Navigating the world of student loans can feel overwhelming. The search “find student loan” reflects a diverse range of needs and anxieties, from prospective students researching options to graduates grappling with repayment strategies. This guide aims to illuminate the entire student loan journey, from understanding different loan types and application processes to managing debt effectively and avoiding potential scams.

We will explore the various motivations behind searching for student loans, examining the different stages individuals go through, and considering the diverse demographics involved. We’ll delve into the specifics of federal versus private loans, providing clear comparisons and examples of popular loan programs. Furthermore, we’ll equip you with the knowledge to confidently navigate the application process, understand factors affecting loan approval, and implement effective debt management strategies.

Understanding the Search Intent Behind “Find Student Loan”

The search query “find student loan” reveals a user actively seeking financial aid for higher education. Understanding the nuances behind this seemingly simple search is crucial for effectively targeting potential borrowers and providing relevant information. This analysis explores the various motivations, stages of the loan journey, and demographics associated with this search.

The motivations behind a “find student loan” search are multifaceted. Individuals may be at different stages in their educational journey, facing varying financial circumstances, and seeking diverse loan types. Some might be prospective students researching options before applying to college, while others might be current students needing additional funding or refinancing existing loans. Still others may be graduates looking to consolidate or manage their debt.

Stages of the Student Loan Journey

The search “find student loan” reflects various stages in a student’s journey toward higher education and beyond. Early stages might involve researching different loan types (federal, private, subsidized, unsubsidized), comparing interest rates and repayment options, and understanding eligibility criteria. Mid-stages may include comparing offers from multiple lenders, completing the application process, and receiving loan disbursement. Finally, later stages involve managing repayments, exploring refinancing opportunities, or dealing with loan default. The search query alone provides little indication of which specific stage a user is in, highlighting the need for comprehensive and adaptable content.

Demographics of Users Searching for Student Loans

The demographic profile of individuals searching for “find student loan” is broad, encompassing a wide range of ages, income levels, and educational backgrounds. The most common demographic is likely to be young adults (18-25 years old) who are either prospective or current college students. However, the search query can also attract older students returning to education, or graduates managing existing loan debt, potentially spanning ages from 18 to 40 or even older. Income levels would vary considerably, reflecting the diverse financial situations of students and their families. Geographical location can also influence search intent, as loan availability and interest rates may vary regionally.

User Persona: Sarah, the Aspiring Engineer

To illustrate a typical searcher, consider Sarah, a 20-year-old sophomore majoring in mechanical engineering at a state university. Sarah’s family cannot fully cover her tuition, so she needs to take out student loans. She is searching for “find student loan” to compare federal and private loan options, focusing on interest rates, repayment terms, and potential deferment options during summer breaks. She is tech-savvy and prefers online applications and digital communication. Sarah represents a common user profile: a motivated student needing financial assistance, actively seeking information online to make informed decisions.

Types of Student Loans Searched For

Understanding the different types of student loans available is crucial for prospective students and their families. The choice between federal and private loans, and the specific programs within each category, significantly impacts the overall cost and repayment terms of a student’s education. This section will clarify the distinctions and provide examples of commonly sought-after loan programs.

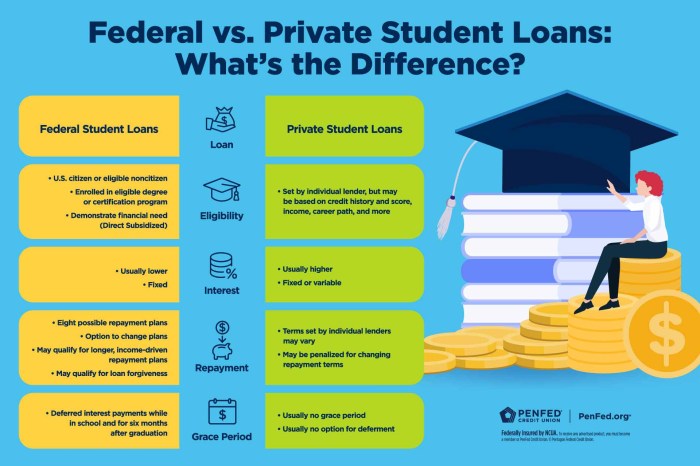

Federal vs. Private Student Loans

Federal and private student loans differ significantly in their eligibility requirements, interest rates, repayment options, and overall terms. Federal loans are offered by the U.S. government and generally come with more borrower protections and flexible repayment plans. Private loans, on the other hand, are offered by banks, credit unions, and other private lenders, and often have stricter eligibility criteria and potentially higher interest rates.

