Navigating the complexities of higher education often involves the crucial step of securing funding. Government student loans represent a significant pathway for many aspiring students, offering financial support to pursue academic goals. Understanding the various loan types, application processes, repayment plans, and potential pitfalls is essential for making informed decisions and successfully managing student debt. This guide provides a comprehensive overview of the landscape of government student loans, equipping you with the knowledge to navigate this important financial journey.

From understanding the differences between subsidized and unsubsidized federal loans to exploring state-specific programs and loan forgiveness options, this resource aims to clarify the intricacies of government student loan programs. We’ll delve into the application process, interest rates, repayment strategies, and the long-term implications of student loan debt, empowering you to make choices that align with your financial future.

Types of Government Student Loans

Securing funding for higher education is a significant step, and understanding the various government loan options available is crucial for making informed financial decisions. This section details the different types of federal and state student loans, their eligibility requirements, and key features.

Federal Student Loans

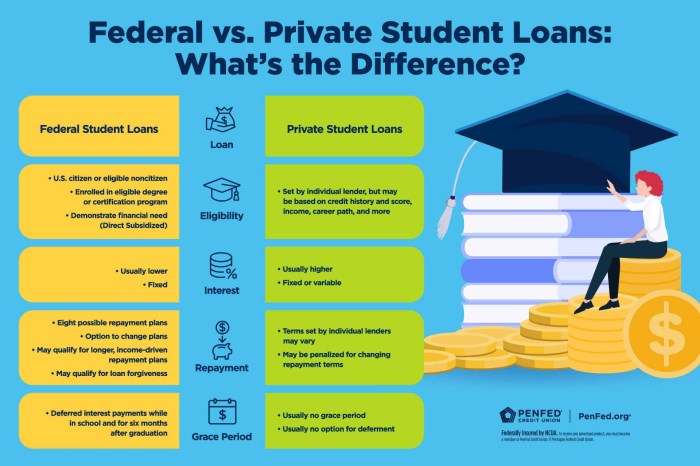

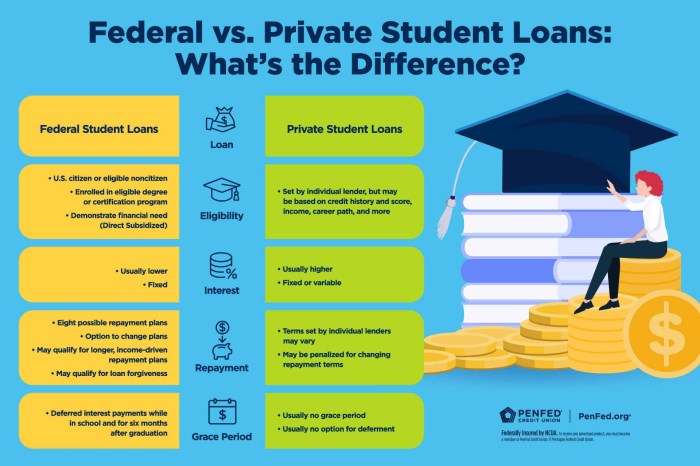

The federal government offers several loan programs designed to assist students in financing their education. These loans are generally preferred over private loans due to their borrower protections and flexible repayment options. Eligibility for federal student loans is primarily determined by financial need, enrollment status, and citizenship. Students must complete the Free Application for Federal Student Aid (FAFSA) to determine their eligibility.

Subsidized vs. Unsubsidized Federal Loans

The primary distinction between subsidized and unsubsidized federal student loans lies in interest accrual. With subsidized loans, the government pays the interest while the student is enrolled at least half-time and during certain grace periods. Unsubsidized loans, however, accrue interest from the time the loan is disbursed, regardless of enrollment status. This means borrowers of unsubsidized loans will owe more upon graduation unless they choose to pay the accruing interest while in school. Both subsidized and unsubsidized loans offer various repayment plans, including standard, extended, graduated, and income-driven repayment.

Federal Direct Loan Programs

Several federal direct loan programs exist, each with specific eligibility criteria and loan limits. These include Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans (for parents and graduate students), and Direct Consolidation Loans (to combine multiple federal loans). Specific eligibility requirements, such as credit history (for PLUS loans), vary depending on the program.

