Navigating the complex landscape of higher education financing can feel daunting, especially when considering government-backed student loans. These loans, a cornerstone of the American higher education system, offer a crucial pathway to academic pursuits but come with a range of options, responsibilities, and potential long-term consequences. Understanding the nuances of different loan types, repayment plans, and forgiveness programs is paramount to making informed decisions and avoiding potential financial pitfalls.

This guide provides a clear and concise overview of government-backed student loans, exploring the various types available, outlining repayment strategies, and examining the potential impact on both personal finances and the broader economy. We’ll delve into loan forgiveness programs, address the serious consequences of default, and speculate on the future of this critical aspect of the educational funding landscape.

Types of Government-Backed Student Loans

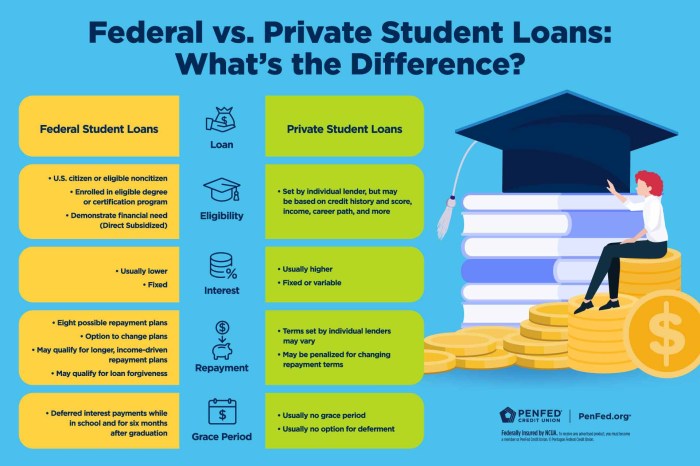

The United States federal government offers several types of student loans to help students finance their higher education. These loans differ in their interest rates, repayment options, and eligibility requirements. Understanding these distinctions is crucial for prospective students to make informed borrowing decisions and manage their debt effectively.

Federal Student Loan Types

The primary types of federal student loans are Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans (for parents and graduate students), and Direct Consolidation Loans. Each loan type caters to different financial needs and student circumstances.

Subsidized vs. Unsubsidized Loans

The key difference between subsidized and unsubsidized loans lies in interest accrual. With subsidized loans, the government pays the interest while you’re in school at least half-time, during grace periods, and during periods of deferment. Unsubsidized loans, however, accrue interest from the moment the loan is disbursed, regardless of your enrollment status. This means you’ll owe more at the end of your studies if you don’t make interest payments while in school with an unsubsidized loan.

Eligibility Requirements for Federal Student Loans

Eligibility for federal student loans depends on several factors, including U.S. citizenship or eligible non-citizen status, enrollment at least half-time in a degree or certificate program at an eligible institution, maintaining satisfactory academic progress, and completing the Free Application for Federal Student Aid (FAFSA). Specific requirements may vary slightly depending on the loan type. For example, PLUS loans have additional credit history and financial responsibility checks.

Comparison of Federal Student Loan Types

| Loan Type | Interest Rate | Repayment Options | Eligibility Criteria |

|---|---|---|---|

| Direct Subsidized Loan | Variable; set annually by the government. | Standard, graduated, extended, income-driven repayment plans. | Demonstrated financial need, U.S. citizenship or eligible non-citizen status, enrollment at least half-time in an eligible program, satisfactory academic progress. |

| Direct Unsubsidized Loan | Variable; set annually by the government. | Standard, graduated, extended, income-driven repayment plans. | U.S. citizenship or eligible non-citizen status, enrollment at least half-time in an eligible program, satisfactory academic progress. |

| Direct PLUS Loan (Parent) | Variable; set annually by the government; higher than subsidized and unsubsidized loans. | Standard, graduated, extended, income-driven repayment plans. | U.S. citizenship or eligible non-citizen status, acceptable credit history, completion of a Master Promissory Note (MPN). |

| Direct PLUS Loan (Graduate Student) | Variable; set annually by the government; higher than subsidized and unsubsidized loans. | Standard, graduated, extended, income-driven repayment plans. | U.S. citizenship or eligible non-citizen status, acceptable credit history, enrollment at least half-time in an eligible graduate program. |

| Direct Consolidation Loan | Fixed; based on a weighted average of the interest rates of the loans being consolidated. | Standard, graduated, extended, income-driven repayment plans. | Must have eligible federal student loans to consolidate. |

Loan Repayment Plans

Choosing the right repayment plan for your federal student loans is crucial, as it significantly impacts your monthly payments and the total amount of interest you’ll pay over the life of the loan. Understanding the various options available allows you to make an informed decision that aligns with your financial situation and long-term goals. Several plans cater to different needs and circumstances.