Types of Student Loans and Their Characteristics

The following table summarizes the key features of various student loan types. Note that interest rates and repayment options can vary based on the specific loan program and the borrower’s creditworthiness.

| Loan Type | Lender Type | Interest Rate Information | Repayment Options |

|---|---|---|---|

| Federal Subsidized Loan | Federal Government | Interest rate set annually by the government; interest does not accrue while the student is enrolled at least half-time. | Standard, graduated, extended, income-driven repayment plans. |

| Federal Unsubsidized Loan | Federal Government | Interest rate set annually by the government; interest accrues while the student is enrolled. | Standard, graduated, extended, income-driven repayment plans. |

| Federal PLUS Loan (Parent/Graduate) | Federal Government | Interest rate set annually by the government; higher interest rate than subsidized and unsubsidized loans. | Standard, graduated, extended repayment plans. |

| Federal Direct Consolidation Loan | Federal Government | Weighted average of the interest rates of the consolidated loans. | Standard, graduated, extended repayment plans. |

| Private Student Loan | Banks, Credit Unions, Sallie Mae, etc. | Variable or fixed interest rates; generally higher than federal loan rates; determined by the lender based on creditworthiness. | Variety of repayment options depending on the lender; may include options similar to federal loans or other customized plans. |

Examples of Specific Loan Programs

Several specific loan programs fall under the broader categories Artikeld above. For example, the Federal Perkins Loan Program (discontinued for new borrowers in 2017 but existing loans still exist) was a low-interest loan program for undergraduate and graduate students with exceptional financial need. Similarly, many private lenders offer specialized programs, such as loans for students attending specific schools or pursuing certain fields of study. These programs may offer competitive interest rates or unique repayment features. Understanding the nuances of these programs can help borrowers find the most suitable financing options for their educational goals.

Resources for Finding Student Loans

Finding the right student loan can feel overwhelming, but thankfully, numerous resources exist to guide you through the process. Understanding the differences between these resources and how to evaluate their trustworthiness is crucial for making informed decisions about your financial future. This section Artikels several reputable sources and explains how to assess their reliability.

Reputable Online Resources for Student Loan Information

Several online platforms offer comprehensive information on student loans. Choosing the right resource depends on your specific needs and preferences. Consider factors such as ease of navigation, comprehensiveness of information, and the reputation of the organization providing the resource.

- Federal Student Aid (FSA): This U.S. Department of Education website is the primary source for information on federal student loans. It offers detailed explanations of different loan programs, eligibility requirements, repayment options, and tools to estimate loan costs. The site’s benefit lies in its authority and accuracy, providing official information directly from the source.

- StudentAid.gov: This website, managed by the FSA, provides a centralized portal for managing federal student loans. Beyond information, it offers tools for applying for loans, tracking loan status, and making payments. Its advantage is the streamlined access it provides to your federal student aid.

- National Education Association (NEA): While not solely focused on student loans, the NEA offers resources and guidance for students and families navigating the financing of higher education. Their benefit is the broader context they provide, often including advice on financial planning and scholarships beyond just loans.

- Sallie Mae: A large private student loan provider, Sallie Mae also offers a wealth of information on student loans, including articles, calculators, and tools for comparing loan options. While providing valuable information, it’s important to remember that Sallie Mae’s perspective is inherently focused on their own loan products.

