Navigating the complexities of student loan repayment can feel overwhelming, especially when considering the impact of your tax filing status. Filing jointly or separately on your tax return significantly influences your eligibility for income-driven repayment plans, potential loan forgiveness programs, and overall tax liability. This guide explores the nuances of filing separately for student loans, examining the financial implications and offering insights to help you make informed decisions.

We’ll delve into how individual incomes affect eligibility for income-driven repayment, the potential benefits and drawbacks based on income levels, and the long-term financial consequences of your choice. Understanding the impact on your credit score and future financial aid applications is crucial, as is comprehending the legal and tax ramifications, including potential penalties. Ultimately, this guide aims to equip you with the knowledge needed to strategize effectively for your unique financial situation.

Understanding the Basics of Filing Separately for Student Loans

Filing your taxes jointly or separately can significantly impact your financial situation, especially when dealing with student loan debt. The choice between these filing statuses affects not only your tax liability but also your eligibility for and the calculation of income-driven repayment (IDR) plans for your student loans. Understanding the nuances of each is crucial for effective financial planning.

Filing jointly means you and your spouse combine your incomes and deductions on a single tax return. Filing separately, on the other hand, means each spouse files their own return, reporting only their individual income and deductions. This seemingly simple difference has profound implications for student loan borrowers.

Impact of Filing Status on Student Loan Repayment Plans

Income-driven repayment plans, such as ICR, PAYE, REPAYE, and IBR, base your monthly student loan payments on your discretionary income. This income is calculated using your adjusted gross income (AGI) from your tax return. Since filing status directly affects your AGI, it also influences your calculated monthly payment under an IDR plan. Filing separately might result in a lower AGI for one spouse, leading to lower monthly payments, while the other spouse might see a higher AGI and consequently higher payments. The optimal filing status depends heavily on the relative incomes of each spouse. For example, if one spouse has significantly higher income than the other, filing separately might be advantageous for the lower-earning spouse, reducing their monthly student loan payments. Conversely, filing jointly might offer tax advantages that outweigh the slightly higher student loan payments for both spouses.

Scenarios Where Filing Separately Might Be Beneficial or Detrimental

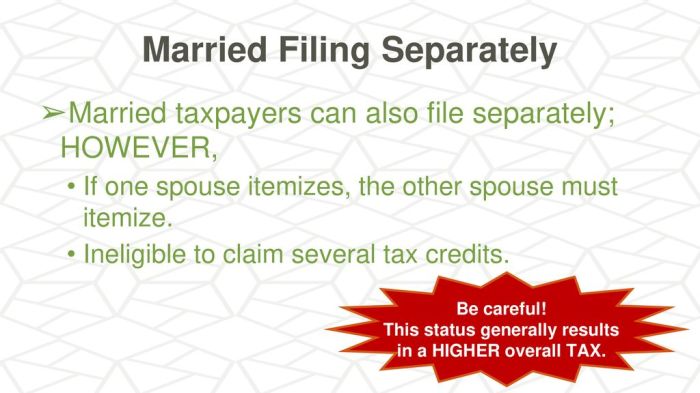

Consider a couple where one spouse (Spouse A) earns significantly more than the other (Spouse B). If Spouse A has substantial student loan debt, filing separately could reduce Spouse B’s AGI, leading to a lower monthly payment on their student loans under an IDR plan. However, Spouse A might face a higher tax liability by filing separately. This is because filing separately often eliminates certain tax benefits available to joint filers, such as the ability to utilize the standard deduction more effectively. Conversely, if both spouses have comparable incomes and student loan debt, filing jointly might be beneficial due to potential tax credits and deductions that are only available to joint filers. This strategy could offset the potentially higher student loan payments.

Tax Implications of Filing Jointly Versus Separately

The following table illustrates a simplified comparison of the tax implications for two hypothetical couples, each with student loan debt. Note that these are illustrative examples and actual tax liability depends on numerous factors including deductions and credits.

| Filing Status | Income | Taxable Income | Tax Liability |

|---|---|---|---|

| Joint | $100,000 | $85,000 | $15,000 |

| Separate (Spouse A) | $70,000 | $60,000 | $10,000 |

| Separate (Spouse B) | $30,000 | $25,000 | $3,000 |

| Joint | $60,000 | $50,000 | $8,000 |

| Separate (Spouse A) | $30,000 | $25,000 | $3,000 |

| Separate (Spouse B) | $30,000 | $25,000 | $3,000 |

Income and Debt Considerations for Separate Filing

Filing for student loans separately from your spouse significantly impacts how your income and debt are considered for repayment plans and potential forgiveness programs. Understanding these implications is crucial for making an informed decision that aligns with your financial circumstances. This section will explore how individual incomes affect eligibility for various repayment options and forgiveness programs, as well as the potential tax implications of separate filing.

