Navigating the complexities of funding a university education can feel overwhelming. This guide provides a clear and concise overview of student loan options, from federal and private loans to grants and scholarships. We’ll explore strategies for minimizing debt, budgeting effectively, and understanding the long-term financial implications of student loan repayment. We also delve into alternative funding sources and loan forgiveness programs to equip you with the knowledge needed to make informed decisions about your educational financing.

Understanding the various funding avenues available, including their eligibility criteria, interest rates, and repayment terms, is crucial for responsible financial planning. This guide aims to empower students to make educated choices, enabling them to pursue higher education without unnecessary financial strain. We’ll cover practical tips for budgeting, debt management, and exploring alternative financing options to create a personalized plan for success.

Understanding Funding Options for University Students

Securing funding for university education is a significant step, often requiring careful consideration of various loan options. Understanding the differences between federal and private loans, eligibility criteria, and repayment terms is crucial for making informed financial decisions. This section will Artikel the key aspects of different student loan programs to help you navigate this process.

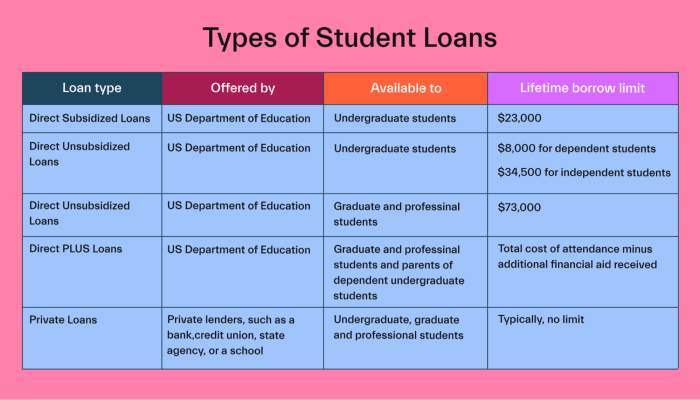

Types of Student Loan Funding

Student loan funding is broadly categorized into federal and private loans. Federal loans are offered by the government and generally offer more favorable terms and greater borrower protections. Private loans, on the other hand, are provided by banks, credit unions, and other private lenders. They often have higher interest rates and less flexible repayment options but can be necessary to fill funding gaps.

Federal Student Loan Eligibility

Eligibility for federal student loans depends on factors such as U.S. citizenship or eligible non-citizen status, enrollment at an eligible institution, financial need (for some programs), and maintaining satisfactory academic progress. Specific requirements vary depending on the type of federal loan. For example, the Federal Pell Grant is need-based, while the Stafford Loan is available to students regardless of need, though the amount may vary.

Private Student Loan Eligibility

Private student loan eligibility is primarily determined by creditworthiness. Students with limited or no credit history may need a co-signer with good credit to qualify. Other factors considered include income, debt-to-income ratio, and the student’s academic standing. Lenders may also assess the reputation and accreditation of the university the student attends.

Interest Rates and Repayment Terms

Interest rates and repayment terms differ significantly between federal and private loans, and even among different federal loan programs. Federal loans typically offer lower fixed interest rates, while private loan rates are variable and often higher, reflecting the lender’s assessment of risk. Repayment plans for federal loans offer various options, including graduated repayment, income-driven repayment, and extended repayment, to suit individual circumstances. Private loans often have less flexible repayment terms.

Examples of Federal and Private Student Loan Options

Examples of federal student loan programs include the Federal Pell Grant (need-based grant), Subsidized Stafford Loans (interest subsidized while in school), and Unsubsidized Stafford Loans (interest accrues while in school). Examples of private student loans include those offered by Sallie Mae, Discover, and private banks, often requiring a credit check and potentially a co-signer.

