Navigating the complexities of student loan interest can feel daunting, but understanding the underlying calculations is key to responsible financial planning. This guide demystifies the process, exploring various interest rate types, factors influencing their calculation, and strategies to minimize your overall repayment costs. We’ll delve into both simple and compound interest calculations, providing clear examples and practical advice to help you make informed decisions about your student loan debt.

From understanding fixed versus variable rates and the impact of your credit score to exploring different repayment plans and the implications of deferment or forbearance, we aim to provide a comprehensive overview. This will empower you to effectively manage your student loans and plan for a financially secure future.

Types of Student Loan Interest

Understanding the type of interest applied to your student loan is crucial for effectively managing your repayment. The two primary types are fixed and variable interest rates, each impacting your overall borrowing cost differently. Choosing a loan with a specific interest rate type depends on your risk tolerance and financial predictions.

Fixed Interest Rates

Fixed interest rates remain constant throughout the loan’s life. This predictability allows for accurate budgeting and repayment planning. The interest calculation is straightforward: the lender applies the fixed percentage to your outstanding principal balance each month. This means your monthly payment remains consistent, excluding any changes resulting from changes to the repayment plan.

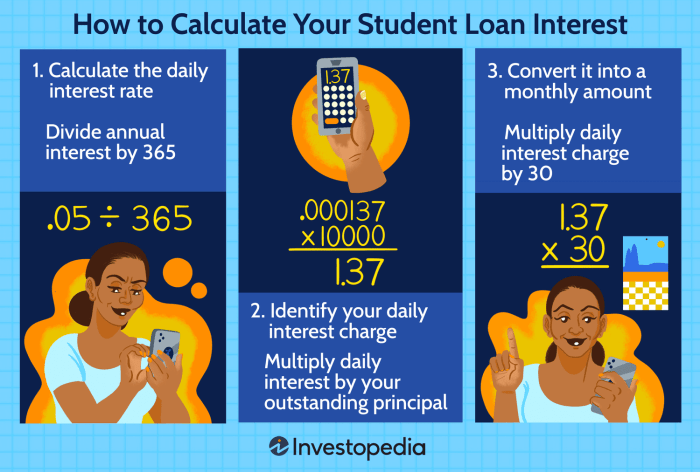

The formula for calculating simple interest is: Interest = Principal x Rate x Time. For monthly calculations, Time is expressed as a fraction of a year (e.g., 1 month = 1/12 year).

For example, a $10,000 loan with a 5% fixed annual interest rate will accrue $41.67 in interest the first month ($10,000 x 0.05 x (1/12)). This interest is added to the principal, and the next month’s interest is calculated on the slightly higher balance. The total interest paid over the life of the loan will depend on the loan’s repayment period.

Variable Interest Rates

Variable interest rates fluctuate based on an index, such as the prime rate or LIBOR (London Interbank Offered Rate). This means your monthly interest payments and total repayment cost can change over time. While potentially offering lower initial interest rates, the uncertainty of future rate increases makes budgeting and long-term financial planning more complex. The calculation method is similar to fixed-rate loans, but the interest rate changes periodically, typically monthly or quarterly. The new rate is applied to the outstanding principal balance to calculate the interest for the period.

Impact of Interest Rates on Repayment Costs

The following table illustrates how different interest rates and repayment periods influence the total interest paid on a student loan.

| Loan Amount | Interest Rate Type | Repayment Period (Years) | Total Interest Paid |

|---|---|---|---|

| $20,000 | Fixed (5%) | 10 | $6,160 (Approximate) |

| $20,000 | Variable (Starting at 4%, potentially increasing) | 10 | $5,000 – $8,000 (Approximate range, depending on rate fluctuations) |

| $30,000 | Fixed (6%) | 15 | $18,480 (Approximate) |

| $30,000 | Variable (Starting at 5%, potentially increasing) | 15 | $15,000 – $25,000 (Approximate range, depending on rate fluctuations) |

*Note: These are simplified examples and do not account for all factors that might affect total interest paid, such as fees or specific repayment plans.*

Factors Affecting Student Loan Interest Rates

Several key factors influence the interest rate a lender assigns to a student loan. Understanding these factors can help borrowers make informed decisions and potentially secure more favorable terms. These factors are interconnected and often work in concert to determine the final interest rate.