Federal student loans offer a variety of repayment plans, each with its own set of advantages and disadvantages. The best option depends on your individual financial circumstances and repayment preferences. Understanding the nuances of each plan is essential for effective debt management.

Standard Repayment Plan

The Standard Repayment Plan is the default option for most federal student loans. It involves fixed monthly payments over a 10-year period. This plan offers the shortest repayment timeline, resulting in less interest paid overall compared to longer-term plans. However, the monthly payments can be higher than other options, potentially creating a financial burden for some borrowers.

Graduated Repayment Plan

Under the Graduated Repayment Plan, monthly payments start low and gradually increase every two years over a 10-year period. This plan can be beneficial for borrowers anticipating increased income in the future. The lower initial payments can be more manageable in the early stages of a career. However, the increasing payments can become challenging later on, and the overall interest paid is generally higher than the Standard Repayment Plan due to the longer period of lower payments.

Extended Repayment Plan

The Extended Repayment Plan offers longer repayment periods than the standard plan, up to 25 years. This significantly reduces monthly payments, making it more manageable for borrowers with limited income. However, it leads to a substantially higher total interest paid over the life of the loan.

Income-Driven Repayment Plans

Income-Driven Repayment (IDR) plans link your monthly payments to your income and family size. Several IDR plans exist, including the Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR) plans. These plans are designed to make repayment more affordable, particularly for borrowers with lower incomes. Payments are typically lower than other plans, potentially resulting in loan forgiveness after 20 or 25 years, depending on the plan and your income. However, the longer repayment period leads to significantly higher total interest paid. Forgiveness may also be subject to taxation.

Applying for an Income-Driven Repayment Plan

Applying for an income-driven repayment plan involves several key steps:

The application process for income-driven repayment plans is straightforward but requires careful attention to detail to ensure accuracy and timely processing. Providing accurate information is crucial to determine your eligibility and the appropriate payment amount.

- Complete the application form online through the Federal Student Aid website (StudentAid.gov).

- Provide documentation verifying your income and family size, such as tax returns or pay stubs.

- Submit the completed application and supporting documentation.

- Your servicer will review your application and notify you of your eligibility and payment amount.

- Regularly update your income and family size information as needed.

Example: Impact of Different Repayment Plans on Total Interest

Let’s consider a hypothetical example: Suppose a borrower has a $30,000 federal student loan with a 5% interest rate.

| Repayment Plan | Monthly Payment (approx.) | Loan Repayment Period | Total Interest Paid (approx.) |

|---|---|---|---|

| Standard | $300 | 10 years | $9,000 |

| Graduated | Starts at $200, increases over time | 10 years | $11,000 |

| Extended | $150 | 25 years | $22,500 |

| Income-Driven (Example) | $100 | 20-25 years | $25,000+ (depending on income and forgiveness) |

This illustrates how choosing a longer repayment period significantly increases the total interest paid, even though monthly payments are lower. The income-driven plan’s interest paid is an estimate and depends heavily on the borrower’s income and the length of time until potential loan forgiveness.

Loan Forgiveness Programs

Federal student loan forgiveness programs offer the possibility of eliminating a portion or all of your student loan debt under specific circumstances. These programs are designed to incentivize borrowers to pursue careers in public service or specific fields with high societal need, or to provide relief in cases of extreme hardship. Understanding the eligibility requirements and application processes is crucial for determining if you qualify for any of these programs.

Public Service Loan Forgiveness (PSLF) Program

The Public Service Loan Forgiveness (PSLF) Program forgives the remaining balance on your Direct Loans after you’ve made 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer. Qualifying employers include government organizations (federal, state, local, or tribal) and not-for-profit organizations. Crucially, the type of employment and the employer’s status must be maintained continuously throughout the 120-month period.