Comparison of Student Loan Programs

| Loan Program | Loan Type | Interest Rate | Repayment Terms |

|---|---|---|---|

| Federal Pell Grant | Federal Grant (not a loan) | 0% | No repayment required |

| Subsidized Stafford Loan | Federal Loan | Variable, set annually by the government | Various options, including graduated, income-driven, and extended repayment |

| Unsubsidized Stafford Loan | Federal Loan | Variable, set annually by the government | Various options, including graduated, income-driven, and extended repayment |

| Private Student Loan (Example) | Private Loan | Variable, depends on creditworthiness | Typically fixed term, less flexible options than federal loans |

Managing Student Loan Debt

Navigating the complexities of student loan debt is a crucial aspect of the university experience. Effective management strategies can significantly impact your financial well-being long after graduation. Understanding how to minimize debt accumulation, budget effectively, and plan for repayment is key to a smoother transition into post-university life.

Strategies for Minimizing Student Loan Debt Accumulation

Careful planning before and during your university years can significantly reduce the amount you borrow. Exploring scholarship opportunities, maximizing grants, and considering part-time employment are all effective ways to lessen your reliance on loans. Prioritizing a cost-effective educational path, such as attending a community college for the first two years before transferring to a four-year university, can also yield substantial savings. Choosing a major with strong job prospects can also indirectly minimize debt by improving your earning potential post-graduation, allowing for quicker loan repayment.

The Importance of Budgeting and Financial Planning During University

Creating and sticking to a budget is paramount for university students, regardless of their financial situation. A well-structured budget allows you to track income and expenses, ensuring that you’re spending within your means and making progress towards your financial goals, including loan repayment. Financial planning during this period establishes healthy financial habits that will serve you well throughout your life. It helps you understand your spending patterns, identify areas for potential savings, and prioritize essential expenses.

Practical Tips for Responsible Borrowing and Repayment

Borrowing only what is absolutely necessary is crucial. Carefully compare loan options, considering interest rates, repayment terms, and any associated fees. Understand the different types of loans available (federal vs. private) and their implications. Explore loan deferment or forbearance options if you face temporary financial hardship after graduation. Always prioritize making on-time payments to avoid penalties and maintain a good credit score.

Sample Budget for a University Student Including Loan Repayment

This is a sample budget and needs to be adjusted based on individual circumstances. Amounts are illustrative.

| Income | Amount ($) |

|---|---|

| Part-time Job | 500 |

| Financial Aid | 1000 |

| Total Income | 1500 |

| Expenses | Amount ($) |

| Tuition | 4000 (per semester – adjust accordingly) |

| Rent/Housing | 500 |

| Groceries | 200 |

| Transportation | 100 |

| Books & Supplies | 100 |

| Loan Repayment | 100 |

| Personal Expenses | 100 |

| Total Expenses | 5100 (per semester – adjust accordingly) |

Note: This budget shows a deficit. The student will likely need to adjust their expenses or find additional income sources to balance their budget. This deficit highlights the importance of careful budgeting and financial planning.

Step-by-Step Guide on Creating a Personalized Debt Repayment Plan

1. Calculate your total debt: Add up the principal balance of all your student loans.

2. Determine your monthly payment capacity: Consider your income, expenses, and other financial obligations.

3. Choose a repayment strategy: Explore options like the standard repayment plan, extended repayment plan, graduated repayment plan, or income-driven repayment plan. The best option depends on your individual circumstances.

4. Prioritize high-interest loans: Focus on paying down loans with the highest interest rates first to minimize the total interest paid.

5. Automate your payments: Set up automatic payments to ensure timely repayments and avoid late fees.

6. Monitor your progress: Regularly review your repayment plan and adjust it as needed to reflect changes in your financial situation.

7. Seek professional advice: Consult a financial advisor if you need assistance creating or managing your repayment plan.

Government Grants and Scholarships

Securing funding for university education can be a significant challenge. Government grants and scholarships offer a crucial avenue for students to access financial aid and reduce the burden of student loan debt. These programs are designed to support students from diverse backgrounds and academic pursuits, making higher education more accessible. Understanding the eligibility criteria and application processes is key to successfully obtaining this vital funding.

Types of Government Grant Programs

Several government grant programs exist at the national and sometimes state level, each with specific eligibility requirements and application processes. These programs often target students based on financial need, academic merit, or specific fields of study. For example, Pell Grants in the United States are need-based grants for undergraduate students, while other grants might focus on supporting students pursuing STEM fields or those from underrepresented minority groups. The availability and specifics of these programs vary depending on the country and the governing educational bodies.

