The transition from student life to the working world often involves the daunting task of student loan repayment. Understanding the grace period, that crucial buffer between graduation and repayment, is paramount to avoiding financial pitfalls. This guide delves into the intricacies of student loan grace periods, offering clarity and practical advice to help you navigate this critical phase.

From defining different grace period types and eligibility criteria to exploring the implications of interest accrual and repayment plan options, we aim to provide a comprehensive understanding of this often-overlooked aspect of student loan management. We’ll also address common concerns and offer resources to ensure you’re well-equipped to handle your student loans effectively.

Definition and Types of Student Loan Grace Periods

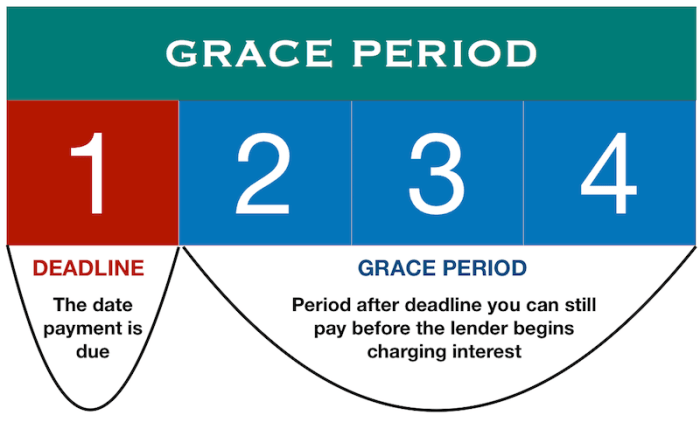

A student loan grace period offers a temporary reprieve from loan repayment after completing your studies. This period allows borrowers time to secure employment and adjust to their post-education financial responsibilities before beginning repayment. Understanding the different types of grace periods and their associated terms is crucial for effective financial planning after graduation.

Grace Period Types and Durations

Several types of grace periods exist, each with specific eligibility requirements and durations. The most common are in-school deferment and post-graduation grace periods. In-school deferment allows borrowers to postpone payments while actively enrolled at least half-time in an eligible educational program. Post-graduation grace periods begin after graduation or leaving school and provide a period before repayment begins. The length of these grace periods varies depending on the loan type and lender, but generally follows established guidelines.

Comparison of Student Loan Grace Period Types

The following table summarizes the key differences between common student loan grace period types. Note that specific terms and conditions may vary depending on the lender and the type of federal or private student loan.

| Grace Period Type | Length | Eligibility Requirements | Loan Forgiveness Implications |

|---|---|---|---|

| In-School Deferment | While enrolled at least half-time | Active enrollment in an eligible degree or certificate program | No impact on loan forgiveness programs; interest may accrue depending on the loan type. |

| Post-Graduation Grace Period (Federal Loans) | 6 months (typically) | Completion of a degree or certificate program or leaving school | No impact on loan forgiveness programs; interest may accrue. |

| Post-Graduation Grace Period (Private Loans) | Varies (0-6 months, or potentially longer, depending on the lender) | Completion of a degree or certificate program or leaving school | Varies depending on the lender and loan terms; interest may accrue. |

Eligibility Criteria for Grace Periods

Securing a grace period on your student loans hinges on several key factors. Understanding these factors is crucial for borrowers to manage their repayment effectively and avoid unnecessary penalties. The eligibility criteria aren’t uniform across all loan types, and certain circumstances may disqualify you, even if you generally meet the requirements.

Eligibility for a grace period primarily depends on the type of loan you have and your adherence to the terms and conditions of your loan agreement. Federal student loans generally offer a standardized grace period, while private loan grace periods are determined by the lender and may vary significantly. Furthermore, certain actions or circumstances can impact your eligibility.

Factors Determining Grace Period Eligibility

Several factors determine whether a borrower is eligible for a grace period. These include the type of loan (federal or private), the borrower’s enrollment status, and whether they’ve completed their education program. Failure to meet specific requirements, such as timely repayment of previous loans, could also affect eligibility.