Government Websites vs. Private Companies: Key Differences

Government websites, like FSA and StudentAid.gov, provide objective, unbiased information on federal student loan programs. They are the definitive source for details on eligibility, repayment plans, and loan forgiveness programs. Private companies, such as Sallie Mae, offer information on both federal and private loans, but their information often promotes their own products and services. While they can provide useful tools and comparisons, it’s crucial to critically evaluate their information and consider the potential bias. Government sites focus on public policy and programs, whereas private companies prioritize their business interests.

Evaluating the Trustworthiness of a Student Loan Resource

Before relying on any student loan resource, critically evaluate its trustworthiness. Look for indicators such as:

- Transparency: Does the site clearly identify its sources and any potential conflicts of interest? A reputable source will be open about its affiliations and funding.

- Accuracy: Does the information align with official government sources like the FSA? Cross-reference information with multiple sources to verify its accuracy.

- Authority: Is the information provided by experts in the field of student loans or financial aid? Look for credentials and experience.

- Up-to-date information: Student loan rules and regulations can change. Ensure the information is current and reflects the latest updates.

- Secure website: Look for a secure website connection (https) to protect your personal information.

The Loan Application Process

Applying for a student loan can seem daunting, but understanding the steps involved and gathering the necessary documentation beforehand can significantly streamline the process. This section Artikels the typical steps, required documents, and tips to increase your chances of approval.

Steps in the Student Loan Application Process

The application process generally follows a series of steps. Careful attention to each stage will improve the efficiency and likelihood of a successful outcome.

-

Complete the FAFSA (Free Application for Federal Student Aid):

This is the first and most crucial step for federal student loans. The FAFSA determines your eligibility for federal aid, including grants and loans. You’ll need your social security number, tax information, and other financial details.

-

Choose a Loan Type and Lender:

Once you know your eligibility, you can choose between federal and private loans. Federal loans typically offer more favorable terms, but private loans may be an option if you need additional funding. Research different lenders to compare interest rates and repayment options.

-

Complete the Loan Application:

Each lender has its own application process. You’ll need to provide personal information, academic details, and financial information. Be thorough and accurate in completing the application.

-

Provide Required Documentation:

Lenders will require supporting documents to verify the information provided in your application. This often includes tax returns, bank statements, and proof of enrollment.

-

Await Loan Approval:

After submitting your application and supporting documentation, the lender will review your information. This process can take several weeks. You’ll receive notification of approval or denial.

-

Accept the Loan Offer:

If your loan is approved, carefully review the loan terms and conditions before accepting the offer. Understand the interest rate, repayment terms, and any fees involved.

Necessary Documentation for a Student Loan Application

Providing complete and accurate documentation is essential for a smooth and successful application. Missing documents can significantly delay the process.

Commonly required documents include:

- Completed FAFSA form

- Social Security number

- Tax returns (yours and your parents’, if applicable)

- Bank statements

- Proof of enrollment (acceptance letter or transcript)

- Driver’s license or other government-issued identification

- Information about your current income and assets

Tips for Improving Loan Approval Chances

Taking proactive steps can significantly improve your chances of loan approval.

Here are some key tips:

- Maintain a good credit history: A strong credit score demonstrates financial responsibility and increases your likelihood of approval, especially for private loans.

- Complete the FAFSA accurately and on time: Submitting a complete and accurate FAFSA is crucial for federal loan eligibility.

- Provide all required documentation: Gather all necessary documents beforehand to avoid delays.

- Shop around for the best loan terms: Compare interest rates and repayment options from different lenders to secure the most favorable loan.

- Understand your financial situation: Be realistic about your ability to repay the loan. Borrowing responsibly is crucial for long-term financial health.

Factors Affecting Loan Eligibility and Approval

Securing a student loan hinges on several key factors that lenders meticulously assess. Understanding these factors empowers prospective borrowers to improve their chances of approval and potentially secure more favorable loan terms. This section details the crucial elements lenders consider during the application process.

