The crushing weight of student loan debt is a pervasive reality for many, forcing graduates into years, even decades, of financial struggle. While traditional repayment methods often feel inadequate, a growing number are turning to crowdfunding platforms like GoFundMe to alleviate this burden. This exploration delves into the complex world of GoFundMe student loan campaigns, examining their effectiveness, ethical considerations, and the broader societal implications of this increasingly popular approach to debt management.

We’ll investigate the strategies employed in successful campaigns, analyze the psychological factors driving donations, and consider the legal and financial ramifications for both borrowers and donors. Furthermore, we’ll compare GoFundMe to alternative solutions, offering a comprehensive overview to help readers understand the nuances of this evolving landscape and make informed decisions about their own financial futures.

GoFundMe’s Role in Student Loan Repayment

GoFundMe, a popular crowdfunding platform, has become an increasingly utilized resource for individuals struggling with the burden of student loan debt. While not a traditional solution, it offers a unique avenue for addressing this significant financial challenge, leveraging the power of personal networks and online communities. This approach, however, comes with its own set of advantages and disadvantages that warrant careful consideration.

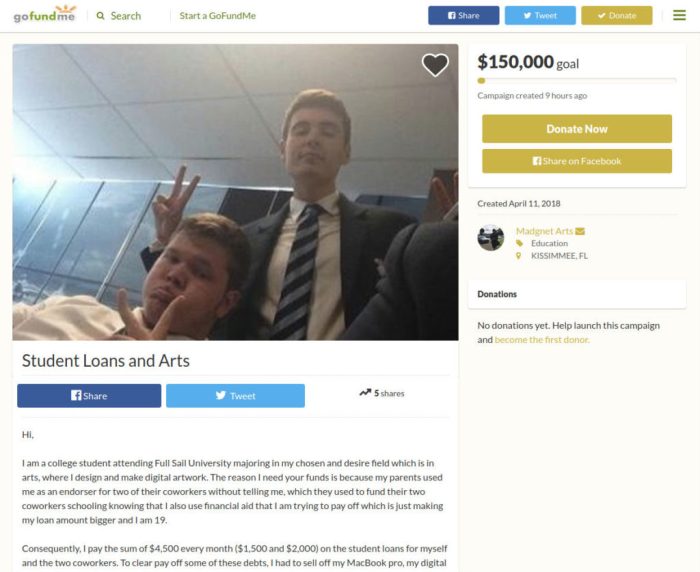

GoFundMe campaigns for student loan repayment operate by allowing individuals to create personalized pages detailing their debt situation and fundraising goals. They often share their educational background, future aspirations, and the impact the debt has on their lives. Donors then contribute voluntarily, motivated by empathy, a belief in the individual’s potential, or a desire to support education. The funds raised are then directly applied to the student loan balance, often documented through updates on the campaign page.

Advantages and Disadvantages of Using GoFundMe for Student Loan Repayment

Using GoFundMe for student loan repayment presents a distinct set of advantages and disadvantages when compared to traditional methods like loan refinancing or income-driven repayment plans. A primary advantage is the potential for significant debt reduction in a relatively short timeframe, particularly if the campaign garners substantial support. Furthermore, it can foster a sense of community and shared responsibility, highlighting the collective burden of student loan debt. However, relying on GoFundMe is inherently unpredictable. The success of a campaign depends entirely on the willingness of others to contribute, leaving the individual vulnerable to fundraising shortfalls. Moreover, the administrative fees associated with GoFundMe can eat into the funds raised, impacting the overall effectiveness of the campaign. Finally, the process can be emotionally taxing, requiring the individual to publicly share their financial struggles.

Successful and Unsuccessful GoFundMe Campaigns for Student Loan Debt

The success or failure of a GoFundMe campaign for student loan repayment hinges on several factors. Successful campaigns typically feature compelling narratives that resonate with potential donors, clearly articulating the individual’s financial challenges and future goals. They often incorporate high-quality visuals, such as photos and videos, to personalize the story and build trust. Furthermore, successful campaigns actively engage with donors, providing regular updates and expressing sincere gratitude. Unsuccessful campaigns, on the other hand, may lack a compelling narrative, fail to clearly define fundraising goals, or neglect to actively engage with potential donors. A lack of compelling visuals or a poorly designed campaign page can also contribute to failure. For example, a campaign focused solely on numbers and devoid of a personal narrative is less likely to succeed than one that shares a heartfelt story of perseverance and aspiration.

