Navigating the complexities of student loan repayment can feel overwhelming, especially when unexpected life events arise. Understanding the option of student loan forbearance is crucial for borrowers facing financial hardship. This guide provides a clear and concise definition of forbearance, detailing its differences from deferment, the various types available, and the potential long-term implications. We’ll explore eligibility criteria, the impact on credit scores, and offer alternative repayment strategies to help you make informed decisions about your financial future.

We’ll delve into the practical aspects of applying for forbearance, communicating effectively with your loan servicer, and planning for repayment once the forbearance period concludes. This comprehensive resource aims to empower you with the knowledge needed to manage your student loans effectively and navigate challenging financial circumstances.

Definition of Student Loan Forbearance

Student loan forbearance is a temporary suspension of your student loan payments. It offers borrowers a reprieve from making payments for a specified period, but it’s crucial to understand that interest typically continues to accrue during this time, potentially increasing your overall loan balance. This differs significantly from deferment, which we’ll explore further.

Forbearance versus Deferment

The key difference between forbearance and deferment lies in who initiates the process and how interest accrues. Deferment is generally granted based on specific circumstances, such as unemployment or enrollment in school, and often results in a pause in both payments and interest accrual (for subsidized loans). Forbearance, on the other hand, is usually requested by the borrower and often involves continued interest accrual, leading to a larger loan balance upon repayment resumption. While both offer temporary payment relief, deferment is generally the more favorable option.

Types of Forbearance Programs

Several types of forbearance programs exist, each with its own eligibility criteria and terms. The specific programs available depend on your loan servicer and the type of federal student loans you hold. These programs are designed to provide short-term relief, and borrowers should utilize them strategically and explore repayment options to avoid long-term debt accumulation.

Comparison of Forbearance Options

The following table compares different potential forbearance options. Note that the specific details can vary depending on your loan servicer and the type of loan you have. It’s crucial to contact your servicer directly to understand the specific terms applicable to your situation.

| Forbearance Type | Maximum Length | Impact on Credit | Eligibility Requirements |

|---|---|---|---|

| General Forbearance | Up to 12 months, potentially renewable | May negatively impact credit score due to late payments | Generally available to borrowers experiencing temporary financial hardship |

| Economic Hardship Forbearance | Up to 36 months, potentially renewable | May negatively impact credit score due to late payments | Requires documentation of economic hardship, such as job loss or medical expenses |

| COVID-19 Forbearance (Past Program) | Varied depending on program implementation | Generally no negative impact if payments were resumed per the program terms | Available during the COVID-19 pandemic based on federal guidelines |

| Other Forbearance Programs | Varies significantly depending on the specific program | Potential negative impact on credit; check with servicer for specifics | Specific criteria set by loan servicer; often requires documentation of need |

Eligibility Criteria for Forbearance

Securing student loan forbearance requires meeting specific eligibility criteria. These criteria vary slightly depending on the loan type and lender, but generally involve demonstrating a temporary inability to make your scheduled payments. The process involves submitting the necessary documentation to support your claim.

Common Eligibility Requirements

Generally, you must be enrolled in a federal student loan program or have a private loan with a forbearance option. Furthermore, you must be experiencing a demonstrable financial hardship that prevents you from making your regular loan payments. This hardship needs to be temporary, with the expectation that you will be able to resume payments in the future. The lender will review your application and supporting documentation to determine your eligibility. Failure to meet these criteria may result in your forbearance request being denied.

Required Documentation for Forbearance

To successfully apply for forbearance, you’ll need to provide documentation that supports your claim of financial hardship. This documentation may include, but is not limited to, proof of unemployment (such as a layoff notice or unemployment benefits statement), medical bills and documentation outlining the financial burden of a medical emergency, proof of a significant decrease in income (such as pay stubs or tax returns), or legal documentation related to a natural disaster impacting your ability to make payments. The specific documents required will vary depending on the reason for your request and the lender’s policies. Always refer to your lender’s specific guidelines for a comprehensive list of acceptable documents.

Situations Qualifying for Forbearance

Several situations commonly qualify for student loan forbearance. Unemployment, resulting from job loss or reduction in work hours, is a frequent reason. Significant medical emergencies, involving substantial medical bills and lost income, also often qualify. Natural disasters, such as hurricanes or floods, can cause considerable financial strain, making forbearance a viable option. Other qualifying situations might include family emergencies requiring significant financial resources or a demonstrated period of reduced income due to a change in employment circumstances. It is crucial to remember that the lender will assess each case individually to determine eligibility.

Forbearance Application Process Flowchart

The application process typically involves these steps:

Step 1: Contact your lender. Begin by contacting your loan servicer to inquire about forbearance options and gather necessary application forms.