Individual Incomes and Income-Driven Repayment Plans

Eligibility for income-driven repayment (IDR) plans, such as ICR, PAYE, REPAYE, andIBR, is determined by your adjusted gross income (AGI). When filing separately, each spouse’s AGI is assessed independently. This means that even if one spouse has a high income, the other spouse might still qualify for an IDR plan if their income falls below the eligibility threshold. For example, if one spouse earns significantly more than the other, the lower-earning spouse may qualify for a lower monthly payment under an IDR plan than if they had filed jointly. Conversely, if both spouses have high incomes, neither might qualify for an IDR plan when filing separately, whereas filing jointly might still allow for participation in a plan with a modified payment amount. The specific income thresholds for IDR plans vary and are subject to change, so it’s essential to consult the official Department of Education website for the most up-to-date information.

High Individual Incomes and Student Loan Forgiveness Programs

High individual incomes can significantly impact eligibility for student loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF) or other income-based repayment forgiveness programs. While the specific income limits vary by program, generally, higher incomes reduce the chances of qualifying for forgiveness. For example, if one spouse has a high income and the other has a lower income, the higher-earning spouse may not meet the income requirements for forgiveness programs, even if they’ve made qualifying payments for the required period. Filing separately can highlight these individual income disparities, making it clearer which spouse, if either, might be eligible for forgiveness. It’s important to note that these programs have complex eligibility criteria, and even if one spouse doesn’t qualify, the other might.

Tax Benefits and Drawbacks of Separate Filing Based on Income Levels

The tax implications of filing separately versus jointly can be complex and depend heavily on individual income levels and other factors like deductions and credits. In some cases, filing separately might result in a lower overall tax liability for the couple, especially if one spouse has significantly higher income than the other and certain deductions or credits are only available to individuals. Conversely, filing jointly may offer better tax benefits in situations where the couple’s combined income results in a lower tax bracket or allows them to claim more significant tax deductions or credits. Tax professionals can assist in analyzing individual circumstances to determine the most advantageous filing status. For example, a couple where one spouse has a very high income and the other has a very low income might find separate filing more beneficial, while a couple with similar incomes might benefit more from joint filing. It’s vital to consult a tax advisor to analyze your specific situation.

Decision-Making Flowchart for Filing Status

The decision of whether to file jointly or separately for student loans is a complex one, requiring a careful consideration of multiple factors. The following flowchart illustrates a simplified decision-making process:

[Imagine a flowchart here. The flowchart would begin with a question: “Are both spouses eligible for income-driven repayment plans when filing separately?” A “Yes” branch would lead to a further question: “Does filing separately result in lower overall taxes and/or better access to student loan forgiveness programs for either spouse?” A “Yes” here would lead to “File Separately.” A “No” would lead to “File Jointly.” A “No” to the initial question would lead to a question: “Does filing jointly offer better tax benefits or access to income-driven repayment plans?” A “Yes” here would lead to “File Jointly.” A “No” would lead to “Consult a financial advisor.”]

Impact on Credit Scores and Financial Aid

Filing for student loans separately from your spouse can have significant implications for your individual credit scores and your eligibility for future financial aid. Understanding these potential consequences is crucial before making a decision. The impact isn’t always negative, but it’s vital to weigh the pros and cons carefully.

Separate filing means each individual’s credit history and debt are evaluated independently. This contrasts with joint filing, where both spouses’ financial information is combined, potentially benefiting one spouse with a stronger credit profile. However, separate filing can also expose weaknesses in an individual’s credit history that might otherwise be masked.

