Navigating the world of student loans can feel overwhelming, especially when faced with the prospect of hefty tuition fees. Understanding the various types of personal loans available, their associated interest rates and repayment terms, is crucial for making informed financial decisions. This guide will equip you with the knowledge to confidently choose the best loan option to support your education and future.

We’ll delve into the specifics of federal versus private student loans, exploring eligibility requirements, application processes, and the importance of responsible borrowing. We’ll also discuss alternative financing options and strategies for improving your credit score to secure the most favorable loan terms. Ultimately, our aim is to empower you to make smart financial choices that align with your academic goals.

Interest Rates and Fees

Securing a personal loan for educational expenses requires careful consideration of interest rates and associated fees. Understanding these factors is crucial for making informed borrowing decisions and managing your finances effectively throughout your studies and beyond. The total cost of your loan will be significantly impacted by these elements.

Interest rates on student personal loans are determined by several factors. Lenders assess your creditworthiness, considering your credit history, income, and debt-to-income ratio. The prevailing market interest rates also play a significant role, influencing the base rate lenders use for calculating your personal loan interest. Your loan term (the length of time you have to repay the loan) also impacts the interest rate; longer loan terms often result in higher overall interest costs but lower monthly payments. Finally, the type of loan and the lender themselves will influence the final interest rate.

Interest Rate Scenarios and Their Impact on Total Loan Cost

Let’s consider two scenarios to illustrate how interest rates affect the total cost of a student personal loan. Suppose you borrow $10,000.

Scenario 1: A 7% annual interest rate over a 5-year term. Using a simple interest calculation (ignoring compounding for simplicity), the total interest paid would be approximately $3,500, resulting in a total repayment of $13,500.

Scenario 2: A 10% annual interest rate over the same 5-year term. The total interest paid would be approximately $5,000, resulting in a total repayment of $15,000. This demonstrates how even a seemingly small difference in interest rates can significantly increase the overall cost of the loan. Accurate calculations should utilize the appropriate compounding interest formula.

Common Fees Associated with Personal Student Loans

Several fees are commonly associated with personal student loans. Origination fees are charges levied by the lender to process your loan application. These fees can range from a percentage of the loan amount to a fixed dollar amount and are typically deducted from the loan proceeds before you receive the funds. Prepayment penalties are fees charged if you repay your loan early. While less common with personal loans than with mortgages, it’s essential to check the loan agreement for any such clauses. Late payment fees are charged if you miss a payment, adding to your overall debt. It’s crucial to review the loan terms and conditions carefully to understand all associated fees.

Comparison of Interest Rates Across Various Lenders

Understanding the range of interest rates offered by different lenders is vital for securing the best possible terms. It is important to note that these are examples and actual rates can vary based on individual circumstances.

The following is a sample comparison, and actual rates will vary depending on creditworthiness and market conditions. Always check with individual lenders for the most up-to-date information.

| Lender | Approximate Interest Rate Range (%) |

|---|---|

| Lender A | 6.5 – 12.0 |

| Lender B | 7.0 – 13.5 |

| Lender C | 8.0 – 15.0 |

Repayment Options and Terms

Choosing the right repayment plan for your student personal loan is crucial for managing your finances effectively after graduation. Understanding the various options and their implications on your long-term budget is key to avoiding financial stress. This section will Artikel common repayment plans and the impact of different loan terms.

Lenders typically offer several repayment options to accommodate varying financial situations. These plans often differ in the length of the repayment period and the resulting monthly payments. Shorter repayment periods generally mean higher monthly payments but lower overall interest paid, while longer periods result in lower monthly payments but higher total interest paid over the life of the loan. Carefully considering your post-graduation income and expenses is vital in selecting a suitable plan.

Repayment Plan Options

Several repayment plans exist, and the availability of specific plans depends on the lender. Common options include standard repayment plans, graduated repayment plans, and extended repayment plans. Standard plans involve fixed monthly payments over a set period. Graduated plans start with lower payments that gradually increase over time, often aligning with anticipated income growth. Extended plans stretch the repayment period, lowering monthly payments but increasing the total interest paid.

