The transition from student to graduate often involves navigating the complexities of student loan repayment. A crucial element in this process is the grace period, a temporary reprieve before repayment officially begins. This period, however, isn’t a free pass; understanding its nuances—length, eligibility, and implications—is paramount to responsible financial management post-graduation.

This guide delves into the intricacies of grace periods for student loans, differentiating between federal and private loans, exploring eligibility requirements, and outlining the consequences of both effective management and potential default. We’ll also equip you with practical advice and resources to navigate this critical phase successfully, setting the stage for long-term financial well-being.

Definition and Types of Student Loan Grace Periods

A grace period on a student loan offers a temporary reprieve from making payments after you finish school or your studies drop below half-time enrollment. This period allows borrowers time to adjust to their post-education financial situation and secure employment before repayment begins. The length and availability of a grace period depend significantly on the type of student loan you have.

Grace periods are crucial for easing the transition from student life to repayment. Without them, recent graduates might face immediate financial strain, potentially leading to delinquency and negatively impacting their credit scores. Understanding the specifics of your loan’s grace period is essential for responsible financial planning.

Federal Student Loan Grace Periods

Federal student loans, offered through the government, typically provide a standard grace period. This grace period applies to subsidized and unsubsidized Stafford Loans, PLUS Loans, and Consolidation Loans. The length of the grace period is usually six months, beginning the month after you graduate, leave school, or drop below half-time enrollment. During this period, interest may or may not accrue, depending on the loan type (subsidized loans typically do not accrue interest during the grace period, while unsubsidized loans do). It’s vital to understand the terms of your specific federal loans to know if interest will accrue during your grace period.

Private Student Loan Grace Periods

Private student loans, offered by banks and other financial institutions, do not have a standardized grace period. The terms and conditions of the grace period, including its length and whether interest accrues, are determined by the lender and Artikeld in the loan agreement. Some private lenders may offer a grace period of six months, similar to federal loans, while others might offer a shorter grace period or none at all. It is essential to review your loan documents carefully to understand the specific grace period terms of your private student loans.

Grace Period Length Comparison

| Loan Type | Typical Grace Period Length | Interest Accrual During Grace Period | Notes |

|---|---|---|---|

| Federal Subsidized Stafford Loans | 6 months | No | Interest does not accrue during the grace period. |

| Federal Unsubsidized Stafford Loans | 6 months | Yes | Interest accrues during the grace period. |

| Federal PLUS Loans | 6 months | Yes | Interest accrues during the grace period. |

| Federal Consolidation Loans | 6 months | May vary depending on the loans consolidated | Check your loan documents for specifics. |

| Private Student Loans | Varies (0-6 months or more) | Varies | Check your loan agreement for details. |

Eligibility Requirements for Grace Periods

Eligibility for a student loan grace period hinges on several factors, primarily relating to the type of loan and the borrower’s academic status. Meeting these requirements ensures the borrower benefits from the temporary reprieve from repayment. Understanding these criteria is crucial for navigating the transition from student to repayment.

Generally, borrowers are eligible for a grace period if they have completed their course of study (or left school under certain circumstances) and their loans are in good standing. This means that they haven’t defaulted on any payments and are adhering to the terms of their loan agreement. The specific requirements can vary depending on the type of loan, the lender, and sometimes even the specific program under which the loan was obtained. For instance, some federal loan programs may have slightly different grace period stipulations than private student loans.

