Navigating the complexities of student loans can be daunting, especially for Florida State University students. This guide provides a comprehensive overview of the various loan options available, from federal programs to private lenders, helping students understand eligibility criteria, interest rates, repayment plans, and potential forgiveness programs. We’ll explore the application process, offer strategies for effective debt management, and discuss the long-term financial implications of student loan debt on career choices and overall well-being.

Understanding your options and making informed decisions is crucial for a successful financial future. This guide aims to empower Florida State students with the knowledge and resources needed to manage their student loan journey effectively. From FAFSA completion to understanding income-driven repayment plans, we’ll cover all the essential aspects to ensure you’re well-prepared for the financial responsibilities ahead.

Types of Florida State Student Loans

Securing funding for higher education is a crucial step for many Florida State University students. Understanding the various loan options available is key to making informed financial decisions. This section Artikels the different types of student loans accessible to FSU students, highlighting eligibility criteria, interest rates, and repayment terms. The information provided is for general understanding and should not be considered exhaustive financial advice. Always consult with a financial aid advisor for personalized guidance.

Federal Student Loans

Federal student loans are government-backed loans offered through programs like the Federal Direct Loan Program. These loans typically offer more favorable terms than private loans, including lower interest rates and various repayment options. Eligibility is primarily determined by financial need and enrollment status at an eligible institution like FSU.

Eligibility Criteria for Federal Student Loans

To be eligible for federal student loans, students must generally be enrolled at least half-time in a degree program, be a U.S. citizen or eligible non-citizen, and maintain satisfactory academic progress. Specific requirements may vary depending on the type of federal loan. Students must complete the Free Application for Federal Student Aid (FAFSA) to determine their eligibility and loan amounts.

Interest Rates and Repayment Terms for Federal Student Loans

Interest rates for federal student loans are set annually by the government and are generally lower than those offered by private lenders. Repayment typically begins six months after graduation or when the student is no longer enrolled at least half-time. Several repayment plans are available, including standard, graduated, extended, and income-driven repayment options. The specific interest rate and repayment terms will depend on the loan type (e.g., subsidized, unsubsidized, PLUS loans).

Private Student Loans

Private student loans are offered by banks, credit unions, and other private lenders. These loans are not backed by the government and often have higher interest rates and less flexible repayment options compared to federal loans. Eligibility for private student loans is based on the borrower’s creditworthiness and financial history. A co-signer with good credit may be required, especially for students with limited or no credit history.

Interest Rates and Repayment Terms for Private Student Loans

Interest rates for private student loans are variable and depend on several factors, including the borrower’s credit score, the loan amount, and the lender’s current rates. Repayment terms vary depending on the lender, but typically range from 5 to 15 years. Prepayment penalties may apply if you pay off the loan early.

Comparison of Federal and Private Student Loans

The following table summarizes the key differences between federal and private student loans available to Florida State University students. Remember that these are general comparisons, and specific terms and conditions will vary based on the lender and individual circumstances.

| Loan Type | Interest Rate | Repayment Options | Eligibility |

|---|---|---|---|

| Federal Student Loan (e.g., Direct Subsidized/Unsubsidized) | Generally lower, fixed; set annually by the government | Standard, graduated, extended, income-driven | Based on financial need, enrollment status, U.S. citizenship/eligibility |

| Private Student Loan | Generally higher, variable; depends on creditworthiness | Varies by lender; typically standard repayment plans | Based on credit history, income, and may require a co-signer |

Accessing and Applying for Florida State Student Loans

Securing funding for your education at Florida State University involves navigating the landscape of federal and private student loans. Understanding the application processes for each is crucial to obtaining the financial assistance you need. This section Artikels the steps involved in applying for both federal and private student loans, highlighting key requirements and considerations.

Federal Student Loan Application Process

Applying for federal student loans begins with completing the Free Application for Federal Student Aid (FAFSA). This form collects information about your financial situation to determine your eligibility for federal student aid, including grants, loans, and work-study. The FAFSA is a critical first step, and accuracy is paramount. Submitting an incomplete or inaccurate FAFSA can delay or even prevent you from receiving financial aid.

