Navigating the world of higher education often involves the significant financial hurdle of tuition fees. For many aspiring students, government student loans represent a crucial stepping stone towards achieving their academic goals. This guide delves into the intricacies of these loans, providing a clear understanding of the various programs, application processes, repayment options, and potential challenges involved. We aim to equip you with the knowledge necessary to make informed decisions about financing your education and securing your future.

From understanding the differences between subsidized and unsubsidized loans to exploring loan forgiveness programs and developing effective repayment strategies, this resource offers a holistic perspective on the entire student loan journey. We’ll examine both the benefits and potential pitfalls, empowering you to approach student loan borrowing with confidence and responsibility.

Types of Government Student Loans

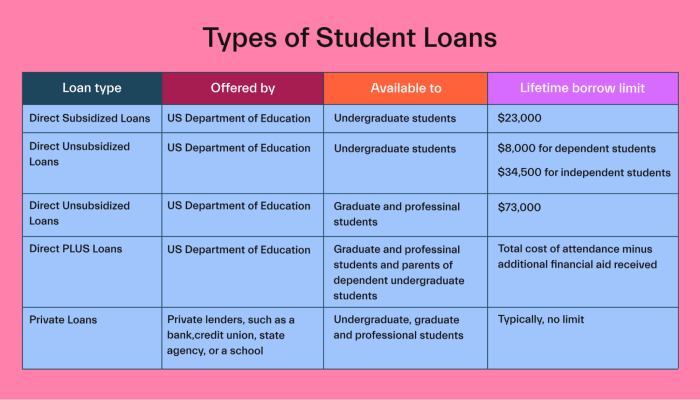

The federal government offers several student loan programs designed to help students finance their education. Understanding the nuances of each program is crucial for making informed borrowing decisions. These loans differ in eligibility requirements, interest rates, and repayment options. Choosing the right loan can significantly impact a student’s long-term financial health.

Federal Student Loan Programs

The primary federal student loan programs are Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans (for parents and graduate students), and Direct Consolidation Loans. Each program serves a specific purpose and carries its own set of terms and conditions.

Subsidized vs. Unsubsidized Loans

Direct Subsidized and Unsubsidized Loans are both offered to undergraduate students, but they differ significantly in how interest accrues. Subsidized loans do not accrue interest while the student is enrolled at least half-time, during grace periods, and during certain deferment periods. Unsubsidized loans, on the other hand, accrue interest from the moment the loan is disbursed, regardless of the student’s enrollment status. This means borrowers of unsubsidized loans will owe more at the end of their repayment period.

Eligibility Criteria for Federal Student Loans

Eligibility for federal student loans hinges on several factors. Generally, students must be enrolled or accepted for enrollment at least half-time in a degree or certificate program at an eligible institution. They must also be a U.S. citizen or eligible non-citizen, possess a valid Social Security number, and maintain satisfactory academic progress. Specific eligibility requirements may vary depending on the loan type. For example, Direct PLUS Loans have additional credit and financial history checks.

Comparison of Federal Student Loan Programs

| Loan Type | Interest Rate (Example – Rates Vary) | Repayment Plans | Deferment Options |

|---|---|---|---|

| Direct Subsidized Loan | Variable, set annually by the government (e.g., 4.99% in a given year) | Standard, Graduated, Extended, Income-Driven | In-school, unemployment, economic hardship |

| Direct Unsubsidized Loan | Variable, set annually by the government (e.g., 6.54% in a given year) | Standard, Graduated, Extended, Income-Driven | In-school, unemployment, economic hardship |

| Direct PLUS Loan (Parent) | Variable, set annually by the government (e.g., 7.54% in a given year), subject to credit check | Standard, Graduated, Extended | Limited deferment options; primarily based on borrower’s financial hardship. |

| Direct PLUS Loan (Graduate) | Variable, set annually by the government (e.g., 7.54% in a given year), subject to credit check | Standard, Graduated, Extended, Income-Driven | Limited deferment options; primarily based on borrower’s financial hardship. |

| Direct Consolidation Loan | Fixed, based on weighted average of consolidated loans | Standard, Graduated, Extended, Income-Driven | Limited deferment options; primarily based on borrower’s financial hardship. |

*Note: Interest rates are examples and are subject to change annually. Check the official Federal Student Aid website for the most up-to-date information.*

Application Process and Requirements

Securing federal student loans involves a multi-step process that requires careful attention to detail and the timely submission of necessary documentation. Understanding the requirements and navigating the application process efficiently is crucial for accessing the financial aid you need for your education. This section will Artikel the steps involved, the necessary documents, and a guide to completing the FAFSA.