Step 2: Gather required documentation. Collect all supporting documentation, as described above, to substantiate your claim for forbearance.

Step 3: Submit your application. Complete the forbearance application form and submit it along with the supporting documentation to your lender.

Step 4: Lender review. Your lender will review your application and supporting documentation to determine your eligibility for forbearance.

Step 5: Approval/Denial. You will receive notification from your lender regarding the approval or denial of your forbearance request.

Step 6: Forbearance period begins. If approved, your forbearance period will commence, during which your payments are temporarily suspended or reduced.

Step 7: Resumption of payments. At the end of the forbearance period, you will need to resume your regular loan payments.

Impact of Forbearance on Student Loans

Forbearance, while offering temporary relief from student loan payments, carries significant long-term financial implications. Understanding these impacts is crucial for borrowers considering this option, as it can substantially affect the total cost of their education. The primary impact stems from the continued accrual of interest and the potential for capitalization.

Forbearance does not eliminate your debt; it merely postpones payments. The principal loan amount remains unchanged during the forbearance period, but interest continues to accrue. This means the total amount owed will increase over time. The longer the forbearance period, the greater the increase in the overall debt. This increased debt is due to the compounding effect of interest. The interest accrued during the forbearance period is added to the principal balance, increasing the amount on which future interest will be calculated.

Interest Capitalization During Forbearance

Interest capitalization occurs when the accumulated interest during the forbearance period is added to the principal loan balance. This effectively increases the total amount you owe. Once capitalized, this interest begins accruing interest itself, leading to a faster growth of your overall debt. For example, if you have a $10,000 loan with a 6% interest rate and enter a one-year forbearance, you might accrue $600 in interest. After capitalization, your new principal balance becomes $10,600, and future interest calculations will be based on this higher amount. This snowball effect can significantly increase the total cost of your loan over its lifetime.

Long-Term Financial Consequences of Forbearance

Consider a borrower with a $30,000 student loan at a 7% interest rate. If they utilize a three-year forbearance period, they could accrue a substantial amount of interest, potentially adding thousands of dollars to their overall debt. After the forbearance period ends, they would face higher monthly payments due to the increased principal balance. Furthermore, if they choose another forbearance period later, the cycle of interest accrual and capitalization could repeat, leading to an even larger debt burden. This could delay their ability to achieve other financial goals, such as buying a home or investing for retirement.

Comparison of Long-Term Costs

Understanding the long-term financial implications requires comparing forbearance with other repayment options. The following bullet points highlight the key differences:

The following table compares the long-term costs of forbearance with other repayment options. Note that these are illustrative examples and the actual costs will vary depending on individual loan terms and circumstances. It’s crucial to consult with a financial advisor or your loan servicer for personalized guidance.

| Repayment Option | Impact on Total Owed | Impact on Monthly Payments | Long-Term Financial Implications |

|---|---|---|---|

| Forbearance | Increases significantly due to interest capitalization | Higher after forbearance period ends | Potential for significant debt increase, delayed financial goals |

| Deferment | May or may not increase depending on loan type and terms; interest may or may not accrue. | Payments are suspended | Less impactful than forbearance, but still potentially delays financial goals. |

| Income-Driven Repayment (IDR) | May result in forgiveness after 20-25 years, but total paid could be higher. | Monthly payments are based on income | Lower monthly payments, but potentially higher total paid over the life of the loan. |

| Standard Repayment | Lowest total cost | Highest monthly payments | Fastest path to paying off loans. |

Alternatives to Forbearance

Forbearance, while offering temporary relief from student loan payments, isn’t always the best long-term solution. It can lead to accumulating interest and a larger overall debt burden. Fortunately, several alternatives exist, offering more sustainable paths to managing student loan repayments. Understanding these options and their implications is crucial for borrowers facing financial hardship.

Income-Driven Repayment Plans Compared to Forbearance

Income-driven repayment (IDR) plans and forbearance both aim to assist borrowers struggling with student loan payments, but they differ significantly in their approach and long-term consequences. Forbearance temporarily suspends payments, but interest usually continues to accrue, increasing the total loan amount. IDR plans, conversely, calculate monthly payments based on your income and family size, resulting in lower payments that are more manageable. While forbearance provides short-term relief, IDR plans offer a longer-term solution for repayment.

Benefits and Drawbacks of Alternative Repayment Options

Choosing the right repayment plan depends on individual circumstances. IDR plans, for instance, offer lower monthly payments, making them attractive to borrowers with limited income. However, they typically extend the repayment period, leading to potentially higher overall interest payments. Repayment plans like the Standard Repayment Plan offer shorter repayment periods, resulting in less interest paid overall, but require higher monthly payments. Careful consideration of both short-term affordability and long-term financial implications is essential.