Completing the FAFSA Form Accurately

Accurate completion of the FAFSA requires careful attention to detail. You’ll need your Social Security number, your parents’ tax information (if you are a dependent student), and your federal tax return information. The IRS Data Retrieval Tool can help you accurately transfer tax information directly from the IRS to your FAFSA application, minimizing errors. Double-check all entries before submitting the form. If you make a mistake, you can correct it online through the FAFSA website. Remember, your FAFSA information is used to determine your eligibility for federal aid, including Pell Grants and federal student loans.

Private Student Loan Application Process

Unlike federal loans, private student loans are offered by banks, credit unions, and other financial institutions. The application process typically involves completing an online application, providing your financial information, and undergoing a credit check (if you are an independent student). Each lender has its own specific requirements and application process. It’s advisable to compare offers from multiple lenders to secure the best interest rates and terms.

Necessary Documentation for Loan Applications

The documentation required for both federal and private student loan applications varies. For federal loans, the FAFSA is the primary document. You may also need to provide additional documentation if requested by your financial aid office. For private student loans, lenders generally require proof of enrollment at Florida State University, your student ID number, and your credit history (if you’re an independent student). You may also need to provide tax returns, bank statements, or other financial documents to verify your income and creditworthiness. Always check the specific requirements of each lender before applying.

Managing and Repaying Florida State Student Loans

Successfully navigating student loan repayment requires understanding the available options and developing sound financial strategies. This section will Artikel various repayment plans, budgeting techniques, the consequences of default, and resources available to assist Florida State University students facing financial challenges related to their loans.

Federal Student Loan Repayment Plans

Several repayment plans are available for federal student loans, each designed to cater to different financial situations and income levels. These plans offer varying monthly payment amounts and repayment periods. Choosing the right plan depends on individual circumstances and long-term financial goals. For instance, the Standard Repayment Plan involves fixed monthly payments over 10 years, while the Extended Repayment Plan stretches payments over a longer period, resulting in lower monthly payments but higher overall interest paid. Income-Driven Repayment (IDR) plans, such as the Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE) plans, base monthly payments on your income and family size. These plans can significantly reduce monthly payments, but they often extend the repayment period. Finally, the Graduated Repayment Plan starts with lower monthly payments that gradually increase over time.

Strategies for Budgeting and Managing Student Loan Debt

Effective budgeting is crucial for managing student loan debt. Creating a realistic budget that tracks income and expenses allows for prioritizing loan payments. This involves identifying areas where spending can be reduced to allocate more funds towards loan repayment. Strategies include creating a detailed monthly budget, using budgeting apps to track expenses, and automating loan payments to ensure timely payments and avoid late fees. Prioritizing high-interest loans for repayment can save money on interest in the long run. Consider exploring loan refinancing options to potentially lower interest rates and monthly payments, although this should be carefully considered based on individual circumstances and creditworthiness.

Consequences of Loan Default and Strategies for Avoiding It

Defaulting on student loans has severe consequences, including damage to credit scores, wage garnishment, tax refund offset, and difficulty obtaining future loans or credit. It can also lead to legal action and collection fees. To avoid default, proactive measures are essential. This includes staying in communication with your loan servicer, exploring available repayment options if facing financial hardship, and diligently making payments on time. Contacting your loan servicer early to discuss repayment options is vital if you anticipate difficulties meeting payments. Consider exploring options like forbearance or deferment if you are temporarily unable to make payments.

Resources for Florida State Students Facing Financial Difficulties

Several resources are available to assist Florida State University students struggling with student loan repayment.

- Financial Aid Office: The FSU Financial Aid Office provides guidance and support to students facing financial challenges, including assistance with loan repayment options.

- Counseling and Psychological Services (CAPS): CAPS offers counseling services to help students manage stress and anxiety related to financial burdens.

