Navigating the complexities of student loan repayment can feel overwhelming, but understanding your options is crucial for long-term financial well-being. This guide delves into Fidelity’s student loan offerings, providing a clear and concise overview of their products, repayment plans, and associated fees. We aim to equip you with the knowledge necessary to make informed decisions about your student loan journey.

From exploring various loan types and interest rates to understanding repayment options and potential forgiveness programs, we’ll cover essential aspects of managing your Fidelity student loans. We will also compare Fidelity’s offerings to those of other major lenders, helping you assess the best fit for your individual circumstances and financial goals. This comprehensive approach ensures you’re well-prepared to manage your student debt effectively.

Fidelity Student Loan Products

Fidelity Investments, while primarily known for its brokerage and investment services, also offers a range of student loan products designed to help borrowers manage their educational debt. Understanding the specifics of these loans, including their features, eligibility requirements, and how they compare to other lenders, is crucial for prospective borrowers. This section provides a detailed overview of Fidelity’s student loan offerings.

Fidelity Student Loan Product Overview

Fidelity’s student loan offerings are primarily focused on refinancing existing federal and private student loans. Unlike some lenders who offer new student loans directly to students, Fidelity’s approach centers on helping borrowers consolidate and potentially lower their monthly payments through refinancing. This allows borrowers to simplify their repayment process and potentially secure a more favorable interest rate. They do not offer direct student loans to current students.

Comparison with Other Major Lenders

Fidelity’s student loan refinancing options compete with a wide range of lenders, including SoFi, Earnest, and Sallie Mae. A key differentiator for Fidelity is its integration with its broader financial services platform. Borrowers who are already Fidelity clients may find the refinancing process smoother due to existing account information and potentially easier access to customer support. However, other lenders may offer more aggressive interest rates or a wider variety of loan terms. Direct comparisons require reviewing current interest rates and terms from each lender, as these are subject to change.

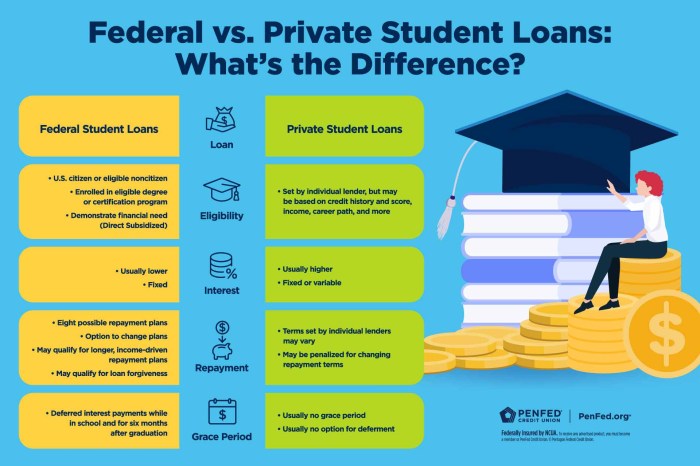

Fidelity Student Loan Eligibility Requirements

Eligibility for Fidelity’s student loan refinancing programs typically involves meeting specific criteria. These usually include having a satisfactory credit score, a stable income, and a demonstrable ability to repay the loan. Specific requirements may vary based on the type of loan being refinanced (federal or private) and the borrower’s individual financial situation. It’s essential to check Fidelity’s website for the most up-to-date eligibility requirements before applying.