Implications of Loan Terms

The length of your loan term significantly impacts your overall cost. A shorter loan term (e.g., 5 years) leads to higher monthly payments but substantially less interest paid over the loan’s lifetime. Conversely, a longer loan term (e.g., 10 years) results in lower monthly payments, but you’ll end up paying significantly more in interest. The optimal choice depends on your individual financial circumstances and risk tolerance.

Hypothetical Repayment Schedule

To illustrate the difference, let’s compare a $10,000 loan with a 5% annual interest rate over 5 years and 10 years. These calculations are simplified and do not include any additional fees.

| Month | Payment Amount (5-year plan) | Payment Amount (10-year plan) |

|---|---|---|

| 1-60 | $188.71 (approx.) | $106.07 (approx.) |

Note: These are approximate monthly payments. Actual payments may vary slightly based on the specific lender’s calculation methods. Using a loan amortization calculator provides more precise figures.

Challenges Students Face During Loan Repayment

Repaying student loans can present several challenges. Unexpected job loss, lower-than-anticipated income, or unexpected expenses (medical bills, car repairs) can create difficulties in making timely payments. Careful budgeting, creating a realistic repayment plan, and establishing an emergency fund are crucial strategies to mitigate these potential challenges. It is also important to be aware of the potential impact of missed payments on credit scores and future borrowing opportunities.

Lenders and Application Process

Securing a personal loan as a student involves navigating various lenders and understanding their respective application processes. Different lenders offer varying levels of flexibility, interest rates, and required documentation. Choosing the right lender depends heavily on your individual financial circumstances and needs.

The application process itself can seem daunting, but with a clear understanding of the requirements and steps involved, it becomes much more manageable. This section will clarify the procedures, documentation, and reputable lenders to consider.

Comparison of Application Processes

Student personal loan applications generally follow a similar pattern across different lenders, but specific requirements and timelines can vary. Some lenders offer fully online applications, while others may require a combination of online and physical document submission. The speed of processing also differs; some lenders provide quick approvals, while others may take several days or even weeks. For example, a large national bank might have a more rigorous application process with longer processing times compared to a smaller online lender specializing in student loans. Understanding these differences is crucial in selecting the lender best suited to your circumstances and urgency.

Required Documentation for Student Loan Applications

Lenders typically require several documents to verify your identity, income, and creditworthiness. These documents commonly include:

- Government-issued photo ID: Such as a driver’s license or passport.

- Proof of enrollment: This might be an acceptance letter, enrollment verification form, or current student ID.

- Proof of income: This could include pay stubs, bank statements showing regular income, or tax returns. If you have a part-time job, even limited income documentation is helpful.

- Credit report: While not always mandatory, a good credit score significantly improves your chances of approval and securing a favorable interest rate. You can obtain your credit report from major credit bureaus.

- Bank statements: These help lenders assess your financial history and ability to manage repayments.

Step-by-Step Guide to Applying for a Student Personal Loan

Applying for a student personal loan usually involves these steps:

- Pre-qualification: Many lenders offer pre-qualification tools that allow you to check your eligibility without impacting your credit score. This helps you understand your potential interest rate and loan amount.

- Application submission: Complete the online application form, providing all the necessary documentation. Ensure all information is accurate and up-to-date.

- Credit check: The lender will perform a credit check to assess your creditworthiness.

- Loan approval/denial: You’ll receive notification regarding the lender’s decision. If approved, you’ll receive loan terms and conditions.

- Loan agreement signing: Review the loan agreement carefully before signing to understand all the terms and conditions.

- Disbursement of funds: Once you’ve signed the agreement, the funds will be disbursed to your account according to the agreed-upon schedule.

Reputable Lenders Offering Student Personal Loans

Choosing a reputable lender is essential. It’s important to research and compare offers from various lenders before making a decision. While specific lenders and their offerings change, examples of reputable lenders (always verify current offerings and terms before applying) include some large national banks, credit unions known for student-friendly services, and reputable online lending platforms. It’s advisable to check independent reviews and ratings before selecting a lender.