- Career Center: The Career Center can assist students in finding employment opportunities to improve their financial situation and manage loan repayment.

- National Foundation for Credit Counseling (NFCC): The NFCC provides free and low-cost credit counseling services, including assistance with student loan debt management.

- Student Loan Servicers: Direct communication with your student loan servicer is crucial. They can provide information on repayment plans, hardship options, and other assistance programs.

Understanding Loan Forgiveness and Deferment Programs

Navigating student loan repayment can be complex, but understanding available forgiveness and deferment options is crucial for Florida State graduates. This section Artikels the conditions for various programs, helping you determine which might be suitable for your circumstances. Remember to always verify details directly with the relevant loan servicer and government agencies.

Loan Forgiveness Programs for Florida State Graduates

Several loan forgiveness programs exist, but eligibility often depends on factors like loan type, employment, and income. The specifics of each program can change, so it’s essential to check for updates regularly. For example, some programs might prioritize graduates pursuing careers in public service or those working in specific high-need fields. Others might focus on borrowers facing significant financial hardship.

Applying for Loan Deferment or Forbearance

Deferment and forbearance temporarily postpone loan payments. Deferment usually requires demonstrating financial hardship or enrollment in school, while forbearance is often granted based on temporary financial difficulties. The application process typically involves contacting your loan servicer and providing supporting documentation, such as proof of income or enrollment. Be aware that interest may still accrue during deferment or forbearance, potentially increasing your total loan amount.

Eligibility Criteria for Income-Driven Repayment Plans

Income-driven repayment (IDR) plans adjust monthly payments based on your income and family size. Eligibility generally depends on having federal student loans. Several IDR plans exist, each with its own calculation method. To determine eligibility, you’ll need to provide income and family size information to your loan servicer. IDR plans can significantly reduce monthly payments, but the repayment period may be longer, resulting in higher overall interest payments.

Public Service Loan Forgiveness (PSLF) Program

The PSLF program offers loan forgiveness for those working full-time in qualifying public service jobs. Florida State graduates employed in government or non-profit organizations may be eligible. Key requirements include making 120 qualifying monthly payments under an IDR plan. The application process involves submitting an employment certification form to your loan servicer annually, verifying your employment status.

| Program Name | Eligibility Requirements | Forgiveness Amount | Application Process |

|---|---|---|---|

| Public Service Loan Forgiveness (PSLF) | Full-time employment in qualifying public service, 120 qualifying monthly payments under an IDR plan | Remaining loan balance | Submit employment certification form annually to loan servicer; apply for forgiveness after 120 payments. |

| Teacher Loan Forgiveness | Full-time employment as an elementary or secondary school teacher in a low-income school for five complete and consecutive academic years | Up to $17,500 | Apply through the Department of Education. |

| Income-Driven Repayment (IDR) Plans (Forgiveness after 20-25 years) | Federal student loans, meet income requirements | Remaining loan balance after 20-25 years of payments | Apply through your loan servicer. |

| State-Specific Loan Forgiveness Programs (Vary by State) | Specific requirements vary widely by state and program; often tied to employment in high-need fields or public service. | Varies by program | Application process varies by program and state. |

The Impact of Student Loans on Florida State Graduates

The accumulation of student loan debt significantly impacts Florida State University graduates’ financial well-being, influencing their career paths, lifestyle choices, and long-term financial security. Understanding the scope of this debt and its potential consequences is crucial for effective financial planning and future success.

Long-Term Financial Implications of Student Loan Debt

Student loan debt can significantly restrict a Florida State graduate’s post-graduation options. High debt levels may force graduates to prioritize higher-paying jobs, potentially sacrificing career satisfaction for financial stability. This could lead to accepting positions that don’t align with their educational background or career aspirations. Furthermore, substantial loan repayments can limit the ability to save for major life events such as purchasing a home, starting a family, or investing in retirement, impacting overall quality of life. The weight of loan repayments can also create considerable financial stress, affecting mental and emotional well-being.

