Navigating the complex landscape of government student loans can feel overwhelming, especially for prospective students and their families. Understanding the various loan types, eligibility criteria, repayment options, and potential pitfalls is crucial for making informed decisions about financing higher education. This guide aims to demystify the process, providing a clear and concise overview of government student loans in the United States.

From the differences between federal and state loans to the intricacies of loan forgiveness programs and responsible borrowing strategies, we will explore the key aspects of this critical financial tool. We will also delve into the impact of student loan debt on career choices and long-term financial well-being, empowering readers to make responsible choices that align with their individual circumstances and future goals.

Types of Government Student Loans

Navigating the world of student loans can be complex, but understanding the different types available is crucial for making informed financial decisions. Government student loans, offered at both the federal and state levels, provide significant financial assistance to students pursuing higher education. However, these loans differ in their terms, eligibility requirements, and repayment options.

Federal vs. State Student Loans

Federal student loans are offered by the U.S. Department of Education and are generally preferred due to their borrower protections, flexible repayment plans, and a wider range of loan types. State student loans, on the other hand, are offered by individual states and vary considerably in terms of availability, eligibility criteria, and loan features. State programs often have more limited funding and may be restricted to residents of that specific state. Furthermore, the interest rates and repayment terms for state loans can be less favorable compared to federal options. Federal loans typically offer more comprehensive borrower benefits and protections, making them a more attractive option for most students.

Types of Federal Student Loans

The federal government offers several types of student loans, each with its own set of characteristics. Understanding these differences is essential for selecting the most appropriate loan for your financial situation.

Subsidized and Unsubsidized Federal Stafford Loans

Subsidized Stafford Loans are need-based loans where the government pays the interest while you are in school at least half-time, during grace periods, and during deferment. Unsubsidized Stafford Loans are not need-based; interest accrues from the time the loan is disbursed, regardless of your enrollment status. Both loan types have a fixed interest rate determined annually and are available to undergraduate and graduate students who meet eligibility requirements.

Federal PLUS Loans

Federal PLUS Loans are available to parents of dependent undergraduate students (Parent PLUS Loans) and to graduate or professional students (Graduate PLUS Loans). Unlike Stafford Loans, credit checks are conducted for PLUS loans, and borrowers must meet certain credit requirements to qualify. These loans carry a higher interest rate than Stafford Loans and interest begins to accrue immediately.

Comparison of Federal Student Loan Types

| Loan Type | Interest Rate | Eligibility | Repayment Options |

|---|---|---|---|

| Subsidized Stafford Loan | Variable; set annually by the government | Demonstrated financial need, enrollment at least half-time | Standard, graduated, extended, income-driven repayment plans |

| Unsubsidized Stafford Loan | Variable; set annually by the government | Enrollment at least half-time | Standard, graduated, extended, income-driven repayment plans |

| Parent PLUS Loan | Variable; set annually by the government; generally higher than Stafford Loans | Parent of a dependent undergraduate student; credit check required | Standard, graduated, extended, income-driven repayment plans |

| Graduate PLUS Loan | Variable; set annually by the government; generally higher than Stafford Loans | Graduate or professional student; credit check required | Standard, graduated, extended, income-driven repayment plans |

Eligibility and Application Process

Securing a government student loan involves understanding the eligibility criteria and navigating the application process. This section will detail the requirements for different loan types and provide a step-by-step guide to applying for federal student loans, including necessary documentation and common reasons for application denial.

Federal Student Loan Eligibility Requirements

Eligibility for federal student loans hinges on several factors. Applicants must be a U.S. citizen or eligible non-citizen, enrolled or accepted for enrollment at least half-time in an eligible degree or certificate program at a participating institution, demonstrate financial need (for some loan types), and maintain satisfactory academic progress. Specific requirements may vary based on the type of loan (e.g., subsidized vs. unsubsidized, PLUS loans). For example, eligibility for a Parent PLUS loan depends on the parent’s credit history. The Department of Education’s website provides detailed information on specific eligibility criteria for each loan program.

