms can extend the financial strain. The overall picture helps the underwriter determine if the applicant can comfortably manage their existing debt obligations alongside a new FHA mortgage.

Student Loan Payment and Repayment History Evaluation

FHA underwriters meticulously examine the borrower’s student loan payment history. They scrutinize the consistency of payments, looking for any instances of late payments, missed payments, or defaults. Even a single instance of delinquency can raise red flags and negatively impact the loan application. The underwriter will also assess the type of repayment plan the borrower is on (standard, income-driven, etc.), as different plans have varying implications for long-term repayment capacity. A history of consistently on-time payments demonstrates financial responsibility, increasing the likelihood of loan approval. Conversely, a pattern of late or missed payments suggests a higher risk of default on the FHA loan. The underwriter will verify the information provided by the borrower with the student loan servicer(s) to ensure accuracy.

Reasons for FHA Loan Denial Related to Student Loan Debt

Understanding the common reasons for FHA loan denial due to student loan debt can help prospective borrowers prepare their applications effectively. The following points represent frequent causes for rejection:

- High Debt-to-Income Ratio (DTI): A DTI exceeding FHA guidelines significantly reduces the chances of approval. This is often the primary reason for denial when student loan debt is substantial.

- Delinquent or Missed Student Loan Payments: A history of late or missed payments demonstrates poor financial management and increases the perceived risk of default on the FHA loan.

- High Student Loan Balance Relative to Income: Even with a manageable DTI, an exceptionally large student loan balance might be viewed as a significant financial burden, impacting approval chances.

- Inconsistent or Incomplete Student Loan Information: Providing inaccurate or incomplete information about student loans during the application process can lead to delays or outright rejection.

- Inaccurate or incomplete documentation: Failure to provide required documentation, such as student loan statements, can result in the application being incomplete and therefore denied.

Impact of Student Loan Forgiveness Programs on FHA Loan Eligibility

Student loan forgiveness programs, such as the Public Service Loan Forgiveness (PSLF) program and Income-Driven Repayment (IDR) plans, can significantly impact your FHA loan eligibility. While these programs aim to alleviate student loan debt, their effect on your FHA application depends heavily on the timing of forgiveness and the documentation you provide. Understanding these nuances is crucial for a smooth and successful loan application.

The timing of student loan forgiveness is a key factor. If forgiveness is granted *before* you apply for an FHA loan, the forgiven amount is generally not considered income and will not affect your debt-to-income ratio (DTI). However, if forgiveness is *pending* at the time of application, underwriters will likely consider your original loan balance as outstanding debt, potentially impacting your DTI and eligibility. This can significantly affect your chances of approval, as a higher DTI often leads to loan denial. Conversely, if forgiveness occurs *after* loan approval, it won’t impact the loan terms.

Proof of Student Loan Forgiveness

Providing clear and verifiable proof of loan forgiveness is essential. This typically involves submitting documentation directly from your loan servicer. This documentation should clearly state the date of forgiveness, the amount forgiven, and any remaining balance. For example, a borrower participating in PSLF might submit a letter from their servicer confirming their eligibility and the complete forgiveness of their federal student loans, including the effective date. Another example could be a statement from a loan servicer indicating the successful completion of an IDR plan, with a detailed breakdown of the forgiven amount and the remaining balance, if any.

Documentation Required for Student Loan Forgiveness Programs

To successfully demonstrate participation in a student loan forgiveness program, you will generally need several key documents. This often includes a letter from your loan servicer confirming your enrollment in the program, a detailed repayment history showing consistent payments, and any supporting documentation demonstrating your eligibility for the program. For example, for PSLF, you would need proof of 120 qualifying monthly payments made under a qualifying federal repayment plan while working full-time for a qualifying employer. For IDR plans, you’d need documentation showing consistent payments under the plan, along with income verification. The specific requirements may vary depending on the program and your individual circumstances. It is advisable to contact your loan servicer well in advance of applying for an FHA loan to gather all necessary documentation and ensure its completeness and accuracy.

Final Summary

Successfully navigating the FHA loan process with existing student loan debt requires careful planning and a thorough understanding of the relevant rules and regulations. By strategically managing your student loans, understanding the underwriting process, and gathering the necessary documentation, you can significantly increase your chances of securing an FHA loan. Remember, seeking professional financial advice can be invaluable in this process. This guide provides a solid foundation, but individual circumstances may require personalized guidance to ensure a successful outcome.

Key Questions Answered

Can I get an FHA loan with defaulted student loans?

Defaulted student loans significantly impact your FHA loan eligibility. Remediation, such as repayment plans or loan rehabilitation, is typically required before approval.

How do income-driven repayment plans affect my DTI?

Income-driven repayment plans (IDR) can lower your monthly student loan payments, thus potentially improving your DTI and increasing your chances of FHA loan approval. However, the long-term impact on your overall debt needs careful consideration.

What if my student loans are in deferment or forbearance?

While deferment or forbearance temporarily suspends payments, underwriters will still consider the full student loan debt amount when calculating your DTI. You may need to demonstrate a plan for repayment once the deferment or forbearance ends.

What documents do I need to provide regarding my student loans?

You’ll typically need to provide documentation showing the loan amount, interest rate, monthly payment, and repayment history. This often includes loan statements or a credit report.

Well done!