Situations Where a Grace Period Might Not Be Granted

There are specific instances where a borrower may not be eligible for a grace period. For example, if a borrower defaults on a previous loan, the lender may deny a grace period on a subsequent loan. Similarly, borrowers who withdraw from their program of study before completing a certain percentage of the program, as defined by their institution, may not qualify. Repeated instances of late payments on other debts could also impact eligibility. The specific criteria for denial will vary depending on the lender and the loan agreement.

Impact of Loan Type on Grace Period Eligibility

Federal student loans typically offer a standard grace period of six months after graduation or leaving school. This grace period applies to subsidized and unsubsidized federal Stafford Loans, PLUS Loans, and Consolidation Loans. However, private student loans often have less predictable grace periods. Some private lenders may offer a grace period, while others may not, and the length of the grace period can vary widely depending on the lender’s policies. Borrowers should carefully review their private loan agreements to understand their specific grace period terms, if any.

Verifying Eligibility for a Grace Period

Verifying eligibility involves carefully reviewing your loan documents and contacting your loan servicer. Your loan servicer can provide definitive information on your eligibility based on your specific loan type, repayment history, and other relevant factors. It is recommended to contact your servicer well in advance of your expected graduation date to ensure a smooth transition into the repayment phase. Proactive communication is key to avoiding any unexpected consequences.

Implications of Entering and Exiting a Grace Period

Understanding the implications of entering and exiting a student loan grace period is crucial for responsible loan management. This period offers a temporary reprieve from repayment, but it’s essential to be aware of how it affects your loan and your financial future. Failing to understand these implications can lead to serious financial consequences.

The grace period, while offering a temporary break from repayment, has significant effects on both the accrued interest and the overall loan balance. Understanding these effects, along with the consequences of default, allows borrowers to navigate this period effectively and avoid potential problems.

Interest Accrual During Grace Periods

During the grace period, interest accrual varies depending on the type of student loan. Federal subsidized loans typically do not accrue interest during the grace period. However, federal unsubsidized loans and most private student loans do accrue interest, which is added to the principal balance. This means that the total amount owed increases even though you are not making payments. Failing to understand this distinction can lead to a substantially larger loan balance upon the end of the grace period. For example, a $10,000 unsubsidized loan with a 5% interest rate will accrue $500 in interest over a 6-month grace period.

Consequences of Defaulting on Student Loans

Defaulting on student loans, whether during or after the grace period, has severe consequences. These consequences can include damage to your credit score, wage garnishment, tax refund offset, and difficulty obtaining future loans or credit. Furthermore, the collection agencies employed by the government can pursue aggressive collection tactics, significantly impacting your financial well-being. Defaulting can make it challenging to secure mortgages, car loans, or even rent an apartment, severely limiting future financial opportunities.

Managing Student Loans During and After the Grace Period

Effective management of student loans is crucial for avoiding the negative consequences of default. A proactive approach is vital.

The following steps Artikel a practical strategy for managing student loans:

- Understand Your Loan Terms: Carefully review your loan documents to understand the terms, interest rates, repayment plans, and grace period length. This foundational knowledge is essential for effective management.

- Track Interest Accrual: Monitor your loan balance regularly to track interest accrual, especially for unsubsidized loans and private loans. This awareness allows for proactive planning and prevents unexpected surprises.

- Create a Budget: Develop a realistic budget that incorporates your student loan repayment. This step is critical for ensuring you can comfortably manage your payments once the grace period ends.

- Explore Repayment Options: Investigate different repayment plans offered by your loan servicer to find one that aligns with your financial capabilities. Federal student loans offer various income-driven repayment plans.

- Communicate with Your Loan Servicer: Contact your loan servicer promptly if you anticipate difficulties making payments. They may offer options such as forbearance or deferment to help you manage your loans effectively.

- Prioritize Loan Repayment: Once the grace period ends, make timely payments to avoid late fees and potential default. Consider automating payments to ensure consistent on-time payments.