Federal Student Loan Application Process

The application process for federal student loans begins with completing the Free Application for Federal Student Aid (FAFSA). This form collects information about your financial situation and educational goals. After submitting the FAFSA, your information is processed, and your eligibility for federal aid, including student loans, is determined. Next, you will receive a Student Aid Report (SAR) summarizing your information and your eligibility for federal student aid. You then accept your loan offer through your school’s financial aid office. Finally, you will receive loan disbursement information from your lender, usually your school. The entire process typically takes several weeks.

Required Documentation for Federal Student Loan Applications

To complete the FAFSA, you will need your Social Security number, federal tax information (yours and your parents’, if applicable), and your driver’s license or state identification number. Additional documentation may be requested depending on your individual circumstances. For example, if you are applying for a Parent PLUS loan, the lender may request your parent’s credit report and tax returns. It’s crucial to ensure all information provided is accurate and complete to avoid delays in processing.

Common Reasons for Federal Student Loan Application Denial

Several factors can lead to a student loan application being denied. These include:

- Failure to meet the minimum credit score requirements for PLUS loans.

- Providing inaccurate or incomplete information on the FAFSA.

- Not maintaining satisfactory academic progress in your studies.

- Being enrolled in a program that is not eligible for federal student aid.

- Having an adverse credit history (for PLUS loans).

- Failure to complete the required steps in the application process.

Addressing these issues proactively can significantly improve your chances of loan approval. If your application is denied, review the denial letter carefully and understand the reason for the denial before reapplying. Contacting the financial aid office at your school can also provide valuable guidance and assistance.

Interest Rates and Repayment Plans

Understanding the interest rates and repayment options for your government student loans is crucial for effective financial planning. This section will clarify how interest rates are calculated and Artikel the various repayment plans available, including illustrative examples to help you make informed decisions.

Interest rates on government student loans are determined by several factors. The most significant is the loan’s type – federal subsidized loans generally have lower rates than unsubsidized loans. The prevailing market interest rates at the time the loan is disbursed also play a key role. These rates are set annually by the government and are influenced by economic conditions. Finally, the loan’s term (length) can also slightly affect the interest rate, though this is usually less impactful than the loan type and market rates. It’s important to note that the interest rate is fixed for the life of the loan, meaning it won’t change once the loan is disbursed, offering predictability in repayment planning. The specific rate for your loan will be clearly stated in your loan documents.

Federal Student Loan Repayment Plan Options

Choosing the right repayment plan is a significant decision impacting your monthly budget and overall repayment timeframe. Several plans cater to different financial situations and repayment preferences.

The most common repayment plans include Standard, Graduated, and Income-Driven Repayment (IDR) plans. Each plan offers a unique approach to repayment, allowing borrowers to tailor their payments to their individual financial circumstances.

Standard Repayment Plan

The Standard Repayment Plan is a fixed monthly payment plan spread over a 10-year period. This plan offers the shortest repayment period, resulting in the lowest total interest paid over the life of the loan. However, monthly payments may be higher compared to other repayment plans. Let’s consider an example: A $20,000 loan with a 5% interest rate would have a monthly payment of approximately $212. This calculation is simplified and doesn’t account for fees or other potential factors, which may slightly alter the final payment.

Graduated Repayment Plan

The Graduated Repayment Plan features lower initial monthly payments that gradually increase every two years. This can be beneficial for borrowers anticipating higher incomes in the future. However, it extends the repayment period, potentially leading to higher overall interest payments compared to the Standard plan. For the same $20,000 loan at 5%, the initial payment might be around $140, increasing over time. The total repayment period could extend beyond 10 years, resulting in higher overall interest.

Income-Driven Repayment Plans

Income-Driven Repayment (IDR) plans link your monthly payment to your income and family size. Several IDR plans exist (e.g., ICR, PAYE, REPAYE), each with its own formula for calculating payments. These plans are designed to make repayment more manageable for borrowers with lower incomes. Payments are typically lower than under Standard or Graduated plans, but the repayment period is significantly longer, often extending to 20 or 25 years. This could lead to higher total interest paid over the life of the loan. The exact calculation varies based on the specific IDR plan and individual income and family size. For example, a borrower with a low income and a $20,000 loan might see a monthly payment of only $50 under an IDR plan, but the loan would take significantly longer to repay.