Creative Fundraising Strategies Employed in GoFundMe Campaigns for Student Loans

Many individuals have employed creative fundraising strategies to enhance the success of their GoFundMe campaigns. These strategies often go beyond simply sharing their story. Some campaigns offer incentives to donors, such as personalized thank-you notes, shout-outs on social media, or exclusive access to content. Others leverage social media platforms and influencer marketing to reach a wider audience. Some individuals have even partnered with local businesses or organizations to offer additional incentives or co-sponsor fundraising events. For instance, a student might partner with a local coffee shop to host a fundraising event, where a percentage of sales is donated to their campaign. Another example could be a musician offering online music lessons in exchange for donations. These creative approaches help to broaden the reach of the campaign and increase the likelihood of success.

The Psychology of Donating to Student Loan Campaigns

Donating to a cause, especially one as relatable as student loan debt, is a complex decision driven by a confluence of psychological and emotional factors. Understanding these influences is crucial for crafting effective GoFundMe campaigns that resonate with potential donors and ultimately achieve their fundraising goals. The decision to donate isn’t simply a rational calculation of need; it’s a deeply personal response influenced by empathy, altruism, and a sense of shared experience.

The factors influencing donation decisions to student loan GoFundMe campaigns are multifaceted. They involve a blend of emotional appeals, the persuasiveness of the narrative presented, and the perceived trustworthiness of the campaign itself. Successful campaigns effectively leverage these elements to inspire generosity.

Emotional Appeals in Successful Campaigns

Successful student loan GoFundMe campaigns often employ emotional appeals to connect with donors on a personal level. These appeals tap into fundamental human emotions, fostering a sense of empathy and encouraging generosity. For instance, appeals to compassion, highlighting the hardship faced by the student borrower, are frequently used. Similarly, appeals to hope, showcasing the potential positive impact of the donation on the borrower’s future, are effective. Finally, appeals to fairness, suggesting that the borrower deserves a chance to overcome their financial burden, can also resonate strongly with potential donors. The most effective campaigns blend these appeals seamlessly into a compelling narrative.

The Role of Storytelling and Personal Narratives

Storytelling is a powerful tool in fundraising. A well-crafted personal narrative humanizes the borrower’s situation, transforming abstract statistics into a relatable experience. Instead of simply stating the amount of debt, a compelling story might detail the borrower’s struggles, aspirations, and the impact of their debt on their daily life. This personal touch allows donors to connect emotionally with the borrower and feel invested in their success. For example, a campaign might detail how the debt is preventing the borrower from pursuing their dream career or supporting their family, making the need for assistance more tangible and impactful.

Campaign Transparency and Accountability and Donation Rates

Transparency and accountability are paramount to building trust with potential donors. Donors are more likely to contribute to campaigns where they can clearly see how their money will be used. Detailed budget breakdowns, regular updates on fundraising progress, and clear communication about the borrower’s plan for repaying their debt all contribute to a sense of accountability and increase the likelihood of donations. Conversely, a lack of transparency can raise red flags and deter potential donors. The presence of verifiable proof of debt, such as student loan statements, further strengthens the campaign’s credibility and encourages donations. Campaigns that demonstrate responsible financial management inspire greater confidence and ultimately lead to higher donation rates.

Legal and Ethical Considerations

Using GoFundMe for student loan repayment presents a complex landscape of legal and ethical considerations. While seemingly a straightforward solution for those burdened by debt, navigating the legal ramifications and ethical implications requires careful consideration for both donors and recipients. Understanding these aspects is crucial for ensuring responsible and transparent use of the platform.

GoFundMe’s Terms of Service and User Expectations

GoFundMe’s terms of service Artikel permissible uses of the platform, emphasizing transparency and prohibiting fraudulent or misleading activities. Users seeking student loan assistance must align their campaigns with these terms, accurately representing their financial situation and intended use of funds. A discrepancy between a user’s stated intentions and actual use of funds could lead to account suspension or legal repercussions. For instance, a campaign claiming funds are for tuition but then used for personal expenses would violate GoFundMe’s terms and potentially expose the user to legal action. The platform’s emphasis on transparency requires clear communication of how funds will be used, including specific details on loan repayment strategies and expected outcomes.

Tax Implications for Donors and Recipients

Donated funds received through GoFundMe are generally considered taxable income for the recipient. The recipient will need to report these funds on their tax return and pay taxes accordingly. The tax implications depend on various factors, including the recipient’s income level and applicable tax laws. For donors, contributions to GoFundMe campaigns are generally not tax-deductible unless the campaign is associated with a registered 501(c)(3) non-profit organization. This means that while donors can show generosity, they generally cannot claim a tax deduction for their contribution towards a student’s loan repayment. This lack of tax deduction for donors can influence the amount of charitable giving compared to other tax-deductible charitable contributions. For example, a donor might contribute more to a charity offering a tax deduction than to a GoFundMe campaign for student loan repayment.