State-Based Student Loan Programs

Many states also offer their own student loan programs, often supplementing federal aid. These programs frequently feature unique benefits, such as lower interest rates, grants, or scholarships, tailored to state residents. Eligibility requirements and application processes vary significantly between states. Some state programs may prioritize students pursuing specific fields of study or those from low-income backgrounds. For example, California’s Cal Grant program offers need-based grants and loans to California residents, while New York’s Tuition Assistance Program (TAP) provides grants to eligible students attending New York colleges. It’s crucial to check with the relevant state agency for specific details.

| Loan Name | Eligibility | Interest Rate | Repayment Options |

|---|---|---|---|

| Direct Subsidized Loan | Demonstrated financial need, enrollment at least half-time | Variable, set annually by the government | Standard, extended, graduated, income-driven |

| Direct Unsubsidized Loan | Enrollment at least half-time | Variable, set annually by the government | Standard, extended, graduated, income-driven |

| Direct PLUS Loan | Credit check required, parent or graduate student | Variable, set annually by the government; higher than unsubsidized loans | Standard, extended, graduated |

| State-Based Loan Programs (Example: Cal Grant) | State residency, financial need (often), may have other requirements | Varies by state and program | Varies by state and program |

Application Process and Requirements

Securing federal student loans involves a multi-step process that requires careful planning and attention to detail. Understanding the requirements and navigating the application system efficiently can significantly reduce stress and ensure a smoother path to financial aid. This section Artikels the key steps, potential challenges, and solutions to help you successfully obtain the funding you need for your education.

The application process for federal student loans centers around the Free Application for Federal Student Aid (FAFSA). This form collects essential information about you and your family’s financial situation to determine your eligibility for various types of federal aid, including loans. Accurate and complete information is crucial for a successful application.

FAFSA Completion and Submission

Completing the FAFSA is the first and most important step in the federal student loan application process. The form requires detailed information about your family’s income, assets, and tax returns. It’s essential to gather this information before you begin. You will need your Social Security number, Federal Tax Return (or tax information), and your parents’ tax information (if you are a dependent student). Once completed, submit your FAFSA electronically through the official website. Accurate and timely submission is crucial, as many schools have deadlines for FAFSA applications.

Verification Process

After submitting your FAFSA, you may be selected for verification. This process involves providing additional documentation to confirm the accuracy of the information you provided on your FAFSA. The Department of Education may request tax returns, W-2 forms, or other supporting documents. Responding promptly to verification requests is crucial, as delays can significantly impact the disbursement of your funds. Failure to respond can lead to delays or denial of your aid.

Potential Roadblocks and Solutions

Several potential roadblocks can arise during the application process. Common issues include incomplete or inaccurate information on the FAFSA, delays in providing verification documents, and misunderstandings about eligibility requirements. Addressing these issues proactively can prevent significant delays. For example, if you encounter problems with the online FAFSA system, contact the Federal Student Aid website’s help desk for assistance. If you are selected for verification, gather all required documents immediately and submit them as soon as possible. If you have questions about your eligibility, contact your school’s financial aid office for clarification.

Step-by-Step Application Process

The application process can be broken down into these key steps:

- Gather necessary documentation (Social Security number, tax information, etc.).

- Complete the FAFSA form online through the official website.

- Review your FAFSA for accuracy and submit it before the deadline.

- Respond promptly to any verification requests from the Department of Education.

- Accept your loan offer and complete any required loan entrance counseling.

- Monitor your student loan account for updates and repayment information.

Interest Rates and Repayment Plans

Understanding the interest rates and repayment options for your government student loans is crucial for effective financial planning. The interest rate you’ll pay and the repayment plan you choose significantly impact the total cost of your education. Careful consideration of these factors can save you considerable money in the long run.