Credit History and Credit Score

A borrower’s credit history and credit score significantly impact their student loan interest rate. Lenders use this information to assess the risk of lending money. A strong credit history, demonstrated by consistent on-time payments and responsible credit utilization, typically results in lower interest rates. Conversely, a poor credit history, marked by late payments, defaults, or high credit utilization, often leads to higher interest rates or even loan denial. The impact of a credit score is substantial; a higher credit score often translates directly into a lower interest rate. For instance, a borrower with an excellent credit score might qualify for an interest rate several percentage points lower than a borrower with a poor credit score, resulting in significant savings over the life of the loan.

Type of Loan: Federal vs. Private

Federal student loans generally offer more favorable interest rates than private student loans. This is because federal loans are backed by the government, reducing the risk for lenders. Federal loan interest rates are often set by law and are usually lower than those offered by private lenders, who must factor in their own risk assessment and profit margins. Private loan interest rates are variable and depend heavily on the borrower’s creditworthiness, the loan amount, and the prevailing market interest rates. A borrower with a strong credit history might secure a competitive rate from a private lender, but those with weaker credit may face significantly higher rates than their federal loan counterparts. The difference in interest rates between federal and private loans can be substantial, potentially amounting to thousands of dollars in additional interest payments over the loan’s lifetime.

Undergraduate vs. Graduate Student Loans

Interest rates for graduate student loans are often higher than those for undergraduate student loans. This is partly due to the generally larger loan amounts involved in graduate studies and the perceived higher risk associated with lending larger sums. Graduate programs often involve higher tuition costs and longer repayment periods, increasing the lender’s risk. Furthermore, graduate students may have less established credit histories than undergraduate students, further contributing to potentially higher interest rates. The specific difference in interest rates varies depending on the lender and the borrower’s creditworthiness but represents a notable factor to consider when planning for graduate education financing.

Calculating Accrued Interest

Understanding how student loan interest accrues is crucial for effective financial planning. Accrued interest represents the total interest accumulated on your loan balance over a specific period. This calculation significantly impacts the total amount you ultimately repay. Accurate calculation helps borrowers anticipate their repayment amounts and plan accordingly.