Fidelity Student Loan Product Details

The following table summarizes key features of Fidelity’s student loan refinancing options. Note that interest rates and fees are subject to change and are based on individual creditworthiness and other factors. This data represents a snapshot in time and should not be considered exhaustive or a guarantee of specific rates.

| Loan Type | Interest Rates (Example Range) | Repayment Options | Fees |

|---|---|---|---|

| Refinancing of Federal Student Loans | Variable: 4.00% – 14.00% APR (Example – subject to change) | Fixed-term, various lengths (e.g., 5, 10, 15 years) | Origination fee (may vary) |

| Refinancing of Private Student Loans | Variable: 4.00% – 14.00% APR (Example – subject to change) | Fixed-term, various lengths (e.g., 5, 10, 15 years) | Origination fee (may vary) |

Fidelity Student Loan Repayment Options

Understanding your repayment options is crucial for successfully managing your Fidelity student loans. Choosing the right plan can significantly impact your monthly payments and overall repayment timeline. Several options are available, each with its own set of advantages and disadvantages. Careful consideration of your financial situation is essential before making a decision.

Fidelity offers various repayment plans designed to accommodate different financial circumstances. These plans generally include Standard Repayment, Extended Repayment, Graduated Repayment, and Income-Driven Repayment (IDR) plans. The Standard Repayment plan typically involves fixed monthly payments over a 10-year period. The Extended Repayment plan extends the repayment period, resulting in lower monthly payments but higher overall interest paid. Graduated Repayment starts with lower payments that gradually increase over time. Finally, Income-Driven Repayment plans base your monthly payments on your income and family size, offering potentially lower payments but potentially longer repayment periods.

Applying for a Repayment Plan Modification

Modifying your repayment plan involves a straightforward process. First, log in to your Fidelity student loan account online. Navigate to the “Repayment” or “Manage Payments” section. You’ll find options to explore different repayment plans and their associated terms. Carefully review the details of each plan to determine which best suits your current financial situation. Once you’ve selected a plan, follow the online instructions to submit your application. Fidelity will review your request and notify you of the outcome. You may need to provide supporting documentation, such as proof of income or family size, depending on the plan you choose.

Consequences of Defaulting on a Fidelity Student Loan

Defaulting on a student loan can have serious and long-lasting financial repercussions. This includes damage to your credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future. Wage garnishment is a possibility, where a portion of your earnings is directly seized to repay the debt. Furthermore, the defaulted loan balance will continue to accrue interest and fees, significantly increasing the total amount owed. In some cases, the debt can be referred to collections agencies, leading to further negative impacts on your credit report and potentially legal action.

Advantages and Disadvantages of Repayment Plans

Understanding the pros and cons of each repayment plan is essential for making an informed decision. The best plan for you depends heavily on your individual financial circumstances and long-term goals.

- Standard Repayment:

- Advantages: Shortest repayment period, lowest total interest paid.

- Disadvantages: Highest monthly payments.

- Extended Repayment:

- Advantages: Lower monthly payments.

- Disadvantages: Longest repayment period, highest total interest paid.

- Graduated Repayment:

- Advantages: Lower initial payments, gradually increasing.

- Disadvantages: Payments can become significantly higher later in the repayment term.

- Income-Driven Repayment (IDR):

- Advantages: Monthly payments based on income, potentially very low payments.

- Disadvantages: Longest repayment period, potential for loan forgiveness after 20-25 years (depending on specific plan and eligibility), interest may still accrue.

Fidelity Student Loan Interest Rates and Fees

Understanding the interest rates and fees associated with your student loan is crucial for effective financial planning. This section will detail Fidelity’s current offerings, comparing them to industry standards to help you make informed decisions. Remember that rates and fees are subject to change, so always confirm the most up-to-date information directly with Fidelity.

Fidelity Student Loan Interest Rates

Fidelity offers various student loan products, each with its own interest rate structure. These rates are typically variable, meaning they can fluctuate based on market conditions. The specific rate you qualify for will depend on factors such as your creditworthiness, loan type, and repayment plan. Unfortunately, precise, real-time interest rate data for Fidelity student loans is not publicly available in a consistently updated format. Directly contacting Fidelity or checking their official website is necessary to obtain the most current rates. Generally, expect rates to be competitive with other major lenders, though this can vary.