Key Features of Different Repayment Plans

The following table summarizes the key features of various student loan repayment plans, allowing for a direct comparison to aid in decision-making.

| Repayment Plan | Monthly Payment | Repayment Period | Interest Accrual |

|---|---|---|---|

| Standard Repayment Plan | Fixed, higher payment | 10 years | Accrues during repayment |

| Graduated Repayment Plan | Starts low, increases over time | 10 years | Accrues during repayment |

| Extended Repayment Plan | Lower payment | Up to 25 years | Accrues during repayment |

| Income-Driven Repayment (IDR) Plans (e.g., ICR, PAYE, REPAYE,IBR) | Based on income and family size | Up to 20-25 years | May accrue depending on plan, potential for forgiveness after 20-25 years |

Forbearance and Credit Score

Entering into a student loan forbearance plan can significantly impact your credit score, often negatively. While it’s a temporary solution to avoid immediate repayment, the consequences on your credit report should be carefully considered. Understanding how forbearance affects your credit and strategies to mitigate the damage is crucial for responsible financial management.

Forbearance is generally reported to credit bureaus as a negative mark, similar to a missed payment. This is because it indicates to lenders that you’re currently unable to meet your financial obligations. The length of the forbearance period and your overall credit history significantly influence the severity of the impact. A longer forbearance period will generally result in a more substantial drop in your credit score.

Factors Influencing Credit Score Impact

Several factors determine the extent to which forbearance affects your credit score. The length of the forbearance period is a primary factor; longer periods lead to more significant negative impacts. Your existing credit score also plays a role; individuals with already lower scores might experience a more pronounced drop. Finally, the number of forbearance periods you’ve previously utilized also matters; multiple forbearances suggest a pattern of repayment difficulties, further damaging your creditworthiness. Lenders assess these factors to gauge the risk associated with lending to you.

Mitigating Negative Credit Score Effects

While forbearance negatively impacts credit scores, proactive steps can minimize the damage. Maintaining open communication with your loan servicer is essential. Demonstrating a commitment to repayment, even during forbearance, through regular contact and outlining a plan for resuming payments after the forbearance period ends, can help. Furthermore, keeping other aspects of your credit health in good standing, such as timely payments on other debts and maintaining low credit utilization, can offset some of the negative effects. Consider exploring credit counseling services for guidance in managing your finances and navigating the forbearance process effectively.

Examples of Forbearance Length and Credit Score Impact

Let’s consider a few hypothetical examples. Suppose a borrower with a 720 credit score enters a three-month forbearance. They might see their score drop by 20-40 points, depending on other credit factors. However, if the same borrower enters a 12-month forbearance, the drop could be significantly larger, potentially 50-100 points or more. A borrower with a lower initial credit score, say 600, might experience a proportionally larger drop in their score for the same forbearance periods. These are estimations, and the actual impact varies depending on individual circumstances and the credit scoring models used by different credit bureaus. It’s important to note that the credit score recovery after forbearance depends on timely and consistent payments post-forbearance.

Communication with Loan Servicers During Forbearance

Maintaining open and proactive communication with your student loan servicer is crucial during a forbearance period. Failing to do so can lead to misunderstandings, missed payments after forbearance ends, and potential negative impacts on your credit score. Regular contact ensures you understand your responsibilities and allows your servicer to assist you in navigating the process effectively.

Proactive management of your forbearance involves more than simply applying and forgetting about it. Consistent communication allows for adjustments and prevents unexpected complications. It’s essential to understand the terms of your forbearance agreement, including its duration and the requirements for re-entry into repayment. Understanding these details allows for informed decision-making and minimizes the risk of future financial difficulties.

Steps for Proactive Forbearance Management

Taking proactive steps ensures a smoother experience. These steps involve regular communication, careful documentation, and a clear understanding of the forbearance agreement. This minimizes potential issues and helps maintain a positive relationship with your loan servicer.

Effective Communication Strategies

Effective communication involves clarity, conciseness, and a professional tone. This approach ensures your message is easily understood and your concerns are addressed promptly. Using a combination of written and verbal communication can provide a comprehensive record and facilitate faster resolution of any issues.

Sample Email Template for Contacting a Loan Servicer

Subject: Inquiry Regarding My Student Loan Forbearance – [Your Account Number]

Dear [Loan Servicer Name],

I am writing to inquire about my student loan forbearance, account number [Your Account Number]. My forbearance period is scheduled to end on [Date]. I would like to [State your request, e.g., confirm the end date, discuss extending the forbearance, inquire about repayment options].