Credit Score Impacts of Separate Filing

Separate filing can affect your credit score in several ways. If one spouse has a significantly higher credit utilization ratio or a history of missed payments, this negative information will only affect their score when filing separately. Conversely, a spouse with a strong credit history will see their score unaffected by the other spouse’s less-than-stellar financial habits. The lack of shared credit history can also lower scores temporarily, as credit bureaus might interpret this as a lack of established credit behavior. For example, a spouse who has primarily relied on joint accounts might see a slight dip in their score after transitioning to separate filing. Conversely, a spouse with a history of responsible credit management on their own accounts will experience little to no negative impact.

Financial Aid Implications of Separate Filing

Separate filing also influences your eligibility for financial aid. Many financial aid applications consider individual income and assets. Filing separately means each spouse’s financial picture is assessed independently, potentially leading to different aid packages. A spouse with lower income might qualify for more aid when filing separately than if their income was combined with a higher-earning spouse. However, this can also result in less overall aid received by the couple compared to joint filing, particularly if one spouse has significant assets. For instance, if one spouse has substantial savings, this wealth could reduce their eligibility for need-based aid when filing separately. Conversely, if both spouses have limited assets, filing separately could increase the total amount of aid received by the couple.

Credit Report Reflections of Separate Filing

Credit reports will show individual credit accounts and activity. For example, if you’ve always had joint accounts with your spouse, your individual report might initially appear “thinner” after separating your finances. This is because the shared accounts will no longer be included on your individual credit report. Over time, however, building credit individually will gradually improve the report’s comprehensiveness. Credit reports won’t explicitly state “filing status,” but the accounts listed and the credit history will reflect the individual financial management.

Factors to Consider Regarding Creditworthiness and Separate Filing

Before deciding whether to file separately, consider these factors:

- Your individual credit scores and history.

- Your spouse’s credit scores and history.

- Your current debt levels.

- Your combined income and assets.

- Your anticipated need for future financial aid or loans.

- The potential impact on your individual credit scores.

Legal and Tax Implications

Filing for student loans separately from your spouse has significant legal and tax ramifications that can impact your overall financial picture. Understanding these implications is crucial for making informed decisions about your tax obligations and potential legal liabilities. This section will Artikel the key considerations related to tax penalties and the process of amending tax returns if errors are discovered.

Potential Tax Penalties for Incorrect Filing Status

Choosing the wrong filing status can result in penalties. The IRS carefully scrutinizes tax returns, and inaccuracies in filing status can lead to underpayment penalties, interest charges, and even audits. The severity of the penalty depends on the amount of underpayment and the reason for the error. For example, intentionally misrepresenting your filing status to reduce your tax liability is a serious offense with potentially severe consequences. Conversely, an honest mistake due to a misunderstanding of the rules may result in a less severe penalty. It is advisable to seek professional tax advice if you are unsure which filing status is appropriate for your circumstances.

Amending a Tax Return Due to Filing Status Errors

If you discover an error in your filing status after submitting your tax return, you can amend it using Form 1040-X, Amended U.S. Individual Income Tax Return. This form allows you to correct the mistake and recalculate your tax liability. The IRS generally provides instructions and guidance on their website for completing this form accurately. It’s important to file the amended return as soon as possible after discovering the error to minimize any potential penalties. Be sure to include all necessary supporting documentation to support the changes you are making.

Calculating Potential Tax Liabilities Under Different Filing Statuses

Let’s illustrate how filing status affects tax liability with hypothetical examples. Assume a couple, Sarah and John, have a combined adjusted gross income (AGI) of $80,000. We’ll consider two scenarios: filing jointly and filing separately. These examples are simplified and do not account for all possible deductions or credits. Consult a tax professional for personalized advice.

Tax Liability Comparison Under Different Scenarios

| Scenario | Filing Status | Taxable Income | Tax Liability (Estimate) |

|---|---|---|---|

| Scenario 1: High Income Earner, Low Income Earner | Married Filing Jointly | $80,000 | $10,000 (This is a hypothetical example; actual tax liability will vary based on deductions and credits.) |

| Scenario 1: High Income Earner, Low Income Earner | Married Filing Separately | $40,000 (each) | $6,000 (each) = $12,000 (Total) (This is a hypothetical example; actual tax liability will vary based on deductions and credits.) |

| Scenario 2: Equal Income | Married Filing Jointly | $80,000 | $10,000 (This is a hypothetical example; actual tax liability will vary based on deductions and credits.) |

| Scenario 2: Equal Income | Married Filing Separately | $40,000 (each) | $6,000 (each) = $12,000 (Total) (This is a hypothetical example; actual tax liability will vary based on deductions and credits.) |

Note: These are simplified examples. Actual tax liability depends on various factors, including deductions, credits, and the specific tax year’s rates. Consult a tax professional for accurate calculations.