The application process for federal student loans primarily revolves around completing the Free Application for Federal Student Aid (FAFSA). This form collects information about your financial situation and is used to determine your eligibility for federal student aid, including loans, grants, and work-study programs. After submitting the FAFSA, the information is processed, and your eligibility is determined by your school’s financial aid office.

Steps Involved in Applying for Federal Student Loans

Applying for federal student loans is a straightforward process once you understand the steps involved. The following steps provide a clear path to securing your financial aid.

- Create a FSA ID: Before you begin the FAFSA, you and at least one parent (if you are a dependent student) will need to create an FSA ID. This is a username and password that you will use to access and manage your FAFSA information.

- Complete the FAFSA: This is the core of the application process. You will need to provide detailed information about your family’s income, assets, and tax information. The FAFSA is available online at studentaid.gov.

- Submit the FAFSA: Once you have completed the FAFSA, review it carefully for accuracy before submitting it electronically.

- Review your Student Aid Report (SAR): After submitting your FAFSA, you will receive a Student Aid Report (SAR). This report summarizes the information you provided and indicates your eligibility for federal student aid. Review this report carefully for any errors.

- Accept your Loan Offer: Your school’s financial aid office will notify you of your loan eligibility and offer. You will need to accept your loan offer through your school’s portal or system.

- Complete Master Promissory Note (MPN): For federal student loans, you will need to complete a Master Promissory Note (MPN). This is a legal agreement that Artikels your responsibilities as a borrower.

- Loan disbursement: Once you have completed all necessary steps, the loan funds will be disbursed to your school to cover tuition and other educational expenses.

Necessary Documentation and Forms

To successfully complete the FAFSA and secure your federal student loans, you will need to gather certain documents. Having these readily available will streamline the process.

- Social Security Number (SSN): Both yours and your parents’ (if you are a dependent student).

- Federal Income Tax Returns (IRS 1040): Your family’s tax returns for the prior tax year.

- W-2 Forms: Your family’s W-2 forms from the prior tax year.

- Bank statements: Information about your family’s savings and checking accounts.

- Driver’s license: For verification of identity.

Completing the FAFSA

The FAFSA is a comprehensive form requiring accurate and complete information. Take your time to ensure accuracy.

- Gather your information: Before you begin, collect all the necessary documents listed above.

- Create your FSA ID: As mentioned previously, you and your parent(s) will need an FSA ID to access and manage your FAFSA application.

- Complete the form online: Go to studentaid.gov and begin the online application. Answer all questions truthfully and completely.

- Review your information: Before submitting, carefully review all the information you have entered to ensure accuracy.

- Submit your FAFSA: Once you are satisfied with the accuracy of your information, submit your FAFSA electronically.

Repayment Options and Plans

Understanding your repayment options is crucial for successfully managing your student loans. Choosing the right plan depends on your individual financial situation, income, and long-term goals. Several repayment plans are available, each with its own advantages and disadvantages. Careful consideration of these factors will help you navigate the repayment process effectively.

Standard Repayment Plan

The Standard Repayment Plan is the default option for most federal student loans. It involves fixed monthly payments over a 10-year period. This plan offers the shortest repayment timeline, leading to less interest paid overall. However, monthly payments can be higher than other plans, potentially creating financial strain for some borrowers.

Extended Repayment Plan

The Extended Repayment Plan offers longer repayment terms than the standard plan, reducing monthly payments. Borrowers can choose between a 12-year or 25-year repayment period, depending on the loan amount. While this reduces the monthly burden, it increases the total interest paid over the life of the loan. This option is beneficial for borrowers who need lower monthly payments but are willing to pay more in interest over time.