Loan Forgiveness and Deferment Programs

Navigating the complexities of student loan repayment can be challenging. Fortunately, several government programs offer pathways to loan forgiveness or temporary relief through deferment and forbearance. Understanding these options is crucial for borrowers seeking to manage their debt effectively. This section Artikels various loan forgiveness programs and details the eligibility requirements for deferment and forbearance.

Government Student Loan Forgiveness Programs

Several programs offer partial or complete forgiveness of federal student loans, contingent upon meeting specific criteria. These programs often target borrowers pursuing careers in public service, education, or other high-need fields. Eligibility varies significantly depending on the program and the type of loan.

| Program Name | Eligibility | Forgiveness Amount | Requirements |

|---|---|---|---|

| Public Service Loan Forgiveness (PSLF) | Borrowers with Direct Loans working full-time for qualifying government or non-profit organizations. | Remaining loan balance after 120 qualifying monthly payments. | 120 qualifying monthly payments under an income-driven repayment plan while employed full-time by a qualifying employer. |

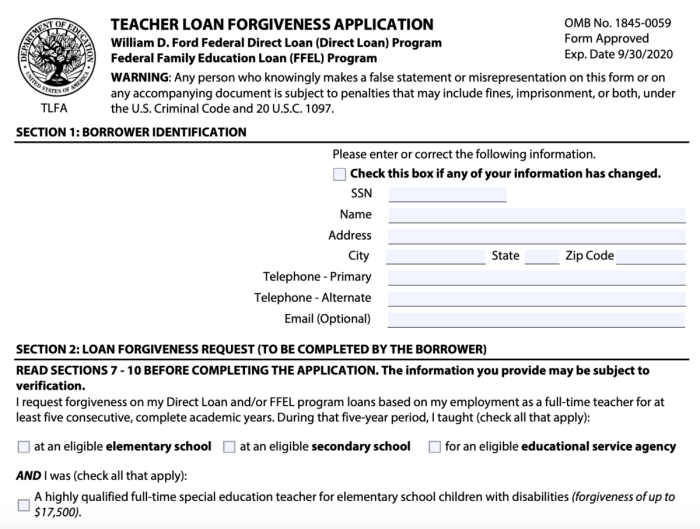

| Teacher Loan Forgiveness | Teachers who have taught full-time for five complete and consecutive academic years in a low-income school or educational service agency. | Up to $17,500 of Direct Subsidized or Unsubsidized Loans. | Meet specific teaching requirements and complete the application process. |

| Income-Driven Repayment (IDR) Plans with Potential Forgiveness | Borrowers with federal student loans who qualify for an IDR plan (such as ICR, PAYE, REPAYE, orIBR). | Remaining loan balance after a specific period (typically 20 or 25 years, depending on the plan). | Consistent payments under a qualifying IDR plan for the required timeframe. |

| State-Specific Loan Forgiveness Programs | Varies by state; often targets borrowers working in specific professions or locations within the state. | Varies by state and program. | Meet the state’s specific eligibility criteria and requirements. |

Loan Deferment and Forbearance

Deferment and forbearance are temporary pauses in student loan repayment. While both provide temporary relief, they differ in their eligibility requirements and the impact on interest accrual. Choosing between them depends on individual circumstances and the type of loan held.

Loan Deferment

Deferment temporarily suspends your student loan payments. Certain types of deferment may not accrue interest, while others may. Eligibility for deferment depends on factors such as unemployment, enrollment in school, or economic hardship. Specific requirements vary depending on the type of deferment and the loan program. For example, economic hardship deferment requires documentation proving financial difficulty.

Loan Forbearance

Forbearance also allows for a temporary pause in student loan payments. However, unlike some deferment options, interest typically continues to accrue during a forbearance period. This can lead to a larger loan balance upon resuming payments. Forbearance is often granted for a shorter duration than deferment and may be available for borrowers facing temporary financial difficulties. The lender typically reviews the request and determines the length of the forbearance period based on the borrower’s situation.