Ethical Considerations: Fairness and Potential for Exploitation

The use of GoFundMe for student loan repayment raises ethical questions about fairness and the potential for exploitation. Some argue that relying on crowdfunding for essential financial needs shifts the burden of responsibility from institutions and government policies onto individuals and their social networks. This could exacerbate existing inequalities, where individuals with stronger social networks or higher earning potential are more likely to receive significant support. Furthermore, there’s a risk of exploitation, with individuals potentially misrepresenting their financial situation to garner donations. A lack of robust verification mechanisms on platforms like GoFundMe increases this risk. For example, a student could exaggerate their debt burden to receive more donations, creating an uneven playing field for those honestly seeking assistance. The ethical considerations highlight the need for transparency and accountability in the use of crowdfunding for such sensitive financial matters.

Visual Representation of Data

Visual representations of data are crucial for understanding the trends and patterns within GoFundMe campaigns for student loan repayment. Effective visualizations can communicate complex information concisely, making it easier to grasp the scale and impact of this fundraising method. The following sections detail potential visualizations to illuminate different aspects of this phenomenon.

Growth of GoFundMe Campaigns for Student Loans Over Time

A line graph would effectively showcase the growth of GoFundMe campaigns for student loans over time. The x-axis would represent time, perhaps in yearly intervals or even quarterly if sufficient data exists, spanning several years to capture long-term trends. The y-axis would represent the number of campaigns launched or the total amount of money raised. Data points would be connected by a line, visually illustrating the upward or downward trends in campaign creation and fundraising success. For enhanced clarity, different colored lines could represent different categories, such as campaigns focused on undergraduate vs. graduate debt, or campaigns achieving varying levels of success (e.g., campaigns reaching their goal vs. those that did not). Including annotations for significant events (like changes in student loan interest rates or major economic shifts) would add context to the visual.

Demographics of Donors to Student Loan GoFundMe Campaigns

A pie chart would effectively illustrate the demographic breakdown of donors. The chart would be segmented into slices, each representing a different demographic category (e.g., age group, income bracket, geographic location, relationship to the borrower – friend, family, colleague, etc.). The size of each slice would be proportional to the percentage of total donations contributed by that demographic group. A legend would clearly label each slice, specifying the demographic and the corresponding percentage. This visualization would quickly reveal which demographic groups are most likely to contribute to student loan repayment campaigns, providing valuable insights into donor behavior and potential fundraising strategies.

Impact of Student Loan Debt on Borrowers’ Lives

An infographic would be a compelling way to visually represent the wide-ranging impact of student loan debt on borrowers’ lives. The infographic could use a combination of charts, icons, and text. For instance, one section could use a bar graph to compare average monthly student loan payments to average monthly rent or mortgage payments in different regions, highlighting the financial strain. Another section could use icons and short descriptive text to illustrate the impact on major life decisions such as buying a home, starting a family, or pursuing further education. A map could visualize the geographic distribution of student loan debt, revealing areas most heavily affected. The infographic could also include short quotes from borrowers describing their personal experiences, adding a human element to the statistical data. This multifaceted approach would create a powerful and easily digestible representation of the multifaceted consequences of student loan debt.

Final Wrap-Up

Ultimately, the use of GoFundMe for student loan repayment presents a double-edged sword. While it offers a potential lifeline for those struggling under immense debt, it’s crucial to approach such campaigns with careful consideration of the legal, ethical, and financial implications. Understanding the factors that contribute to successful campaigns, coupled with awareness of alternative solutions, empowers individuals to navigate this challenging terrain and make choices that best serve their long-term financial well-being. The journey towards debt freedom requires a multifaceted approach, and this exploration serves as a guidepost in that journey.

Common Queries

What are the tax implications of donating to a GoFundMe student loan campaign?

Donations to GoFundMe campaigns are generally not tax-deductible for the donor. However, the recipient may be required to report the funds received as income and may be subject to applicable taxes.

Can GoFundMe guarantee repayment of student loans?

No, GoFundMe does not guarantee repayment of student loans. The platform facilitates fundraising, but the success of a campaign depends entirely on the generosity of donors.

What happens if a GoFundMe campaign doesn’t reach its goal?

The campaign organizer receives all funds raised, regardless of whether the goal is met. However, campaigns that fall short of their target may not provide sufficient funds to significantly impact the borrower’s debt.

Are there any fees associated with using GoFundMe for student loan repayment?

GoFundMe charges a platform fee on funds raised, which varies depending on the campaign’s location and the payment processor used. Organizers should factor this into their fundraising goals.