Grace Period and Loan Repayment Plans

Understanding how your student loan repayment plan interacts with your grace period is crucial for effective financial planning. The grace period offers a temporary reprieve from repayment, but the choice of repayment plan significantly impacts your overall loan cost and the length of time it takes to repay your debt. Different plans affect both the monthly payment amount and the total interest paid over the life of the loan.

Loan Repayment Plan Comparison and Interaction with Grace Periods

Various repayment plans exist, each with its own characteristics. Standard repayment plans typically involve fixed monthly payments over a 10-year period. Income-driven repayment (IDR) plans, such as the Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE) plans, tie your monthly payment to your income and family size, often resulting in lower monthly payments but potentially extending the repayment period significantly. Extended repayment plans stretch payments over a longer period, generally up to 25 years, reducing monthly payments but increasing total interest paid. Graduated repayment plans start with lower monthly payments that gradually increase over time. The grace period applies uniformly across all these plans; it’s a period before repayment begins, regardless of the chosen plan. However, the length of the repayment period after the grace period varies considerably based on the selected plan.

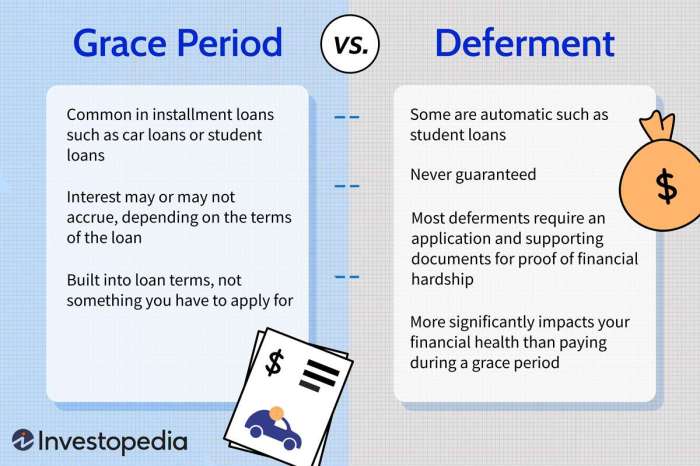

Impact of Deferment and Forbearance on Grace Periods

Deferment and forbearance are temporary pauses in loan repayment, different from a grace period. Deferment is generally granted for specific reasons, such as returning to school or experiencing unemployment. Forbearance is often granted for temporary financial hardship. Crucially, both deferment and forbearance can extend the repayment period beyond the initial loan term, including the time spent in the grace period. While a grace period is a built-in feature, deferment and forbearance are granted on a case-by-case basis. Both deferment and forbearance usually accrue interest, increasing the overall loan cost. The grace period, on the other hand, typically doesn’t accrue interest on subsidized loans.

Hypothetical Scenario: Repayment Plan Impact on Loan Cost

Let’s consider a hypothetical scenario: Sarah borrows $30,000 in subsidized federal student loans. She has a six-month grace period.

Scenario 1: Standard Repayment Plan (10 years). Assuming a 5% interest rate, her monthly payment would be approximately $330, and the total interest paid over 10 years would be around $10,000. Total cost: $40,000.

Scenario 2: Income-Driven Repayment Plan (20 years). If her income qualifies for a significantly reduced monthly payment (e.g., $150), her total interest paid over 20 years would likely be considerably higher, perhaps $20,000 or more. Total cost: $50,000 or more.

Scenario 3: Extended Repayment Plan (25 years). With the same 5% interest rate, her monthly payments would be lower, but the total interest paid would likely exceed $25,000. Total cost: $55,000 or more.

This illustrates how choosing a repayment plan with lower monthly payments significantly impacts the total loan cost due to increased interest accumulation over a longer repayment period.

Interest Accrual Calculation

Calculating total interest accrued requires considering the interest rate, principal balance, and repayment schedule. For subsidized loans, interest generally does not accrue during the grace period. Unsubsidized loans, however, accrue interest during the grace period, which is added to the principal balance upon repayment commencement. The following formula can be used to calculate simple interest:

Interest = Principal x Rate x Time

Where:

* Principal is the loan amount.