The Application Process and Eligibility Requirements

The application process for government grants generally involves completing a detailed application form, providing documentation of financial need (such as tax returns or family income statements), and often submitting academic transcripts. Eligibility requirements vary depending on the specific grant. Common requirements include being a U.S. citizen or permanent resident (for U.S. based grants), maintaining a minimum GPA, and being enrolled in an eligible educational program. Many applications are submitted through centralized online portals, making the process relatively streamlined. It’s crucial to thoroughly review the specific requirements for each grant program before applying.

Comparison of Scholarship Opportunities

Scholarships, unlike grants, are often merit-based, awarded based on academic achievement, extracurricular activities, or specific talents. Some scholarships are offered by government agencies, while others are provided by private organizations, universities, or corporations. Government scholarships might focus on specific fields of study or target students from underrepresented groups. Private scholarships can be incredibly diverse, ranging from scholarships for athletes to those for students pursuing specific career paths. The application processes for scholarships can vary widely, some requiring essays, letters of recommendation, and interviews, while others are simpler application forms.

Resources for Finding Scholarship Information

Numerous resources exist to help students locate and apply for scholarships. Government websites often maintain comprehensive databases of available grants and scholarships. Many educational institutions have dedicated financial aid offices that can assist students in identifying suitable opportunities. Numerous online scholarship search engines aggregate information from various sources, allowing students to search for scholarships based on criteria such as their major, GPA, and demographic information. Professional organizations and community groups often sponsor scholarships for students pursuing careers in their respective fields.

Examples of Grant and Scholarship Opportunities

| Opportunity Name | Provider | Eligibility Requirements | Award Amount |

|---|---|---|---|

| Pell Grant | U.S. Department of Education | U.S. citizenship or eligible non-citizen status, enrolled at least half-time in an eligible program, demonstrates financial need | Varies, based on financial need and cost of attendance |

| National Merit Scholarship | National Merit Scholarship Corporation | High PSAT/NMSQT scores, strong academic record, recommendation from high school counselor | Varies, ranging from $2500 to full tuition |

| Gates Millennium Scholars | Bill & Melinda Gates Foundation | Exceptional leadership potential, high academic achievement, financial need, member of an underrepresented minority group | Covers full tuition, fees, and living expenses |

| Fulbright Scholarship | U.S. Department of State | U.S. citizenship, strong academic record, proposed research or study plan aligned with program goals | Varies, covers travel, tuition, living expenses |

The Impact of Student Loans on Future Finances

Navigating the complexities of student loan debt is crucial for long-term financial well-being. Understanding the potential impact on your future finances, from credit scores to major life decisions, empowers you to make informed choices and develop a robust financial strategy. Failing to plan effectively can lead to significant financial strain for years to come.

Student loan debt significantly influences your financial future, extending beyond the immediate repayment period. The amount borrowed, the interest rate, and the chosen repayment plan all contribute to the overall cost and long-term implications. This section explores these impacts in detail, providing practical advice for managing finances after graduation and mitigating potential risks.

Long-Term Financial Implications of Student Loan Debt

Student loan debt can dramatically alter your long-term financial trajectory. The monthly payments represent a significant recurring expense that reduces disposable income, potentially impacting savings for retirement, investments, or other financial goals. For example, a graduate with $50,000 in student loans at a 6% interest rate could face monthly payments exceeding $500 depending on the repayment plan, leaving less money for emergency funds or down payments on a house. This extended period of repayment can delay achieving major financial milestones. Careful budgeting and financial planning are essential to navigate this challenge.

The Effect of Student Loans on Credit Scores and Borrowing Power

Your student loan repayment history directly impacts your credit score. Consistent on-time payments contribute positively, while missed or late payments can significantly lower your score. A lower credit score can make it more difficult and expensive to secure loans for a house, car, or even a credit card in the future. Lenders view a history of responsible loan repayment as an indicator of creditworthiness. Conversely, a poor repayment history can lead to higher interest rates on future loans, increasing the overall cost of borrowing.