Simple Interest Calculation

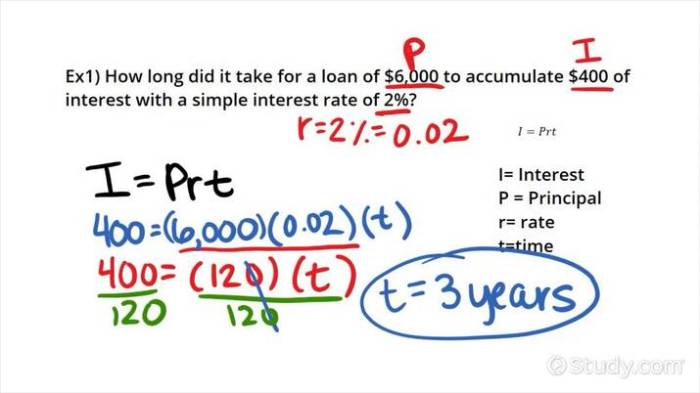

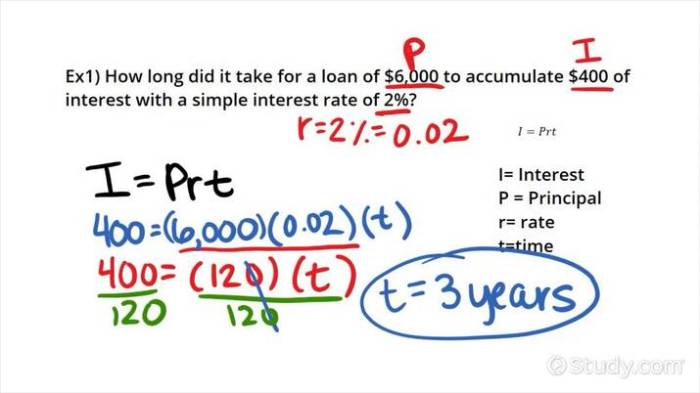

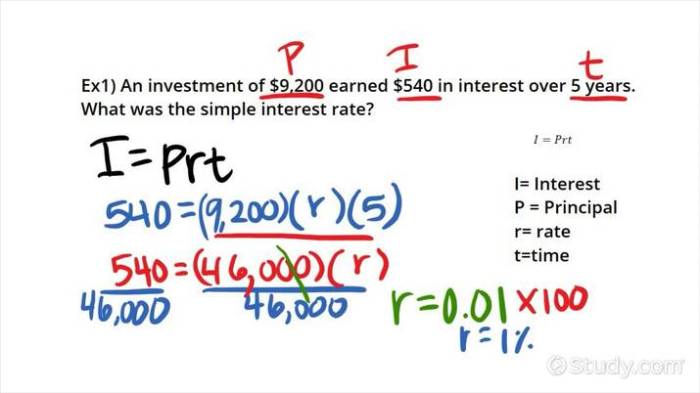

Simple interest is calculated only on the principal loan amount. This method is straightforward but less common for student loans than compound interest. The formula for calculating simple interest is:

Simple Interest = Principal x Interest Rate x Time

Where:

* Principal is the original loan amount.

* Interest Rate is the annual interest rate (expressed as a decimal).

* Time is the loan term in years.

Compound Interest Calculation

Compound interest is calculated on both the principal and the accumulated interest. This means that interest earned in one period is added to the principal, and subsequent interest calculations include this added amount. This leads to faster growth of the loan balance compared to simple interest. A step-by-step approach to calculating compound interest is Artikeld below.

Let’s consider a loan of $10,000 with a 5% annual interest rate compounded annually over 3 years.

- Year 1: Interest = $10,000 (Principal) x 0.05 (Interest Rate) = $500. New balance: $10,000 + $500 = $10,500.

- Year 2: Interest = $10,500 (New Principal) x 0.05 = $525. New balance: $10,500 + $525 = $11,025.

- Year 3: Interest = $11,025 x 0.05 = $551.25. New balance: $11,025 + $551.25 = $11,576.25.

Therefore, after three years, the total interest accrued is $1,576.25 ($11,576.25 – $10,000).

Simple vs. Compound Interest: A Comparative Example

To illustrate the difference, let’s compare the accumulation of simple and compound interest on a $5,000 loan with a 6% annual interest rate over 5 years.

The following example demonstrates the significant difference between simple and compound interest accumulation over time. It highlights the importance of understanding how interest is calculated to accurately estimate total repayment costs.

- Simple Interest:

- Annual Interest: $5,000 x 0.06 = $300

- Total Interest after 5 years: $300 x 5 = $1,500

- Total amount owed after 5 years: $5,000 + $1,500 = $6,500

- Compound Interest (compounded annually):

- Year 1: Interest = $5,000 x 0.06 = $300; Balance = $5,300

- Year 2: Interest = $5,300 x 0.06 = $318; Balance = $5,618

- Year 3: Interest = $5,618 x 0.06 = $337.08; Balance = $5,955.08

- Year 4: Interest = $5,955.08 x 0.06 = $357.30; Balance = $6,312.38

- Year 5: Interest = $6,312.38 x 0.06 = $378.74; Balance = $6,691.12

- Total Interest after 5 years: $6,691.12 – $5,000 = $1,691.12

This example clearly shows that compound interest results in a significantly higher total repayment amount ($6,691.12 vs. $6,500) compared to simple interest over the same period.

Understanding Loan Repayment Plans

Choosing the right repayment plan is crucial for managing your student loan debt effectively. Different plans offer varying payment amounts and timelines, impacting your overall repayment cost. Understanding the nuances of each plan is essential for making informed financial decisions.