The Impact of Government Student Loans on Higher Education

Government student loan programs have profoundly reshaped the landscape of higher education, significantly impacting access, affordability, and the financial trajectories of graduates. Their influence is multifaceted, affecting not only individual students but also the broader economy and the future of the workforce. Understanding this impact is crucial for policymakers, educational institutions, and prospective students alike.

Government student loans have undeniably expanded access to higher education for millions. Prior to the widespread availability of federal loan programs, higher education was largely the privilege of affluent families. Loans have allowed individuals from lower socioeconomic backgrounds to pursue post-secondary education, broadening participation and diversifying college campuses. This increased access has contributed to a more skilled and educated workforce, benefiting society as a whole.

The Effect of Student Loan Debt on Graduates’ Financial Well-being

The accumulation of student loan debt significantly impacts graduates’ financial well-being in both the short and long term. Many graduates face substantial monthly payments, often delaying major life decisions such as homeownership, starting a family, or investing in retirement. High levels of debt can also lead to increased stress and anxiety, affecting overall mental health. The weight of loan repayment can restrict career choices, forcing graduates to prioritize higher-paying jobs over those that might align better with their passions or values. For example, a recent study showed that individuals with significant student loan debt are more likely to delay marriage and having children, while others may choose a higher-paying but less fulfilling career path in order to manage their debt faster.

The Relationship Between Student Loan Debt and Career Choices

Student loan debt exerts a considerable influence on the career paths graduates pursue. The pressure to repay loans often leads graduates to prioritize high-paying jobs, even if those jobs don’t perfectly align with their academic background or personal interests. This can lead to a mismatch between skills and employment, potentially hindering career satisfaction and long-term professional fulfillment. For instance, a graduate with a degree in the humanities might feel compelled to accept a well-paying position in finance to quickly pay off their loans, foregoing a potentially more rewarding career in a less lucrative field. This financial constraint can limit career exploration and potentially stunt professional growth. Conversely, some graduates might pursue careers that offer loan forgiveness programs, such as teaching or public service, even if the salary is lower. This illustrates how student loan debt can shape career decisions and influence the overall workforce distribution.

Potential Challenges and Pitfalls of Student Loans

Navigating the world of student loans requires careful planning and understanding of the potential risks involved. While student loans can be a crucial stepping stone to higher education and future career opportunities, accumulating significant debt without a clear strategy can lead to long-term financial difficulties. This section explores the potential challenges and pitfalls associated with student loan debt, offering strategies for responsible borrowing and management.

The primary risk associated with student loan debt is the sheer financial burden it can represent. High interest rates can quickly escalate the total amount owed, especially if repayment isn’t started promptly after graduation. This can significantly impact an individual’s ability to save for a down payment on a house, start a family, or invest in other crucial life goals. The weight of this debt can also lead to stress and anxiety, negatively affecting overall well-being.

Risks of Significant Student Loan Debt

High levels of student loan debt can severely limit financial flexibility. For example, a graduate burdened with six-figure debt might struggle to afford a mortgage, impacting their ability to build long-term wealth through homeownership. Furthermore, the long repayment periods often associated with student loans can tie up significant portions of monthly income for years, hindering the ability to save for retirement or other important financial objectives. In extreme cases, borrowers may face default, leading to damaged credit scores and potential legal repercussions. This can significantly impact future borrowing opportunities, such as obtaining a car loan or a mortgage.

Strategies for Responsible Student Loan Borrowing and Management

Effective planning and responsible borrowing are essential to mitigating the risks associated with student loans. Before taking out any loans, thoroughly research the different repayment options available and carefully consider the total cost of borrowing, including interest and fees. Prioritize scholarships and grants to minimize the need for loans. Budgeting and tracking expenses are crucial for understanding one’s financial capacity and ensuring loan repayments remain manageable. Regularly reviewing loan statements and seeking professional financial advice can also help borrowers stay on track and avoid potential pitfalls.