Managing Finances After Graduation While Repaying Loans

Creating a realistic budget immediately after graduation is paramount. This involves tracking income and expenses meticulously, prioritizing loan repayments, and identifying areas where spending can be reduced. Consider exploring options like budgeting apps or financial advisors to assist with this process. Prioritizing high-interest debt and exploring options like refinancing or income-driven repayment plans can also alleviate the burden. Building an emergency fund is equally crucial, providing a safety net for unexpected expenses that could otherwise derail repayment efforts. A well-structured budget, coupled with responsible financial habits, will significantly improve your ability to manage loan repayments while still meeting your personal financial goals.

The Effect of Different Repayment Plans on Total Interest Paid

The choice of repayment plan significantly influences the total interest paid over the life of the loan. Standard repayment plans typically involve fixed monthly payments over a 10-year period. However, income-driven repayment plans adjust monthly payments based on income, potentially extending the repayment period but reducing monthly expenses. While income-driven plans typically result in higher total interest paid, they provide short-term financial relief. For example, a $50,000 loan at 6% interest could result in approximately $20,000 in interest over 10 years under a standard plan, compared to a potentially higher total interest amount under an income-driven plan, but with significantly lower monthly payments. Careful consideration of long-term versus short-term financial implications is necessary.

The Impact of Student Loan Debt on Major Life Decisions

Student loan debt can significantly impact major life decisions such as buying a house or starting a family. High monthly loan payments can reduce the amount you can afford to borrow for a mortgage, potentially limiting housing options. Similarly, the financial burden of student loans might delay plans to start a family or limit the ability to save for childcare expenses. For instance, a large student loan balance may prevent someone from affording a down payment on a house or from comfortably supporting a growing family. Careful financial planning and realistic budgeting are vital to balance loan repayments with these life goals.

Alternative Funding Sources

Securing funding for university education often extends beyond traditional student loans. A range of alternative financing options can significantly alleviate the financial burden and provide flexibility in managing educational costs. Exploring these avenues can be crucial for students seeking a diverse and robust funding strategy.

Many students successfully combine various funding sources to meet their educational expenses. A well-rounded approach might involve a blend of loans, grants, scholarships, and the alternative options discussed below. This diversification can minimize reliance on any single source and mitigate potential risks associated with a singular funding strategy.

Crowdfunding Platforms

Crowdfunding platforms offer a unique avenue for securing funds. These online platforms allow individuals to solicit donations from a large network of potential contributors, often friends, family, and even strangers who support the cause. Platforms like GoFundMe and Kickstarter have been used successfully by students to raise money for tuition, books, and living expenses. While successful campaigns can generate substantial funds, it’s important to note that there’s no guarantee of reaching funding goals, and significant effort is required in promoting the campaign to attract donors. The emotional investment required to share personal details and solicit funds from a wide audience should also be considered.

Personal Savings and Family Contributions

Utilizing personal savings or seeking contributions from family members represents a readily available source of funding. Students who have diligently saved throughout high school or have supportive families can leverage these resources to cover a portion or, in some cases, the entirety of their tuition fees. The advantage lies in the absence of interest payments or repayment schedules associated with loans. However, reliance on personal savings might restrict other financial opportunities, and family contributions may create financial strain on the contributing parties. Open communication and realistic budgeting are crucial to successfully leverage this funding avenue.

Part-Time Jobs

Many students supplement their education funding through part-time employment. Working during the academic year or during breaks can provide a consistent income stream to cover living expenses, tuition fees, or other educational costs. While this method provides valuable work experience and financial independence, it demands careful time management to balance work commitments with academic responsibilities. The potential impact on academic performance should be carefully considered. Finding a job that complements academic schedules and offers flexibility is crucial for successful implementation.

Alternative Funding Sources: A Summary

The following list summarizes various alternative funding sources, highlighting their potential benefits and drawbacks:

- Crowdfunding:

- Benefits: Potential for significant funding, broad reach.

- Drawbacks: No guarantee of success, requires significant effort in promotion, potential emotional toll.

- Personal Savings:

- Benefits: No interest payments, readily available.

- Drawbacks: May limit other financial opportunities, potential depletion of savings.

- Family Contributions:

- Benefits: Significant financial assistance, strong support network.

- Drawbacks: Potential strain on family finances, potential for family conflict.