Student Loan Repayment Plan Options

Several repayment plans are available to borrowers, each tailored to different financial situations and needs. The optimal choice depends on factors such as income, debt load, and long-term financial goals.

| Plan Name | Payment Structure | Interest Accrual | Eligibility Criteria |

|---|---|---|---|

| Standard Repayment Plan | Fixed monthly payments over 10 years. | Interest accrues throughout the repayment period. | Available to most federal student loan borrowers. |

| Graduated Repayment Plan | Payments start low and gradually increase over time (typically every two years) for 10 years. | Interest accrues throughout the repayment period. | Available to most federal student loan borrowers. |

| Extended Repayment Plan | Fixed monthly payments over a longer period (up to 25 years, depending on the loan amount). | Interest accrues throughout the repayment period. Longer repayment periods generally lead to higher total interest paid. | Available to most federal student loan borrowers with loan balances exceeding a certain threshold. |

| Income-Driven Repayment (IDR) Plans | Monthly payments are calculated based on your discretionary income and family size. Several IDR plans exist, including ICR, PAYE, REPAYE, and IBR. | Interest accrues throughout the repayment period. For some plans, unpaid interest may be capitalized at the end of the repayment period or after a period of forbearance. | Available to federal student loan borrowers who meet specific income requirements. |

Interest Capitalization

Interest capitalization is the process of adding accumulated unpaid interest to the principal loan balance. This increases the total amount you owe and, consequently, your future payments. For example, if you have unpaid interest of $500, this amount is added to your principal balance. Subsequent interest calculations are then based on this higher principal amount, leading to a larger overall debt. Capitalization can significantly impact the total cost of your loan over time. It typically occurs when you are in a period of deferment or forbearance, where you are not making regular payments. Understanding when and how capitalization occurs is critical for managing your loan effectively.

Capitalization increases your principal balance, leading to higher future payments and total repayment costs.

Impact of Loan Deferment and Forbearance

Deferment and forbearance are temporary pauses in student loan repayment, but they significantly impact the overall cost of borrowing. While offering crucial short-term relief, they allow interest to continue accruing, often resulting in a larger total debt burden upon repayment resumption. Understanding the nuances of each is crucial for responsible financial planning.

Deferment and forbearance are distinct but similar options available to borrowers facing financial hardship. Both temporarily suspend the requirement to make monthly payments, but they differ in how interest accrues and the eligibility requirements. Deferment often applies to specific situations like returning to school or experiencing unemployment, while forbearance is typically granted due to financial hardship that doesn’t necessarily fit into a specific deferment category.

Interest Accrual During Deferment and Forbearance

During a deferment period, interest may or may not accrue depending on the type of loan. Subsidized federal loans typically do not accrue interest during deferment periods, while unsubsidized federal loans and private student loans generally do. Forbearance, on the other hand, almost always allows interest to accrue on all loan types. This means that the principal loan amount increases over time, leading to a higher total repayment amount once the forbearance period ends.

Situations Warranting Deferment or Forbearance

Several circumstances may justify seeking deferment or forbearance. Examples include: unemployment, a significant medical emergency resulting in substantial medical bills, a period of low income, or a return to school to pursue further education. Borrowers should carefully evaluate their financial situation and determine if a deferment or forbearance is necessary, as it can lead to a long-term increase in the cost of their education.

Comparison of Interest Paid Under Different Scenarios

Let’s consider a simplified example to illustrate the impact. Suppose a student has a $20,000 unsubsidized federal loan with a 5% annual interest rate.

Scenario 1: No Deferment/Forbearance. The borrower makes consistent monthly payments according to the standard repayment plan. Over the loan’s lifetime, let’s assume they pay approximately $5,000 in interest.

Scenario 2: 12-month Deferment. The borrower defers their payments for one year. Assuming a simple interest calculation (interest is only calculated on the principal), approximately $1,000 in interest would accrue during the deferment period. When payments resume, the principal is now $21,000, leading to a higher total interest paid over the loan’s life. This might increase total interest paid to approximately $6,000.