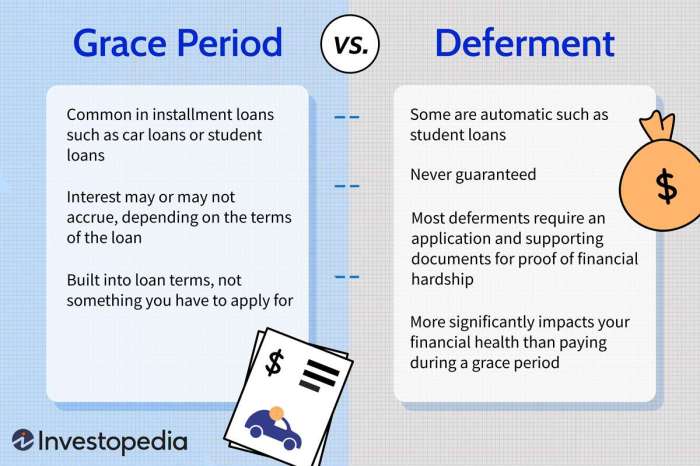

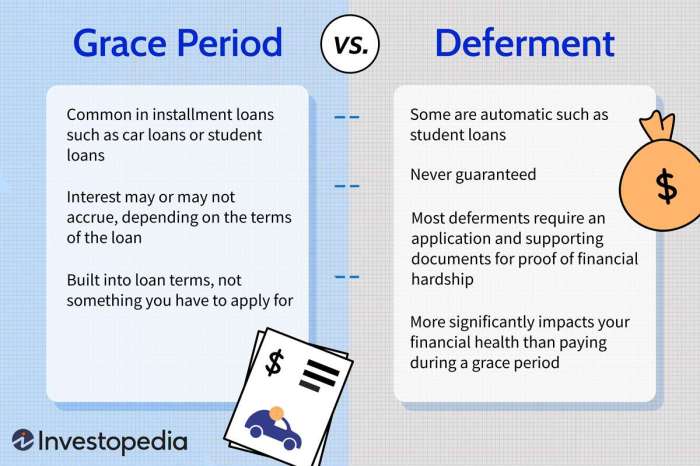

Impact of Deferment or Forbearance on Grace Period Eligibility

Deferment and forbearance are temporary pauses in loan repayment, but they affect grace period eligibility differently. Deferment, typically granted for reasons like unemployment or return to school, often does *not* consume the grace period. The grace period remains intact after the deferment concludes. However, forbearance, usually granted for financial hardship, might sometimes impact the grace period’s availability, depending on the lender and the specific circumstances. Borrowers should carefully review their loan agreements or contact their lender to understand the specific implications of deferment or forbearance on their grace period.

Situations Where a Grace Period Might Be Waived or Forfeited

In certain situations, the grace period might be waived or forfeited. For instance, if a borrower begins making payments on their loans before the grace period ends, the remaining grace period is typically lost. Similarly, defaulting on a loan prior to or during the grace period would automatically void any remaining grace period and likely result in additional penalties and fees. Specific circumstances causing forfeiture might include failing to maintain satisfactory academic progress (SAP) requirements while enrolled in school, or engaging in fraudulent activity related to the loan application or disbursement.

Examples Affecting Grace Period Eligibility

Several scenarios can impact grace period eligibility. A borrower who graduates and immediately secures employment might fully utilize their grace period. Conversely, a borrower who withdraws from school before completing their program might still qualify for a grace period, provided they meet specific criteria Artikeld by their lender. Another example is a borrower who experiences financial hardship and seeks forbearance; this might impact their grace period depending on the terms of the forbearance agreement. Finally, a borrower who defaults on a loan before the grace period ends forfeits the remaining grace period and incurs penalties. Understanding these different scenarios is key to effective loan management.

Implications of Entering and Exiting the Grace Period

Understanding the implications of entering and exiting a student loan grace period is crucial for responsible financial management. The grace period offers a temporary reprieve from repayment, but it’s essential to be aware of the financial consequences involved both during and after this period. Failing to understand these implications can lead to significant financial burdens down the line.

Interest Accrual During the Grace Period

For most federal student loans, interest continues to accrue during the grace period. This means that interest charges are added to your loan balance even though you are not making payments. The amount of interest accrued will depend on your loan’s interest rate and the length of your grace period. This accumulated interest can significantly increase your overall loan balance, leading to higher monthly payments and increased total repayment costs once the grace period ends. For example, a loan with a $10,000 balance and a 5% interest rate could accrue several hundred dollars in interest during a six-month grace period. It’s important to note that some loan programs may have different interest accrual policies during grace periods, so reviewing your specific loan terms is essential.

Exiting the Grace Period and Transitioning to Repayment

Exiting the grace period typically involves receiving a notification from your loan servicer outlining your repayment options and the first payment due date. This notification usually includes details about your loan balance (including accrued interest), your repayment plan options, and contact information for your loan servicer. The transition to repayment requires careful planning to ensure timely payments. Failing to make timely payments can lead to negative consequences, including late fees, damaged credit scores, and potential default. Borrowers should familiarize themselves with their repayment options and choose a plan that aligns with their financial capabilities. Direct contact with the loan servicer is encouraged to discuss options and address any concerns before the first payment is due.