Fidelity Student Loan Fees

Fidelity may charge fees associated with your student loan. Common fees include origination fees, which are typically a percentage of the loan amount and are paid upfront. Late payment fees can also apply if you miss a payment. Again, the exact fees charged will depend on your specific loan terms and agreement. It’s essential to carefully review your loan documents to understand all applicable fees before signing. For example, a hypothetical origination fee might be 1% of the loan amount, while a late payment fee could range from $25 to $50. These are illustrative examples and not a reflection of Fidelity’s current fee structure.

Comparison of Fidelity’s Interest Rates and Fees with Competitors

Direct comparison of Fidelity’s rates and fees with competitors requires real-time data from multiple lenders. This data changes frequently. However, a general observation is that Fidelity aims to be competitive within the market. To get a precise comparison, you should gather current rate and fee information from several lenders (e.g., Sallie Mae, Discover, etc.) and compare them side-by-side with Fidelity’s current offerings.

Visual Representation of Interest Rates Across Loan Terms

Let’s imagine a simplified chart illustrating interest rates for a hypothetical $10,000 loan across different loan terms (e.g., 5-year, 10-year, 15-year). This is a hypothetical example, and actual rates will vary.

| Loan Term (Years) | Hypothetical Interest Rate (Variable) |

|---|---|

| 5 | 6.5% |

| 10 | 7.0% |

| 15 | 7.5% |

This table demonstrates that longer loan terms may be associated with higher interest rates, resulting in greater overall interest paid over the life of the loan. This is a common practice across various lenders. Remember that this is a hypothetical example, and actual rates will vary depending on several factors, including creditworthiness and market conditions. Always obtain current rate information directly from the lender.

Managing Your Fidelity Student Loans

Efficiently managing your Fidelity student loans is crucial for successful repayment and maintaining a positive credit history. Understanding the various payment methods, account access procedures, and support channels available will empower you to navigate the loan repayment process with ease and confidence. This section details the key aspects of managing your Fidelity student loans.

Making Payments on Your Fidelity Student Loan

Fidelity offers several convenient methods for making your student loan payments. You can choose the option that best suits your preferences and schedule. Payments can be made online through your account dashboard, providing immediate confirmation and tracking capabilities. Alternatively, you can mail a check or money order to the designated address provided in your loan documents. Finally, for those who prefer a phone-based approach, you can make payments via phone using a debit or credit card. Remember to always include your loan account number on any payment you submit.

Accessing Your Fidelity Student Loan Account Online

Accessing your account online allows you to monitor your loan balance, view payment history, and manage your personal information efficiently. To access your account, navigate to the Fidelity student loan website and locate the “Login” or “Account Access” button. You will then be prompted to enter your username and password. If you’ve forgotten your login credentials, the website provides a secure password reset option. Once logged in, you’ll have access to a comprehensive dashboard displaying all relevant account information.

Updating Personal Information Associated with Your Fidelity Student Loan Account

Keeping your personal information up-to-date is essential for ensuring accurate communication and avoiding potential delays in processing payments or other account-related requests. To update your information, log in to your online account. Locate the “Profile” or “Personal Information” section, usually found within the account settings. From there, you can modify your address, phone number, email address, and other relevant details. After making changes, remember to save your updates to ensure they are reflected in your account.

Contacting Fidelity Student Loan Customer Support

Should you require assistance or have questions regarding your student loan, Fidelity provides multiple avenues for contacting customer support. Their website usually lists a phone number for direct contact with a representative. You can also often find an email address for inquiries that don’t require immediate attention. Furthermore, many lenders offer a comprehensive FAQ section on their website, which may answer your question without needing to contact support directly. If you prefer written communication, consider sending a secure message through your online account. When contacting support, be prepared to provide your loan account number for efficient service.

Fidelity Student Loan Consolidation

Consolidating your student loans with Fidelity can simplify your repayment process by combining multiple loans into a single, manageable payment. This can lead to a streamlined repayment schedule and potentially lower monthly payments, although it’s crucial to understand the implications before proceeding.