Interest Rate Determination

The interest rate applied to federal student loans is determined by a variety of factors. For subsidized loans, the interest rate is set by Congress annually and remains fixed for the life of the loan. Unsubsidized loans, on the other hand, may have a variable interest rate depending on the market conditions at the time the loan is disbursed. The specific interest rate will be clearly stated in your loan documents. Generally, the type of loan (subsidized vs. unsubsidized), the loan’s disbursement date, and prevailing market interest rates all play a role in determining the final rate. For example, a subsidized loan taken out in 2023 will have a different fixed interest rate than a subsidized loan taken out in 2024 due to Congressional adjustments.

Repayment Plan Options

Several repayment plan options are available to help borrowers manage their student loan debt. The best option for you depends on your individual financial circumstances and long-term goals. Understanding the differences between these plans is key to making an informed decision.

Standard Repayment Plan

The standard repayment plan is a fixed monthly payment spread over 10 years. This plan is straightforward, offering predictable payments, but may result in higher monthly payments compared to other options.

Extended Repayment Plan

This plan extends the repayment period to up to 25 years, resulting in lower monthly payments but potentially higher total interest paid over the life of the loan. This option is suitable for borrowers who need more manageable monthly payments.

Graduated Repayment Plan

With a graduated repayment plan, payments start low and gradually increase over time. This option can be appealing initially, but payments can become substantially higher in later years. This approach requires careful budgeting as monthly payments will increase significantly over the repayment period.

Income-Driven Repayment Plans

Income-driven repayment plans tie your monthly payments to your income and family size. Several variations exist (such as PAYE, REPAYE, ICR, andIBR), each with slightly different eligibility criteria and payment calculation methods. These plans offer more flexibility and potentially lower monthly payments, but the repayment period may extend beyond the standard 10 years. This can lead to paying more interest over the long term.

Repayment Plan Comparison

| Plan Name | Payment Schedule | Interest Accrual | Total Cost |

|---|---|---|---|

| Standard | Fixed monthly payments over 10 years | Fixed throughout the repayment period | Lower due to shorter repayment period, but higher monthly payments. |

| Extended | Fixed monthly payments over up to 25 years | Fixed throughout the repayment period | Higher due to longer repayment period, but lower monthly payments. |

| Graduated | Payments increase gradually over time | Fixed throughout the repayment period | Potentially higher due to interest accruing over a longer period, but initially lower payments. |

| Income-Driven | Payments based on income and family size | Fixed throughout the repayment period | Potentially higher due to longer repayment period, but lower monthly payments. |

Loan Forgiveness and Deferment Options

Navigating the complexities of student loan repayment can be challenging. Fortunately, several programs offer loan forgiveness or temporary relief through deferment or forbearance. Understanding these options is crucial for responsible financial planning and managing your student loan debt effectively. This section will detail the eligibility requirements, potential impacts, and available programs.

Loan forgiveness programs eliminate a portion or all of your student loan debt under specific circumstances. Deferment and forbearance, on the other hand, offer temporary pauses in your loan repayments, preventing negative impacts on your credit score while you navigate a difficult financial period. Both options can significantly impact your long-term financial health, but they differ in their eligibility criteria and consequences.

Public Service Loan Forgiveness (PSLF) Eligibility Criteria

Public Service Loan Forgiveness (PSLF) is a program designed to forgive the remaining balance on your Direct Loans after you’ve made 120 qualifying monthly payments under an income-driven repayment plan while working full-time for a qualifying government or non-profit organization. Eligibility hinges on several key factors: the type of loan (Direct Loans only), the type of employment (government or non-profit), and consistent, qualifying payments. For example, a teacher working for a public school system would likely qualify, while a software engineer working for a for-profit company would not. Detailed verification of employment and payment history is crucial for approval. Failure to meet all requirements, even a single missed payment or a brief period of ineligible employment, can significantly impact eligibility.

Situations Warranting Loan Deferment or Forbearance

Deferment and forbearance are temporary pauses in loan repayments, often granted due to extenuating circumstances. Deferment typically requires demonstrating financial hardship, such as unemployment or enrollment in school. Forbearance, on the other hand, may be granted for reasons such as temporary financial difficulty, regardless of the cause. Examples include a recent job loss leading to a significant decrease in income, or a serious medical condition requiring extensive treatment and resulting in lost wages. The specific terms and conditions for both deferment and forbearance will vary depending on the lender and the borrower’s individual circumstances. It’s important to note that interest may still accrue during deferment or forbearance, potentially increasing the overall loan balance.