Consequences of Defaulting on Loans After the Grace Period

Defaulting on student loans after the grace period has significant and long-lasting consequences. Default occurs when you fail to make payments for a specific period (typically 90 days). The consequences of default include damage to your credit score, wage garnishment, tax refund offset, and difficulty obtaining future loans or credit. Additionally, your loan balance will continue to accrue interest and potentially late fees, further increasing your debt. Default can also affect your ability to secure employment in certain fields and can have long-term negative impacts on your financial well-being. It is crucial to contact your loan servicer immediately if you anticipate difficulties making payments to explore available options for avoiding default.

Interest Capitalization During and After the Grace Period

Interest capitalization is the process of adding accrued interest to the principal loan balance. During the grace period, interest accrues but is typically not capitalized unless specified in the loan terms. However, once the grace period ends and you enter repayment, interest capitalization can occur depending on the repayment plan chosen. Capitalization increases the principal balance, leading to higher future payments. For instance, if $500 in interest accrued during the grace period and is capitalized, the principal loan balance will increase by $500. This means future interest calculations will be based on the larger principal amount, resulting in a higher overall repayment cost. Understanding the capitalization process and its impact on your loan balance is critical for effective financial planning.

Navigating Grace Periods for Different Loan Types

Understanding grace periods is crucial for responsible student loan management. The length and specifics of your grace period significantly impact your repayment schedule and overall loan costs. Different loan types offer varying grace period provisions, requiring borrowers to understand these nuances to avoid penalties and late fees.

Federal Student Loan Grace Periods

Federal student loans, encompassing subsidized and unsubsidized loans, generally offer a standard grace period. This grace period begins after you graduate, leave school, or drop below half-time enrollment. The length of this grace period is typically six months for most federal student loans. During this period, interest may or may not accrue depending on the loan type. Subsidized loans typically do not accrue interest during the grace period, while unsubsidized loans do. Borrowers should carefully review their loan documents to confirm the exact terms of their grace period.

Private Student Loan Grace Periods

Private student loans, unlike federal loans, do not have a standardized grace period. The terms of the grace period, if one is offered at all, are determined by the individual lender and the specific loan agreement. Some private lenders may offer a grace period of six months, while others may offer a shorter period or no grace period at all. It is essential to thoroughly review the loan agreement for private student loans to determine the exact length and conditions of the grace period, if applicable. Many private loans begin accruing interest immediately upon disbursement, regardless of a grace period.

Comparison of Federal and Private Loan Grace Periods

A key difference lies in the consistency and length of grace periods. Federal student loans offer a consistent six-month grace period (for most loan types), providing a predictable timeframe for borrowers to prepare for repayment. Private student loans, conversely, offer variable grace periods, with some lenders providing none at all. This lack of standardization makes planning repayment more challenging for borrowers with private loans. Additionally, the accrual of interest during the grace period varies significantly between federal and private loans, further impacting the overall cost of borrowing.

Managing Grace Periods Effectively: A Flowchart

The following describes a flowchart illustrating the steps to effectively manage grace periods. Imagine a flowchart with boxes connected by arrows.

* Box 1: Loan Disbursement: This box represents the point when your loan funds are released.

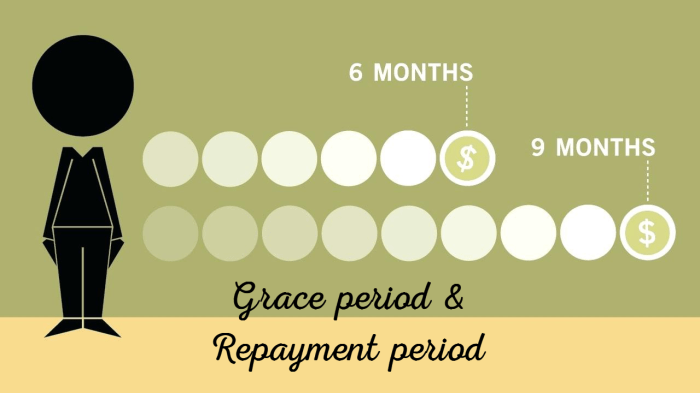

* Box 2: Graduation/Withdrawal: This box indicates the event triggering the start of your grace period. It includes graduation, leaving school, or dropping below half-time enrollment.