- Part-Time Employment:

- Benefits: Consistent income stream, valuable work experience.

- Drawbacks: Requires careful time management, potential impact on academic performance.

- Scholarships from Private Organizations:

- Benefits: Merit-based funding, can significantly reduce tuition costs.

- Drawbacks: Competitive application process, specific eligibility criteria.

Understanding Loan Forgiveness Programs

Navigating the complexities of student loan repayment can be daunting. Fortunately, several loan forgiveness programs exist to alleviate this burden for eligible borrowers. These programs offer partial or complete cancellation of student loan debt under specific circumstances, providing crucial financial relief. Understanding the nuances of these programs is key to determining eligibility and maximizing potential benefits.

Types of Student Loan Forgiveness Programs

Several federal and state-sponsored programs offer loan forgiveness based on various factors, including occupation, public service, and economic hardship. These programs vary significantly in their eligibility requirements, application processes, and the amount of debt forgiven. Careful consideration of each program is essential to determine the most suitable option.

Eligibility Requirements and Application Processes

Eligibility for loan forgiveness programs is determined by a combination of factors. These often include the type of loan, the borrower’s income, the type of employment, and the length of service in a qualifying position. The application process typically involves submitting detailed documentation, such as tax returns, employment verification, and loan details. Many programs have strict deadlines and specific forms that must be completed accurately. Failure to meet these requirements can lead to application rejection.

Benefits and Limitations of Loan Forgiveness Options

While loan forgiveness offers significant financial relief, it’s crucial to understand its limitations. A major benefit is the reduction or elimination of student loan debt, leading to improved financial stability. However, some programs require a significant commitment of time in a specific profession, and the forgiveness may be spread over several years. Furthermore, forgiven debt may be considered taxable income in some cases, leading to unexpected tax liabilities.

Examples of Qualifying Professions

Numerous professions qualify for loan forgiveness programs, primarily those involving public service. Examples include teachers, nurses, social workers, and members of the military. Specific requirements vary depending on the program and the level of public service provided. For instance, teachers working in low-income schools might qualify for loan forgiveness programs designed to incentivize service in underserved communities. Similarly, doctors and nurses working in rural or underserved areas might be eligible for programs targeted at addressing healthcare disparities.

Comparison of Loan Forgiveness Programs

| Program Name | Eligibility Requirements | Forgiveness Amount | Application Process |

|---|---|---|---|

| Public Service Loan Forgiveness (PSLF) | 120 qualifying monthly payments under an income-driven repayment plan while employed full-time by a government or non-profit organization. | Remaining balance of eligible federal student loans. | Annual certification of employment and repayment plan. |

| Teacher Loan Forgiveness | Five years of full-time teaching in a low-income school. | Up to $17,500 in eligible federal student loans. | Application through the Federal Student Aid website. |

| Income-Driven Repayment Plans (IDR) | Based on income and family size; monthly payments are adjusted accordingly. | Remaining balance after 20-25 years of payments, depending on the plan. | Application through your loan servicer. |

| State-Specific Programs | Vary widely by state; often require specific professions or residency requirements. | Varies by program and state. | Application process varies by state and program. |

Ending Remarks

Securing funding for university is a significant step, and understanding the available options is key to responsible financial planning. By carefully considering the various loan programs, grants, scholarships, and alternative funding sources, students can create a sustainable financial plan for their education. Remember, proactive planning, responsible borrowing, and a clear understanding of repayment terms are crucial for navigating the financial landscape of higher education successfully and confidently entering post-graduate life.

FAQs

What is the difference between federal and private student loans?

Federal loans are offered by the government and often have more favorable terms and repayment options. Private loans are offered by banks and credit unions and typically have higher interest rates.

How can I improve my chances of getting a scholarship?

Strong academic records, compelling personal essays, and involvement in extracurricular activities significantly enhance scholarship applications.

What happens if I can’t repay my student loans?

Defaulting on student loans has serious consequences, including damage to your credit score and potential wage garnishment. Explore repayment options with your lender if you’re struggling.

Are there any loan forgiveness programs for specific careers?

Yes, several programs offer loan forgiveness for individuals working in public service, teaching, or certain medical fields. Eligibility criteria vary.