Please let me know what steps I need to take to [State your goal, e.g., prepare for repayment, extend my forbearance]. I can be reached at [Your Phone Number] or [Your Email Address].

Thank you for your time and assistance.

Sincerely,

[Your Name]

Exiting Forbearance

Exiting a student loan forbearance period requires careful planning and proactive communication with your loan servicer. Understanding the process and available repayment options will ensure a smooth transition back to regular repayment and help avoid potential negative consequences.

The process of exiting forbearance typically involves contacting your loan servicer to request the end of the forbearance period. They will likely confirm your eligibility to exit forbearance and provide you with details about resuming your loan payments. This may involve a new payment plan or a return to your original payment schedule. Failure to contact your servicer and resume payments can lead to delinquency and damage your credit score.

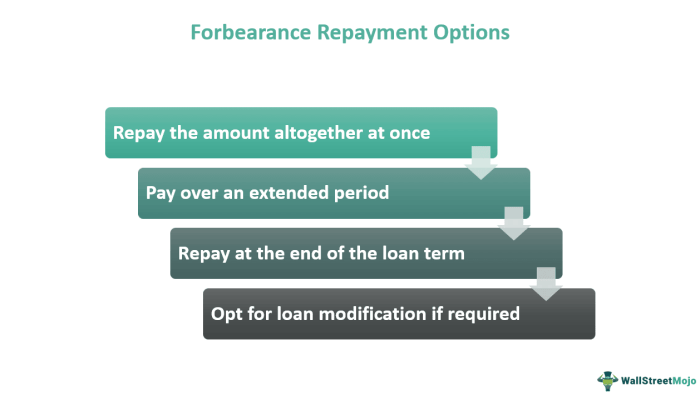

Repayment Options After Forbearance

After your forbearance period concludes, several repayment options might be available. These options often depend on your individual circumstances, loan type, and your loan servicer’s policies. You may be able to resume your original payment plan, enroll in an income-driven repayment plan (IDR), or explore other repayment options such as extended repayment plans. Contacting your loan servicer is crucial to understanding your available options and selecting the most suitable one based on your financial situation. Choosing a repayment plan that aligns with your budget is key to preventing future delinquency.

Planning for Repayment After Forbearance

Effective planning is crucial to successfully navigating the transition from forbearance back to repayment. This includes carefully reviewing your budget, assessing your current financial situation, and projecting your future income. Creating a realistic repayment plan that accounts for your expenses and income is vital to prevent falling behind on payments. Consider exploring budgeting tools and resources to assist with this process. It’s also beneficial to build an emergency fund to cover unexpected expenses that might disrupt your repayment plan. A well-structured plan will help you avoid the stress and financial difficulties associated with missed payments. For example, if you anticipate a decrease in income, you may want to proactively contact your loan servicer to discuss potential options such as modifying your payment plan or exploring alternative repayment options.

Checklist for Exiting Forbearance

Preparing a checklist ensures a smooth transition out of forbearance. This organized approach minimizes the risk of overlooking crucial steps.

- Before Exiting Forbearance: Contact your loan servicer well in advance of the forbearance end date to discuss your repayment options and confirm your exit plan. Review your loan terms and understand your payment obligations. Create a detailed budget to assess your repayment capacity and identify potential financial challenges.

- After Exiting Forbearance: Make your first payment on time. Monitor your loan account regularly to ensure payments are correctly processed. Keep records of all communications and transactions with your loan servicer. Review your credit report to confirm that your loan status reflects accurate and up-to-date information.

Closing Summary

Successfully navigating student loan repayment requires a proactive approach and a thorough understanding of available options. While forbearance can provide temporary relief, it’s essential to carefully weigh its long-term financial consequences. By understanding the nuances of forbearance, exploring alternative repayment plans, and maintaining open communication with your loan servicer, you can effectively manage your student loan debt and pave the way for a secure financial future. Remember to always prioritize proactive planning and informed decision-making to ensure the best possible outcome.

FAQ Corner

What happens to interest during forbearance?

Interest typically continues to accrue on your loan during forbearance, increasing your overall debt. The method of handling this accrued interest (capitalization or not) varies depending on your loan type and forbearance plan.

Can I apply for forbearance multiple times?

The possibility of multiple forbearance periods depends on your loan servicer and the specific circumstances. Contact your servicer to discuss your eligibility for additional forbearance.

How long can a forbearance period last?

The maximum length of a forbearance period varies depending on your loan type and servicer, ranging from a few months to several years. Check with your servicer for specifics on your loan.

Does forbearance affect my eligibility for federal student aid programs in the future?

Forbearance may impact future eligibility for certain federal student aid programs, so it is best to consult with a financial aid advisor or your loan servicer for clarification.