* Box 3: Grace Period Begins: This box marks the start of your grace period, noting the length (six months for most federal loans, variable for private loans).

* Box 4: Interest Accrual Check: This box involves checking if interest accrues during the grace period (yes for unsubsidized federal loans and most private loans, no for subsidized federal loans).

* Box 5: Repayment Plan Selection: This box represents the selection of a repayment plan before the grace period ends.

* Box 6: Repayment Begins: This box marks the start of your loan repayment, highlighting the importance of making on-time payments.

* Box 7: Maintain Good Credit: This box emphasizes the importance of timely payments to maintain a good credit score.

Practical Advice and Resources for Managing Grace Periods

Navigating the student loan grace period effectively requires proactive financial planning and resourcefulness. This period offers a crucial opportunity to organize your finances, prepare for repayment, and avoid accumulating unnecessary interest. Understanding your options and utilizing available resources can significantly impact your long-term financial well-being.

Practical Tips for Managing Finances During the Grace Period

The grace period shouldn’t be viewed as a time of financial inactivity. Instead, it’s a valuable period to build a strong financial foundation for repayment. Effective budgeting, exploring additional income streams, and prioritizing debt reduction are key strategies.

- Create a detailed budget: Track all income and expenses to identify areas for potential savings. This will help you understand your financial capacity and prepare for upcoming loan payments.

- Explore additional income streams: Consider part-time employment, freelancing, or selling unused possessions to generate extra funds for repayment or to build an emergency fund.

- Prioritize high-interest debt: If you have other debts besides student loans, focus on paying down those with the highest interest rates first to minimize overall interest charges.

- Build an emergency fund: Having 3-6 months’ worth of living expenses saved can provide a safety net in case of unexpected job loss or medical emergencies, preventing you from falling behind on loan payments.

- Research income-driven repayment plans: Explore options like Income-Driven Repayment (IDR) plans to potentially lower your monthly payments after the grace period ends.

Reputable Resources for Borrowers Seeking Assistance

Several organizations offer valuable support and guidance to student loan borrowers. These resources can provide crucial information, assistance with repayment strategies, and help in navigating the complexities of student loan management.

- The National Foundation for Credit Counseling (NFCC): The NFCC offers free and low-cost credit counseling services, including assistance with student loan repayment planning and debt management.

- The U.S. Department of Education: The Department of Education website provides comprehensive information on federal student loans, repayment plans, and other relevant resources.

- Your Loan Servicer: Your loan servicer is your primary point of contact for all matters related to your student loans, including questions about your grace period and repayment options.

- Student Loan Hero: This website offers educational resources, calculators, and tools to help borrowers manage their student loans effectively.

Calculating Interest Accrued During the Grace Period

Understanding how interest accrues during the grace period is vital for effective financial planning. Most federal student loans accrue interest during the grace period, increasing the total loan amount you’ll eventually need to repay.

The formula for calculating simple interest is: Interest = Principal x Interest Rate x Time.

For example, if you have a $10,000 loan with a 5% interest rate and a 6-month grace period, the interest accrued would be: $10,000 x 0.05 x (6/12) = $250. This $250 would be added to your principal loan balance at the end of the grace period. Note that the exact calculation may vary depending on the type of loan and the loan servicer’s calculation methods.

Contacting Loan Servicers Regarding Grace Periods

Effective communication with your loan servicer is crucial for navigating the grace period successfully. Knowing how to contact them and what information to provide ensures a smooth transition into repayment.

- Gather necessary information: Before contacting your servicer, collect your student loan details, including your loan numbers, account numbers, and any relevant documentation.

- Locate contact information: Find your loan servicer’s contact information on their website or your loan documents. Look for phone numbers, email addresses, and mailing addresses.

- Choose your preferred method of contact: Decide whether to call, email, or send a letter, considering your preference and the urgency of your inquiry.

- Clearly state your inquiry: When contacting your servicer, clearly explain your question or concern regarding your grace period. Be polite and professional in your communication.