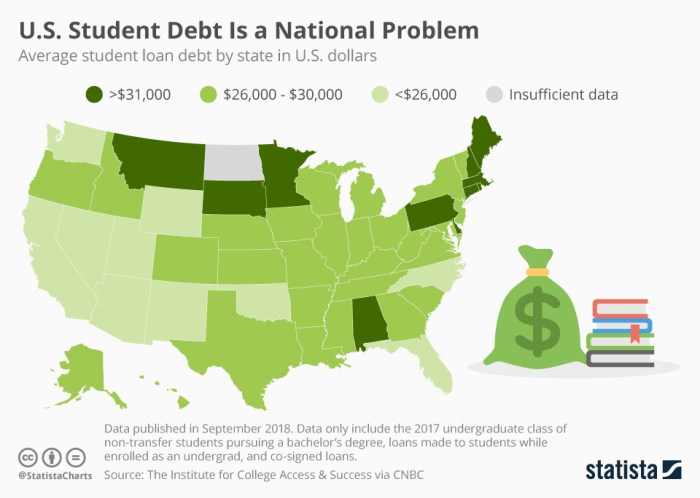

Comparison of Florida State Graduates’ Average Student Loan Debt to National Averages

Precise figures fluctuate yearly, but generally, Florida State graduates’ average student loan debt is comparable to, or slightly below, the national average for public university graduates. While specific data requires referencing the most recent reports from sources like the National Center for Education Statistics (NCES) and the Institute for College Access & Success (TICAS), it’s important to note that averages can be misleading. The actual debt burden varies significantly depending on factors such as the student’s chosen major, the length of their program, and their reliance on loans versus other forms of financial aid. Some graduates may have significantly higher debt levels than others, while some may graduate debt-free.

Hypothetical Scenario: Impact of Different Repayment Strategies

Let’s consider two Florida State graduates, both with $50,000 in student loan debt at a 6% interest rate. Graduate A chooses a standard 10-year repayment plan, resulting in higher monthly payments but a shorter repayment period. Graduate B opts for an extended 20-year repayment plan, resulting in lower monthly payments but significantly higher total interest paid over the life of the loan.

Graduate A’s monthly payment would be approximately $550, and they would pay approximately $16,000 in interest over the life of the loan. Graduate B’s monthly payment would be approximately $350, but they would pay approximately $36,000 in interest over the life of the loan – more than double the interest paid by Graduate A. This illustrates the significant long-term financial implications of choosing a repayment plan.

Impact of Interest Capitalization

Interest capitalization occurs when accrued interest is added to the principal loan balance, increasing the total amount owed. This significantly increases the total cost of the loan over time. For instance, if Graduate B from the previous example experienced interest capitalization during periods of deferment or forbearance, their final loan repayment amount would be even higher than the already substantial $86,000. Understanding interest capitalization and actively managing loan payments to avoid it is crucial for minimizing overall repayment costs.

Conclusion

Securing a higher education is a significant investment, and understanding the intricacies of student loans is paramount to responsible financial planning. This guide has provided a framework for navigating the landscape of Florida State student loans, from application and management to repayment strategies and potential forgiveness programs. By utilizing the resources and information presented, Florida State students can make informed decisions, mitigate financial risks, and ultimately, achieve their academic and career aspirations with greater financial confidence.

Expert Answers

What is the difference between subsidized and unsubsidized federal loans?

Subsidized loans don’t accrue interest while you’re in school, whereas unsubsidized loans do.

Can I consolidate my federal student loans?

Yes, consolidating your federal loans can simplify repayment by combining them into a single loan with one monthly payment.

What happens if I default on my student loans?

Defaulting can result in wage garnishment, tax refund offset, and damage to your credit score.

Are there any scholarships specifically for Florida State students?

Yes, Florida State University offers numerous scholarships; check their financial aid website for details.

Keep shining!