Eligibility requires having Direct Loans (not Federal Family Education Loans (FFEL) or Perkins Loans, unless consolidated into a Direct Consolidation Loan). Borrowers must be employed full-time by a qualifying employer and be enrolled in an income-driven repayment plan. The application process involves certifying employment with your employer and submitting the PSLF form annually. Failure to consistently meet these requirements can result in ineligibility.

Teacher Loan Forgiveness Program

The Teacher Loan Forgiveness Program provides forgiveness for up to $17,500 of your federal student loans if you teach full-time for five complete and consecutive academic years in a low-income school or educational service agency. “Low-income school” is defined by the U.S. Department of Education. The program is designed to attract and retain qualified teachers in underserved communities.

To qualify, you must have received a TEACH Grant, and subsequently completed the required service. The application process involves completing a form, providing documentation of your employment, and submitting the necessary information to your loan servicer. Failure to meet the required service obligation will result in the TEACH Grant being converted to a loan.

Other Loan Forgiveness Programs

Several other federal loan forgiveness programs exist, often targeting specific professions or situations. These programs often have unique eligibility criteria and application processes. For instance, some programs might forgive loans for individuals working in specific healthcare fields or for those who experience significant financial hardship. It is crucial to research the specific program details relevant to your individual circumstances.

| Program | Eligibility Criteria | Forgiveness Amount | Application Process |

|---|---|---|---|

| Public Service Loan Forgiveness (PSLF) | 120 qualifying payments under an income-driven repayment plan while working full-time for a qualifying employer; Direct Loans. | Remaining loan balance | Annual certification of employment; PSLF form submission. |

| Teacher Loan Forgiveness | 5 consecutive years of full-time teaching at a low-income school or educational service agency; TEACH Grant recipient. | Up to $17,500 | Form completion; documentation of employment; submission to loan servicer. |

| Other Programs | Vary widely depending on the specific program; often profession- or hardship-based. | Varies depending on the program. | Varies depending on the program; typically involves documentation and form submission. |

The Impact of Government-Backed Student Loans on the Economy

Government-backed student loans play a crucial role in financing higher education, enabling millions to pursue degrees and contribute to the skilled workforce. However, the rising levels of student loan debt present complex economic implications, impacting both individual borrowers and the broader economy. This section examines the multifaceted relationship between government-backed student loans and economic well-being.

The primary function of government-backed student loans is to bridge the financial gap between the cost of higher education and students’ ability to pay. These loans, offered through programs like the Federal Student Aid system in the United States, make higher education accessible to a wider range of individuals, regardless of their socioeconomic background. This increased access contributes to a more skilled and educated workforce, potentially boosting economic productivity and innovation in the long run.

Effects of Student Loan Debt on Personal Finances

Student loan debt significantly impacts personal finances. Many graduates face substantial monthly payments, delaying major life decisions such as homeownership, starting a family, or investing in retirement. This can lead to reduced consumer spending and overall economic slowdown.

High student loan debt can constrain financial freedom, limiting opportunities for investment and wealth accumulation.

The weight of student loan debt can also impact credit scores, making it more difficult to secure loans for housing, cars, or business ventures. This further limits economic mobility and participation in the broader economy. For instance, a recent study indicated that individuals with high student loan debt were less likely to start businesses compared to their debt-free peers.

Effects of Student Loan Debt on the Overall Economy

The accumulation of student loan debt has broader macroeconomic consequences. As individuals prioritize debt repayment, they may reduce discretionary spending, affecting various sectors of the economy, from retail to hospitality. This reduced consumer spending can contribute to slower economic growth.

A significant portion of disposable income is diverted to loan repayment, potentially hindering economic expansion.

Furthermore, high levels of student loan debt can contribute to income inequality. Individuals burdened with substantial debt may struggle to achieve financial stability, widening the gap between high and low-income earners. The potential for a large-scale default on student loans poses a significant risk to the financial system, potentially triggering a wider economic crisis, similar to the subprime mortgage crisis of 2008, though on a different scale.

Potential Long-Term Consequences of High Student Loan Debt

The long-term consequences of high student loan debt are multifaceted and potentially severe. Continued increases in tuition costs coupled with rising loan balances could lead to a sustained period of constrained economic growth. This could also affect future generations, as high levels of student debt can have intergenerational implications, affecting family wealth and social mobility.

The cumulative effect of high student loan debt could lead to slower economic growth and increased income inequality across generations.