Income-Driven Repayment Plans

Income-driven repayment plans tie your monthly payment to your income and family size. Several plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). These plans typically offer lower monthly payments than standard or extended plans, making them suitable for borrowers with lower incomes or significant financial obligations. However, they often extend the repayment period to 20 or 25 years, leading to higher overall interest costs. Forgiveness may be possible after a certain number of payments, depending on the specific plan and your income.

Examples of Repayment Scenarios

Let’s consider a borrower with a $30,000 federal student loan.

* Standard Repayment (10 years): Assuming a 5% interest rate, the estimated monthly payment would be approximately $330. The total interest paid over 10 years would be roughly $10,000.

* Extended Repayment (25 years): With the same interest rate, a 25-year plan would reduce the monthly payment to approximately $165. However, the total interest paid would significantly increase to approximately $27,000.

* Income-Driven Repayment: The monthly payment under an income-driven plan would vary significantly based on the borrower’s income and family size. It could range from a very low amount (potentially under $100) to a payment closer to the standard repayment amount, depending on individual circumstances. The total interest paid and repayment period would also vary greatly.

Monthly Payment Comparison Table

| Loan Amount | Standard Repayment (10 years) | Extended Repayment (25 years) | Income-Driven Repayment (Example) |

|---|---|---|---|

| $10,000 | ~$110 | ~$55 | ~$25 – $80 (variable) |

| $20,000 | ~$220 | ~$110 | ~$50 – $160 (variable) |

| $30,000 | ~$330 | ~$165 | ~$75 – $240 (variable) |

Loan Forgiveness and Cancellation Programs

Student loan forgiveness and cancellation programs offer a lifeline to borrowers facing financial hardship or pursuing careers in public service. These programs reduce or eliminate student loan debt under specific circumstances, providing significant financial relief. Understanding the eligibility requirements and application processes is crucial for those seeking to benefit from these initiatives.

Public Service Loan Forgiveness (PSLF) Program

The Public Service Loan Forgiveness (PSLF) Program forgives the remaining balance on your Direct Loans after you have made 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer. A qualifying employer includes government organizations at the federal, state, local, or tribal level, as well as certain non-profit organizations. To qualify, borrowers must have Direct Loans and be enrolled in an income-driven repayment plan. The application process involves certifying your employment with your employer and submitting an application through the Federal Student Aid website. Examples of professions that qualify include teachers, social workers, nurses, and military personnel working for eligible employers.

Teacher Loan Forgiveness Program

This program provides forgiveness of up to $17,500 on federal student loans for teachers who have completed five years of full-time service in a low-income school or educational service agency. Eligibility requires teaching in a low-income school or educational service agency, as designated by the Department of Education. Borrowers must have received a federal student loan, and the application involves submitting documentation of their employment and loan information. This program specifically targets educators dedicated to working in underserved communities.

Income-Driven Repayment (IDR) Plans

While not strictly loan forgiveness, Income-Driven Repayment (IDR) plans significantly lower monthly payments based on income and family size. After a set number of years (typically 20 or 25), any remaining balance may be forgiven. These plans, such as ICR, PAYE, REPAYE, andIBR, are designed to make repayment more manageable, ultimately leading to potential loan forgiveness for some borrowers. Eligibility varies slightly depending on the plan chosen, but generally requires federal student loans and an application through the student aid website. This approach helps borrowers struggling with high debt burdens to manage their finances while potentially achieving eventual loan forgiveness.

Other Loan Forgiveness Programs

Several other loan forgiveness or cancellation programs exist, often targeted at specific professions or situations, such as those involving military service, certain types of medical professions serving in underserved areas, or those experiencing total and permanent disability. These programs usually have specific eligibility criteria and application processes that need to be met to qualify for loan forgiveness or cancellation. It’s crucial to research and understand the specific requirements of each program to determine eligibility. For instance, the program for those with total and permanent disability requires documentation from a physician verifying the disability.

Potential Challenges and Risks

Student loans, while offering crucial access to higher education, come with inherent financial risks. Understanding these risks and planning accordingly is vital to avoid long-term financial hardship. Failing to manage student loan debt effectively can have serious consequences, impacting credit scores, employment opportunities, and overall financial well-being.

The potential for significant debt accumulation is a primary concern. The total cost of tuition, fees, and living expenses can quickly escalate, leading to substantial loan balances upon graduation. This debt can overshadow other financial goals, such as purchasing a home, starting a family, or investing for retirement. Furthermore, unexpected life events, like job loss or illness, can severely impact a borrower’s ability to repay their loans.