Financial Responsibility and Budgeting

Securing a student loan can significantly ease the financial burden of higher education, but responsible financial planning is crucial for successful repayment. Before accepting any loan offer, it’s essential to create a realistic budget that accounts for loan repayments alongside your living expenses and other financial commitments. Failing to do so can lead to financial hardship and ultimately, loan default.

Understanding the long-term implications of student loan debt is paramount. Effective budgeting and responsible borrowing habits are key to navigating this financial commitment successfully.

Consequences of Student Loan Default

Defaulting on a student loan has severe repercussions. These consequences can include damage to your credit score, making it difficult to obtain future loans or credit cards, wage garnishment (where a portion of your earnings is seized to repay the debt), and even legal action. The impact on your financial future can be substantial and long-lasting, making responsible repayment a top priority. For example, a defaulted loan can prevent you from buying a house or securing a favorable interest rate on a car loan for many years.

Tips for Responsible Borrowing and Effective Debt Management

Careful planning and responsible practices are essential for managing student loan debt effectively. The following tips can help students navigate their loan repayment journey successfully.

- Create a Detailed Budget: Track your income and expenses meticulously. Identify areas where you can cut back on spending to free up funds for loan repayments. A realistic budget should include not only essential expenses like rent and food but also discretionary spending, such as entertainment and dining out.

- Understand Loan Terms: Before signing any loan agreement, thoroughly review the terms and conditions, including interest rates, repayment schedules, and any associated fees. Understanding these details empowers you to make informed decisions and avoid unexpected costs.

- Prioritize Repayment: Make loan repayments a priority in your monthly budget. Consider setting up automatic payments to ensure timely and consistent repayments. Explore options such as income-driven repayment plans if you face financial difficulties.

- Explore Repayment Options: Many lenders offer various repayment plans, such as graduated repayment (where payments increase over time) or extended repayment (where the loan is paid off over a longer period). Choose a plan that aligns with your financial capabilities and long-term goals.

- Build an Emergency Fund: Having a savings account for unexpected expenses can help prevent loan default during financial emergencies. Aim to save at least three to six months’ worth of living expenses to provide a financial buffer.

- Seek Financial Counseling: If you’re struggling to manage your student loan debt, consider seeking professional financial advice. Many non-profit organizations offer free or low-cost counseling services to help you develop a personalized repayment plan.

Alternatives to Personal Loans

Securing funding for higher education shouldn’t solely rely on personal loans. Exploring alternative financing options can significantly reduce your debt burden after graduation. These alternatives often come with fewer strings attached and potentially more favorable terms than personal loans. Understanding these options and their suitability for your individual circumstances is crucial in making informed financial decisions.

While personal loans offer immediate access to funds, they typically involve interest charges and repayment schedules that can strain post-graduation finances. Alternatives, such as scholarships, grants, and work-study programs, provide financial assistance without the same level of repayment obligations. This section will delve into these alternatives, comparing them to personal loans and guiding you toward resources that can help you secure funding.

Scholarships and Grants

Scholarships and grants represent non-repayable financial aid for education. Scholarships are often merit-based, awarded based on academic achievement, athletic prowess, or specific talents. Grants, on the other hand, are typically need-based, considering factors like family income and financial need. Both can significantly reduce the overall cost of higher education, minimizing the need for loans.

Numerous organizations offer scholarships and grants. Some are institution-specific, provided by the college or university you attend. Others are offered by private organizations, corporations, and even professional associations. Many scholarships are highly competitive, requiring strong academic records and compelling applications. Grants, while often less competitive, require thorough documentation of financial need.

Work-Study Programs

Federal Work-Study programs offer part-time employment opportunities for students who demonstrate financial need. These programs provide income to help cover educational expenses, reducing reliance on loans. The type of work varies, ranging from campus-related jobs to community service positions. Earnings from Work-Study can be used for tuition, fees, books, and other educational costs.