Long-Term Financial Planning and Separate Filing

Choosing to file separately for student loans has significant long-term financial implications that extend far beyond the immediate repayment period. Understanding these implications is crucial for making informed decisions that align with your overall financial goals. This section will explore how separate filing affects retirement planning, investment strategies, and overall financial health over the long term.

Separate filing for student loans can impact various aspects of long-term financial planning. For example, individual credit scores will be affected, potentially influencing interest rates on future loans (like mortgages) and even impacting eligibility for certain financial products. Furthermore, separate filing can alter tax brackets and deductions, influencing the amount of taxes owed each year. These factors can significantly impact a couple’s ability to save for retirement and invest in their future.

Retirement Planning and Investment Strategies

Separate filing can influence retirement planning in several ways. If one spouse has a significantly higher income than the other, filing separately might result in a lower tax burden for the higher earner in the short term. However, this could reduce the overall amount contributed to retirement accounts over the long term, potentially leading to a smaller nest egg during retirement. Moreover, separate credit scores could impact the ability to secure favorable interest rates on retirement savings accounts or investment opportunities. For example, if one spouse has a lower credit score due to separate student loan management, they might face higher interest rates on a retirement annuity, reducing their overall returns.

Financial Impact Comparison: Separate vs. Joint Filing (10-Year Period)

Comparing the overall financial impact of filing separately versus jointly requires considering multiple factors, making a generalized comparison difficult. However, a hypothetical example can illustrate potential differences. Consider a couple where one spouse (Spouse A) has significantly higher student loan debt and income than the other (Spouse B). Filing separately might allow Spouse A to deduct more interest payments on their taxes initially. However, over ten years, Spouse B, with a lower income and potentially less aggressive investment opportunities due to separate filing’s impact on credit, might accumulate less wealth. Conversely, joint filing might initially result in a higher tax burden but could allow for joint investment strategies, potentially leading to greater overall wealth accumulation over the ten-year period due to economies of scale and shared resources. The optimal approach depends heavily on individual circumstances and risk tolerance.

Hypothetical Case Study: The Millers

The Millers, a young couple, both graduated with significant student loan debt. Sarah, a high-earning lawyer, carries $150,000 in loans, while Mark, a teacher, has $50,000. Filing separately allows Sarah to potentially deduct more interest initially, reducing her tax burden. However, Mark’s lower income and potentially lower credit score (due to separate management of his loans) hinder his ability to contribute aggressively to retirement accounts and secure favorable interest rates on investments. Over ten years, Sarah might have paid off her loans faster, but Mark’s slower progress could leave them with a significant retirement savings gap. Had they filed jointly, they might have benefited from shared tax advantages and combined investment strategies, potentially leading to a more balanced and ultimately larger retirement fund. This illustrates how the long-term financial implications of separate filing are complex and highly dependent on individual financial circumstances.

Epilogue

Choosing between filing jointly and separately for student loans is a deeply personal financial decision with far-reaching consequences. While separate filing might offer advantages in certain circumstances, a thorough understanding of the potential impacts on your taxes, credit score, and future financial aid eligibility is paramount. By carefully weighing the pros and cons based on your individual income, debt level, and long-term financial goals, you can make an informed choice that aligns with your overall financial well-being. Remember to consult with a qualified financial advisor or tax professional for personalized guidance.

FAQ

Can I switch from filing jointly to separately after filing?

Yes, you can amend your tax return if you made a mistake regarding your filing status. However, there are deadlines to consider, so act promptly.

Does filing separately affect my spouse’s tax liability?

Yes, filing separately means each spouse’s income and deductions are considered independently, affecting each person’s tax liability separately.

How does filing separately impact my eligibility for federal student loan forgiveness programs?

It depends on the specific program and your income. Separate filing might impact income-based repayment plan calculations, potentially affecting your eligibility for forgiveness.

Will filing separately always save me money on taxes?

Not necessarily. The tax implications depend on your individual circumstances and income levels. In some cases, filing jointly might result in a lower overall tax liability.