Fidelity’s student loan consolidation process involves applying for a new loan that pays off your existing student loans. This new loan will have its own terms and interest rate, which may differ from your original loans. Careful consideration of the new loan’s terms is essential to ensure it aligns with your financial goals.

Fidelity Student Loan Consolidation Process

The process of consolidating your student loans through Fidelity involves several key steps. Understanding these steps will help you navigate the application and approval process efficiently.

- Check Eligibility: Confirm you meet Fidelity’s eligibility requirements, which typically include having multiple federal or private student loans and a good credit history. Specific requirements may vary depending on the type and amount of your loans.

- Gather Necessary Documentation: Collect all required documents, including details about your existing loans, such as loan amounts, interest rates, and lenders. You may also need to provide proof of income and identity.

- Complete the Application: Submit a complete and accurate application to Fidelity. This usually involves providing personal information, loan details, and agreeing to the terms and conditions of the consolidation loan.

- Review and Acceptance: Fidelity will review your application and notify you of their decision. If approved, you’ll receive a loan agreement outlining the terms of your consolidated loan.

- Loan Disbursement and Repayment: Once you accept the loan agreement, Fidelity will disburse the funds to pay off your existing loans. You’ll then begin making payments on your consolidated loan according to the agreed-upon schedule.

Benefits of Student Loan Consolidation

Consolidating student loans offers several potential advantages. However, it’s important to weigh these benefits against potential drawbacks.

- Simplified Repayment: Managing one monthly payment instead of multiple payments simplifies the repayment process and reduces the risk of missed payments.

- Potentially Lower Monthly Payments: Consolidation can extend the repayment period, resulting in lower monthly payments. However, this also means paying more interest over the life of the loan.

- Fixed Interest Rate (Potentially): A consolidated loan might offer a fixed interest rate, protecting you from interest rate fluctuations that could occur with variable-rate loans.

Drawbacks of Student Loan Consolidation

While consolidation offers benefits, it’s essential to be aware of potential downsides.

- Higher Total Interest Paid: Extending the repayment term, as often happens with consolidation, generally leads to paying more interest over the life of the loan.

- Loss of Certain Benefits: Consolidating federal student loans into a private loan might mean losing access to certain federal repayment programs or benefits, such as income-driven repayment plans.

- Impact on Credit Score (Potentially): While a consolidated loan can improve your credit score by simplifying your debt, the application process itself might temporarily lower your score.

Eligibility Requirements for Fidelity Student Loan Consolidation

Eligibility criteria for Fidelity student loan consolidation typically include having multiple student loans, meeting minimum credit score requirements, and providing accurate and complete documentation. Specific requirements are subject to change, so it’s always best to check directly with Fidelity for the most up-to-date information. Fidelity will assess your creditworthiness and financial situation to determine your eligibility.

Final Wrap-Up

Successfully managing student loan debt requires proactive planning and a thorough understanding of available resources. This guide has provided a framework for navigating the specifics of Fidelity student loans, from understanding various product offerings and repayment strategies to exploring potential avenues for loan forgiveness. By leveraging the information presented here, you can confidently approach your student loan repayment journey, fostering financial stability and achieving your long-term financial aspirations.

Question Bank

What happens if I miss a payment on my Fidelity student loan?

Missing a payment can result in late fees and negatively impact your credit score. Contact Fidelity immediately to discuss payment options if you anticipate difficulty making a payment.

Can I refinance my Fidelity student loan with another lender?

Yes, you can typically refinance your student loans with other lenders. However, carefully compare interest rates and fees before refinancing to ensure it’s financially beneficial.

Does Fidelity offer any hardship programs for student loan borrowers?

Fidelity may offer forbearance or deferment options under certain circumstances, such as unemployment or medical hardship. Contact their customer service for details and eligibility requirements.

How long does it take to consolidate my student loans through Fidelity?

The processing time for student loan consolidation varies, but it generally takes several weeks. Check Fidelity’s website or contact customer service for estimated timelines.