The benefits of Work-Study include earning income while gaining valuable work experience. It can also alleviate some financial pressure during your studies. However, the income generated might not fully cover all educational expenses, potentially requiring supplemental funding through other means. The number of hours available through Work-Study can also be limited, impacting the total amount of income earned.

Comparison of Options

| Feature | Personal Loan | Scholarship | Grant | Work-Study |

|---|---|---|---|---|

| Funding Source | Financial Institution | Organizations, Institutions | Government, Organizations | Federal Government |

| Repayment | Required with Interest | Not Required | Not Required | Not Applicable (Earned Income) |

| Eligibility | Creditworthiness | Merit or Specific Criteria | Financial Need | Financial Need and Enrollment |

| Impact on Future Finances | Debt Accumulation | Positive Impact | Positive Impact | Positive Impact (Income & Experience) |

Resources for Finding Scholarships and Grants

Finding scholarships and grants requires proactive research. Several online resources can assist in this process. Websites like Fastweb, Scholarships.com, and the U.S. Department of Education’s website provide comprehensive databases of scholarships and grants. Additionally, your college or university’s financial aid office can offer personalized guidance and assistance in locating suitable opportunities. Many professional organizations and community groups also offer scholarships tailored to specific fields or demographics. Remember to thoroughly research the eligibility requirements and deadlines for each opportunity.

Understanding Credit Scores

Your credit score is a crucial factor influencing your ability to secure a personal loan and the terms you’ll receive. Lenders use it to assess your creditworthiness – essentially, how likely you are to repay the loan on time. A higher credit score typically translates to better loan offers, including lower interest rates and more favorable repayment terms. Conversely, a low credit score can significantly limit your loan options or result in higher interest rates and less flexible repayment plans.

Credit scores are calculated using a complex algorithm that considers various factors from your credit history. These factors include payment history (the most significant element), amounts owed, length of credit history, new credit, and credit mix. Understanding these components can empower you to make informed decisions about your finances and improve your creditworthiness.

Credit Scores and Loan Approval

A good credit score significantly increases your chances of loan approval. Lenders view individuals with high scores as lower-risk borrowers, making them more likely to approve their loan applications. Conversely, a low credit score may lead to rejection, especially if you’re applying for a large loan amount or have limited credit history. Even if approved, a low credit score will almost certainly result in a higher interest rate, increasing the overall cost of the loan. For example, someone with a credit score above 750 might qualify for an interest rate of 7%, while someone with a score below 600 might face an interest rate of 15% or higher, significantly impacting the total repayment amount.

Strategies for Improving Credit Scores

Improving your credit score takes time and consistent effort, but the rewards are substantial. Focusing on responsible financial habits is key. This includes consistently paying bills on time, maintaining low credit utilization (the percentage of available credit you’re using), and keeping your credit accounts open for a longer period. Avoiding excessive applications for new credit also helps, as each inquiry can slightly lower your score. By diligently following these strategies, you can significantly improve your credit score over several months or years. A consistent improvement of even 20-30 points can lead to noticeably better loan terms.

Impact of a Low Credit Score

A low credit score can severely restrict your loan options. Lenders may be hesitant to offer loans, especially at favorable rates. If you are approved, expect higher interest rates, potentially leading to substantially increased borrowing costs. You might also encounter stricter loan terms, such as shorter repayment periods or higher fees. For instance, a loan with a high interest rate might require a larger monthly payment, making repayment more challenging. In extreme cases, a low credit score can make obtaining a loan practically impossible.

Actions to Improve a Credit Score

Improving your credit score requires a multifaceted approach. The following actions can positively impact your score over time:

Consistent and timely payments are paramount. Even a single missed payment can negatively impact your score. Make every effort to pay all your bills on time, every time.

- Pay all bills on time.

- Keep credit utilization low (ideally below 30%).

- Maintain a diverse credit mix (credit cards, loans, etc.).