- Keep records: Maintain records of all communication with your loan servicer, including dates, methods of contact, and summaries of conversations or correspondence.

Impact of Grace Periods on Long-Term Financial Planning

Grace periods offer a temporary reprieve from student loan repayments, but their impact on long-term financial health shouldn’t be underestimated. Understanding how these periods affect your overall financial picture is crucial for responsible financial planning. Failing to account for interest accrual during this time can significantly increase your total loan burden and delay your path to financial independence.

Utilizing a grace period effectively requires proactive planning and a clear understanding of its financial implications. While the temporary suspension of payments provides breathing room, it’s essential to recognize that interest continues to accrue on most federal and private student loans during this period. This means your loan balance will grow even without making payments, leading to a larger overall debt and potentially higher monthly payments once repayment begins. This added debt can impact your credit score and limit your ability to access other forms of credit in the future.

Interest Accrual During Grace Periods and Mitigation Strategies

Minimizing the financial impact of interest during the grace period necessitates proactive strategies. One key approach is to make interest-only payments during this time. While this doesn’t reduce the principal balance, it prevents the interest from capitalizing (adding to the principal balance), thus slowing down the growth of your total debt. Another strategy is to actively save and allocate funds specifically for student loan repayment during the grace period. This creates a buffer to reduce the shock of resuming full payments once the grace period ends and potentially make larger principal payments to reduce the loan faster. For example, if you anticipate a $300 monthly payment, saving that amount monthly during your grace period allows for a significant head start on repayment. This proactive approach reduces the overall repayment time and the total interest paid.

Budgeting and Repayment Plan Creation Before Grace Period Ends

Creating a realistic budget and repayment plan well before the grace period ends is paramount. This involves carefully assessing your income, expenses, and debt obligations. A comprehensive budget identifies areas for potential savings and ensures you can comfortably manage your student loan payments alongside other financial responsibilities. Exploring different repayment plans—such as standard, extended, or income-driven repayment—is crucial to selecting an option that aligns with your financial capabilities and long-term goals. For instance, an extended repayment plan stretches out payments over a longer period, lowering monthly payments but increasing the total interest paid. Conversely, an income-driven repayment plan adjusts monthly payments based on your income, offering more flexibility but potentially extending the repayment timeline. Carefully comparing these options is vital to finding the best fit for your individual circumstances.

Extending Repayment Plans Beyond the Initial Grace Period

Extending repayment plans beyond the initial grace period presents both benefits and drawbacks. Extending the repayment plan can significantly lower monthly payments, providing immediate financial relief. However, this typically results in paying more interest over the life of the loan. The decision to extend should be carefully weighed against the long-term financial implications. For example, if you are facing significant financial hardship, an extended plan may offer necessary short-term relief, allowing you to manage your finances without defaulting on your loans. However, this should be viewed as a temporary solution, as the higher total interest paid over the long term could significantly impact your financial health. It’s important to develop a plan to aggressively pay down the loan once your financial situation improves.

Closure

Successfully navigating the grace period in your student loan journey requires proactive planning and a clear understanding of your loan terms. By carefully considering the information presented—from eligibility criteria to the long-term financial implications of interest accrual—you can effectively manage this transitional phase and establish a solid foundation for responsible debt repayment. Remember, utilizing available resources and seeking assistance when needed can significantly ease the process and contribute to your overall financial success.

Frequently Asked Questions

What happens if I don’t start repayment after my grace period ends?

Failure to begin repayment after your grace period concludes can lead to delinquency, negatively impacting your credit score and potentially resulting in default, with severe financial consequences.

Can I extend my grace period?

Generally, grace periods are fixed in length. However, certain circumstances, such as enrollment in an eligible graduate program or documented economic hardship, might allow for deferment or forbearance, temporarily delaying repayment.

How is interest calculated during the grace period?

For unsubsidized federal loans, interest accrues during the grace period, adding to your loan principal. Subsidized federal loans typically do not accrue interest during this period.

What if I consolidate my loans? How does that affect my grace period?

Consolidating your loans may reset your grace period, depending on the type of consolidation and the terms of your new loan. Check with your loan servicer for specifics.

Where can I find my loan servicer’s contact information?

Your loan servicer’s contact information is typically found on your loan documents or through the National Student Loan Data System (NSLDS) website.