Credit Score and Credit History

A strong credit score and positive credit history significantly influence loan approval. Lenders use credit reports to gauge your reliability in repaying borrowed funds. A higher credit score generally translates to better loan terms, such as lower interest rates and more favorable repayment options. Conversely, a poor credit history, including late payments or defaults, can lead to loan denial or significantly higher interest rates. For example, a borrower with a credit score above 750 might qualify for a subsidized loan with a low interest rate, while a borrower with a score below 600 might face loan rejection or significantly higher interest rates and fees.

Income and Debt-to-Income Ratio

Your income and debt-to-income (DTI) ratio are critical indicators of your ability to manage loan repayments. Lenders assess your monthly income against your existing debt obligations to determine your capacity to handle additional debt. A lower DTI ratio generally improves your chances of approval. For instance, a borrower with a high income and low existing debt will likely have a lower DTI ratio, making them a less risky borrower and increasing their likelihood of approval. Conversely, a borrower with a low income and high existing debt may be deemed a higher risk and face difficulty securing a loan. A high DTI ratio may lead to loan rejection or necessitate a co-signer to mitigate the lender’s risk.

Other Factors Affecting Loan Eligibility

Beyond credit score and income, other factors influence loan eligibility. These include your educational background, the type of degree you’re pursuing, your enrollment status, and your co-signer’s creditworthiness (if applicable). For example, lenders may favor applicants pursuing degrees in high-demand fields or those enrolled in accredited institutions. A co-signer with a strong credit history can significantly improve the chances of loan approval, especially for borrowers with limited credit history or a low credit score. The lender’s specific policies and risk assessment models also play a significant role. Different lenders have varying criteria and may prioritize different factors.

Managing Student Loan Debt

Successfully navigating student loan debt requires proactive planning and a clear understanding of your repayment options. Failing to manage this debt effectively can significantly impact your financial future, potentially hindering major life goals like homeownership or starting a family. This section Artikels strategies for responsible repayment and explores options for managing your loans more efficiently.

Effective Student Loan Repayment Strategies

Prioritizing repayment is crucial. A successful strategy often involves creating a realistic budget that incorporates your loan payments. This budget should account for all income and expenses, ensuring your loan payments are manageable without compromising essential living costs. Consider exploring different repayment plans offered by your loan servicer, such as graduated repayment (lower payments initially, increasing over time) or income-driven repayment (payments based on your income and family size). Automating payments can also help prevent late fees and ensure consistent progress towards debt elimination. Finally, actively monitoring your loan account and staying informed about changes in interest rates and repayment options is key to maintaining control.

Understanding Loan Terms and Conditions

Thoroughly understanding your loan terms and conditions is paramount. This includes knowing your interest rate, loan balance, repayment schedule, and any applicable fees. Understanding these terms allows you to make informed decisions about your repayment strategy and anticipate potential challenges. For example, understanding the difference between fixed and variable interest rates can significantly impact your long-term repayment costs. Ignoring these details could lead to unexpected expenses and a prolonged repayment period. Review your loan documents carefully and don’t hesitate to contact your loan servicer if you have any questions or require clarification.

Loan Consolidation and Refinancing Options

Loan consolidation and refinancing are two options that can simplify repayment and potentially lower your monthly payments or interest rate. Consolidation combines multiple loans into a single loan, simplifying the repayment process and providing a single monthly payment. Refinancing involves replacing your existing loans with a new loan, often with a lower interest rate. Both options can be beneficial, but it’s crucial to carefully compare the terms and conditions of any new loan before making a decision. Consider the fees associated with these processes and assess whether the potential savings outweigh the costs. It’s also important to check your credit score before applying, as a higher score generally leads to better loan terms.

Visual Representation of Repayment Strategies

Imagine a graph with “Years to Repay” on the x-axis and “Total Interest Paid” on the y-axis. Three lines represent different repayment strategies:

* Standard Repayment: This line shows a relatively steep curve, indicating a shorter repayment period but a higher total interest paid. For example, a $30,000 loan at 6% interest might be repaid in 10 years with approximately $10,000 in interest paid.

* Extended Repayment: This line is flatter and longer, indicating a longer repayment period (e.g., 20 years) but a significantly lower total interest paid (e.g., $18,000). However, the overall cost might still be higher due to the extended timeframe.