* Rate is the annual interest rate (expressed as a decimal).

* Time is the time period in years.

For example, on a $10,000 unsubsidized loan with a 6% interest rate during a 6-month grace period, the interest accrued would be:

Interest = $10,000 x 0.06 x (6/12) = $300

This $300 would be added to the principal balance before repayment begins. More complex calculations are needed for plans with varying monthly payments. Loan servicers typically provide amortization schedules detailing the interest and principal portions of each payment.

Resources and Further Information

Navigating the complexities of student loan grace periods can be challenging. Fortunately, numerous resources are available to provide guidance and support. Understanding where to find reliable information is crucial for making informed decisions about your student loan repayment. This section details reputable sources offering comprehensive information on student loan grace periods and contact information for assistance.

Accessing accurate and up-to-date information is essential for effectively managing your student loans. The following resources provide detailed information, tools, and support to help you understand and navigate your grace period and beyond.

Reputable Websites and Organizations

Several government agencies and non-profit organizations offer valuable resources regarding student loan grace periods and repayment options. These organizations provide detailed information, tools, and support to help borrowers understand their rights and responsibilities.

| Organization Name | Website URL | Description of Services |

|---|---|---|

| Federal Student Aid (FSA) | studentaid.gov | The official U.S. Department of Education website for federal student aid. Provides information on all aspects of federal student loans, including grace periods, repayment plans, and loan forgiveness programs. |

| National Foundation for Credit Counseling (NFCC) | nfcc.org | A non-profit organization offering free and low-cost credit counseling services. They can provide guidance on managing student loan debt, including understanding grace periods and developing a repayment plan. |

| Consumer Financial Protection Bureau (CFPB) | consumerfinance.gov | A U.S. government agency that works to protect consumers from unfair, deceptive, or abusive financial practices. They offer resources and tools to help borrowers understand their rights and responsibilities related to student loans. |

| Student Loan Borrower Assistance | studentaid.gov/contact-us | Provides contact information and resources for those needing assistance with their federal student loans. |

Contacting Relevant Authorities

Contacting the appropriate authority depends on the type of student loan you have. For federal student loans, the Federal Student Aid (FSA) website is the primary resource. For private student loans, you’ll need to contact your lender directly. Each contact method offers a different level of support and response time.

For federal student loans, you can contact the Federal Student Aid (FSA) through their website, studentaid.gov, which provides various contact methods, including online forms, phone numbers, and mailing addresses. Their website also offers a comprehensive FAQ section addressing many common questions. Response times vary depending on the method used and the volume of inquiries.

For private student loans, contacting your lender directly is essential. Your loan documents should contain the lender’s contact information, including phone numbers, email addresses, and mailing addresses. Private lenders may offer online portals for account management and communication. It’s important to keep accurate records of all communication with your lender.

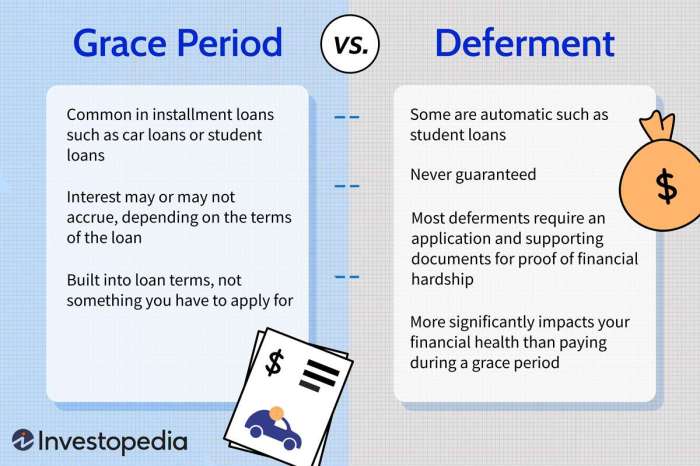

Visual Representation of Grace Period Timeline

Understanding the timeline of your student loan repayment is crucial for effective financial planning. A visual representation can help clarify the different stages involved, from your time in school to the eventual repayment of your loan. The following description details a simple yet informative graphic depicting this timeline.