Moreover, the increasing burden of student loan debt may discourage individuals from pursuing higher education, potentially hindering the development of a skilled workforce and impacting national competitiveness in the global economy. The potential for a large-scale default poses a systemic risk, impacting financial institutions and the overall stability of the economy. For example, the rising default rates in certain loan programs illustrate the potential severity of this risk.

Defaulting on Government-Backed Student Loans

Defaulting on federal student loans carries significant and long-lasting consequences that extend far beyond simply owing money. It impacts credit scores, future borrowing opportunities, and even employment prospects. Understanding these consequences is crucial for borrowers to prioritize responsible loan management.

Consequences of Defaulting on Federal Student Loans

Defaulting on a federal student loan triggers a cascade of negative events. The most immediate consequence is the reporting of the default to credit bureaus, severely damaging your credit score. This can make it difficult or impossible to secure loans, mortgages, credit cards, or even rent an apartment in the future. Beyond credit issues, the government employs various collection methods, including wage garnishment (a portion of your paycheck is seized), tax refund offset (your tax refund is applied to the debt), and even the seizure of assets. Furthermore, professional licenses may be revoked in some professions, and eligibility for federal benefits, such as financial aid or government jobs, could be jeopardized. The accumulation of late fees and penalties adds substantially to the original loan amount, escalating the debt significantly.

Government Collection Methods for Defaulted Loans

The Department of Education employs several strategies to recover defaulted student loan debt. These methods are progressively more forceful, beginning with attempts to contact the borrower directly through phone calls and letters. If these attempts are unsuccessful, the government may refer the debt to a collection agency, which will intensify collection efforts. More severe measures, such as wage garnishment and tax refund offset, are implemented if the borrower continues to fail to make payments. In extreme cases, the government may even seize assets to recover the debt. The specific methods used will depend on the borrower’s financial situation and the amount of the debt. It’s important to note that the government’s ability to pursue these collection actions can last for many years.

Impact on Credit Scores and Future Borrowing

A federal student loan default has a profoundly negative impact on credit scores. This is because default is a serious indicator of financial irresponsibility. A low credit score makes it substantially harder to obtain loans, mortgages, or credit cards in the future. Even seemingly small purchases, like renting a car or obtaining a mobile phone contract, may become difficult or impossible. The higher interest rates associated with poor credit further compound the financial burden. The impact on future borrowing opportunities can be long-lasting, potentially affecting major life decisions like buying a home or starting a business. Rebuilding credit after a default requires significant time and effort, and it’s not guaranteed.

Flowchart Illustrating Loan Default and its Consequences

[Imagine a flowchart here. The flowchart would begin with “Student Loan Payment Missed.” This would branch into “Repeated Missed Payments,” leading to “Loan Default.” From “Loan Default,” there would be multiple branches representing the consequences: “Damaged Credit Score,” “Wage Garnishment,” “Tax Refund Offset,” “Asset Seizure,” “Difficulty Obtaining Future Loans,” and “Potential Loss of Professional Licenses/Federal Benefits.” Each consequence would have a brief description. The flowchart would visually represent the escalating severity of the consequences as a result of continued non-payment.]

The Future of Government-Backed Student Loans

The US student loan system is at a critical juncture. Decades of expanding access to higher education through government-backed loans have resulted in a massive accumulation of student loan debt, impacting borrowers’ financial well-being and the broader economy. Current policy debates center on finding sustainable solutions that balance affordability, access, and fiscal responsibility. The future of this system will likely involve significant changes, driven by evolving economic conditions and shifting political priorities.

The current student loan system faces numerous challenges. High levels of student loan debt burden borrowers for years, hindering their ability to save for retirement, purchase homes, and start families. The system’s complexity also contributes to confusion and difficulties for borrowers navigating repayment options. Furthermore, the rising cost of higher education continues to outpace inflation, making it increasingly difficult for students to finance their education without incurring significant debt.

Current Policy Debates Surrounding Government-Backed Student Loans

Several key policy debates are shaping the future of government-backed student loans. These include discussions around income-driven repayment (IDR) plans, loan forgiveness programs, and the overall role of the government in financing higher education. There is considerable disagreement on the effectiveness and cost-effectiveness of existing IDR plans and the potential benefits and drawbacks of broader loan forgiveness initiatives. Furthermore, debates continue regarding the appropriate level of government involvement in higher education financing, with some advocating for increased funding and others pushing for market-based solutions. The debate often hinges on differing views about the social benefits of higher education and the responsibility of both individuals and the government in financing it.