* Aggressive Repayment (extra payments): This line shows a much steeper descent, reaching zero balance much faster than standard repayment. This represents making extra payments beyond the minimum, significantly reducing the total interest paid and the overall repayment time (e.g., 5 years with $3,000 interest paid). This requires a higher initial monthly payment but results in substantial long-term savings. This scenario demonstrates that while a longer repayment period might seem appealing, it often leads to paying significantly more in interest over the life of the loan.

Potential Scams and Misinformation

Navigating the world of student loans can be challenging, and unfortunately, it’s also a landscape rife with potential scams and misleading information. Understanding how to identify and avoid these pitfalls is crucial to protecting your financial well-being. This section will highlight common scams and deceptive practices to help you make informed decisions.

The sheer volume of information available online, coupled with the urgency many students feel to secure funding, creates fertile ground for fraudulent activities. Scammers often prey on those desperate for financial assistance, using high-pressure tactics and false promises to lure victims into traps.

Common Student Loan Scams

Several types of student loan scams are prevalent. These range from fake loan offers promising unrealistically low interest rates or guaranteed approvals to schemes involving upfront fees for loan processing that never materialize. Others might involve phishing emails or websites mimicking legitimate lenders to steal personal information. It’s essential to be vigilant and critically evaluate all loan offers.

Identifying Fraudulent Loan Offers

Spotting fraudulent loan offers requires a discerning eye. Be wary of offers that seem too good to be true, particularly those advertising extremely low interest rates or promising guaranteed approval without a thorough credit check. Legitimate lenders always conduct a credit assessment and may require additional documentation. Also, be cautious of unsolicited loan offers, especially those arriving via email or text message. Always verify the legitimacy of the lender through independent research before proceeding.

Verifying the Legitimacy of Loan Providers

Verifying a lender’s legitimacy is paramount. Never rely solely on online advertising or unsolicited communications. Instead, independently research the lender using reputable sources like the Federal Student Aid website (studentaid.gov), the Better Business Bureau, or your state’s attorney general’s office. Check for licensing and accreditation, and look for reviews and complaints from other borrowers. A legitimate lender will be transparent about its fees, interest rates, and terms.

Deceptive Practices to Watch Out For

Several deceptive practices are employed by fraudulent student loan providers. These include high-pressure sales tactics designed to rush you into a decision before you can fully assess the terms, upfront fees disguised as application or processing charges, and guarantees of loan approval regardless of creditworthiness. Also, be wary of lenders who demand personal information before providing details about the loan terms. A legitimate lender will never pressure you into a decision and will provide all necessary information upfront. For example, a scammer might claim a “guaranteed” loan approval, regardless of credit history, for a substantial upfront fee, which is a clear red flag. Another example could be an email claiming to be from a well-known lender, asking for immediate personal information to “process” a loan application – a classic phishing attempt.

Epilogue

Securing a student loan is a significant financial decision, and understanding the process is crucial for success. This guide has provided a comprehensive overview of the various aspects involved, from identifying your needs and researching loan options to navigating the application and managing your debt responsibly. By being informed and proactive, you can effectively manage your student loan journey and pave the way for a brighter financial future. Remember to always verify the legitimacy of any loan provider and be wary of potential scams.

FAQ Explained

What is the difference between subsidized and unsubsidized federal loans?

Subsidized loans don’t accrue interest while you’re in school, whereas unsubsidized loans do.

What is a credit score, and why is it important for loan applications?

A credit score is a numerical representation of your creditworthiness. Lenders use it to assess your risk and determine your eligibility for a loan. A higher credit score generally leads to better loan terms.

Can I refinance my student loans?

Yes, refinancing can consolidate multiple loans into one with a potentially lower interest rate. However, it’s important to compare offers carefully.

What should I do if I suspect a student loan scam?

Report the suspicious activity to the Federal Trade Commission (FTC) and your state’s attorney general’s office. Never share sensitive personal or financial information unless you are certain of the lender’s legitimacy.