A horizontal bar chart effectively illustrates the various phases of student loan repayment. The chart is divided into three distinct sections, each represented by a different color and shape.

Student Loan Repayment Timeline Chart

The first section, representing the “In-School Period,” is depicted as a long, light green rectangle. This color symbolizes growth and progress, reflecting the educational journey. The length of this rectangle varies depending on the length of the student’s program of study, for example, four years for a bachelor’s degree or longer for postgraduate studies. Above this rectangle, we might label it “In-School Period” and potentially include the start and end dates, or the specific academic years.

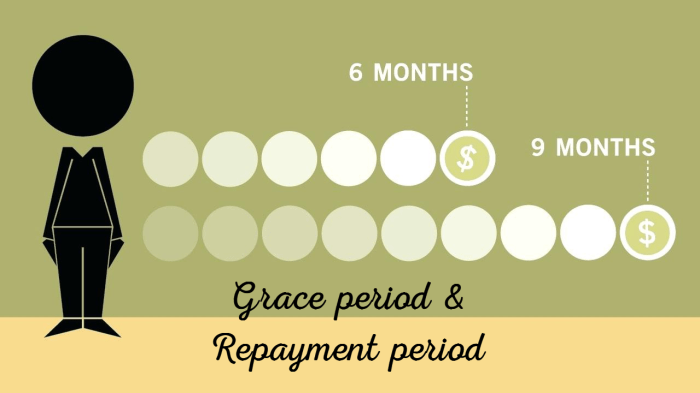

The second section, representing the “Grace Period,” is a shorter, narrower rectangle in a lighter blue. Blue signifies a transitional period, reflecting the pause before the onset of repayment. The length of this blue rectangle is fixed, typically six months, though it can vary based on loan type and lender. Again, labels like “Grace Period” and duration (e.g., “6 Months”) would be included above the rectangle.

Finally, the third section, representing the “Repayment Period,” is a longer rectangle in a darker shade of blue, perhaps a deep navy. This darker shade represents the commitment and responsibility of repaying the loan. The length of this rectangle is the longest of the three, indicating the extended duration of the repayment schedule, typically 10 years or more. Above this section, we might include “Repayment Period” and the potential length, such as “10 Years (Example)”.

The three rectangles are positioned consecutively along the horizontal axis, visually demonstrating the flow from the in-school period through the grace period and into the repayment period. The entire chart could be enclosed in a simple border, perhaps a thin black line, for clarity and visual appeal. This visual representation provides a clear and concise overview of the student loan repayment timeline, emphasizing the distinct phases and their relative durations.

Closure

Successfully navigating the grace period for your student loans requires careful planning and understanding. By familiarizing yourself with the various types of grace periods, eligibility requirements, and the potential consequences of default, you can significantly reduce the stress and financial burden associated with loan repayment. Remember to utilize the available resources and seek professional guidance when needed to ensure a smooth transition into the repayment phase.

Frequently Asked Questions

What happens if I don’t start repaying my loans after the grace period ends?

Failure to begin repayment after the grace period concludes can lead to delinquency, negatively impacting your credit score and potentially resulting in default. This can have serious long-term financial consequences.

Can I extend my grace period?

Extending a grace period is generally not possible, except under specific circumstances such as economic hardship or enrollment in a qualifying rehabilitation program. Contact your loan servicer to explore potential options.

How does my grace period affect my credit score?

During the grace period, your loan status is typically reported as “in grace,” which generally doesn’t negatively affect your credit score. However, failing to begin repayment after the grace period ends will negatively impact your credit score.

What if I have both federal and private student loans?

Grace periods for federal and private student loans may differ in length and eligibility requirements. Check with each lender to understand the specific terms of your loans.

This particular is so helpful! The advice on saving for a car is gold. I’ve been using this strategy, and it’s helped me on track. I also created a free tool to calculate how much to save, which your readers might appreciate. Great job!