Potential Reforms or Changes to the Student Loan System

Potential reforms range from relatively modest adjustments to the existing system to more radical overhauls. One area of potential reform focuses on simplifying the loan repayment process and making it more transparent for borrowers. This could involve streamlining application processes, consolidating various loan types, and providing clearer information about repayment options. Another area of potential reform is improving the targeting of financial aid to ensure that it reaches students most in need. This could involve reforms to the Free Application for Federal Student Aid (FAFSA) process and adjustments to eligibility criteria for various loan programs. Finally, there is ongoing discussion about reforming the way higher education is funded, potentially involving greater investment in public institutions, exploring alternative financing models, and addressing the rising cost of tuition.

Predictions for the Future of Student Loan Debt in the US

Predicting the future of student loan debt is challenging, but several factors suggest continued growth, at least in the short term. The rising cost of college tuition continues to drive up borrowing. Without significant policy changes, the total amount of student loan debt is likely to continue increasing, placing further strain on borrowers and the economy. However, the long-term trajectory is less certain. Increased awareness of the challenges of student loan debt, coupled with potential reforms, could lead to more responsible borrowing behaviors and a slowing of debt growth. Furthermore, a potential shift in public policy towards greater affordability in higher education could alter the landscape significantly. A scenario where tuition costs are effectively controlled, coupled with broader access to grants and scholarships, could fundamentally reshape the student loan landscape.

A Potential Future Scenario for Student Loan Policy and its Impact

Consider a scenario where significant reforms are implemented over the next decade. These reforms include simplified loan repayment plans with greater transparency, increased funding for need-based grants and scholarships, and a renewed focus on controlling the cost of higher education. In this scenario, the growth of student loan debt would slow considerably. Borrowers would face less financial strain, and the overall economic impact of student loan debt would be mitigated. This would lead to a healthier economy, with individuals better positioned to contribute to economic growth and participate fully in society. However, the transition to such a system would require significant political will and a commitment to long-term planning. This scenario, while optimistic, underscores the potential for positive change through proactive policy interventions.

Final Conclusion

Securing a higher education is a significant investment, and understanding the intricacies of government-backed student loans is crucial for navigating this journey successfully. From choosing the right loan type and repayment plan to exploring forgiveness options and avoiding default, informed decision-making empowers individuals to manage their student loan debt effectively and build a secure financial future. While the system presents challenges, awareness and proactive planning are key to maximizing the benefits and minimizing the risks associated with government-backed student loans.

FAQ Guide

What happens if I can’t make my student loan payments?

Failing to make payments can lead to delinquency, negatively impacting your credit score and potentially resulting in wage garnishment or tax refund offset. Contact your loan servicer immediately to explore options like deferment or forbearance.

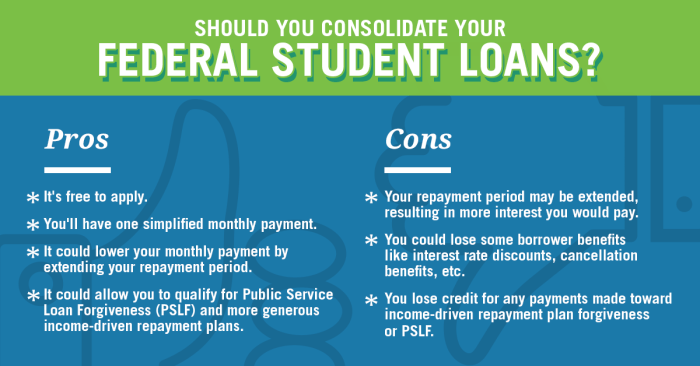

Can I consolidate my federal student loans?

Yes, consolidating multiple federal loans into a single loan can simplify repayment, potentially lowering your monthly payment. However, it might also extend your repayment period and increase the total interest paid.

Are there income-based repayment plans for private student loans?

Generally, income-driven repayment plans are only available for federal student loans. Private loan repayment options vary by lender.

What is the difference between a subsidized and unsubsidized loan?

Subsidized loans don’t accrue interest while you’re in school, grace periods, or during deferment. Unsubsidized loans accrue interest from the time the loan is disbursed.