Consequences of Defaulting on Student Loans

Defaulting on student loans has severe repercussions. It involves failing to make timely payments for a prolonged period, typically 9 months or more. The immediate consequence is damage to your credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future. Wage garnishment is another possibility, where a portion of your earnings is automatically deducted to repay the debt. The government can also seize tax refunds and withhold Social Security benefits. In some cases, default can lead to legal action and even the potential for damage to your professional standing. For example, a default could impact your ability to secure certain licenses or professional certifications.

Responsible Borrowing and Financial Planning

Responsible borrowing necessitates careful planning and budgeting. Before taking out student loans, thoroughly research the cost of education, including tuition, fees, and living expenses. Explore all financial aid options, including scholarships, grants, and work-study programs, to minimize the amount of loan debt needed. Create a realistic budget that accounts for loan repayments after graduation, factoring in living expenses and potential career earnings. Consider the potential return on investment (ROI) of your education; will your chosen field provide sufficient income to comfortably manage your student loan debt? For example, a student pursuing a high-demand field like engineering might have a higher earning potential to offset the cost of education than a student in a less lucrative field. This requires proactive research and realistic self-assessment.

Tips for Managing Student Loan Debt Effectively

Understanding your loan terms and repayment options is crucial for effective debt management. Explore different repayment plans, such as income-driven repayment, to find one that aligns with your financial situation. Prioritize making timely payments to avoid penalties and maintain a good credit score. Consider refinancing your loans if interest rates drop to potentially lower your monthly payments. Budgeting and tracking your expenses are essential for responsible debt management. Use online tools or budgeting apps to monitor your spending and ensure you’re allocating sufficient funds for loan repayments.

- Create a detailed budget that includes loan repayments.

- Explore income-driven repayment plans if struggling to make payments.

- Make extra payments whenever possible to reduce the principal balance and interest.

- Consider refinancing your loans to potentially lower interest rates.

- Automate your loan payments to ensure timely repayments.

- Monitor your credit report regularly to check for errors or inconsistencies.

- Seek professional financial advice if needed.

Resources and Further Assistance

Navigating the complexities of government student loans can be challenging, but numerous resources are available to provide support and guidance throughout the process. Understanding where to find reliable information and assistance is crucial for successful loan management and repayment. This section details the various avenues available to students and borrowers seeking help.

Finding the right resources can significantly impact your ability to manage your student loan debt effectively. This includes understanding your repayment options, accessing potential forgiveness programs, and resolving any issues that may arise. Knowing who to contact and where to find accurate information can alleviate stress and improve your overall experience.

Government Agencies and Organizations

Several government agencies play a vital role in administering student loan programs and providing support to borrowers. The primary agency is typically the federal equivalent of a national student loan service, which manages loan applications, disbursements, and repayment. Contact information, including phone numbers, email addresses, and mailing addresses, is readily available on their official website. State-level agencies may also offer additional assistance and resources specific to your region. These agencies often have dedicated helplines for answering questions about eligibility, applications, and repayment plans.

Reputable Websites Offering Student Loan Information

Numerous websites offer comprehensive information regarding student loans. These sites often provide detailed explanations of different loan types, eligibility criteria, and application procedures. They also feature calculators to help estimate monthly payments and total repayment costs under various scenarios. Many sites provide access to downloadable resources, such as guides and checklists, to assist borrowers in managing their loans. Some websites may also offer personalized advice based on individual financial situations. It is important to verify the credibility and authority of any website before relying on the information it provides.

Student Loan Counselors and Financial Aid Advisors

Student loan counselors and financial aid advisors provide invaluable support to students and borrowers. These professionals offer personalized guidance on selecting appropriate loan types, completing the application process, and developing effective repayment strategies. They can assist with understanding loan terms and conditions, exploring loan forgiveness options, and managing debt effectively. Many colleges and universities employ financial aid advisors who provide free counseling services to their students. Independent student loan counselors are also available, often offering paid services, though some non-profit organizations may provide free or low-cost counseling.