Impact on Credit Score and Future Borrowing Capacity

While loan forgiveness is a positive outcome for borrowers, it can sometimes be reported to credit bureaus, though it shouldn’t negatively affect credit scores. However, consistent on-time payments are still crucial for maintaining a good credit history. Deferment and forbearance, while providing temporary relief, can have a negative impact on your credit score if not managed carefully. Late payments during deferment or forbearance will likely appear on your credit report, potentially lowering your credit score and making it more challenging to obtain loans or credit in the future. The impact depends on the length of the deferment or forbearance and the borrower’s overall credit history. For example, a short-term deferment for a temporary job loss may have minimal impact, while multiple instances of extended forbearance could significantly affect your creditworthiness.

Various Loan Forgiveness Programs and Their Requirements

Several programs offer loan forgiveness opportunities beyond PSLF. The eligibility criteria and requirements vary significantly between programs. Careful consideration of each program’s specific requirements is essential.

- Teacher Loan Forgiveness: Forgives a portion of federal student loans for teachers who work full-time for five consecutive academic years in a low-income school or educational service agency.

- Public Service Loan Forgiveness (PSLF): Forgives the remaining balance on Direct Loans after 120 qualifying monthly payments under an income-driven repayment plan while working full-time for a qualifying government or non-profit organization.

- Income-Driven Repayment (IDR) Plans: While not loan forgiveness programs themselves, IDR plans can lead to loan forgiveness after 20 or 25 years of payments, depending on the plan. Payments are based on income and family size, making them more manageable for some borrowers. However, this often results in a larger total amount paid over the life of the loan.

- State-Specific Loan Forgiveness Programs: Some states offer loan forgiveness programs for specific professions, such as healthcare workers or teachers. Eligibility criteria and benefits vary widely by state.

Managing Student Loan Debt

Successfully navigating student loan repayment requires a proactive and organized approach. Understanding your loan terms, creating a realistic budget, and exploring available repayment options are crucial steps in minimizing financial strain and achieving timely repayment. Failing to manage student loan debt effectively can have significant long-term consequences.

Effective Strategies for Repaying Student Loans

Several strategies can significantly improve your ability to manage and repay your student loans. These range from simple budgeting techniques to exploring government-sponsored repayment programs. Prioritizing loan payments and actively monitoring your progress are essential components of a successful repayment plan. Consider consolidating multiple loans into a single payment, potentially lowering your monthly payment and simplifying the repayment process. Furthermore, exploring income-driven repayment plans may provide more manageable monthly payments based on your income and family size.

Budgeting and Prioritizing Loan Payments

Creating a detailed budget is paramount to successful student loan repayment. This involves meticulously tracking all income and expenses to identify areas where savings can be achieved. Prioritizing loan payments within this budget ensures consistent repayment and avoids missed payments, which can negatively impact your credit score. A practical approach involves allocating a specific portion of your monthly income towards loan repayment, treating it as a non-negotiable expense similar to rent or utilities. Regularly reviewing and adjusting your budget as your financial situation changes is crucial for maintaining its effectiveness. For example, a budget might allocate 20% of monthly income to student loan payments, prioritizing these payments before discretionary spending like entertainment or dining out.

Consequences of Defaulting on Student Loans

Defaulting on student loans has severe repercussions. These consequences extend beyond impacting your credit score, which can make securing future loans, mortgages, or even employment significantly more challenging. Wage garnishment, tax refund offset, and even legal action are all potential outcomes of default. The impact on your credit history can persist for years, making it difficult to obtain favorable interest rates on future loans or even rent an apartment. For example, a default could lead to a significant portion of your paycheck being garnished, making it difficult to meet your other financial obligations.