Common Mistakes in Student Loan Management

One common mistake is failing to understand the terms and conditions of the loan agreement. Borrowers should thoroughly review all aspects of their loan, including interest rates, repayment schedules, and any potential fees. Another frequent error is neglecting to explore different repayment options. For instance, income-driven repayment plans can significantly reduce monthly payments, making them more manageable for borrowers with lower incomes. Failing to budget effectively and track loan payments can lead to missed payments and negatively impact credit scores. Finally, delaying repayment after graduation can result in increased interest charges and a larger overall debt burden. For example, delaying repayment for even a year can significantly increase the total amount owed over the life of the loan.

Government Regulations and Oversight of Student Loans

The government plays a crucial role in regulating the student loan industry to protect borrowers and ensure fair lending practices. Several agencies work together to oversee various aspects of the process, from loan origination to repayment. This oversight is vital in preventing exploitation and promoting responsible borrowing.

Government agencies such as the Department of Education (in the US context, adapt as needed for other countries) establish regulations governing interest rates, loan terms, and eligibility criteria for federal student loan programs. They also monitor lending institutions to ensure compliance with these regulations and take action against those engaging in predatory lending practices. Independent oversight bodies may also conduct audits and investigations to ensure accountability.

Agencies Involved in Student Loan Regulation

The Department of Education (or its equivalent in other countries) is the primary agency responsible for administering federal student loan programs. This involves setting eligibility requirements, disbursing funds, and managing repayment processes. Other agencies, such as the Consumer Financial Protection Bureau (CFPB) in the US, focus on consumer protection and preventing predatory lending practices. These agencies work collaboratively to ensure a fair and transparent student loan system. Their oversight includes reviewing complaints, conducting investigations, and imposing penalties on institutions that violate regulations.

Measures to Prevent Predatory Lending Practices

Several measures are implemented to combat predatory lending in the student loan market. These include strict regulations on interest rates, limitations on fees and charges, and requirements for clear and concise disclosure of loan terms. Agencies actively monitor lenders for violations and investigate complaints from borrowers. Furthermore, educational initiatives aim to equip students with the knowledge and resources to make informed borrowing decisions, reducing their vulnerability to predatory practices. For example, the US government mandates clear explanations of loan terms and repayment options before a student signs a loan agreement. This helps students understand the implications of their borrowing decisions and prevents them from entering into agreements they don’t fully comprehend.

Rights and Responsibilities of Student Loan Borrowers

Understanding your rights and responsibilities as a student loan borrower is essential for navigating the loan process successfully and avoiding potential pitfalls.

Borrowers have the right to:

- Receive clear and concise information about loan terms, interest rates, and repayment options.

- Access to accurate and timely information regarding their loan accounts.

- Fair and impartial treatment from lenders and loan servicers.

- Explore and utilize available repayment plans and loan forgiveness programs.

- File complaints and seek redress for any violations of their rights.

Borrowers also have the responsibility to:

- Understand the terms of their loan agreement before signing.

- Make timely and accurate loan payments.

- Maintain open communication with their loan servicer.

- Keep their contact information updated.

- Explore available resources and seek assistance if they encounter difficulties in repaying their loans.

Epilogue

Securing a higher education often necessitates leveraging government student loans, a powerful tool that can unlock opportunities but also presents significant financial responsibilities. By understanding the various loan types, eligibility requirements, repayment plans, and potential risks, students and families can make informed decisions, minimizing financial strain and maximizing the benefits of higher education. Remember that responsible borrowing and proactive management are key to navigating the complexities of student loan debt successfully.

Common Queries

What happens if I can’t make my student loan payments?

Several options exist, including deferment (temporarily postponing payments), forbearance (reducing or suspending payments), and income-driven repayment plans. Contact your loan servicer immediately to discuss your options and avoid default.

Can I consolidate my student loans?

Yes, loan consolidation combines multiple federal student loans into a single loan with a new interest rate and repayment plan. This can simplify repayment, but it might not always lower your overall interest cost.

What is the difference between subsidized and unsubsidized loans?

Subsidized loans don’t accrue interest while you’re in school (at least half-time), during grace periods, or during deferment. Unsubsidized loans accrue interest from the time the loan is disbursed.

How do I find my student loan servicer?

Your loan servicer information is typically available on the National Student Loan Data System (NSLDS) website or through your student loan provider.