- Avoid opening multiple new credit accounts within a short period.

- Review your credit report regularly for errors and inaccuracies.

- Consider a secured credit card to build credit history if you have limited or no credit.

Concluding Remarks

Securing a good personal loan for your education requires careful planning and research. By understanding the different loan types, interest rates, repayment options, and the importance of responsible borrowing, you can make informed decisions that minimize financial strain and maximize your chances of academic success. Remember to explore all available options, including scholarships and grants, and always prioritize building a strong credit history for better loan terms in the future. Your financial well-being is a critical component of your overall success.

FAQ Insights

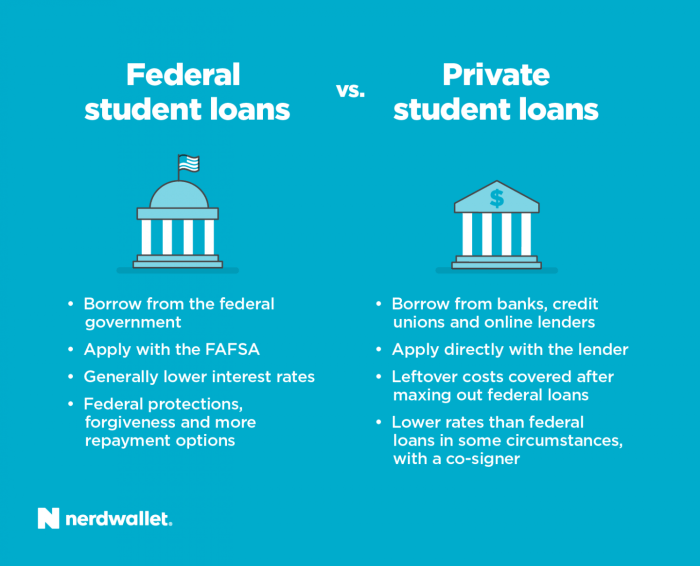

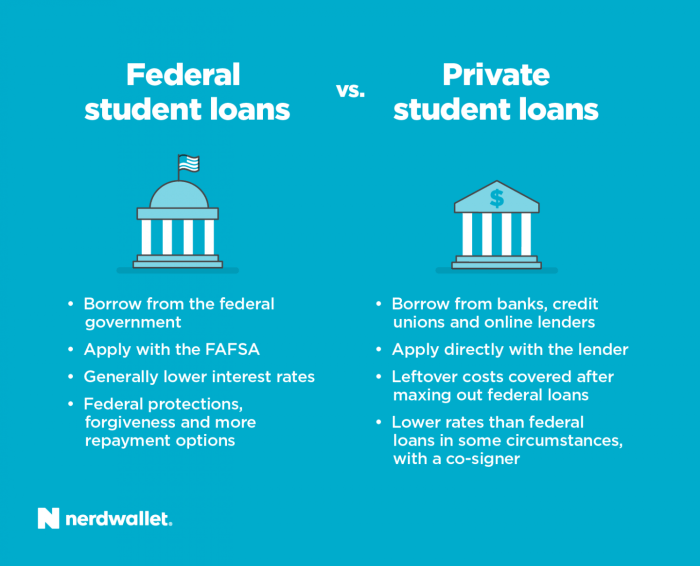

What is the difference between a federal and private student loan?

Federal loans are offered by the government and typically have more favorable terms and protections for borrowers. Private loans are offered by banks and credit unions and often have higher interest rates and less stringent eligibility requirements.

How can I improve my chances of loan approval?

Maintain a good credit score, demonstrate a stable income (or co-signer with a stable income), and provide all necessary documentation accurately and completely during the application process.

What happens if I default on my student loan?

Defaulting on a student loan can severely damage your credit score, leading to difficulty obtaining future loans or credit. It can also result in wage garnishment and legal action.

Are there any hidden fees associated with student loans?

Always carefully review the loan agreement for any fees, such as origination fees, prepayment penalties, or late payment fees. These can significantly impact the overall cost of the loan.