Using a Loan Amortization Schedule

A loan amortization schedule provides a clear visualization of your loan repayment. This schedule details each payment, the amount applied to principal and interest, and the remaining loan balance over the repayment period. By using this tool, you can track your progress, understand the impact of extra payments, and project when your loan will be fully repaid. Many online calculators are available to generate personalized amortization schedules based on your loan terms. For instance, an amortization schedule might show that making an extra $100 payment each month will reduce the loan repayment period by several years. This visualization aids in maintaining motivation and understanding the long-term benefits of consistent and strategic repayment.

Impact of Government Student Loans on Higher Education

Government student loan programs have profoundly reshaped the landscape of higher education, significantly impacting both accessibility and affordability. Their influence is multifaceted, encompassing benefits and drawbacks that extend to individuals, institutions, and the economy as a whole. Understanding this complex interplay is crucial for developing effective policies that promote equitable access to higher education while mitigating potential risks.

Government student loans have undeniably expanded access to higher education for millions. Prior to widespread loan availability, college was largely limited to those from affluent backgrounds. Loans have enabled students from lower-income families to pursue higher education, thereby increasing social mobility and broadening the talent pool available to the workforce. However, this increased access has come at a cost.

The Role of Government Student Loans in Expanding Access to Higher Education

The expansion of government student loan programs has dramatically increased college enrollment. This is particularly evident in the rise of college attendance among students from lower socioeconomic backgrounds. For example, the Pell Grant program, a need-based grant, combined with federal student loans, has allowed many students who would otherwise be unable to afford college to pursue higher education. The availability of these loans has also fueled the growth of the higher education sector itself, leading to increased tuition costs in some instances.

Benefits and Drawbacks of Increased Reliance on Student Loans

The increased reliance on student loans presents a double-edged sword. On one hand, it has undeniably broadened access to higher education, leading to a more diverse and skilled workforce. On the other hand, the rising cost of tuition, often exceeding the rate of inflation, has led to a situation where many students graduate with substantial debt burdens. This debt can delay major life decisions like homeownership, starting a family, and investing in retirement. Furthermore, the increasing reliance on loans can incentivize colleges and universities to raise tuition, creating a cycle of increasing costs and debt. This is because institutions know that students can access loans to cover the costs.

Long-Term Effects of Student Loan Debt on Individuals and the Economy

The long-term consequences of student loan debt are significant. For individuals, substantial debt can lead to financial stress, delaying major life milestones, and potentially impacting mental health. Economically, high levels of student loan debt can dampen consumer spending, hinder economic growth, and contribute to income inequality. For instance, studies have shown a correlation between high student loan debt and lower rates of homeownership and entrepreneurship. This is because individuals are diverting their income towards loan repayments, reducing their capacity for other investments.

The impact of government student loans on higher education is a complex interplay of increased access and affordability alongside the substantial burden of rising tuition costs and accumulating student loan debt. While loans have undeniably broadened access to higher education, the long-term consequences of high levels of student debt on individuals and the economy require careful consideration and proactive policy interventions.

Summary

Securing a government student loan can be a pivotal step towards achieving higher education aspirations. However, responsible borrowing and careful planning are paramount. By understanding the various loan types, application processes, repayment options, and potential challenges, students can make informed decisions that minimize financial strain and maximize their chances of success. Remember to thoroughly research your options, compare programs, and develop a sound financial strategy to manage your student loan debt effectively. The future of your education and financial well-being hinges on this crucial decision.

User Queries

What happens if I can’t repay my student loans?

Defaulting on student loans has severe consequences, including damage to your credit score, wage garnishment, and potential legal action. Explore options like deferment, forbearance, or income-driven repayment plans before defaulting.

Can I refinance my government student loans?

While you can’t refinance federal student loans with another federal loan, private lenders offer refinancing options. Carefully compare interest rates and terms before refinancing, as it might impact eligibility for certain federal repayment programs.

What is the difference between a subsidized and unsubsidized loan?

Subsidized loans don’t accrue interest while you’re in school (at least half-time), during grace periods, or deferment. Unsubsidized loans accrue interest from the time the loan is disbursed.

How do I find my loan servicer?

Your loan servicer is the company responsible for your loan repayment. You can usually find this information on the National Student Loan Data System (NSLDS) website or your student loan documents.