Types of Information and Support Available

The information and support available from these resources encompass a wide range of topics. This includes detailed explanations of federal and private student loan programs, guidance on completing the Free Application for Federal Student Aid (FAFSA), assistance with understanding repayment plans and options (such as income-driven repayment), information on loan consolidation and refinancing, and details on loan forgiveness and cancellation programs. These resources also often provide budgeting tools and financial literacy resources to help borrowers manage their finances effectively and avoid potential financial difficulties. Additionally, support may be offered in resolving issues such as late payments, loan defaults, and disputes with lenders.

Illustrative Scenarios

Understanding the impact of government student loans requires examining both positive and negative experiences. These scenarios illustrate the potential benefits and challenges associated with student loan debt, highlighting the importance of responsible financial planning.

Successful Student Loan Utilization

Maria, a bright and ambitious student, secured a government student loan to pursue a degree in nursing. She carefully researched her loan options, choosing a repayment plan that aligned with her anticipated post-graduation income. Throughout her studies, she maintained a part-time job to minimize her reliance on loans and built good credit. After graduation, Maria secured a well-paying nursing position and diligently repaid her loans, completing her repayment ahead of schedule. The nursing degree significantly improved her earning potential, allowing her to comfortably manage her debt and build a strong financial foundation. This scenario exemplifies how responsible planning and diligent repayment can transform a student loan from a potential burden into a valuable investment in one’s future.

Struggles with Student Loan Repayment

In contrast, David, also a college graduate, found himself overwhelmed by student loan debt. He borrowed extensively without fully understanding the long-term implications, choosing a less rigorous course of study with limited job prospects after graduation. He also failed to track his spending or budget effectively. After graduation, David struggled to find a well-paying job in his field. The high interest on his loans quickly accumulated, and he fell behind on his payments. This led to damaged credit, increased stress, and difficulty securing financial stability. This situation illustrates how irresponsible borrowing and a lack of financial planning can create significant long-term financial hardship.

Avoiding Student Loan Repayment Difficulties

To avoid the challenges faced by David, students should prioritize careful planning and proactive management of their finances. This involves thoroughly researching different loan options and understanding the terms and conditions, including interest rates and repayment schedules. Creating a realistic budget and tracking expenses are crucial for monitoring spending and ensuring loan payments remain manageable. Pursuing a course of study that leads to high-demand job prospects significantly increases the likelihood of successful loan repayment. Furthermore, building good credit and maintaining open communication with loan servicers can help mitigate potential problems. Seeking guidance from a financial advisor can also provide valuable support in navigating the complexities of student loan repayment.

Long-Term Financial Implications of Responsible vs. Irresponsible Student Loan Management

Responsible student loan management, as demonstrated by Maria’s scenario, leads to significant long-term financial benefits. Maria’s proactive approach enabled her to secure a stable career, manage her debt effectively, and build a solid financial foundation for the future, including homeownership and investments. In contrast, irresponsible management, as seen in David’s situation, resulted in a cycle of debt, damaged credit, and limited financial opportunities. The long-term consequences included financial instability, stress, and reduced quality of life. The difference highlights the importance of informed decision-making and proactive financial planning when it comes to student loans. The financial implications can be substantial, affecting not only immediate financial well-being but also long-term goals such as homeownership, retirement savings, and overall financial security.

Outcome Summary

Securing a higher education is a significant investment in your future, and understanding the landscape of government student loans is paramount. This guide has provided a foundational understanding of the various loan types, application procedures, repayment plans, and potential risks involved. Remember that responsible borrowing and careful financial planning are crucial for successful loan management. By leveraging the resources available and making informed choices, you can navigate the complexities of student loans and pave the way for a brighter future.

FAQ Explained

What is the difference between subsidized and unsubsidized loans?

Subsidized loans don’t accrue interest while you’re in school, whereas unsubsidized loans do.

What happens if I default on my student loans?

Defaulting can lead to wage garnishment, tax refund offset, and damage to your credit score.

Can I refinance my student loans?

Yes, refinancing options exist through private lenders, often offering lower interest rates but potentially losing federal benefits.

How long does it take to process a FAFSA application?

Processing times vary, but you should receive a Student Aid Report (SAR) within a few weeks.

Where can I find a student loan counselor?

Many colleges and universities offer free financial aid advising services; you can also search online for independent counselors.