Scenario 3: 24-month Forbearance. The borrower enters a two-year forbearance period. Similar to the deferment, interest accrues on the principal. Approximately $2,000 in interest would accrue during the forbearance period, increasing the principal to $22,000. The total interest paid would likely exceed $7,000.

This simplified example demonstrates that deferment and forbearance can significantly increase the total interest paid on student loans. The visual representation would be a bar graph. The x-axis would show the scenarios (No Deferment/Forbearance, 12-month Deferment, 24-month Forbearance). The y-axis would represent the total interest paid in each scenario. The bar for Scenario 1 would be the shortest, followed by Scenario 2, and Scenario 3 would have the tallest bar, visually representing the increasing total interest paid due to deferment and forbearance. It’s crucial to remember that this is a simplified illustration; actual interest calculations can be more complex depending on the loan terms and repayment plan.

Strategies for Minimizing Interest Costs

Minimizing student loan interest is crucial for long-term financial health. High interest can significantly increase the total cost of your education, delaying your ability to achieve other financial goals. Fortunately, several strategies can help borrowers reduce their overall interest payments.

The most effective strategies focus on reducing the principal balance as quickly as possible and strategically managing your loan repayment plan. This involves a combination of proactive payment strategies and careful consideration of refinancing options.

Making Extra Payments

Making extra payments on your student loans, even small amounts, can substantially reduce the total interest paid over the life of the loan. Every extra payment reduces the principal balance, meaning less principal accrues interest in subsequent months. For example, if you have a $30,000 loan at 6% interest, an extra $100 payment each month will significantly shorten the repayment period and reduce the total interest paid. This strategy is particularly effective in the early years of repayment when the interest portion of your payment is higher. The accelerated repayment can save thousands of dollars in interest over the loan’s lifespan.

Refinancing Student Loans

Refinancing involves replacing your existing student loans with a new loan from a different lender, typically at a lower interest rate. This can be beneficial if interest rates have fallen since you initially took out your loans or if you qualify for a better rate based on improved credit. However, refinancing has drawbacks. You might lose benefits associated with federal student loans, such as income-driven repayment plans or loan forgiveness programs. Additionally, refinancing might extend your repayment term, potentially increasing the total interest paid if you choose a longer repayment period. Careful consideration of the benefits and risks is crucial before refinancing.

Comparing Long-Term Financial Implications

The long-term financial implications of different interest reduction strategies vary greatly depending on individual circumstances and loan terms. For example, while making extra payments always reduces total interest, refinancing might be more advantageous if the interest rate reduction is substantial enough to offset any potential loss of benefits. It’s essential to carefully analyze your individual financial situation, including your credit score, income, and loan terms, before deciding on the best strategy. Consider using online loan calculators to model different scenarios and compare the total interest paid under various strategies. For instance, a scenario comparing making extra payments versus refinancing might show a savings of $5,000 over 10 years with extra payments versus $7,000 with refinancing, but refinancing could also mean losing access to a crucial federal loan forgiveness program. This highlights the importance of a comprehensive financial evaluation.

End of Discussion

Successfully managing student loan debt requires a thorough understanding of interest calculations and repayment strategies. By grasping the concepts Artikeld in this guide – from the fundamental formula for calculating interest to the nuances of different repayment plans and interest reduction strategies – you can take control of your financial future. Remember to carefully consider your individual circumstances and seek professional advice when needed to make the best decisions for your unique situation.

Commonly Asked Questions

What is interest capitalization?

Interest capitalization is the process of adding accrued but unpaid interest to your principal loan balance. This increases the total amount you owe and consequently increases future interest charges.

How often is interest calculated on student loans?

The frequency of interest calculation varies depending on the lender and loan type. It’s typically calculated daily or monthly, but the interest is usually billed and added to your balance periodically (e.g., monthly or quarterly).

Can I pay off my student loans faster than the scheduled repayment plan?

Yes, making extra payments toward your principal balance can significantly reduce the total interest you pay over the life of the loan and shorten the repayment period.

What happens if I miss a student loan payment?

Missing payments can lead to late fees, damage your credit score, and potentially result in default, which has serious financial consequences.